Which forex brokers offer TradingView?

Here is a list of forex brokers that offer TradingView in 2024, based on data pulled from our independently researched database of the top forex brokers. This list is ordered by our latest ratings and rankings:

What stockbrokers offer TradingView?

The TradingView platform offers news updates, community ideas, earnings calendars, and detailed information on individual stocks and securities across over 60 countries and regions. As such, it’s not surprising that some U.S. stockbrokers support integration with the TradingView platform. Here are the top three U.S. stockbrokers that offer TradingView, based on the overall broker ratings provided by our sister site, StockBrokers.com:

1. Interactive Brokers

Founded in 1977, Interactive Brokers is publicly traded (NASDAQ: IBKR) and regulated in six Tier-1 jurisdictions. Professional stock traders at Interactive Brokers can take advantage of industry-leading commission rates and the ability to trade in 135 international markets. Beginner and/or casual stock traders can access $0 stock and ETF trades through IBKR Lite. Read the the review of Interactive Brokers’ stock trading offering at our sister site, StockBrokers.com.

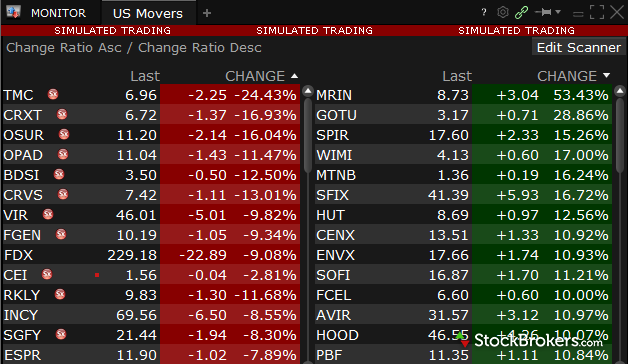

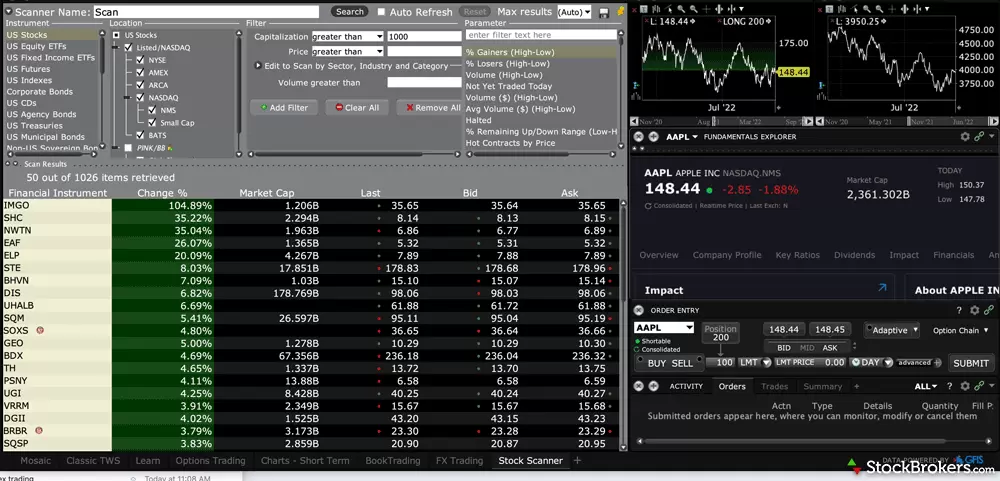

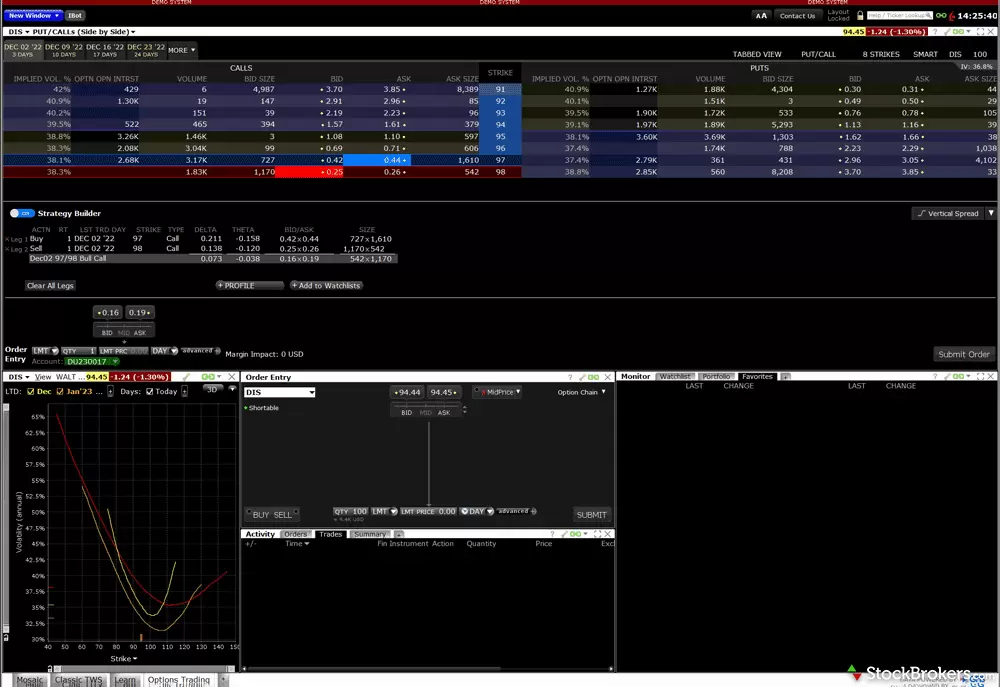

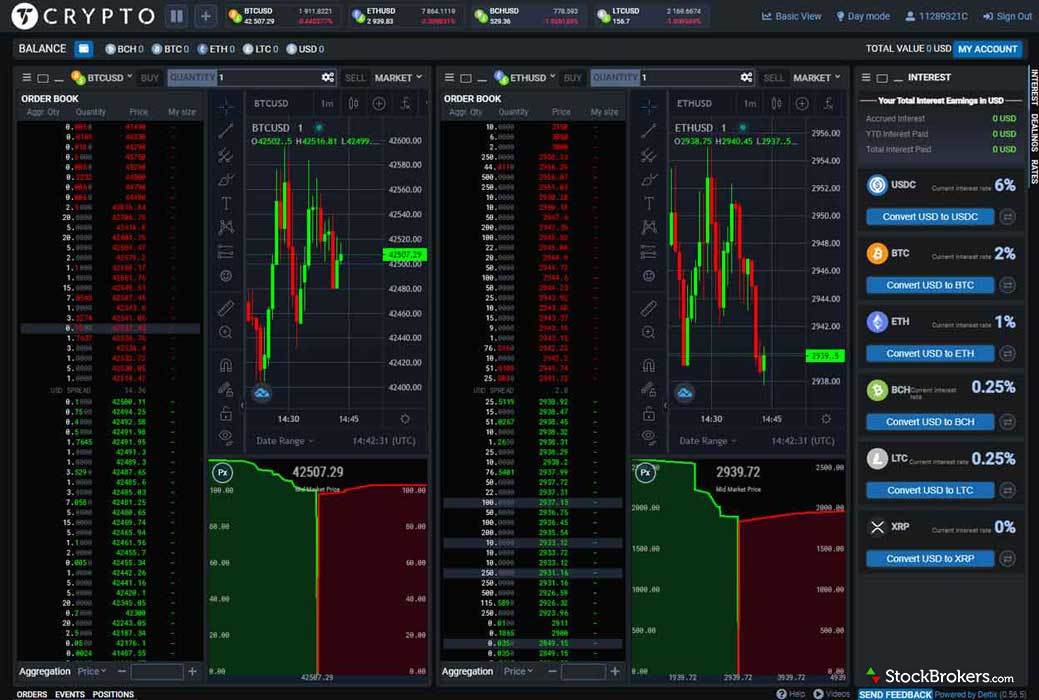

Check out a gallery of screenshots of the IBKR Trader Workstation (TWS) platform, taken by the research team at StockBrokers.com.

2. TradeStation

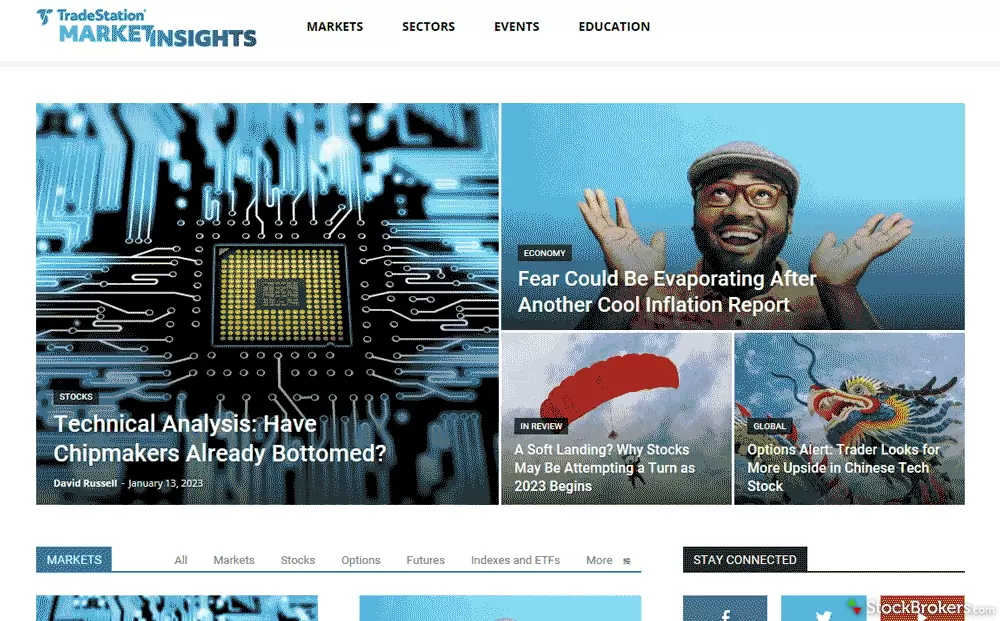

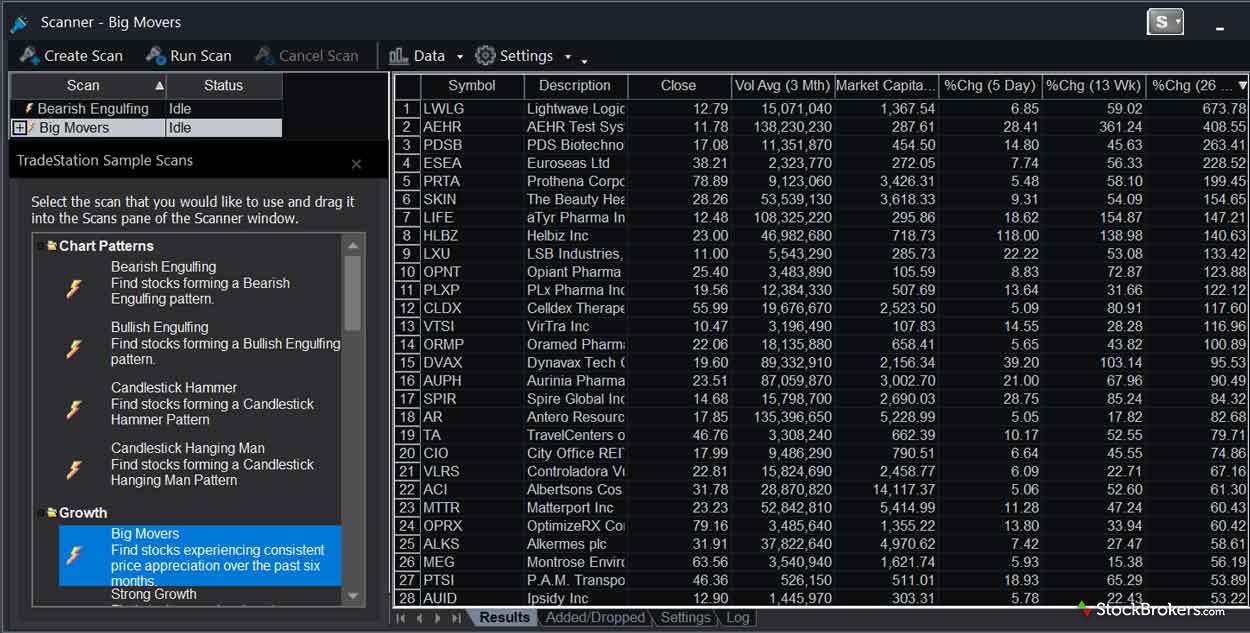

TradeStation offers a desktop platform loaded with trading tools that will meet the needs of most active traders. Casual investors and beginners will likely gravitate toward TradeStation’s simpler web trading platform, which is well-designed, customizable, and easy to use. Fans of automated stock trading will appreciate that TradeStation offers a proprietary programming language, EasyLanguage, though this feature isn’t for beginners. Read the review of TradeStation on our sister site, StockBrokers.com.

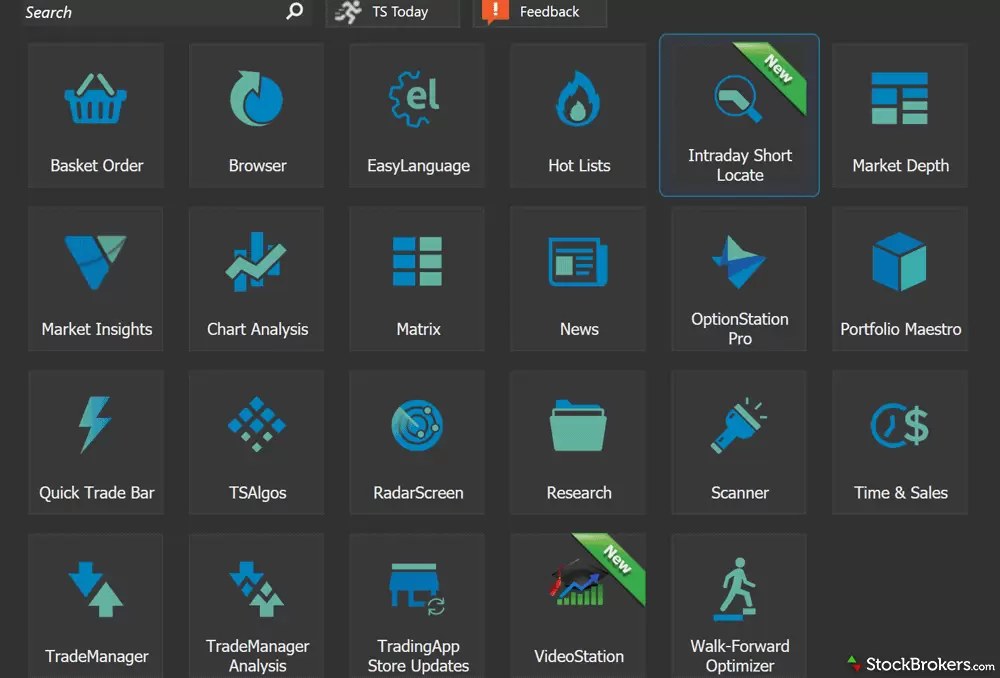

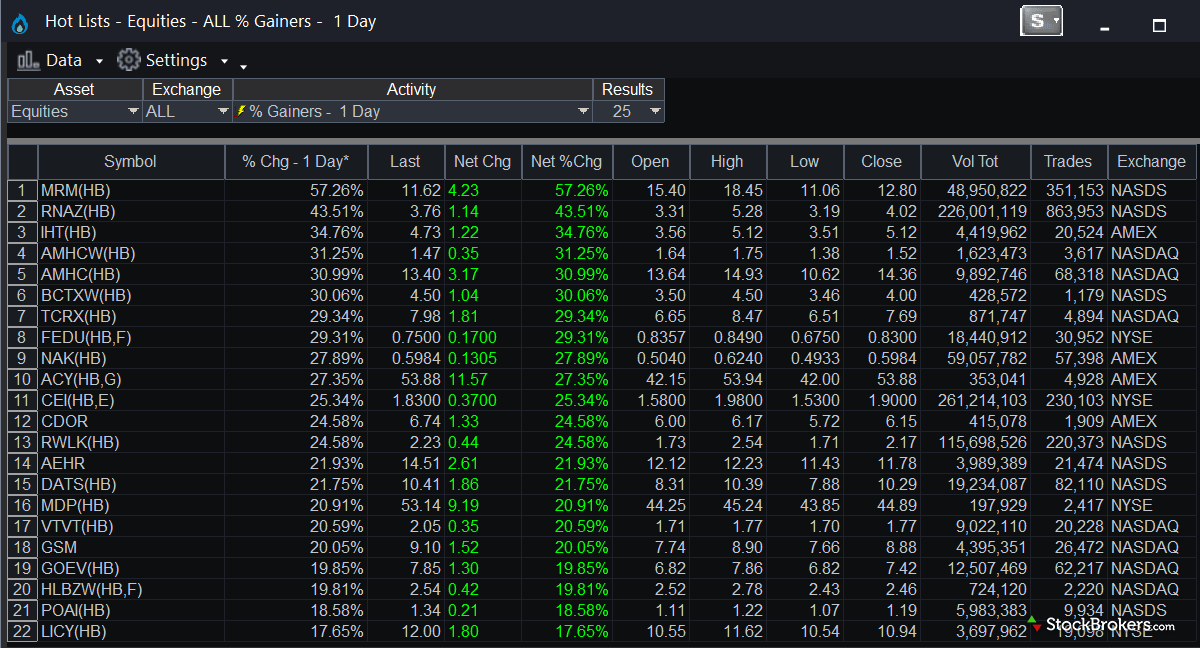

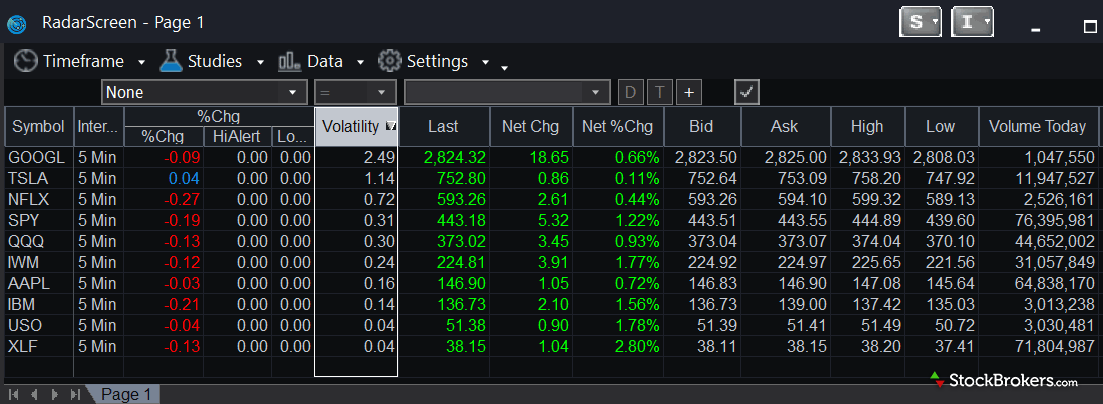

Browse a gallery of screenshots of the TradeStation's platform offering, taken by the research team at StockBrokers.com.

3. Ally Invest

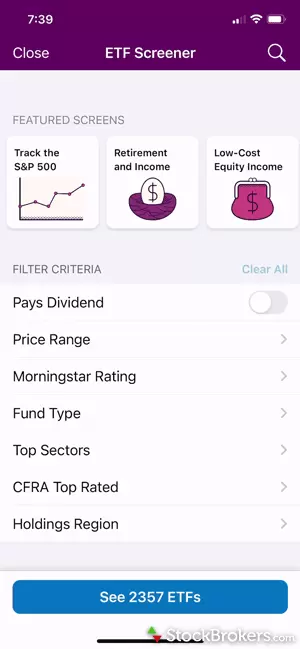

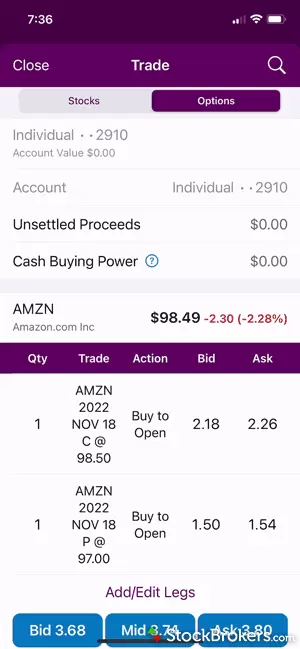

Ally is a good stockbroker for beginners who want to bank and invest at the same firm, with instant money transfers between accounts and universal account access. That being said, the range of tools and features available to traders at Ally is limited. Pricing at Ally is competitive for stock traders, with a $0 minimum deposit and $0 stock, mutual fund, and ETF trades. There’s decent research available on the Ally Invest site, but Ally’s educational content is lackluster. Read the review of Ally Invest at our sister site, StockBrokers.com.

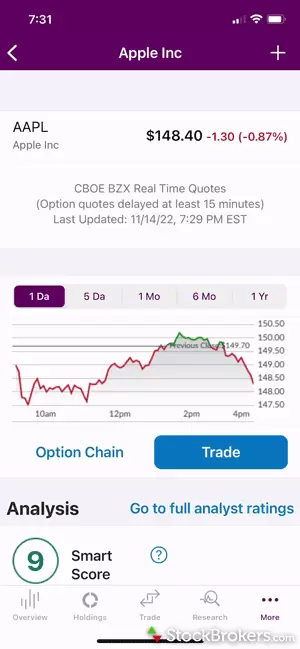

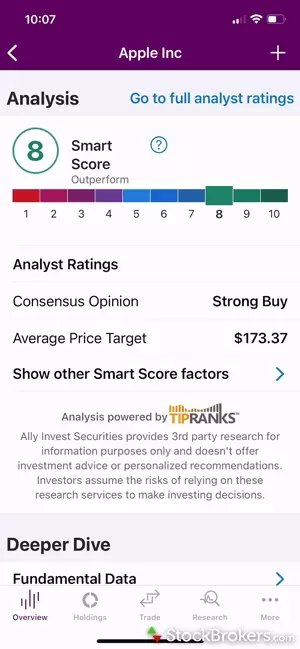

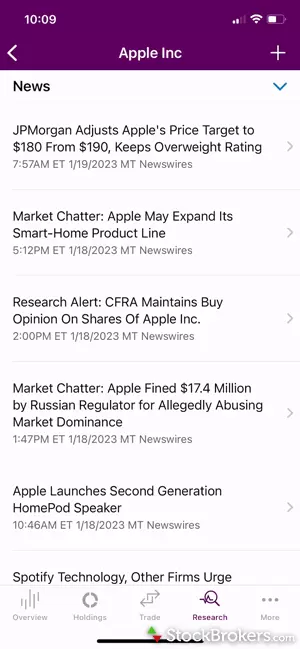

Here's a gallery of screenshots of the Ally Invest mobile app, taken by the research team at StockBrokers.com.

Do I need a broker for TradingView?

Yes, you’ll need a broker that supports TradingView integration if you want the ability to execute trades, track your orders, and/or manage your positions from within the TradingView platform. That said, if you are only using TradingView to conduct technical analysis, use charts, and/or discover trading ideas from the TradingView community, then you won’t necessarily need the platform to be connected to a broker.

In my view, however, it just makes more sense to have your TradingView platform connected and integrated with your forex broker. If you want to move quickly to take advantage of a trading opportunity, for example, having to switch platforms to a different (unsupported) broker can be an unnecessary impediment.

reportChoose a regulated forex broker

Looking for a forex broker that supports TradingView integration? Choosing a well-regulated, properly licensed forex broker can help traders and investors avoid scam forex brokers. My educational series about financial scams has helpful tips for identifying common forex scams.

How do I connect a broker to TradingView?

Connecting TradingView to your forex broker of choice is relatively simple. In order to do so, however, you’ll need to have a live trading account with a compatible broker that offers TradingView. To get started, just log into the TradingView web platform and open the chart view. Then, you simply navigate to the Trading Panel section and select your supported broker of choice (you’ll need an existing broker account login).

How much does TradingView cost?

TradingView offers a free default version of the platform, as well as various paid versions that offer greater flexibility and a wider range of features. TradingView’s paid versions include Pro (which starts at 14.95 per month), Pro+ ($29.95 per month), and Premium ($59.95 per month). These upgraded plans deliver a host of benefits that aren’t available with the free version, such as a greater level of customization and an increase in the number of available indicators, charts, and saveable chart layouts.

Other perks include an ad-free experience, custom time intervals, and alerts that don’t expire. My personal feeling based on nearly a decade of experience with this software is that unless you are a hardcore TradingView user or a professional trader, the free version of the TradingView software should work just fine.

How do you paper trade on TradingView?

The best way to paper trade (practice trading without risking real money) on TradingView is to open a free demo account with a compatible broker that offers the TradingView platform. Once your demo account is set up, you can either log in to the broker’s version of the TradingView platform or connect to your broker directly through TradingView’s Trading Panel tab.

Demo accounts are a great tool that can help you learn more about how your broker’s trading platform works without risking any of your real trading funds. I’ve always recommended that beginner forex traders use demo (or, virtual) accounts to practice trading before moving on to a live forex trading account with a trusted forex broker.

schoolNew to forex trading?

Check out our beginner’s guide to forex trading for tips and tricks for beginner forex traders and to see our picks for the best forex brokers for beginners.

Is TradingView good for trading forex?

TradingView can be an excellent platform for conducting technical analysis on forex pairs and for discovering technical trading opportunities shared within TradingView’s community. Originally, TradingView’s functionality was limited to its charting and community features, but it has since evolved to include the features and tools that you’d expect from a full-service trading platform like MetaTrader or cTrader. As a result, more forex traders gravitate towards using TradingView each year, and the number of forex brokers that support the TradingView platform continues to increase.

In this video, I give a high-level overview of the popular TradingView platform. I demonstrate how to seamlessly resize TradingView charts and how to search for instruments from a variety of brokers:

Several brokers post trading ideas or technical analysis from their in-house analysts within Trading View. As an example, Pepperstone posted the following chart depicting a banking ETF following the collapse of Silicon Valley Bank (SVB) in the U.S.:

What is the best forex broker compatible with TradingView?

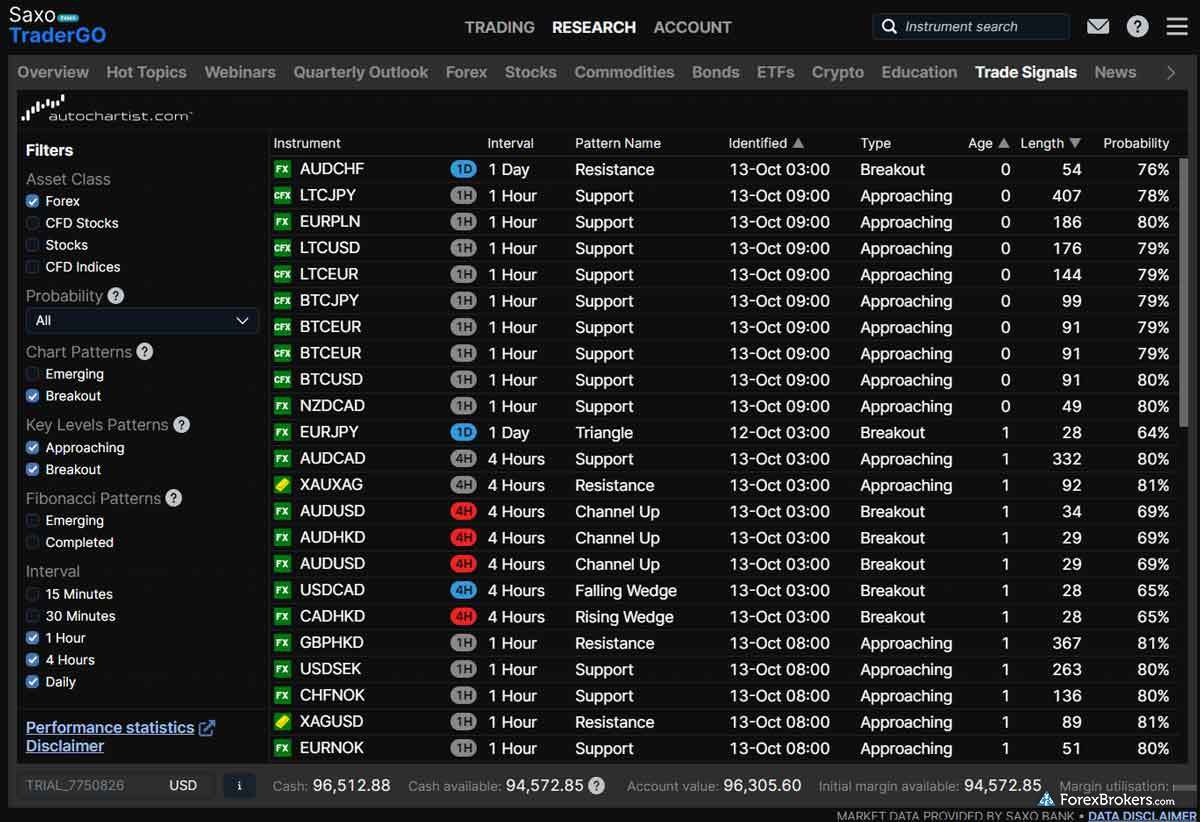

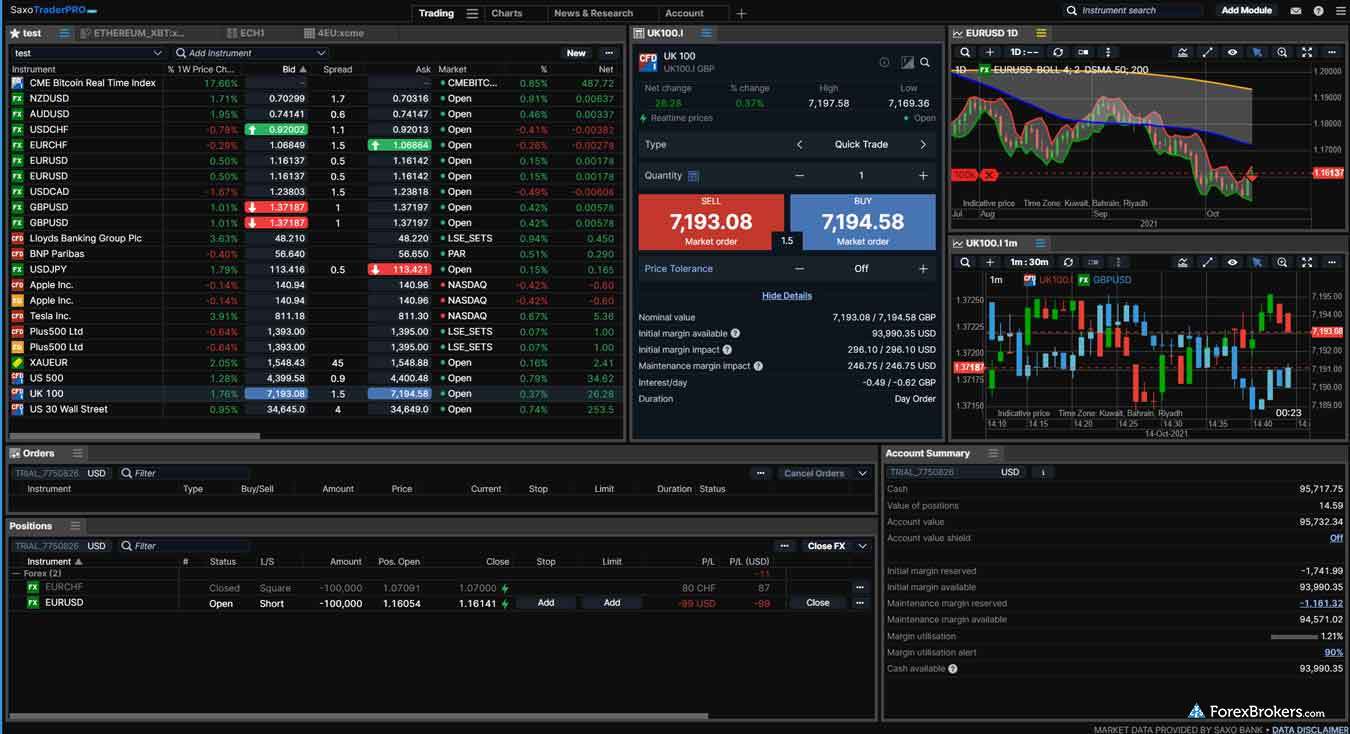

Saxo is our pick for the best forex broker in 2024 that supports integration with TradingView. Traders at Saxo can use their existing brokerage accounts and platform logins with the TradingView platform, granting them access to the same vast numbers of forex pairs, CFDs, stocks, and thousands of other symbols across Saxo’s wide range of global markets. Saxo also offers its own highly rated proprietary platform suite that earned the broker our 2024 Annual Award for #1 Platforms & Tools. Learn more by reading our in-depth review of Saxo.

Check out this gallery of screenshots of Saxo's award-winning platform suite, taken by our research team during our product testing.

Is TradingView free for forex trading?

Yes, TradingView is free when you are using it with a compatible broker. That being said, the TradingView features available with your broker will almost certainly be limited to what is provided with the free version of the TradingView platform.

Does TradingView support backtesting for forex?

Yes, TradingView allows for backtesting indicator-based strategies using the platform’s Strategy Tester tab. This feature provides an overview of the backtest that displays a performance summary and a list of trades that demonstrate how the strategy would have performed on the chart’s time horizon. By default, there are 23 Strategies to choose from, and you can choose to create your own scripts or select scripts that have been shared by TradingView’s community.

While TradingView does support backtesting, I personally recommend using MetaTrader for backtesting – especially if you want to use historical data. MetaTrader 5’s Strategy Tester allows for highly complex backtesting with advanced settings and support for multi-threaded backtests in 64 bits.

ForexBrokers.com 2024 Overall Rankings

Now that you've seen our picks for the best forex brokers for MetaTrader, check out the ForexBrokers.com Overall Rankings. We've evaluated over 60 forex brokers, using a testing methodology that's based on 100+ data-driven variables and thousands of data points. Check out our full-length, in-depth forex broker reviews.

Popular guides to forex trading tools and platforms

Popular Forex Guides

More Forex Guides

Popular Forex Broker Reviews

Methodology

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

In order to assess the best brokers for traders looking to use the TradingView platform, we examine a wide range of features and evaluate forex brokers based on our own data-driven variables. We determine whether the broker offers the full range of TradingView features, and we look for a number of supplementary features that can distinguish individual broker offerings.

Browser-based TradingView platforms are tested using the latest version of the Google Chrome browser. Our Desktop PCs run Windows 11, and we use MacBook Pro laptops running macOS 12.5 to test TradingView on the go. We also test TradingView on mobile devices; for Apple, we test using the iPhone XS running iOS 15, and for Android, we use the Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra devices running Android OS 12.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

About the Editorial Team

Steven Hatzakis

Steven Hatzakis is the Global Director of Research for ForexBrokers.com. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. A forex industry expert and an active fintech and crypto researcher, Steven advises blockchain companies at the board level and holds a Series III license in the U.S. as a Commodity Trading Advisor (CTA).

John Bringans

John Bringans is the Senior Editor of ForexBrokers.com. An experienced media professional, John has close to a decade of editorial experience with a background that includes key leadership roles at global newsroom outlets. He holds a Bachelor’s Degree in English Literature from San Francisco State University, and conducts research on forex and the financial services industry while assisting in the production of content.

Joey Shadeck

Joey Shadeck is the Content Strategist and Research Analyst for ForexBrokers.com. He holds dual degrees in Finance and Marketing from Oakland University, and has been an active trader and investor for close to ten years. An industry veteran, Joey obtains and verifies data, conducts research, and analyzes and validates our content.

Saxo

Saxo

Interactive Brokers

Interactive Brokers

FOREX.com

FOREX.com

City Index

City Index

FXCM

FXCM

Capital.com

Capital.com

Pepperstone

Pepperstone

IG

IG

CMC Markets

CMC Markets

TD Ameritrade

TD Ameritrade

XTB

XTB

eToro

eToro

Swissquote

Swissquote

AvaTrade

AvaTrade

Plus500

Plus500

OANDA

OANDA

Admirals

Admirals

XM Group

XM Group

FP Markets

FP Markets

FxPro

FxPro

IC Markets

IC Markets

Markets.com

Markets.com

Tickmill

Tickmill

Fineco Bank

Fineco Bank

BlackBull Markets

BlackBull Markets

Vantage

Vantage

HYCM (Henyep Capital Markets)

HYCM (Henyep Capital Markets)

HFM

HFM

ThinkMarkets

ThinkMarkets

FlowBank

FlowBank

DooPrime

DooPrime

Trading 212

Trading 212

BDSwiss

BDSwiss

Trade Nation

Trade Nation

TMGM

TMGM

Moneta Markets

Moneta Markets

Eightcap

Eightcap

MultiBank

MultiBank

ACY Securities

ACY Securities

RoboForex (RoboMarkets)

RoboForex (RoboMarkets)

VT Markets

VT Markets

easyMarkets

easyMarkets

IronFX

IronFX

Spreadex

Spreadex

IFC Markets

IFC Markets

Trade360

Trade360

Octa

Octa

Axi

Axi

TeleTrade

TeleTrade

GKFX

GKFX

Vestle

Vestle

FXOpen

FXOpen

FXPrimus

FXPrimus

Forex4you

Forex4you

GBE brokers

GBE brokers

Alpari

Alpari

TopFX

TopFX

Libertex (Forex Club)

Libertex (Forex Club)

LegacyFX

LegacyFX

FXGT.com

FXGT.com

ATFX

ATFX

Xtrade

Xtrade