BlackBull Markets Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74-89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

BlackBull Markets offers multiple platforms, inluding the full MetaTrader suite (MetaTrader 4 and MetaTrader 5), cTrader, TradingView, and multiple social copy trading apps.

While its sparse education and modest research materials can't compete with what's offered by the best forex brokers in those categories, BlackBull Markets continues to grow quickly and has shown major progress in developing its product offering.

-

Minimum Deposit:

$0 -

Trust Score:

78 -

Tradeable Symbols (Total):

26000

Can I open an account with this broker?

Yes, based on your detected country of HK, you can open an account with this broker.

BlackBull Markets pros & cons

Pros

- Available to residents of New Zealand – unlike many brokers that don’t have the required FMA license.

- Provides both MetaTrader 4 and MetaTrader 5.

- Offers a growing range of third-party trading tools from Autochartist and Acuity.

- In our 2024 Annual Awards, BlackBull Markets earned Best in Class honors for Offering of Investments.

- Supports multiple third-party copy trading platforms, such as ZuluTrade, Duplitrade, Hokocloud, and Myfxbook.

- Integration with the TradingView web platform was made available in 2021.

- With the launch of BlackBull Shares, traders can access over 26,000 tradeable symbols.

- The recently launched BlackBull CopyTrader web platform boosts the broker's existing social copy trading offering.

- BlackBull Markets recently received a significant private equity investment from Milford Private Equity Fund III LP, helping to bolster its position as a leading broker in New Zealand.

Cons

- BlackBull lacks additional Tier-1 regulatory licenses outside of New Zealand.

- BlackBull’s Seychelles-licensed entity only offers light regulatory protection.

- The narrow scope of BlackBull’s educational content can’t compete with what the best MetaTrader brokers offer.

- Based on the average spreads we obtained, commissions and fees at BlackBull Markets appear to be in line with the industry average.

Overall Summary

| Feature |

BlackBull Markets BlackBull Markets

|

|---|---|

| Overall Rating |

|

| Trust Score | 78 |

| Offering of Investments |

|

| Commissions & Fees |

|

| Platform & Tools |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Is BlackBull Markets safe?

BlackBull Markets is considered Average Risk, with an overall Trust Score of 78 out of 99. BlackBull Markets is not publicly traded, does not operate a bank, and is authorised by one Tier-1 regulators (Highly Trusted), zero Tier-2 regulators (Trusted), zero Tier-3 regulators (Average Risk), and one Tier-4 regulator (High Risk). BlackBull Markets is authorised by the following Tier-1 regulator: Financial Markets Authority (FMA) . Learn more about Trust Score or see where the different BlackBull Markets entities are regulated.

| Feature |

BlackBull Markets BlackBull Markets

|

|---|---|

| Year Founded | 2014 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 1 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 1 |

Offering of investments

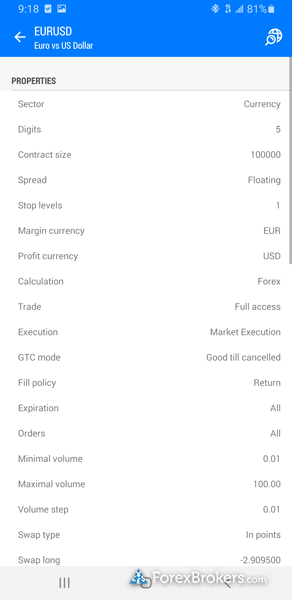

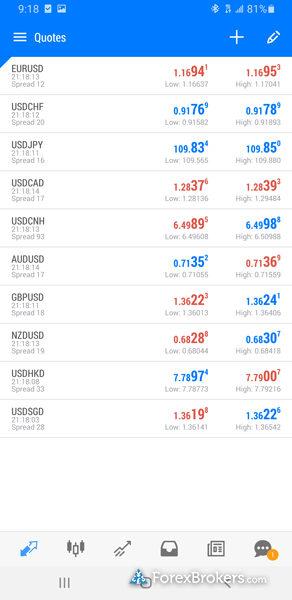

BlackBull Markets has significantly expanded its range of markets with the launch of BlackBull Shares. Today, BlackBull offers over 26,000 tradeable symbols; 2,500 are available on MetaTrader 5 (716 in Prime account) and TradingView, and 311 symbols on MetaTrader 4. The table below summarizes the different investment products available to BlackBull Markets clients.

Cryptocurrency: Cryptocurrency trading is available at BlackBull Markets through CFDs, but not available through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents.

| Feature |

BlackBull Markets BlackBull Markets

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 26000 |

| Forex Pairs (Total) | 72 |

| U.S. Stock Trading (Non CFD) | Yes |

| Int'l Stock Trading (Non CFD) | Yes |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (Derivative) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). |

Commissions and fees

Trading costs at BlackBull Markets are about average for the industry, and will vary depending on which of its three account types you choose.

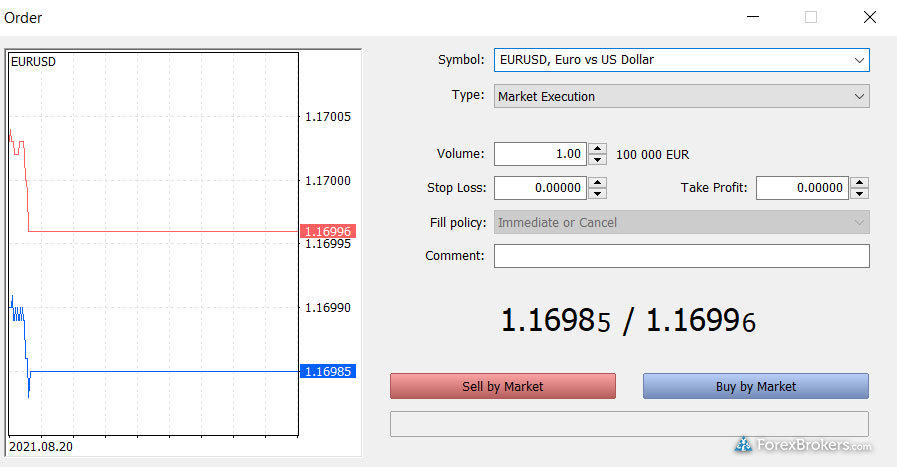

Spreads: The average spread on the EUR/USD at BlackBull Markets for the Prime account is 0.16 based on March 2024 data, which equates to an all-in cost of 0.76 after factoring the per-side commission of 0.3 pips or $6 per 10,000 traded. This makes the Prime account my preferred choice compared to the Standard account.

Accounts comparison: The Standard account is commission-free and has no minimum deposit requirement but higher spreads comparably. The Prime account offers lower spreads, but requires a $2,000 minimum deposit, and there is a commission of $3 per side or $6 round turn per lot. The ECN Institutional account is BlackBull’s more exclusive option for active traders that deposit at least $20,000, with commission rates of $2 per side or $4 per round turn.

| Feature |

BlackBull Markets BlackBull Markets

|

|---|---|

| Minimum Deposit | $0 |

| Average Spread EUR/USD - Standard | 0.76 |

| All-in Cost EUR/USD - Active | 0.76 |

| Active Trader or VIP Discounts | Yes |

| ACH or SEPA Transfers | No |

| PayPal (Deposit/Withdraw) | No |

| Skrill (Deposit/Withdraw) | Yes |

| Visa/Mastercard (Credit/Debit) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

Mobile trading apps

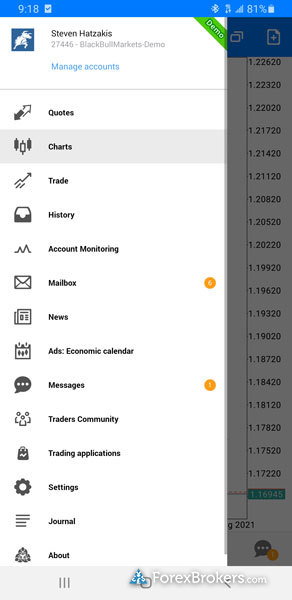

With no proprietary mobile app available, BlackBull Markets trails behind industry leaders such as IG and Saxo. That said, it's worth noting that BlackBull continues to launch additional 3rd party trading platforms, including TradingView, and most recently its BlackBull Trader platform powered by DXTrade, developed by DevExperts. For our top picks among trading apps, read our guide to Best Forex Trading Apps.

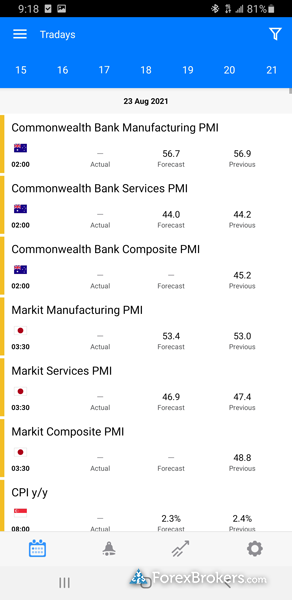

Apps overview: BlackBull Markets offers the full MetaTrader suite with iOS and Android versions of the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) apps come standard and are both available for download from the Apple App Store and Google Play store, respectively. In addition, BlackBull Markets offers TradingView, and cTrader, available for mobile on the iOS and Google Play store.

| Feature |

BlackBull Markets BlackBull Markets

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts - Basic Fields | Yes |

| Watchlists - Total Fields | 6 |

| Watchlist Syncing | Yes |

| Charting - Indicators / Studies (Total) | 109 |

| Charting - Drawing Tools (Total) | 60 |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Charting - Multiple Time Frames | Yes |

| Mobile Economic Calendar | Yes |

Other trading platforms

BlackBull Markets offers the full MetaTrader suite, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5) for desktop and web, and BlackBull Markets' own BlackBull Shares platform (powered by Interactive Brokers’ TWS platform). Also available is TradingView, a popular trading platform that delivers a range of powerful charting functions and robust analysis tools. Learn more by reading our TradingView guide. More recently, BlackBull further expanded its platform offering with the addition of its web-based BlackBull Trade platform powered by DXTrade.

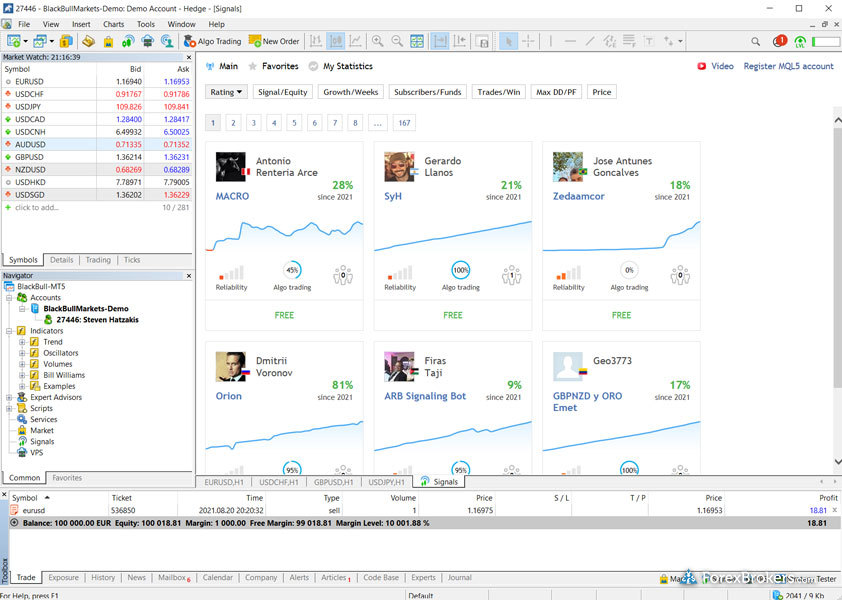

Platforms overview: With a limited range of markets and no platform add-ons, there is simply not much to say about the broker’s MetaTrader offering. The special features that are available come by way of third-party providers, such as support for Virtual Private Servers (VPS) hosting and the integration of third-party social copy trading apps, and the growing selection of additional platforms, including cTrader and TradingView.

Social copy trading: BlackBull Markets offers several third-party apps for social copy trading, in addition to the native Signals market available in MT4. Supported copy trading platforms include ZuluTrade and MyFxbook. BlackBull CopyTrader (which delivers full integration with MetaTrader powered by Hokocloud) is a recent proprietary addition to the broker's social copy trading suite.

VPS hosting: For algorithmic traders that want to run their MetaTrader platform 24-7 from a Virtual Private Server (VPS), BlackBull Markets offers VPS service from BeeksFX for a monthly fee. Free VPS service is also available if you deposit at least $2,000 in the ECN Prime account and complete at least 20 standard lots (2,000,000 units worth of trading volume) each month.

| Feature |

BlackBull Markets BlackBull Markets

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | No |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| DupliTrade | No |

| ZuluTrade | Yes |

| Charting - Indicators / Studies (Total) | 109 |

| Charting - Drawing Tools (Total) | 60 |

| Charting - Trade From Chart | Yes |

| Watchlists - Total Fields | 6 |

Market Research

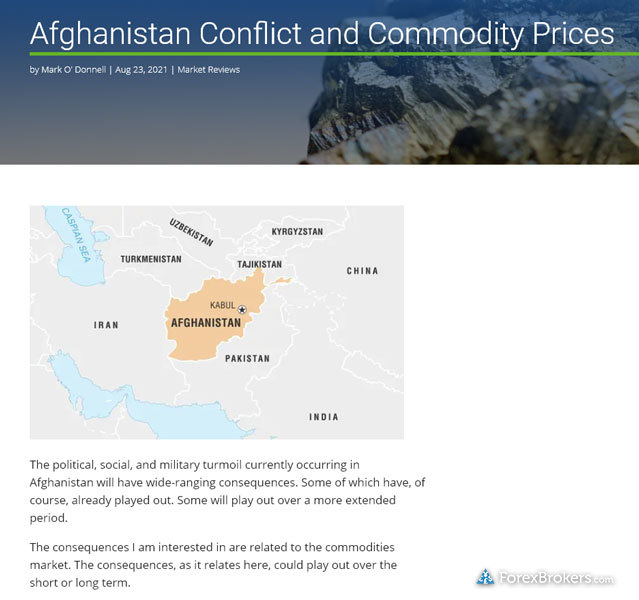

BlackBull Markets recently expanded its market research coverage with the acquisition of research firm ATM Strategy. Considerable progress has been made in the broker's research offering, though BlackBull Markets still trails behind the best forex and CFD brokers in this category.

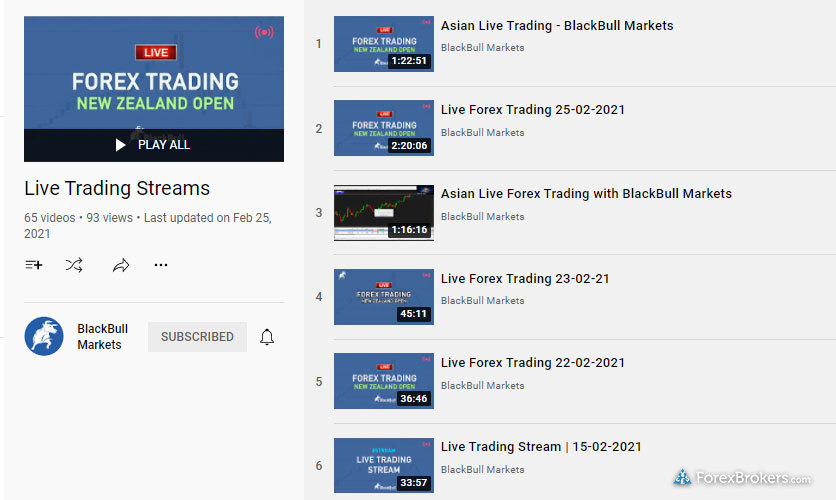

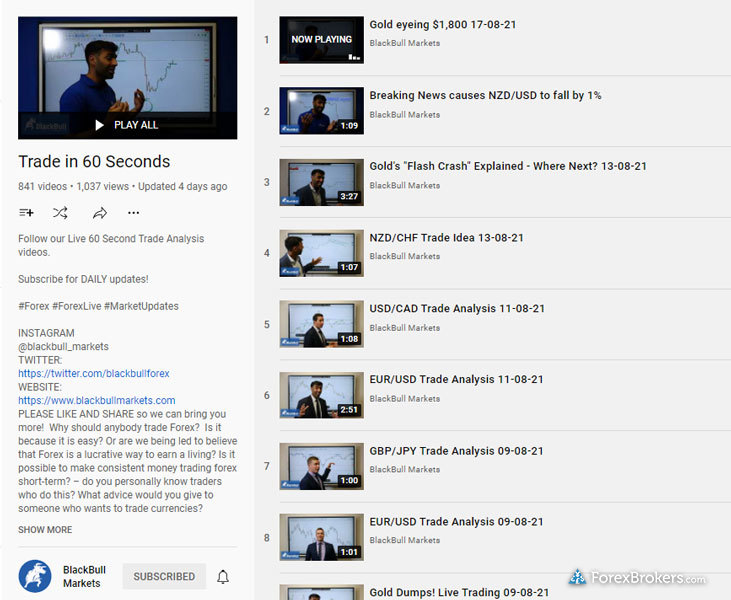

Research overview: BlackBull Markets produces a daily series featuring technical and fundamental analysis for specific trading symbols. For example, the Trade in 60 Seconds series are one-minute recordings that focus on a particular trading symbol – such as a given forex pair or CFD. There are also articles as part of its Trading Opportunities series that feature fundamental analysis – though these are housed under its education section, and not in a dedicated research category.

Market news and analysis: Both the Market Reviews articles and the selection of videos produced by BlackBull Markets’ in-house team are high-quality, and provide depth from a technical and fundamental analysis perspective. I was just disappointed to find that there isn’t more daily content.

Resuming the production of live streams would be a step in the right direction for BlackBull Markets, along with a general expansion of daily content.

| Feature |

BlackBull Markets BlackBull Markets

|

|---|---|

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | No |

| Autochartist | Yes |

| Trading Central (Recognia) | No |

| Social Sentiment - Currency Pairs | Yes |

Education

BlackBull Markets’ overall educational offering has made good progress recently with an expanded number of articles that are organized by category, yet still has long way to go to catch up to the best forex brokers for beginners. For example, the addition of quizzes and progress tracking features could help BlackBull further improve its educational offering for retail traders.

Education Hub: BlackBull Markets's Education Hub is a section of the BlackBull website that is exclusive dedicated to trader education. This Education Hub has recently been expanded with dozens of new themed articles which are organized by experience level. BlackBull Markets has also increased its offering of educational video content and has added new playlists and webinar recordings to its YouTube channel. I found these playlists – such as the Elliot Wave Theory series and the Whiteboard Wizards playlist – to be of decent quality. Likewise, the more advanced courses such as the Forex 303 lessons, were good quality albeit very short and more akin to articles than actual courses. Overall, I'm happy to see that BlackBull continues to build on its position in this category, though there is still room to improve.

| Feature |

BlackBull Markets BlackBull Markets

|

|---|---|

| Education (Forex or CFDs) | Yes |

| Client Webinars | Yes |

| Client Webinars (Archived) | Yes |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | Yes |

| Investor Dictionary (Glossary) | Yes |

Final thoughts

Despite a growing product range on MetaTrader and support for social copy trading tools, and the addition of new platforms, BlackBull Markets falls behind the best brokers in several key categories, such as education and research, although has made considerable progress in these categories since last year. It’s also important to note that BlackBull Markets currently has a relatively small number of regulatory licenses.

BlackBull Markets is a maturing broker that has been in operation for nearly a decade and has made great strides over the last two years toward improving its value proposition to traders and investors. In our 2024 Annual Awards, BlackBull earned Best in Class honors for our Offering of Investments category. That said, BlackBull still has room to further improve against the competition. We’d love to see the broker acquire more regulatory licenses in Tier-1 jurisdictions, which would only improve its Trust Score.

About BlackBull Markets

Founded in 2014, BlackBull Markets is a forex and CFD broker headquartered in New Zealand. The broker has been fully authorized by the Financial Markets Authority (FMA) in New Zealand since 2020, and registered on the Financial Services Provider Register (FSPR) since the end of 2014. The BlackBull Markets brand also holds a license in the offshore island nation of Seychelles with the Financial Services Authority (FSA). In May 2023, BlackBull Markets received an investment from Milford Asset Management, a prominent private equity firm in New Zealand, which included the appointment of an independent Chairman.

ForexBrokers.com 2024 Annual Awards

For the ForexBrokers.com 2024 Annual Awards, brokers were evaluated against ForexBrokers.com’s 8 Primary Categories: Commissions & Fees, Offering of Investments, Platforms & Tools, Mobile Trading Apps, Research, Education, Trust Score, and Overall.

Best in Class honors were awarded to the Top 7 forex brokers in each of the following areas: Beginners, Social Copy Trading, Ease of Use, MetaTrader, Algo Trading, Crypto Trading, and Professional Trading.

For more information, see how we test.

Category awards

BlackBull Markets BlackBull Markets

|

Offering of Investments |

| Rank #1 | |

| Streak #1 | |

| Best in Class | |

| Best in Class Streak | 2 |

2024 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Article Resources

BlackBull Markets Regulation BlackBull Markets Education

Popular Forex Guides

- Best MetaTrader 4 Brokers of 2024

- Best Forex Trading Apps of 2024

- International Forex Brokers Search

- Best Forex Brokers of 2024

- Best Copy Trading Platforms of 2024

- Best Forex Brokers for Beginners of 2024

- Compare Forex Brokers

- Best TradingView Forex Brokers of 2024

- Best Zero Spread Forex Brokers of 2024

More Forex Guides

Popular Forex Broker Reviews

Compare BlackBull Markets Competitors

Select one or more of these brokers to compare against BlackBull Markets.

Show all