Plus500 Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Your capital is at risk. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Plus500 is a trusted global brand that offers an easy-to-use trading platform for online traders, alongside access to share trading via the Plus500 Invest platform, futures within the U.S. market, and a thorough selection of CFDs through the broker’s separate Plus500 CFD platform.

Plus500’s simplified trading platform attracts beginners looking for a user-friendly experience and delivers a growing selection of educational content. While strides continue to be made, Plus500's narrow selection of market research will leave active traders wanting more.

-

Minimum Deposit:

€100 -

Trust Score:

99 -

Tradeable Symbols (Total):

5500

Can I open an account with this broker?

Yes, based on your detected country of HK, you can open an account with this broker.

Plus500 pros & cons

Pros

- Founded in 2008, Plus500 is publicly traded (LSE: PLUS) and part of the FTSE 250 Index.

- Plus500 is regulated in six Tier-1 jurisdictions, three Tier-2 jurisdictions, and one Tier-4 jurisdiction (learn more about Trust Score).

- I found Plus500's user-friendly web-based trading platform to be a solid choice for beginner traders. (Disclosure: A trading platform recommended for beginners does not make it easy to make money. Trading is risky.)

- The new +Insights analytics tool incorporates proprietary sentiment data as well as the integration of advanced sentiment features from Trading Central and FactSet.

- Plus500’s web platform and mobile app feature robust charting, with a consistent experience across devices.

- Good range of 2,800 tradeable symbols, which can be traded as CFDs.

- Plus500 appears to offer spreads close to the industry average on most of its major forex pairs.

- CFD option contracts are available for 20+ popular symbols.

Cons

- The Plus500 platform offers a touch more than just basic features, making it less attractive for active traders.

- Plus500’s Trading Academy continues to grow, yet still trails the best brokers for education. Plus500 does not offer an extensive variety of educational content to learn financial markets.

- Despite its integrated economic calendar and +Insights sentiment data, news headlines are absent from the Plus500 platform suite.

- Plus500’s research content consists of just a few daily articles, and its video content lacks market updates or analysis.

Overall summary

| Feature |

Plus500 Plus500

|

|---|---|

| Overall Rating |

|

| Trust Score | 99 |

| Offering of Investments |

|

| Commissions & Fees |

|

| Platform & Tools |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Is Plus500 Safe?

Plus500 is considered Highly Trusted with an overall trust score of 99 out of 99. Plus500 is publicly traded and does not operate a bank. Plus500 is authorised by six Tier-1 regulators (Highly Trusted), three Tier-2 regulators (Trusted), zero Tier-3 regulators (Average Risk), and one Tier-4 regulator (High Risk). Plus500 is authorised by the following Tier-1 regulators: Financial Conduct Authority (FCA), Australian Securities & Investment Commission (ASIC), Japanese Financial Services Authority (JFSA), Financial Markets Authority (FMA), Monetary Authority of Singapore (MAS), and regulated in the European Union via the MiFID passporting system. Learn more about Trust Score or see where the different Plus500 entities are regulated.

| Feature |

Plus500 Plus500

|

|---|---|

| Year Founded | 2008 |

| Publicly Traded (Listed) | Yes |

| Bank | No |

| Tier-1 Licenses | 6 |

| Tier-2 Licenses | 3 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 1 |

Offering of investments

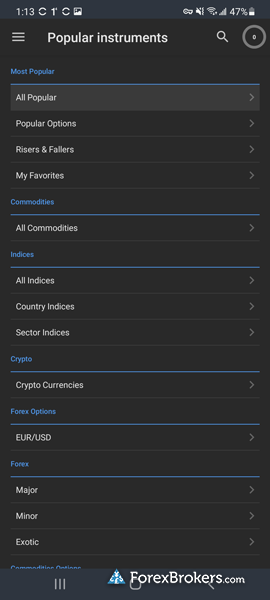

Unlike brokers who offer non-deliverable spot forex as a rolling contract, all forex trading at Plus500 is done by way of CFDs. Plus500 launched shares trading in 2021 via Plus500 Invest, and also acquired a futures firm in the U.S. and subsequently launched futures trading on domestic exchanges to U.S. residents. The table below summarizes the different investment products available to Plus500 clients.

Cryptocurrency: Cryptocurrency trading is available through CFDs, but not available through trading the underlying asset (e.g., buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents.

The table below summarizes the CFD investment products available at Plus500. Non-CFD shares are only available through the broker's Plus500 Invest platform.

| Feature |

Plus500 Plus500

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 5500 |

| Forex Pairs (Total) | 65 |

| U.S. Stock Trading (Non CFD) | Yes |

| Int'l Stock Trading (Non CFD) | Yes |

| Social Trading / Copy Trading | No |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (Derivative) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). Non-CFD share trading at Plus500 is only available through the Plus500 Invest account. |

Commissions and fees

Overall, Plus500's pricing is in line with the industry average but trails the best forex brokers when it comes to active trader pricing (see IG or Saxo for comparison). Plus500 does not provide discounts to retail clients, but does offer cash rebates (akin to an active trader program) if you qualify and are designated as a Professional client.

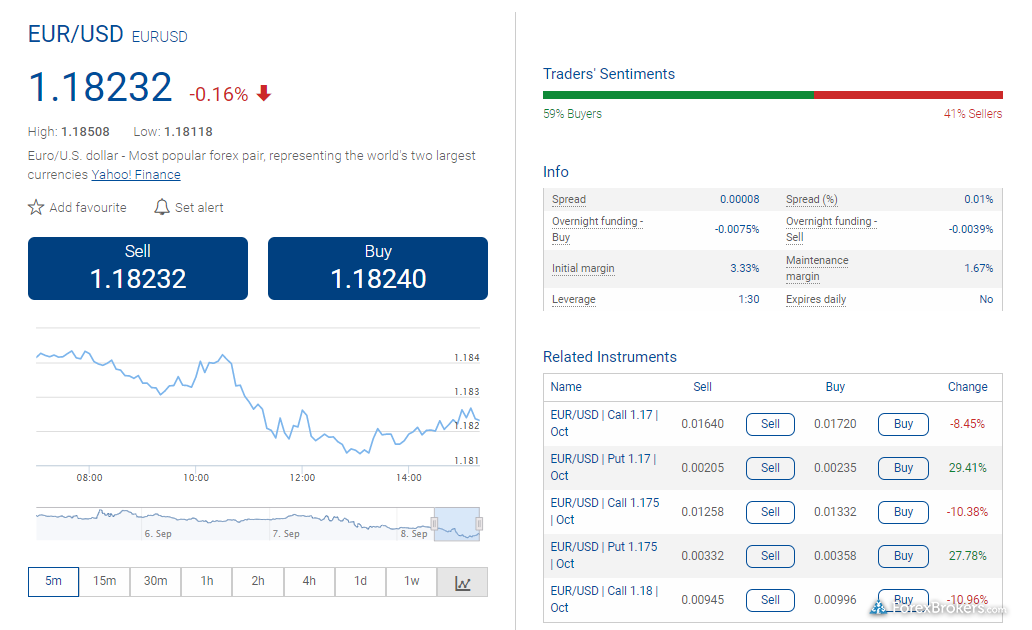

Spreads: For the EUR/USD, the Plus500 platform displays a dynamic spread of 0.00008 (0.8 pips). Accordingly, the average spread from Plus500 for the EUR/USD during August 2021 was 0.8 pips, which is in line with the industry average.

| Feature |

Plus500 Plus500

|

|---|---|

| Minimum Deposit | €100 |

| Average Spread EUR/USD - Standard | N/A |

| All-in Cost EUR/USD - Active | N/A |

| Active Trader or VIP Discounts | No |

| ACH or SEPA Transfers | No |

| PayPal (Deposit/Withdraw) | Yes |

| Skrill (Deposit/Withdraw) | Yes |

| Visa/Mastercard (Credit/Debit) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

Mobile trading apps

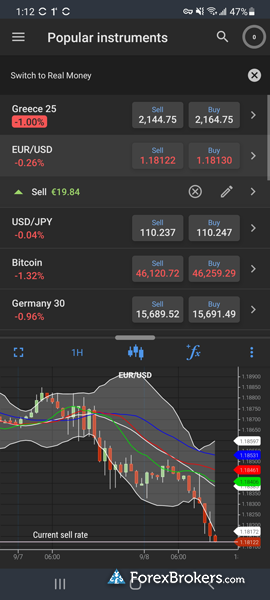

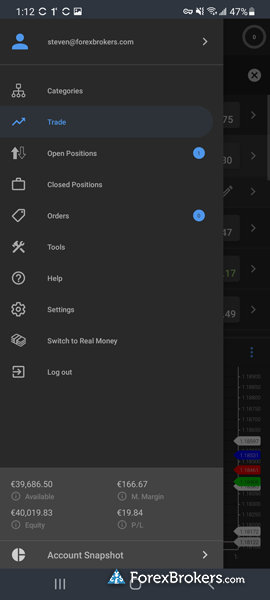

The look, feel, and functionality of the Plus500 trading app closely mirrors the WebTrader browser platform, offering a satisfyingly seamless transition between platforms.

That said, like its WebTrader counterpart, the Plus500 trading app lacks the advanced tools and all-around functionality to challenge industry leaders. As an example, Plus500’s web charts do not sync with the mobile app – a feature you’ll find within the trading apps available at Saxo and TD Ameritrade (U.S. residents only).

Trading tools: Plus500 has significantly improved its charting, offering 109 indicators and over 20 drawing tools. However, there remains plenty of room for improvement, and I’d like to see an increase in the number of features, such as news, research, and advanced trading tools – all of which are currently absent from Plus500’s mobile app.

| Feature |

Plus500 Plus500

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts - Basic Fields | Yes |

| Watchlists - Total Fields | 10 |

| Watchlist Syncing | Yes |

| Charting - Indicators / Studies (Total) | 110 |

| Charting - Drawing Tools (Total) | 21 |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Charting - Multiple Time Frames | Yes |

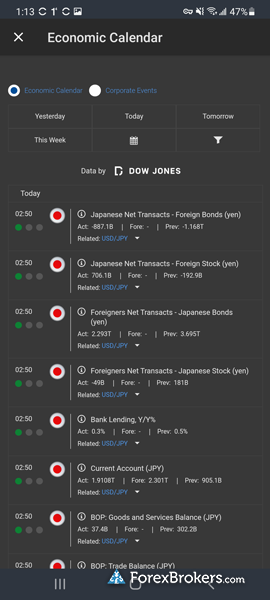

| Mobile Economic Calendar | Yes |

Other trading platforms

The Plus500 web trading platform, WebTrader, is an excellent choice for casual investors due to its ease of use and its focus on providing just the essentials. Plus500 has continued to make minor improvements to its platform over the years, and as those enhancements have stacked up, Plus500 has edged closer to competing with the industry leaders in this category.

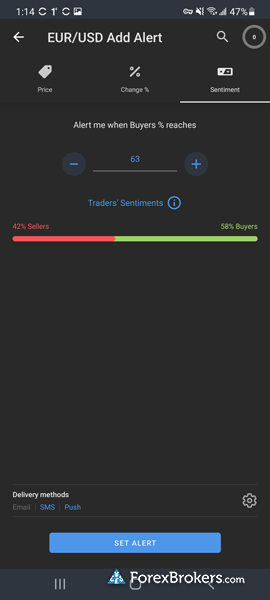

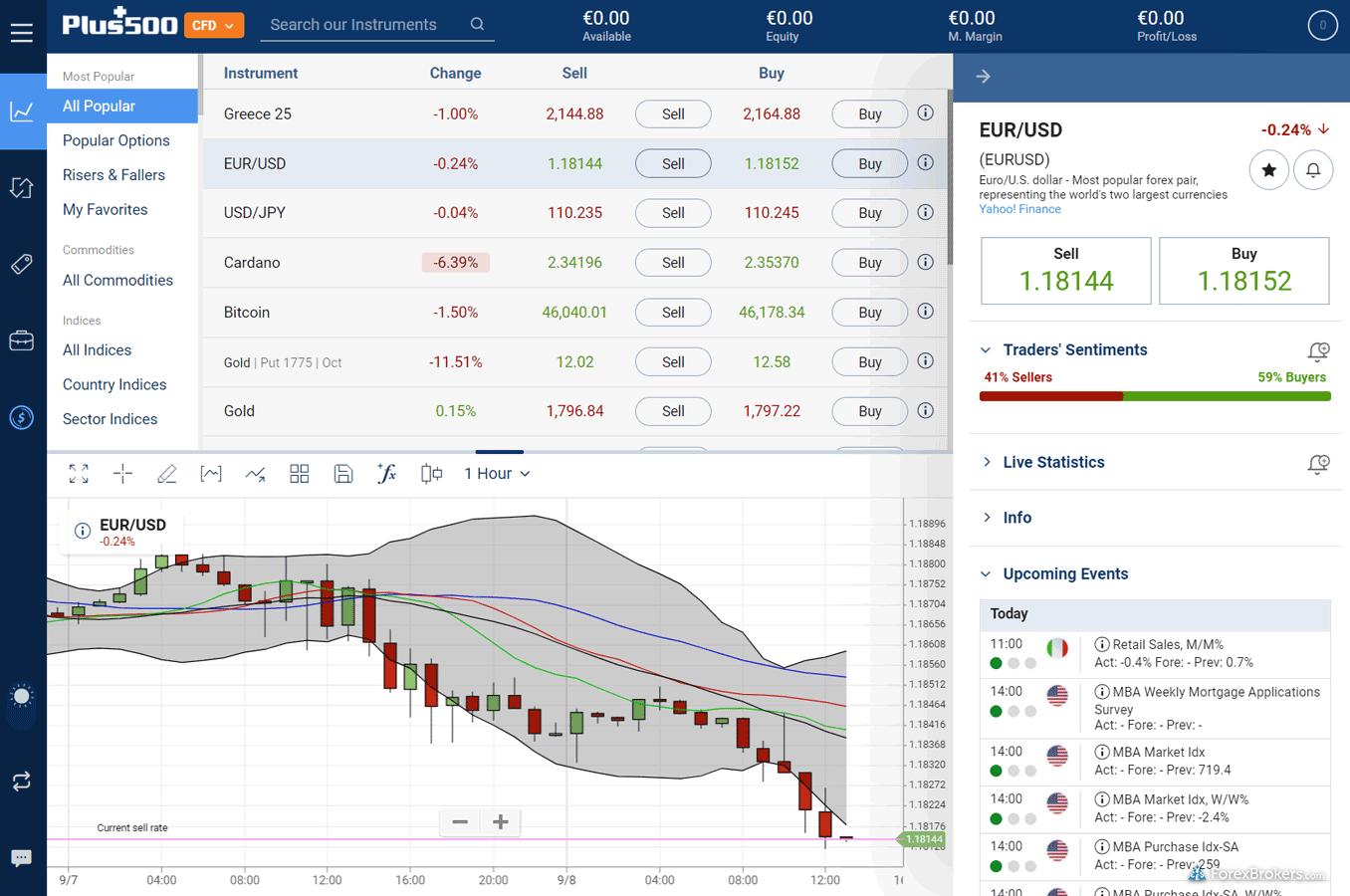

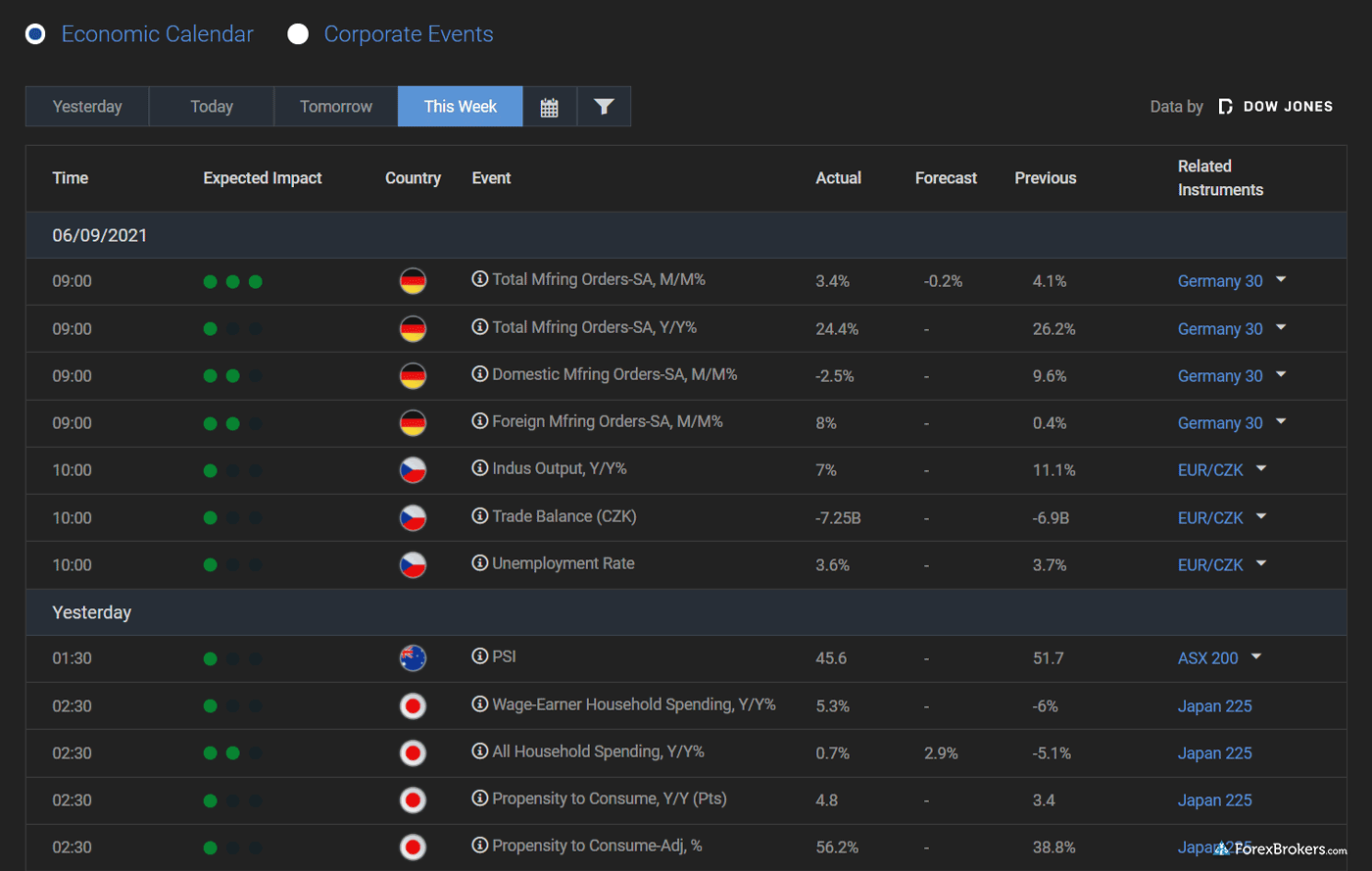

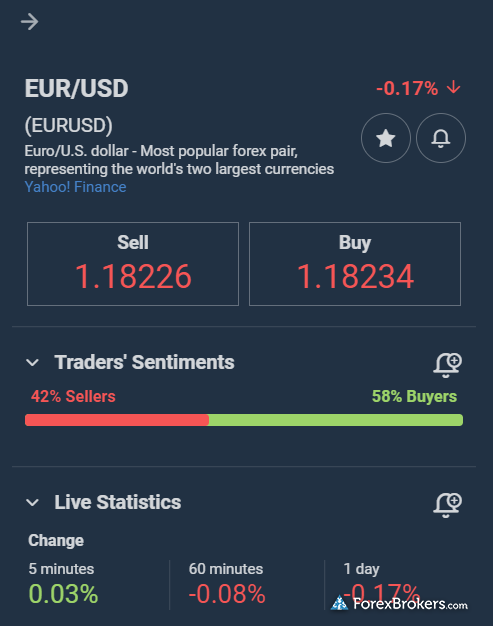

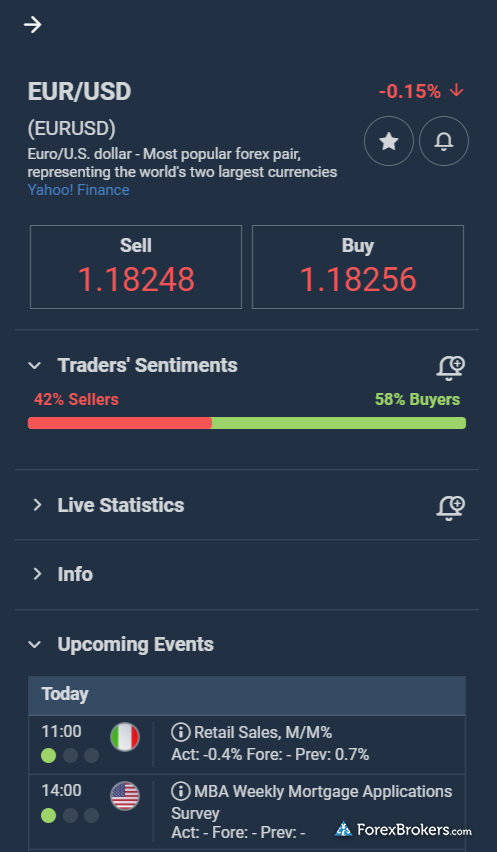

Platforms overview: Plus500’s web trading platform continues to be refined, and features both pre-defined and customizable watchlists, the ability to add alerts on client sentiment data, and an economic calendar that displays related news powered by Dow Jones, and instrument information from Yahoo Finance that appears when viewing a given symbol.

While the desktop version of the app is no longer supported, the web version meets the requirements of a progressive web app and is installable as a Chrome app.

Charting: The Plus500 web platform features 110 indicators, over 20 drawing tools, and 13 different chart types. Though indicators are not automatically saved within the platform, you bypass this issue by instead saving your chart templates. It’s also worth noting that your chart settings won’t sync with the Plus500 mobile app, so they won’t carry over across devices. Overall, I was impressed, and I found Plus500 charts to be a smooth, responsive experience.

Ease of use: For newer traders, Plus500’s browser-based WebTrader is a great starting point before graduating to a more advanced platform. WebTrader is cleanly designed and focuses on simplicity. The few advanced features available within Plus500's flagship platform include trailing stops and guaranteed stop-loss orders (GSLO), which can be helpful risk management tools for casual traders.

MetaTrader, algo trading, copy trading: Plus500 does not support algo trading, social copy trading, or the MetaTrader suite of platforms – though it does provide its own proprietary trading platform.

| Feature |

Plus500 Plus500

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | No |

| Web Platform | Yes |

| Social Trading / Copy Trading | No |

| MetaTrader 4 (MT4) | No |

| MetaTrader 5 (MT5) | No |

| DupliTrade | No |

| ZuluTrade | No |

| Charting - Indicators / Studies (Total) | 110 |

| Charting - Drawing Tools (Total) | 21 |

| Charting - Trade From Chart | No |

| Watchlists - Total Fields | 10 |

Market research

Investment research at Plus500 continues to make progress though still leaves more to be desired, especially when compared to research leaders such as CMC Markets, Saxo, and IG. Plus500 has begun adding to this category with daily articles covering market analysis and commentary as well as webinars (which are only available to Premium users), but still lacks integrated forex news headlines. There are notifications that look like headlines, but those are less frequent than the streaming news headlines offered by the best brokers in this category.

Plus500 has expanded its client sentiment data offering with the launch of advanced sentiment features from Trading Central and FactSet, and Plus500’s promising new +Insights module. This new tool delivers advanced insights into the activity of Plus500 traders and a range of statistics related to its trader base. For example, the Trader's Trends module displays the number of views and level of popularity for a given asset (including its ranking as either a profit-making or loss-making position over a 24-hour period).

Research overview: Research in the Plus500 web trading platform consists of client sentiment data, and an economic calendar powered by Dow Jones with links to Yahoo Finance for each trading symbol. There are no news headlines or technical and fundamental analysis.

Market news and analysis: Plus500 publishes a daily article Sunday through Thursday as part of its News and Market Insights category, which features good quality reporting. That said, I found the content to be mostly focused on fundamental analysis and lacking charts and technical analysis – features and information you’ll find with the best brokers in this category. Plus500 also recently added its Global Trends feature, which uses data powered by Trading Central to summarize news volume and sources along with crowd sentiment data. Global Trends can be found within the +Insights panel on Plus500's web platform.

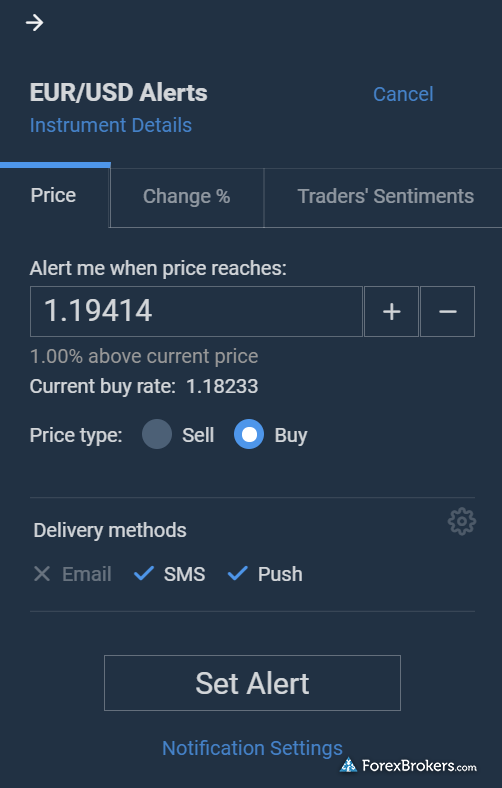

Alerts: Plus500’s alert features allow for both precision and creativity in how you track your data. For example, you can place alerts on percentage changes within client sentiment data. I found this to be an imaginative addition, and a step above the basic price alerts you’d normally find. It would be great to see Plus500 take the next logical step, and offer alerts for indicators.

| Feature |

Plus500 Plus500

|

|---|---|

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | No |

| Autochartist | No |

| Trading Central (Recognia) | Yes |

| Social Sentiment - Currency Pairs | Yes |

Education

Plus500 does not offer an extensive array of educational content for traders when compared to education leaders such as City Index, IG, or CMC Markets. That being said, Plus500 has made significant progress in the education category with the launch of its Trading Academy, which includes video content, written articles, and webinars (webinars are only available to Premium users). Plus500 has also made content from the Corellian Academy available on its YouTube channel, along with the broker’s newly added Trader's Guide series.

Learning center: Plus500 has a Trader’s Guide section where there are a handful of articles and roughly a dozen educational videos. Beyond a few articles and an eBook, there isn’t much else of substance at Plus500 for financial markets education, especially when compared to the best brokers in this category.

Room for improvement: Increasing the range of videos and articles would help Plus500 expand its otherwise light educational offering. Adding interactive courses that feature progress tracking and quizzes would be a logical next step for Plus500 to further enhance its educational content. It’s worth noting that while the videos in the Trader’s Guide series are good, many of them feel like platform tutorials.

| Feature |

Plus500 Plus500

|

|---|---|

| Education (Forex or CFDs) | Yes |

| Client Webinars | Yes |

| Client Webinars (Archived) | Yes |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | Yes |

| Investor Dictionary (Glossary) | No |

Final thoughts

Despite a lack of educational content, Plus500 is a winner for less-experienced traders who desire ease of use and simplicity. A highly trusted broker, Plus500 remains an excellent choice for beginner traders and ranks highly for its ease of use. In our 2024 Annual Awards, Plus500 earned Best in Class honors for our Trust Score, Ease of Use, and Beginners categories.

The integrated economic calendar, enhanced charts, and new +Insights tool have improved the Plus500 web platform. That said, advanced and active traders looking for additional tools and market research will be left wanting more. For a more advanced trading experience, consider IG, and CMC Markets.

With nearly 2,000 CFDs available alongside a low minimum deposit requirement for opening a live account, Plus500 provides new market entrants an easy way to explore the world of online trading.

What is the minimum deposit for Plus500?

The minimum deposit at Plus500 is generally 100 units of currency ($100 or equivalent) depending on your account denomination and the payment method you select from the client dashboard.

For example, if your account balance is in euros, the minimum deposit will be 100 euros if you choose either Skrill, PayPal, or debit/credit cards, whereas a bank transfer (wire) requires a $500 minimum deposit when you fund your Plus500 account.

Is Plus500 good for beginners?

While Plus500 currently has a limited array of educational materials, it remains a good choice for beginners due to its software’s ease-of-use factor. The design simplicity of the Plus500 trading platform makes it easy for a beginner to navigate and learn the software, compared to the complex trading platforms offered by other brokers.

While this is no guarantee that you will succeed, using a trading platform that is less complex is important for beginners that want to avoid a steep learning curve.

Is Plus500 a good broker?

Plus500 is a well-rounded broker that continues to improve its offering for beginners as well as advanced traders, with a growing selection of trading tools and advanced charting on its trading platform suite.

Plus500 is also a trusted broker thanks to its years of operation — dating to 2008 — and numerous regulatory licenses in Tier-1 jurisdictions, including the U.K., EU, Australia, and Singapore. The broker was listed on the London Stock Exchange (ticker symbol LSE: PLUS) in 2013, subjecting itself to reporting requirements, and is today among the largest 250 public companies on the FTSE 250 index.

About Plus500

Founded in 2008, Plus500 is publicly traded on the London Stock Exchange (LSE: PLUS) and is part of the FTSE 250 Index. Plus500 serves online traders through its regulated subsidiaries that hold licenses in major financial hubs, including the United Kingdom, Australia, New Zealand, Israel, and Singapore. In 2019, Plus500 serviced over 430,000 active customer accounts that opened 85 million positions, totaling $1.7 trillion in traded value. As of 2021, Plus500's customer base reached 20 million. For more on the company, see Plus500's Wikipedia page.

Plus500AU Pty Ltd (ACN 153301681), licenced by: ASIC in Australia AFSL #417727. FMA in New Zealand FSP #486026, Authorised Financial Services Provider in South Africa FSP #47546. Plus500UK Ltd is authorized and regulated by the Financial Conduct Authority (FRN 509909). You do not own or have any rights to the underlying assets. Consider if you fall within our Target Market Distribution. Please refer to the Disclosure documents available on the Plus500 website.

ForexBrokers.com 2024 Annual Awards

For the ForexBrokers.com 2024 Annual Awards, brokers were evaluated against ForexBrokers.com’s 8 Primary Categories: Commissions & Fees, Offering of Investments, Platforms & Tools, Mobile Trading Apps, Research, Education, Trust Score, and Overall.

Best in Class honors were awarded to the Top 7 forex brokers in each of the following areas: Beginners, Social Copy Trading, Ease of Use, MetaTrader, Algo Trading, Crypto Trading, and Professional Trading.

For more information, see how we test.

Category awards

Plus500 Plus500

|

Beginners | Ease of Use | Trust Score |

| Rank #1 | |||

| Streak #1 | |||

| Best in Class | |||

| Best in Class Streak | 5 | 6 | 1 |

2024 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Popular Forex Guides

- Best MetaTrader 4 Brokers of 2024

- Best Copy Trading Platforms of 2024

- Best Forex Brokers of 2024

- Best Forex Trading Apps of 2024

- International Forex Brokers Search

- Best Zero Spread Forex Brokers of 2024

- Best TradingView Forex Brokers of 2024

- Compare Forex Brokers

- Best Forex Brokers for Beginners of 2024

More Forex Guides

Popular Forex Broker Reviews

Compare Plus500 Competitors

Select one or more of these brokers to compare against Plus500.

Show all