XM Group Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.33% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

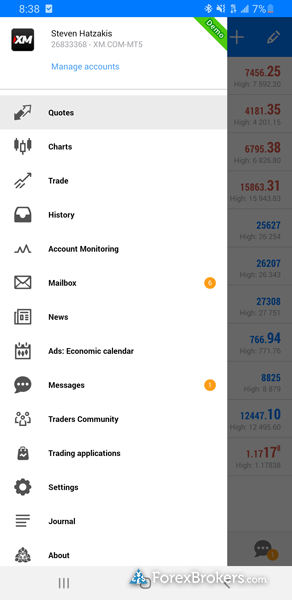

XM Group is a MetaTrader-only broker that offers an outstanding selection of high-quality educational content and market research.

That said, XM falls behind with its limited pricing, range of markets, and platform offering — none of which can compete with the best brokers in this space.

-

Minimum Deposit:

$5 -

Trust Score:

88 -

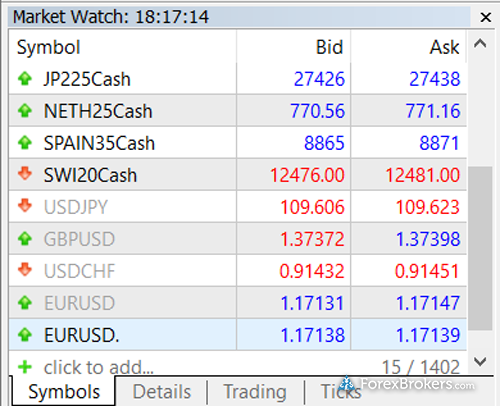

Tradeable Symbols (Total):

1429

Can I open an account with this broker?

Yes, based on your detected country of HK, you can open an account with this broker.

XM pros & cons

Pros

- Offers 1,429 CFDs, including 55 forex pairs.

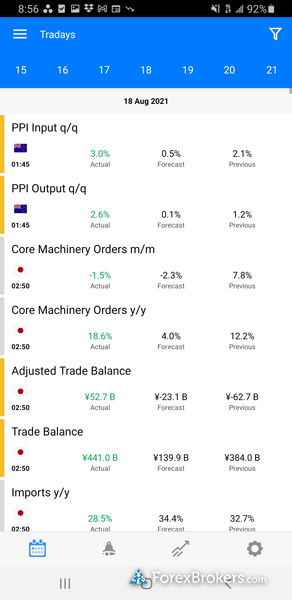

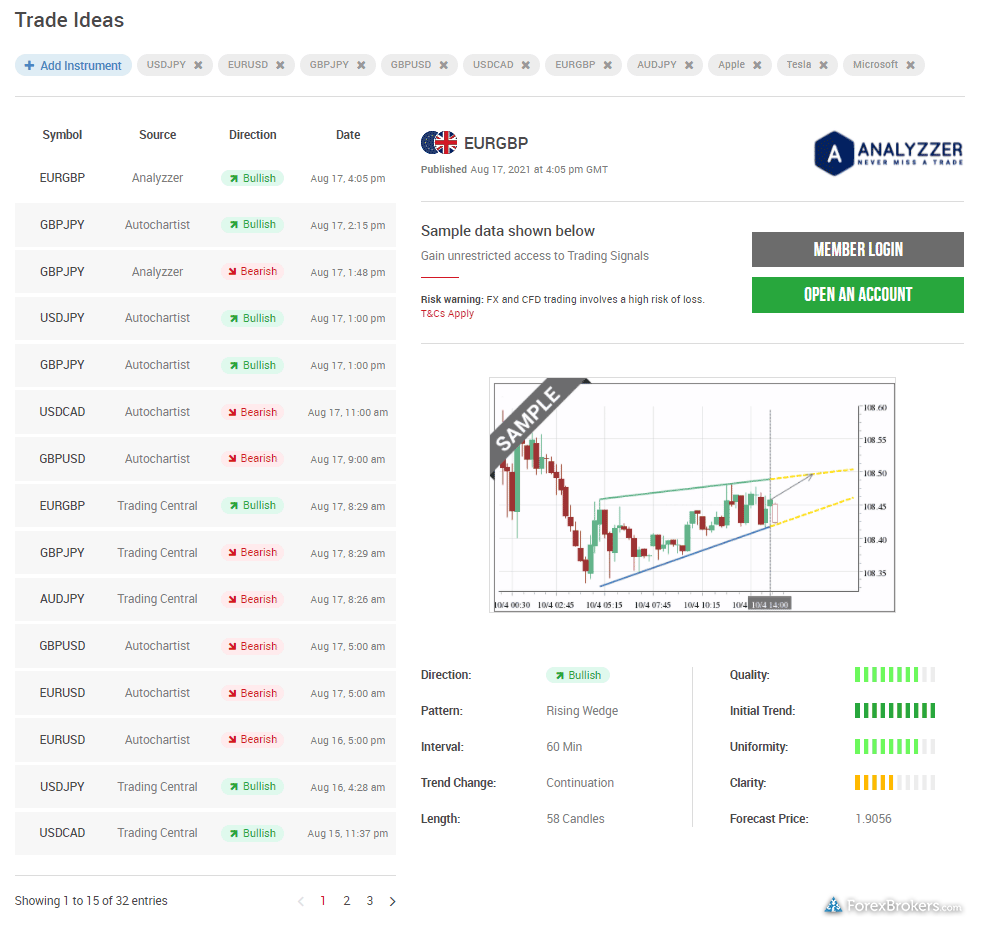

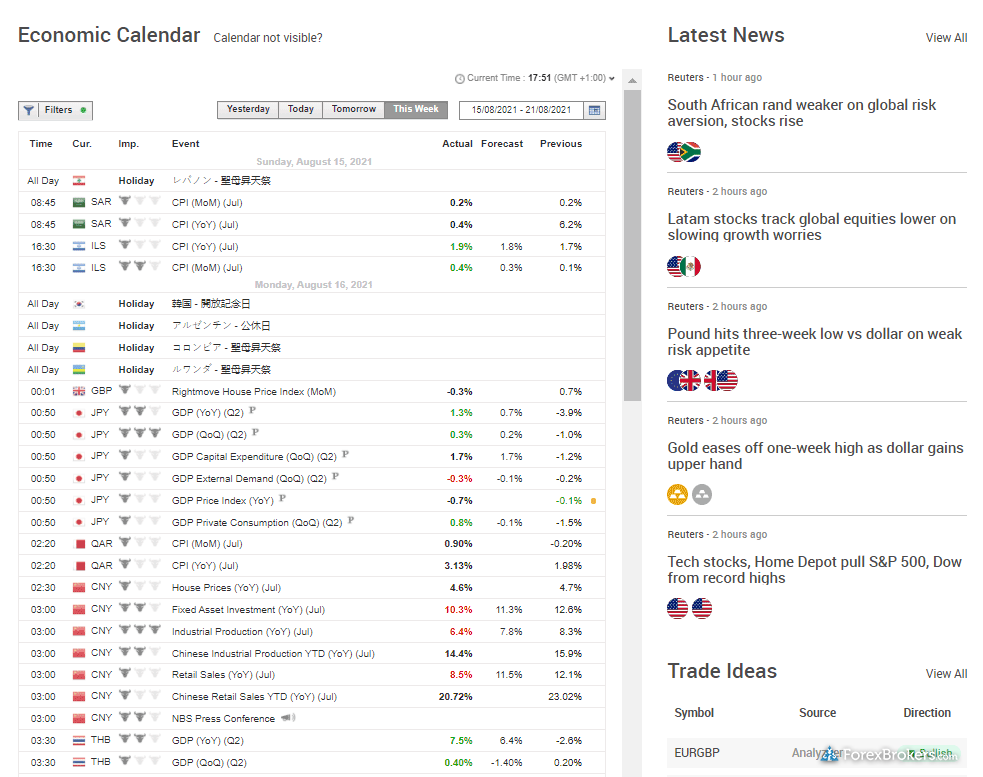

- Trading Central's tools and content complement XM Group's in-house research offering.

- The XM Shares account requires a $10,000 deposit if you want exchange-traded securities (non-CFD).

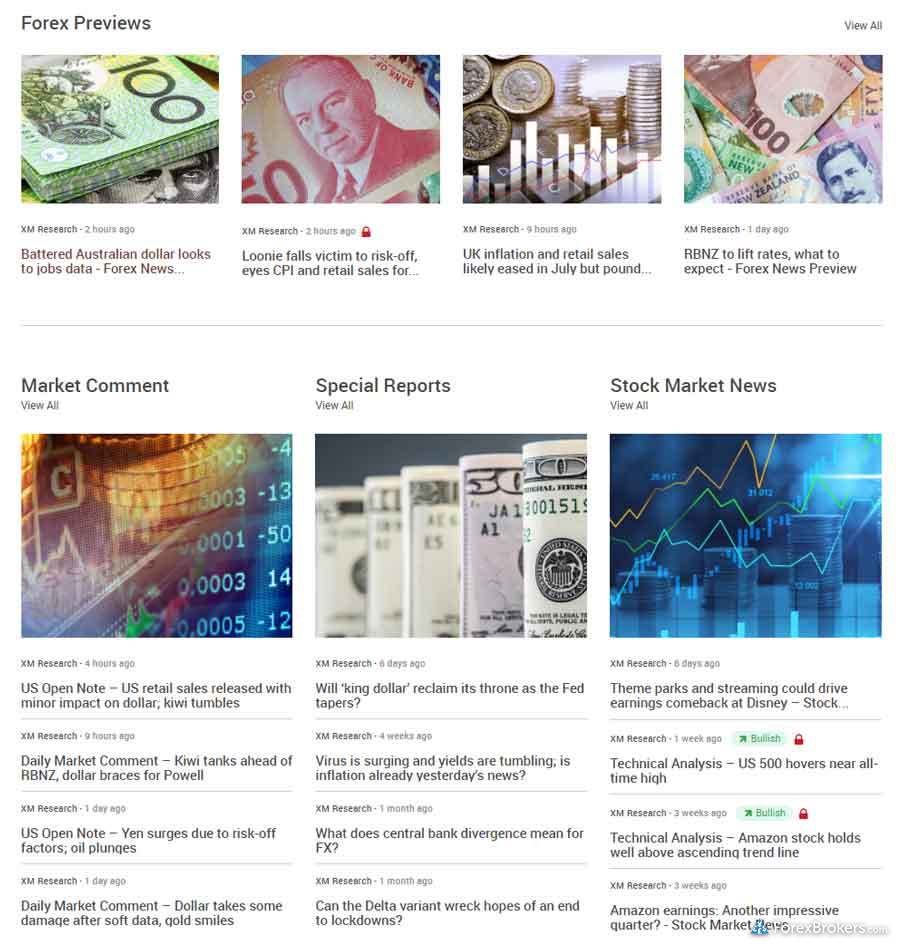

- XM's excellent research content, including daily videos, podcasts, and organized articles, helped it earn Best in Class honors for Research in our 2024 Annual Awards.

- XM Group's in-house broadcasting features TV-quality video content and live recordings.

- Comprehensive selection of educational webinars, articles, and Tradepedia courses.

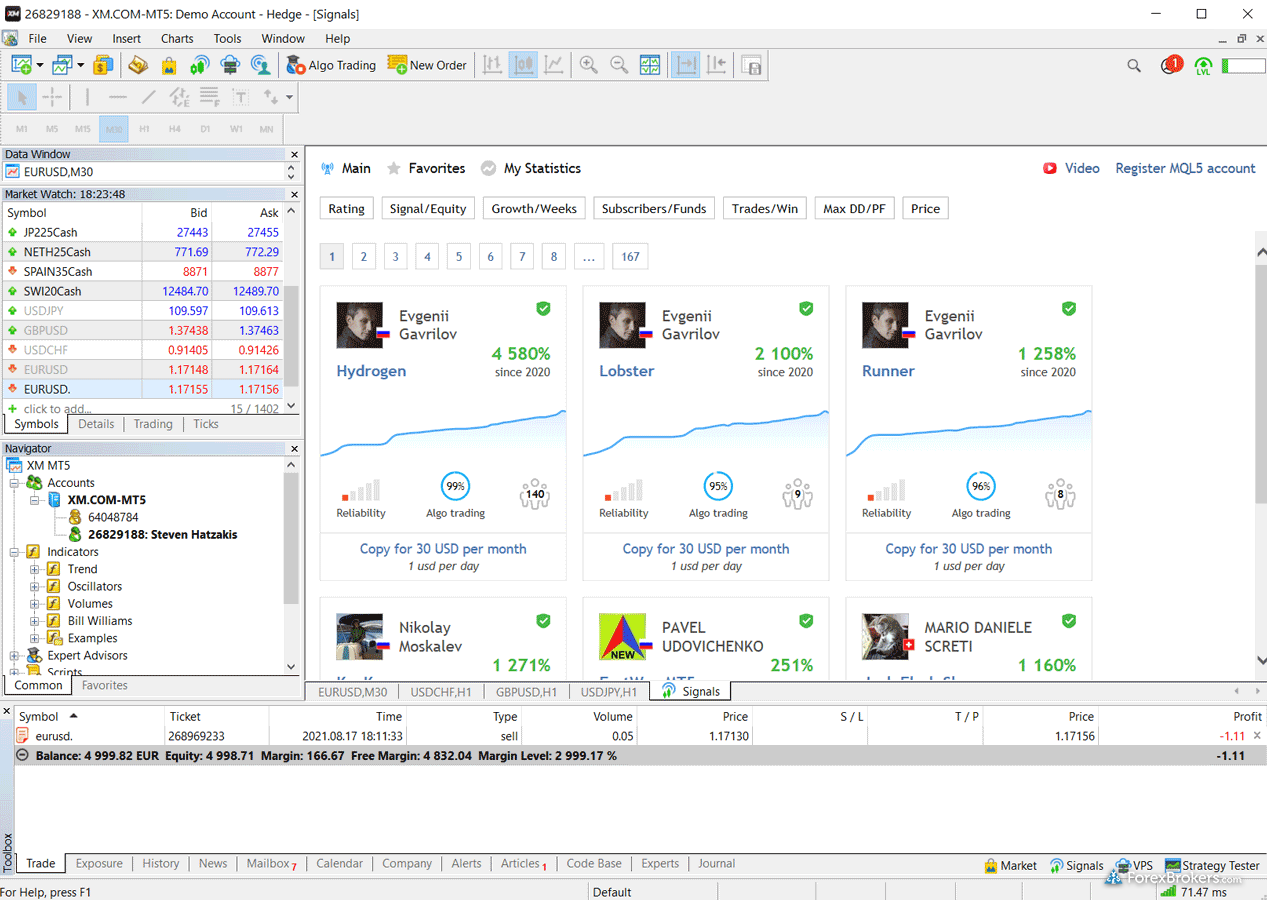

- Offers the full MetaTrader suite — which features signals market for copy trading, along with Analyzzer algorithm.

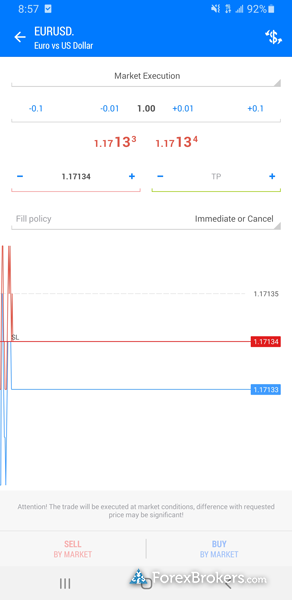

- Offers guaranteed fills for market, stop-loss, and limit orders on trades up to 50 lots (5 million units of currency).

- XM has serviced over 10 million clients since its inception, executing over 2.4 billion trades since 2009.

Cons

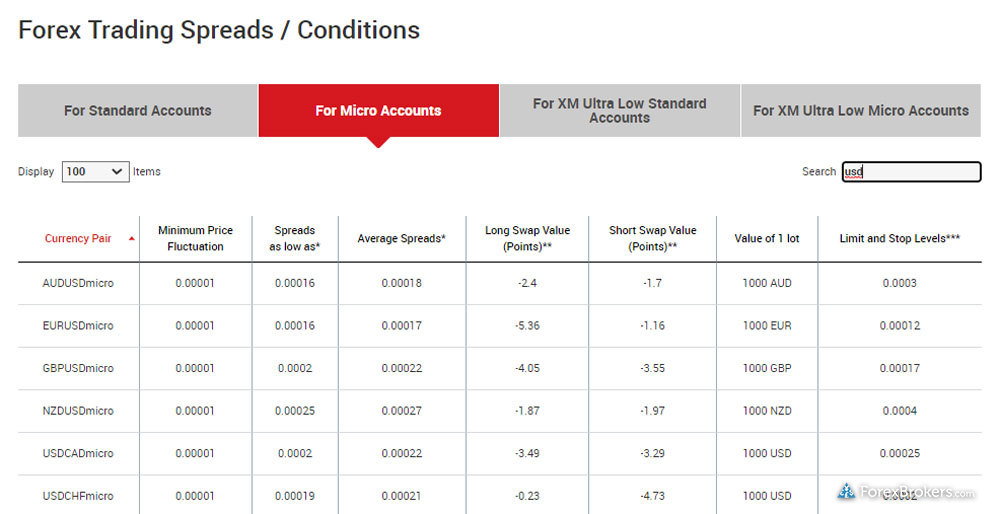

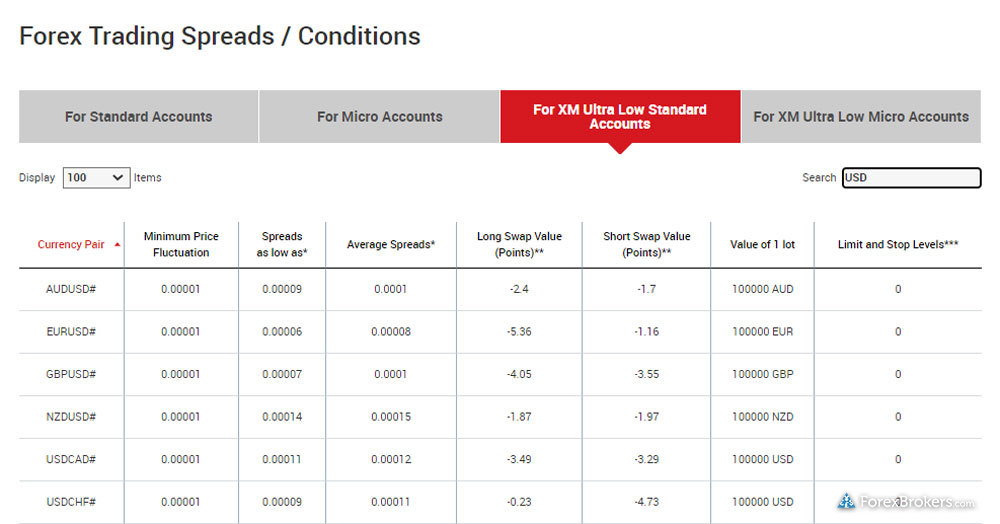

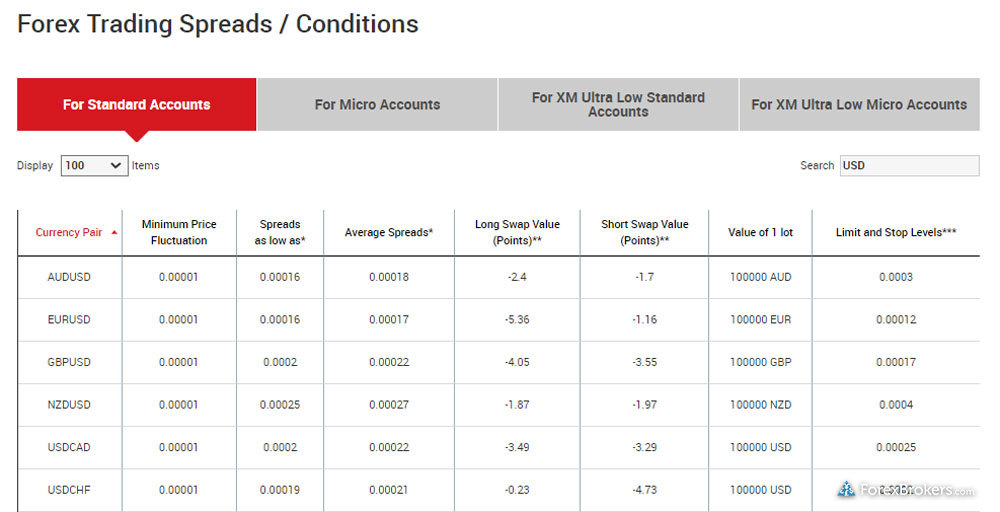

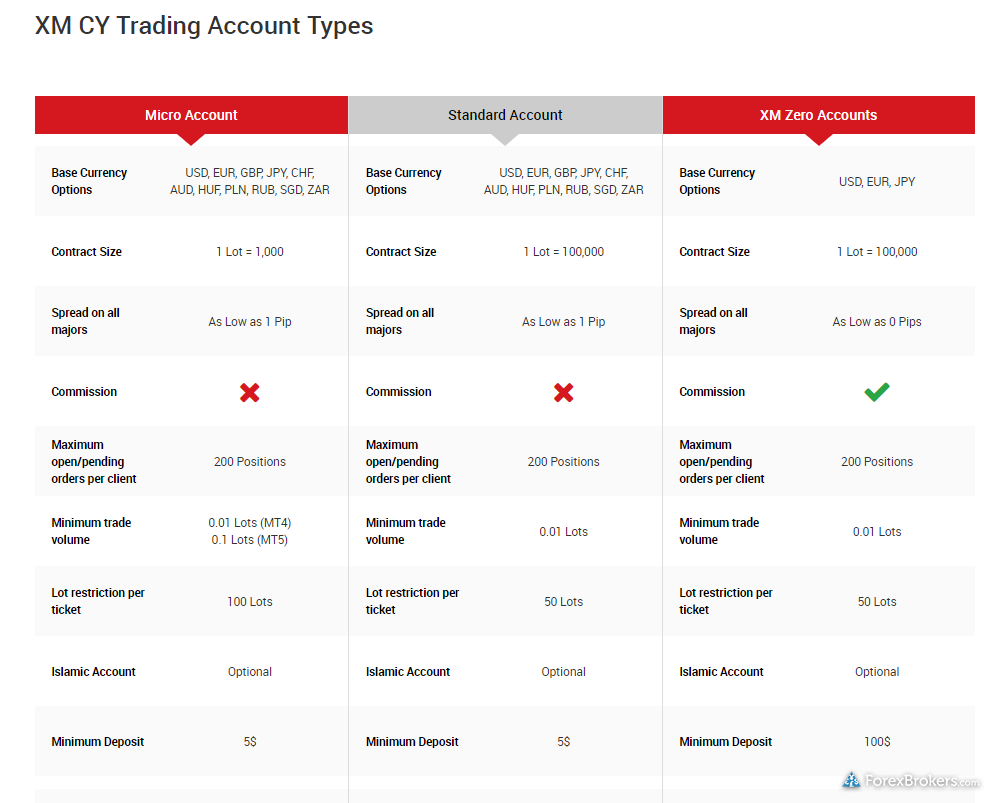

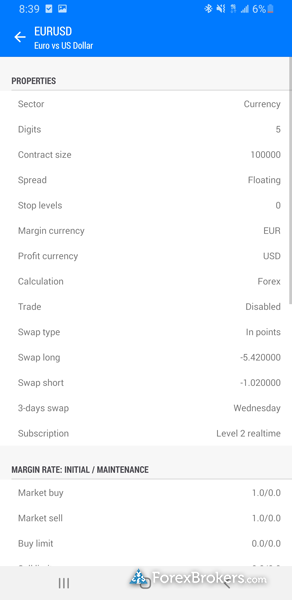

- Standard account spreads are expensive compared to some of the best forex brokers.

- Average spreads are not published for the commission-based XM Zero account.

- Though MetaTrader is available, XM Group doesn't offer any proprietary trading platforms.

Overall Summary

| Feature |

XM Group XM Group

|

|---|---|

| Overall Rating |

|

| Trust Score | 88 |

| Offering of Investments |

|

| Commissions & Fees |

|

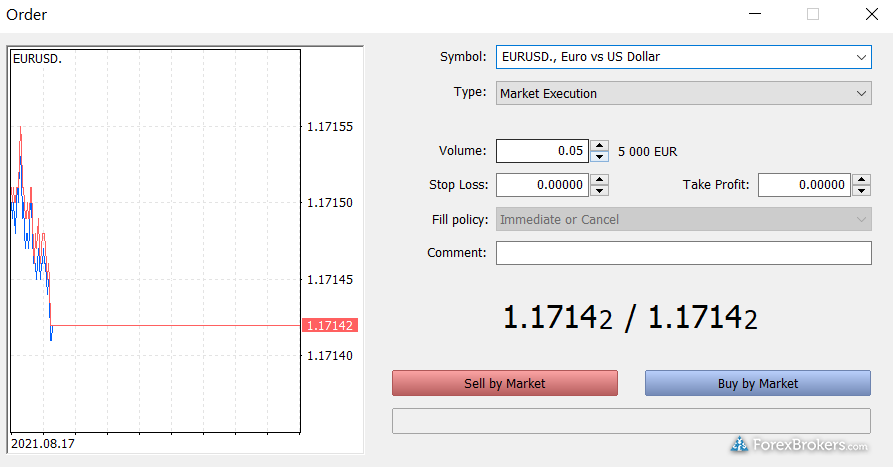

| Platform & Tools |

|

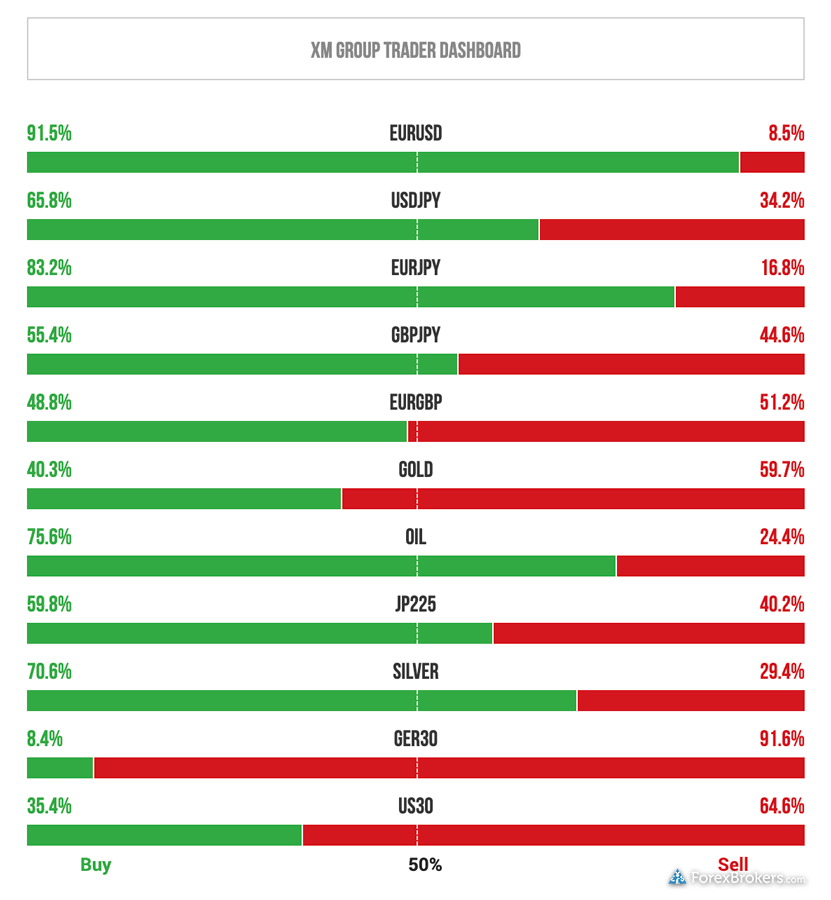

| Research |

|

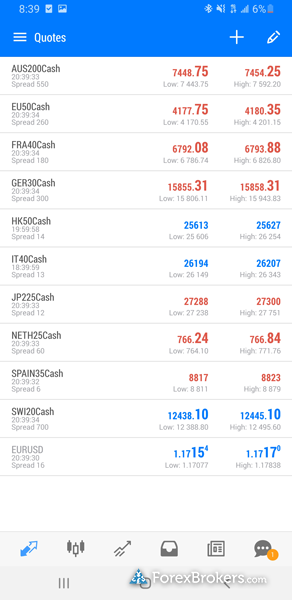

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Is XM Group safe?

XM Group is considered Trusted, with an overall Trust Score of 88 out of 99. XM Group is not publicly traded, does not operate a bank, and is authorised by four Tier-1 regulators (Highly Trusted), one Tier-2 regulator (Trusted), zero Tier-3 regulators (Average Risk), and one Tier-4 regulator (High Risk). XM Group is authorised by the following Tier-1 regulators: Australian Securities & Investment Commission (ASIC), Financial Conduct Authority (FCA), Commodity Futures Trading Commission (CFTC), and regulated in the European Union via the MiFID passporting system. Learn more about Trust Score or see where the different XM entities are regulated.

| Feature |

XM Group XM Group

|

|---|---|

| Year Founded | 2009 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 4 |

| Tier-2 Licenses | 1 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 1 |

ForexBrokers.com 2024 Annual Awards

For the ForexBrokers.com 2024 Annual Awards, brokers were evaluated against ForexBrokers.com’s 8 Primary Categories: Commissions & Fees, Offering of Investments, Platforms & Tools, Mobile Trading Apps, Research, Education, Trust Score, and Overall.

Best in Class honors were awarded to the Top 7 forex brokers in each of the following areas: Beginners, Social Copy Trading, Ease of Use, MetaTrader, Algo Trading, Crypto Trading, and Professional Trading.

For more information, see how we test.

Category awards

XM Group XM Group

|

Research |

| Rank #1 | |

| Streak #1 | |

| Best in Class | |

| Best in Class Streak | 1 |

2024 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Article Resources

Popular Forex Guides

- Best Forex Brokers of 2024

- Compare Forex Brokers

- Best MetaTrader 4 Brokers of 2024

- Best Copy Trading Platforms of 2024

- Best Forex Brokers for Beginners of 2024

- Best Zero Spread Forex Brokers of 2024

- Best Forex Trading Apps of 2024

- International Forex Brokers Search

- Best TradingView Forex Brokers of 2024

More Forex Guides

Popular Forex Broker Reviews

Compare XM Group Competitors

Select one or more of these brokers to compare against XM Group.

Show all