Best Forex Brokers in Canada for 2024

ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Trading forex (currencies) in international markets is popular among residents in Canada. Before any forex broker in Canada can accept forex and CFD traders as clients, they must become authorised by Canada's regulatory body: the Canadian Investment Regulatory Organization (CIRO).

Founded in June 2023, the CIRO consolidates and carries on the functions of the Investment Industry Regulatory Organization (IIROC) and Mutual Fund Dealers Association (MFDA). We also recommend Canadian residents follow IIROC on Twitter, @IIROCinfo and @FINTRAC_Canada.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Best Canadian Forex Brokers for 2024

To find the best forex brokers in Canada, we created a list of all firms authorised by Canada's new regulator, the CIRO, then ranked the brokers by their Overall ranking. Here is our list of the top Canadian forex brokers.

-

Interactive Brokers

- Great overall, best for professionals

- CMC Markets - Excellent overall, best platform technology

- FOREX.com - Excellent all-round offering

-

AvaTrade

- Great for beginners and copy trading

- OANDA - Trusted broker, great research

-

FXCM

- Excellent trading platforms and tools

Best Forex Brokers Canada Comparison

Compare Canada authorised forex and CFDs brokers side by side using the forex broker comparison tool or the summary table below. This broker list is sorted by my Overall rankings of the top forex brokers.

| Company | Accepts CA Residents | Regulated by the CIRO | Average Spread EUR/USD - Standard | Minimum Deposit | Overall Rating | Visit Site |

Interactive Brokers Interactive Brokers

|

0.63 | $0 |

|

Visit Site

|

||

CMC Markets CMC Markets

|

0.61 | $0 |

|

|||

FOREX.com FOREX.com

|

1.4 | $100 |

|

|||

AvaTrade AvaTrade

|

0.92 | $100 |

|

Visit Site

|

||

OANDA OANDA

|

1.57 | $0 |

|

|||

FXCM FXCM

|

0.74 | Starts from $50 |

|

Visit Site

|

||

Saxo Saxo

|

1.1 | $0 |

|

Visit Site

|

||

FP Markets FP Markets

|

1.1 | $100 AUD |

|

Visit Site

|

||

Eightcap Eightcap

|

1.0 | $100 |

|

Visit Site

|

||

MultiBank MultiBank

|

N/A | $50 |

|

|||

Spreadex Spreadex

|

0.81 | $0 |

|

Visit Site

|

||

IFC Markets IFC Markets

|

1.44 | $1 |

|

Interested in stock trading? Read our guide to the best online brokers in Canada.

Why regulation is important

Choosing a well-regulated forex broker is important for avoiding forex scams. Check out my popular educational series that teaches you how to identify common forex scams and provides helpful information about what to do if you've been scammed. For crypto traders, I explain how you can spot common crypto scams.

How to Verify IIROC Regulation

To identify if a forex broker is regulated as Dealer Member by IIROC, the first step is to identify the registered name from the disclosure text at the bottom of the broker's homepage. For example, here's the key disclosure text from OANDA's website:

OANDA (Canada) Corporation ULC is regulated by the Investment Industry Regulatory Organization of Canada (IIROC), which includes IIROC's online advisor check database (IIROC AdvisorReport), and customer accounts are protected by the Canadian Investor Protection Fund within specified limits.

Next, look up the firm name on the Dealer Member section or AdvisorReport module of the IIROC website. Here is the official page for OANDA and results are also available on the CSA's website which shows each province that the broker can operate in Canada.

About CIRO (previously known as IIROC)

As of June 2023, CIRO is the new regulator in Canada, following a rebranding and reorganization from IIROC. IIROC was a national self-regulatory organization (SRO) that was established as a non-profit corporation on June 1st, 2008 as part of the consolidation of the Investment Dealers Association of Canada (IDA) and the Market Regulation Services Inc. (RS). CIRO is recognized by the Canadian Securities Administrators (CSA) which includes all Canadian provinces including the following regulatory bodies in Canada:

- British Columbia Securities Commission

- Alberta Securities Commission

- Financial and Consumer Affairs Authority

- Manitoba Securities Commission

- Ontario Securities Commission

- Autorité des marchés financiers

- Financial and Consumer Services Commission

- Nova Scotia Securities Commission

- Prince Edward Island

- Government of Yukon Securities Registrar

- Newfoundland Securities Commission

- Northwest Territories Securities Commission

- Office of the Superintendent of Securities (Nunavut)

For a historical breakdown, here's a link to IIROC's webpage on Wikipedia.

Is forex legal in Canada?

Yes, forex trading is legal in Canada. It’s always recommended to choose a broker that is well-regulated (preferably locally) and highly trusted. Forex trading in Canada is regulated provincially; each Canadian province is regulated by its own respective regulatory authority. It’s worth noting that regulators in certain jurisdictions – such as the British Columbia Securities Commission– regulate more strictly than others.

Do you pay tax on forex trading in Canada?

With the important caveat that we cannot provide tax advice, it should be said that residents of Canada must report all income to the Canadian Government – including all capital gains (or losses) over $200 that come from trading forex.

According to the Canada Revenue Agency (CRA), “Foreign exchange gains or losses from capital transactions of foreign currencies (that is money) are considered to be capital gains or losses. However, you only have to report the amount of your net gain or loss for the year that is more than $200.”

How your tax professional may elect to apply any such gains or losses you have from trading in the financial market may vary depending on your unique circumstances. It may be best for Canadian citizens or residents to consult a tax professional to determine any potential Canadian tax obligations. If you are not a Canadian resident or citizen, you must report your global income from forex trading in the country of your permanent residence.

How do I start trading forex in Canada?

To open a forex trading account in Canada, it’s important to start by selecting a forex broker that is well-regulated and properly licensed in Canada by the Canadian Investment Regulatory Organization (CIRO). Once you’ve chosen a forex broker, you can follow this step-by-step guide to getting started with forex trading in Canada:

- Complete the live account application process with your forex broker and read through the applicable terms and conditions.

- Next, you’ll need to fund your new brokerage account. Choose your preferred deposit method, and make sure you are starting with an amount you can afford to risk.

- Check out a demo (or, virtual trading) account to familiarize yourself with the broker’s trading platform. Get comfortable with the broker’s website and product offerings, and consume any available educational content.

- Put together a trading plan. Even the best traders can lose money, but the key to long-term success lies in sticking to a trading plan that keeps your average losses low (relative to your average profits).

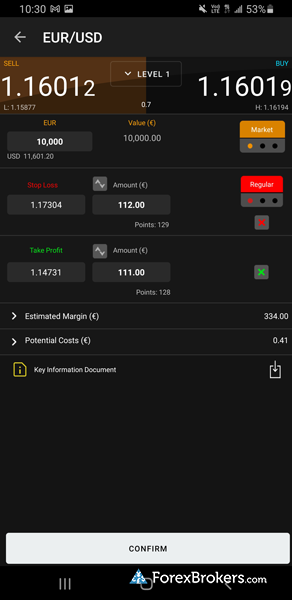

- Now, you can enter the forex market. Choose your desired trade size, and open a long position by clicking buy on a given currency, or open a short position by clicking sell.

How to start forex trading

Learn more about getting started as a forex trader by checking out my in-depth Forex 101 educational series. I go over everything you need to know to start out as a forex trader; you'll learn about forex and currency trading, leverage in the forex market, how to calculate pips, and more.

Who is the best forex broker in Canada?

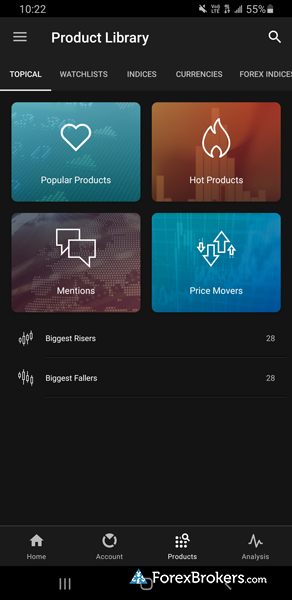

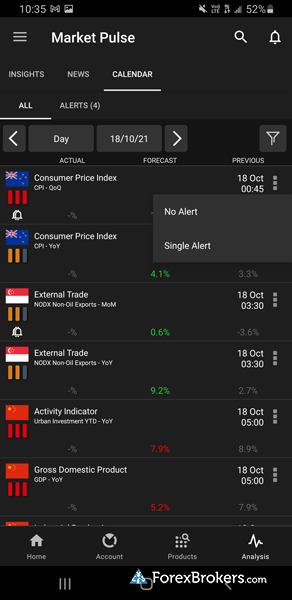

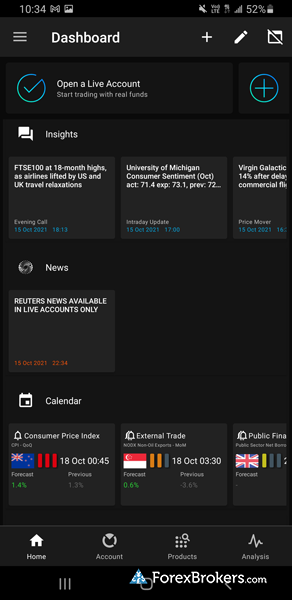

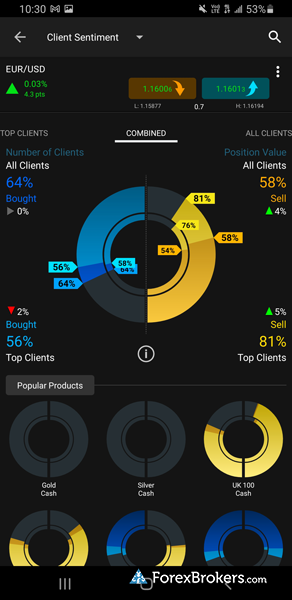

CMC Markets is our number one rated forex broker in Canada in 2024. CMC Markets is a highly trusted brand that is publicly traded (LON: CMCX) and regulated by the Canadian Investment Regulatory Organization (CIRO), CMC Markets offers an extensive range of 10,000+ tradeable investment products on its Next Generation web trading platform and mobile app.

What is the best forex trading app in Canada?

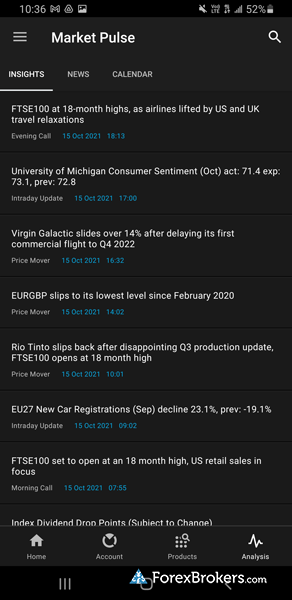

The best forex trading app available to forex traders in Canada is CMC Markets’ mobile app. CMC Markets delivers a terrific overall mobile app experience. Featuring a clean, intuitive design, CMC Markets' mobile app delivers powerful charts, multiple research tools, integrated educational content, and much more. Our researchers have rated CMC Markets’ mobile forex trading app highly in our full-length review of CMC Markets.

Check out our walkthrough of CMC Markets' highly rated mobile app:

Check out a gallery of screenshots from CMC Markets' mobile trading app, taken by our research team during our product testing.

What is the best forex broker for beginners in Canada?

AvaTrade is my pick for the best forex broker in Canada for beginner forex traders in 2024. The quality (and quantity) of educational content provided by AvaTrade helped it win Best in Class honors for our Beginners and Education categories in our 2024 Annual Awards. AvaTrade offers over 100 educational articles as well as a wide assortment of videos to help beginners learn the ropes of forex trading. Well over 100 lessons are available, accompanied by dozens of quizzes for beginners to test their forex trading knowledge. Third-party educational content from award-winning providers, such as Trading Central, is available to AvaTrade clients. Simply put, AvaTrade delivers a high-quality experience for beginner forex traders.

Article Resources

- Canadian Investment Regulatory Organization (CIRO)

- Investment Industry Regulatory Organization

- New Self-Regulatory Organization (New SRO)

- IIROC Wikipedia

Compare Canada Brokers

Popular Forex Guides

- Best Forex Brokers of 2024

- Best TradingView Forex Brokers of 2024

- Best Zero Spread Forex Brokers of 2024

- Best Forex Trading Apps of 2024

- Best Copy Trading Platforms of 2024

- Best MetaTrader 4 Brokers of 2024

- Compare Forex Brokers

- Best Forex Brokers for Beginners of 2024

- International Forex Brokers Search

More Forex Guides

Find the best forex brokers in The Americas

- Best Forex Brokers in Brazil for 2024

- Best Forex Brokers in Canada for 2024

- Best US Forex Brokers of 2024

Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team, led by Steven Hatazkis, conducts thorough testing on a wide range of features, products, and services. We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables. Our research team collects and validates thousands of data points each year.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s regulatory status and number of held regulatory licenses.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser. Our Desktop PCs run Windows 11, and we use MacBook Pro laptops running the latest version of macOS to test trading on the go.

We also test on mobile devices; for Apple, we test using the iPhone XS running iOS 16, and for Android we use the Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra devices running Android OS 13.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.