TopFX Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

TopFX offers the MetaTrader and cTrader platform suites, and grants access to a medium range of CFD markets and forex pairs. However, TopFX struggles to compete with the best brokers in several categories, including market research and education.

-

Minimum Deposit:

Depends on payment method -

Trust Score:

67 -

Tradeable Symbols (Total):

655

Can I open an account with this broker?

Use our country selector tool to view available brokers in your country.

TopFX pros & cons

Pros

- MetaTrader 4 and cTrader are both available.

- Autochartist integration is available within the cTrader platform.

Cons

- No published average spread data for assessing trading costs.

- Lacks useful market research.

- MetaTrader 5 is not offered.

- Educational content is severely limited.

ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Overall summary

| Feature |

TopFX TopFX

|

|---|---|

| Overall Rating |

|

| Trust Score | 67 |

| Offering of Investments |

|

| Commissions & Fees |

|

| Platform & Tools |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

Compare TopFX with the best forex brokers in the industry

Want to see how TopFX stacks up against the competition? Click here to use our interactive comparison tool and compare TopFX with dozens of top forex brokers.

Is TopFX safe?

TopFX is considered High Risk, with an overall Trust Score of 67 out of 99. TopFX is not publicly traded and does not operate a bank. TopFX is authorised by one Tier-1 regulator (Highly Trusted), zero Tier-2 regulators (Trusted), zero Tier-3 regulators (Average Risk), one Tier-4 regulator (High Risk). TopFX is authorised by the following Tier-1 regulators: Regulated in the European Union via the MiFID passporting system. Learn more about Trust Score.

| Feature |

TopFX TopFX

|

|---|---|

| Year Founded | 2010 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 1 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 1 |

Offering of investments

TopFX offers 548 CFDs across a variety of popular asset classes that includes equities, ETFs, commodities, metals, and forex.

Cryptocurrency: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents.

| Feature |

TopFX TopFX

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 655 |

| Forex Pairs (Total) | 60 |

| U.S. Stock Trading (Non CFD) | No |

| Int'l Stock Trading (Non CFD) | No |

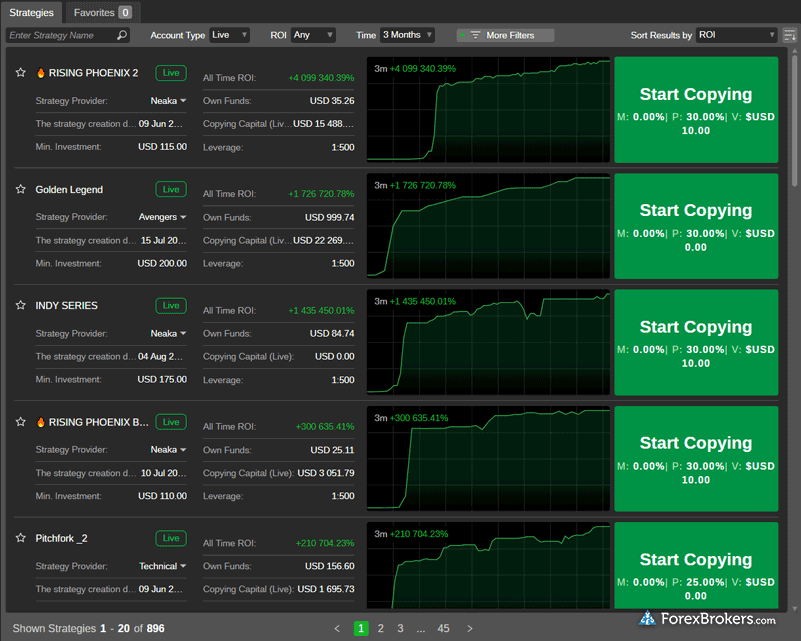

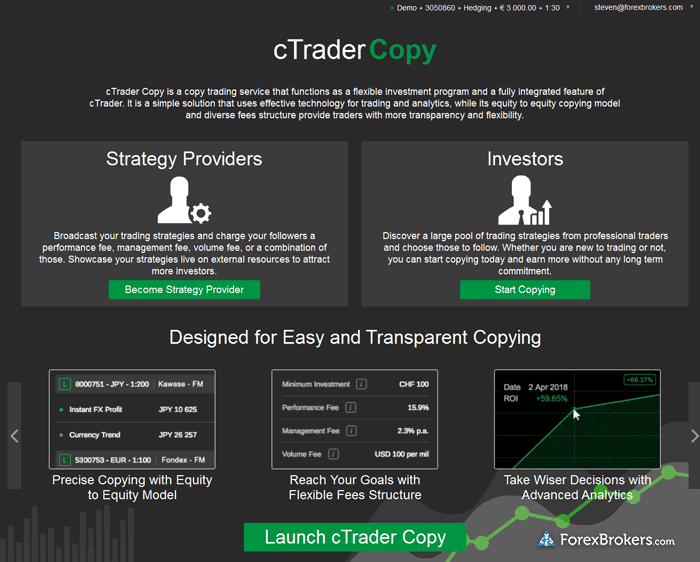

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (Derivative) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). |

Commissions and fees

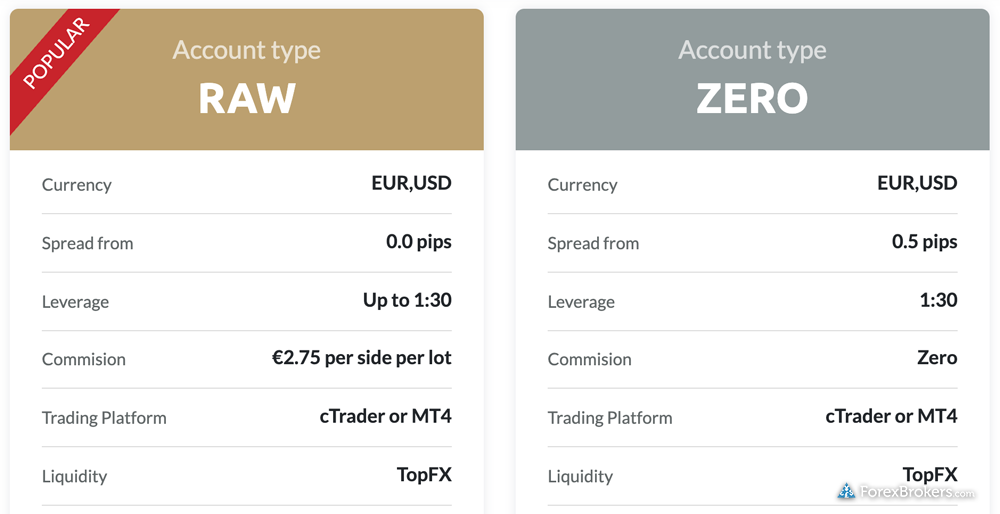

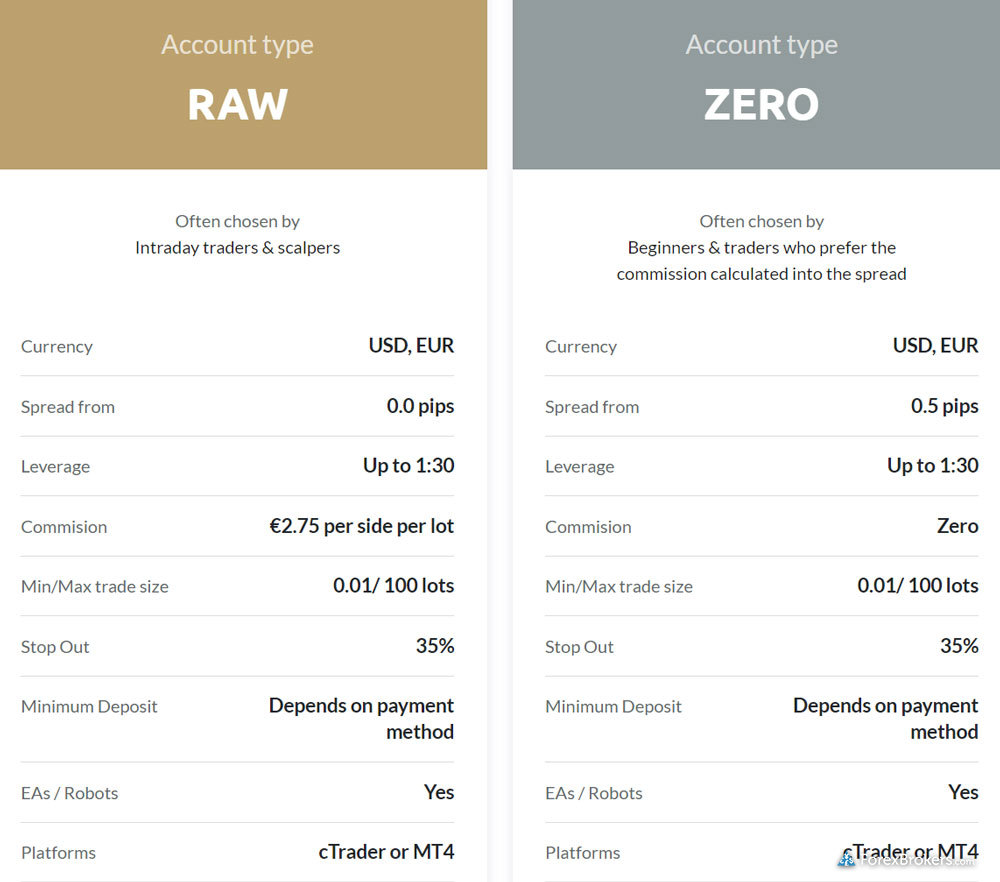

TopFX offers two account types – both of which are available on MetaTrader and cTrader. There’s the spread-only ZERO account, and the commission-based RAW account. The RAW account charges a commission of 2.75 EUR per side (5.50 per round turn standard lot). The minimum deposit depends on your chosen payment method. Keep in mind: there are no average spreads available to assess the true cost of trading with TopFX.

| Feature |

TopFX TopFX

|

|---|---|

| Minimum Deposit | Depends on payment method |

| Average Spread EUR/USD - Standard | N/A |

| All-in Cost EUR/USD - Active | N/A |

| Active Trader or VIP Discounts | No |

| ACH or SEPA Transfers | No |

| PayPal (Deposit/Withdraw) | Yes |

| Skrill (Deposit/Withdraw) | Yes |

| Visa/Mastercard (Credit/Debit) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

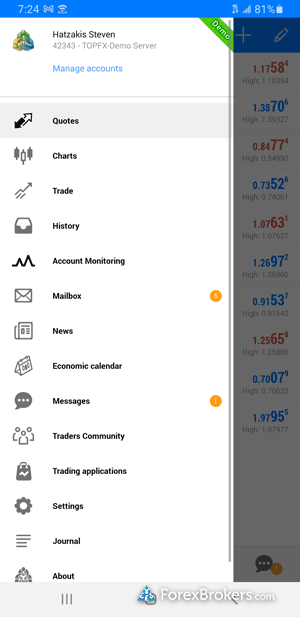

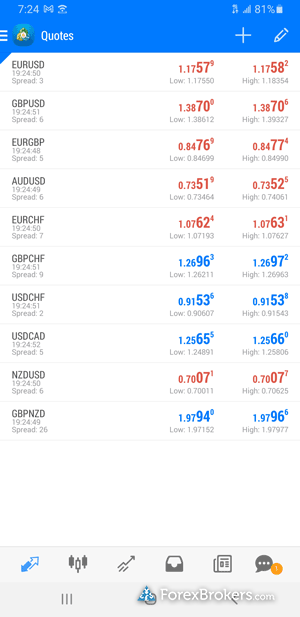

Mobile trading apps

With no proprietary mobile app available, TopFX trails behind industry leaders such as IG and Saxo. For our top picks among trading apps, read our guide to Best Forex Trading Apps.

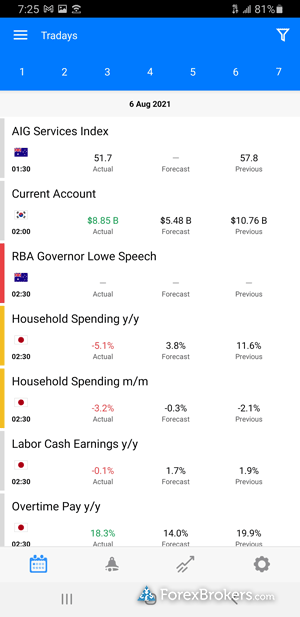

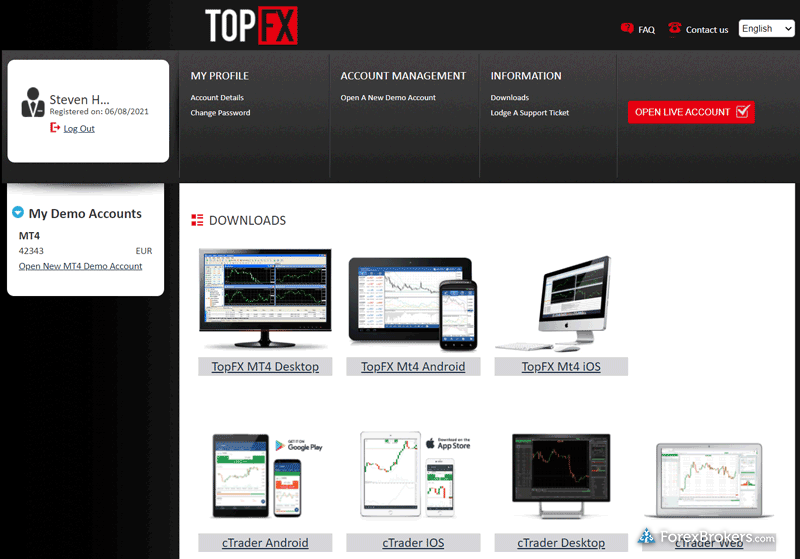

Apps overview: TopFX offers two mobile trading apps: cTrader and MetaTrader 4 (MT4). iOS and Android versions of both apps are available respectively from the Apple App Store and Google Play store.

| Feature |

TopFX TopFX

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts - Basic Fields | Yes |

| Watchlists - Total Fields | 7 |

| Watchlist Syncing | No |

| Charting - Indicators / Studies (Total) | 30 |

| Charting - Drawing Tools (Total) | 15 |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Charting - Multiple Time Frames | Yes |

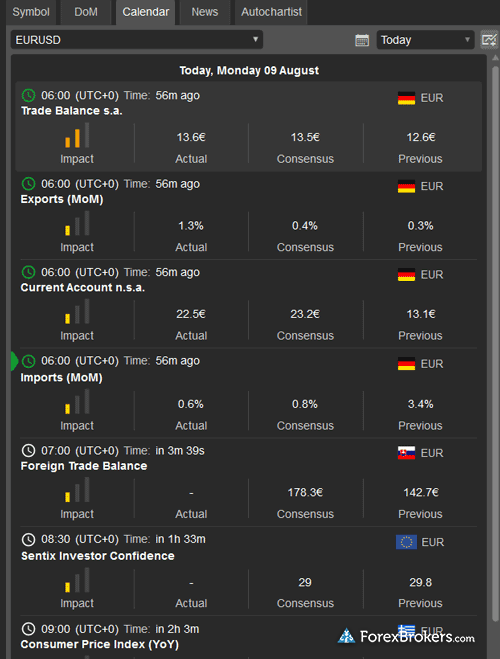

| Mobile Economic Calendar | Yes |

Other trading platforms

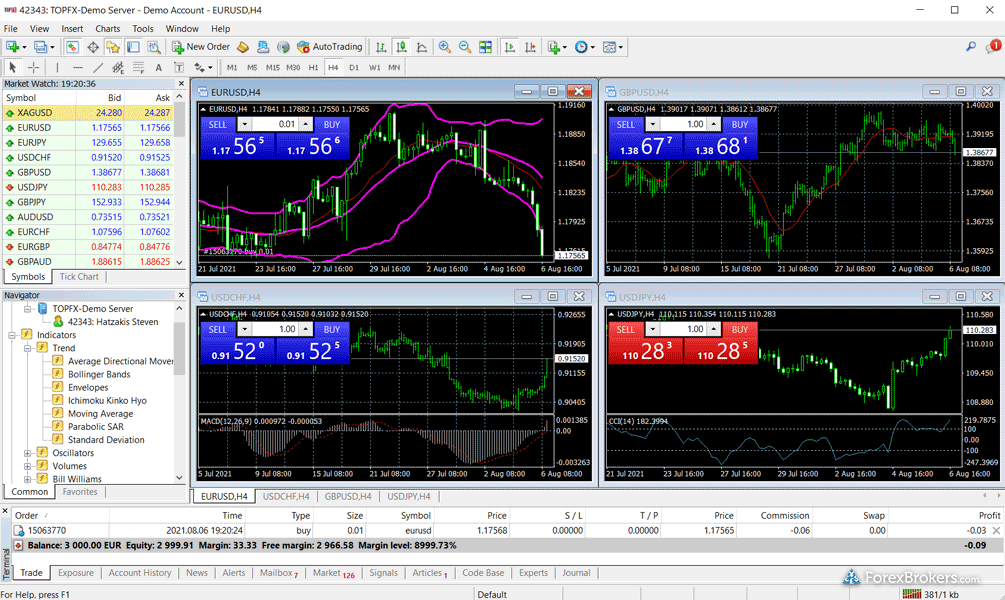

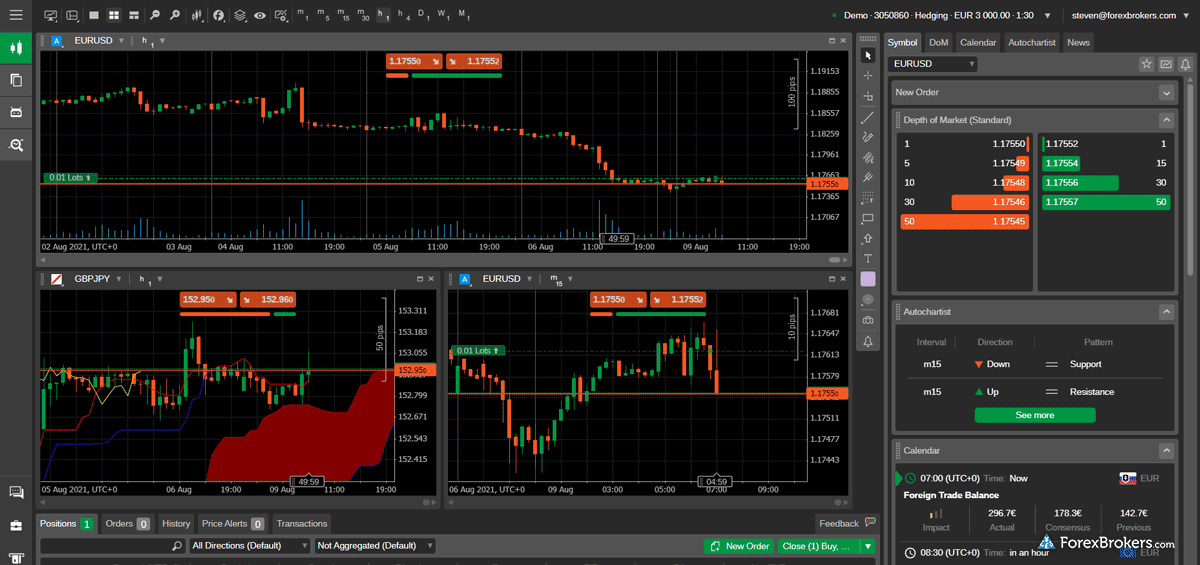

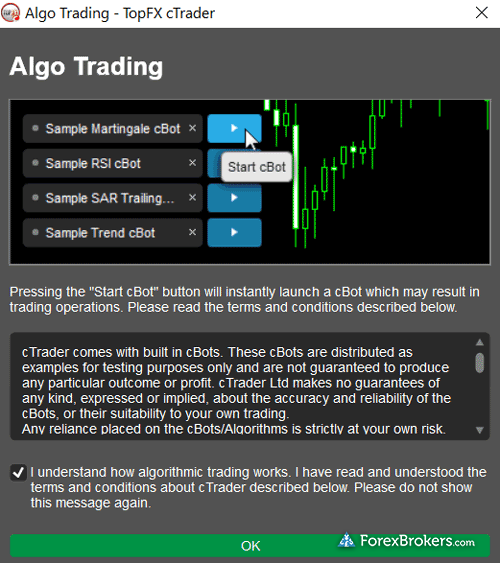

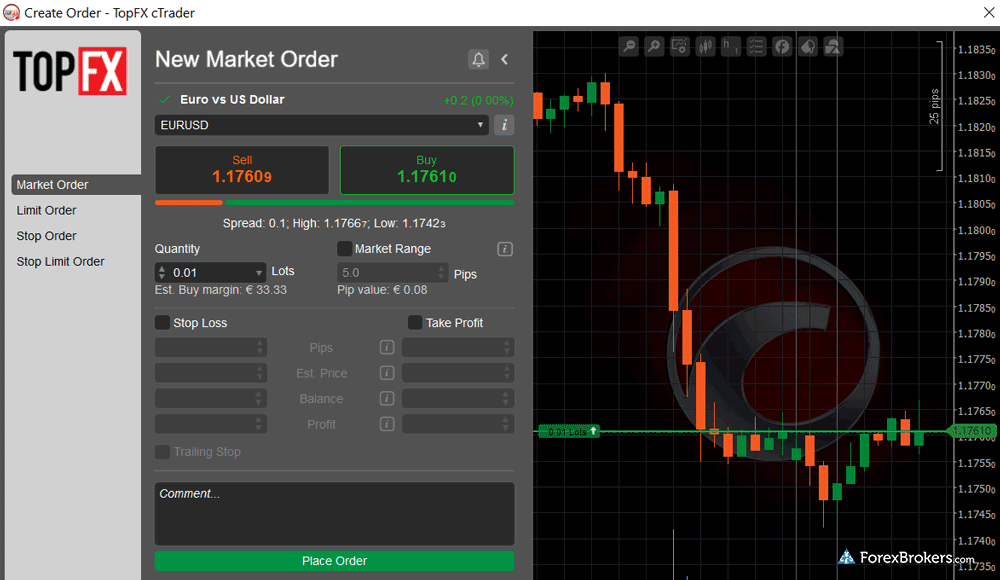

TopFX offers both the cTrader (a good platform option for algo trading) and MetaTrader 4 (MT4) trading platforms. Autochartist is integrated directly into cTrader, but MT4 is the standard out-of-the-box developer version, and there are no notable add-ons to help TopFX stand out from amongst the best MetaTrader brokers.

Platforms overview: The MetaTrader 4 suite is available at TopFX for macOS and Windows operating systems, alongside the web version that can be accessed via any modern browser.

Charting: The MetaTrader platform suite is known for its robust user-friendly charts. Zooming in and out and rearranging windows and tabs is a breeze on MT4. It also supports the ability to drag and drop from the default list of nearly 50 indicators. cTrader charts are equally impressive with 65 indicators, four chart types, and dozens of drawing tools.

Autochartist: TopFX offers cTrader with Autochartist directly integrated to help traders find investment opportunities.

| Feature |

TopFX TopFX

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | No |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | No |

| DupliTrade | No |

| ZuluTrade | No |

| Charting - Indicators / Studies (Total) | 30 |

| Charting - Drawing Tools (Total) | 15 |

| Charting - Trade From Chart | Yes |

| Watchlists - Total Fields | 7 |

Market research

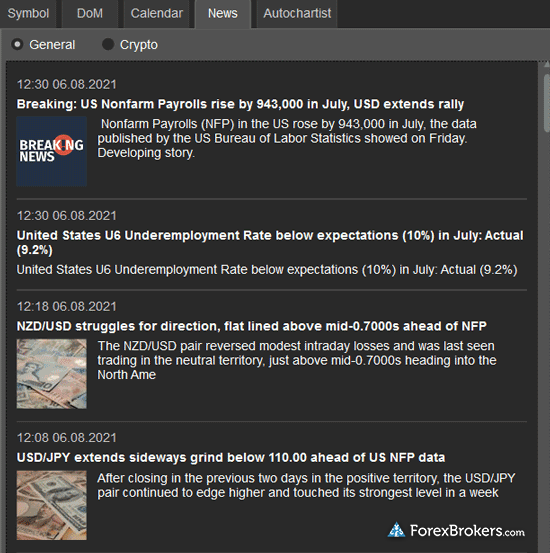

Market research is lacking at TopFX, which puts it at a disadvantage against most of the brokers I’ve reviewed. I couldn’t find any articles, analysis, videos, or market commentary at TopFX, making it a poor choice for market research – especially when compared to the best brokers in this category.

| Feature |

TopFX TopFX

|

|---|---|

| Daily Market Commentary | No |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | Yes |

| Trading Central (Recognia) | Yes |

| Social Sentiment - Currency Pairs | Yes |

Education

Educational content at TopFX is largely absent. TopFX’s Facebook page does feature a quarterly recap of stock earnings, some basic platform tutorials, and a few (albeit very brief) educational videos.

Room for improvement: The addition of written articles and an expansion of its range of educational videos would give a needed boost to TopFX’s learning center. The top brokers in this category offer educational videos and articles, and sometimes even quizzes and progress tracking to help you learn about trading and investing. TopFX has lots of space to improve in this category.

| Feature |

TopFX TopFX

|

|---|---|

| Education (Forex or CFDs) | No |

| Client Webinars | No |

| Client Webinars (Archived) | No |

| Videos - Beginner Trading Videos | No |

| Videos - Advanced Trading Videos | No |

| Investor Dictionary (Glossary) | No |

Final thoughts

TopFX has built a good foundation for its platform offering by making both MT4 and cTrader available. It offers a decent variety of instruments, with 548 symbols and 45 forex pairs.

However, TopFX doesn’t offer MT5 or the larger range of markets typically offered by the leading brokers. Moreover, market research is practically non-existent on the TopFX platform, and it lacks meaningful educational content. Finally, publishing its average spread data each month would highlight the true value of its pricing across its two main account types.

About TopFX

Founded in 2010, TopFX is regulated by the Cyprus Securities and Investment Commission (CySEC) and in Seychelles is a brand of Fondex Limited which is regulated by the Financial Services Authority (FSA).

2024 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Popular Forex Guides

- Best Forex Brokers for Beginners of 2024

- Best Forex Trading Apps of 2024

- International Forex Brokers Search

- Best Zero Spread Forex Brokers of 2024

- Best MetaTrader 4 Brokers of 2024

- Best Forex Brokers of 2024

- Best Copy Trading Platforms of 2024

- Best TradingView Forex Brokers of 2024

- Compare Forex Brokers