How to Avoid Forex Trading Scams in 2024

The global forex market turns over trillions of dollars a day. With the explosive popularity of forex trading, thousands of forex brokers have emerged to serve the needs of everyday forex traders. There are some excellent, award-winning forex brokers to choose from, but there's also a huge number of brokers that are unregulated, registered in offshore jurisdictions with little to no oversight, and/or solely interested in stealing money from their clients.

In my 20+ years of researching and covering the forex industry, I've seen all kinds of forex scams and spoken with countless victims of financial scams. My goal with this guide is to help everyday consumers, traders, and investors protect themselves from forex scams. You'll find some tips for spotting scams, as well as some helpful questions to ask yourself when choosing a forex broker.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Most Trusted Forex Brokers Comparison

Taken from our forex broker comparison tool, here's a comparison of the must trusted forex brokers.

| Company | Trust Score | Year Founded | Publicly Traded (Listed) | Bank | Tier-1 Licenses | Tier-2 Licenses | Tier-3 Licenses | Regulated in one or more EU or EEA countries (MiFID). |

IG IG

|

99 | 1974 | Yes | Yes | 8 | 2 | 0 | Yes |

Interactive Brokers Interactive Brokers

|

99 | 1977 | Yes | No | 9 | 1 | 0 | Yes |

Saxo Saxo

|

99 | 1992 | No | Yes | 7 | 1 | 0 | Yes |

FOREX.com FOREX.com

|

99 | 1999 | Yes | No | 7 | 1 | 0 | Yes |

Swissquote Swissquote

|

99 | 1996 | Yes | Yes | 5 | 1 | 0 | Yes |

Top seven tips for spotting forex scams

1. If something seems too good to be true, it probably is.

If you are considering investing in something that appears too good to be true, that should serve as a reminder to explore the details of the offering more closely. Always read the fine print, and make sure to examine your broker’s Terms and Conditions closely.

2. Watch out for anyone asking you to send them cryptocurrency.

Scammers prefer being paid in crypto because such transactions are irreversible and hard to associate with a person’s true identity. If a person or company specifically requests that you pay for their services with cryptocurrency, be wary. Legitimate forex brokers accept payment in a variety of currencies and from a range of deposit methods – even PayPal.

3. Beware of people on WhatsApp or Instagram posing as financial advisors.

There are a growing number of self-proclaimed financial gurus and influencers on social media that go to great lengths to convince their followers to send them money in purported forex schemes. In my experience, it’s never wise to make decisions about how to invest your money by following the advice of social media influencers.

Finding a trustworthy financial advisor

If you are looking for an actual financial advisor, I'd recommend checking out investor.com's exceptional educational series dedicated to helping consumers find a trustworthy financial advisor.

4. Don’t be drawn in by the promise of guaranteed returns.

Keep an eye out for anyone making unbalanced claims, promising huge profits, or using the word “guaranteed” in relation to investment returns – those are huge red flags. No investments or investment opportunities – even AAA-rated government bonds which have fixed income returns – are guaranteed to turn a profit.

5. Look for broker reviews from trusted sources.

In addition to checking that a broker is regulated and verifying their credentials, it’s important to read reviews from impartial sources – just as you would when buying something on Amazon. I’ve been independently reviewing dozens of the top forex brokers for years now – check out my independent, unbiased forex broker reviews.

6. Reference regulator blacklists and scam broker lists.

It’s always prudent to make sure that your broker is not on a blacklist or warning list from a national regulator.

7. Always verify your broker is regulated.

Go on your broker’s website to identify their license number and regulator information (which can usually be found on the footer of their website), and then verify with the relevant regulatory body. It’s also a good idea to have the broker’s representative email you from an email address that has the same domain name as the one that you verified, to ensure that you are not dealing with an imposter (imposters are more common than you might think).

Questions to ask to avoid a forex trading scam

- Is the broker regulated?

- If regulated, how trustworthy is the regulatory body?

- How do I know what regulators are legitimate?

- Is the broker offering profits or rewards for opening an account?

- Is the broker offering a cash bonus for opening an account?

- Is the broker offering automatic trades or signals to guarantee profits?

- Is there any credible information about the company on its official website, such as its history, financials, or headquarters' address?

- If awards are cited, can I verify their authenticity?

- If a big corporate sponsorship is promoted (e.g. athlete sponsorship), am I doing my due diligence to ensure the company can be trusted?

We'll go through each of these important questions in detail below, to make sure you have the information you need to avoid forex scams.

1. Is the broker regulated?

Unregulated brokers do not have to report to a governing body. If an unregulated broker scams you in any way, whether it be via “glitches” or “malfunctions” that cause slippage in their system or unprocessed withdrawals of funds that never arrive – you are out of luck. Because unregulated forex brokers have no oversight and do not report to any governing bodies, traders that have been scammed have little recourse beyond posting a negative review.

How do I check if my broker is regulated?

Take a look at footer of your broker's website. The broker's registration number and governing regulatory body should be clearly displayed. You should then visit the regulator's website to verify the status of your broker's license. Check out this video where I walk through how to verify a broker's regulatory license.

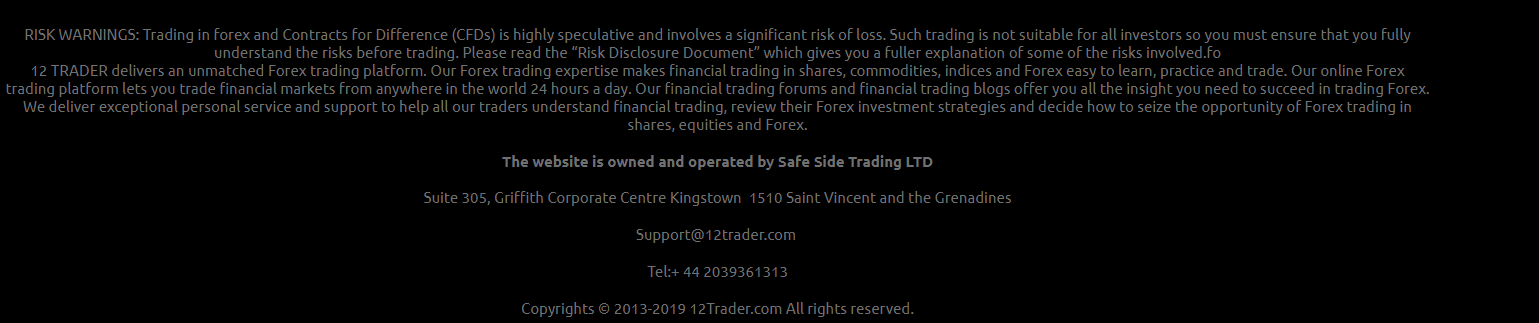

Pictured below is the website footer for 12Trader, a forex broker that is no longer in business. You’ll notice that there is no regulatory body or license number listed in this screenshot. Additionally, the “About Us” page on the site sent users to an account login page, and there is no listing of company history. All of these warning signs should make you cautious.

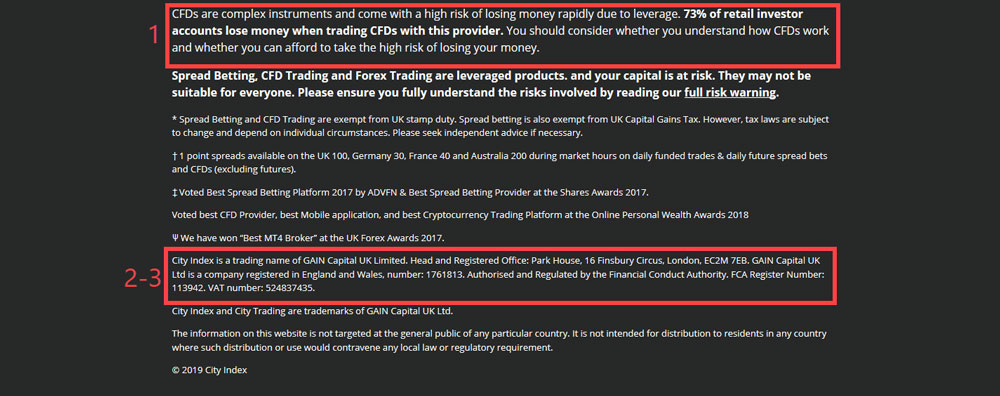

Now let’s look at the website footer of a trusted and highly regulated broker: City Index.

There are three things that indicate you are dealing with a trustworthy, regulated forex broker:

- City Index has a disclaimer that warns of the risks involved when trading CFDs. There are no unbalanced claims or profit guarantees.

- City Index is registered in the U.K. under its parent company, StoneX. A registered business address is provided.

- City Index company is authorized and regulated by the Financial Conduct Authority (FCA), and has posted a verifiable registration number.

Note: Regulated forex brokers are required to include proper risk disclaimers and regulatory information at the bottom of all their website pages.

Finding a trusted, regulated forex broker

To make it easy for investors, we've developed a Trust Score rating for all 60+ forex brokers reviewed on ForexBrokers.com. Trust Score is a data-driven formula designed to assess a firm's overall trustworthiness, based on variables such as number of held regulatory licenses and years in business.

2. If regulated, how trustworthy is the regulatory body?

Some scam brokers claim to be regulated and registered by a governing body that does not monitor or regulate forex companies.

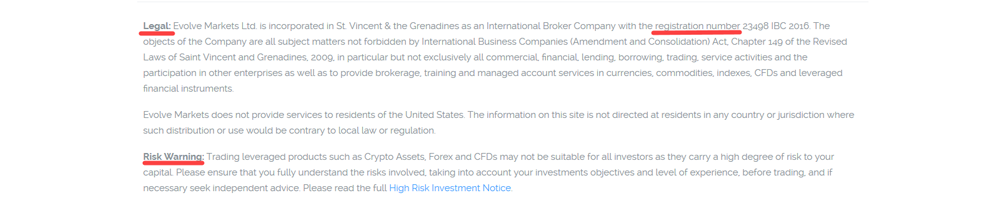

For example, let’s look at Evolve Markets.

The disclosures at the bottom of the homepage give the appearance of a regulated broker. There is a warning of the risks of trading CFDs, and there is a legal section. Upon further examination of the legal section, you’ll notice that while the firm is registered as an international broker company in St. Vincent & the Grenadines, it is not regulated.

This statement from St. Vincent & the Grenadines shows there is a warning against false claims of registration or license.

3. How do I know what regulators are legitimate?

There is a wide range of regulatory bodies that grant licenses to forex brokers, and not all regulatory licenses carry the same weight. For example, becoming licensed by the Commodity Futures Trading Commission (CFTC) to operate in the United States is far more complicated, expensive, and, as a result, more significant than registering with the Financial Sector Conduct Authority (FSCA) in South Africa.

At ForexBrokers.com, we track 250+ licenses across 60+ forex brokers, and we recognize and monitor 80+ regulatory jurisdictions. To make it easier to choose a reliable forex broker, we've organized regulatory jurisdictions into five Tiers (Tier-1 is the most stringent, and Tier-5 is for regulators that should not be trusted).

Below, you can find our list of the Tier-1 jurisdictions we track. These major hubs represent the most highly trusted regulatory jurisdictions in the forex industry:

Tier-1 Jurisdictions (Highly Trusted):

- Australian Securities & Investment Commission (ASIC) - Australia

- Canadian Investment Regulatory Organization - Canada

- European Union Authorised (MiFiD) - Europe

- Securities Futures Commission (SFC) - Hong Kong

- Japanese Financial Services Authority (JFSA) - Japan

- Monetary Authority of Singapore (MAS) - Singapore

- Financial Markets Authority (FMA) - New Zealand

- Swiss Financial Market Supervisory Authority (FINMA) - Switzerland

- Financial Conduct Authority (FCA) - United Kingdom (UK)

- Commodity Futures Trading Commission (CFTC) - United States

Remember:

There's a vast difference between being regulated in the U.K. by the FCA and holding a license from an offshore jurisdiction like Saint Vincent & The Grenadines. Check out our country-specific forex guides to learn more.

4. Is the broker offering profits or rewards for opening an account?

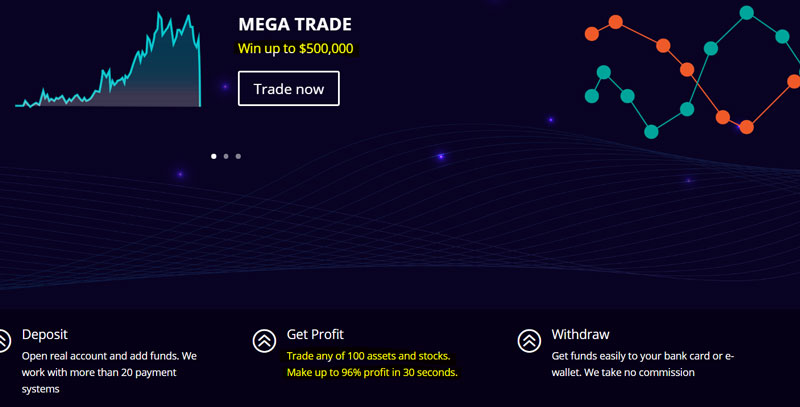

Scam brokers often make claims such as: “make $50 a day from a $250 investment”, “make 80% returns on profit signals”, or “96% success rate.” These claims are a scam, regardless of whether they are being made for forex, CFDs, or binary options. Forex brokers should never promise returns, small or large. Simply put, if a broker is promising to make you money, it is a scam. Other common scam practices include advertising pictures of expensive cars that are given away to lucky investors.

This Wikipedia page on binary options does a great job of summarizing risks related to binary options:

"Many binary option "brokers" have been exposed as fraudulent operations. In those cases, there is no real brokerage; the customer is betting against the broker, who is acting as a bucket shop. Manipulation of price data to cause customers to lose is common. Withdrawals are regularly stalled or refused by such operations; if a client has good reason to expect payment, the operator will simply stop taking their phone calls. Though binary options sometimes trade on a regulated exchange, they are generally unregulated, trading on the Internet, and prone to fraud."

Remember:

If a binary options or forex broker promises you big returns on your money, this is a clear sign of a scam. You will not make $100,000 on a mega trade; you will not make a 96% profit in 30 seconds; and you will not win a $40,000 car by depositing $2,000.

5. Is the broker offering a cash bonus for opening an account?

When an unregulated (or lightly regulated) broker offers an abnormally high cash bonus that is vague on details, you are likely dealing with a scam broker. For example, 1000Extra was a scam forex broker that is no longer in business. You can see in the below screenshot that they were advertising a $1,000 signup bonus – but with zero additional context. The broker's website used a classic scam tactic: trick users into clicking on a promo link that takes them directly to the account signup page.

Don't seek out promotional bonuses

In most regulated regions around the world, promotional bonuses for opening a new account are simply not allowed. The two exceptions are the United States and Asia.

6. Is the broker offering automatic trades or signals to guarantee profits?

Some scam brokers offer automated trading services, claiming that they are powered by "robots" or sophisticated algorithms that can guarantee profits. These brokers claim their robots use trading signals to generate money. Often, these brokers focus on cryptocurrency or binary options. Below are screenshots of a proven scam broker, Crypto Robot 365.

Remember:

There has never been a company that could consistently generate huge profits through automated or signal trading. If they could, they would never offer it to traders for free. Sometimes, when you are unsure, it's good to fall back on common sense: if it sounds too good to be true, it probably is.

7. Is there any credible information about the company on its official website, such as its history, financials, or headquarters' address?

If there is no information about the company executive team, physical headquarters location, or phone support, it is most likely a scam. Scam brokers don’t want any names, locations, or contact information linked back to them when they inevitably get into trouble.

If you can’t find honest reviews of the broker you are interested in, don’t sign up for an account. For example, look at this text from a review site that promotes scam brokers:

The review text is essentially just promoting the scam broker Crypto Robot 365 (remember them from above?), making the same promises that appear on the scam broker's website. This “review” has no content depth and no integrity.

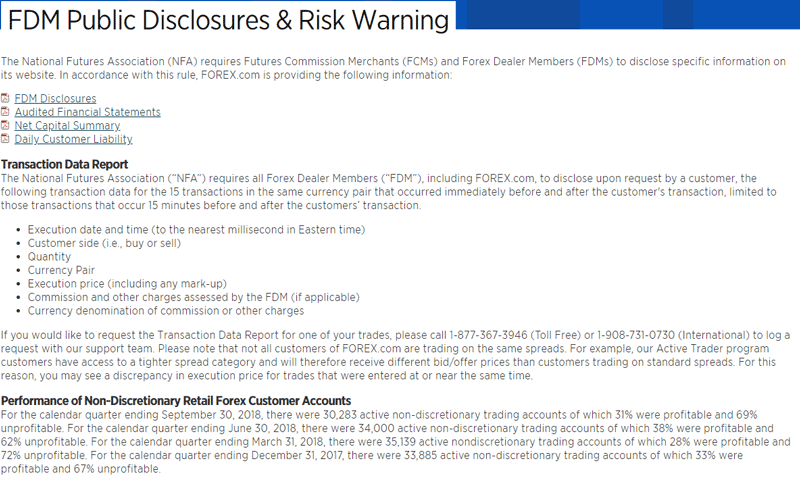

It is also important to check for disclosure documents, which provide important information about the company. Companies that have no disclosures are likely not regulated and should always be viewed with caution. For example, look at the disclosures page on FOREX.com, which offers performance history for forex customers, audited financial statements, and disclosures:

When deciding on a forex broker, it's always worth taking the time to read multiple reviews. I've been covering the forex industry for over 20 years, and I've been reviewing forex brokers at ForexBrokers.com for over 7 years now. Check out some of my unbiased, independent forex broker reviews.

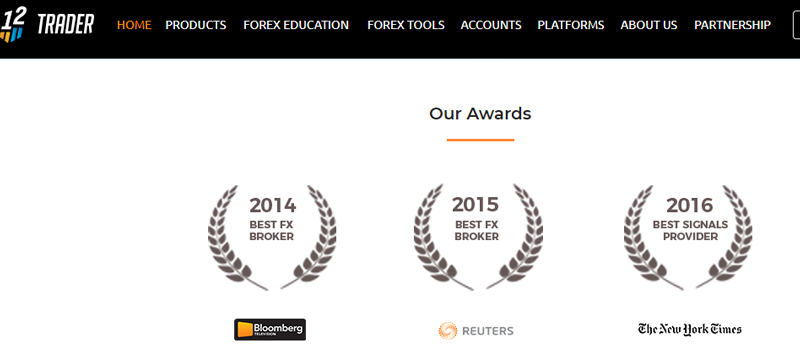

8. If awards are cited, can I verify their authenticity?

Lots of scam forex brokers claim to have won some impressive awards. Most of the time the award will say something like, “Best broker 2015.” Often, the source will either be unviewable or unreliable.

Other times, the scam broker will display awards from reliable media outlets, but the awards are simply fake. This screenshot is from a former scam broker called 12Trader. 12Trader decided to promote obviously fake awards from Bloomberg and The New York Times.

If those awards were real, you would have been able to click on a link and view them (or, easily find them by running a basic Google search). For example, The New York Times does not currently give out a “best signals provider” award.

Remember:

Scam brokers will often post out-of-date post fake awards, because those are more difficult to verify than awards from the current year. It's never a bad idea to double-check the sources for any awards your broker is claiming to have won.

9) If a big corporate sponsorship is being promoted (i.e., sports team or famous athlete) by a forex broker, am I still doing my due diligence to ensure the company can be trusted?

Never assume that a broker is trustworthy because it sponsors a football club or professional athlete. Just because a firm is paying to be a major sponsor or to have their name featured on a jersey doesn’t mean they should be trusted.

The recent collapse of FTX is a great example. FTX threw a (presumably) massive amount of money at high-profile athletes like Tom Brady, Shaquille O'Neal, and Steph Curry to promote the FTX exchange. Now, in the wake of the spectacular collapse of FTX, those athletes and spokespeople are being sued by investors.

Don't take financial advice from professional athletes

Never trust a forex broker (or a crypto exchange) just because it sponsors a celebrity, football club, or professional athlete. If you start to feel swayed by a high-profile endorsement, just remember the fraudulent practices of FTX and this FTX commercial starring Steph Curry.

Can you get scammed when forex trading?

Yes, you can be scammed when trading forex. Unfortunately, there are countless forex scam brokers (and many other forex scams –on the internet. Just like any investment offering, it’s important to verify that your forex broker is an authentic financial institution that is appropriately licensed as a broker.

Is forex legit?

Yes, the forex market can be a legitimate way to trade and invest. Forex, short for foreign exchange, is the largest financial market in the world. Average daily trading volume in the forex market can hit over $7.5 trillion, according to the latest survey by the Bank of International Settlements (BIS). However, because the forex market is decentralized, the laws and regulatory protections that apply to forex brokerage firms can vary considerably across international jurisdictions.

So, while forex trading may be legit in certain countries – such as the Marshall Islands – that doesn’t mean you should trust a broker that operates exclusively from offshore jurisdictions. Brokers regulated in trusted jurisdictions by top-tier regulators, like the Commodity Futures Trading Commission (CFTC) in the U.S. or the Financial Conduct Authority (FCA) in the U.K., are subject to stringent rules and regulations designed to protect consumers and reduce your risk of dealing with a potential scam broker.

Learn more about forex trading

Learn more about the basics of forex trading by checking out my in-depth, Forex 101 educational series covering everything you’ll need to know about forex and currency trading. I dive into the ins and outs of leverage, explain how pips work, and more.

What does a forex scam look like?

There are many potential variations of forex scams across the world (and all over the internet), but there are a few common warning signs to look out for. Forex scams often assert that they can guarantee profits – something no reputable firm or broker would ever claim. While downplaying risk, forex scams tend to use high-pressure sales tactics (as in, FOMO on an incredible investment opportunity) to persuade you to send them money.

Another forex scam to look out for is the phenomenon of impersonators and imposters. Scammers will steal photos and personal information to create fake social media accounts of high-profile traders (I’ve been impersonated dozens of times).

To sum it up, remember the following four warning signs if you want to avoid forex scams:

- Unbalanced claims. Forex scams promise high returns and downplay risk.

- Urgency. Scam operators will pressure you into sending money, and prey on your fear of missing out (FOMO) on an opportunity.

- Imposters. Forex scam artists may impersonate real people (using their name, identity, and photos) and impersonate legitimate brands by imitating the websites of reputable brokers.

- Regulation. The best way to protect yourself from forex scams is to make sure your forex broker is properly licensed in trusted regulatory jurisdictions. Learn more about how that works by visiting our Trust Score page.

Final Thoughts

To recap, here again are the eight simple questions to ask yourself when considering a broker to trade forex or CFDs (binary options are a complete scam and should never be traded):

- Is the broker regulated?

- If regulated, how trustworthy is the regulatory body?

- Is the broker offering profits or rewards for signing up?

- Is the broker offering big cash bonuses for signing up?

- Is the broker offering automatic trades or signals to guarantee profits?

- Is any credible information about the company included on its website, such as company history, financials, headquarters' address, or similar?

- If awards are cited, can I verify their authenticity?

- If a big corporate sponsorhip is referenced, am I doing my due diligence to ensure the company can be trusted?

ForexBrokers.com 2024 Overall Ranking

We've evaluated over 60 forex brokers, using a testing methodology that's based on 100+ data-driven variables and thousands of data points. Check out our full-length, in-depth forex broker reviews.

| Company | Overall Rating | Offering of Investments | Commissions & Fees | Platform & Tools | Research | Education | Mobile Trading | Trust Score | Visit Site |

IG IG

|

|

|

|

|

|

|

|

99 |

Visit Site

|

Interactive Brokers Interactive Brokers

|

|

|

|

|

|

|

|

99 |

Visit Site

|

Saxo Saxo

|

|

|

|

|

|

|

|

99 |

Visit Site

|

CMC Markets CMC Markets

|

|

|

|

|

|

|

|

99 | |

FOREX.com FOREX.com

|

|

|

|

|

|

|

|

99 | |

TD Ameritrade TD Ameritrade

|

|

|

|

|

|

|

|

99 | |

City Index City Index

|

|

|

|

|

|

|

|

99 | |

XTB XTB

|

|

|

|

|

|

|

|

96 | |

eToro eToro

|

|

|

|

|

|

|

|

90 | |

Swissquote Swissquote

|

|

|

|

|

|

|

|

99 | |

Capital.com Capital.com

|

|

|

|

|

|

|

|

87 |

Visit Site

|

AvaTrade AvaTrade

|

|

|

|

|

|

|

|

94 |

Visit Site

|

Plus500 Plus500

|

|

|

|

|

|

|

|

99 |

Visit Site

|

OANDA OANDA

|

|

|

|

|

|

|

|

93 | |

FXCM FXCM

|

|

|

|

|

|

|

|

95 |

Visit Site

|

Admirals Admirals

|

|

|

|

|

|

|

|

93 | |

Pepperstone Pepperstone

|

|

|

|

|

|

|

|

95 |

Visit Site

|

XM Group XM Group

|

|

|

|

|

|

|

|

88 |

Visit Site

|

FP Markets FP Markets

|

|

|

|

|

|

|

|

87 |

Visit Site

|

FxPro FxPro

|

|

|

|

|

|

|

|

90 | |

IC Markets IC Markets

|

|

|

|

|

|

|

|

84 |

Visit Site

|

Markets.com Markets.com

|

|

|

|

|

|

|

|

96 | |

Tickmill Tickmill

|

|

|

|

|

|

|

|

86 |

Visit Site

|

Fineco Bank Fineco Bank

|

|

|

|

|

|

|

|

94 | |

BlackBull Markets BlackBull Markets

|

|

|

|

|

|

|

|

78 |

Visit Site

|

Vantage Vantage

|

|

|

|

|

|

|

|

90 | |

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

|

|

|

|

|

|

88 | |

HFM HFM

|

|

|

|

|

|

|

|

86 | |

ThinkMarkets ThinkMarkets

|

|

|

|

|

|

|

|

92 | |

FlowBank FlowBank

|

|

|

|

|

|

|

|

80 | |

DooPrime DooPrime

|

|

|

|

|

|

|

|

83 | |

Trading 212 Trading 212

|

|

|

|

|

|

|

|

79 | |

BDSwiss BDSwiss

|

|

|

|

|

|

|

|

76 | |

Trade Nation Trade Nation

|

|

|

|

|

|

|

|

85 | |

TMGM TMGM

|

|

|

|

|

|

|

|

83 | |

Moneta Markets Moneta Markets

|

|

|

|

|

|

|

|

72 | |

Eightcap Eightcap

|

|

|

|

|

|

|

|

85 |

Visit Site

|

MultiBank MultiBank

|

|

|

|

|

|

|

|

84 | |

ACY Securities ACY Securities

|

|

|

|

|

|

|

|

75 |

Visit Site

|

RoboForex (RoboMarkets) RoboForex (RoboMarkets)

|

|

|

|

|

|

|

|

71 | |

VT Markets VT Markets

|

|

|

|

|

|

|

|

70 | |

easyMarkets easyMarkets

|

|

|

|

|

|

|

|

80 |

Visit Site

|

IronFX IronFX

|

|

|

|

|

|

|

|

83 | |

Spreadex Spreadex

|

|

|

|

|

|

|

|

71 | |

IFC Markets IFC Markets

|

|

|

|

|

|

|

|

67 | |

Trade360 Trade360

|

|

|

|

|

|

|

|

76 | |

Octa Octa

|

|

|

|

|

|

|

|

70 | |

Axi Axi

|

|

|

|

|

|

|

|

81 | |

TeleTrade TeleTrade

|

|

|

|

|

|

|

|

71 | |

GKFX GKFX

|

|

|

|

|

|

|

|

65 | |

Vestle Vestle

|

|

|

|

|

|

|

|

78 | |

FXOpen FXOpen

|

|

|

|

|

|

|

|

80 | |

FXPrimus FXPrimus

|

|

|

|

|

|

|

|

71 | |

Forex4you Forex4you

|

|

|

|

|

|

|

|

61 | |

GBE brokers GBE brokers

|

|

|

|

|

|

|

|

71 | |

Alpari Alpari

|

|

|

|

|

|

|

|

68 | |

TopFX TopFX

|

|

|

|

|

|

|

|

67 | |

Libertex (Forex Club) Libertex (Forex Club)

|

|

|

|

|

|

|

|

73 |

Visit Site

|

LegacyFX LegacyFX

|

|

|

|

|

|

|

|

67 | |

FXGT.com FXGT.com

|

|

|

|

|

|

|

|

69 | |

ATFX ATFX

|

|

|

|

|

|

|

|

73 | |

Xtrade Xtrade

|

|

|

|

|

|

|

|

80 |

Popular Forex Guides

- Best Forex Brokers of 2024

- Best Forex Trading Apps of 2024

- International Forex Brokers Search

- Compare Forex Brokers

- Best Copy Trading Platforms of 2024

- Best TradingView Forex Brokers of 2024

- Best Forex Brokers for Beginners of 2024

- Best MetaTrader 4 Brokers of 2024

- Best Zero Spread Forex Brokers of 2024

More Forex Guides

Popular Forex Broker Reviews

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Intro to Forex Trading Scams

What To Do if You’ve Been Scammed by a Forex Broker