TMGM Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

TMGM stands out for its impressive education toolset, though it still trails behind the best brokers in most categories. TMGM offers a small range of markets via the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platform. While primarily a MetaTrader broker, it also offers the more exclusive IRESS platform – though the platform-specific requirements will limit who can use it.

-

Minimum Deposit:

$100 -

Trust Score:

83 -

Tradeable Symbols (Total):

12000

Can I open an account with this broker?

Use our country selector tool to view available brokers in your country.

TMGM pros & cons

Pros

- Commission rates are competitive on the Edge account.

- Minimum deposit starts at $100 for spread-only or commission-based accounts.

- Provides access to the award-winning suite of third-party tools from Trading Central.

- TMGM recently introduced trading tools from Acuity Trading, including its Signal Centre, calendars, and headlines from Dow Jones News.

- TMGM now offers the full MetaTrader suite, including MetaTrader 5 (MT5).

- Offers indemnity insurance for professional liability with up to 10 million AUD in coverage.

Cons

- The TMGM Academy was removed thus hindering the broker's educational offering, with few articles and videos remaining to fill the void.

- The majority of available symbols are segmented on the IRESS platform which is not optimized for forex trading (and requires a $5,000 deposit).

- MT5 platform only features 148 tradeable symbols.

- Average spreads were not available for the EUR/USD pair to asses trading costs.

Overall summary

| Feature |

TMGM TMGM

|

|---|---|

| Overall Rating |

|

| Trust Score | 83 |

| Offering of Investments |

|

| Commissions & Fees |

|

| Platform & Tools |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Is TMGM safe?

TMGM is considered Trusted, with an overall Trust Score of 83 out of 99. TMGM is not publicly traded and does not operate a bank. TMGM is authorised by two Tier-1 regulators (Highly Trusted), zero Tier-2 regulators (Trusted), zero Tier-3 regulators (Average Risk), and two Tier-4 regulator (High Risk). TMGM is authorised by the following tier-1 regulators: the Australian Securities & Investment Commission (ASIC) and the Financial Markets Authority (FMA). Learn more about Trust Score.

| Feature |

TMGM TMGM

|

|---|---|

| Year Founded | 2013 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 2 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 2 |

Offering of investments

TMGM provides access to dozens of forex pairs and CFDs across its brands regulated in Australia, New Zealand, and Vanuatu, all available via its MetaTrader platform offering. Select clients gain additional access to share trading on its IRESS trading platform.

Cryptocurrency: CFDs are available across 12 cryptocurrency pairs against the U.S. Dollar, including bitcoin, ethereum, link, uniswap, and other popular crypto assets.

| Feature |

TMGM TMGM

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 12000 |

| Forex Pairs (Total) | 62 |

| U.S. Stock Trading (Non CFD) | No |

| Int'l Stock Trading (Non CFD) | No |

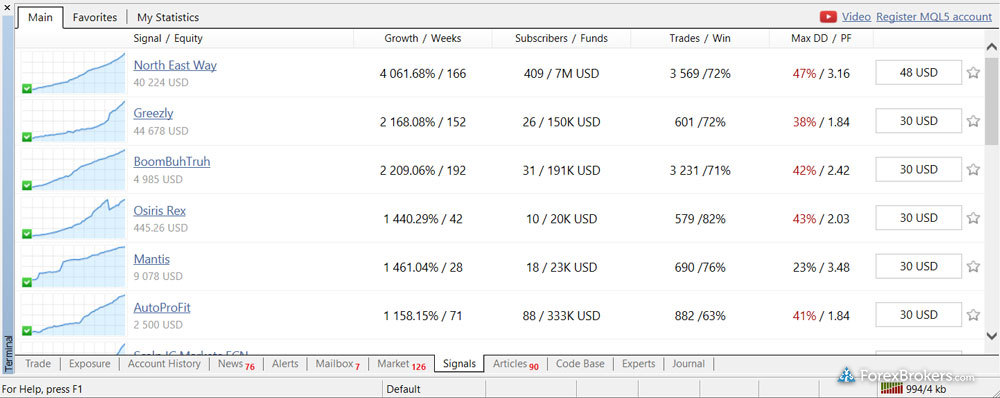

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (Derivative) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). |

Commissions and fees

TMGM offers competitive commission rates for its Edge account with low spreads and no requotes. That said, recent average spread data for the EUR/USD was not available for the EUR/USD. I've found that the best forex brokers publish average spread data. This data allows for more detailed assessments of overall trading costs.

Account types: Trading costs at TMGM will depend on whether you choose the spread-only Classic account, or the commission-based Edge account. The Edge account would be my choice, as it only charges a small commission of $3.50 per side ($7 per round trip), in addition to low prevailing spreads.

Interest-free accounts: Islamic finance customers seeking Sharia-compliant accounts must choose the Edge account, as swap-free accounts are not available with the Classic option.

| Feature |

TMGM TMGM

|

|---|---|

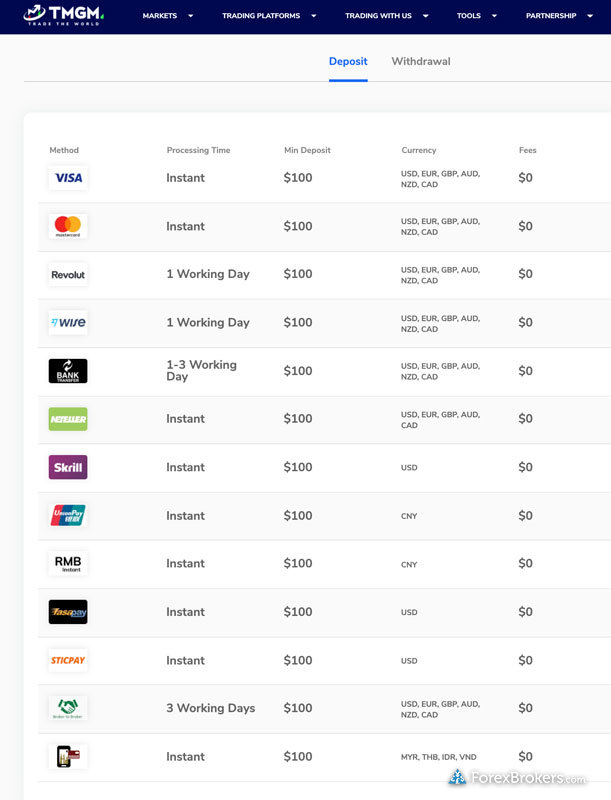

| Minimum Deposit | $100 |

| Average Spread EUR/USD - Standard | N/A |

| All-in Cost EUR/USD - Active | N/A |

| Active Trader or VIP Discounts | No |

| ACH or SEPA Transfers | No |

| PayPal (Deposit/Withdraw) | Yes |

| Skrill (Deposit/Withdraw) | Yes |

| Visa/Mastercard (Credit/Debit) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

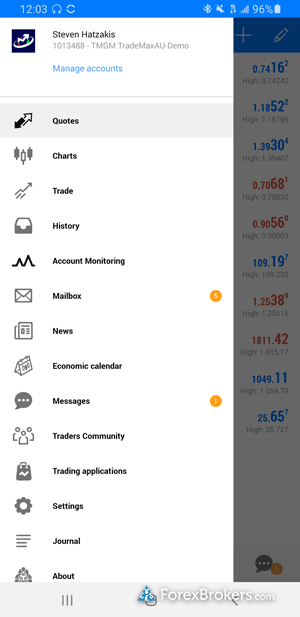

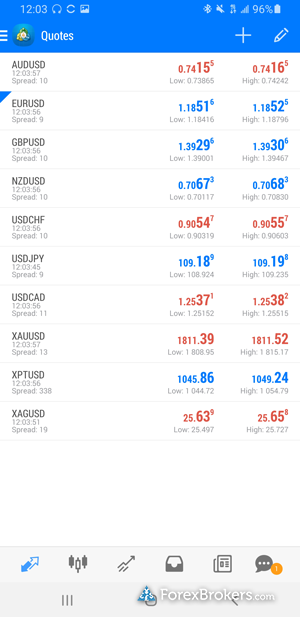

Mobile trading apps

With no proprietary mobile app available, TMGM trails behind industry leaders such as IG and Saxo. For our top picks among trading apps, read our guide to Best Forex Trading Apps.

Apps overview: Since TMGM is a MetaTrader-only broker, iOS and Android versions of the MT4 and MT5 app come standard and are both available for download from the Apple App Store and Android Play store, respectively. While TMGM primarily offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) mobile app for forex trading, it also offers the IRESS mobile app which contains its full range of CFDs. For this review we focused on TMGM’s MT5 app.

| Feature |

TMGM TMGM

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts - Basic Fields | Yes |

| Watchlists - Total Fields | 7 |

| Watchlist Syncing | No |

| Charting - Indicators / Studies (Total) | 30 |

| Charting - Drawing Tools (Total) | 15 |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Charting - Multiple Time Frames | Yes |

| Mobile Economic Calendar | Yes |

Other trading platforms

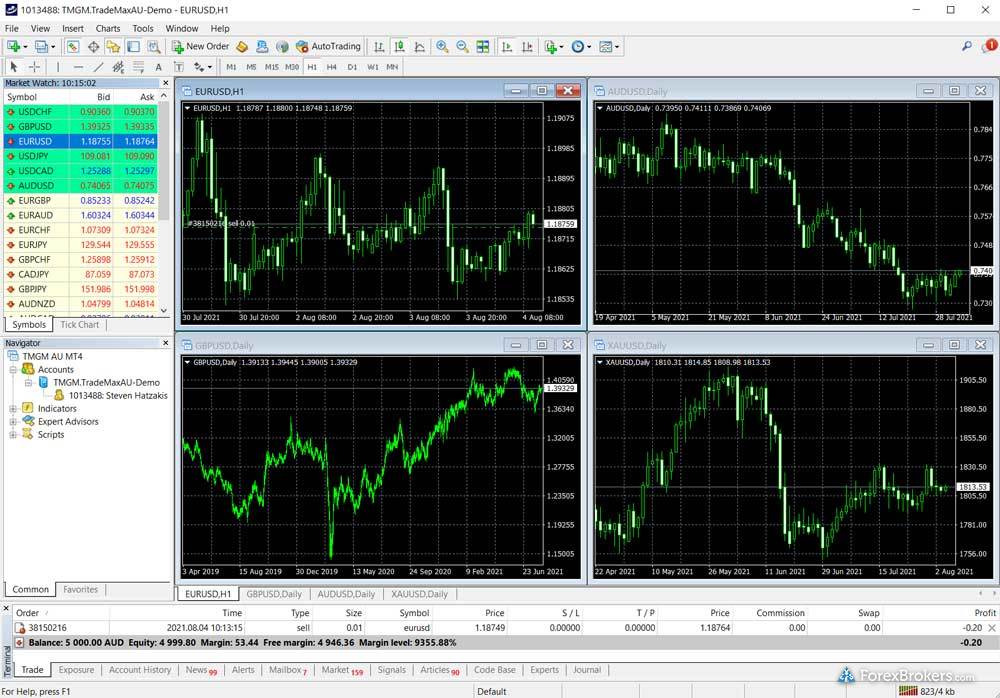

TMGM is primarily a MetaTrader broker, offering the standard, out-of-the-box MT4 experience. Unfortunately, there are no notable add-ons to help TMGM stand out among the best MetaTrader brokers. MetaTrader 5 (MT5) was recently launched at TMGM.

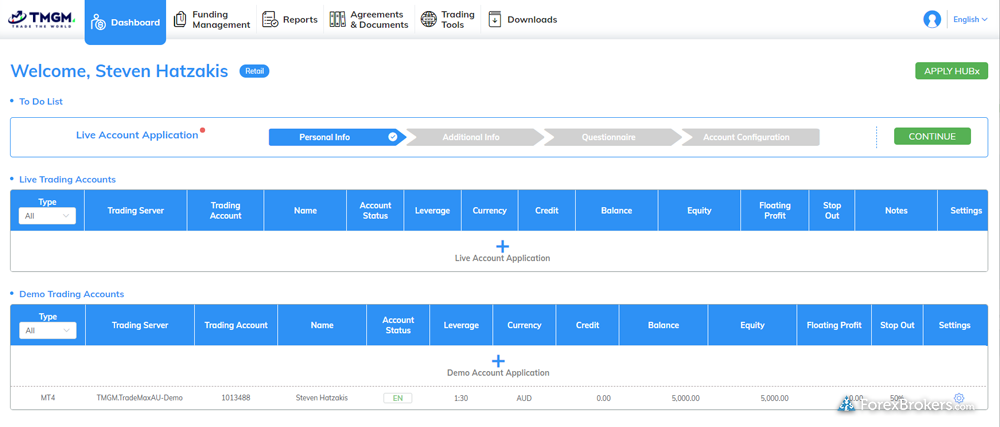

Platforms overview: The MT4 desktop platform is available for the macOS and Windows operating systems straight from the developer, and is provided by TMGM as an installable file once you open a live or demo account. The IRESS platform is primarily for share-trading – it is not optimized for forex trading.

Charting: MT4 is known for offering robust charts with versatile functionality. Zooming in and out and rearranging windows and tabs is a breeze on MT4. It also supports the ability to drag and drop from the default list of nearly 50 indicators.

Trading tools: Forex Virtual Private Servers (VPS) are available at TMGM for traders who are running algorithmic strategies on MT4, and who want to host their platform in a cloud environment that can run 24-7 without interruption. The basic service is free if you deposit $3,000 or trade at least 7 standard lots per month if you are a new client, or deposit $20,000 if you are a high-frequency trader (HFT).

| Feature |

TMGM TMGM

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | No |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| DupliTrade | No |

| ZuluTrade | No |

| Charting - Indicators / Studies (Total) | 30 |

| Charting - Drawing Tools (Total) | 15 |

| Charting - Trade From Chart | Yes |

| Watchlists - Total Fields | 7 |

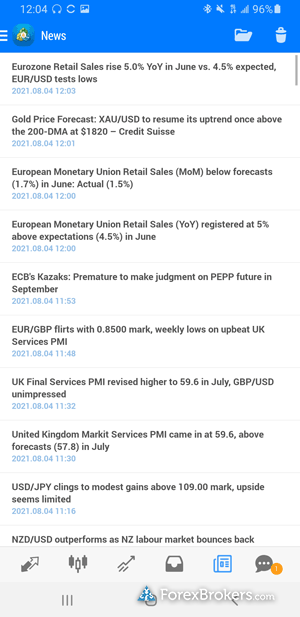

Market research

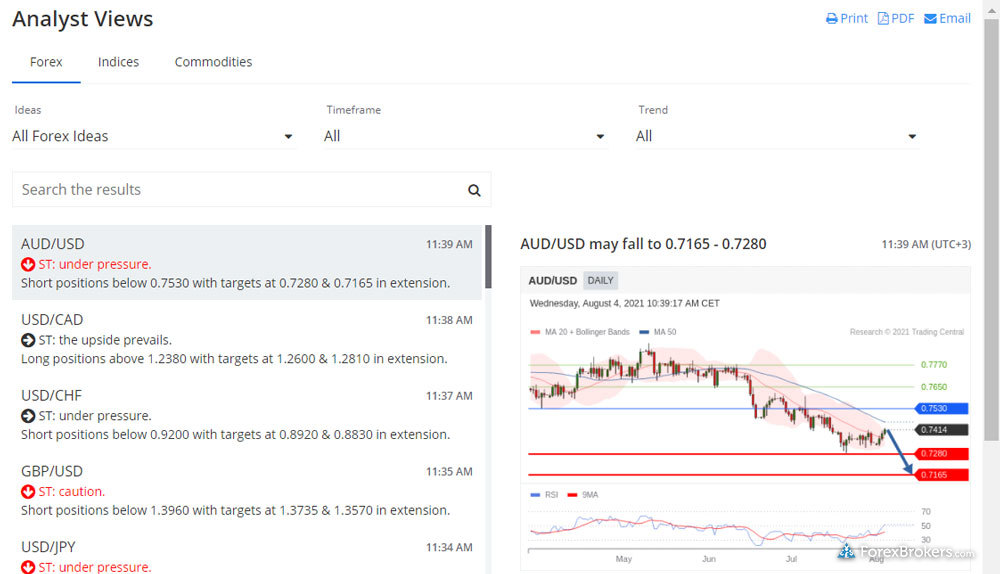

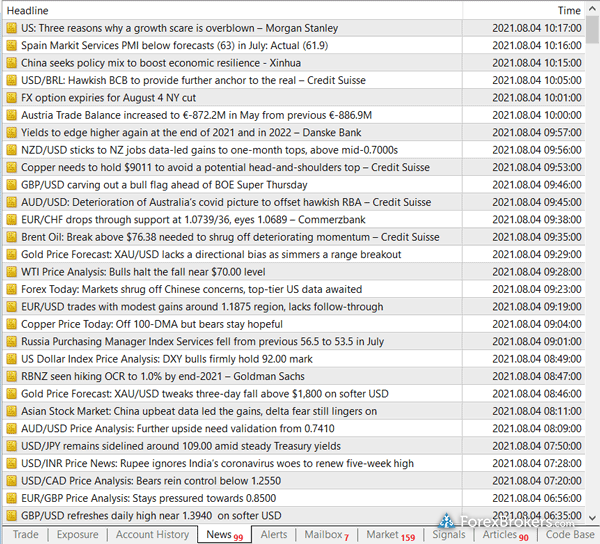

TMGM trails behind the industry average with its research content, and offers little to no market commentary beyond the excellent suite of third-party tools from Trading Central, and recently launched tools from Acuity Trading. As of March 2024, the TMGM blog has yet to return since its removal last year, limiting its offering in this category .

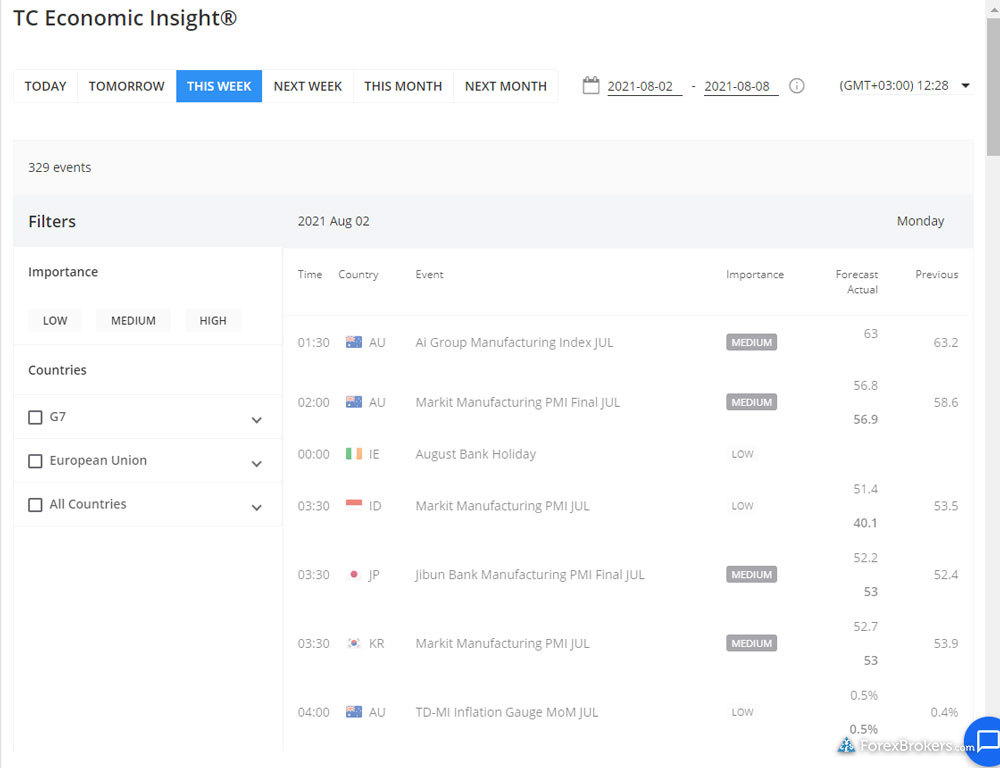

Research overview: Much of the research content at TMGM is powered by Trading Central (TC) and Acuity Trading. The Trading Central modules include the Market Buzz and Economic Insight tools. Market Buzz depicts a sentiment-guided heatmap of instruments, whereas Economic Insight is a TC-powered economic calendar. The Acuity Trading modules are also nicely integrated ino the client portal, including two dedicated economic calendars, alongside news headlines from Dow Jones News, and trading signals from its Signal Centre product suite.

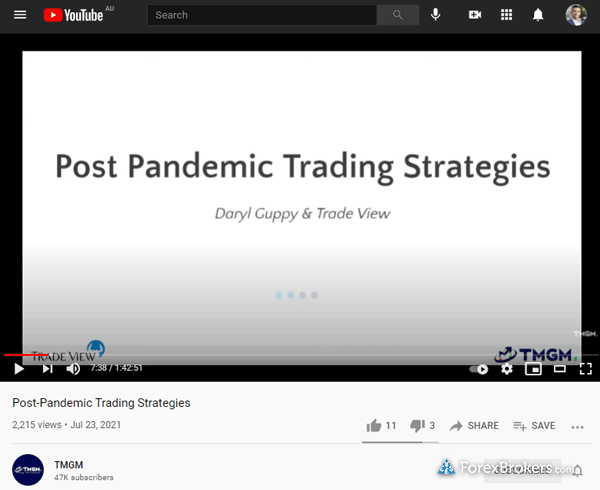

Market news and analysis: TMGM’s blog included daily market commentary as well as technical and fundamental analysis, but the removal of all blog content in 2023 has severely weighed down TMGM's rating for this category in 2024. Articles are generally consistent in authorship and format. The video content on TMGM’s official YouTube channel still lacks variety, consisting mostly of promotional commercials along with a small handful of tutorials and webinars. Expanding the scope of articles and videos would help elevate TMGM’s research offering closer to the industry average.

| Feature |

TMGM TMGM

|

|---|---|

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central (Recognia) | Yes |

| Social Sentiment - Currency Pairs | Yes |

Education

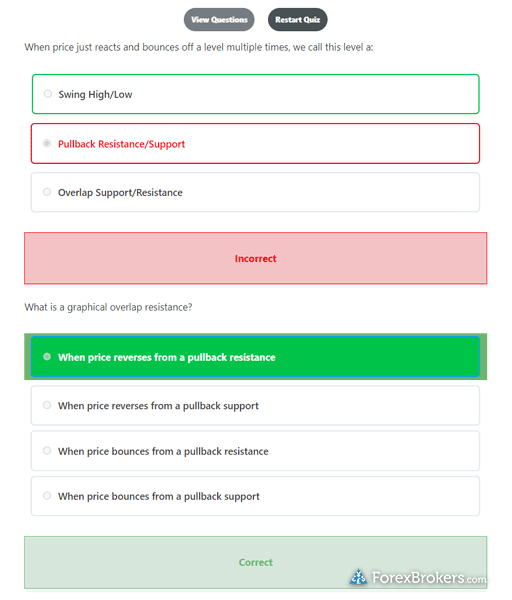

TMGM's impressive educational course provides comprehensive quizzes designed to test your knowledge. These quizzes are a genuine challenge – I’ve found that if you want to pass them, you either need to really study the material, or be an expert on the subject matter. This is an excellent tool for gaining an understanding of the theoretical side of forex and CFD trading.

Update: As of August 2023, the TMGM Academy is unavailable. I reached out to TMGM to clarify, and they confirmed the removal and noted that they plan to launch a new version in the future, but as of March 2024 that has yet to materialize.

Learning center: The TMGM Academy contains three modules that are grouped by experience level – beginner, intermediate, and advanced. It allows you to track your progress and gives you the freedom to jump between chapters. Each chapter has its own interactive quiz at the end with multiple-choice questions.

Room for improvement: A greater variety of written articles and videos would only strengthen TMGM’s educational offering.

| Feature |

TMGM TMGM

|

|---|---|

| Education (Forex or CFDs) | No |

| Client Webinars | No |

| Client Webinars (Archived) | Yes |

| Videos - Beginner Trading Videos | No |

| Videos - Advanced Trading Videos | No |

| Investor Dictionary (Glossary) | Yes |

Final thoughts

TMGM’s offering is mixed. Its greatest range of markets is on the IRESS platform which is not optimized for FX trading. Whereas its MT4 offering, on the other hand, offers only 79 CFDs and 62 forex pairs – and MT5 is not yet available. While there is room for its educational offering to improve, TMGM does stand out for its TMGM Academy which features interactive quizzes that test your knowledge.

Overall, TMGM offers some solid features, but still struggles to compete with the best MetaTrader brokers across some key categories.

About TMGM

Trademax Global Markets (TMGM) was founded in 2013, and holds regulatory licenses in Australia with the Australian Securities and Investment Commission (ASIC) and in New Zealand with the Financial Markets Authority (FMA). TMGM is also authorised in Vanuatu by the Vanuatu Financial Services Commission (VFSC), and in Maritius with the Financial Services Commission (FSC).

2024 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Popular Forex Guides

- Compare Forex Brokers

- Best MetaTrader 4 Brokers of 2024

- Best Forex Trading Apps of 2024

- Best Forex Brokers of 2024

- Best Zero Spread Forex Brokers of 2024

- International Forex Brokers Search

- Best Forex Brokers for Beginners of 2024

- Best Copy Trading Platforms of 2024

- Best TradingView Forex Brokers of 2024