What are forex options?

All forex options are either puts or calls, similar to regular options. Holding a put option conveys the right to sell while holding a call option conveys the right to buy. Like regular options, forex options are a riskier investment.

- The holder (buyer) of a put option has the right to sell the underlying asset at a specified strike price on or before expiration. A put option is a bearish (short) position that profits when the cost of the underlying decreases.

- The holder (buyer) of a call option has the right to purchase the underlying asset at a specified strike price on or before expiration. A call option is a bullish (long) position that profits when the cost of the underlying increases.

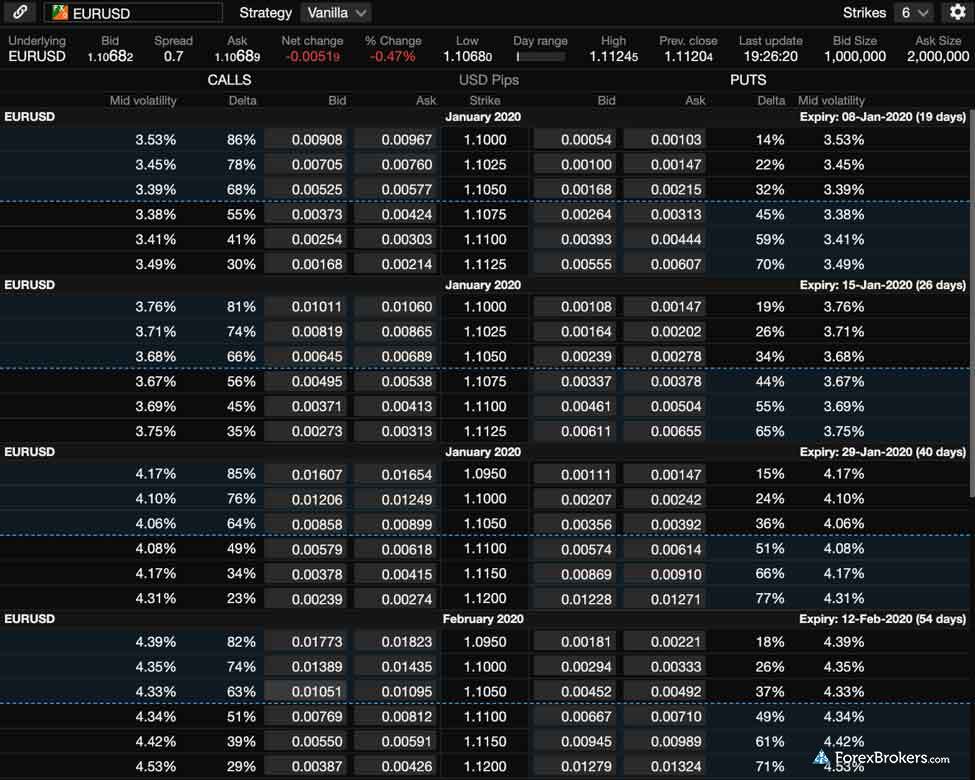

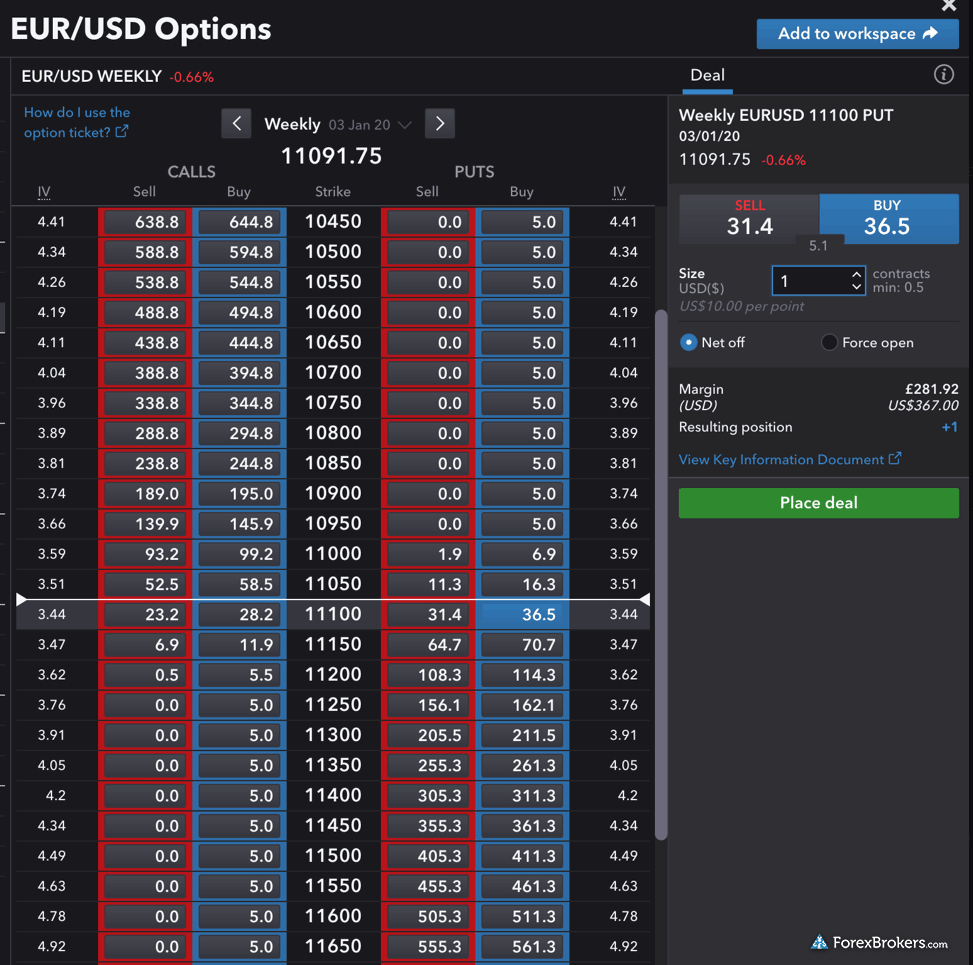

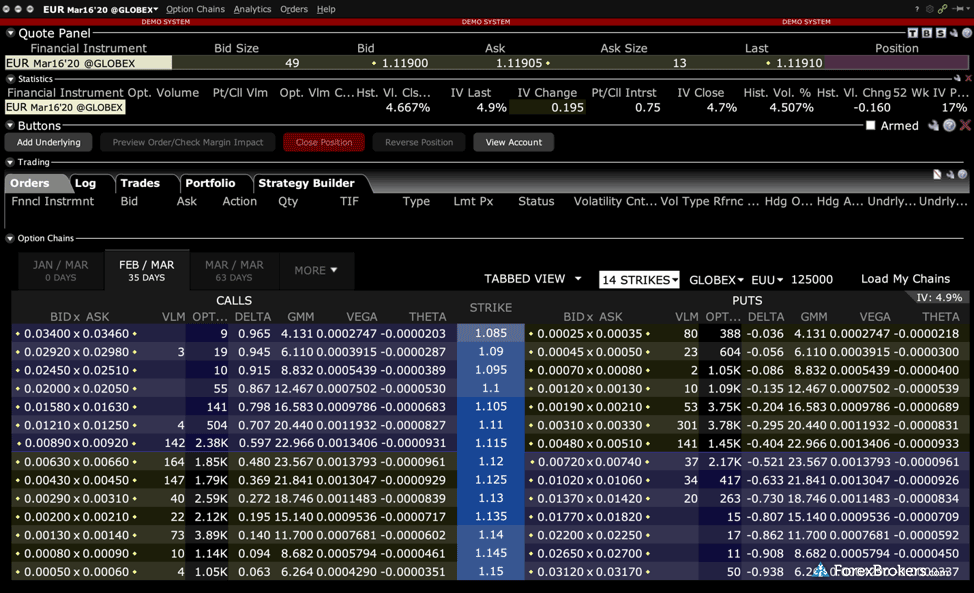

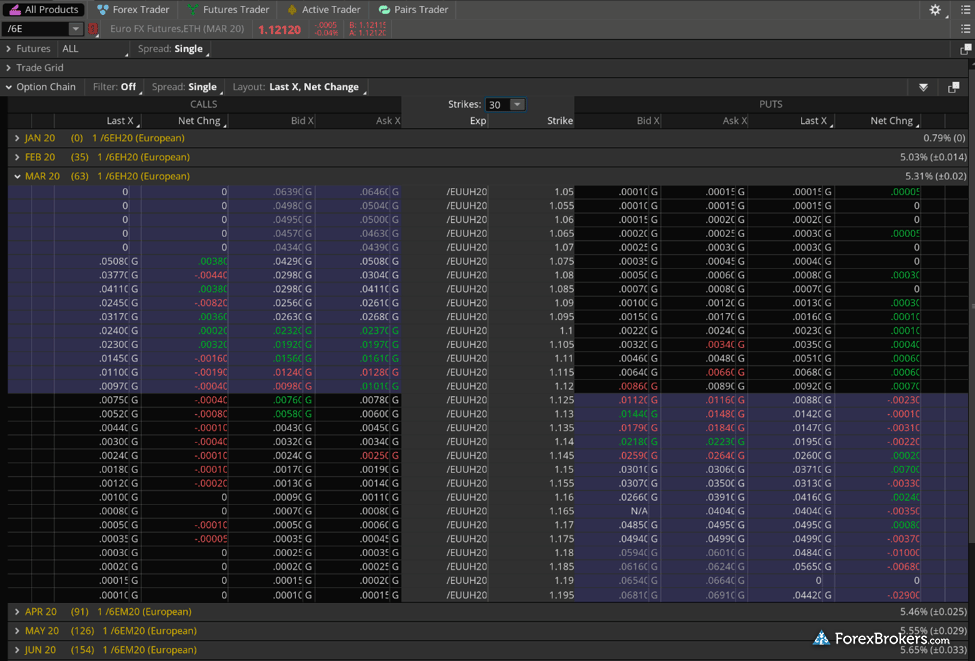

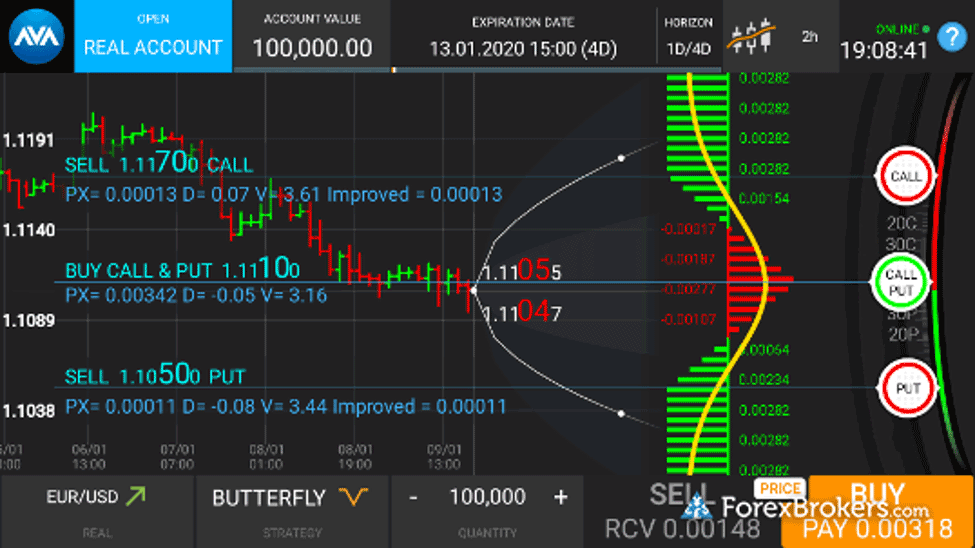

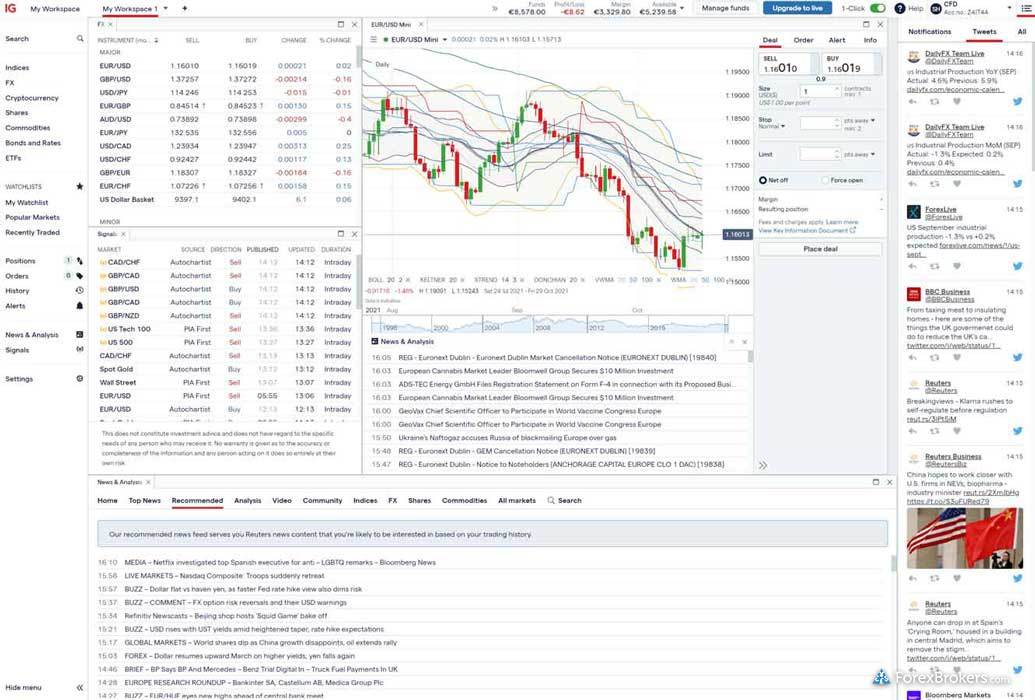

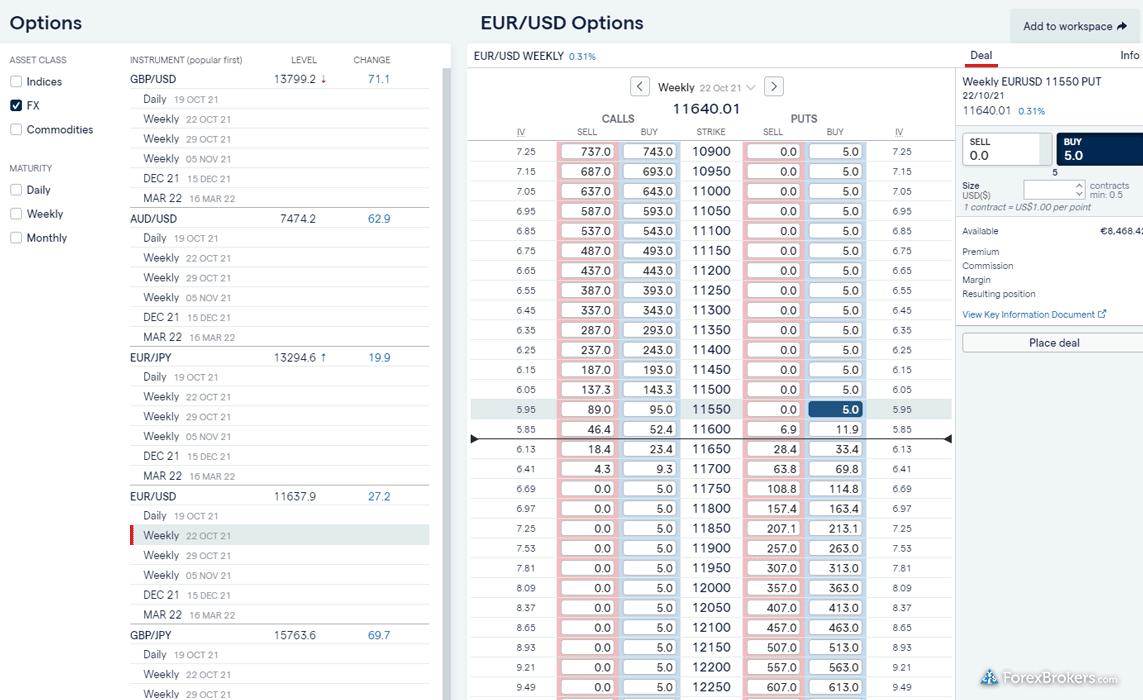

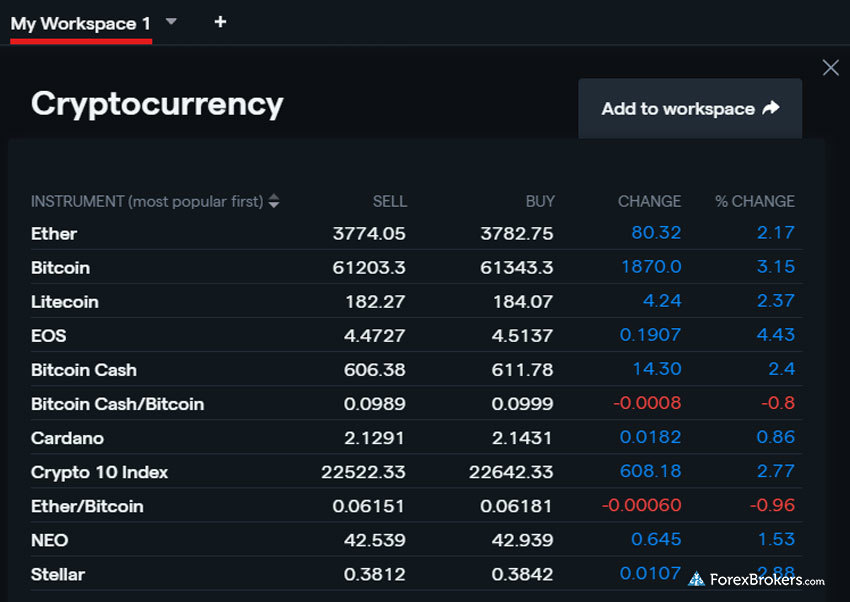

The gallery below contains pictures of forex options featured on the best forex options brokers.

What is the best broker for trading forex options?

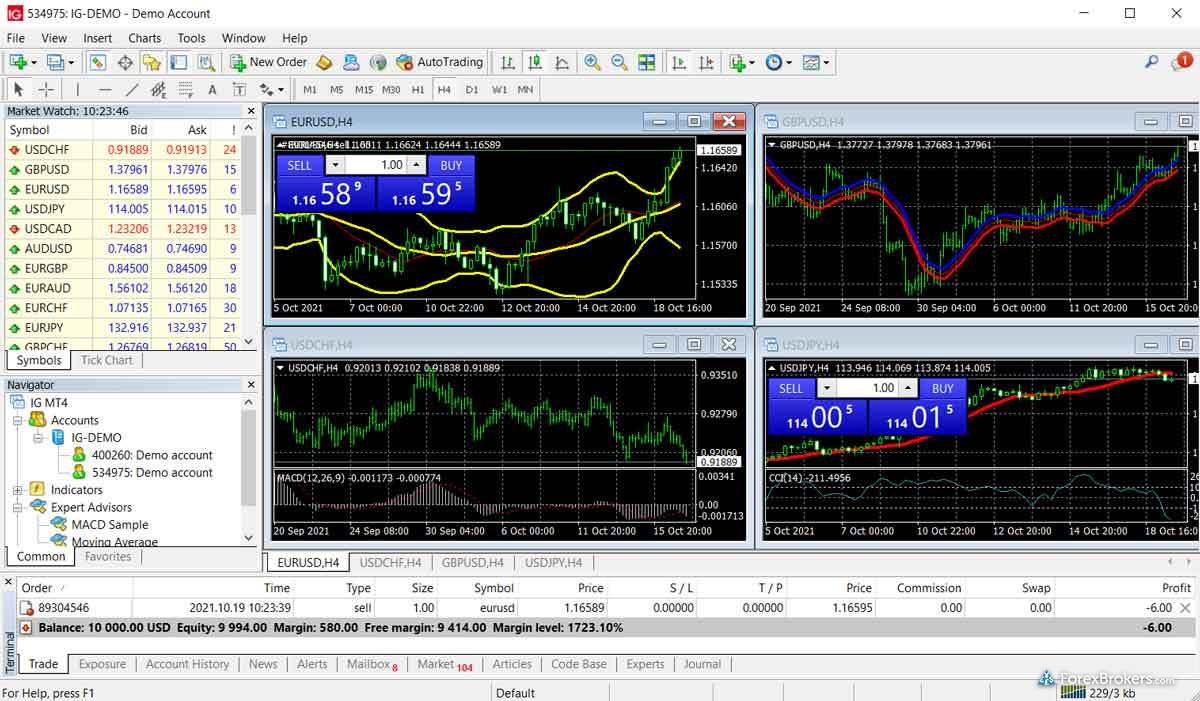

IG is my pick for the best forex broker for options trading. IG offers exchange-traded as well as off-exchange (over-the-counter) options across a number of global marketplaces, as well as Turbos and other exotic options that cater to a wide variety of investor risk appetites. IG offers exchange-traded options in the U.S. through its TastyTrade subsidiary. In the EU, IG operates a Multilateral Trading Facility (MTF) for its exchange-traded forex options. It’s also worth noting that the off-exchange OTC options available at IG feature versatile contract sizes (compared to the standardized contracts you’ll find on exchanges).

Check out some screenshots of IG’s highly rated suite of trading platforms, taken during our product testing.

Forex options terms to know

Below are seven terms every trader should know before trading forex options:

- Strike Price - The price level the contract can be exercised at (i.e., exercise price)

- Time Value - The portion of the premium represented by any remaining time

- Spot Price - The current market price of the underlying asset

- Premium - The value of time remaining plus any positive difference between spot and strike price

- Break-Even Level - The difference between the Spot price and any time value

- Intrinsic - The positive difference between the strike price and underlying spot price

- Extrinsic - The negative difference between the strike price and the underlying spot price

Different types of forex options

Aside from differences related to where you trade forex options, there are also different forex options types beyond the plain-vanilla options, including more exotic currency options. Here is a basic course on options. Below are examples of varying forex option types:

- Average rate options

- Barrier options (turbo warrants, touch brackets)

- Swaptions (converts to a swap position)

- Currency warrants (long-term options)

- Binary options (Digital 100s)

- Countdowns

Why trade forex options?

While not suitable for all investors, options can be attractive to forex traders due to their inherent properties not found in other forex instruments. Below is a list of some of the perceived advantages of why investors trade forex options trading:

- Pre-defined risk when buying options

- No chance of a margin call or getting liquidated (except for Turbo or Barrier options)

- Can be used to offset or fully hedge an existing position

- A combination of options can create highly specific trading strategies

- Have pre-defined time remaining until expiry

- Can be highly risky if selling options with undefined risk or buying low probability out-of-the-money options

What is a forex put option?

A put option is a bearish (short) position that profits when the price of the underlying decreases.

A trader who is expecting the price of the EUR/USD to fall by a specific date may purchase a put option with enough remaining time-value.

What is a forex call option?

A call option is a bullish (long) position that profits when the price of the underlying increases.

A trader who is expecting the price of a currency pair such as the EUR/USD to appreciate by a specific future date may purchase a call option. The option should have enough remaining time-value to cover the trader's forecasted time-horizon for that trade.

What are the different levels of forex options trading?

Selling puts or calls to open a position will generally require considerably more margin than buying puts or calls. Forex traders in the US are required to get approval for that level of options trading, across the following four tiers:

- Level one options trading: Default level, includes protective puts and covered calls

- Level two options trading: Buying options (puts or calls)

- Level three options trading: Credit and Debit spreads (defined risk/reward)

- Level four options trading: Naked position (undefined risk)

What are some common strategies for options trading?

Depending on what you are expecting in the market for a given forex pair and time-frame, there are over a dozen popular strategies used to establish an options position with predefined risk in anticipation of specific market behavior related to price direction and volatility, some of which are listed below:

- A combination position includes more than one option in the same contract at the same time.

- A straddle (or strangle) combines writing (or purchasing) both a put and call at the same strike price (or different strike prices) and the same expiration date.

- A spread position is one where you are both the buyer and the writer (seller) of the same type of option, although strike price and expiry dates can be different.

What are exotic forex options?

Some forex options lose value if the underlying spot price touches a barrier level, such as a turbo warrant (known as turbos, or touch brackets).

- For example, if a turbo call option trades at a level below its strike price (i.e., breaking its barrier), it becomes worthless, even if the price recovers before expiration.

- Meanwhile, other forex turbos can have a barrier level that is different than the strike price level. Furthermore, a Turbo may have a barrier that only activates at a specific time, such as after one touch.

Are forex options cash-settled?

Almost all forex options are cash-settled, where no delivery takes place. Thus, it can be convenient to trade these financial instruments in the same way investors trade non-deliverable spot forex (i.e., CFD trading).

Can retail traders buy forex options?

Certain forex brokers will require that you are a professional client to trade options, such as Digital 100’s (binaries). At the same time, other brokers may also offer FX Forwards, in addition to forex options and currency futures, and forex instruments available to retail traders (i.e., CFDs).

Are there risks involved in trading forex options?

All types of forex options trading should be considered high-risk investments. Whether trading out-of-the-money options that have a higher probability of expiring worthless and thus could be deemed “riskier”, or even when trading an option that is deeply in-the-money with lower-probability of expiring worthless. In all cases, forex options are risky, complex financial instruments, and even if you understand them well, they may not be suitable for everyone.

Are forex options profitable?

The profitability of forex options will depend on a variety of factors, such as its strike price relative to the underlying market, the prevailing spread, the scope of any intrinsic and/or extrinsic value remaining in its premium, and the difference between these values when entering the market. The net result will be either a profit, loss, or break-even when factoring in the cost of the trade (i.e. any bid/ask spread, in addition to the changes in the value of premiums).

Here’s an example:

An investor expecting that the EUR/USD will appreciate above 1.1500 may purchase an American-style call option with a strike price of 1.1500. After fees, their break-even point might be 1.1550; this would require that the EUR/USD move higher than that point before expiration for the option to be profitable.

lightbulbFun fact

European-style options can only be exercised upon expiration, not before (though the contract can still be exited early with a profit or loss). Compared to an American-style option, improvements in the underlying price will not always reflect as quickly (or at all) in the value of the options premium, even with all other things being equal (i.e. strike prices, spreads, contract size, etc.).

ForexBrokers.com 2024 Overall Ranking

Now that you've seen our picks for the top brokers for forex options, check out the ForexBrokers.com Overall Rankings. We've evaluated over 60 forex brokers, using a testing methodology that's based on 100+ data-driven variables and thousands of data points. Check out our full-length, in-depth forex broker reviews.

Popular Forex Guides

More Forex Guides

Popular Forex Broker Reviews

Methodology

At ForexBrokers.com, our evaluations of online brokers and their products and services are based on our collected quantitative data as well as the qualitative observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the online forex brokerage industry, and we evaluate dozens of international regulator agencies (click here to learn about how we calculate Trust Score).

Our research team, led by Steven Hatazkis, conducts thorough testing on a range of features, including each broker’s individual products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

When examining a broker’s offering of forex options, we examine the full range of available options contracts. Among other factors, we specifically consider the availability of spread trading and other complex multi-legged options strategies, the number of underlying assets available for options trading, and whether the broker’s forex options are over-the-counter (OTC) or exchange-traded (listed).

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and an exhaustive list of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser. Our Desktop PCs run Windows 11, and we use MacBook Pro laptops running macOS 12.5 to test trading on the go.

We also test on mobile devices; for Apple, we test using the iPhone XS running iOS 15, and for Android we use the Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra devices running Android OS 12.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. For a full explanation and accounting of our research and testing process, please click here to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

About the Editorial Team

Steven Hatzakis

Steven Hatzakis is the Global Director of Research for ForexBrokers.com. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. A forex industry expert and an active fintech and crypto researcher, Steven advises blockchain companies at the board level and holds a Series III license in the U.S. as a Commodity Trading Advisor (CTA).

John Bringans

John Bringans is the Senior Editor of ForexBrokers.com. An experienced media professional, John has close to a decade of editorial experience with a background that includes key leadership roles at global newsroom outlets. He holds a Bachelor’s Degree in English Literature from San Francisco State University, and conducts research on forex and the financial services industry while assisting in the production of content.

Joey Shadeck

Joey Shadeck is the Content Strategist and Research Analyst for ForexBrokers.com. He holds dual degrees in Finance and Marketing from Oakland University, and has been an active trader and investor for close to ten years. An industry veteran, Joey obtains and verifies data, conducts research, and analyzes and validates our content.

Blain Reinkensmeyer

Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. He heads research for all U.S.-based brokerages on StockBrokers.com and is respected by executives as the leading expert covering the online broker industry. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets.

FOREX.com

FOREX.com

City Index

City Index

XTB

XTB

eToro

eToro

Swissquote

Swissquote

Capital.com

Capital.com

Plus500

Plus500

OANDA

OANDA

FXCM

FXCM

Admirals

Admirals

Pepperstone

Pepperstone

XM Group

XM Group

FP Markets

FP Markets

FxPro

FxPro

IC Markets

IC Markets

Markets.com

Markets.com

Tickmill

Tickmill

Fineco Bank

Fineco Bank

BlackBull Markets

BlackBull Markets

Vantage

Vantage

HYCM (Henyep Capital Markets)

HYCM (Henyep Capital Markets)

HFM

HFM

ThinkMarkets

ThinkMarkets

FlowBank

FlowBank

DooPrime

DooPrime

Trading 212

Trading 212

BDSwiss

BDSwiss

Trade Nation

Trade Nation

TMGM

TMGM

Moneta Markets

Moneta Markets

Eightcap

Eightcap

MultiBank

MultiBank

ACY Securities

ACY Securities

RoboForex (RoboMarkets)

RoboForex (RoboMarkets)

VT Markets

VT Markets

easyMarkets

easyMarkets

IronFX

IronFX

Spreadex

Spreadex

IFC Markets

IFC Markets

Trade360

Trade360

Octa

Octa

Axi

Axi

TeleTrade

TeleTrade

GKFX

GKFX

Vestle

Vestle

FXOpen

FXOpen

FXPrimus

FXPrimus

Forex4you

Forex4you

GBE brokers

GBE brokers

Alpari

Alpari

TopFX

TopFX

Libertex (Forex Club)

Libertex (Forex Club)

LegacyFX

LegacyFX

FXGT.com

FXGT.com

ATFX

ATFX

Xtrade

Xtrade