What is PayPal?

PayPal is a digital payment platform that enables its users to send and receive electronic payments and make online financial transfers. PayPal customers link their credit card or checking account directly to their PayPal account, creating a digital payment option for a wide variety of payment scenarios.

An ecommerce titan, PayPal has processed billions of payment transactions across the globe and expanded its reach to over 200 countries and regions. Since its founding in 1998, PayPal has expanded its services to include credit cards and credit lines, cryptocurrencies, and business operations solutions.

What are the best forex brokers that allow you to deposit and withdraw with PayPal?

Winner: IG - Best Overall

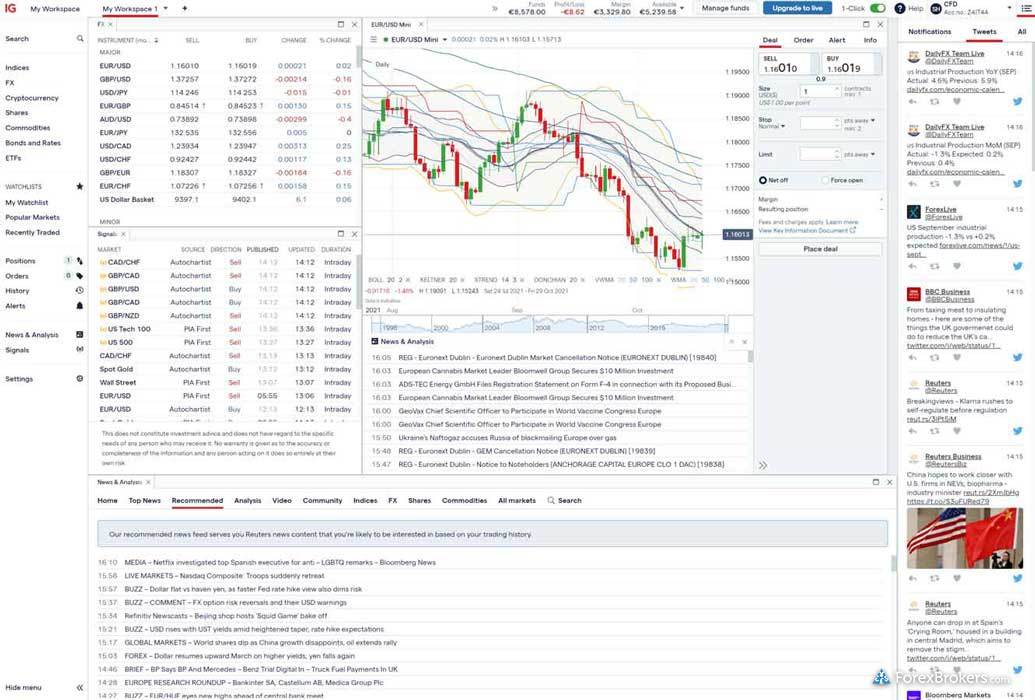

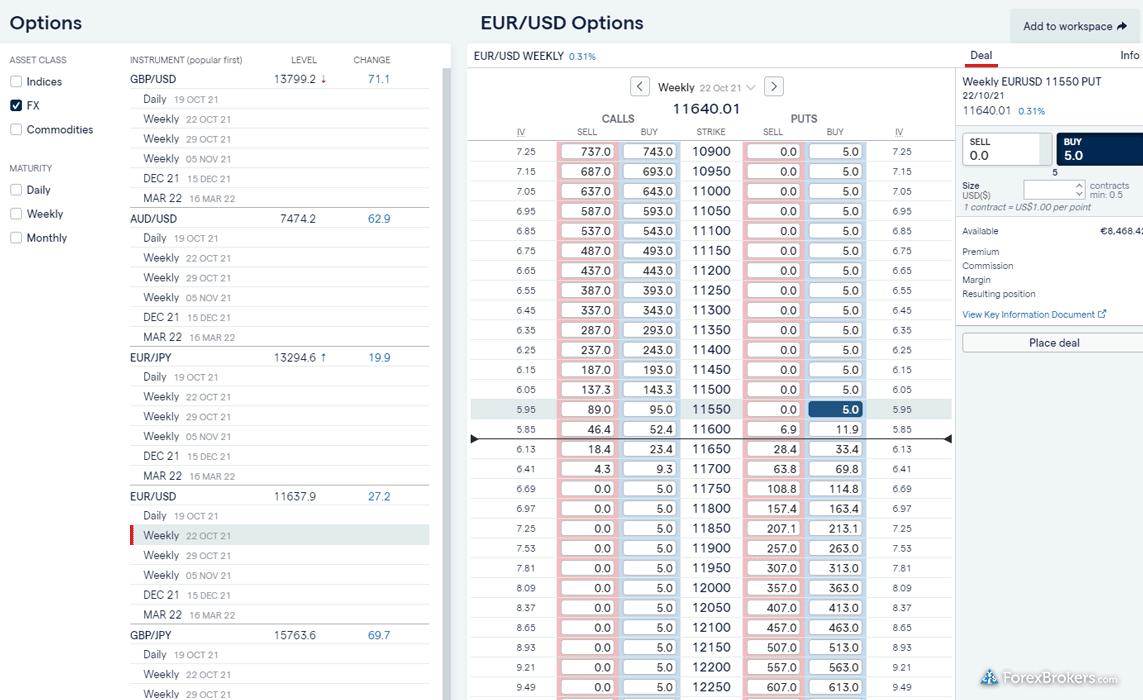

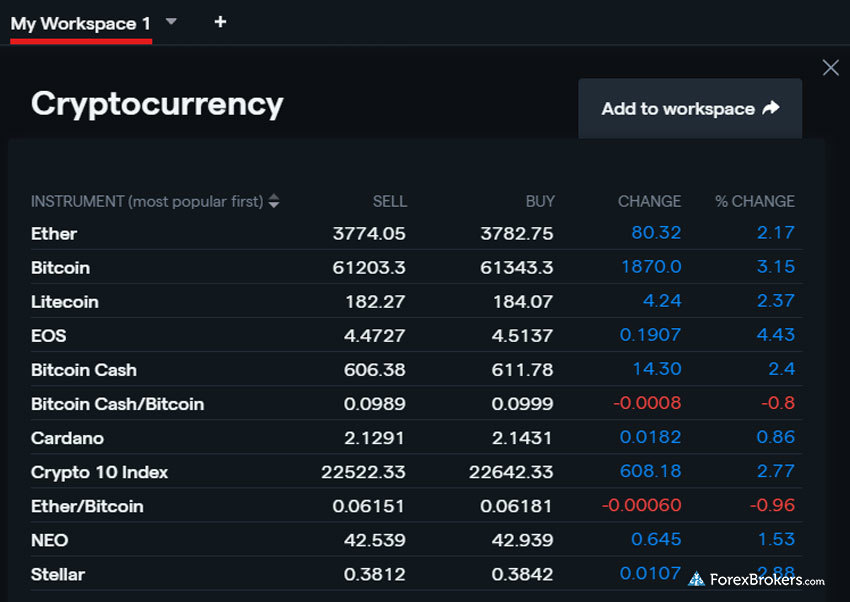

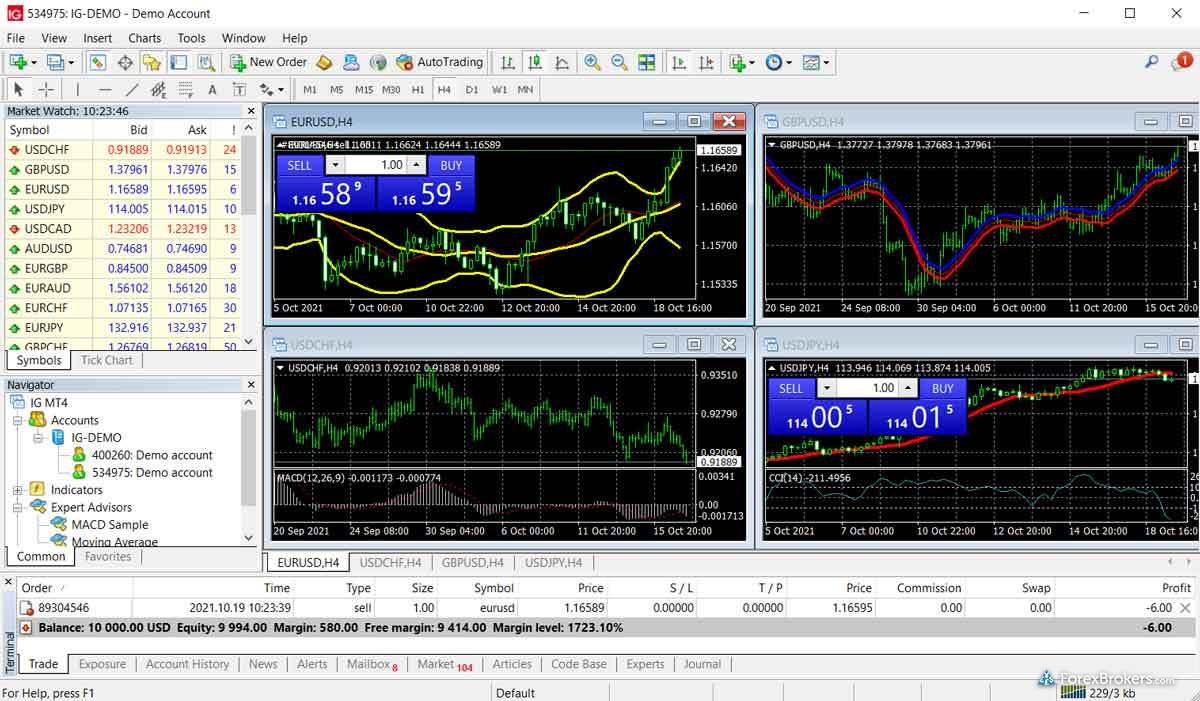

IG is our pick for the best forex broker that allows users to make deposits and withdrawals with PayPal. IG is publicly-traded (LON: IGG), well-regulated, and licensed by over a dozen international regulatory agencies (IG has earned our highest possible Trust Score). IG stands apart from the competition with its impressive offering of tradeable markets and its excellent selection of trading tools. Minimum deposit requirements at IG will vary depending on your country of residence and can range from $250 or €300 euros to as much as 2,500 Swiss francs (CHF). Read our full-length IG review.

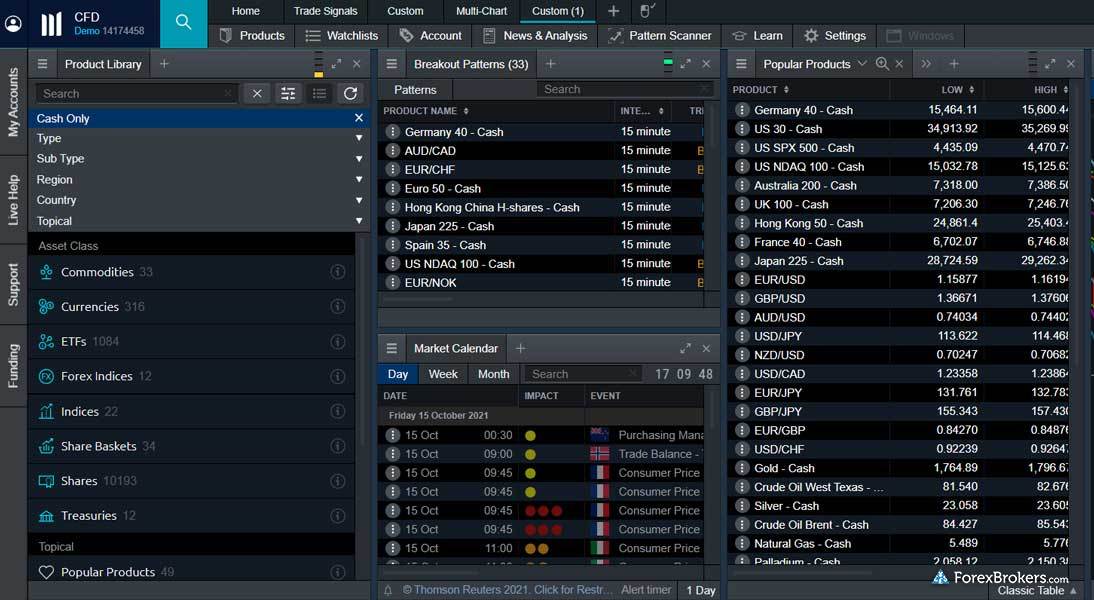

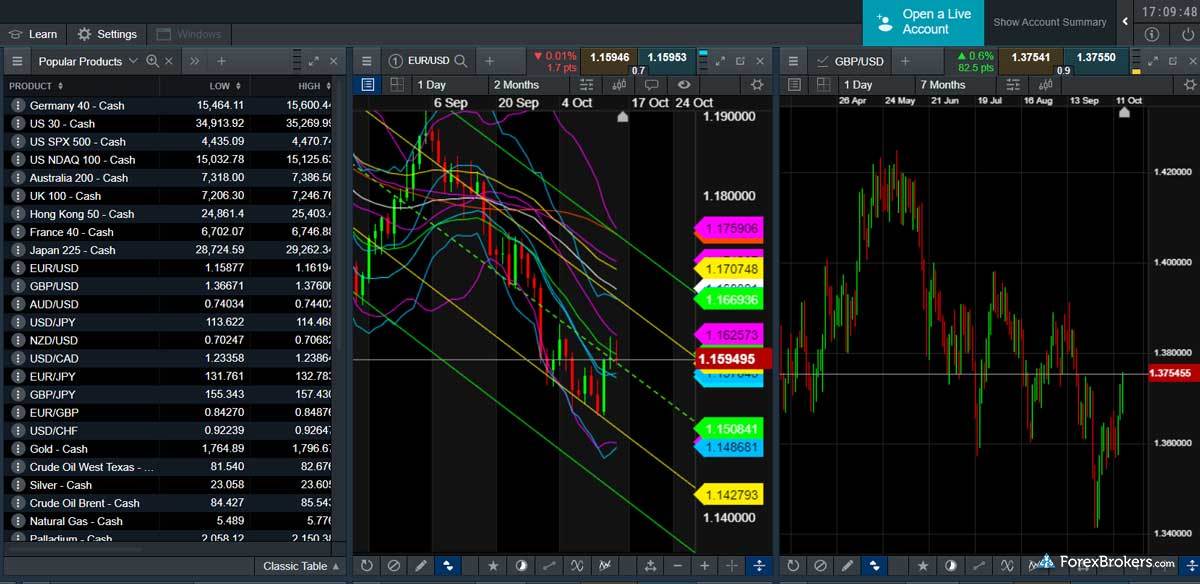

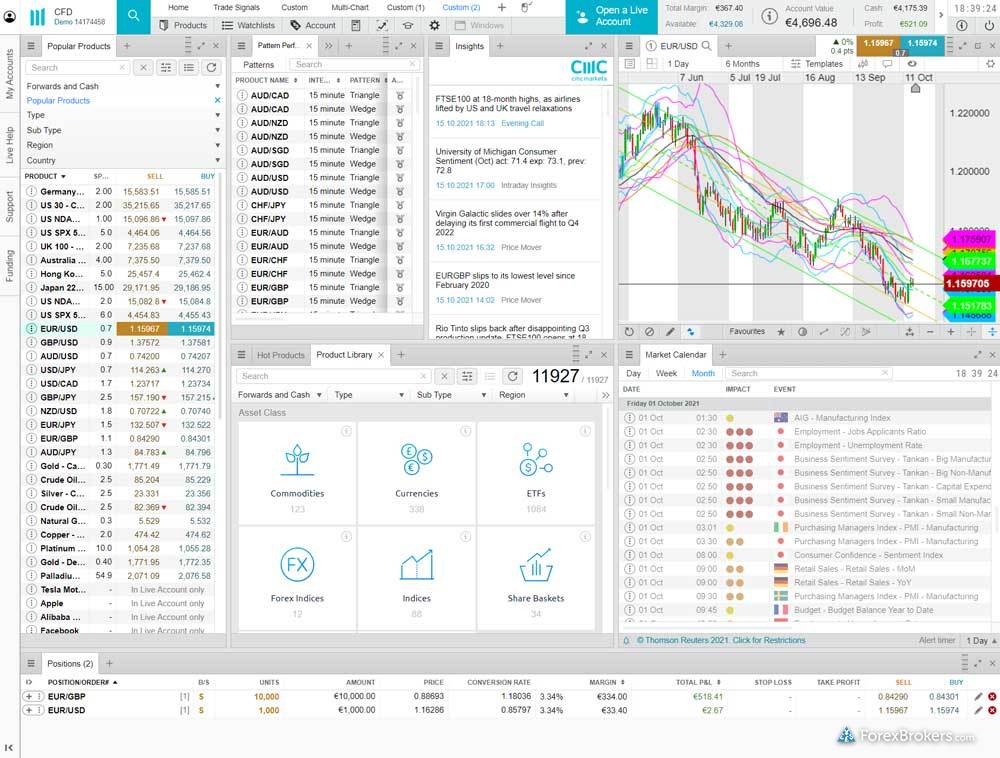

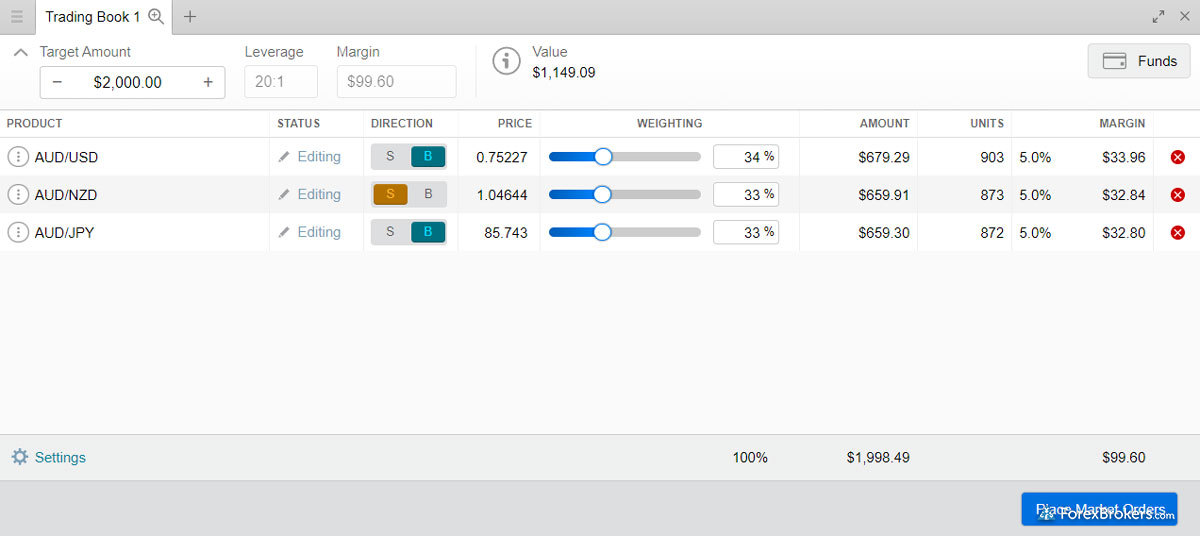

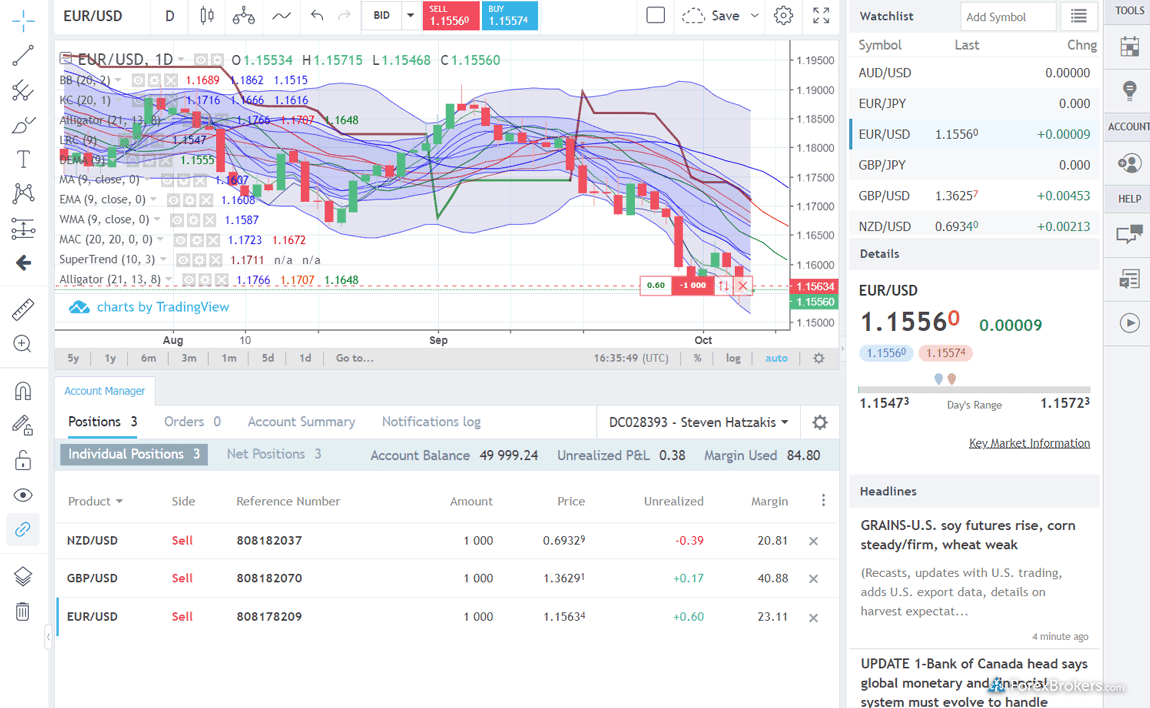

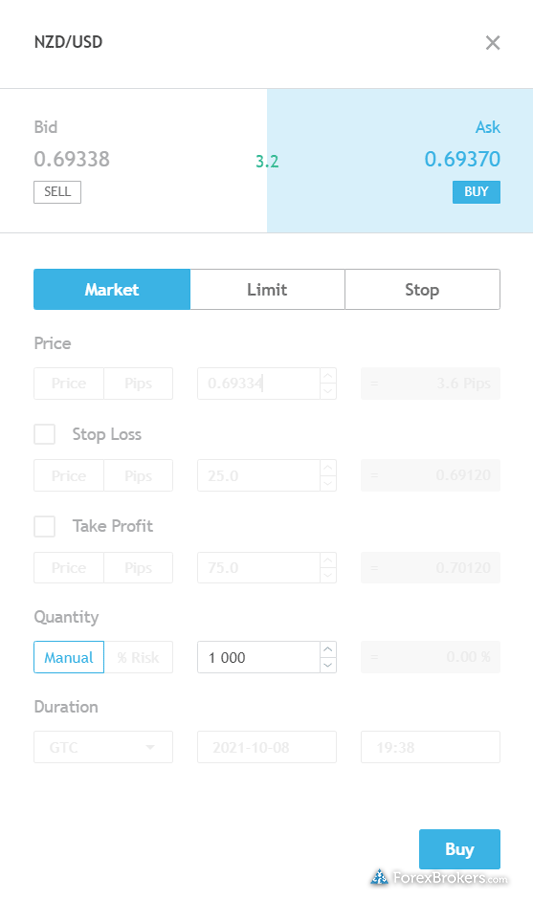

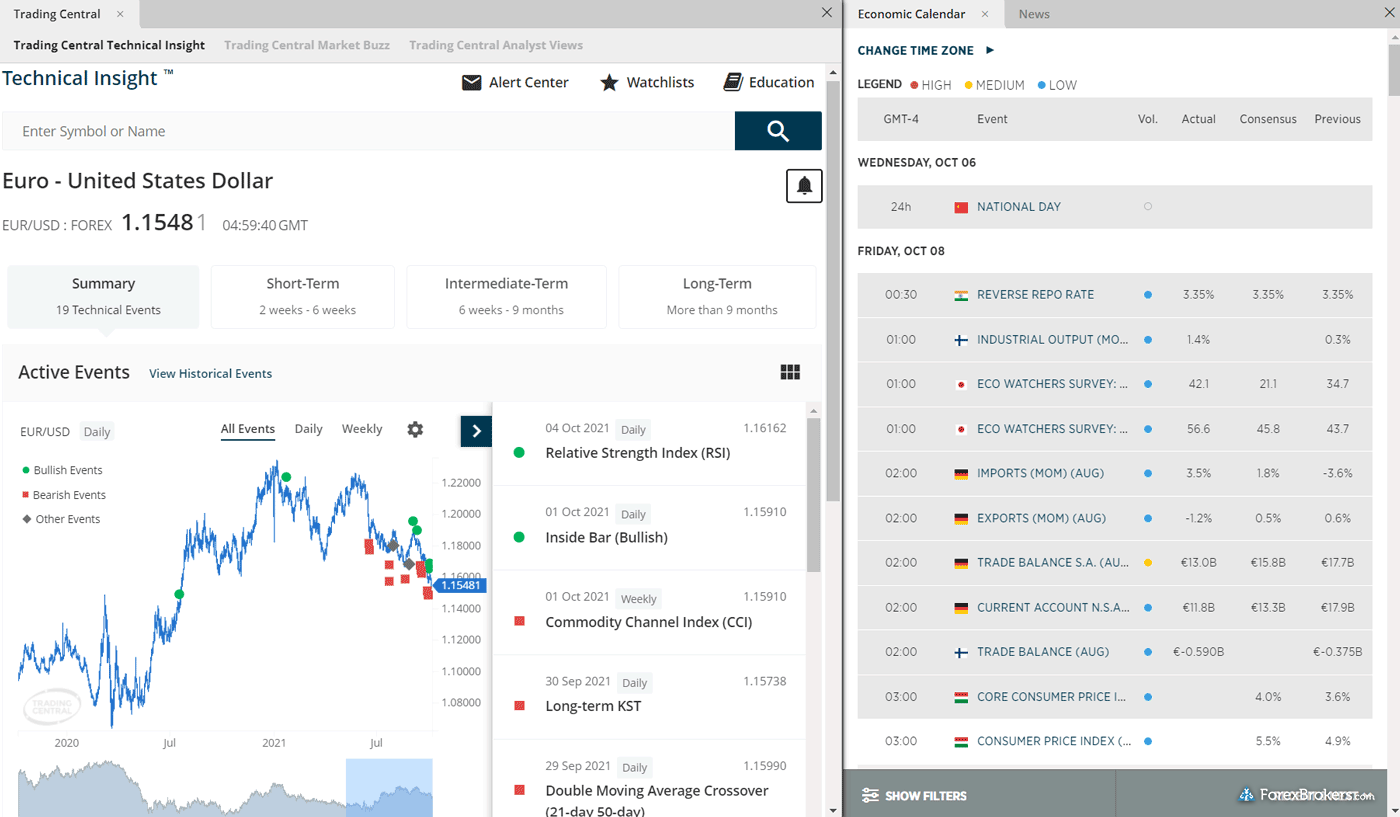

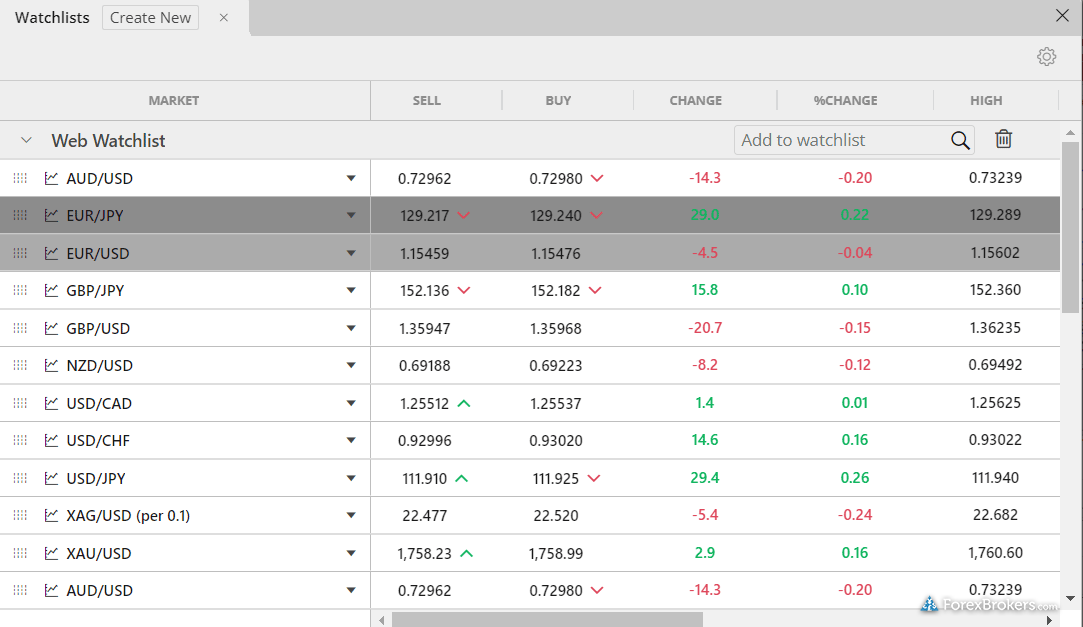

Check out a gallery of screenshots from IG's trading platforms, taken by our research team during our product testing.

Runner up: CMC Markets

A great choice for CFD and forex traders that want to use PayPal for funding their trading account, CMC Markets features competitive pricing and over 12,000 instruments spanning virtually every market and asset class. CMC Markets is highly regulated and publicly traded (LON: CMCX), and its Next Generation platform is powerful, versatile, and packed with plenty of customization tools and configuration options. Regardless of the CMC Markets entity you choose — U.K., Singapore, Australia, Germany, or Canada – there is no minimum deposit requirement at CMC Markets. Read our full-length CMC Markets review.

Check out some screenshots from CMC Market's trading platforms, taken by our research team during our product testing.

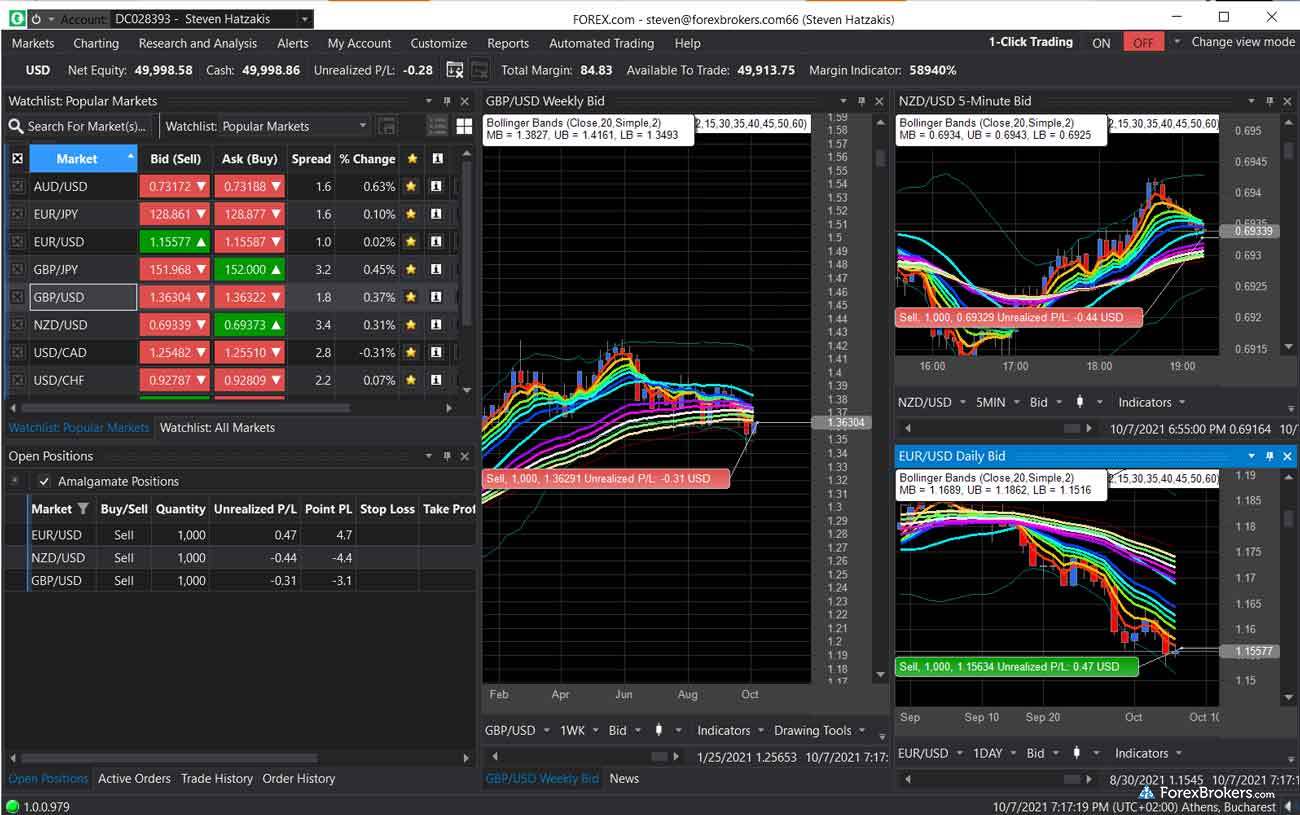

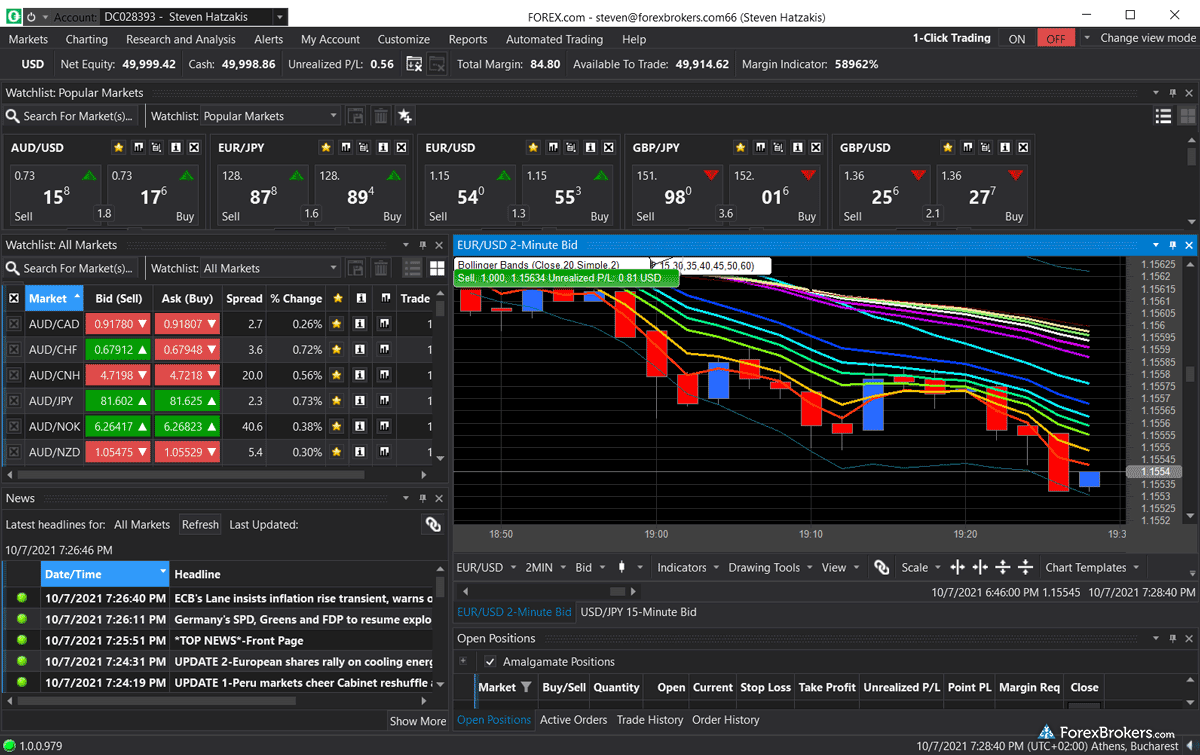

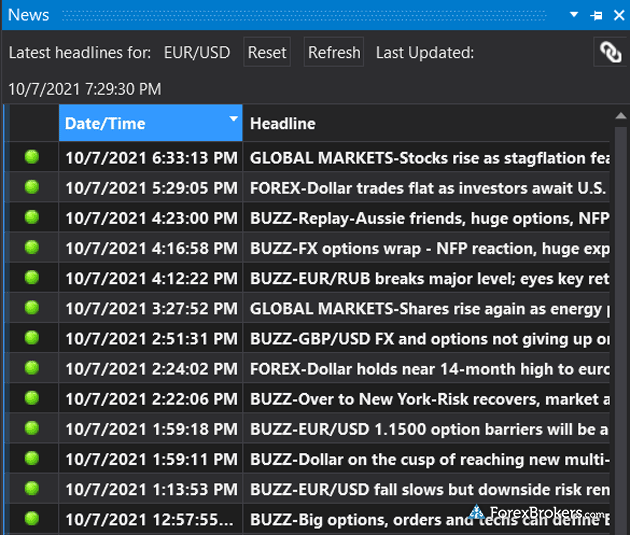

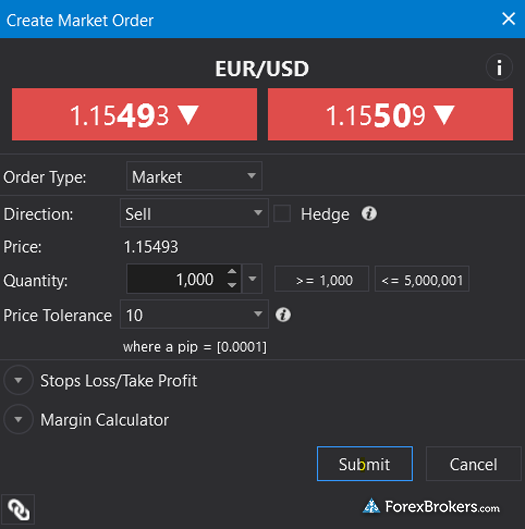

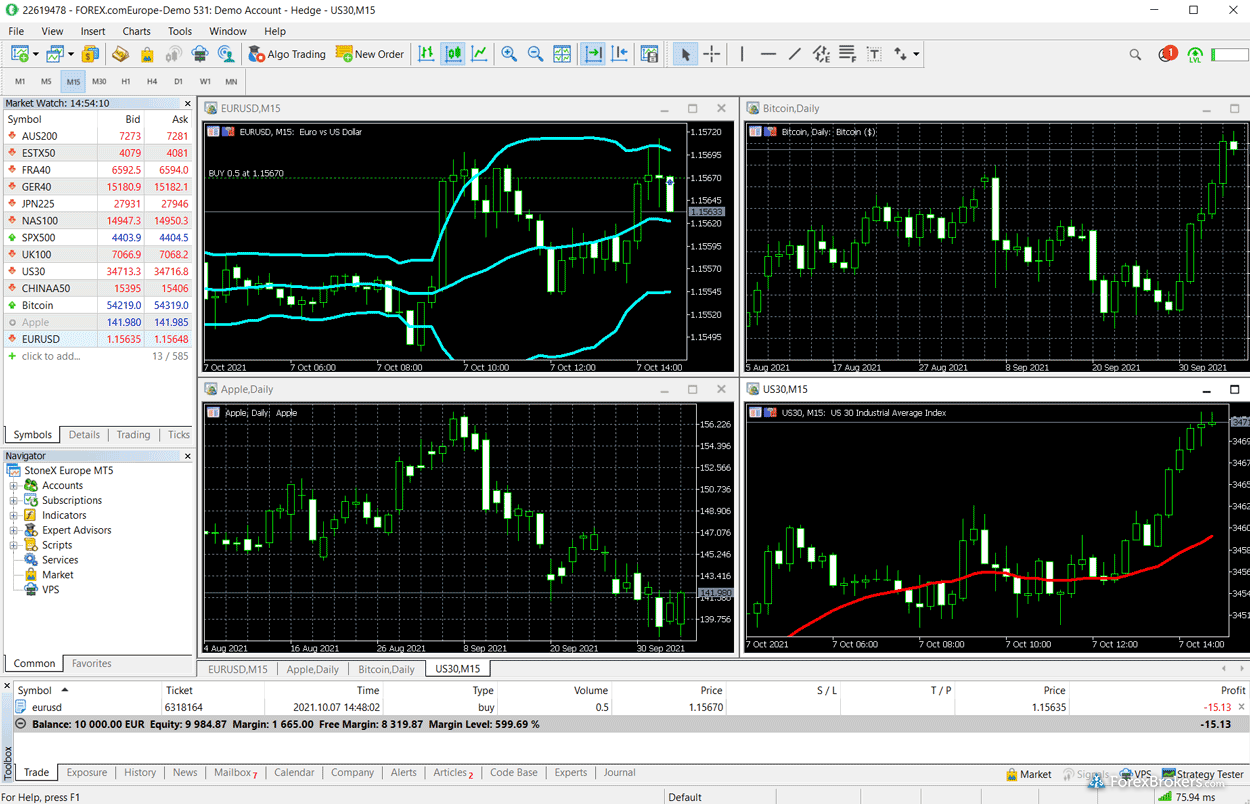

Podium finisher: FOREX.com

FOREX.com is a trusted brand that accepts PayPal deposits within the U.K. (and from a number of its global offices). The FOREX.com brand is part of the publicly traded StoneX group (NASDAQ: SNEX), and supports a wide variety of deposit currencies and payment methods. Although not available for corporate account holders or in certain countries (such as the U.S.), PayPal deposits at FOREX.com can be made with a minimum currency equivalent of 100 USD, EUR, or GBP per transaction. The maximum deposit transaction you can make with PayPal at FOREX.com is $50,000. Read our full-length FOREX.com review.

Check out some screenshots from FOREX.com's trading platforms, taken by our research team during our product testing.

Why use PayPal as a trading payment option?

It’s hard to beat PayPal when it comes to convenience, security, and ease of use. Simply put: PayPal is fast, safe, and easy to navigate. Traders can quickly make instant deposits to (or withdrawals from) their forex trading accounts with a PayPal account. It’s also relatively affordable; PayPal doesn’t charge fees for opening a new account (though you might be liable for payment fees, depending on your payment method and country of residence).

Another thing forex traders will appreciate: PayPal’s global presence is massive, and its international service coverage is extensive. PayPal is available in more than 200 countries and regions, and it supports 25 different currencies, including the USD, CAD, EUR, DKK, JPY, GBP, and INR. Check out PayPal’s full list of supported currencies on their website.

Pros & Cons of funding your forex account with Paypal

Pros

- Traders can use PayPal from pretty much anywhere. PayPal’s international presence is extensive. Traders can send and receive payments in over 200 countries/regions.

- Dozens of supported currencies. PayPal supports 25 currencies, including (but not limited to) USD, EUR, CAD, JPY, and GBP. Check out the full list on PayPal’s website.

- Using PayPal is fast… In most cases, payments are instantaneous. Also, using PayPal to make withdrawals might actually be quicker than traditional bank account transfers.

- …and it’s also easy. It only takes a few clicks to fund an account (assuming your PayPal account is already set up - but account setup is pretty easy, too).

Cons

- You’ll need to open a PayPal account. Traders will need to open, set up, and maintain a PayPal account in order to use the service as a payment method.

- Withdrawing funds from PayPal isn’t immediate. It can take three to five business days for a withdrawal from PayPal to hit your bank account – and you may be charged a fee in the process.

How to deposit using PayPal

Though each forex broker’s process for funding or sending payments may vary slightly, we’ve listed out the most important steps for depositing funds with your forex broker using PayPal:

- Log in to your broker’s client portal or visit the funding page on your broker’s website.

- Read the broker’s payment/funding information to determine if PayPal is available in your region (sometimes your forex broker will accept PayPal – but only in certain countries or regions).

- Once you’ve selected PayPal as your payment method, you’ll be redirected to log in to your PayPal account.

- From within your PayPal account, you’ll need to authorize the payment to fund your brokerage account (and confirm the transaction details).

Note: Some brokers require that you fund your live trading account with a credit card before allowing you to use PayPal as a deposit method. Always remember to follow the explicit instructions that come directly from your regulated forex broker’s website to protect yourself from scams. Check out my educational series about financial scams for some easy-to-follow tips for avoiding forex scams.

Alternatives to using PayPal

Most often, the easiest and most straightforward alternative payment method (if you don’t have access to an e-wallet such as PayPal) for funding your trading account is simply to use a debit card. Other popular alternatives to using PayPal for funding your forex trading account are Skrill and Neteller, both of which are widely available in Europe (for other international regions, check with your broker directly to see if these methods are available).

In Asia, WeChat and FasaPay are popular methods for sending and receiving funds. Today, a growing number of brokers allow traders to make deposits using cryptocurrencies, such as bitcoin (check out our guide to the best bitcoin brokers).

PayPal fees

PayPal fees can range from a few dollars to as much as 1.5% of the transaction value. Therefore, PayPal can be a viable payment method for smaller amounts. However, if you are sending or receiving larger sums, it may end up being cheaper to wire the funds to your broker through your bank. It may be worth looking into an Automated Clearing House (ACH) or Single Euro Payments Area (SEPA) transfer, as bank transfers will have fixed fees – regardless of the amount sent.

Which forex brokers accept PayPal?

PayPal has become a popular payment method for traders looking for convenient ways to fund their forex trading accounts. However, not all forex brokers accept PayPal for sending and receiving funds (though the list of PayPal forex brokers continues to grow). We’ve determined which forex brokers support PayPal and listed them below:

Which brokers accept PayPal in South Africa?

PayPal is available in South Africa for South African forex traders – though it’s worth noting that PayPal does not currently accept the South African Rand (ZAR) currency. A handful of the industry’s top forex brokers that accept clients from South Africa also support PayPal for sending and receiving funds:

IG

IG is a trusted broker that offers brilliant trading tools and access to nearly every global market (over 19,500 tradeable assets). The minimum deposit size for clients of IG South Africa is 4,000 South African rand (ZAR). Read our full-length IG review.

AvaTrade

AvaTrade stands out for its rich selection of trading platform options, and for its educational content for beginners. The minimum deposit at AvaTrade is generally 100 units of currency, depending on the denomination of your account balance. Read our full-length AvaTrade review.

Plus500

Plus500 is a winner for less-experienced traders who desire ease of use and simplicity. The minimum deposit at Plus500 is generally 100 units of currency ($100 or equivalent) depending on your account denomination and the payment method you select from the client dashboard. Read our full-length Plus500 review.

FP Markets

FP Markets shines as a low-cost broker for trading forex and CFDs – as long as traders use the MetaTrader platform. The minimum deposit at FP Markets is 100 AUD – or the currency equivalent. Read our full-length FP Markets review.

South Africa is home to a Tier-2 regulatory agency in the Financial Sector Conduct Authority (FSCA) (you can follow the FSCA on twitter at https://twitter.com/fsca_za). Forex brokers are not obligated to become authorised by the FSCA, but carrying a Tier-2 regulatory license can be a signal of legitimacy to forex traders.

At ForexBrokers.com, we always recommend using a well-regulated, highly trusted forex broker – learn more about the regulatory agencies and jurisdictions that we track on our Trust Score page. If you are a resident of South Africa and you need help picking a forex broker, check out our guide to the best forex brokers in South Africa.

What are the best ways to deposit money for forex trading?

While some forex brokers may offer a greater variety of deposit options than others, almost every broker will, at a minimum, offer common methods such as bank wire or bank transfer (Automated Clearing House (ACH) in the U.S., or Single Euro Payments Area (SEPA) in Europe), or using a supported debit card such as VISA or Mastercard. PayPal is a popular choice due to the fact that your brokerage account can be credited almost immediately, (unless additional information is requested by your broker).

Does MetaTrader 4 accept PayPal?

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are trading platforms – not forex brokers, and therefore do not accept funds for trading. That being said, there are a growing number of regulated forex brokers that support MT4 and/or MT5 and accept PayPal for sending and receiving funds. To learn more about MetaTrader, check out our MetaTrader guide. If you are interested in the newest version of the trading platform, MetaTrader 5 (MT5), read our full MetaTrader 5 guide or check out my MT4 vs MT5 guide to learn about the differences between these two versions of the popular MetaTrader platform..

ForexBrokers.com 2024 Overall Rankings

Now that you've seen our picks for the top seven MetaTrader 5 brokers, check out the ForexBrokers.com Overall Rankings. We've evaluated over 60 forex brokers, using a testing methodology that's based on 100+ data-driven variables and thousands of data points. Check out our full-length, in-depth forex broker forex broker reviews.

Popular Forex Guides

More Forex Guides

Popular Forex Broker Reviews

Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team, led by Steven Hatazkis, conducts thorough testing on a wide range of features, products, and services. We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables. Our research team collects and validates thousands of data points each year.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s regulatory status and number of held regulatory licenses.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser. Our Desktop PCs run Windows 11, and we use MacBook Pro laptops running the latest version of macOS to test trading on the go.

We also test on mobile devices; for Apple, we test using the iPhone XS running iOS 16, and for Android we use the Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra devices running Android OS 13.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

About the Editorial Team

Steven Hatzakis

Steven Hatzakis is the Global Director of Research for ForexBrokers.com. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. A forex industry expert and an active fintech and crypto researcher, Steven advises blockchain companies at the board level and holds a Series III license in the U.S. as a Commodity Trading Advisor (CTA).

John Bringans

John Bringans is the Senior Editor of ForexBrokers.com. An experienced media professional, John has close to a decade of editorial experience with a background that includes key leadership roles at global newsroom outlets. He holds a Bachelor’s Degree in English Literature from San Francisco State University, and conducts research on forex and the financial services industry while assisting in the production of content.

Joey Shadeck

Joey Shadeck is the Content Strategist and Research Analyst for ForexBrokers.com. He holds dual degrees in Finance and Marketing from Oakland University, and has been an active trader and investor for close to ten years. An industry veteran, Joey obtains and verifies data, conducts research, and analyzes and validates our content.

Blain Reinkensmeyer

Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. He heads research for all U.S.-based brokerages on StockBrokers.com and is respected by executives as the leading expert covering the online broker industry. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets.

Interactive Brokers

Interactive Brokers

Saxo

Saxo

TD Ameritrade

TD Ameritrade

Capital.com

Capital.com

AvaTrade

AvaTrade

Plus500

Plus500

OANDA

OANDA

FXCM

FXCM

Admirals

Admirals

Pepperstone

Pepperstone

XM Group

XM Group

FP Markets

FP Markets

FxPro

FxPro

IC Markets

IC Markets

Markets.com

Markets.com

Tickmill

Tickmill

Fineco Bank

Fineco Bank

BlackBull Markets

BlackBull Markets

Vantage

Vantage

HYCM (Henyep Capital Markets)

HYCM (Henyep Capital Markets)

HFM

HFM

ThinkMarkets

ThinkMarkets

FlowBank

FlowBank

DooPrime

DooPrime

Trading 212

Trading 212

BDSwiss

BDSwiss

Trade Nation

Trade Nation

TMGM

TMGM

Moneta Markets

Moneta Markets

Eightcap

Eightcap

MultiBank

MultiBank

ACY Securities

ACY Securities

RoboForex (RoboMarkets)

RoboForex (RoboMarkets)

VT Markets

VT Markets

easyMarkets

easyMarkets

IronFX

IronFX

Spreadex

Spreadex

IFC Markets

IFC Markets

Trade360

Trade360

Octa

Octa

Axi

Axi

TeleTrade

TeleTrade

GKFX

GKFX

Vestle

Vestle

FXOpen

FXOpen

FXPrimus

FXPrimus

Forex4you

Forex4you

GBE brokers

GBE brokers

Alpari

Alpari

TopFX

TopFX

Libertex (Forex Club)

Libertex (Forex Club)

LegacyFX

LegacyFX

FXGT.com

FXGT.com

ATFX

ATFX

Xtrade

Xtrade