What is MetaTrader 4 (MT4)?

Arguably the world’s most well-known forex trading platform, MetaTrader 4 (MT4) belongs to the MetaTrader suite of trading platforms developed by MetaQuotes Software Corp. In the nearly 20 years since its launch (2005), MT4 has become known for its customizable functions, wide range of built-in technical indicators, integrated programming language, automated trading capabilities, and sophisticated analysis tools.

downloadMT4 remains wildly popular

MT4 has been downloaded over 10 million times from the Google Play store and holds a rating of 4.8 stars (with over 68,000 user ratings) in Apple’s App Store. MT4 is available for desktop and as a mobile trading app.

Note: MetaTrader is not a broker; it is a third-party trading platform that connects to a forex broker for forex trading. You’ll still need to choose a great forex broker, whether you use MT4 or MT5.

What is MetaTrader 5 (MT5)?

MetaTrader 5 is a next-generation trading platform and the successor to MetaTrader 4. Like MT4, MT5 is free to use (so long as your forex broker has paid to license the platform for its clients). Though the two platforms have a similar look, MT5’s wider range of tradeable instruments can better meet the needs of multi-asset traders looking to trade instruments such as commodities, stocks, CFDs, futures, options, and bonds.

MT5 also offers a deeper set of advanced tools and features, such as the MQL5 programming language, additional graphical objects and indicators, new statistical functions, an enhanced version of Strategy Tester, and the ability to both hedge and net trades.

announcementMore about MetaTrader 5

Learn more about MT5’s unique functions by checking out my guide to MetaTrader 5.

Key differences between MT4 and MT5

Technical Analysis Tools

Technical analysis tools enable traders to assess investments and identify trading opportunities in the market - whether they are bullish, bearish, or sideways. Common tools for technical analysis include charts, drawing tools, and backtests.

Here, MT5 outshines MT4. I'll show you why:

Charting:

The MT5 platform delivers a wider range of default studies with 38 technical indicators, 44 analytical objects, and 21 time frames (compared to MT4's 30, 23, and 9). Because of MT5’s processing capabilities, certain custom indicators and strategies can only run on MT5.

Drawing Tools:

Also known as analytical objects, these annotation tools enable traders to mark chart lines, channels, tools, geometric shapes, symbols, and graphical objects, but they differ from technical indicators in that they must be plotted manually. MT5 gives you greater precision and more options for marking up your charts.

Strategy Tester:

MT5’s revamped Strategy Tester supports multi-core and multi-threaded backtests optimized for 64-bit machines. As a result, MT5 has a greater capacity to handle large backtest projects (a backtest that takes a few hours on MT5 might take hundreds of hours to perform on MT4).

Hedging

You can use both MT4 and MT5 to hedge your trades (learn more about hedging by checking out my full guide on forex hedging), but MT5 offers the added functionality of being able to net your trades. Let’s say you have an open trade. Under MT5’s netting system, if you open a trade on the same market in the opposite direction, your initial trade will be closed, lowered in volume, or reversed.

zoom_inFind a hedging forex broker

Hedging isn't permitted by every broker or in every region. Check out my guide to the best hedging brokers to find a broker that allows you to explore a hedging strategy.

Cost

MT4 and MT5 are both free to use for retail forex traders (though your forex broker will need to offer the platforms to its clients). It’s worth noting that forex brokers offering MT4 and/or MT5 may still charge you commissions, spreads, fees, or a combination of such trading costs (depending on the broker and its account offering). Looking for a low-cost broker? Check out my guide to the Best Zero Spread Brokers to find forex brokers with the lowest spreads in the industry.

Tradeable symbols

Since forex brokers license MetaTrader platforms from MetaQuotes, the total tradeable symbols available will vary by broker. It’s worth noting that the developer has imposed a symbol cap on MT4. For example, CMC Markets has over 12,000 total tradeable symbols on its CMC Next Generation platform, but the symbol cap limits CMC Markets’ MT4 offering to 1,024 instruments.

Why use MT4 over MT5?

MetaTrader 4 has been on the market for eighteen years and has established a strong, loyal client base. MT4 can be used with hundreds of brokers around the world. When deciding between MT4 and MT5, you should always consider the account options, range of markets, and execution methods available to you with your broker’s MetaTrader offering.

updateImportant note:

MetaQuotes Software has announced they will no longer update MT4. Over time, more traders will gravitate towards MT5.

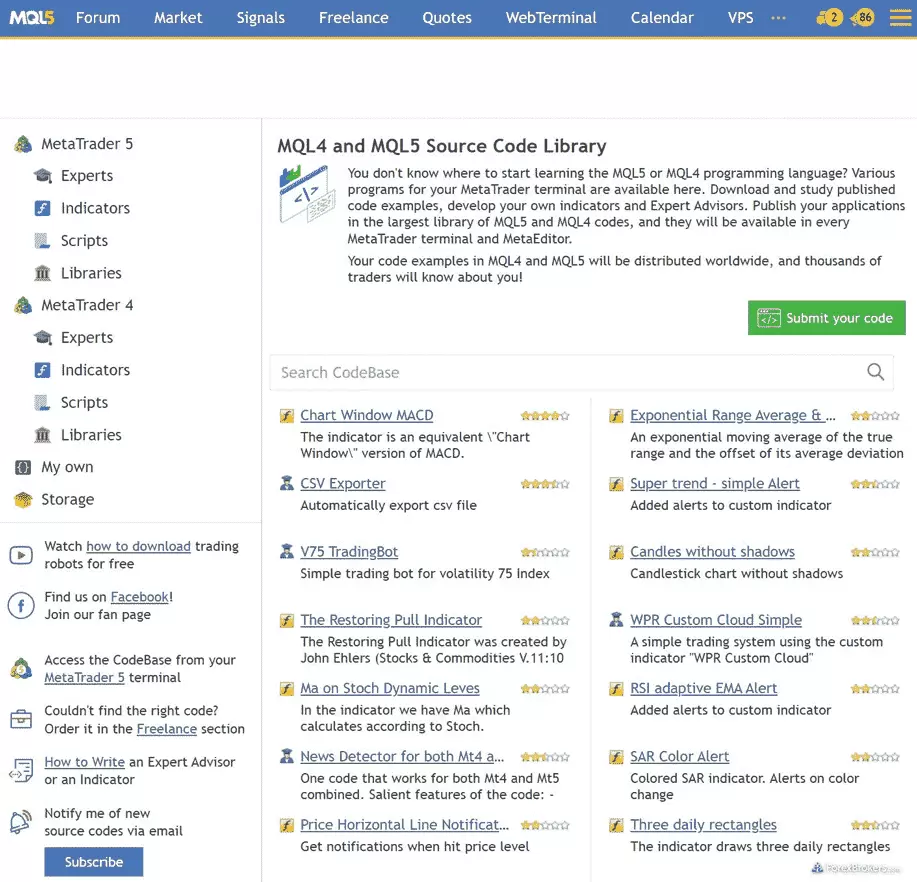

MQL4 vs MQL5: Some traders may choose to use MT4 because they created an Expert using the MQL4 programming language. Bringing that Expert over to MT5 would require rewriting the code in the newer version of MetaQuotes’ programming language (MQL5). This is one of the main reasons why it took so long for many traders to switch over to MT5; the majority of algorithmic trading programs designed for MetaTrader were built for MT4.

Why use MT5 over MT4?

Though MT5 has been slower to gain adoption among forex brokers and retail traders (it took eleven long years for MT5’s use among forex brokers to eclipse MT4), it is beginning to gain momentum among some of the best brokers in the industry.

Here are just a few reasons to pick MT5 over MT4:

MT5 is a true multi-asset trading platform. Traders using MT5 can trade financial instruments such as commodities, stocks, futures, options, and bonds (MT4 is limited to forex pairs and CFDs).

MT5's MQL5 programming language can handle multi-threading and asynchronous operations, which can carry out faster operations when performing backtesting or executing algorithmic trading via the use of Experts and custom indicators (MT4 only supports single-thread operation).

MT5’s DOM Toolbox displays market depth information; trade volumes are displayed alongside asset prices for new positions.

MT5’s Strategy Tester includes new advanced settings and supports multi-threaded backtests in 64 bits, leading to faster backtests than was previously possible.

MT5's built-in economic calendar can be pinned to charts so you don’t need to visit external news sites to check potential market-moving events. The economic calendar includes descriptions of macroeconomic indicators and their release dates.

MT5 also offers an advanced Secure Sockets Layer (SSL) certificate feature, which digitally binds cryptographic keys to any data transferred between client terminals and platform servers.

Which is better, MT4 or MT5?

MT5 is the newest version of the MetaTrader platform and thus receives full support from the developer. MT5 is a great choice for traders who are looking for a more powerful, more advanced trading platform than its predecessor. MT5 offers more order types, technical indicators, analytical objects, time frames, and charts. MT5 is also good for traders who want to perform complex backtesting, thanks to its advanced Strategy Tester features. Simply put, MT5 is the better choice for traders of all types.

Will MT4 be phased out?

Although MetaQuotes discontinued support for MT4 client terminal versions below 1065 in 2017 and stopped issuing MT4 licenses to new clients in 2018, the MT4 platform is still available for download via the MetaQuotes Software site (here is the link to the MT4 download landing page). Though MT5 is more feature-rich than its predecessor and has now surpassed MT4 in terms of the number of companies using the platform, no public statements have been made by MetaQuotes indicating that MT4 will be officially phased out.

Can I use both MT4 and MT5?

Yes, you can use both MT4 and MT5, so long as your broker of choice is licensed by MetaQuotes Software to offer the full MetaTrader platform suite. Not all brokers offer both MetaTrader platforms; check out my guides to the best MT4 brokers and the best MT5 brokers to see the list of brokers that offer each platform (and find my picks for the best MetaTrader brokers).

Which platform is better for beginners, MT4 or MT5?

Though MT4 and MT5 look nearly identical on the surface, there are some notable differences between the two trading platform versions. That said, either platform can be suitable if you are a beginner forex trader. Just because MT4 offers fewer charts and a less-specialized trading platform doesn’t mean that its user experience is markedly easier for first-time users.

MT5 is more widely supported by the developer. Brokers often offer a larger range of markets and better pricing (for trading costs and spreads) on their MT5 offering than what is available using MT4 (this of course depends on your broker and your individual trading account).

How does MetaTrader compare to cTrader?

cTrader offers a more modern user interface and sleeker design, as well as a larger number of time frames (26) than MT4 (9) or MT5 (21). I’m a huge fan of cTrader’s charts and it’s great to see the platform enjoy adoption by a decent number of trusted forex brokers. That said, MetaTrader platforms are far more popular and more widely available.

Final Thoughts - From a Trader’s Perspective

Though MT4 and MT5 were created by the same software developer, they offer a different range of functions and trading abilities. MT4 offers a relatively simple trading experience, whereas MT5 is a feature-rich, multi-asset platform that accommodates instruments and asset classes beyond just forex and CFDs. My view is that MT5 will continue to gain wide adoption, and – as developer support dwindles – MT4 will gradually be left behind.

ForexBrokers.com 2024 Overall Rankings

Now that you've seen our picks for the best forex brokers for MetaTrader, check out the ForexBrokers.com Overall Rankings. We've evaluated over 60 forex brokers, using a testing methodology that's based on 100+ data-driven variables and thousands of data points. Check out our full-length, in-depth forex broker reviews.

Popular guides to forex trading tools and platforms

Popular Forex Guides

More Forex Guides

Popular Forex Broker Reviews

Methodology

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

In order to assess the best brokers for traders looking to use the MetaTrader platform, we research and test each individual broker’s MetaTrader offering.

We examine a wide range of features and evaluate forex brokers based on our own data-driven MetaTrader-specific variables. We determine whether the broker offers the full platform suite offered by MetaQuotes Software Corp, and we look for a number of supplementary features that can distinguish MetaTrader broker offerings. Features that our researchers look for include custom Expert Advisors (Experts), the availability of the signals market, the ability to use VPN, number of account types and execution methods, among a host of other data-driven variables.

Browser-based MetaTrader platforms are tested using the latest version of the Google Chrome browser. Our Desktop PCs run Windows 11, and we use MacBook Pro laptops running macOS 12.5 to test MetaTrader on the go. We also test MetaTrader on mobile devices; for Apple, we test using the iPhone XS running iOS 15, and for Android, we use the Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra devices running Android OS 12.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

About the Editorial Team

Steven Hatzakis

Steven Hatzakis is the Global Director of Research for ForexBrokers.com. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. A forex industry expert and an active fintech and crypto researcher, Steven advises blockchain companies at the board level and holds a Series III license in the U.S. as a Commodity Trading Advisor (CTA).

John Bringans

John Bringans is the Senior Editor of ForexBrokers.com. An experienced media professional, John has close to a decade of editorial experience with a background that includes key leadership roles at global newsroom outlets. He holds a Bachelor’s Degree in English Literature from San Francisco State University, and conducts research on forex and the financial services industry while assisting in the production of content.

Joey Shadeck

Joey Shadeck is the Content Strategist and Research Analyst for ForexBrokers.com. He holds dual degrees in Finance and Marketing from Oakland University, and has been an active trader and investor for close to ten years. An industry veteran, Joey obtains and verifies data, conducts research, and analyzes and validates our content.

IG

IG

Interactive Brokers

Interactive Brokers

Saxo

Saxo

CMC Markets

CMC Markets

TD Ameritrade

TD Ameritrade

City Index

City Index

XTB

XTB

eToro

eToro

Swissquote

Swissquote

Capital.com

Capital.com

AvaTrade

AvaTrade

Plus500

Plus500

OANDA

OANDA

FXCM

FXCM

Admirals

Admirals

XM Group

XM Group

Markets.com

Markets.com

Fineco Bank

Fineco Bank

BlackBull Markets

BlackBull Markets

HYCM (Henyep Capital Markets)

HYCM (Henyep Capital Markets)

HFM

HFM

ThinkMarkets

ThinkMarkets

FlowBank

FlowBank

DooPrime

DooPrime

Trading 212

Trading 212

BDSwiss

BDSwiss

Trade Nation

Trade Nation

TMGM

TMGM

Moneta Markets

Moneta Markets

Eightcap

Eightcap

MultiBank

MultiBank

ACY Securities

ACY Securities

RoboForex (RoboMarkets)

RoboForex (RoboMarkets)

VT Markets

VT Markets

easyMarkets

easyMarkets

IronFX

IronFX

Spreadex

Spreadex

IFC Markets

IFC Markets

Trade360

Trade360

Octa

Octa

Axi

Axi

TeleTrade

TeleTrade

GKFX

GKFX

Vestle

Vestle

FXOpen

FXOpen

FXPrimus

FXPrimus

Forex4you

Forex4you

GBE brokers

GBE brokers

Alpari

Alpari

TopFX

TopFX

Libertex (Forex Club)

Libertex (Forex Club)

LegacyFX

LegacyFX

FXGT.com

FXGT.com

ATFX

ATFX

Xtrade

Xtrade