MetaTrader 4 Brokers List

Here is a list of forex brokers that offer MetaTrader 4:

Admiral Markets,

ACY Securities,

AvaTrade,

BDSwiss,

BlackBull Markets,

City Index,

CMC Markets,

Capital.com,

Eightcap Review,

Forex.com,

FP Markets,

FXCM,

FxPro,

HYCM,

HFM,

IC Markets,

IG,

LegacyFX,

OANDA,

OctaFX,

Pepperstone,

Saxo,

Swissquote,

Tickmill,

TMGM,

TopFX,

Trade Nation,

Trade 360,

Vantage,

VT Markets,

XM Group, and

XTB.

What is an MT4 broker?

Any broker that offers the MetaTrader 4 (MT4) trading software can be considered an MT4 broker. MetaTrader 4 and MetaTrader 5 (MT5) belong to a suite of trading platforms developed by MetaQuotes Software Corp. for mobile, web, and desktop computers.

A forex broker simply needs a proper license from the developer in order to offer MT4 to you as a customer. However, some forex brokers that offer MT4 may lack proper regulation in the countries in which they operate, thus it is important to only choose trustworthy MT4 brokers.

See how we evaluate brokers' trustworthiness.

Is MetaTrader 4 a broker?

No. MetaTrader 4 is a third-party trading platform that connects to a broker for forex trading. MetaTrader 4 is the most popular third-party platform for trading forex. MT4 alternatives do exist; cTrader is another popular third-party trading platform. I've been using cTrader for over five years – check out my cTrader guide to learn more.

In addition to offering MetaTrader, some brokers also build their own custom in-house trading platforms. Based on our assessments of over 60 forex brokers, we've found that the best forex brokers also offer proprietary platforms.

wifiPro tip:

There is a web-based version of MT4 and MT5 available, though these are not offered by all brokers. It's important to note that the web version does not support automated trading.

Do I need a broker for MetaTrader 4?

Yes, you'll need to open a live trading account with a supporting broker if you want to place real trades within the MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platforms. If you select a broker's server name from the dropdown menu when logging in (this applies to the version of the software downloaded directly from the developer), you can open an account with the broker of your choice and access live rates within MT4 or MT5.

MetaTrader does offer the use of a free demo account, which many traders use without connecting with a forex broker for conducting technical analysis on historical rates — but this won't include access to any live trading capabilities or updated market rates.

startGetting started with MT4

Choose the right broker for you that offers MT4 (or MT5), and then download the broker’s version of the platform directly from the broker’s website to start trading (or practicing with a demo account).

How do I set up a broker on MetaTrader 4?

Once you’ve chosen a forex broker, simply open and fund a brokerage account and then download the MetaTrader 4 software directly from your broker to start trading forex and CFDs. Most brokers also offer demo accounts that allow you to practice trading with virtual funds before graduating to live trading with real money.

Note: Always choose trustworthy brokers that are properly licensed and regulated to reduce your chances of dealing with a scam MetaTrader 4 broker. Scam brokers of all kinds have only become more sophisticated in recent years; check out my guide to common forex scams to learn more.

I’ve tested dozens of the best forex and CFD brokers and compiled a list of the best MetaTrader 4 brokers. Our top pick for MetaTrader in 2024 is IC Markets, which offers the full MetaTrader suite alongside competitive pricing, add-on trading tools, and quality market research. Check out our full-length review of IC Markets’ here.

warningPro tip:

I've been covering the forex industry for over twenty years, and I always recommend choosing a forex broker that is properly licensed and regulated. Our proprietary Trust Score can help you find a regulated, trustworthy broker – click here to learn how it works.

MetaTrader Platforms Comparison

Who created MetaTrader?

Founded in 2000, MetaQuotes Software Corp is the developer of MetaTrader4 (MT4) and MetaTrader5 (MT5) software. The MetaTrader suite, which is licensed by brokers and offered to traders, is one of the most widely-used trading platforms for retail forex and CFDs trading globally.

How many MT4 brokers are there?

MetaQuotes Software does not release any figures that reveal the number of brokers that use MT4. That being said, our research found that there are at least 3,006 (counted on mobile) MetaTrader 4 (MT4) servers, and an even larger number of MetaTrader 5 (MT5) servers globally. The number of actual brokers will be fewer than the number of servers, as many brokers will offer multiple servers in order to cater to different groups of clients and across various locations.

For example, a given broker may maintain one server in London and another in Australia, or a different server for each of their account types.

Is MetaTrader safe?

Yes, MetaTrader itself is safe – but it’s important to remember that MetaTrader is a software suite (developed by MetaQuotes Software), not a broker. When trading forex on MT4 or MT5, your level of safety will depend entirely on the trustworthiness of your broker, and any measures they’ve taken to safeguard their customers.

emoji_objectsRemember

Always choose MetaTrader brokers that are highly regulated in reputable jurisdictions. Even brokers that are not outright scams can use questionable dealing practices within the MetaTrader platform – such as providing poor execution and causing asymmetrical slippage. Check out our guide to avoiding forex scams to learn more.

What is the difference between MT4 and MT5?

MetaTrader 4 is based on a prior generation (version) of software, whereas MetaTrader 5 is the latest version. (For a deep dive into the differences between these two popular versions of the MetaTrader software, check out my MT4 vs MT5 guide).

In addition to CFDs and forex trading, MT5 can support stock trading and futures trading, making it more of a multi-asset platform. MT5 also includes advanced functions like utilizing cloud storage to run strategies and to conduct backtesting. With MT4, backtesting must be done locally or through a virtual private server (VPS).

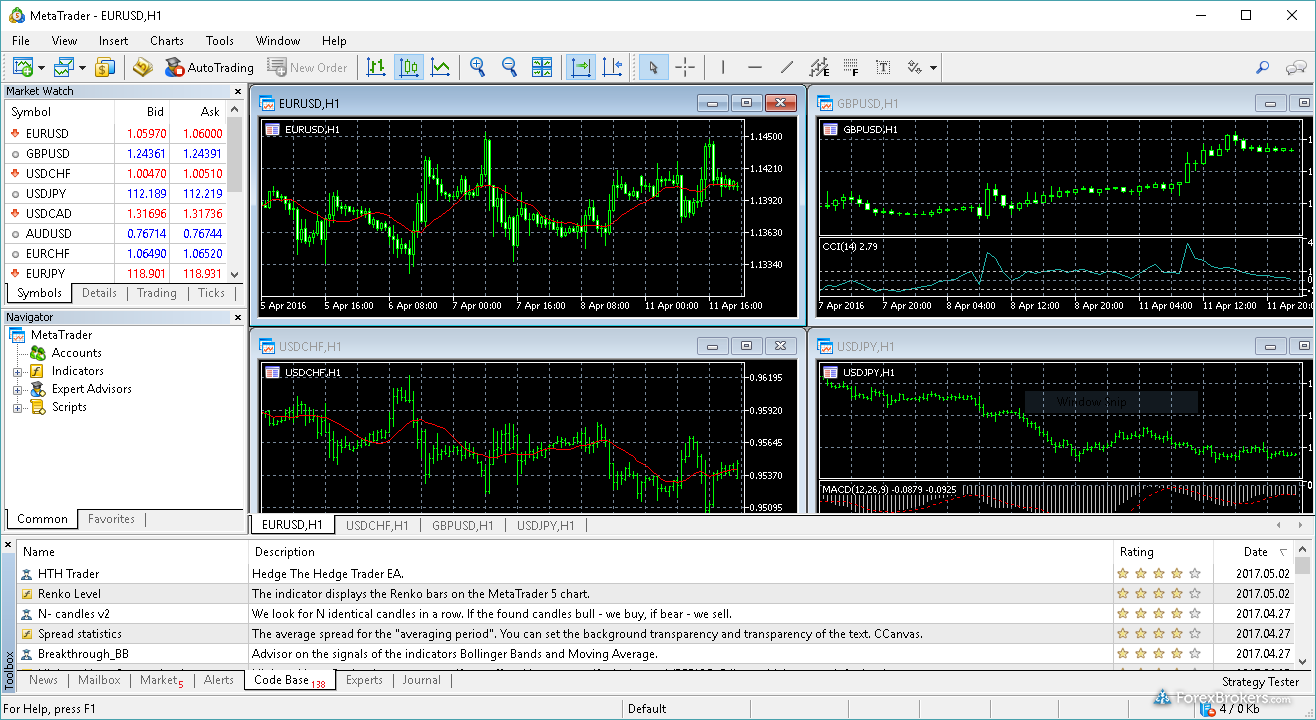

While it looks and feels similar to MT4, MT5 is a faster, more modern trading platform. Check out our MetaTrader 5 guide to learn about the platform's advanced features and to get a behind-the-scenes look at mobile, web, and desktop versions of the platform.

Though MT4 is still more widely used, the number of MT5 servers recently surpassed the number of MT4 servers globally (it took only a decade). This is mainly because more MT4-only brokers continue to launch MT5, offering the full MetaTrader suite, in addition to increasing the range of trading products available on MT5.

Does MetaTrader 4 cost money?

MetaTrader 4 is completely free to use, whether you have a demo or live account. That said, you can still incur trading costs charged by your broker (or market-maker) in the form of spreads and commissions when you buy or sell securities such as forex and CFDs.

It can also cost money to hold trades overnight — known as carry charges or overnight rollover premiums — depending on the live account type you have (Sharia-compliant accounts are usually interest-free, but may incur other costs).

Does MetaTrader 4 take a commission?

The MT4 platform developer never charges you any commissions, but brokers can charge you commissions and spread fees from within the MT4 or MT5 platforms, depending entirely on the account type you open — which varies by broker.

Forex brokers may offer the MetaTrader 4 and MetaTrader 5 platforms for free, but will still charge fees for trading (regardless of the platform you choose). Whether your broker will charge you a commission, spread, or a combination of such trading costs depends entirely on the broker and its account offering.

How do you deposit and withdraw money from MT4?

To deposit and withdraw money from MetaTrader, you’ll use the methods available to you via your forex broker – these can vary depending on the broker and your country of residence. For withdrawals, you’ll need to complete an electronic withdrawal request through your broker’s website or client portal, or complete a withdrawal form provided to you by your broker and send it to them for processing. Note: If you have multiple trading accounts, remember to indicate which MT4 account you’ll be withdrawing from.

PayPal has become a popular method for depositing and withdrawing money from live forex trading accounts, and there are a number of highly rated, well-trusted forex brokers that support the use of PayPal. PayPal also has an extensive international presence and accepts a wide range of global currencies. Learn more about using PayPal by reading our guide to the best PayPal forex brokers.

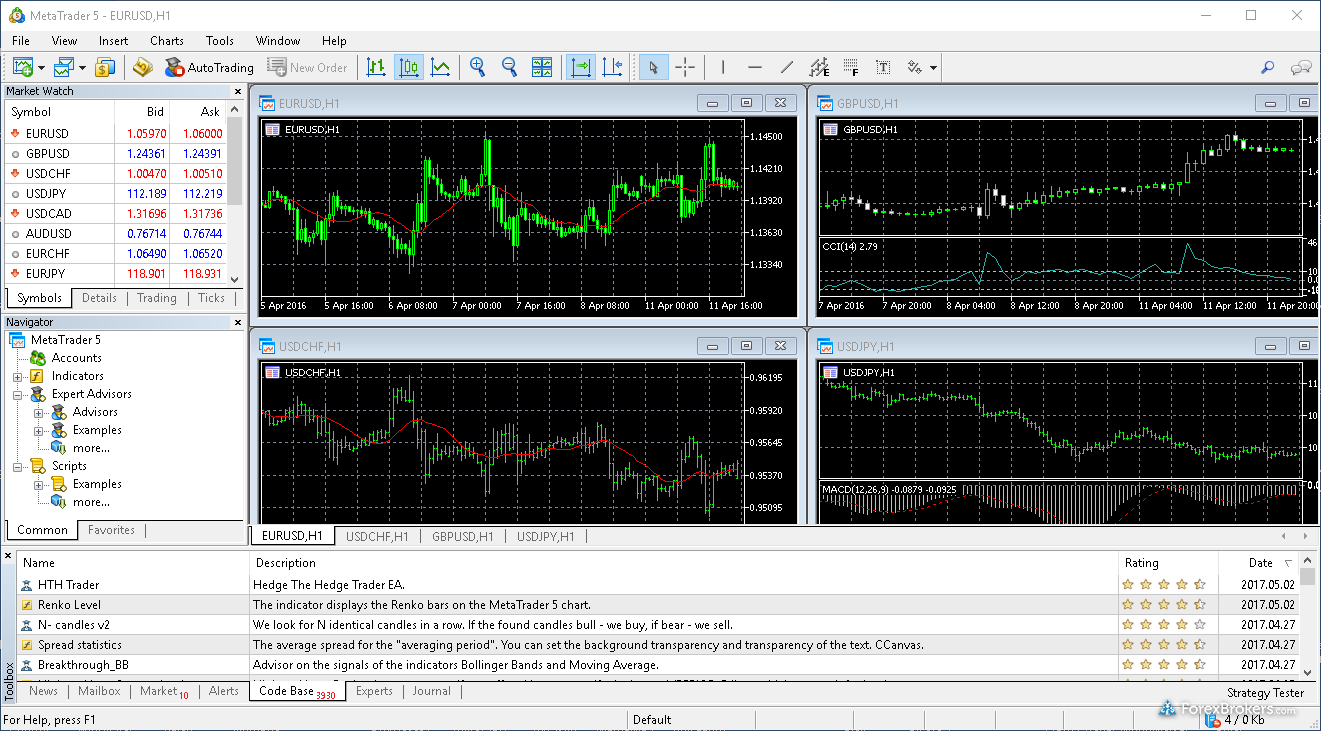

MetaTrader charts

Both MetaTrader 4 and MetaTrader 5 provide an easy-to-navigate layout, with customizable templates that can control the appearance of default charts. While the numbers may vary, you'll generally find a few dozen different charting tools and technical indicators, providing traders with a good starting point for performing basic technical analysis. Traders can also save all their charts within their profile, so the entire workspace is backed up — including all trend lines and chart configurations.

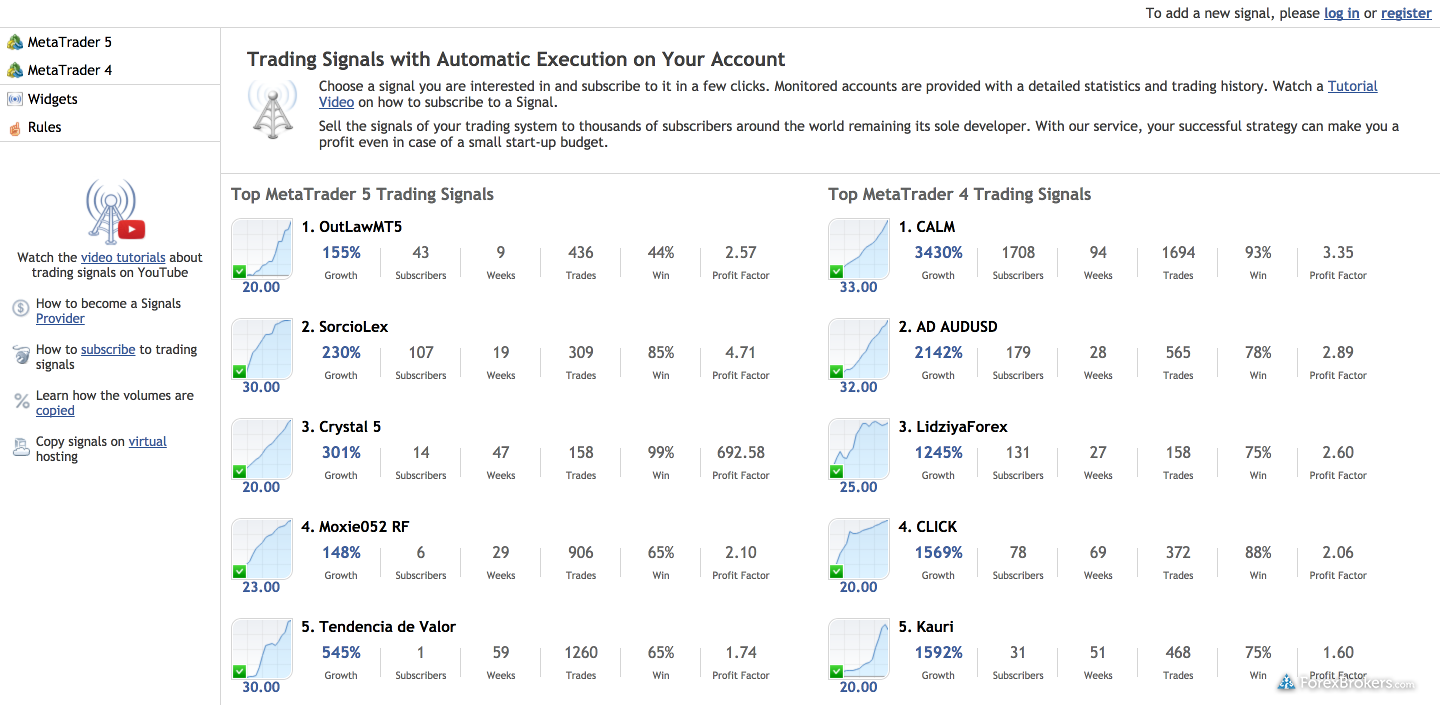

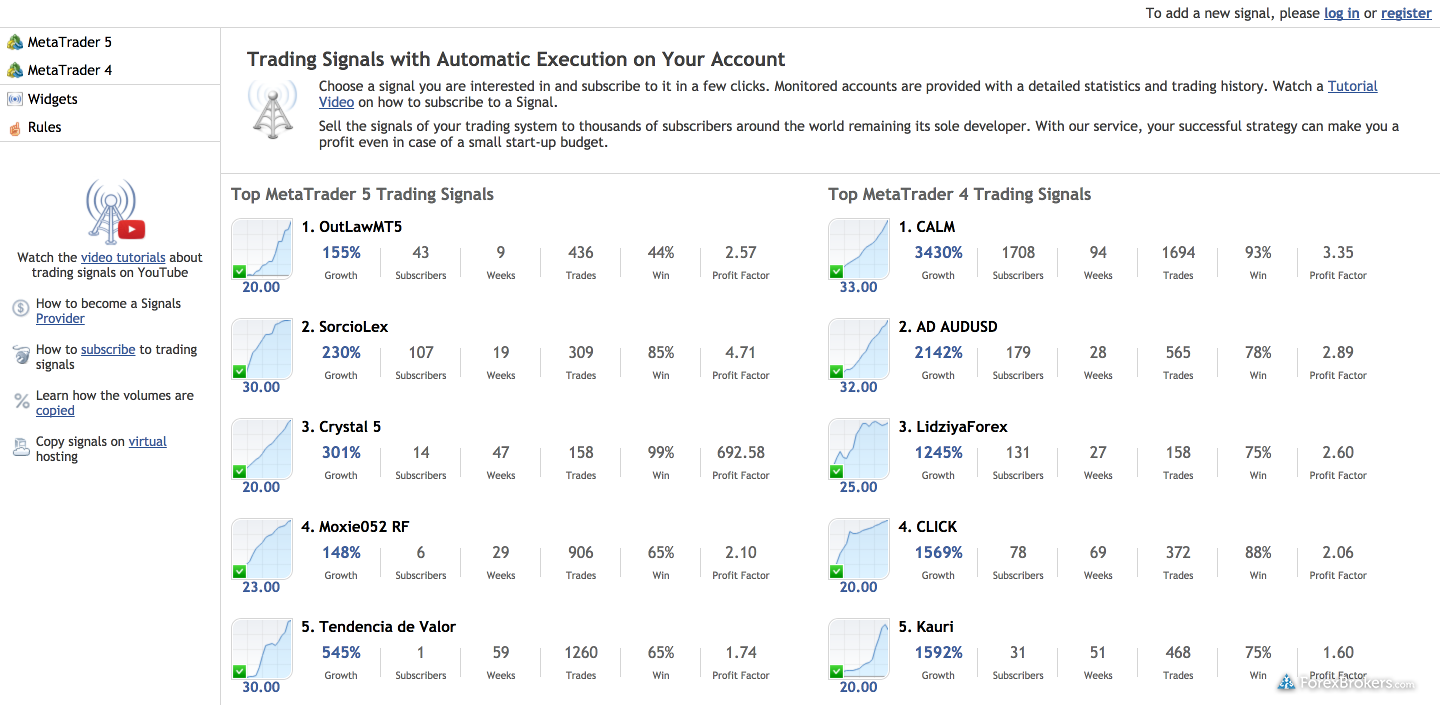

Does MetaTrader support copy trading?

The signals market available on the MQL5 Community enables users to copy the live trades of approved signal providers. Also known as social copy trading, each signal provider charges a different subscription fee for access.

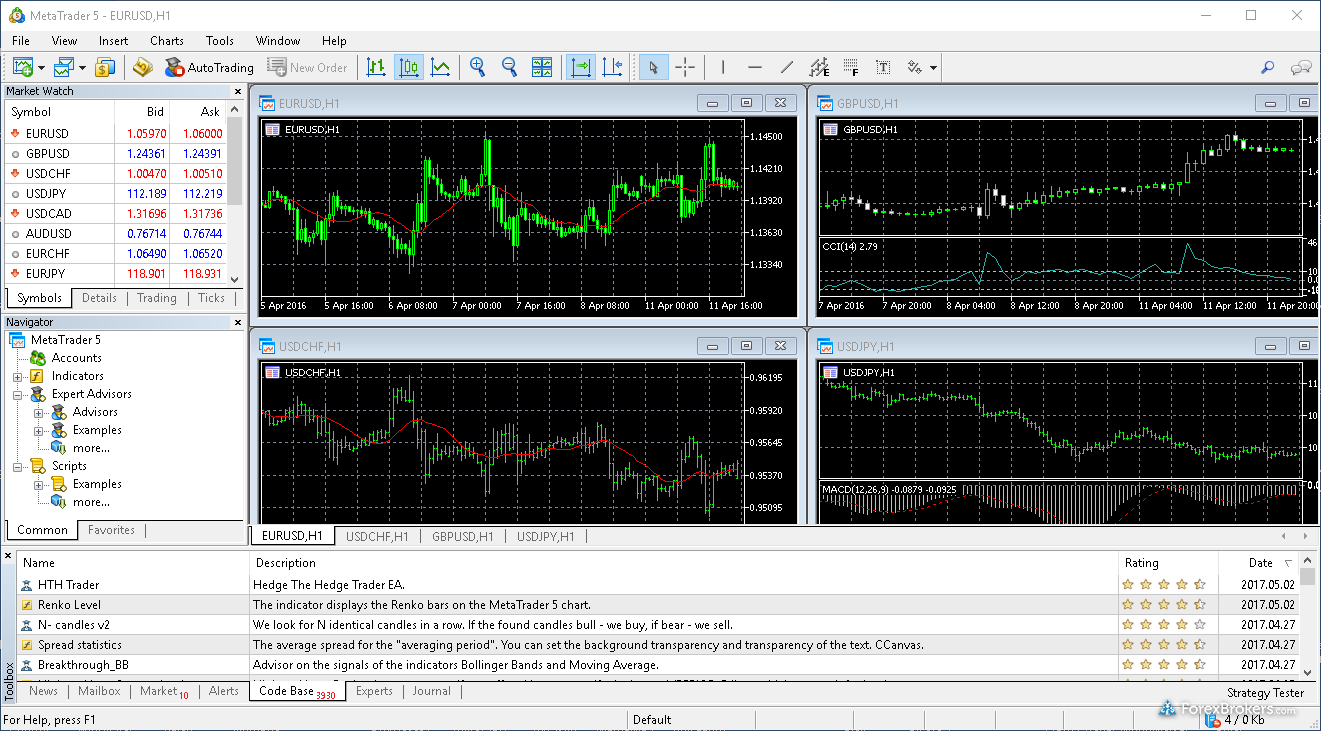

Does MetaTrader support automated trading systems?

Yes. Expert Advisors, or EAs, are used in the MT4 and MT5 platforms to run automated trading systems. An EA will either be a modifiable copy of the original .MQ4 file that contains the source code, or it will be an .EX4 (executable) file of the same code, which cannot be modified or tampered with. The latter is often chosen by those who want to distribute their strategies without revealing their source code.

Most EAs have a range of customizable parameters that let users specify the position size and risk/reward-related attributes, among other elements, that may be configured before automated trading is enabled.

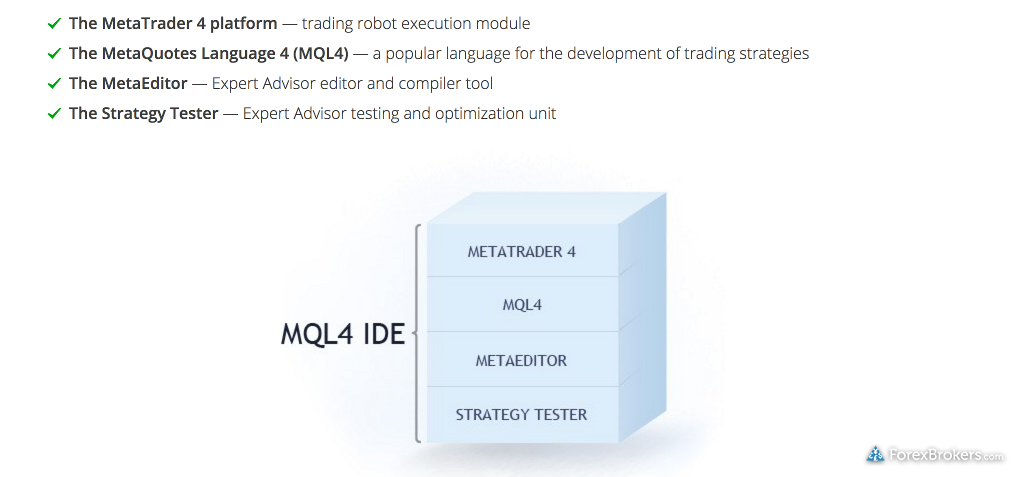

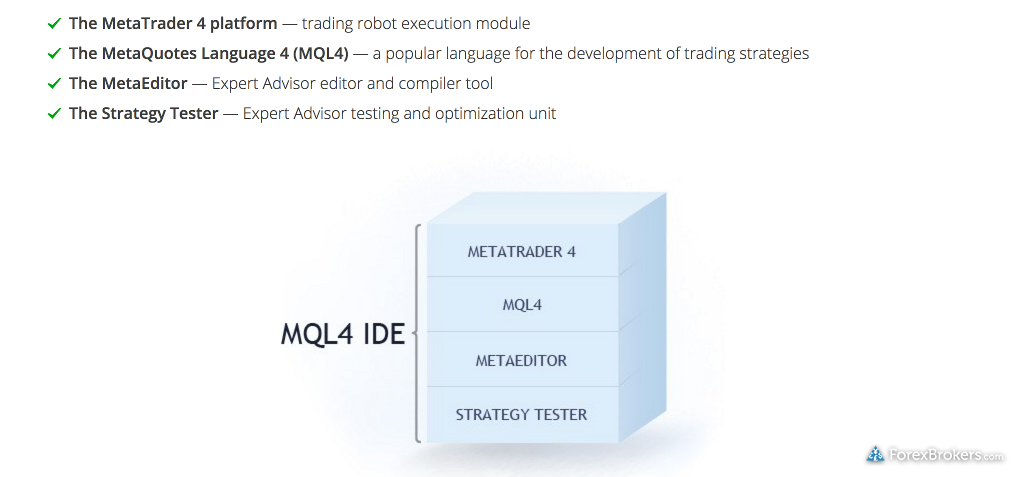

Does MetaTrader support developers?

Today, MT4 and MT5 have extensive documentation, codebase, and articles to help developers create algorithmic trading systems. The MetaQuotes Language (MQL) syntax enables programmers to create automated scripts and trading systems.

The proprietary MQL language supports custom scripts, utilities, libraries, indicators, and automated trading strategies known as Expert Advisors (EAs). The MetaTrader developer ecosystem continues to evolve each year.

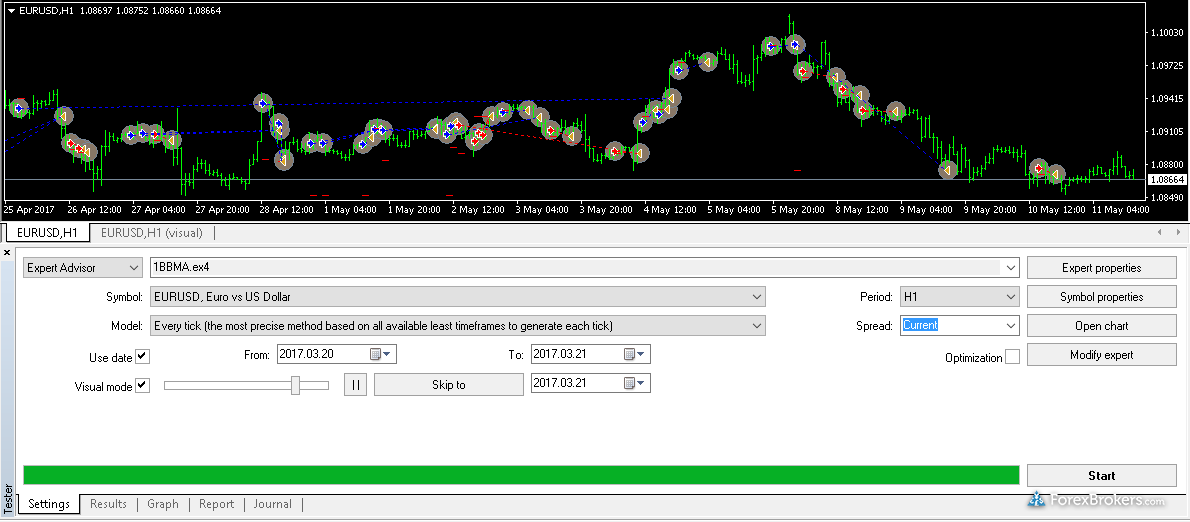

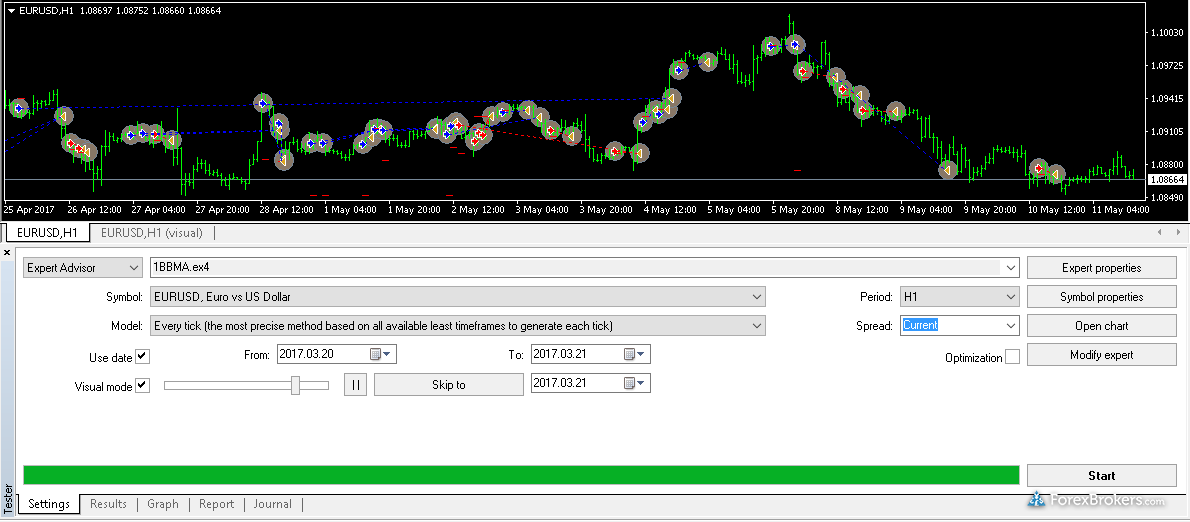

Does MetaTrader support backtesting?

Backtesting, or using historical data to assess how a strategy would have performed in the past, is an important part of assessing the quality of any automated trading system. With MT4 and MT5, backtesting enables traders to see how an EA would have performed over a historical period of time for a requested instrument (like a currency pair, for example).

When an EA is built and then tested on historical data for the first time, this is known as testing on out-of-sample data, which means the EA has never used these historical prices (in which case the result will not have the benefit of hindsight).

What are the risks of backtesting?

While backtesting is used by traders, it is also used by the signal creators too. Some developers may optimize their strategies over a historical data set (i.e., run it multiple times over the past three months of EUR/USD tick data) on purpose, which can lead to curve-fitted results.

While there can be some benefits to optimizing a strategy using historical data, results of a curve-fitted strategy can be misleading as only the best trades are cherry-picked, and the results of forward-testing the same strategy can be significantly different. Therefore, forward-testing a strategy can be even more important than backtesting it, before the value of results can be assessed.

Is automated trading with MetaTrader risky?

Yes. Experts, which are automated trading systems in MT4 and MT5, are built by traders and rely on backtesting to prove their profitability. As the famous market adage says, "past performance is not indicative of future results." The problem with automated strategies is that they rely on the benefit of hindsight bias. The reality is that very few trading systems are profitable over the course of an entire year.

Therefore, while there can be pros to using an automated strategy, traders must be aware of the pitfalls and know how to assess any strategy before using it to manage their investment capital.

Here are several tips to help you select a good automated trading strategy:

- Research and learn the trading methodology (strategy) the expert advisor follows for its automated strategy.

- Backtest the strategy across multiple instruments/timeframes, if possible, and examine its historical performance (if available).

- Compare the subscription cost and historical performance to similar automated strategies.

- Once you decide on a strategy, test the strategy with a small amount of capital first, then slowly increase your investment size over time.

If you are interested in learning about algorithmic trading and automated high-frequency trading systems, check out our guide to high-frequency trading.

Who is the best broker for MT4?

To determine the best MetaTrader 4 brokers for 2024, we researched and tested each individual broker’s MetaTrader offering.

- IC Markets - Best overall for MetaTrader

- FP Markets - Full MetaTrader suite, competitive pricing

- Pepperstone - MetaTrader suite with add-ons

- FXCM- MetaTrader suite, great research

- CMC Markets - MetaTrader suite, excellent pricing

- Vantage - MetaTrader suite, great pricing for higher balances

- Tickmill- Best overall broker for low costs

IC Markets is our top pick for best MT4 broker overall in 2024. It executes more trading volume than any other MetaTrader broker each month and offers the full MetaTrader suite alongside competitive pricing, add-on trading tools, and quality market research.

Is MetaTrader 4 only for trading forex?

The MetaTrader 4 (MT4) platform is predominantly used for forex trading. However, depending on the broker, MT4 often comes with a range of other symbols — such as CFDs on indices, commodities, futures, energies, and metals. If you’d like to learn more about how CFDs work – or you’d just like to see our list of the best CFD trading platforms – check out our full-length guide to the Best CFD Brokers and Trading Platforms.

What are "Expert Advisors" in MetaTrader?

When using MetaTrader platforms, such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5), there are automated trading systems known as Expert Advisors (EAs), or Experts for short. Experts are not humans. Rather, they are the automated trading systems created by traders to execute a trading strategy.

Final thoughts

When selecting a MetaTrader broker, traders should consider the trustworthiness of the broker (where and how it is regulated), the number of tradeable securities offered, pricing, customer service quality, and any available add-ons offered beyond the default MetaTrader experience.

All in all, MetaQuotes has proven itself to be a trusted leader in developing forex and multi-asset trading platforms for online forex brokers and retail traders globally.

To sign up for a live forex account or demo trading account with a MetaTrader broker that offers MT4 or MT5, see our list of reviewed brokers above to choose a broker that best suits your overall trading needs.

ForexBrokers.com 2024 Overall Rankings

Now that you've seen our picks for the best forex brokers for MetaTrader, check out the ForexBrokers.com Overall Rankings. We've evaluated over 60 forex brokers, using a testing methodology that's based on 100+ data-driven variables and thousands of data points. Check out our full-length, in-depth forex broker reviews.

Popular guides to forex trading tools and platforms

Popular Forex Guides

More Forex Guides

Popular Forex Broker Reviews

Methodology

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

In order to assess the best brokers for traders looking to use the MetaTrader platform, we research and test each individual broker’s MetaTrader offering.

We examine a wide range of features and evaluate forex brokers based on our own data-driven MetaTrader-specific variables. We determine whether the broker offers the full platform suite offered by MetaQuotes Software Corp, and we look for a number of supplementary features that can distinguish MetaTrader broker offerings. Features that our researchers look for include custom Expert Advisors (Experts), the availability of the signals market, the ability to use VPN, number of account types and execution methods, among a host of other data-driven variables.

Browser-based MetaTrader platforms are tested using the latest version of the Google Chrome browser. Our Desktop PCs run Windows 11, and we use MacBook Pro laptops running macOS 12.5 to test MetaTrader on the go. We also test MetaTrader on mobile devices; for Apple, we test using the iPhone XS running iOS 15, and for Android, we use the Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra devices running Android OS 12.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

About the Editorial Team

Steven Hatzakis

Steven Hatzakis is the Global Director of Research for ForexBrokers.com. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. A forex industry expert and an active fintech and crypto researcher, Steven advises blockchain companies at the board level and holds a Series III license in the U.S. as a Commodity Trading Advisor (CTA).

John Bringans

John Bringans is the Senior Editor of ForexBrokers.com. An experienced media professional, John has close to a decade of editorial experience with a background that includes key leadership roles at global newsroom outlets. He holds a Bachelor’s Degree in English Literature from San Francisco State University, and conducts research on forex and the financial services industry while assisting in the production of content.

Joey Shadeck

Joey Shadeck is the Content Strategist and Research Analyst for ForexBrokers.com. He holds dual degrees in Finance and Marketing from Oakland University, and has been an active trader and investor for close to ten years. An industry veteran, Joey obtains and verifies data, conducts research, and analyzes and validates our content.

Blain Reinkensmeyer

Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. He heads research for all U.S.-based brokerages on StockBrokers.com and is respected by executives as the leading expert covering the online broker industry. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets.

IC Markets

IC Markets

FP Markets

FP Markets

Pepperstone

Pepperstone

CMC Markets

CMC Markets

FOREX.com

FOREX.com

FxPro

FxPro

Tickmill

Tickmill

IG

IG

Interactive Brokers

Interactive Brokers

Saxo

Saxo

TD Ameritrade

TD Ameritrade

City Index

City Index

XTB

XTB

eToro

eToro

Swissquote

Swissquote

Capital.com

Capital.com

AvaTrade

AvaTrade

Plus500

Plus500

OANDA

OANDA

FXCM

FXCM

Admirals

Admirals

XM Group

XM Group

Markets.com

Markets.com

Fineco Bank

Fineco Bank

BlackBull Markets

BlackBull Markets

Vantage

Vantage

HYCM (Henyep Capital Markets)

HYCM (Henyep Capital Markets)

HFM

HFM

ThinkMarkets

ThinkMarkets

FlowBank

FlowBank

DooPrime

DooPrime

Trading 212

Trading 212

BDSwiss

BDSwiss

Trade Nation

Trade Nation

TMGM

TMGM

Moneta Markets

Moneta Markets

Eightcap

Eightcap

MultiBank

MultiBank

ACY Securities

ACY Securities

RoboForex (RoboMarkets)

RoboForex (RoboMarkets)

VT Markets

VT Markets

easyMarkets

easyMarkets

IronFX

IronFX

Spreadex

Spreadex

IFC Markets

IFC Markets

Trade360

Trade360

Octa

Octa

Axi

Axi

TeleTrade

TeleTrade

GKFX

GKFX

Vestle

Vestle

FXOpen

FXOpen

FXPrimus

FXPrimus

Forex4you

Forex4you

GBE brokers

GBE brokers

Alpari

Alpari

TopFX

TopFX

Libertex (Forex Club)

Libertex (Forex Club)

LegacyFX

LegacyFX

FXGT.com

FXGT.com

ATFX

ATFX

Xtrade

Xtrade