Best UK Forex Brokers of 2024

ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Trading forex (currencies) in the United Kingdom (UK) is popular among residents. Before any fx broker can accept UK forex and CFD traders as clients, they must become authorised by the Financial Conduct Authority (FCA), which is the financial regulatory body in the UK. The FCA's website is FCA.org.uk. We recommend UK residents also follow the FCA on twitter, @TheFCA.

The FCA was formed out of the Financial Services Act of 2012, effectively replacing its predecessor, the Financial Services Authority (FSA). For a historical breakdown, here's a link to Financial Conduct Authority webpage on Wikipedia.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Best UK Forex Brokers for 2024

To find the best forex brokers in the UK, we created a list of all FCA authorised brokers, then ranked brokers by their Overall ranking.

Here is our list of the top UK forex brokers.

-

IG

- Best overall broker, most trusted

-

Interactive Brokers

- Great overall, best for professionals

-

Saxo

- Best web-based trading platform

- CMC Markets - Excellent overall, best platform technology

- FOREX.com - Excellent all-round offering

- City Index - Excellent all-round offering

- XTB - Great research and education

Best Forex Brokers UK Comparison

Compare UK authorised forex and CFDs brokers side by side using the forex broker comparison tool or the summary table below. This broker list is sorted by my overall rankings of the top forex brokers.

| Company | Accepts GB Residents | Authorised or Regulated by the FCA | Average Spread EUR/USD - Standard | Minimum Deposit | Overall Rating | Visit Site |

IG IG

|

0.98 | £250.00 |

|

Visit Site

|

||

Interactive Brokers Interactive Brokers

|

0.63 | $0 |

|

Visit Site

|

||

Saxo Saxo

|

1.1 | $0 |

|

Visit Site

|

||

CMC Markets CMC Markets

|

0.61 | $0 |

|

|||

FOREX.com FOREX.com

|

1.4 | $100 |

|

|||

City Index City Index

|

1.4 | £100.00 |

|

|||

XTB XTB

|

1.00 | $0 |

|

|||

eToro eToro

|

1 | $10-$10,000 |

|

|||

Swissquote Swissquote

|

N/A | $1000 |

|

|||

Plus500 Plus500

|

N/A | €100 |

|

Visit Site

|

||

FXCM FXCM

|

0.74 | Starts from $50 |

|

Visit Site

|

||

Admirals Admirals

|

0.8 | $100 |

|

|||

Pepperstone Pepperstone

|

0.77 | $200 |

|

Visit Site

|

||

Tickmill Tickmill

|

0.51 | $100 |

|

Visit Site

|

||

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

0.6 | $20 |

|

|||

HFM HFM

|

1.2 | $0 |

|

Visit Site

|

||

Trading 212 Trading 212

|

1.9 | €10 |

|

|||

Trade Nation Trade Nation

|

0.6 | $0 |

|

|||

Eightcap Eightcap

|

1.0 | $100 |

|

Visit Site

|

||

Spreadex Spreadex

|

0.81 | $0 |

|

Visit Site

|

||

AvaTrade AvaTrade

|

0.92 | $100 |

|

Visit Site

|

||

FP Markets FP Markets

|

1.1 | $100 AUD |

|

Visit Site

|

||

IC Markets IC Markets

|

0.62 | $200 |

|

Visit Site

|

||

BlackBull Markets BlackBull Markets

|

0.76 | $0 |

|

Visit Site

|

||

FlowBank FlowBank

|

N/A | $0 |

|

|||

MultiBank MultiBank

|

N/A | $50 |

|

|||

ACY Securities ACY Securities

|

1.2 | $50 |

|

Visit Site

|

||

easyMarkets easyMarkets

|

0.9 | $50 |

|

|||

IFC Markets IFC Markets

|

1.44 | $1 |

|

Who are the most trusted forex brokers in the UK?

Some of the best forex brokers from around the world hold regulatory licenses with the FCA. We’ve tested over 60 of the best international brokers in the industry and conducted thorough research into each broker’s range of regulatory licenses to determine their individual Trust Scores. Of the brokers that are regulated by the FCA, we’ve selected the following brokers as the Top 5 most trusted forex brokers in the U.K. in 2024:

1. IG

99 Trust Score - Most trusted broker in 2024, Best Overall Broker in 2024

IG is fully regulated by the FCA and holds dozens of regulatory licenses from major regulatory agencies around the globe. IG is also publicly traded and well-capitalized, and we’ve consistently ranked it as one of the most trusted brokers in the industry. In fact, IG won the coveted top ranking for our Trust Score category for the ForexBrokers.com 2024 Annual Awards. Check out our in-depth review of IG to learn more about why IG was our top-ranked forex broker in 2024.

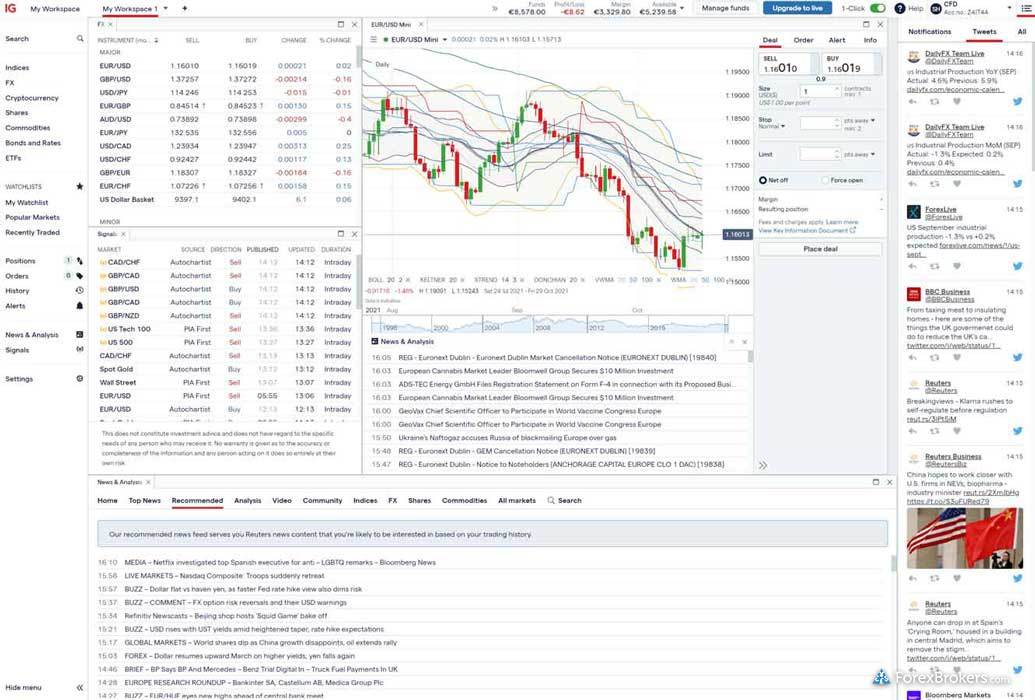

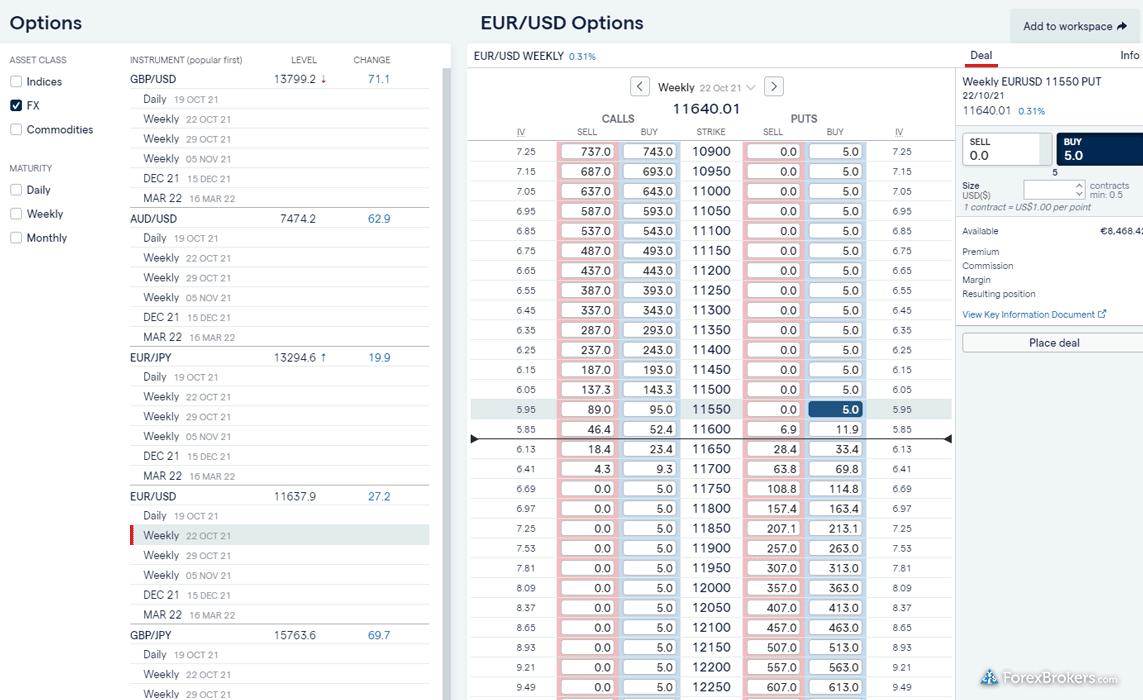

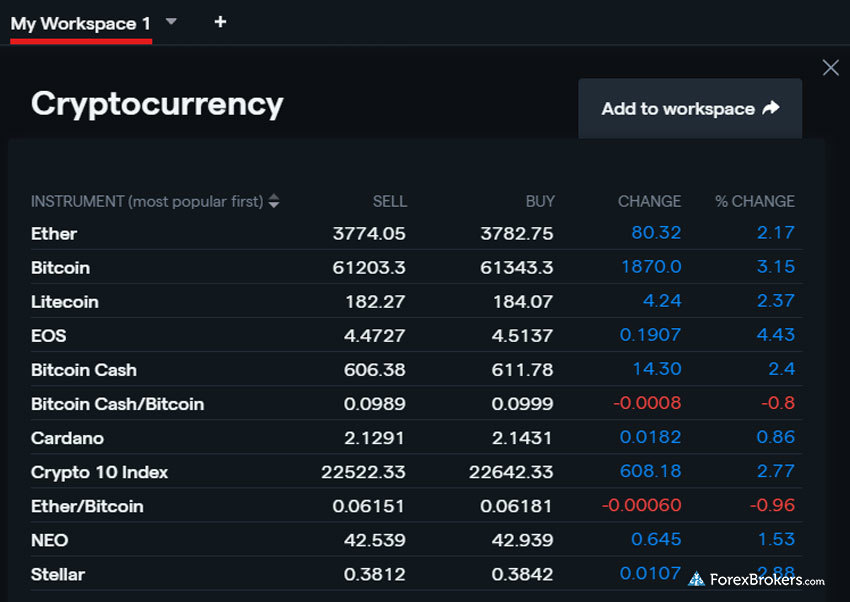

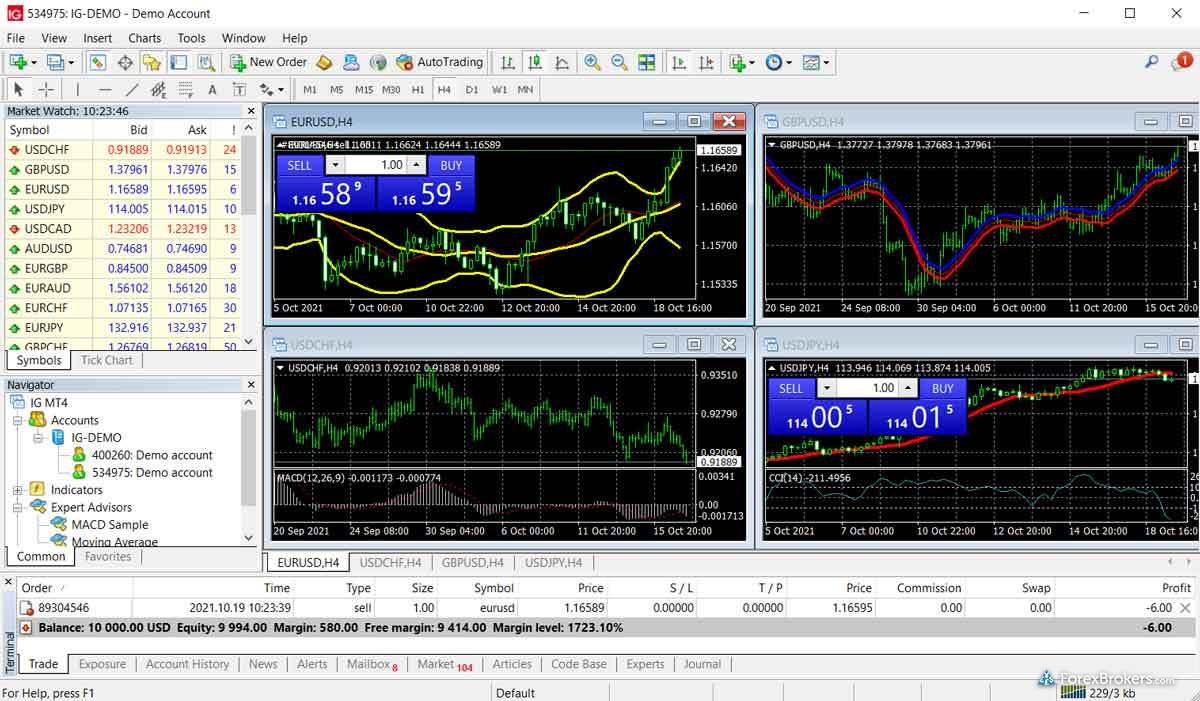

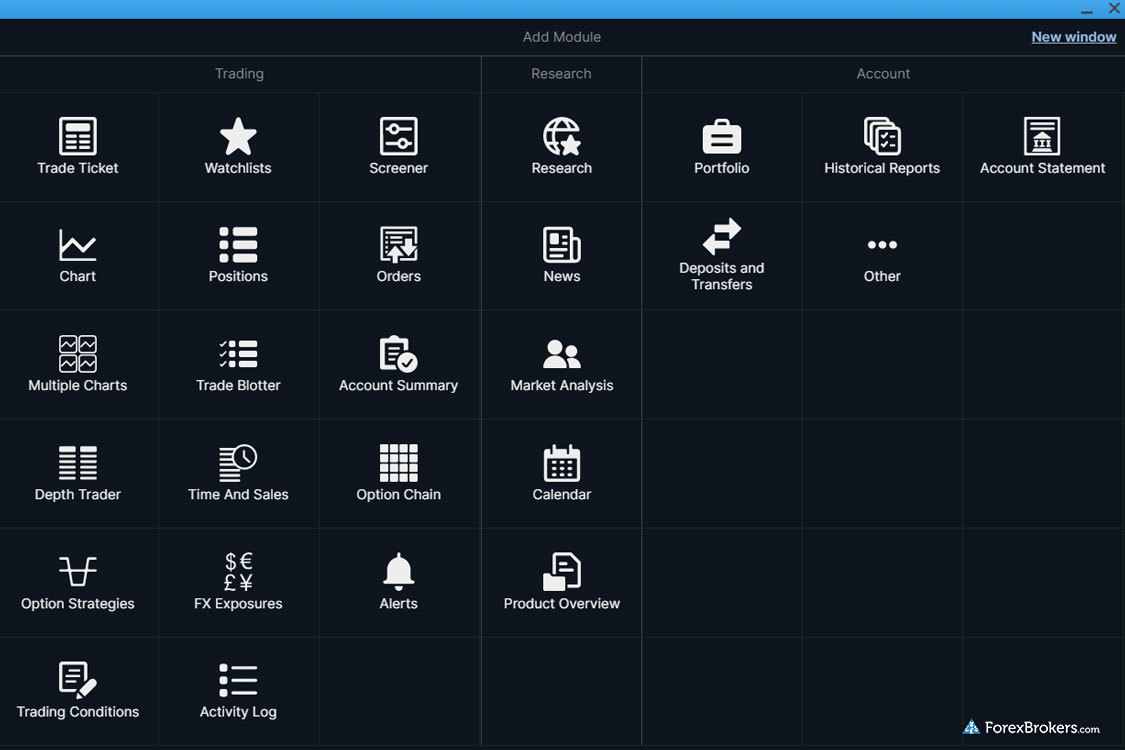

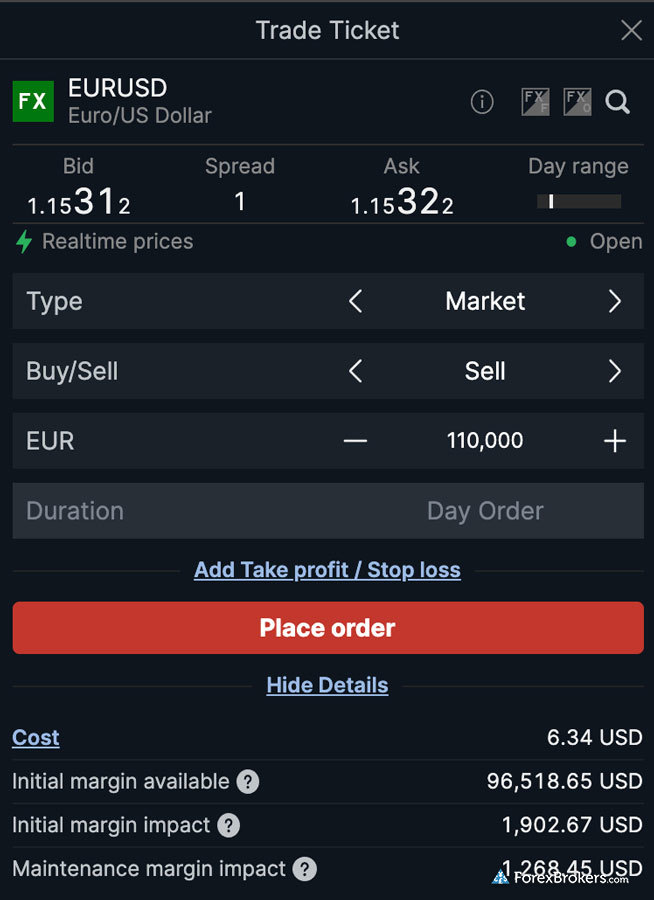

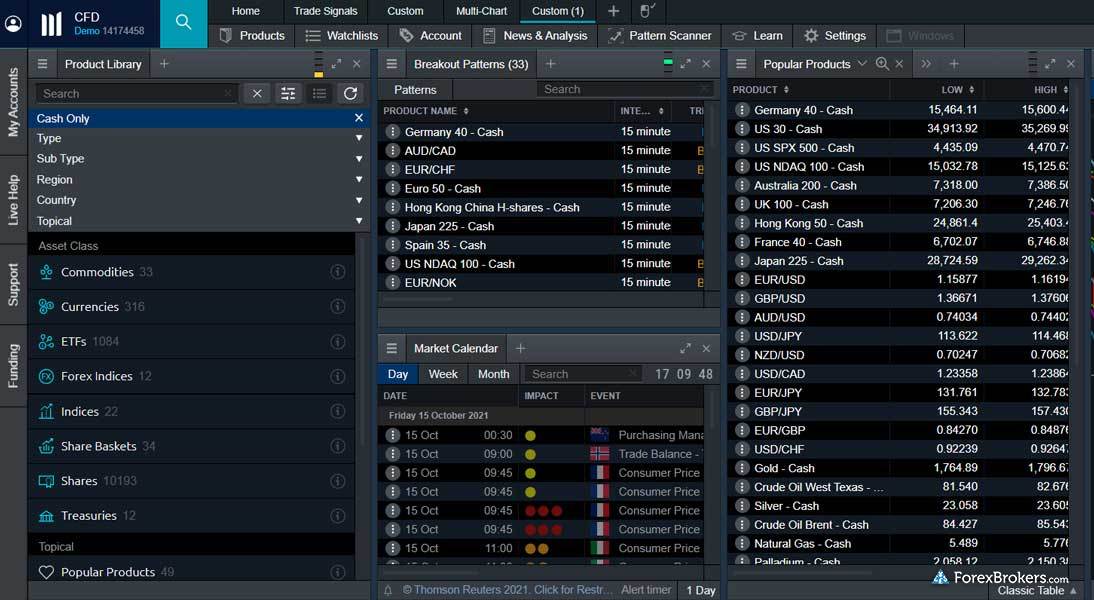

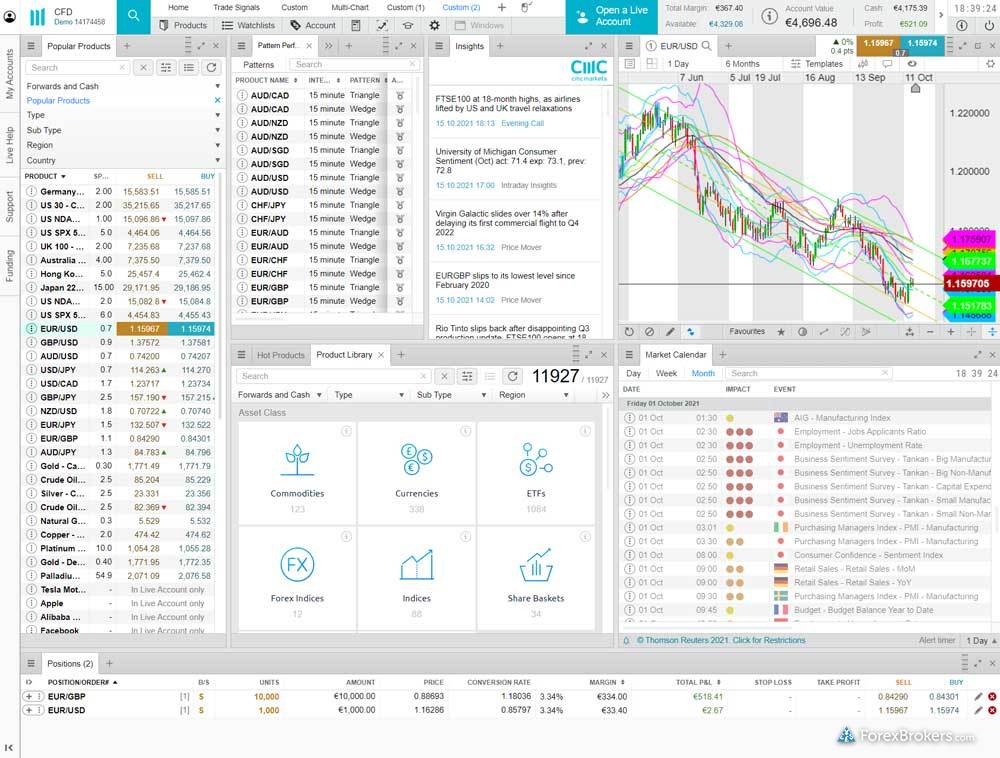

Check out a gallery of screenshots from IG's trading platforms, taken by our research team during our product testing.

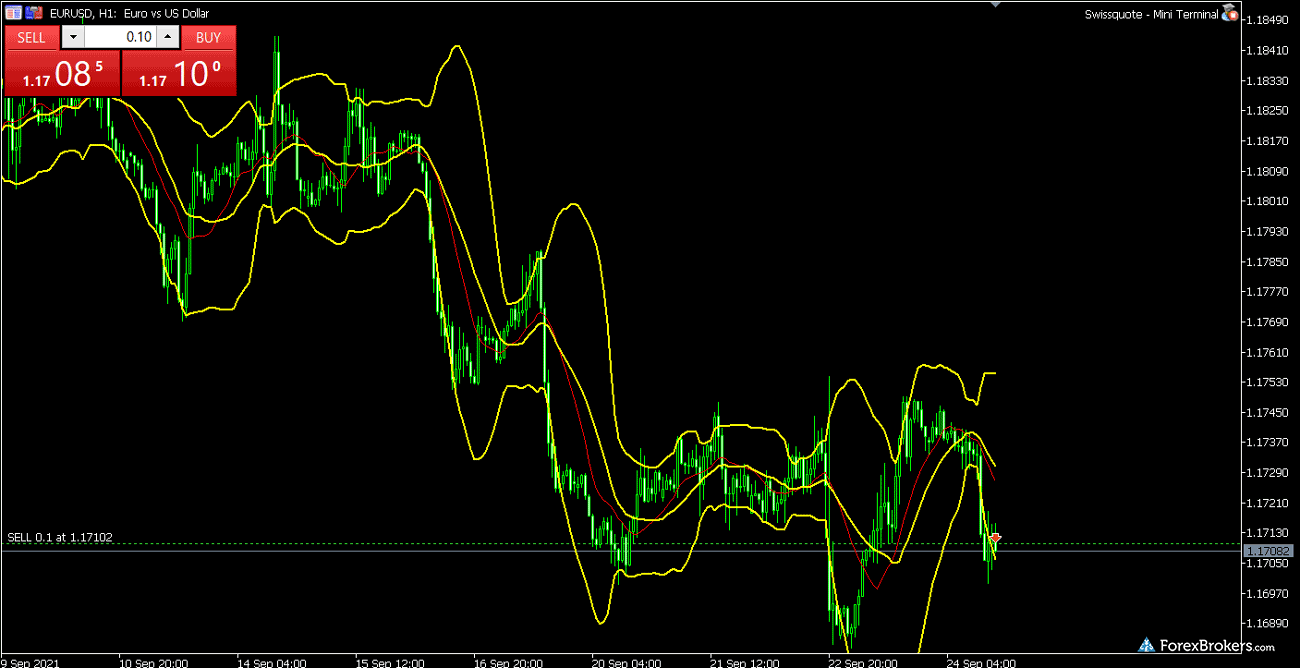

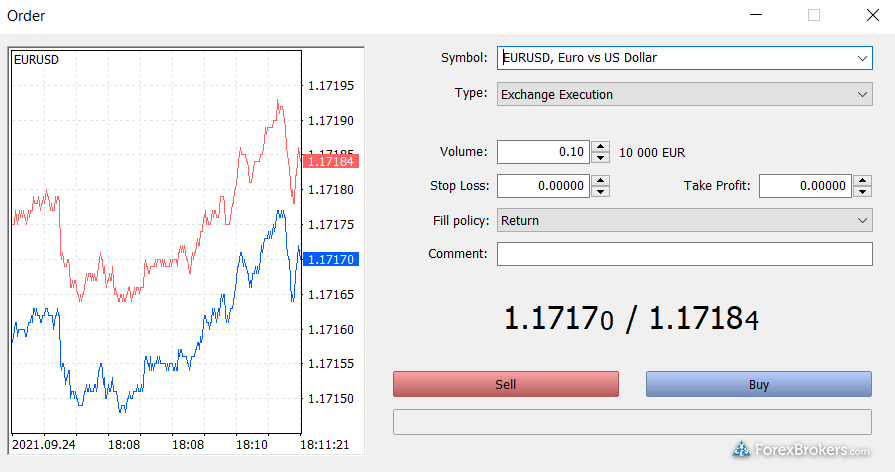

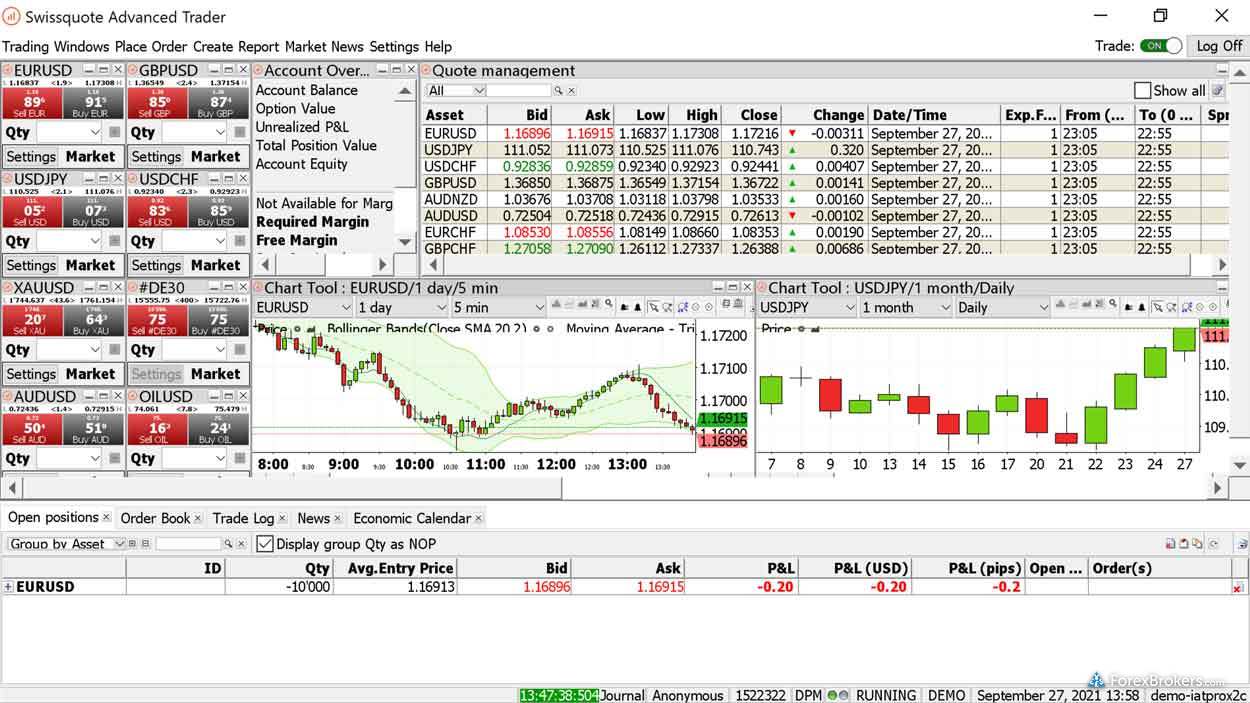

2. Swissquote

99 Trust Score - Great all-around forex broker, operates a Swiss bank

Swissquote is regulated by multiple Tier-1 regulators and also operates not one, but two banks (forex brokers that operate banks undergo considerable due diligence to ensure the bank will be viable and sustainable as a custodian and potential fiduciary). Swissquote also took the #1 spot for Best Banking Services in the ForexBrokers.com 2024 Annual Awards. Read our full-length review of Swissquote to find out more.

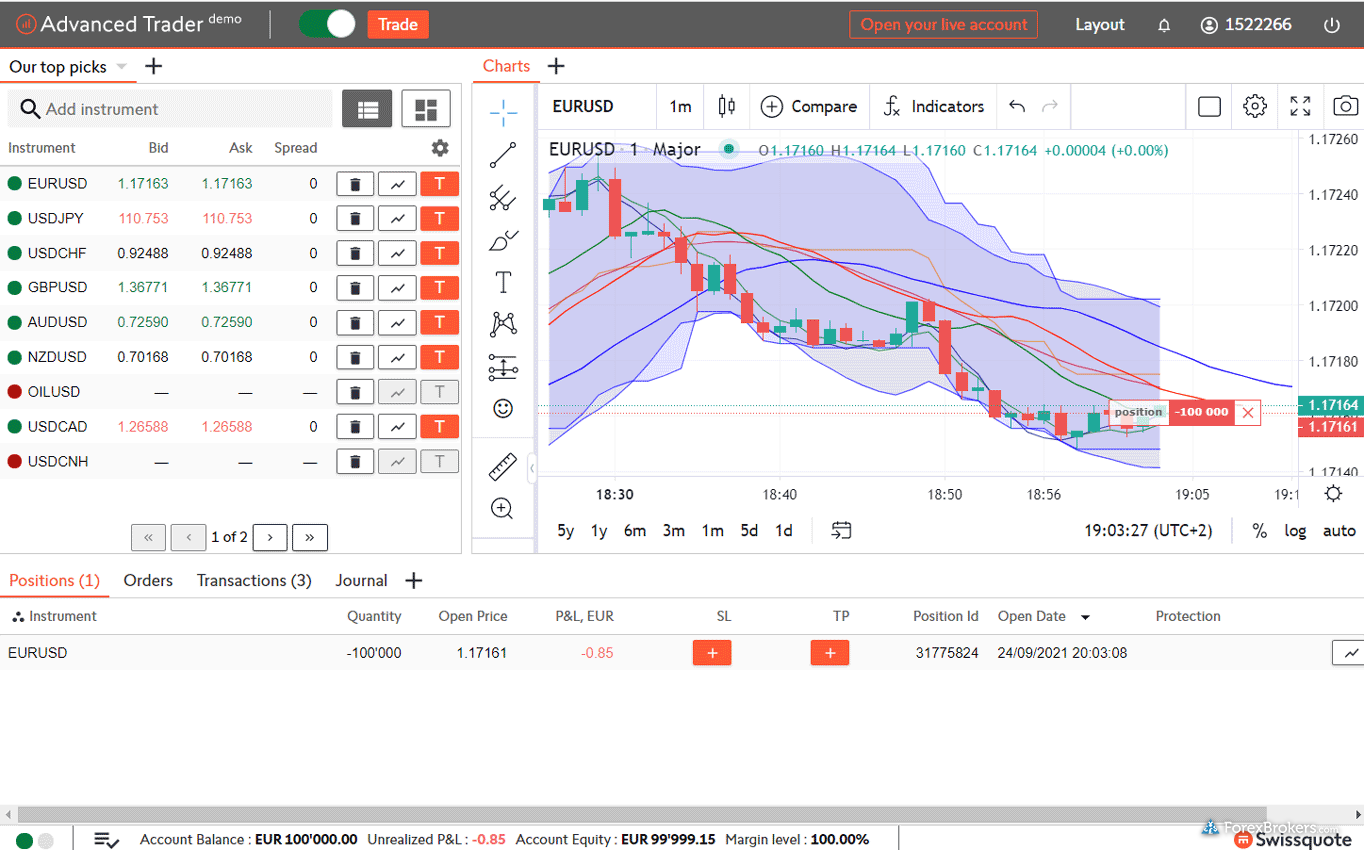

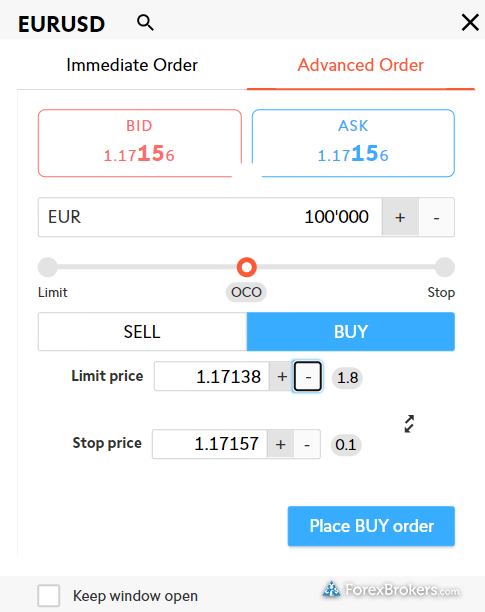

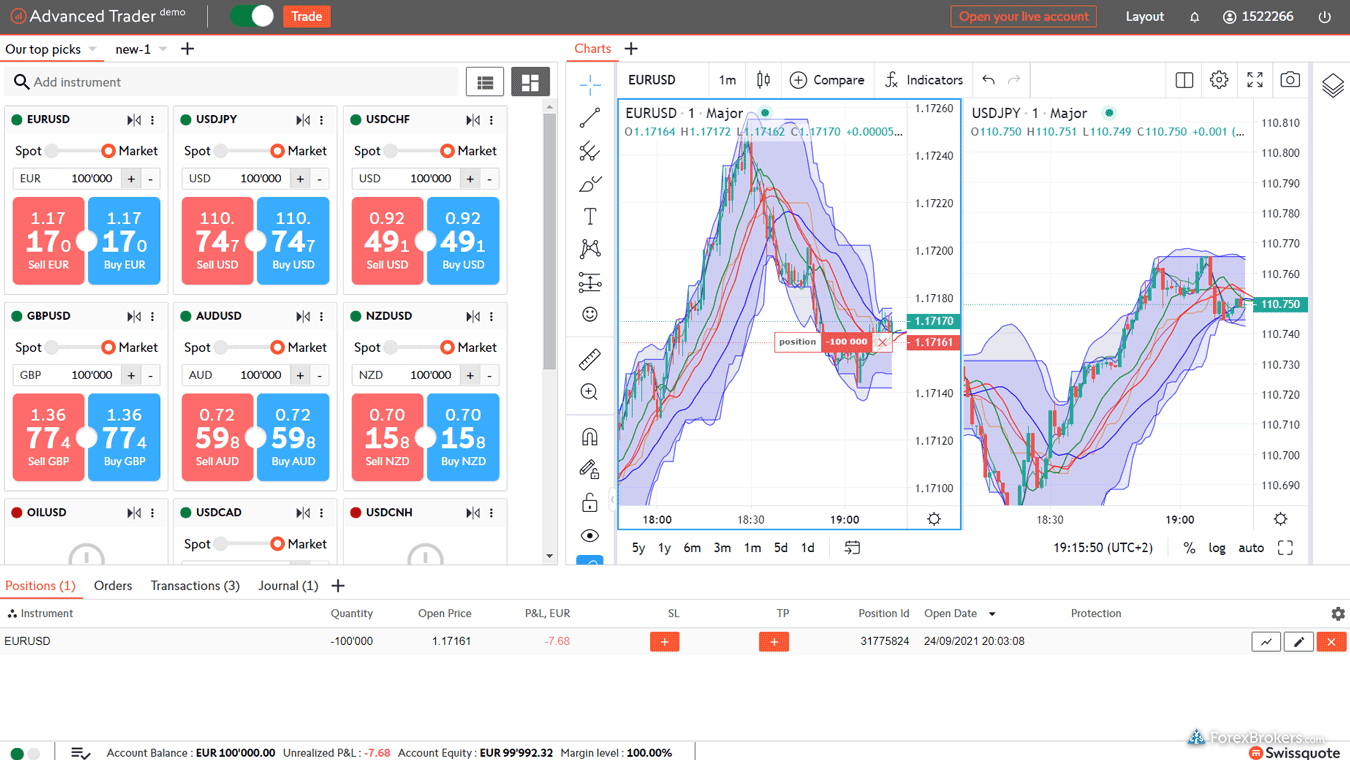

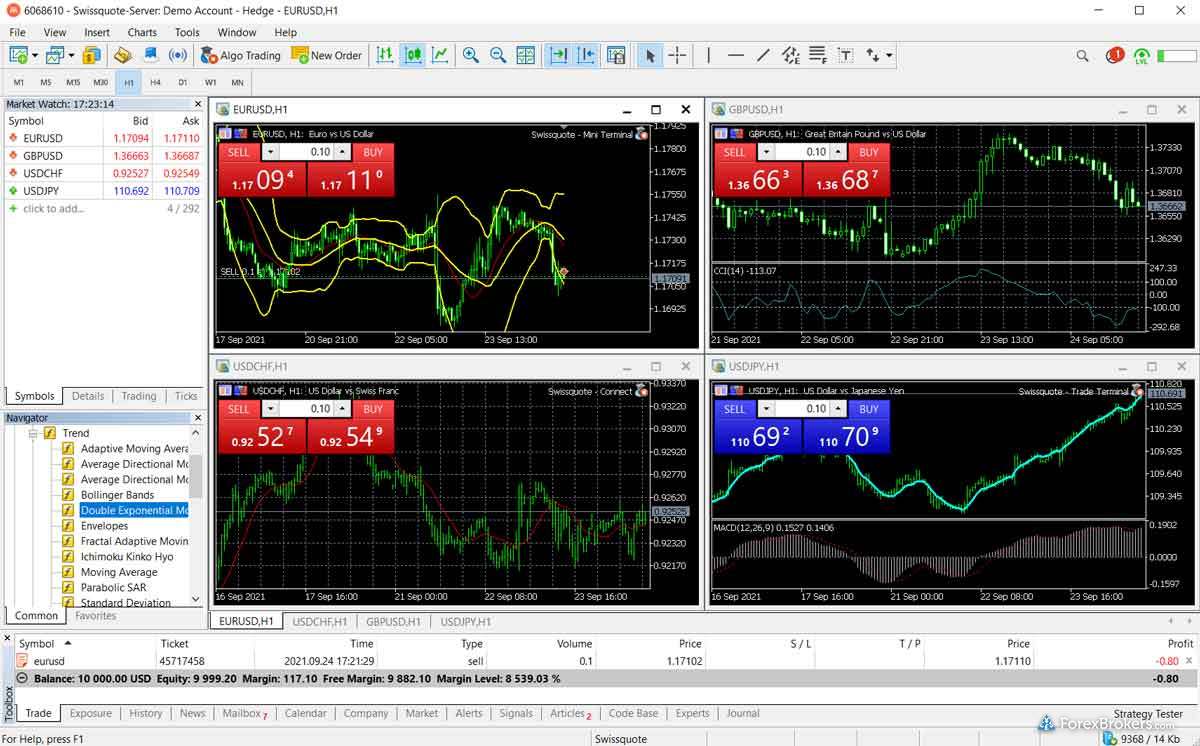

Take a look at a gallery of screenshots from Swissquote's trading platforms, taken by our research team during our product testing.

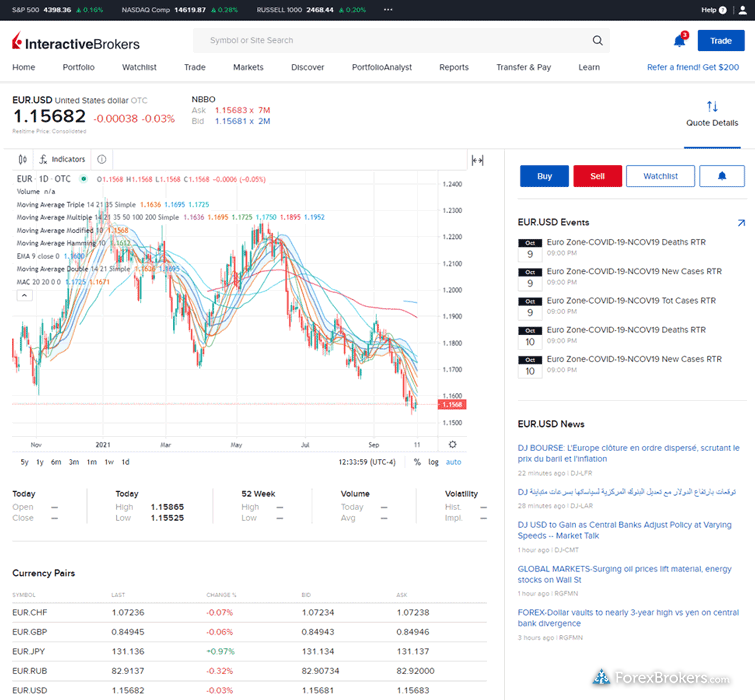

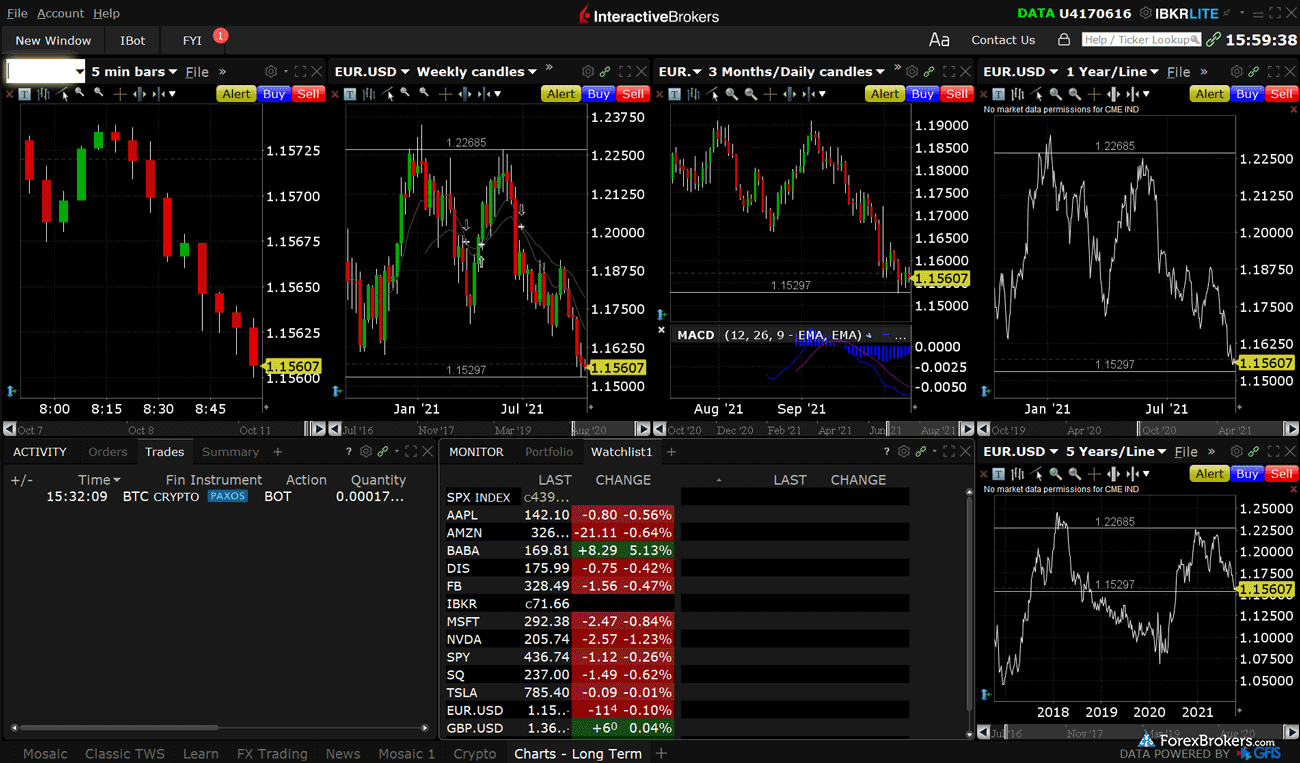

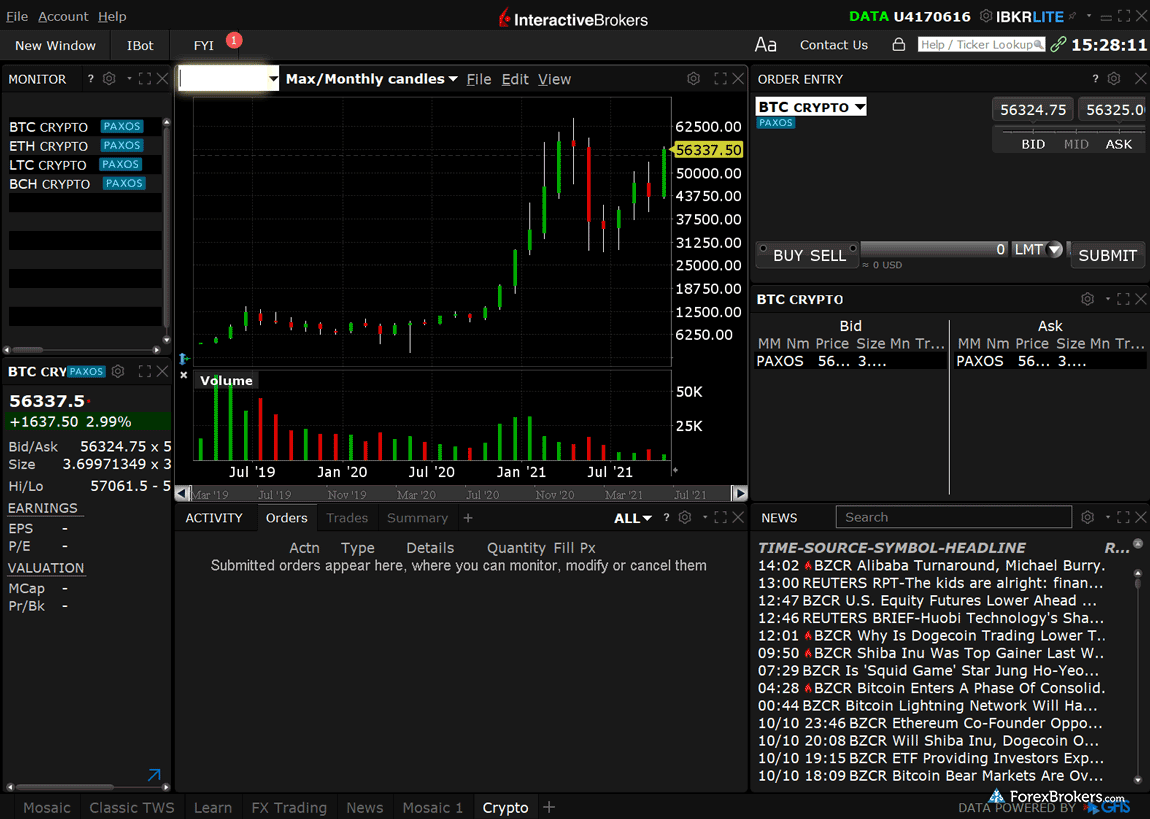

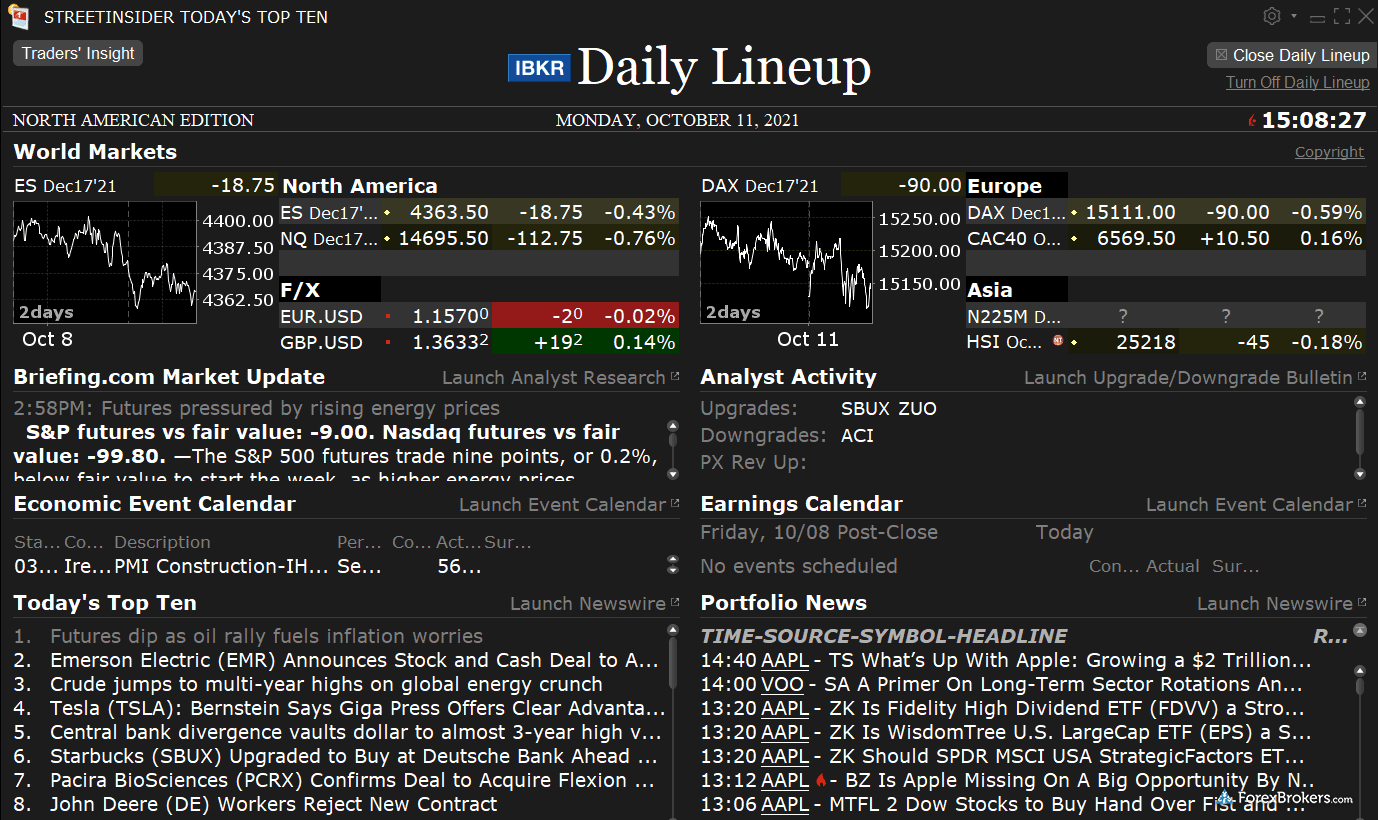

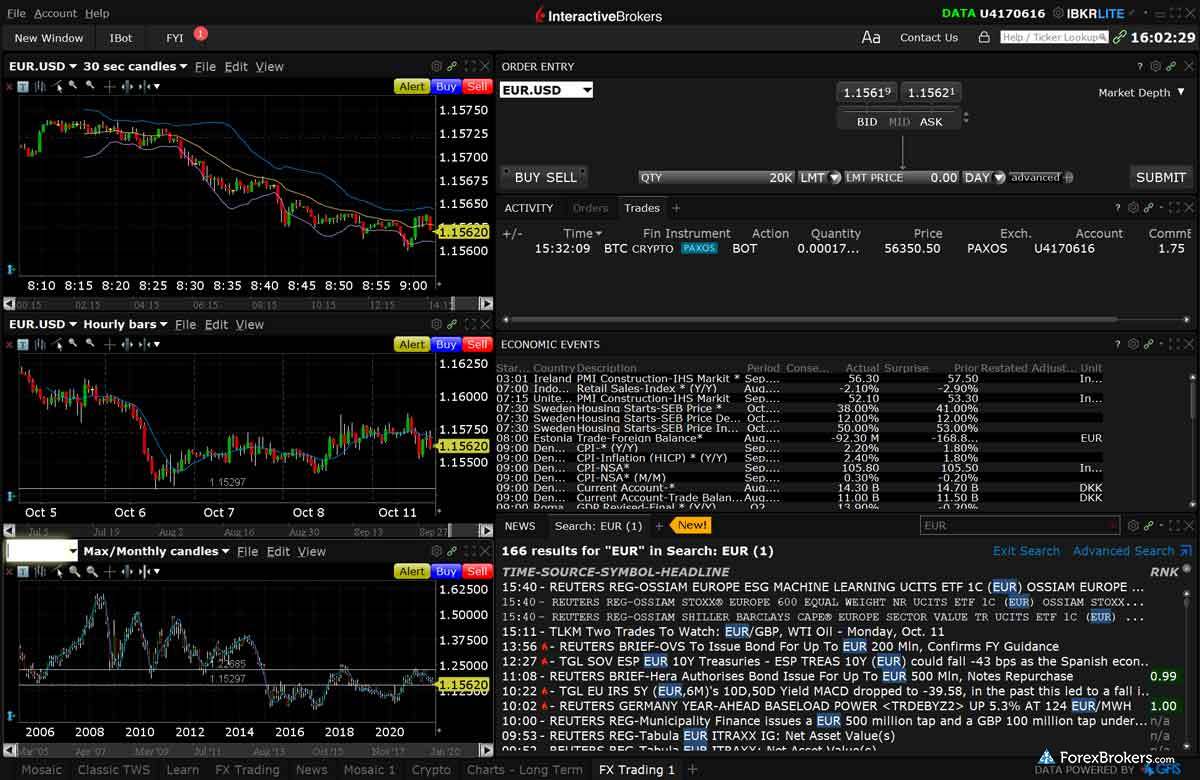

3. Interactive Brokers

99 Trust Score - Publicly traded and well-capitalized, earned our top 2024 Annual Award for Offering of Investments

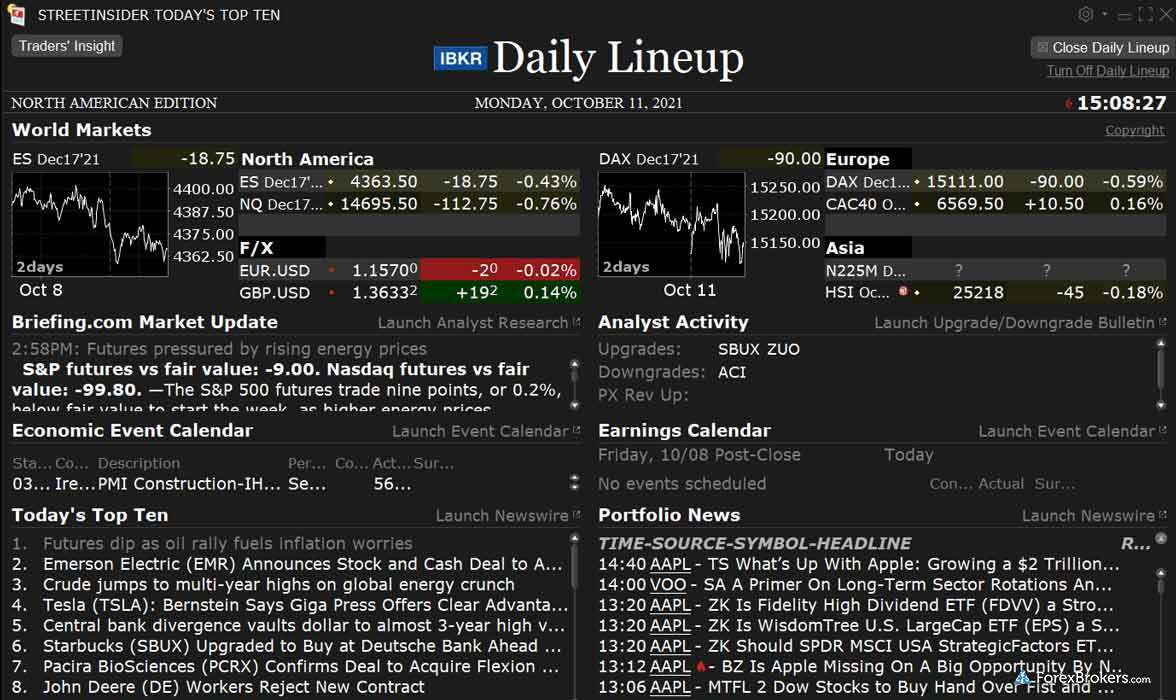

Founded in 1977, Interactive Brokers is publicly traded (NASDAQ: IBKR) and regulated in nine Tier-1 jurisdictions. Interactive Brokers is well-capitalized with USD 373.8 billion of ending client equity and USD 10.01 billion of equity capital. Learn more by reading our full-length review of Interactive Brokers.

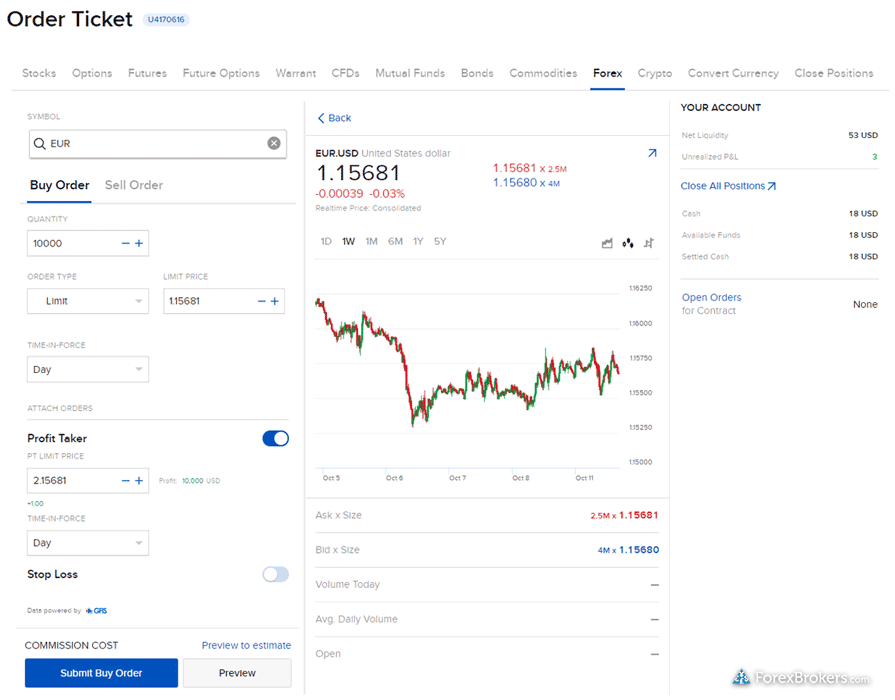

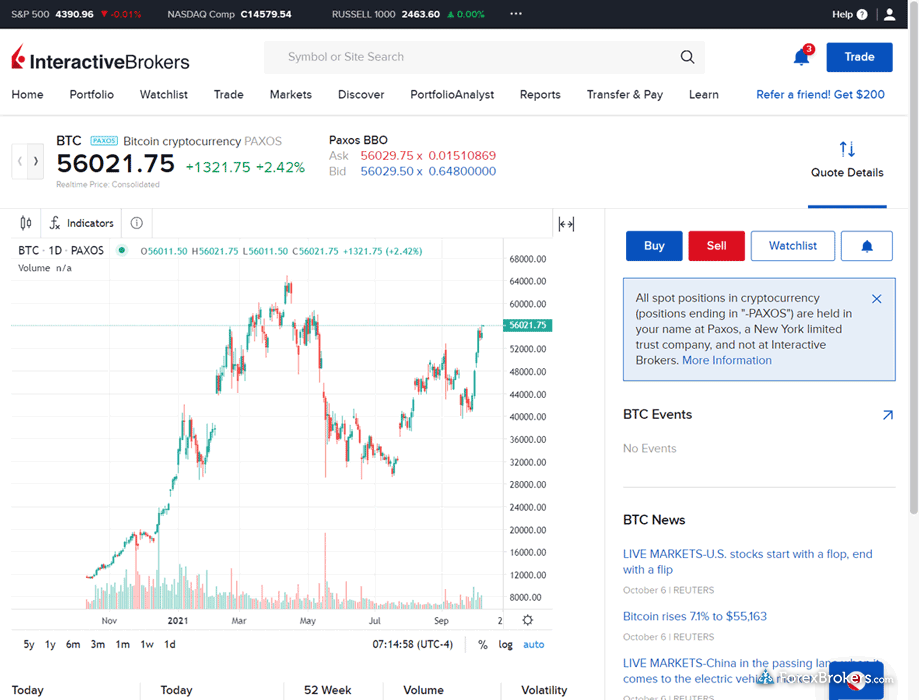

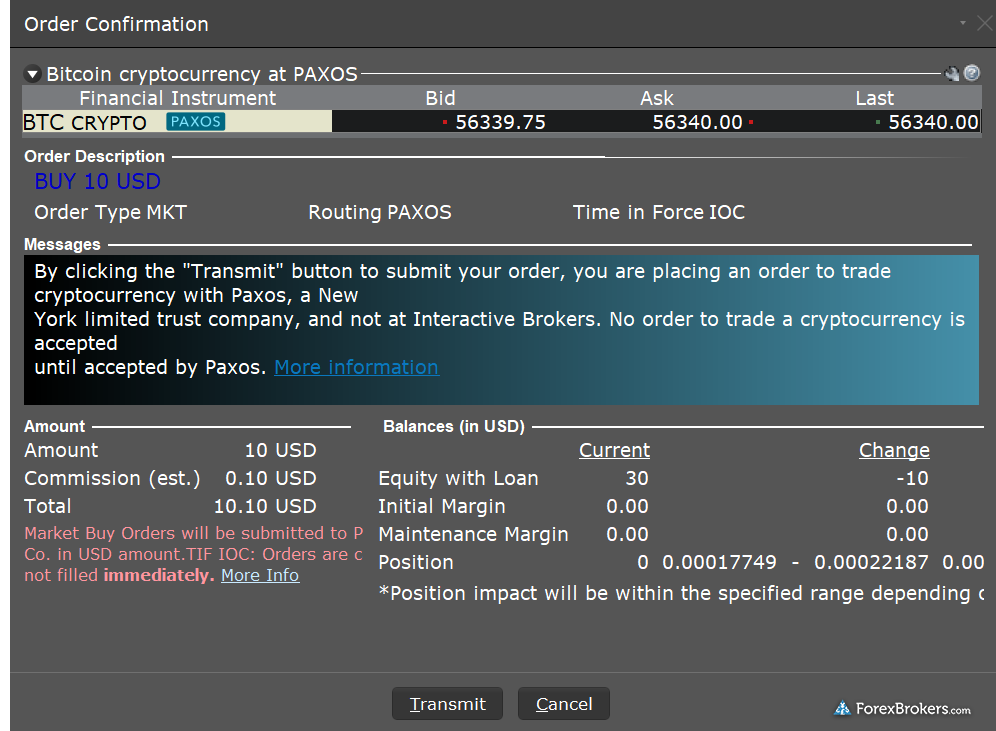

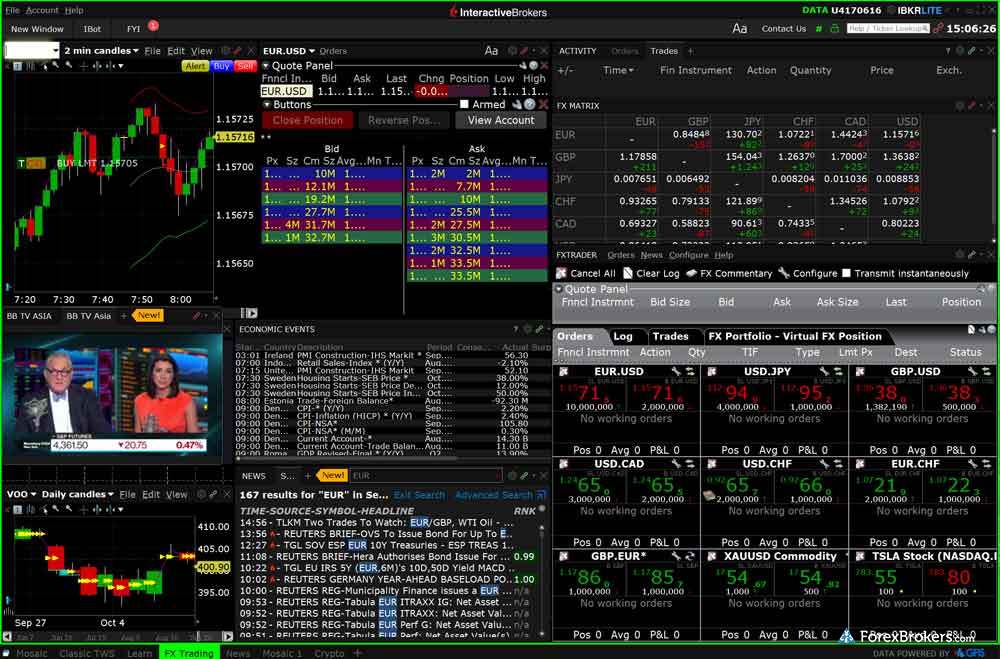

Here are some screenshots of Interactive Brokers' trading platforms, taken by our research team during our product testing.

4. Saxo

99 Trust Score - Operates three banks, earned our top 2024 Annual Award for Platforms & Tools

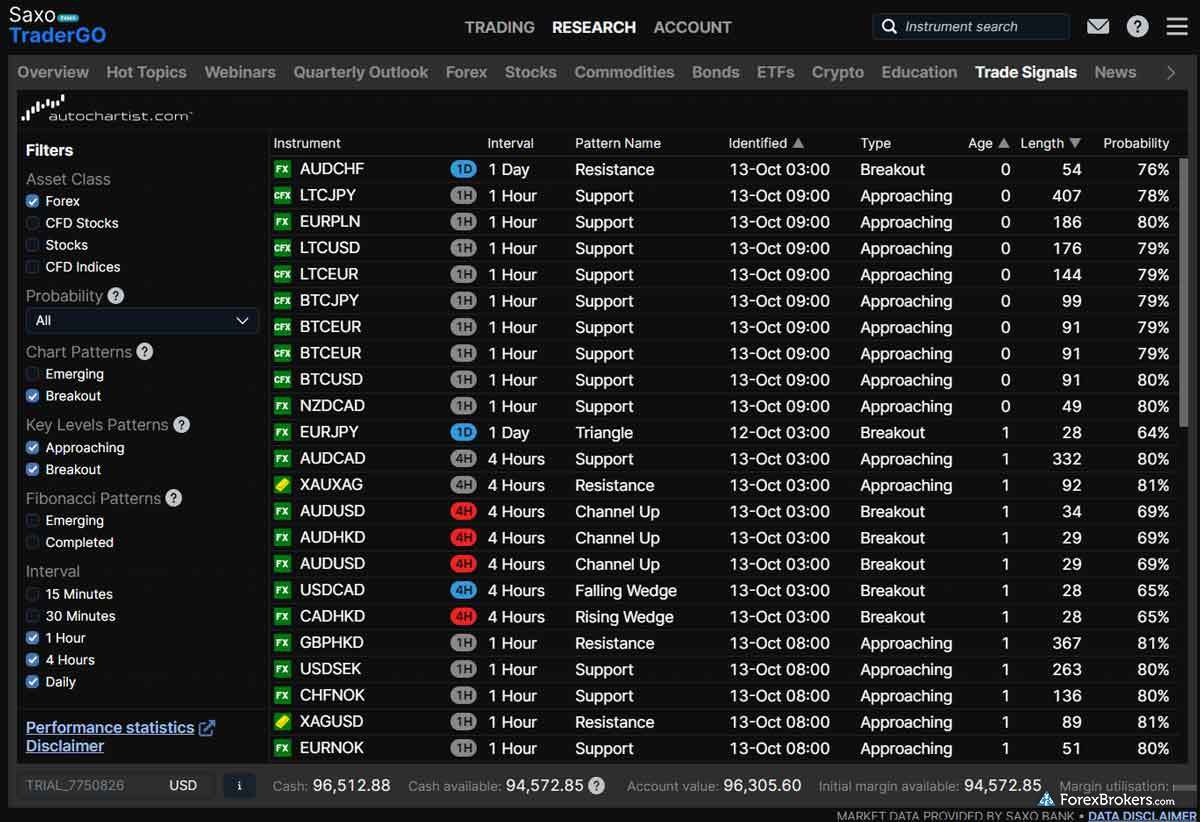

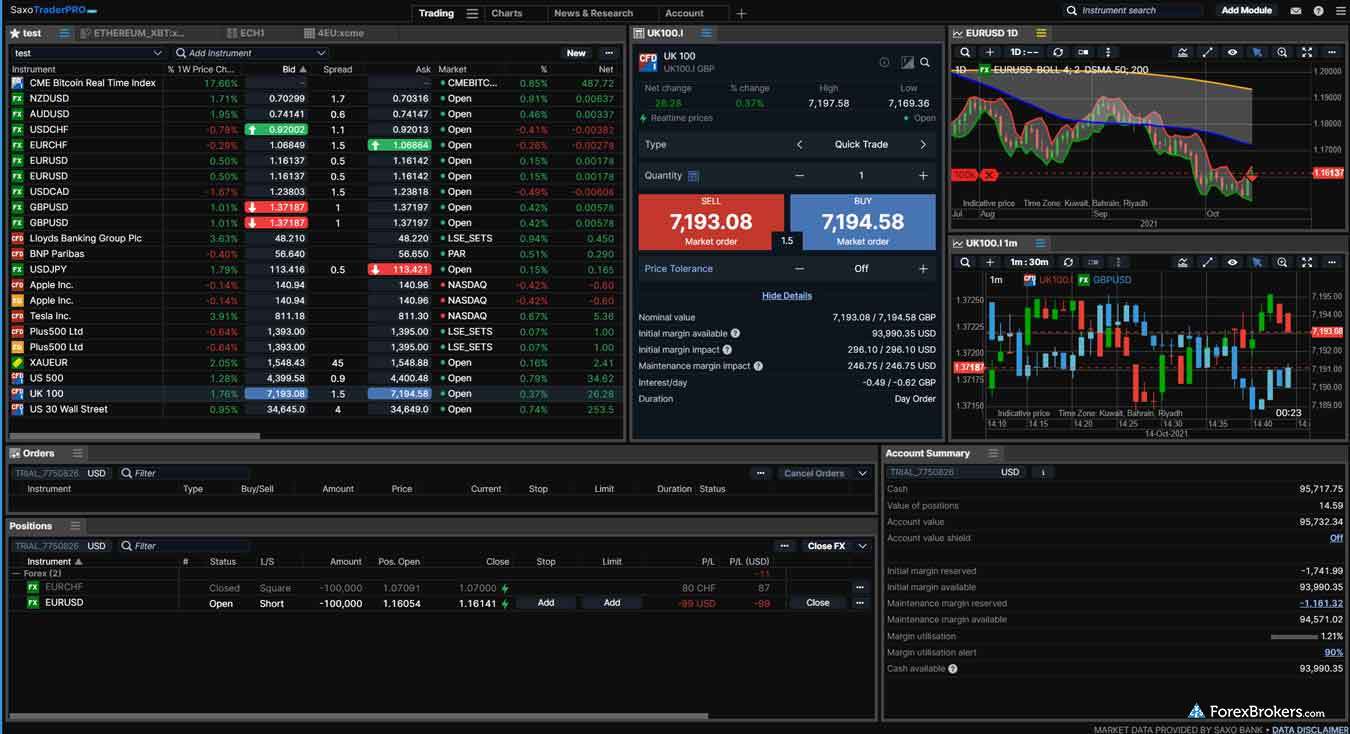

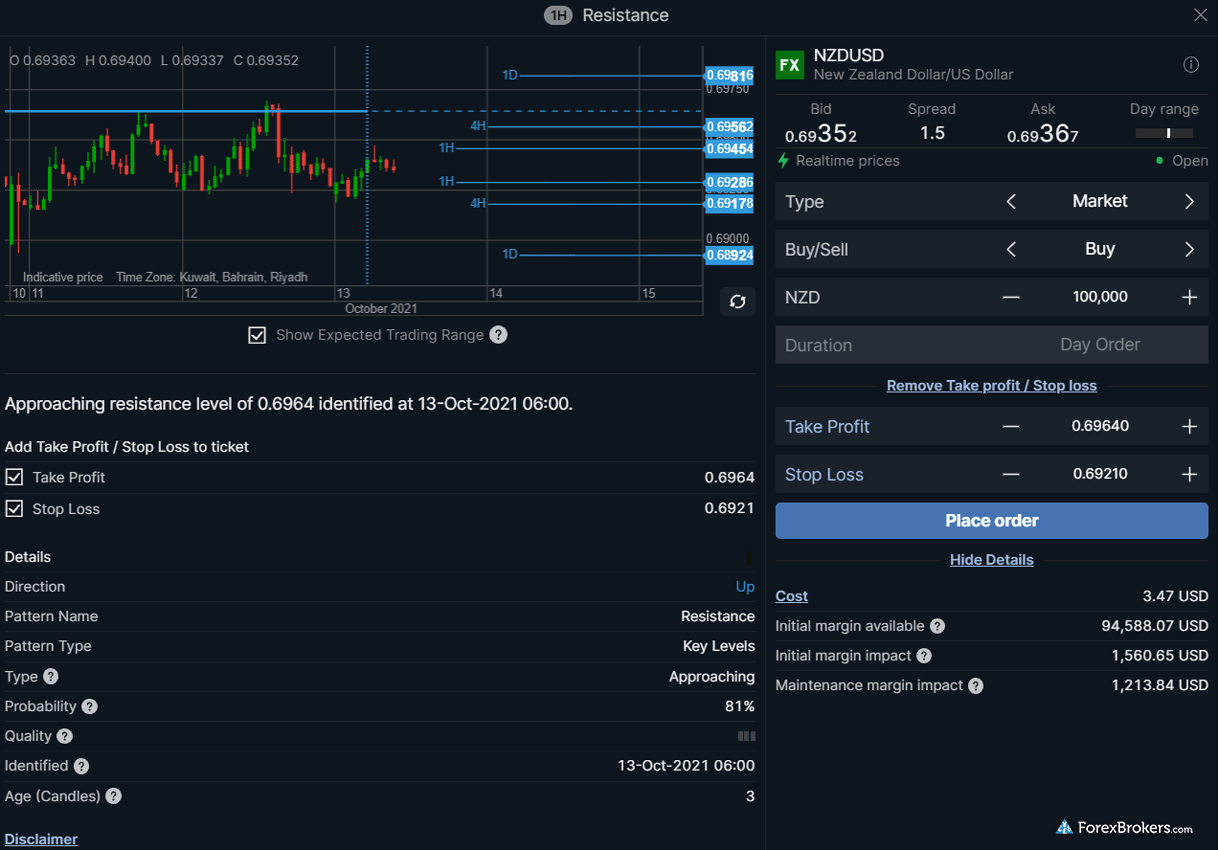

Saxo operates three fully regulated banks and is licensed in seven Tier-1 jurisdictions across more than a dozen international jurisdictions. Saxo holds over €85 billion in client assets and has been in operation for over thirty years. Check out our full-length review of Saxo to learn more.

Browse a gallery of screenshots from Saxo's trading platforms, taken by our research team during our product testing.

5. CMC Markets

99 Trust Score - Publicly traded, won our 2024 Annual Award for #1 Most Currency Pairs

CMC Markets is regulated by some of the most important global financial regulators, including five Tier-1 jurisdictions. CMC Markets is also publicly traded – to become publicly traded, brokers must make numerous public disclosures for compliance purposes. Read our full-length review of CMC Markets.

Check out some screenshots from CMC Market's trading platforms, taken by our research team during our product testing.

How can I trade forex in the U.K.?

First, select a trustworthy U.K. forex broker regulated by the Financial Conduct Authority (FCA). Next, open and fund your new brokerage account, and fill out the order ticket to place a trade. Most online brokers offer demo accounts so you can practice with virtual currency and become familiar with how the trading platform works before funding your account with real money.

More details: Choosing an FCA-regulated broker will ensure that you are entitled to any applicable legal protections. To be FCA-regulated in the U.K., brokers must comply with a strict list of requirements.

How to verify FCA Authorisation

To verify if a forex broker is licensed to operate in the United Kingdom (U.K.), the first step is to identify the register number from the disclosure text at the bottom of the broker's U.K. homepage. For example, here's the key disclosure text from IG's website:

Both IG Markets Ltd (Register number 195355) and IG Index Ltd (Register number 114059) are authorised and regulated by the Financial Conduct Authority."

Next, look up the firm on the FCA website to validate the register number is, in fact, legitimate. Here is the official FCA page for IG Markets Limited.

Why is the Financial Conduct Authority (FCA) important for forex traders in the UK?

The Financial Conduct Authority (FCA) regulates U.K.-based brokers that legally offer forex and other derivatives to retail and professional traders. According to the regulator’s official website, the FCA regulates the conduct of 50,000 firms across the U.K. and prudentially supervises 48,000 firms.

The FCA aims to enforce compliance and ensure that firms are following the rules and regulations set forth in the FCA handbook. In extraordinary circumstances, the FCA can take emergency action and prevent brokers from opening new trades for customers, or suspend (or even revoke) a broker’s license if there have been substantial compliance failures and/or violations.

Like any financial markets regulator, the FCA’s role is to protect investors (including forex traders) and to uphold market integrity within the U.K. forex trading industry. The FCA is a strict regulator with stringent rules and regulations, which has contributed to our ranking of the FCA as a Tier-1 regulatory agency. Learn more about regulators and our tiered ranking system by visiting our Trust Score page.

Why regulation is important

Choosing a well-regulated forex broker is important for avoiding forex scams. Check out my popular educational series that teaches you how to identify common forex scams and provides helpful information about what to do if you've been scammed. For crypto traders, I explain how you can spot common crypto scams.

Is forex trading legal in the UK?

Yes, forex trading is legal in the U.K. and regulated by the Financial Conduct Authority (FCA). The FCA requires that brokers obtain proper licensing and authorization in order to legally offer forex trading to clients.

FCA-regulated brokers: Per the FCA’s handbook, forex is a regulated activity. As such, brokers that handle customer deposits and arrange and/or deal in investments – whether acting as the principal or agent – must hold proper authorization from the FCA.

Deposit insurance: FCA-regulated forex brokers also provide certain compensation rights to retail customers in the extraordinary event of insolvency or bankruptcy. The UK’s Financial Services Compensation Scheme (FSCS) provides up to 85,000 GBP of protection per eligible person.

Professional clients: It’s important to note that U.K. clients that have been designated as professional traders do not receive any such protections from the FSCS.

Avoiding potential scams: Since forex trading requires that brokers obtain proper licenses with the FCA, you must be certain that your broker is FCA-regulated to avoid falling victim to a potential scam. Learn more by reading our guide to avoiding forex scams in 2024.

What is the best forex broker in the UK?

From among all brokers that we have reviewed that are regulated by the FCA, IG is the best forex broker in the UK in 2024. IG is fully regulated by the FCA and holds dozens of regulatory licenses from major regulatory agencies around the globe. IG is also publicly traded and well-capitalized, and we’ve consistently ranked it as one of the most trusted brokers in the industry. In fact, IG won the coveted top ranking for our Trust Score category for our 2024 Annual Awards.

IG offers a substantial range of markets, powerful trading platforms and mobile apps, an impressive array of high-quality market research, and excellent educational content for beginner traders and investors (beginner U.K. forex traders can check out our beginners guide to forex trading). Overall, IG is our top choice for U.K. residents in 2024.

What is the best share dealing broker in the U.K.?

IG is the best share dealing broker in the U.K. in 2024. In addition to being regulated in the U.K. by the FCA, IG delivers an excellent share dealing experience with competitive U.K. commission rates and no commissions on U.S. stocks for semi-frequent traders. Traders at IG gain access to powerful trading tools, multiple user-friendly mobile apps, exceptional educational resources, and share dealing rates that are amongst the cheapest of all brokers that offer ISA accounts.

Trading in the U.K.

Looking to trade more than just forex in the U.K.? Our sister site, UK.StockBrokers.com, can help you find the best U.K.-based brokers, trading platforms, and stock trading apps.

Do you pay tax on forex trading in the U.K.?

Yes, U.K. residents must report their worldwide income in the U.K. – including any gains from forex trading. That said, there is an exception for tax obligations if you are trading forex via spread betting. Gains from forex spread betting are tax-free for UK residents, while gains from regular forex trading are not exempt, and are taxed accordingly. Additionally, forex trades do not incur the U.K.’s stamp duty tax obligation, which applies to any online or offline share trading.

It’s also worth mentioning that there is a small tax exemption of up to £1,000 provided by the UK tax authority HM Revenue and Customs (HRMC) available to certain individuals. If your capital gains from trading over a calendar year do not exceed £1,000, you may not need to pay taxes on thatincome (though you may have to register for a self-assessment with the HRMC).

Note: Claiming this exemption may prevent you from claiming other exemptions of greater value (such as capital allowances). It’s always prudent to consult a tax advisor; each person has unique financial circumstances and applicable tax elections may vary.

Is copy trading legal in the U.K.?

Yes, copy trading is legal in the U.K. That said, copy trading can only be offered in the U.K. by a platform provider that is regulated by the Financial Conduct Authority (FCA). The FCA has released its own guidance on copy trading which aligns with the EU’s MiFID. The FCA is the U.K.’s financial markets regulator that is mandated to oversee regulated brokers, uphold market integrity, and protect consumers by enforcing regulations and compliance across its market participants.

Choosing a broker for copy trading

Looking for trusted, highly rated brokers that offer copy trading? Check out our popular guide to the best brokers for copy trading.

Is MetaTrader 4 legal in the UK?

Yes, MetaTrader 4 is legal to use in the U.K. MetaTrader 4 (MT4) is a popular trading platform developed by MetaQuotes Software Corporation and offered by forex and CFD brokers all over the world.

While many of the brokers that offer MT4 are properly regulated (our MetaTrader Guide can help you choose a highly rated, well-regulated MetaTrader broker), potential scam brokers will sometimes offer MT4 without holding any valid regulatory licenses. This practice attracted the attention of Apple in 2022, resulting in a temporary ban of MetaTrader 4 and MetaTrader 5 in the Apple App Store (both MetaTrader apps have been restored as of March, 2023).

Note: U.K. residents should always make sure to choose a forex broker that is FCA-regulated. This way, you will receive the strictest available regulatory protections and reduce your chances of falling victim to a scam broker.

What is the best MetaTrader broker in the UK?

Of the top forex brokers that hold a license from the FCA, Pepperstone is our top choice for U.K. traders who want to use MetaTrader. Pepperstone offers the full MetaTrader platform suite, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), and traders gain access to over 600 share CFDs and 60 forex pairs on Pepperstone’s MT5 offering (learn more about the newest, most up-to-date version of MetaTrader by checking out our popular MT5 Guide).

Pepperstone’s low trading costs available on its Razor account help to round out its overall offering, and cement its status as the best MetaTrader broker in the U.K. Learn more by reading our full-length review of Pepperstone.

Here are our top five picks for the best MetaTrader brokers in the U.K. in 2024:

- Pepperstone- Large range of markets to trade on MT4

- FXCM- Great for algorithmic trading on MT4

- CMC Markets - Competitive spreads

- Vantage- Well-balanced overall offering

- Tickmill- Lowest trading costs on Pro account

Article Resources

FCA Wikipedia, FCA.org.uk, FCA Registration Example

Compare UK Brokers

Popular Forex Guides

- Best Forex Trading Apps of 2024

- International Forex Brokers Search

- Compare Forex Brokers

- Best Forex Brokers of 2024

- Best Zero Spread Forex Brokers of 2024

- Best TradingView Forex Brokers of 2024

- Best MetaTrader 4 Brokers of 2024

- Best Forex Brokers for Beginners of 2024

- Best Copy Trading Platforms of 2024

Find the best forex brokers in Europe

- Best Forex Brokers in Austria for 2024

- Best Forex Brokers in Cyprus for 2024

- Best Forex Brokers in Denmark for 2024

- Best Forex Brokers in Finland for 2024

- Best Forex Brokers in France for 2024

- Best Forex Brokers in Germany for 2024

- Best Forex Brokers in Ireland for 2024

- Best Forex Brokers in Italy for 2024

- Best Netherlands Forex Brokers of 2024

- Best Forex Brokers in Norway for 2024

- Best Forex Brokers in Poland for 2024

- Best Forex Brokers in Portugal for 2024

- Best Forex Brokers in Spain for 2024

- Best Forex Brokers in Sweden for 2024

- Best Switzerland Forex Brokers of 2024

- Best Forex Brokers in Turkey for 2024

- Best Forex Brokers in Ukraine for 2024

- Best UK Forex Brokers of 2024

Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team, led by Steven Hatazkis, conducts thorough testing on a wide range of features, products, and services. We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables. Our research team collects and validates thousands of data points each year.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s regulatory status and number of held regulatory licenses.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser. Our Desktop PCs run Windows 11, and we use MacBook Pro laptops running the latest version of macOS to test trading on the go.

We also test on mobile devices; for Apple, we test using the iPhone XS running iOS 16, and for Android we use the Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra devices running Android OS 13.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses.Read more on forex trading risks.