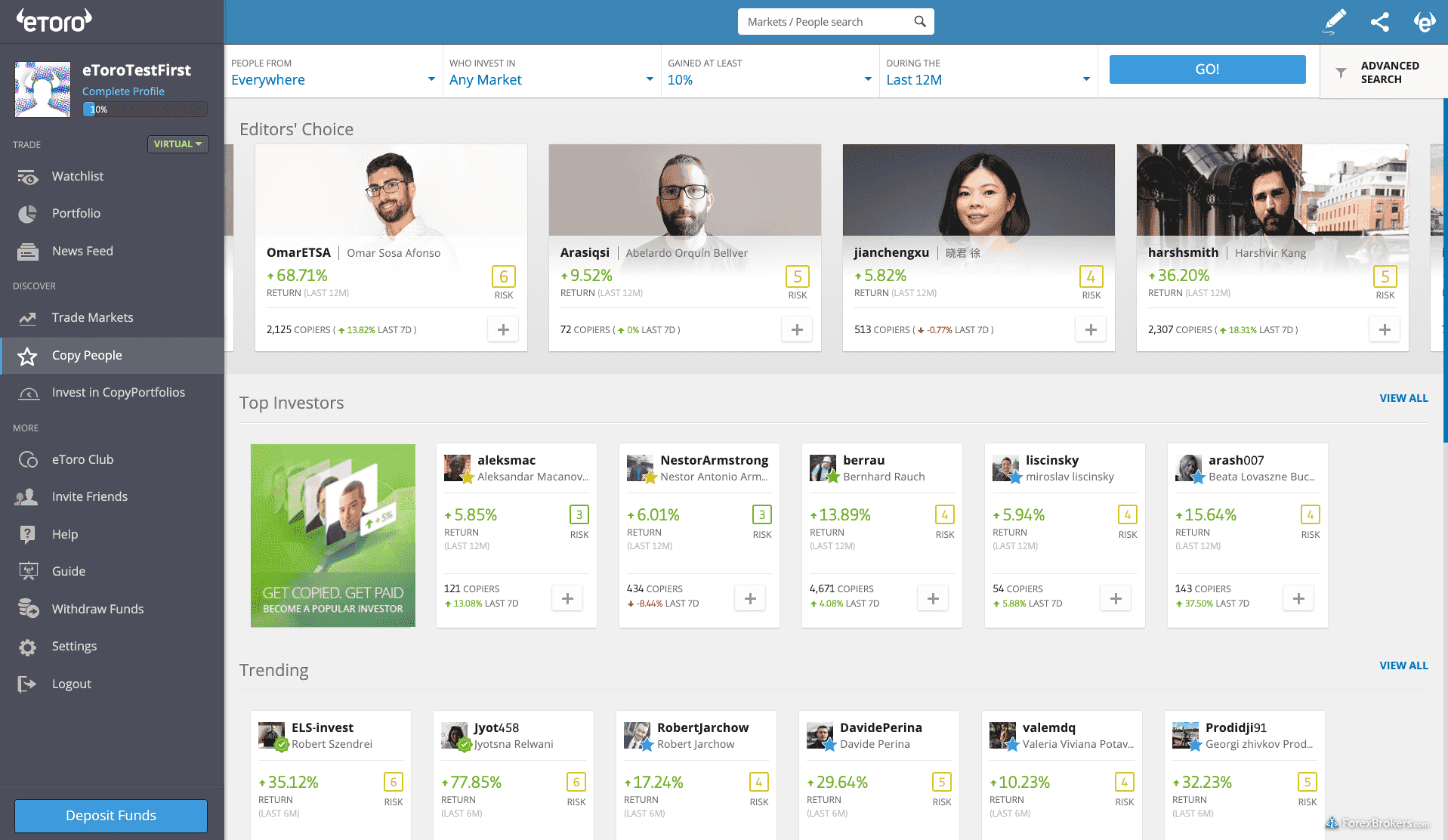

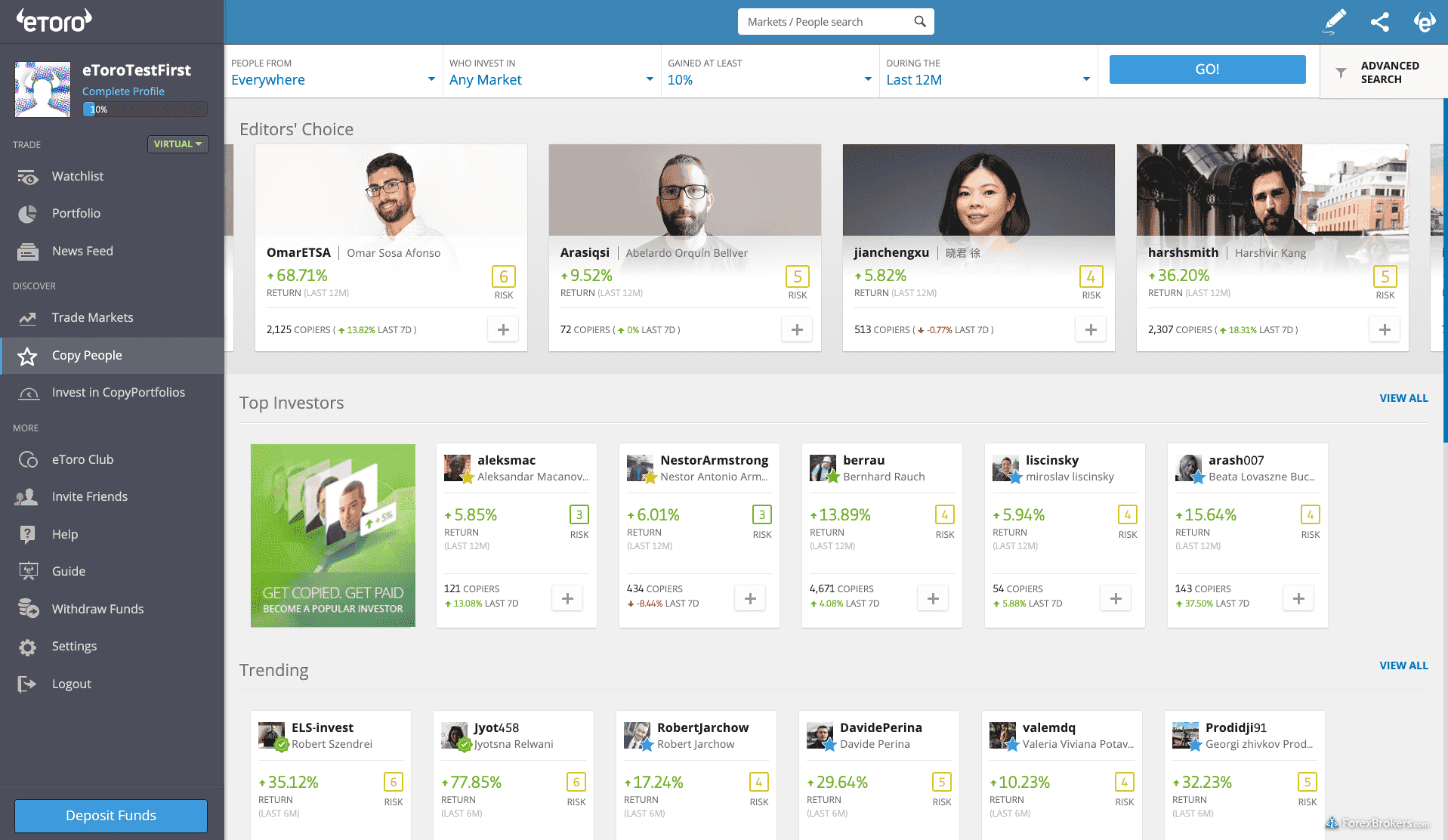

Winner: eToro

eToro is a winner for its easy-to-use copy-trading platform where traders can duplicate the trades of investors across over 2300 instruments, including exchange-traded securities, forex, CFDs, and popular cryptocurrencies.

- Trust: eToro was founded in 2007 and is regulated in three Tier-1 jurisdictions and one Tier-4 jurisdiction, earning a Highly Trusted rating for trading forex and CFDs within the ForexBrokers.com Trust Score rating system.

- Commissions: For trading forex and CFDs, eToro is slightly pricier than most of its competitors, despite recently cutting spreads and introducing zero-dollar commissions for U.S. stock trading.

- Copy trading platforms: eToro's main innovation is merging self-directed trading and copy trading under a unified trading experience. It is a winning combination.

Note: Past performance is not an indication of future results. Copy trading does not amount to investment advice. Copy trading takes place in a self-directed account, and your capital is no less at risk. The value of your investments may go up or down.

Runner-Up: AvaTrade

AvaTrade is a trusted global brand best known for offering traders an extensive selection of trading platform options. Our testing found AvaTrade to be great for copy trading, competitive for mobile, mostly in line with the industry average for pricing and research, and a good choice for investor education.

- Trust: Founded in 2006, AvaTrade is regulated in four Tier-1 jurisdictions, three Tier-2 jurisdictions, and one Tier-4 jurisdiction. We consider AvaTrade to be Highly Trusted for forex and CFD trading, and AvaTrade's licenses have earned it a Trust Score rating of 94.

- Commissions: Compared to pricing leaders such as IG and Saxo, AvaTrade does not rank among the best brokers for low-cost trading, except for clients designated as Professional traders in the EU.

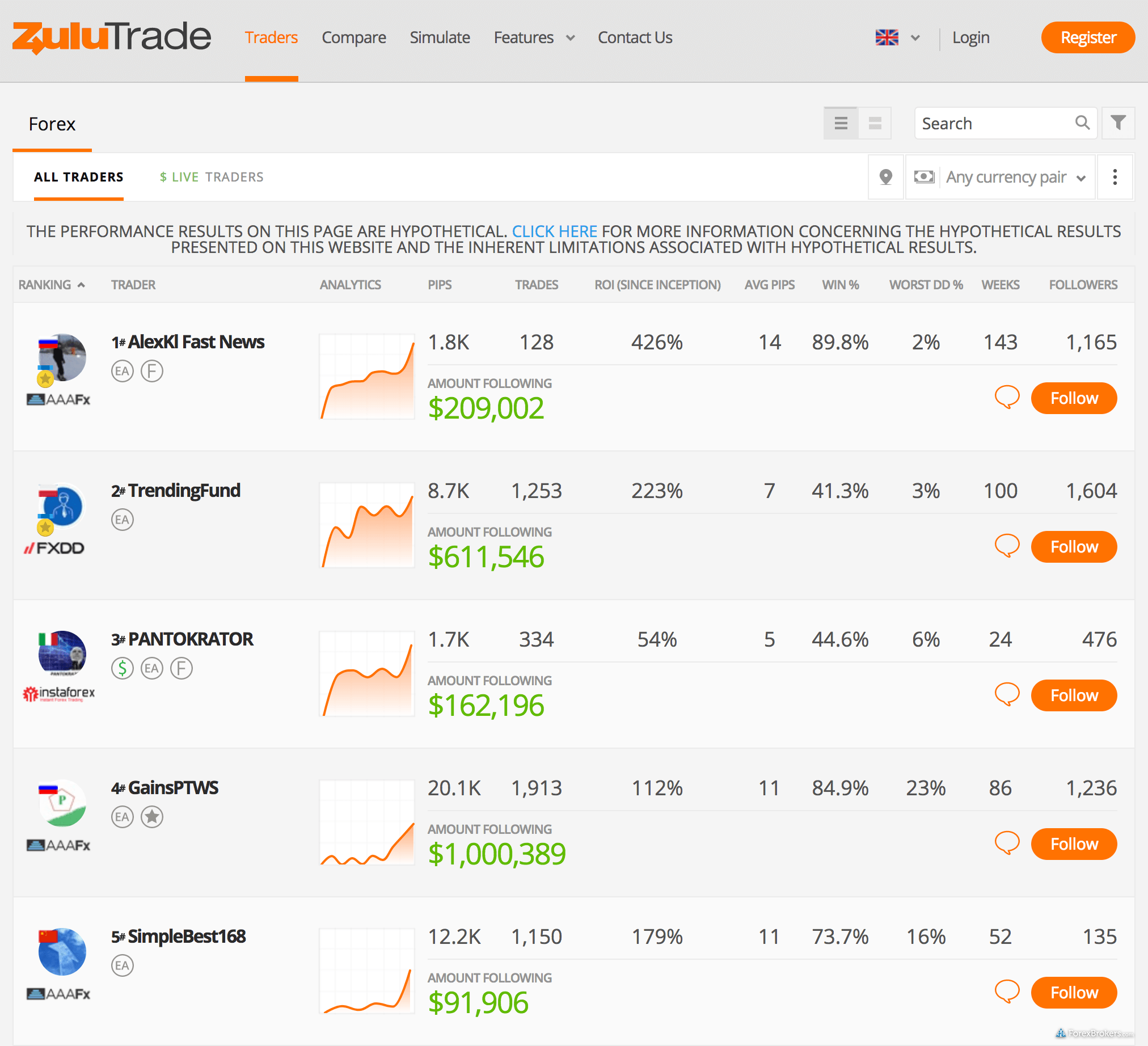

- Copy trading platforms: Alongside MetaTrader, AvaTrade offers its proprietary platforms, as well as ZuluTrade and DupliTrade, for social copy trading. The variety of platform options makes AvaTrade competitive in this area.

Copy trading history

Many of the early pioneers in social trading technology started out as third-party platform developers, such as Tradency, ZuluTrade, and eToro. While some of these firms are still independent service providers, or (ISPs), others went in a new direction. eToro, for example, became a broker – check out our full-length eToro review (and our review of eToro’s U.S. stock trading offering at our sister site, StockBrokers.com.

Today, thanks to precise legal definitions and ever-evolving trading technology, regulators in nearly every jurisdiction consider copy trading to be self-directed — because the client must decide who to copy, even if the copying happens automatically (for each signal).

It's important to note that not all trading platforms with social features provide copy trading.

Is copy trading legal?

Copy trading is legal in most countries, as long as the broker itself is properly regulated. When investing in financial markets through a regulated broker, there are procedures in place during the account opening process that should ensure it is legal for you to trade (depending on your country of residence).

Is copy trading legal in the U.S.?

Yes, copy trading is legal in the U.S. – provided that your broker is properly regulated by either the Commodity Futures Trading Commission (CFTC) in the case of forex or the Securities and Exchange Commission (SEC) for stocks. For cryptocurrency copy trading, your broker must be a registered Money Services Business (MSB) and licensed by FinCEN. In legal terms, copy trading is typically treated as a self-directed account.

Before copy trading existed, a power of attorney form was required to authorize a fund manager to trade on your behalf. Today, individual investors agree to a Letter of Direction (LoD), which is a form that authorizes the broker to copy the trades of other traders automatically based on your explicit instruction.

Fun fact: The LoD (which is now incorporated in each platform’s terms and conditions) was a crucial piece of the innovation that helped legalize copy trading in the U.S., making it largely indistinguishable from a regular self-directed brokerage account. That said, in certain countries, there are still restrictions. In the U.K., for example, additional money-management licenses are required for copy trading.

mapLooking for a copy trading broker in the U.S.?

Check out my guide to the best forex brokers in the U.S. to learn about legal forex trading for U.S. residents, and to see my picks for the best U.S. forex brokers that are regulated for forex trading.

Which US Brokers offer copy trading?

The following U.S.-regulated brokers offer copy trading either via their proprietary platform or from within the Signals market on MetaTrader:

What is the best copy trading platform?

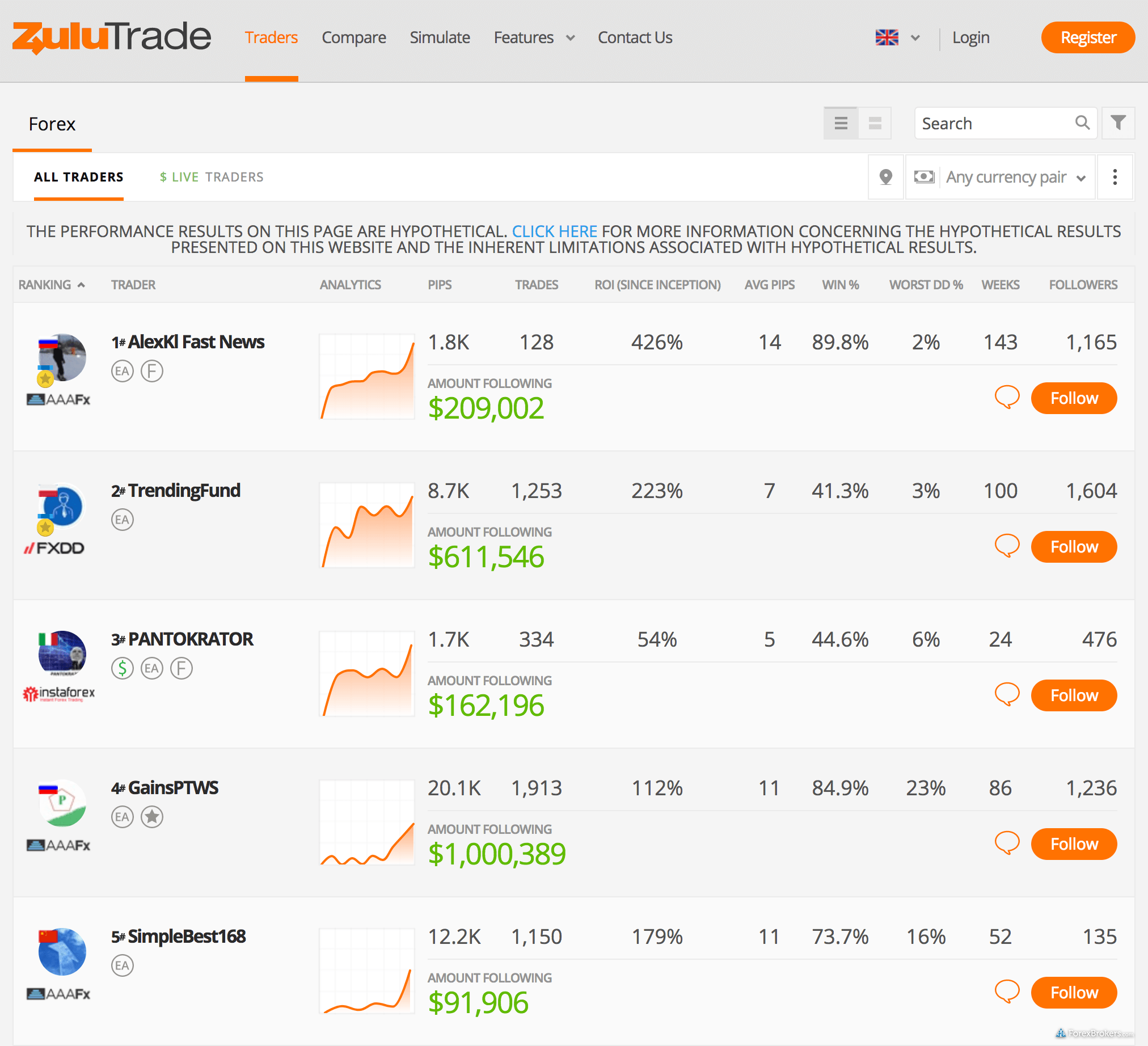

Our testing found that eToro is the best copy trading platform available in 2024, compared to the range of platforms available from brokers and third-party provides such as ZuluTrade, cTrader, the MetaTrader Signals market, DupliTrade, and Myfxbook.

Check out our mobile walkthrough of eToro's copy trading platform, CopyTrade:

In the above video walkthrough, we demonstrate how simple it is to find and select a signal provider in eToro's CopyTrader. We scroll through the signal provider's profile (which includes the trader's Overview, Stats, Portfolio, and Charts), and then we select how much to allocate towards copying the trader.

Overall, eToro is our top pick for social copy trading and cryptocurrency trading in 2024. Check out our full-length eToro review to see video walkthroughs of eToro's user-friendly web platform and well-designed mobile app – both of which are great for casual investors and beginners.

How do you copy trade?

If you want to start copy trading, your first step will be to choose a copy trading platform. Copy trading platforms allow users to automatically copy trades in real-time using individually customized account settings and platform tools. Next, you’ll need to choose a trader to copy. People that make their trades available to be copied in real-time are known as signal providers. Once you’ve chosen a signal provider, you’ll need to decide to what degree you want to copy the signal provider, and how much capital to allocate.

cell_towerPro tip:

The best signal providers typically have a large following, an established track record of performance (i.e., history of monthly trading results), consistent risk-adjusted returns, and above-average overall results. That said, the past performance of any provider is not a guarantee of future results.

How to start copy trading, in 7 steps:

- Compare the performance rankings and statistics of a variety of signal providers.

- Select a signal provider that complements your own trading goals and risk tolerance.

- Determine how much of your account balance to allocate towards copying the provider’s trades.

- Fine-tune your risk management settings and consider whether you’ll copy the provider’s existing open positions, or only new positions moving forward.

- Once you are comfortable with the settings you have configured, click to copy trade the traders you have decided to follow.

- Monitor the performance of your trading account as often as needed, depending on the frequency of trades established in your copy trading account.

- Adjust your parameters and subscriptions as conditions change (such as signal provider performance, or your own market expectations.

Top 5 copy trading tips

1. Look beyond a signal provider's absolute returns. It’s impossible to predict market movements 100% of the time, so you should seek out traders that are statistically consistent.

2. Review a wide variety of statistics and metrics when analyzing the performance of a signal provider. Analyze data points such as average profit and loss, number of trades placed, and average trade duration.

3. Find the right balance of diversification for your trading goals. Copy trading can give you the ability to incorporate a variety of trading styles and tradeable markets within your investment portfolio.

4. Always consider the time horizon (or, expected duration) of your investment when copying another trader. Even if you’ve analyzed the signal provider’s historical performance and found it to be consistent, keep in mind that their investment strategy may vary day-to-day in frequency and/or volume.

5. Familiarize yourself with your copy trading platform's settings for managing risk. Social copy trading is not without risk. It’s important to customize your limits and/or thresholds for risk management purposes. For example, you can customize the amount of capital at risk for each signal provider that you are copying.

What is an example of copy trading?

Once you’ve decided which traders you want to copy from within the copy trading platform, you’ll allocate a portion of your account balances towards each trader (or, signal provider) to enable copy trading. For example, if you are copying a trader who buys 100,000 units of the EUR/USD currency, you will see the same proportionally-sized trade in your account – depending on how much you allocate. The trade size in your account may be smaller or larger, depending on how you configured your account when initially subscribing to copy each investor).

Pro tip: Once you find one or more traders you wish to copy from within a copy trading platform, you will need to decide whether you want to only take on any new trades they establish, or immediately copy any of their pre-existing positions that may already be open. There may be additional parameters that you can configure — such as the maximum amount of risk you are willing to take for each trader you copy — and other controls that may affect how you manage your account when copy trading (these can vary depending on the copy trading platform you use).

Besides choosing a trader with good historical results, it's important to look at the performance statistics for each system, such as the amount of risk taken (maximum drawdown) and average trade size, duration, and frequency of trades. Some investors select more than one strategy, but having enough capital and choosing the right risk parameters (if any) is crucial when you copy trade forex strategies. Remember, copy trading is risky. Never invest more money than you are willing to lose.

Is copy trading risky?

Yes, copy trading can be risky. Any form of trading in financial markets carries risk, and forex and CFDs are high-risk investments regardless of your preferred trading method. Some may argue that using a copy trading strategy can be less risky than regular self-directed trading because most trading system developers employ risk management on every trade (i.e. stop-loss and limit orders). It’s important to realize, however, that no copy trading signal providers can guarantee successful returns.

Can you make money from copy trading?

Copy trading is like any investment, in the sense that you can either make money or lose money. Your profitability is determined by which traders you follow, as well as the timing of when you copy their trades — both of these factors will affect any resulting profits or losses.

You should assess the profitability of each trader before choosing which one to follow, and remember: just because a trader is making money at a particular time doesn't mean it's the best time to copy them.

As the market adage goes, "Past performance is not indicative of future results." As copy trading is risky (and many traders do lose money), you should only invest what you are willing to lose. Start with a small amount of capital, and do thorough research before committing to a strategy.

How do I choose the best trading system to forex copy trade?

The best trading system to copy isn't necessarily the most profitable. It is crucial to align your risk parameters with the strategy that best suits your investment goals. For example, a more conservative investor may choose a system with a lower average loss per trade, relative to the average profit. On the other hand, a more aggressive investor may choose a strategy that has higher volatility, which means a higher risk for losses — but also higher relative potential profits.

Many modern copy trading forex platforms contain hundreds or even thousands of signal providers. As a result, it can be difficult for traders to decide who to follow. Thus, it is always important to do research, start with a small amount, and never risk more than you are willing to lose.

Is copy trading good for beginners?

Copy trading can be good for beginners, provided they learn the basics and approach copy trading the same way they would any other self-directed trading account. Beginners should always start small before trading more seriously with larger amounts, and it’s always wise to learn how to use the software with a demo account before diving straight into live trading of any kind.

It's important to note that copy trading still requires active account management — it's not a quick fix or an easy way to make money. Copy trading should be thought of as a way to complement your portfolio and existing trading tool arsenal.

Whether or not copy trading is a good idea for you will depend on your preferences, trading goals, and risk tolerance. You'll need to specify various risk/reward parameters and maximum drawdown thresholds and decide which providers to copy (if any).

Beginners should analyze all available performance metrics when deciding whether to copy a particular signal provider. Understanding a given signal provider’s risk tolerance is just as important as measuring their average profits or their overall results. It’s also important to look at a signal provider’s trading volume and frequency, and to decide whether their style of trading would be suitable for your own account balance, profit goals, and risk tolerance.

Remember: Copy trading is not a replacement for self-directed trading, and should not be thought of as a passive investment or managed account.

Does copy trading really work?

Yes, copy trading really works, and you can verify the proof by checking the results of the best-performing traders. Likewise, there are traders that do lose money when copy trading. The key to success is picking the right strategies at the right time, and then allocating enough capital to each strategy, in addition to setting any risk/reward thresholds depending on your needs.

Copying a trader who has a successful track record or history of positive returns is no guarantee that you will succeed, although it can help increase the probability of making money compared to copying a trader that has poor historical performance.

Pro tip: The tools available for analyzing traders and managing risk can vary widely across copy trading platforms, and database biases may come into play (for example, recency bias, which can lead to simply following the trader currently performing best, which is not always the best choice). In addition, investors may be led astray by strategy drift — which is when a trader deviates from the strategy that led to their historical performance, which can produce unexpected results. The key to success is to do your research and keep up to date with your account performance, and intervene when necessary if copy trading doesn't work for you.

Other thoughts on copy trading:

Understanding how social copy trading networks calculate trading performance is an essential aspect of successful copy trading, as it affects the ordering of trader rankings. The method used to measure and track profit and loss also influences trade copiers.

Instant backfill bias is just one example of the challenges social trading technology developers face if they permit traders to instantly upload their entire trading history at the click of a button.

Such challenges have been known for years, and thanks to broker procedures, regulation, and robust technology, these concerns are mostly non-issues, especially for top-rated forex brokers. Nonetheless, if in doubt, it's always prudent to check and ask questions.

Forex copy trading platforms comparison

ForexBrokers.com 2024 Overall Rankings

Now that you've seen our picks for the best forex brokers for copy trading, check out the ForexBrokers.com Overall Rankings. We've evaluated over 60 forex brokers, using a testing methodology that's based on 100+ data-driven variables and thousands of data points. Check out our full-length, in-depth forex broker reviews.

Popular Forex Guides

More Forex Guides

Popular Forex Broker Reviews

Methodology

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

In order to assess the best brokers for copy trading, we conduct extensive research on a wide variety of copy trading platforms and services. We test copy trading platforms as provided by the online brokers themselves, and evaluate the overall proprietary social copy trading experience, and we test copy trading services offered by third-party providers.

We also examine the costs of these services, to determine whether these costs are folded into the spread or charged as standalone fees or subscriptions, for example. We test these services across a variety of platforms and devices and assess the fluidity between self-directed trading and copy trading within each broker’s offering.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser. Our Desktop PCs run Windows 11, and we use MacBook Pro laptops running macOS 12.5 to test copy trading on the go. We also test copy trading services on mobile devices; for Apple, we test using the iPhone XS running iOS 15, and for Android we use the Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra devices running Android OS 12.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

About the Editorial Team

Steven Hatzakis

Steven Hatzakis is the Global Director of Research for ForexBrokers.com. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. A forex industry expert and an active fintech and crypto researcher, Steven advises blockchain companies at the board level and holds a Series III license in the U.S. as a Commodity Trading Advisor (CTA).

John Bringans

John Bringans is the Senior Editor of ForexBrokers.com. An experienced media professional, John has close to a decade of editorial experience with a background that includes key leadership roles at global newsroom outlets. He holds a Bachelor’s Degree in English Literature from San Francisco State University, and conducts research on forex and the financial services industry while assisting in the production of content.

Joey Shadeck

Joey Shadeck is the Content Strategist and Research Analyst for ForexBrokers.com. He holds dual degrees in Finance and Marketing from Oakland University, and has been an active trader and investor for close to ten years. An industry veteran, Joey obtains and verifies data, conducts research, and analyzes and validates our content.

Blain Reinkensmeyer

Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. He heads research for all U.S.-based brokerages on StockBrokers.com and is respected by executives as the leading expert covering the online broker industry. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets.

eToro

eToro

AvaTrade

AvaTrade

Pepperstone

Pepperstone

Vantage

Vantage

FXCM

FXCM

Tickmill

Tickmill

IC Markets

IC Markets

IG

IG

Interactive Brokers

Interactive Brokers

Saxo

Saxo

CMC Markets

CMC Markets

FOREX.com

FOREX.com

TD Ameritrade

TD Ameritrade

City Index

City Index

XTB

XTB

Swissquote

Swissquote

Capital.com

Capital.com

Plus500

Plus500

OANDA

OANDA

Admirals

Admirals

XM Group

XM Group

FP Markets

FP Markets

FxPro

FxPro

Markets.com

Markets.com

Fineco Bank

Fineco Bank

BlackBull Markets

BlackBull Markets

HYCM (Henyep Capital Markets)

HYCM (Henyep Capital Markets)

HFM

HFM

ThinkMarkets

ThinkMarkets

FlowBank

FlowBank

DooPrime

DooPrime

Trading 212

Trading 212

BDSwiss

BDSwiss

Trade Nation

Trade Nation

TMGM

TMGM

Moneta Markets

Moneta Markets

Eightcap

Eightcap

MultiBank

MultiBank

ACY Securities

ACY Securities

RoboForex (RoboMarkets)

RoboForex (RoboMarkets)

VT Markets

VT Markets

easyMarkets

easyMarkets

IronFX

IronFX

Spreadex

Spreadex

IFC Markets

IFC Markets

Trade360

Trade360

Octa

Octa

Axi

Axi

TeleTrade

TeleTrade

GKFX

GKFX

Vestle

Vestle

FXOpen

FXOpen

FXPrimus

FXPrimus

Forex4you

Forex4you

GBE brokers

GBE brokers

Alpari

Alpari

TopFX

TopFX

Libertex (Forex Club)

Libertex (Forex Club)

LegacyFX

LegacyFX

FXGT.com

FXGT.com

ATFX

ATFX

Xtrade

Xtrade