ACY Securities Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74-89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

ACY Securities is a MetaTrader-only broker with a reasonable range of markets and a balanced account offering. The broker’s research and educational content, however, could be greatly improved upon.

-

Minimum Deposit:

$50 -

Trust Score:

75 -

Tradeable Symbols (Total):

2200

Can I open an account with this broker?

Yes, based on your detected country of HK, you can open an account with this broker.

ACY Securities pros & cons

Pros

- Offers the full MetaTrader suite (MT4 and MT5).

- Offers a good range of CFD markets.

- Competitive spreads on gold, and commission-based ProZero account with discounts available via an active trader program.

- Finologix charts have a good foundation for ACY’s proprietary platform development and are integrated into the ACY Cloud client portal.

- Share trading is available on MT5.

- Expanded social-copy trading offering with the addition of Signal Start, as well as SoFinX.

- Yearlong Trading Cup competition crowdsources the best day traders to compete for allocations, akin to a proprietary trading firm.

Cons

- Per-trade fee for commission-based forex accounts is more expensive for international clients, but discounted if you are Australia-based.

- Spreads on standard account are slightly higher than industry average; while ProZero account spreads are lower, the round-turn commission is twice as high outside Australia.

- Educational content is poorly organized.

- ACY Securities no longer onboards clients under its Vanuatu entity. The broker holds licenses with ASIC and St. Vincent and the Grenadines' FSA (a Tier-5 Trust Score jurisdiction that offers little to no consumer protection).

Overall Summary

| Feature |

ACY Securities ACY Securities

|

|---|---|

| Overall Rating |

|

| Trust Score | 75 |

| Offering of Investments |

|

| Commissions & Fees |

|

| Platform & Tools |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Is ACY Securities safe?

ACY Securities is considered Average Risk, with an overall Trust Score of 75 out of 99. ACY Securities is not publicly traded and does not operate a bank. ACY Securities is authorized by one Tier-1 regulator (Highly Trusted), zero Tier-2 regulators (Trusted), zero Tier-3 regulators (Average Risk), and one Tier-4 Regulator (High Risk). ACY Securities is authorised by the following Tier-1 regulators: the Australian Securities & Investment Commission (ASIC). Learn more about Trust Score.

| Feature |

ACY Securities ACY Securities

|

|---|---|

| Year Founded | 2011 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 1 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 1 |

Offering of investments

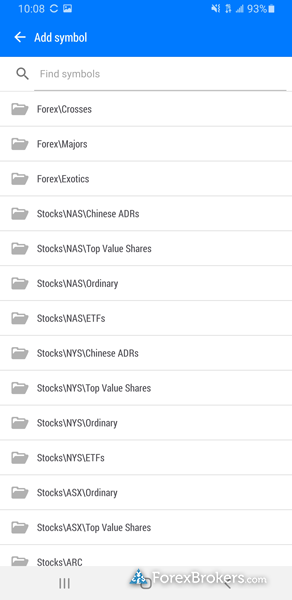

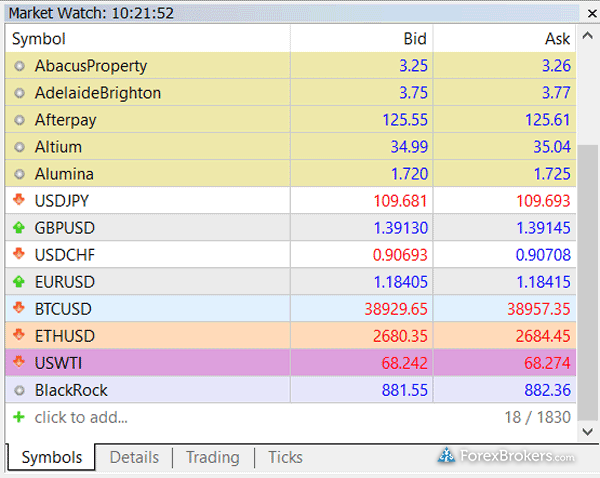

ACY Securities offers CFDs across a variety of popular asset classes that include equities, ETFs, commodities, metals, forex and cryptocurrencies.

Cryptocurrency: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents.

| Feature |

ACY Securities ACY Securities

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 2200 |

| Forex Pairs (Total) | 66 |

| U.S. Stock Trading (Non CFD) | No |

| Int'l Stock Trading (Non CFD) | No |

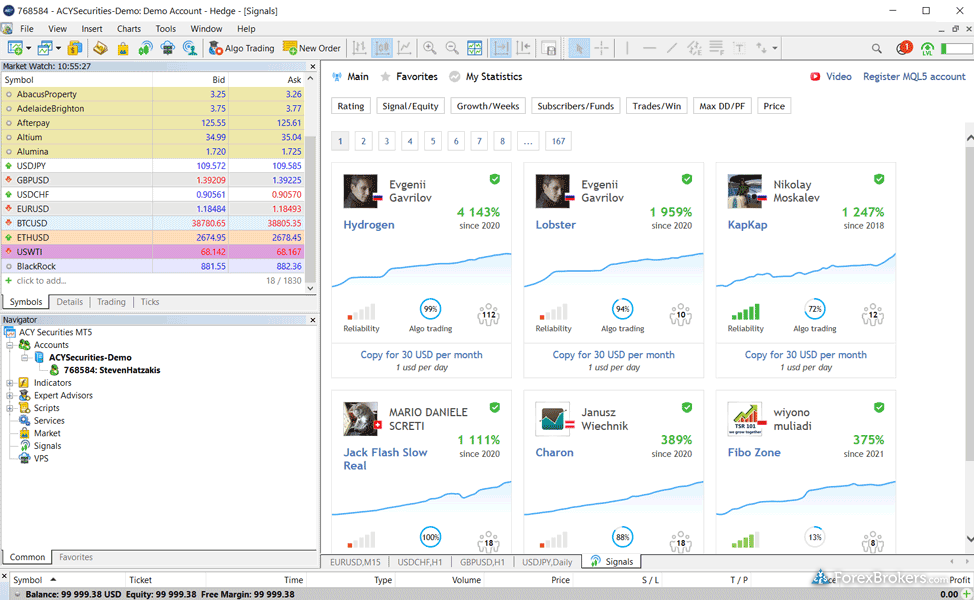

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (Derivative) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). |

Commissions and fees

ACY Securities caters to a wide variety of traders by offering both low-deposit and commission-based account options. While pricing on its Standard account is slightly higher than the industry average, the ProZero account effective spreads are slightly better than the industry average. If you reside in Australia, the all-in cost is even lower.

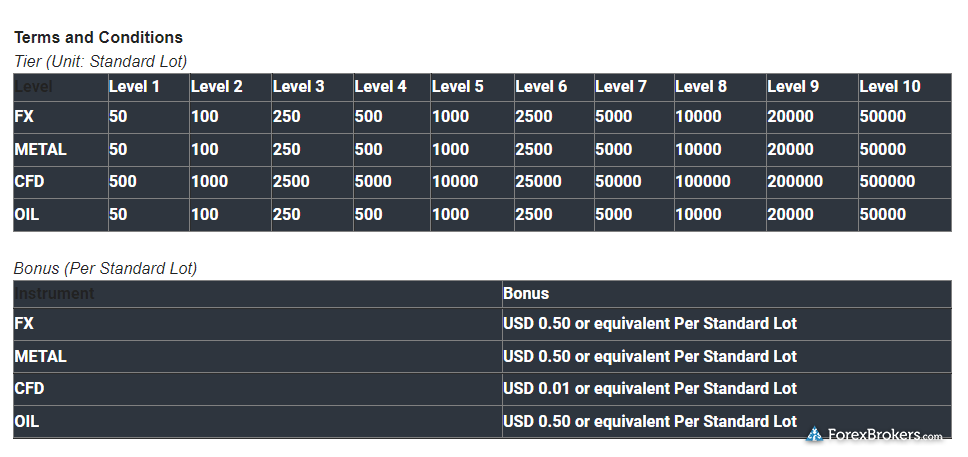

Account types: ACY Securities offers three account types with varying minimum deposits, spreads and commissions. Additionally, an active trader program with 10 tiers can lower your trading costs by 0.5 pips per lot if you have more than 50 standard lots in monthly volume.

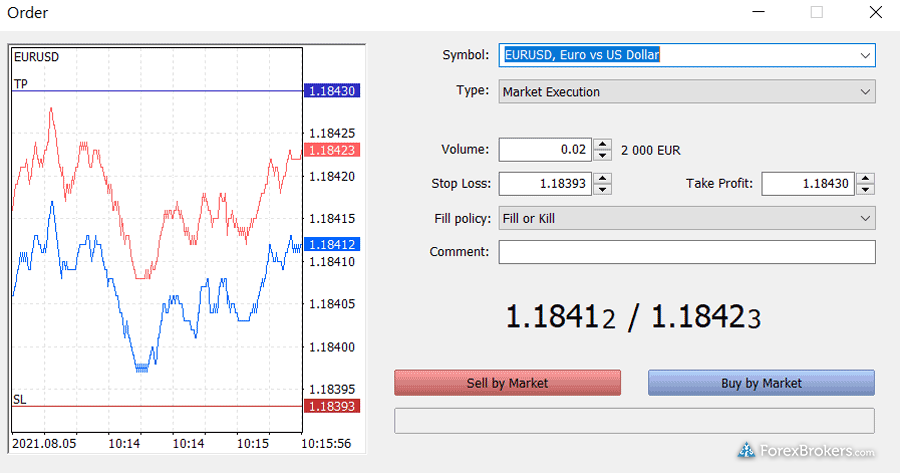

Trading costs: The Standard account is commission-free with spreads averaging 1.2 pips on the EUR/USD in September 2021, and requires just a $50 deposit – but it has wider spreads than ACY’s commission-based ProZero and Bespoke accounts, where average spreads drop to 0.25 during the same period. The commission-based accounts require larger minimum deposits, starting at $200 for the ProZero account and $10,000 for the Bespoke account. The commission rate varies from $5 per round turn (RT) on the Bespoke account to $6 per RT on the ProZero. It’s worth noting again that, for residents of Australia, the commission on the ProZero account drops to $3 per RT, bringing the effective spreads to 0.55 in September 2021. That’s comparable to pricing from category leaders such as Tickmill.

Trading Cup contest: In this yearlong contest, traders are eligible to receive allocations ranging from $50,000 to $500,000 for a total of $1 million across the top five finalists. Unlike most bonuses that are volume-based, the Trading Cup contest requires at least 10 round-trip trades of any amount to be eligible — but the catch is that winners can only withdraw up to 50% of any profits and must adhere to strict money management guidelines.

| Feature |

ACY Securities ACY Securities

|

|---|---|

| Minimum Deposit | $50 |

| Average Spread EUR/USD - Standard | 1.2 |

| All-in Cost EUR/USD - Active | 0.85 |

| Active Trader or VIP Discounts | Yes |

| ACH or SEPA Transfers | Yes |

| PayPal (Deposit/Withdraw) | No |

| Skrill (Deposit/Withdraw) | Yes |

| Visa/Mastercard (Credit/Debit) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

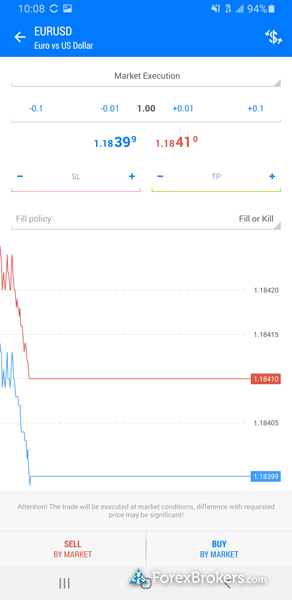

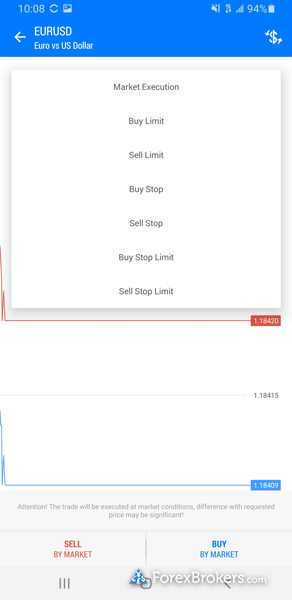

Mobile trading apps

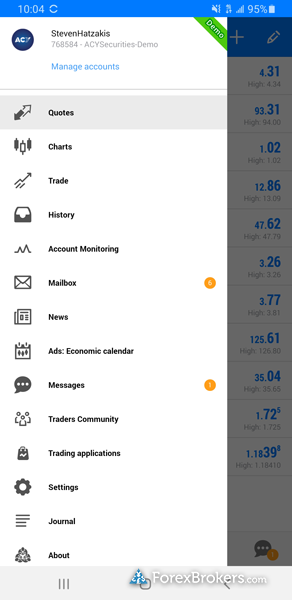

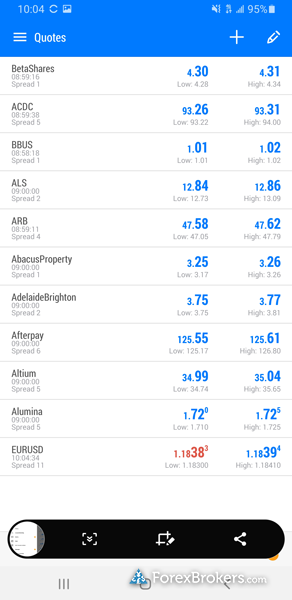

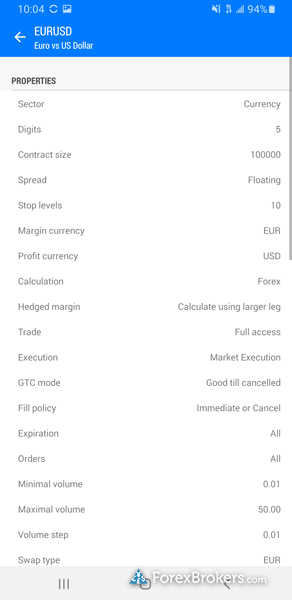

Apps overview: As ACY Securities is a MetaTrader-only broker, iOS and Android versions of the MT4 and MT5 app come standard and are both available for download from the Apple App Store and Google Play store, respectively.

Ease of use: Most brokers now offer the MT4 and MT5 mobile apps due to the user-friendly interfaces and variety of standard features. The MT4 app makes viewing and managing positions simple and easy, but it doesn’t support algorithmic trading – for that you’ll need the desktop app.

Charting: Accessing functions such as changing the time frame or chart tap is as easy as tapping and holding the screen, which brings up the quick pie menu.

Trading tools: The Tradays app powers the economic calendar feature for both MT4 and MT5. This requires a separate installation that launches from within the MetaTrader app. Traders can also benefit from the specialized MetaTrader community features in the app, which can be accessed by logging into the MQL5 community.

| Feature |

ACY Securities ACY Securities

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts - Basic Fields | Yes |

| Watchlists - Total Fields | 7 |

| Watchlist Syncing | No |

| Charting - Indicators / Studies (Total) | 30 |

| Charting - Drawing Tools (Total) | 15 |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Charting - Multiple Time Frames | Yes |

| Mobile Economic Calendar | No |

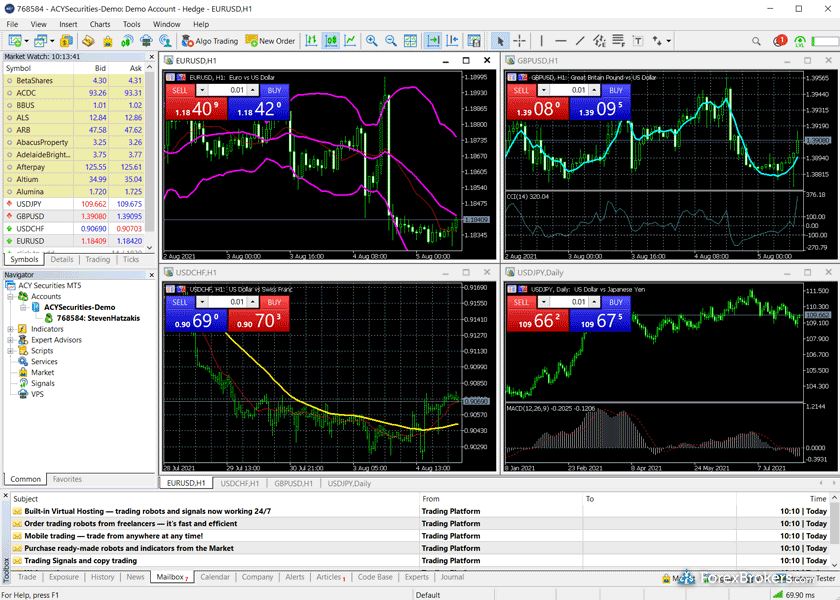

Other trading platforms

In addition to MT4 and MT5, there are over a dozen plug-ins available in the form of scripts and indicators; but no other significant add-ons to help the broker stand out from among the best MetaTrader brokers.

Platform overview: The full MetaTrader suite is available — albeit the standard, run-of-the-mill versions — for MacOS and Windows, alongside the web version that can be accessed via any modern browser.

Charting: The MetaTrader platform suite is well-known for its adaptable charting software. User-friendly and functional, it allows users to drag and drop from the default list of nearly 50 indicators. Zooming in and out and rearranging windows and tabs is a breeze on both MT4 and MT5.

| Feature |

ACY Securities ACY Securities

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | No |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| DupliTrade | No |

| ZuluTrade | No |

| Charting - Indicators / Studies (Total) | 30 |

| Charting - Drawing Tools (Total) | 15 |

| Charting - Trade From Chart | Yes |

| Watchlists - Total Fields | 7 |

Market research

ACY Securities provides basic research coverage in the form of daily market analysis in written and video format. The market research articles include a good balance of written content and associated multimedia such as charts and graphs. Though ACY’s offering has variety, it still trails the best brokers in the category, such as IG and Saxo.

Research overview: ACY Securities’ main research offering is its Daily Market Report video series, which is complemented by detailed written articles that cover fundamental and technical analysis.

Market news and analysis: The Latest News and Market Analysis sections of the ACY Securities website provide timely, up-to-date information.

| Feature |

ACY Securities ACY Securities

|

|---|---|

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | No |

| Autochartist | No |

| Trading Central (Recognia) | No |

| Social Sentiment - Currency Pairs | No |

Education

With over 50 articles and over a dozen videos, ACY Securities has built a good foundation of content for its educational offering. It’s an impressive start, but ACY Securities still lags the best brokers in this category.

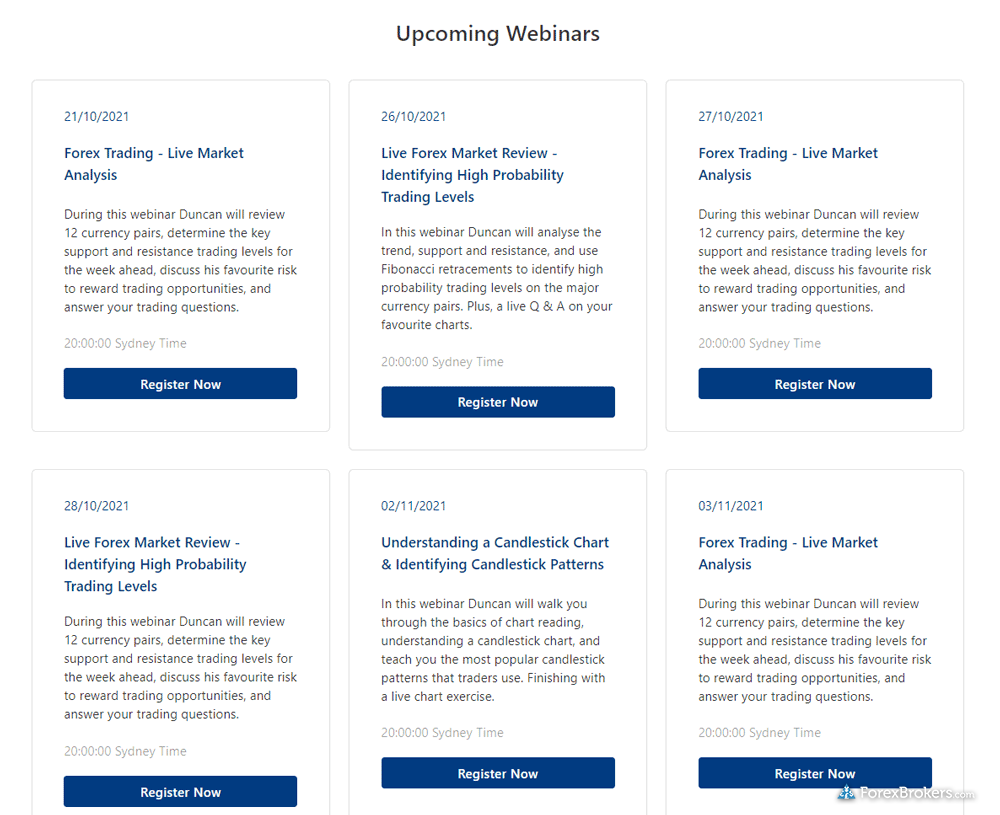

Learning center: I found ACY Securities to have good-quality educational content, on par with the industry average, in both video and written format. It also provides daily educational webinars, with at least 30 archived on ACY Securities' YouTube channel.

Room for improvement: ACY Securities’ educational offering could be improved by adding the ability to filter and organize its content by experience level. I’d also like to see a general expansion of the topics covered. Some of the best brokers in this category offer lesson programs, complete with quizzes and progress tracking.

| Feature |

ACY Securities ACY Securities

|

|---|---|

| Education (Forex or CFDs) | Yes |

| Client Webinars | Yes |

| Client Webinars (Archived) | Yes |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | No |

| Investor Dictionary (Glossary) | No |

Final thoughts

ACY Securities provides access to a decent range of markets and over 2,200 symbols by way of its offshore and Australian entities. As a MetaTrader-only broker, it also gives traders access to the powerful MT4 and MT5 trading platforms.

I was impressed by its commission-based accounts, although its proprietary ICHI Scalper tool was discontinued. Some significant limitations come along with those benefits, however, such as sparse educational content and out-of-date research materials. It's important to note that while ACY Securities is regulated in multiple jurisdictions, its recent operations in St. Vincent and the Grenadines do not provide traders with any regulatory protection.

About ACY Securities

Founded in 2011, ACY Securities Pty Ltd is regulated by the Australian Securities and Investments Commission (ASIC) and in Vanuatu, ACY Capital Australia Limited is regulated by the Vanuatu Financial Services Commission (VFSC).

2024 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Popular Forex Guides

- Best Forex Brokers of 2024

- International Forex Brokers Search

- Best MetaTrader 4 Brokers of 2024

- Best Zero Spread Forex Brokers of 2024

- Best TradingView Forex Brokers of 2024

- Best Forex Brokers for Beginners of 2024

- Best Copy Trading Platforms of 2024

- Compare Forex Brokers

- Best Forex Trading Apps of 2024

More Forex Guides

Popular Forex Broker Reviews

Compare ACY Securities Competitors

Select one or more of these brokers to compare against ACY Securities.

Show all