What is high-frequency trading?

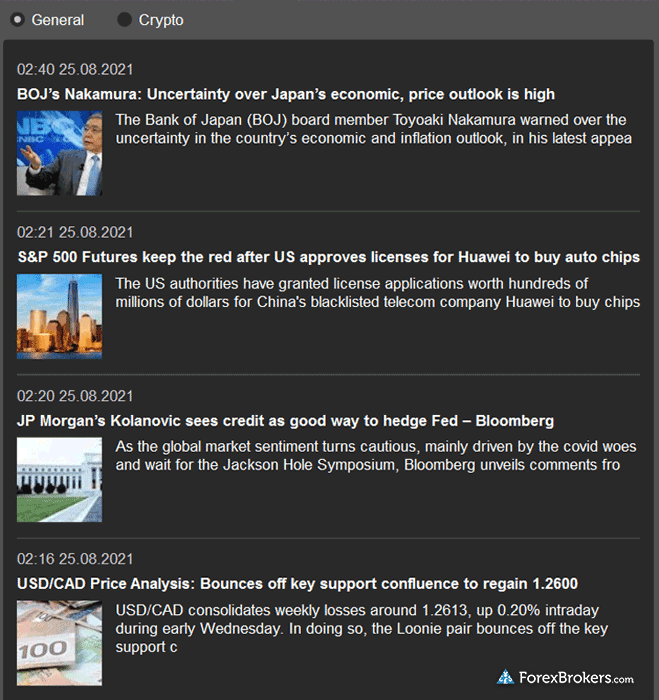

High-frequency trading (HFT) refers to a type of algorithmic trading system that conducts a large number of trades throughout the trading day within extremely narrow time frames. A piece of algo trading software may execute hundreds of trades per day, while an HFT system can execute many thousands of trades in a matter of seconds. Usually employed by institutions or professional traders, HFT systems utilize complex mathematical algorithms that rapidly analyze market prices and news events in order to identify trading opportunities.

HFT systems also demand extraordinary computing power and require advanced high-frequency trading software. These high-powered trading programs can open and close trading positions in just microseconds.Reducing latency (the time elapsed between when an order is placed and when it is executed) is of such importance for HFT trading strategies that the servers that run these advanced trading systems typically need to be within close physical proximity of the broker’s data center or trading venue.

Is high-frequency forex trading legal?

Yes, high-frequency trading is legal. That being said, it’s possible that high-frequency trading strategies will not be permitted by your broker. Price-driven strategies (such as scalping) or latency-driven arbitrage strategies are prohibited altogether by some brokers. You should check with your broker directly to see if your HFT strategy will be allowed – and it’s always important to carefully examine your broker’s terms and conditions.

If your broker does permit HFT strategies or systems, it’s important to note the specific kinds of trading conditions that are available and to pay attention to your broker’s execution methods and trading costs. Even if your broker permits high-frequency trading, it may simply not be a feasible strategy if your broker makes it cost-prohibitive.

Though HFT systems are legal, they are also controversial. There are some well-known HFT practices that are simply illegal, such as spoofing and front-running.

Spoofing: Spoofing occurs when a high-frequency trading system rapidly places a large number of orders – and then cancels those orders before they can be executed. This strategy is done with the intent of creating an artificial sense of demand for a certain asset or instrument (or falsely driving demand downwards).

Front-running: Sometimes, HFT traders (or institutions) are able to identify significant impending orders for a certain asset or instrument within the market – before the orders are executed. This is (typically) done illegally, with insider (or, non-public) information. Then these traders or institutions are able to use the speed of HFT systems to quickly buy large amounts of that asset, which can be turned around and sold at a profit.

All that being said, the last 20 years or so have seen rules and regulations put in place to prevent practices like front-running, and to generally uphold market integrity and protect market participants. For example, some securities exchanges have implemented a universal speed bump that slows down all incoming orders in an attempt to level the playing field. Today, HFT strategies that are latency-driven or solely looking for price arbitrage are prohibited altogether by many forex market brokers and trading venues.

Pros & Cons of High-Frequency Trading

Pros

- Decisions are handled by computers. High-frequency trading is conducted by complex algorithms and high-powered computers, so these strategies won’t ever make decisions based on human emotion or psychology.

- HFT systems move fast. High-frequency trading systems are able to react rapidly to market movements and global news events that can impact markets.

Cons

- Computers aren’t perfect. HFT algorithms and systems may be complex, but they don’t make perfect decisions. In particular, they may not have the sophistication to determine whether a market-moving event is genuine, and they may not always react appropriately to volatility.

- HFT isn’t for everyone. An immense amount of technical skill is required to successfully develop and maintain an HFT strategy.

Best stockbrokers for high-frequency trading

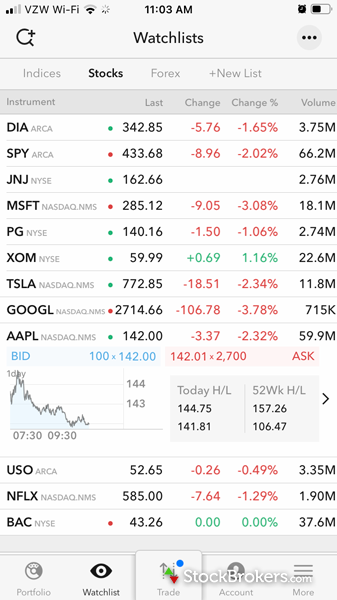

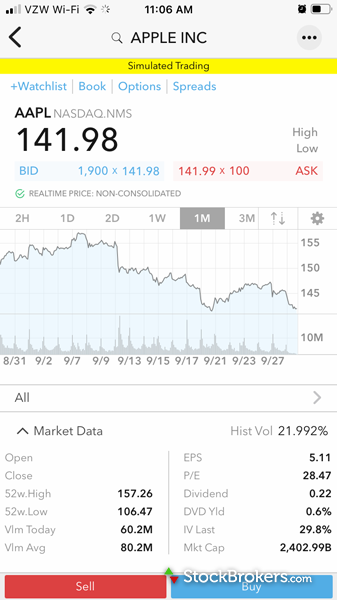

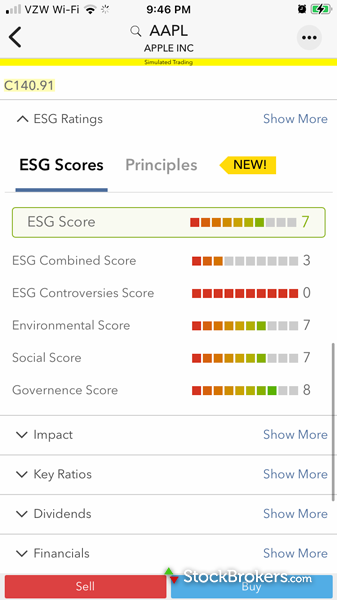

Our research team has tested a wide range of stockbrokers that offer algorithmic trading, API access, and cash equities. Thanks to its low trading costs and connectivity to over 100 trading venues across the globe, Interactive Brokers is our top pick for high-frequency trading. If you want to read more about Interactive Brokers’ stock trading offering, you can read the full-length review of Interactive Brokers on our sister site, StockBrokers.com.

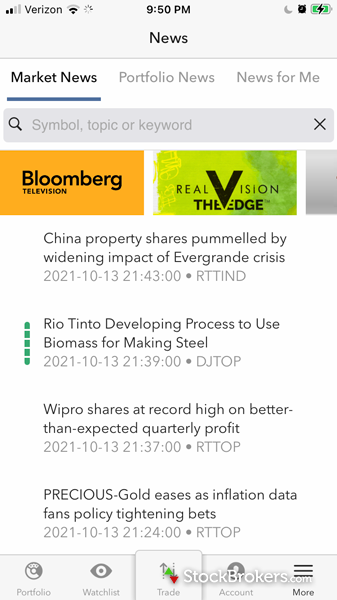

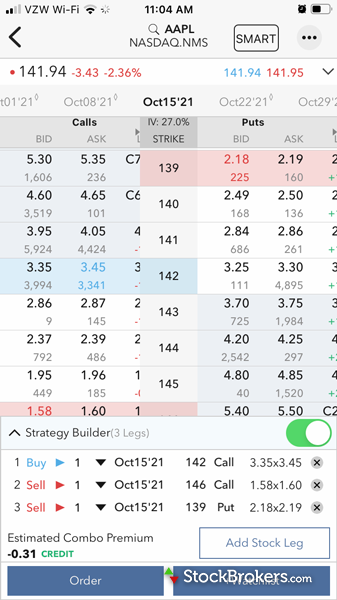

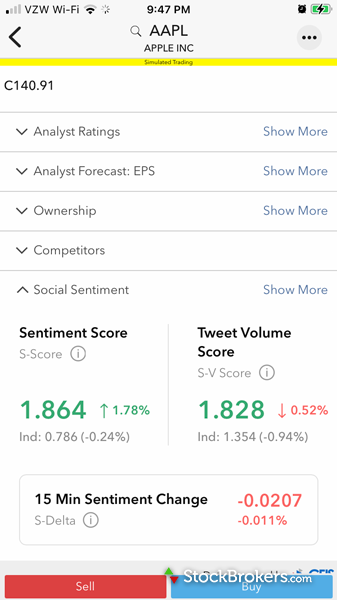

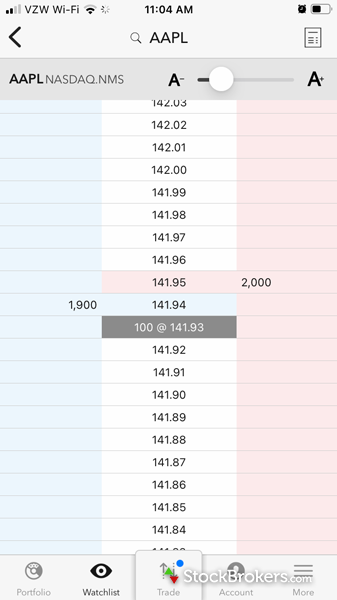

Check out a gallery of screenshots from Interactive Brokers’ mobile stock trading app taken by the research team at our sister site, StockBrokers.com, during their product testing.

The following brokers are our top picks for using high-frequency trading strategies to trade stocks:

Can you do high-frequency trading on a mobile app?

Generally speaking, it isn't possible to run a true high-frequency trading system from your mobile device. That being said, there are a number of third-party solutions that allow traders to run algo trading software on a variety of platforms and devices. For example, Capitalize.ai is a tool that allows you to build algorithmic HFT systems using natural (code-free) language. Trading with Capitalize.ai is not done on the typical scale of HFT, but it still offers a form of algorithmic trading that – for now – is as close as you'll get to running a full-fledged HFT strategy from your mobile device.

The following forex brokers offer Capitalize.ai for trading forex algorithmically:

smartphoneTrading on the go?

Check out my guide to the best mobile forex trading apps to learn more about mobile trading and to find my top picks for the best mobile trading apps.

Can you do high-frequency trading with forex?

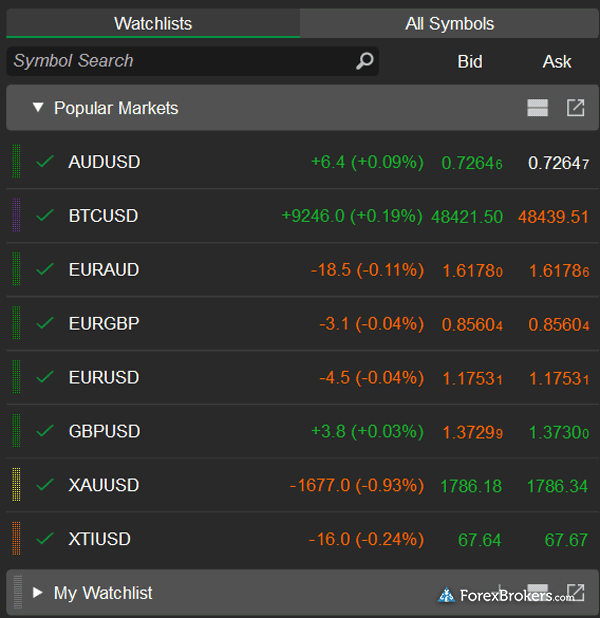

Yes, there are many algorithmic trading programs that can be used by traders in the forex market to trade at a high frequency – sometimes thousands of orders per day. Though HFT programs are typically found at institutional trading desks, it is becoming more common for retail forex traders to gain access to algorithmic trading programs – including those that could meet the definition of being an HFT.

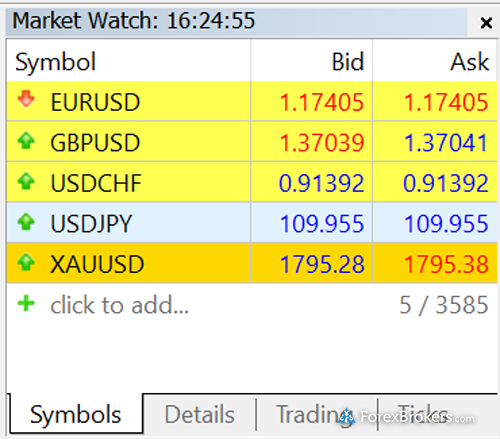

To set up a high-frequency trading strategy for forex, you’ll need to determine what kind of strategy you will employ, and decide how orders will be triggered programmatically – regardless of whether you are using a trading API with your own software or a third-party trading platform such as MetaTrader.

Check out our full-length guide to the best brokers with Trading APIs, as well as our guide to the best MetaTrader brokers.

HFT strategies that are more price-sensitive will likely use limit orders, whereas execution-sensitive strategies may use market orders.

Note: Many brokers offer multiple execution methods across their account types and platforms.

Is high-frequency forex trading profitable?

Yes, high-frequency trading strategies can be profitable for forex traders. That being said, all trading strategies – including those that utilise HFT systems – involve risk. When considering any forex trading strategy, it’s important to remember that the vast majority of retail forex traders lose money. Finding success and making money with an HFT system will depend largely on which HFT system you’ve chosen, and on your HFT system’s configurations.

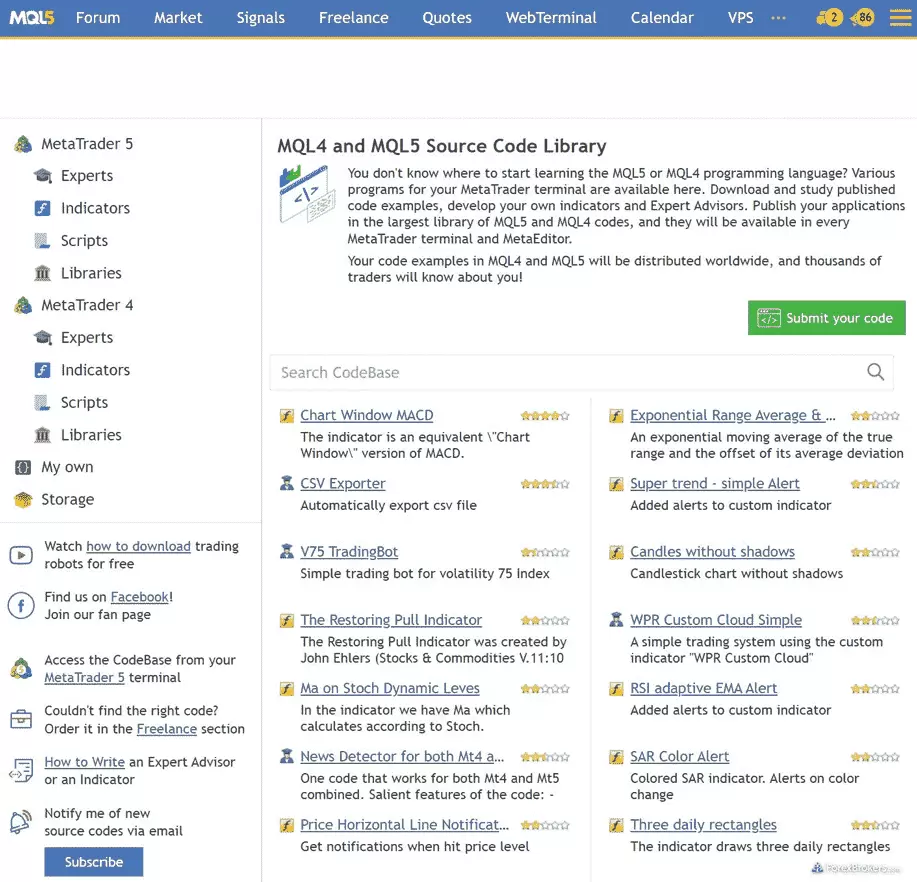

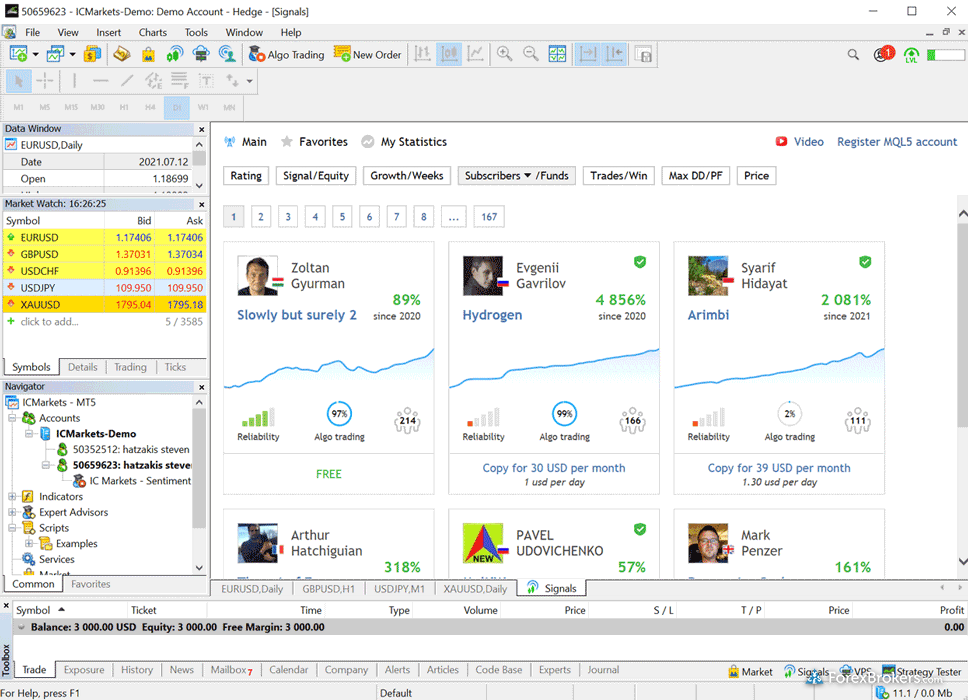

Choosing an HFT system: Thousands of individual HFT programs can be leased or purchased from third-party developers. One such source for third-party HFT systems is MetaTrader’s MQL5 community – you can learn more about MetaTrader and MQL5 by reading our popular MetaTrader 5 guide.

Check out a gallery of screenshots of the MQL Dashboard and Source Library, taken by our research team.

Note: Leasing or purchasing a third-party HFT system does not guarantee success or profitability, however, and any program’s overall effectiveness will still rely on the quality of its historical data and its actual live trading results, among other factors.

How do I get started with HFT trading?

HFT and algorithmic trading are nearly synonymous when it comes to retail trading. Most retail traders that dabble in HFT start out with commercially-available algorithmic trading systems that are compatible with popular trading platforms, such as MetaTrader, cTrader, and NinjaTrader.

If you decide to build your own HFT system, you’ll need to test your strategy by performing backtests on historical data. It’s important to use that data to get an idea of how your system would have performed before using it on a forward-testing basis.

Retail vs. Institutional: Retail trading systems for HFT might carry out tens or thousands of trades per day, whereas institutional HFT systems can execute thousands of trades per minute. These systems require advanced (and extremely expensive) equipment, as well as the ability to physically co-locate near the exchange or trading venue.

What is the best forex broker for high-frequency trading?

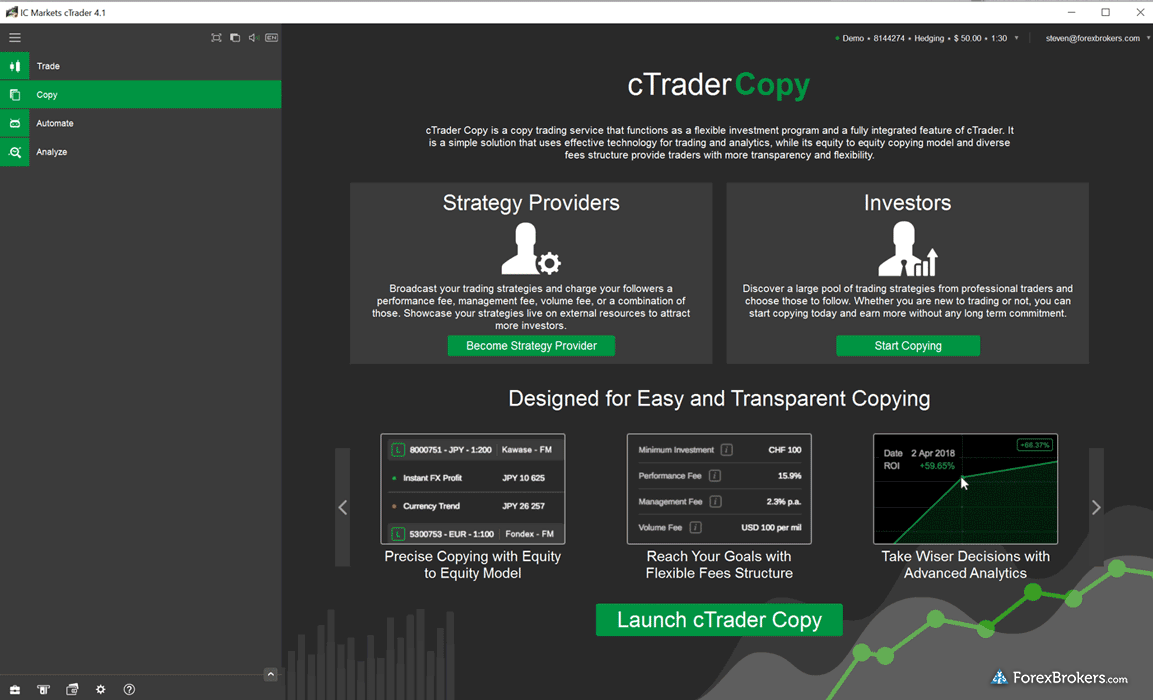

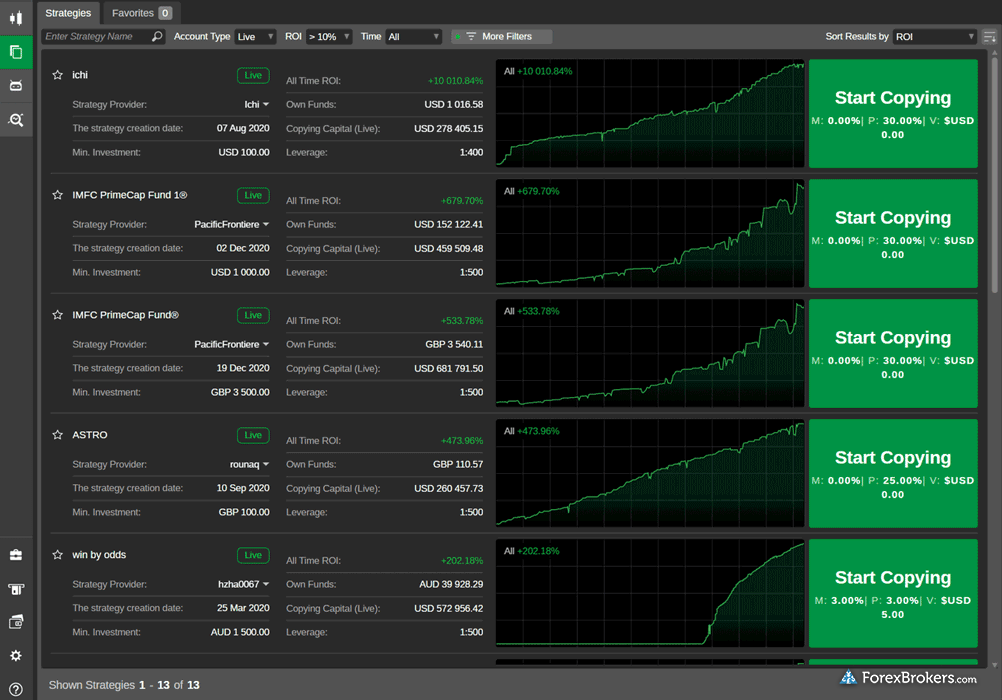

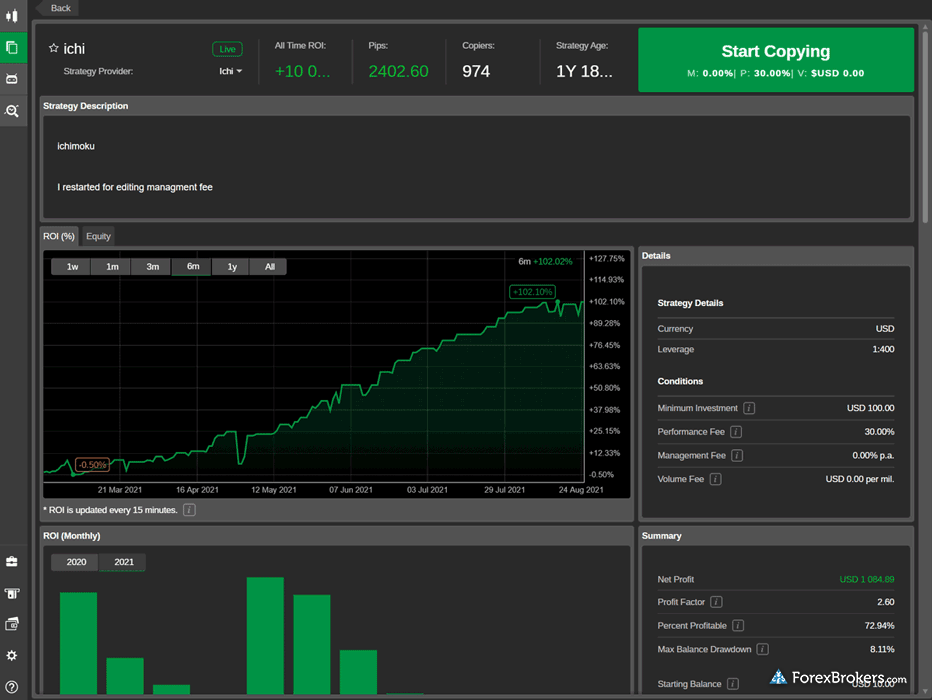

IC Markets is the best broker for traders who are looking to run high-frequency trading strategies for forex and CFDs, thanks to its robust order execution policy, low trading costs, and the option for FIX API connectivity to its cTrader platform. Our research team has conducted extensive testing on IC Markets’ entire product offering, check out our full-length review of IC Markets to read more about our findings.

Check out a gallery of screenshots from IC Markets’ desktop trading platform, taken by our research team during our product testing.

If you are looking to run your HFT systems at IC Markets, you have the option to either build it on MetaTrader 4 (MT4) or MetaTrader 5 (MT5) using the MQL syntax, or use the cTrader platform outright (or via API). “MQL” is MetaQuotes Software’s own programming language, designed to allow programmers to develop scripts, libraries, and technical indicators. You can learn more about MQL and MetaTrader by reading our full guide to MetaTrader 5 or by checking out my MT4 vs MT5 guide.

computerTrading APIs

There's a wide range of third-party applications that can be used to programmatically connect to FIX APIs for the purpose of trading using an HFT system, and open-source code can be found on Github. For more in-depth information about trading APIs, read our guide to the best brokers for trading APIs.

ForexBrokers.com 2024 Overall Rankings

Now that you've seen our picks for the best high-frequency trading platforms, check out the ForexBrokers.com Overall Rankings. We've evaluated over 60 forex brokers, using a testing methodology that's based on 100+ data-driven variables and thousands of data points. Check out our full-length, in-depth forex broker reviews.

Popular Forex Guides

More Forex Guides

Popular Forex Broker Reviews

Methodology

At ForexBrokers.com, our evaluations of online brokers and their products and services are based on our collected quantitative data as well as the qualitative observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the online forex brokerage industry, and we evaluate dozens of international regulator agencies (read more about how we calculate Trust Score).

In order to assess the best brokers for high-frequency trading, we research and test each individual broker’s algorithmic product offering. We examine a wide range of features and evaluate forex brokers based on our own data-driven variables. We determine whether the broker offers algorithmic trading or API access, and we look for a number of supplementary features that can distinguish any HFT system offerings.

Browser-based platforms are tested using the latest version of the Google Chrome browser. Our Desktop PCs run Windows 11, and we test algorithmic programs on mobile devices; for Android, we use the Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra devices running Android OS 12.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Read more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

About the Editorial Team

Steven Hatzakis

Steven Hatzakis is the Global Director of Research for ForexBrokers.com. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. A forex industry expert and an active fintech and crypto researcher, Steven advises blockchain companies at the board level and holds a Series III license in the U.S. as a Commodity Trading Advisor (CTA).

John Bringans

John Bringans is the Senior Editor of ForexBrokers.com. An experienced media professional, John has close to a decade of editorial experience with a background that includes key leadership roles at global newsroom outlets. He holds a Bachelor’s Degree in English Literature from San Francisco State University, and conducts research on forex and the financial services industry while assisting in the production of content.

Joey Shadeck

Joey Shadeck is the Content Strategist and Research Analyst for ForexBrokers.com. He holds dual degrees in Finance and Marketing from Oakland University, and has been an active trader and investor for close to ten years. An industry veteran, Joey obtains and verifies data, conducts research, and analyzes and validates our content.

Blain Reinkensmeyer

Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. He heads research for all U.S.-based brokerages on StockBrokers.com and is respected by executives as the leading expert covering the online broker industry. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets.

IG

IG

Interactive Brokers

Interactive Brokers

Saxo

Saxo

CMC Markets

CMC Markets

FOREX.com

FOREX.com

TD Ameritrade

TD Ameritrade

City Index

City Index

XTB

XTB

eToro

eToro

Swissquote

Swissquote

Capital.com

Capital.com

AvaTrade

AvaTrade

Plus500

Plus500

OANDA

OANDA

Admirals

Admirals

Markets.com

Markets.com

Fineco Bank

Fineco Bank

BlackBull Markets

BlackBull Markets

Vantage

Vantage

HYCM (Henyep Capital Markets)

HYCM (Henyep Capital Markets)

HFM

HFM

ThinkMarkets

ThinkMarkets

FlowBank

FlowBank

DooPrime

DooPrime

Trading 212

Trading 212

BDSwiss

BDSwiss

Trade Nation

Trade Nation

TMGM

TMGM

Moneta Markets

Moneta Markets

Eightcap

Eightcap

MultiBank

MultiBank

ACY Securities

ACY Securities

RoboForex (RoboMarkets)

RoboForex (RoboMarkets)

VT Markets

VT Markets

easyMarkets

easyMarkets

IronFX

IronFX

Spreadex

Spreadex

IFC Markets

IFC Markets

Trade360

Trade360

Octa

Octa

Axi

Axi

TeleTrade

TeleTrade

GKFX

GKFX

Vestle

Vestle

FXOpen

FXOpen

FXPrimus

FXPrimus

Forex4you

Forex4you

GBE brokers

GBE brokers

Alpari

Alpari

TopFX

TopFX

Libertex (Forex Club)

Libertex (Forex Club)

LegacyFX

LegacyFX

FXGT.com

FXGT.com

ATFX

ATFX

Xtrade

Xtrade