Best Forex Brokers in Saudi Arabia for 2024

ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Trading forex (currencies) in Saudi Arabia is popular among residents. While recommended, forex brokers are not required to become authorised by the Capital Market Authority (CMA) to accept residents of Saudi Arabia as customers.

The Capital Market Authority is the financial regulatory body in Saudi Arabia. Website: https://cma.org.sa. We recommend Saudi Arabia residents also follow the CMA on Twitter, https://twitter.com/SAUDICMA.

The CMA, which was formed in 2003, regulates and develops the Saudi Arabian Capital Market. For a historical breakdown, here's a link to the Capital Market Authority webpage on Wikipedia.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Best Forex Brokers Saudi Arabia

To find the best forex brokers in Saudi Arabia, we created a list of all brokers that list Saudi Arabia as a country they accept new customers from. We then ranked brokers by their Overall ranking.

Here is our list of the best forex brokers in Saudi Arabia:

-

IG

- Best overall broker, most trusted

-

Interactive Brokers

- Great overall, best for professionals

-

Saxo

- Best web-based trading platform

- FOREX.com - Excellent all-round offering

- XTB - Great research and education

- Swissquote - Trusted broker, best banking services

-

Capital.com

- Great for beginners, easy to use

Saudi Arabia Forex Brokers Comparison

Compare Saudi Arabia authorised forex and CFDs brokers side by side using the forex broker comparison tool or the summary table below. This broker list is sorted by my overall rankings of the top forex brokers.

| Company | Accepts SA Residents | Average Spread EUR/USD - Standard | Minimum Deposit | Overall Rating | Visit Site |

IG IG

|

0.98 | £250.00 |

|

Visit Site

|

|

Interactive Brokers Interactive Brokers

|

0.63 | $0 |

|

Visit Site

|

|

Saxo Saxo

|

1.1 | $0 |

|

Visit Site

|

|

FOREX.com FOREX.com

|

1.4 | $100 |

|

||

XTB XTB

|

1.00 | $0 |

|

||

Swissquote Swissquote

|

N/A | $1000 |

|

||

Capital.com Capital.com

|

0.67 | $20 |

|

Visit Site

|

|

AvaTrade AvaTrade

|

0.92 | $100 |

|

Visit Site

|

|

Plus500 Plus500

|

N/A | €100 |

|

Visit Site

|

|

OANDA OANDA

|

1.57 | $0 |

|

||

FXCM FXCM

|

0.74 | Starts from $50 |

|

Visit Site

|

|

Admirals Admirals

|

0.8 | $100 |

|

||

Pepperstone Pepperstone

|

0.77 | $200 |

|

Visit Site

|

|

XM Group XM Group

|

1.6 | $5 |

|

Visit Site

|

|

FP Markets FP Markets

|

1.1 | $100 AUD |

|

Visit Site

|

|

IC Markets IC Markets

|

0.62 | $200 |

|

Visit Site

|

|

Tickmill Tickmill

|

0.51 | $100 |

|

Visit Site

|

|

BlackBull Markets BlackBull Markets

|

0.76 | $0 |

|

Visit Site

|

|

Vantage Vantage

|

1.30 | $50 |

|

||

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

0.6 | $20 |

|

||

HFM HFM

|

1.2 | $0 |

|

Visit Site

|

|

FlowBank FlowBank

|

N/A | $0 |

|

||

Trade Nation Trade Nation

|

0.6 | $0 |

|

||

Moneta Markets Moneta Markets

|

1.27 | $50 |

|

||

Eightcap Eightcap

|

1.0 | $100 |

|

Visit Site

|

|

MultiBank MultiBank

|

N/A | $50 |

|

||

ACY Securities ACY Securities

|

1.2 | $50 |

|

Visit Site

|

|

easyMarkets easyMarkets

|

0.9 | $50 |

|

||

Libertex (Forex Club) Libertex (Forex Club)

|

N/A | $10 |

|

What is the best trading platform in Saudi Arabia?

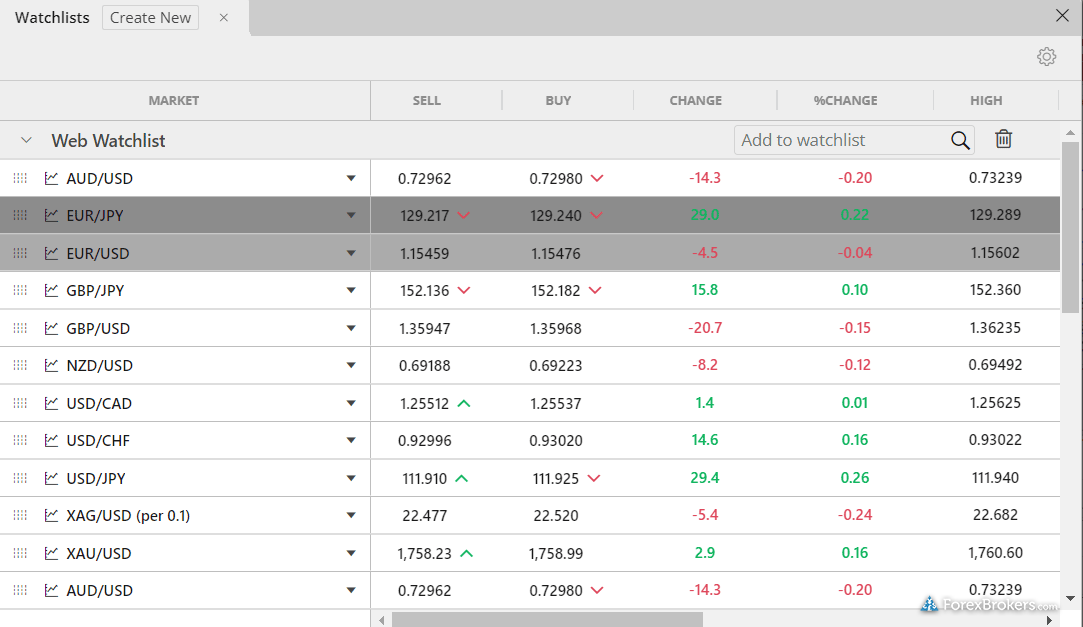

No matter where you live, it’s always important to choose a broker that offers a trading platform that will suit your individual forex trading needs. I’ve been testing the best trading platforms for over 7 years – read below to see my picks for the best forex trading platforms available to residents of Saudi Arabia in 2024:

1. IG

99 Trust Score - Most trusted broker in 2024, Best Overall Broker in 2024

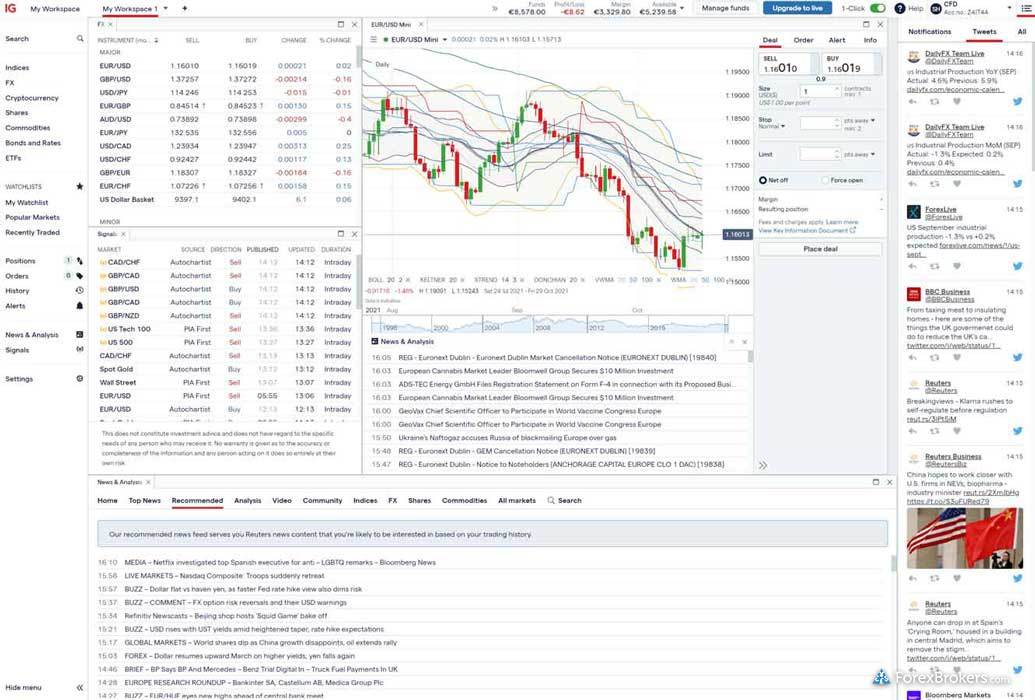

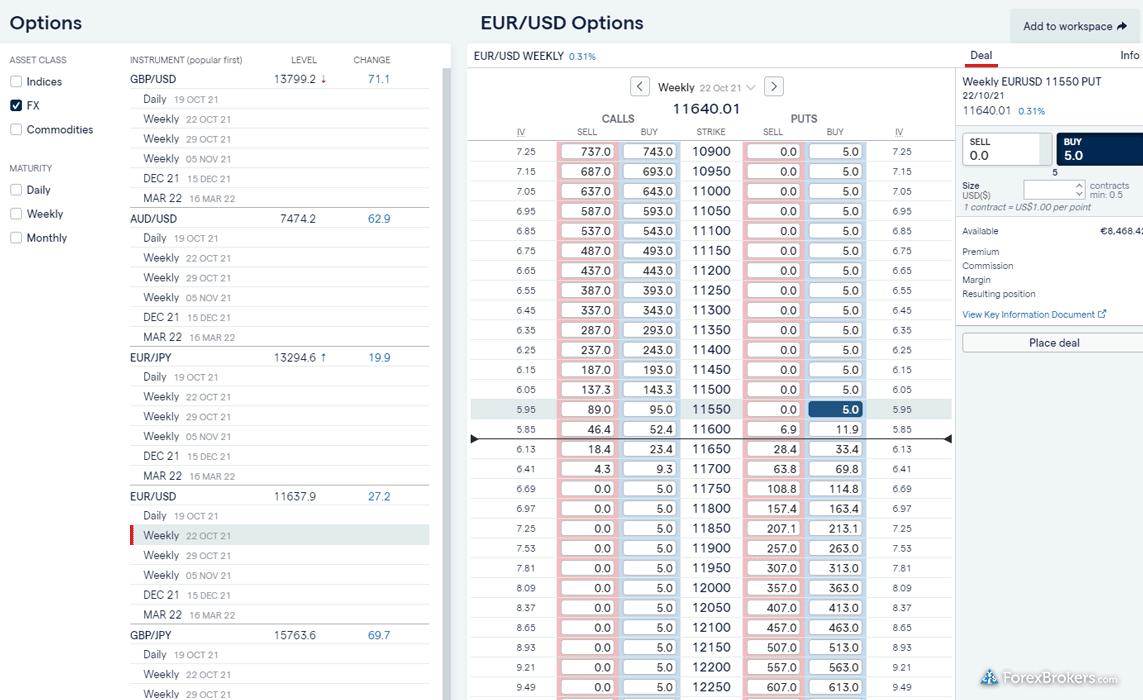

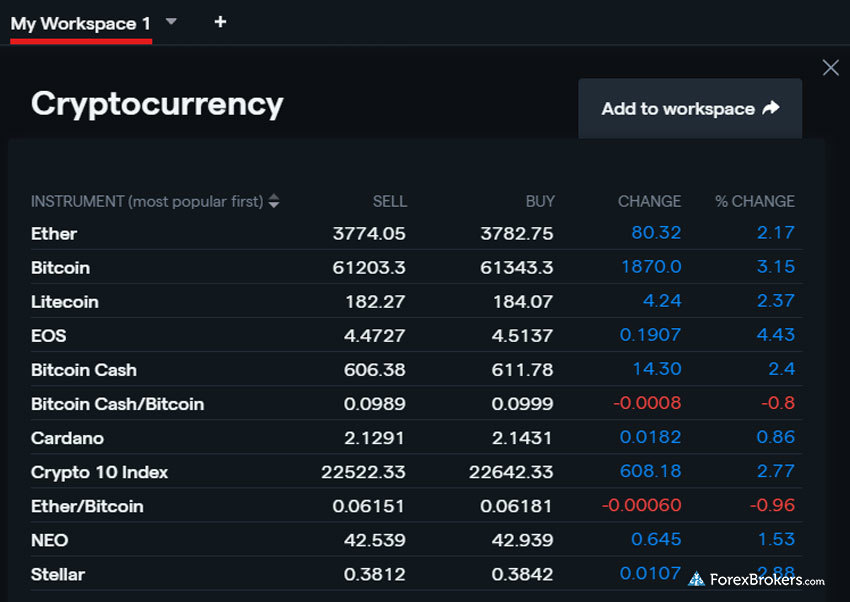

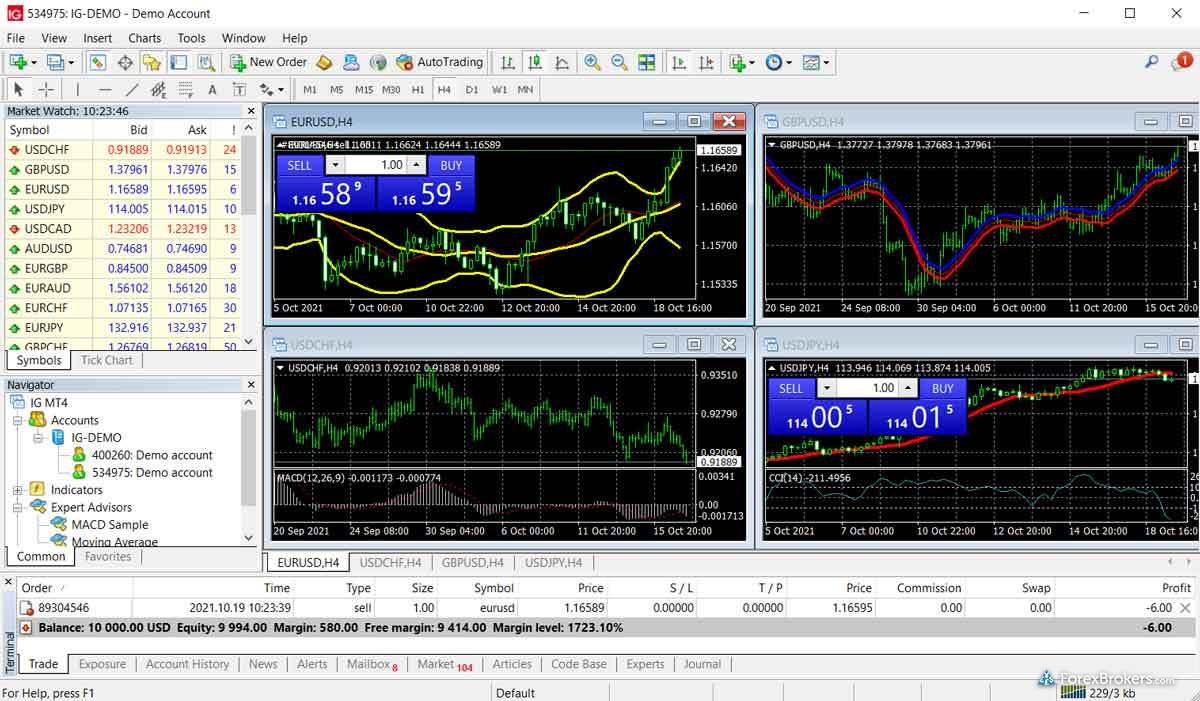

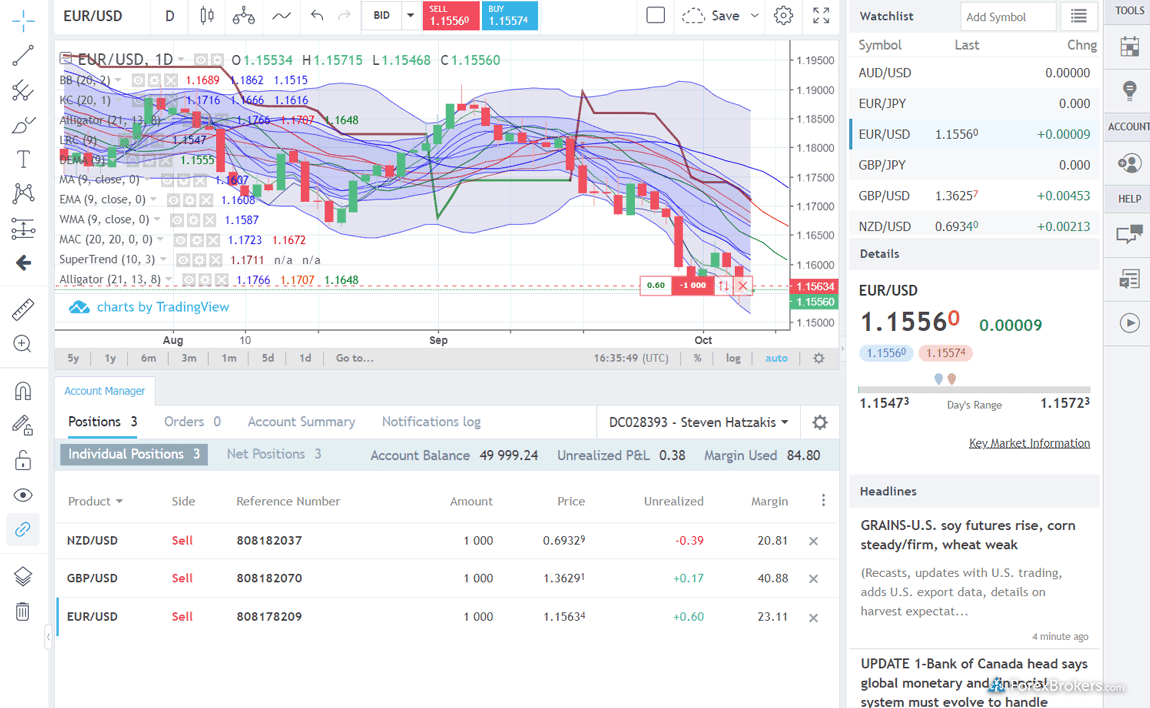

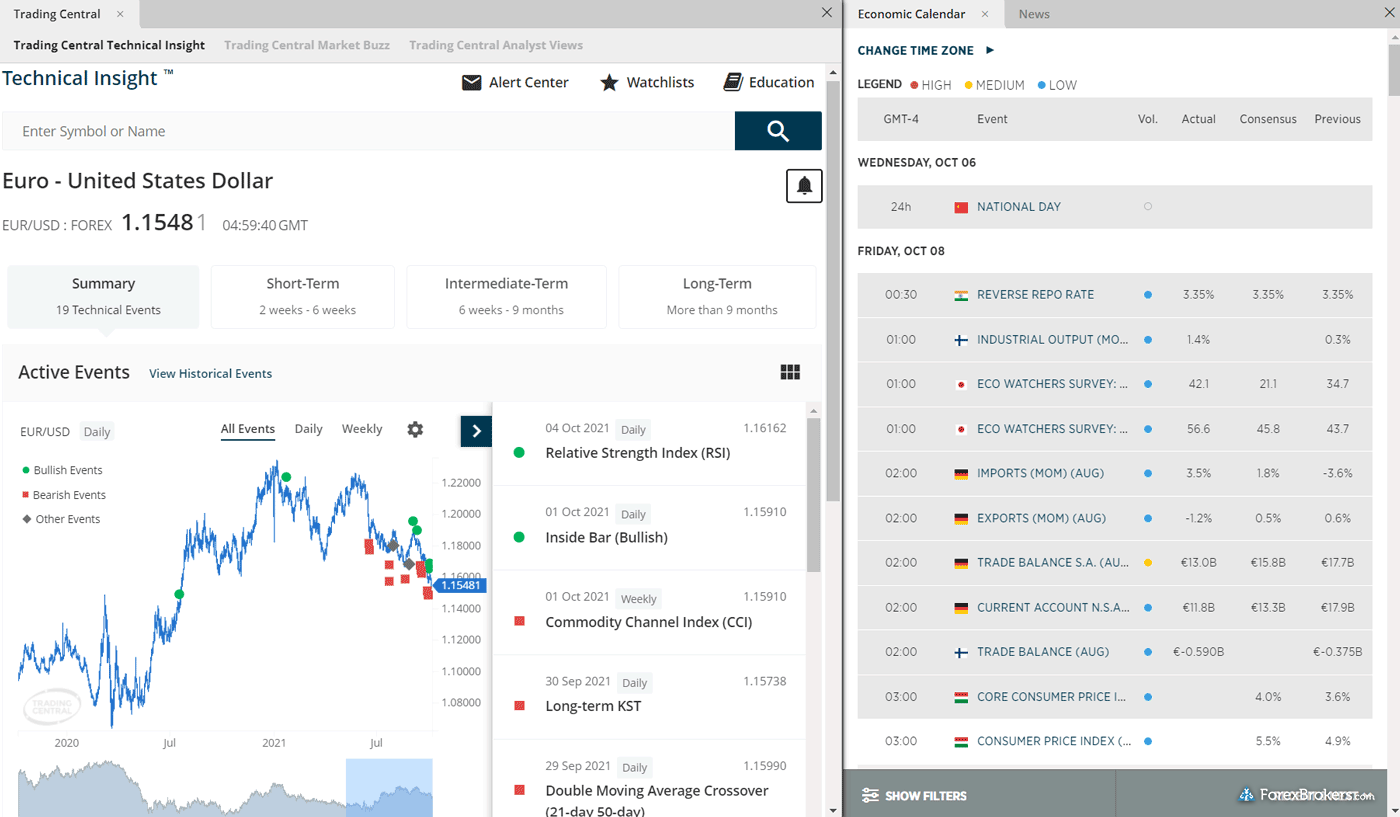

IG offers the best forex trading platform in Saudi Arabia in 2024. In my years of testing IG’s products and services, I’ve found that IG consistently delivers an excellent selection of trading platforms and tools. IG’s proprietary web platform is highly customizable and includes integrated forex trading signals and research modules, as well as advanced charting capabilities. Usability is at the heart of IG’s platform experience, and IG’s tools and features serve traders of all experience levels. IG also offers access to the wildly popular MetaTrader 4 platform. Learn more by checking out my review of IG.

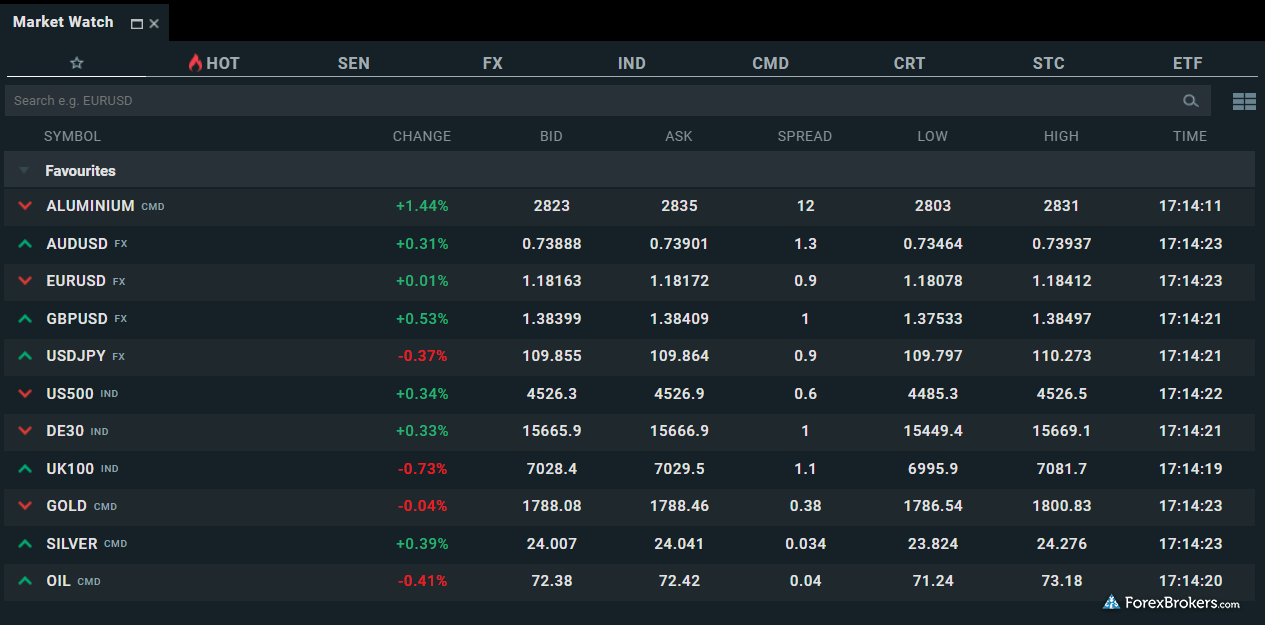

Check out a gallery of screenshots from IG's trading platforms, taken by our research team during our product testing.

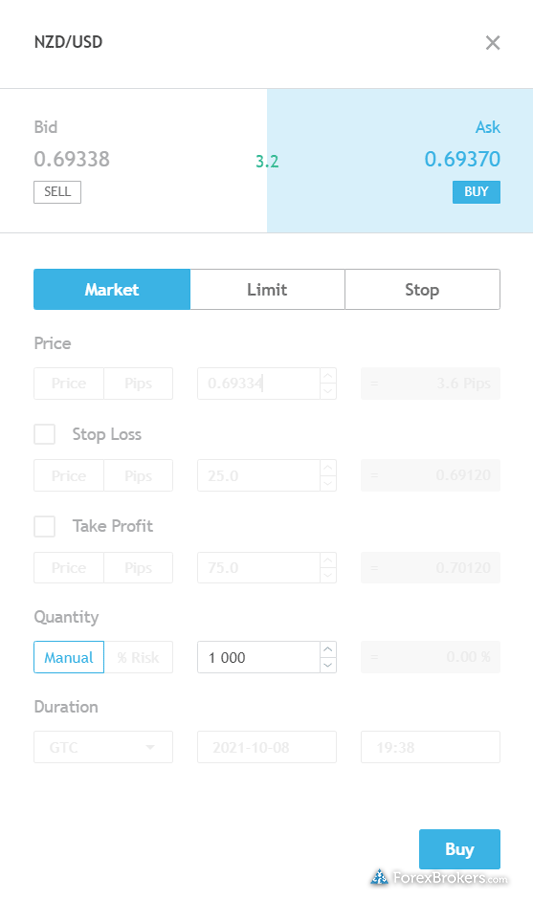

2. FOREX.com

99 Trust Score - Earned the Industry Award for #1 Interactive Educational Experience in our 2024 Annual Awards

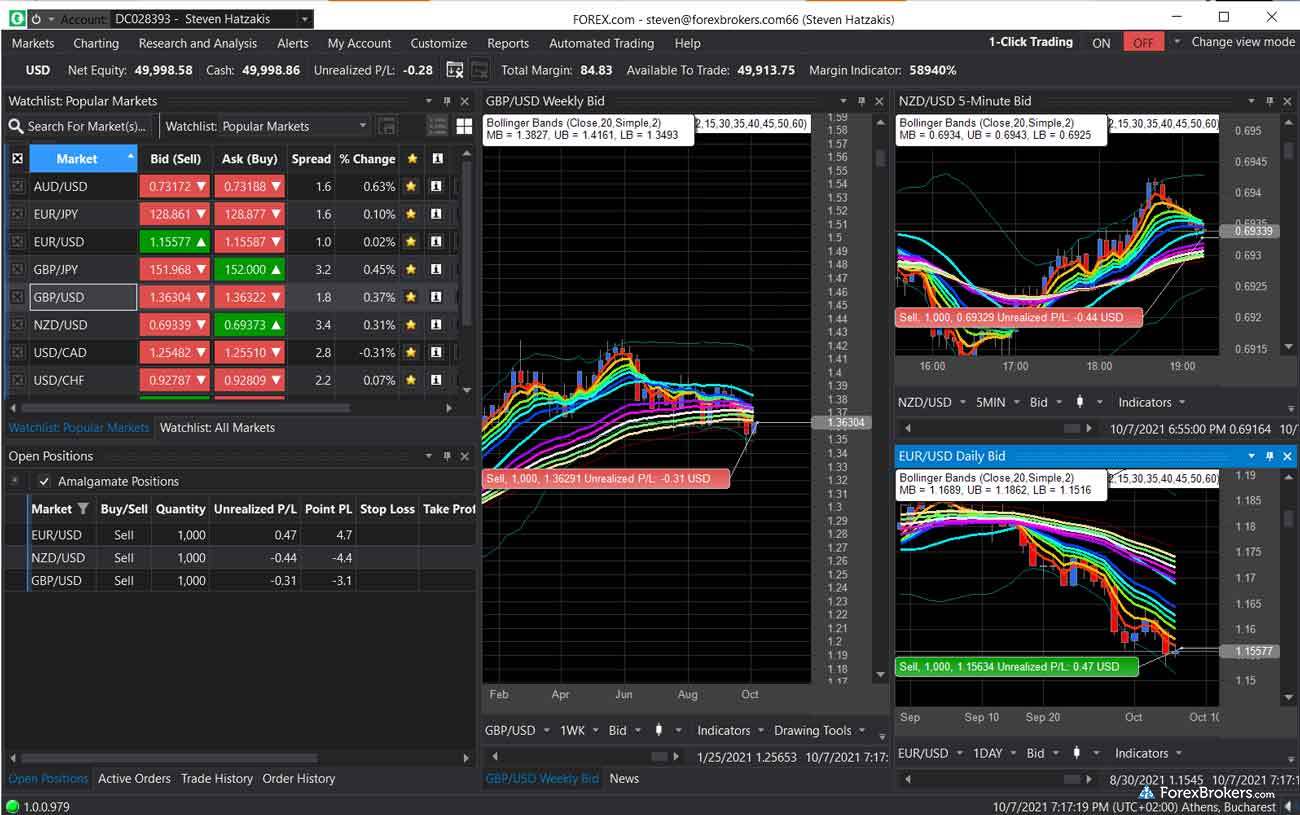

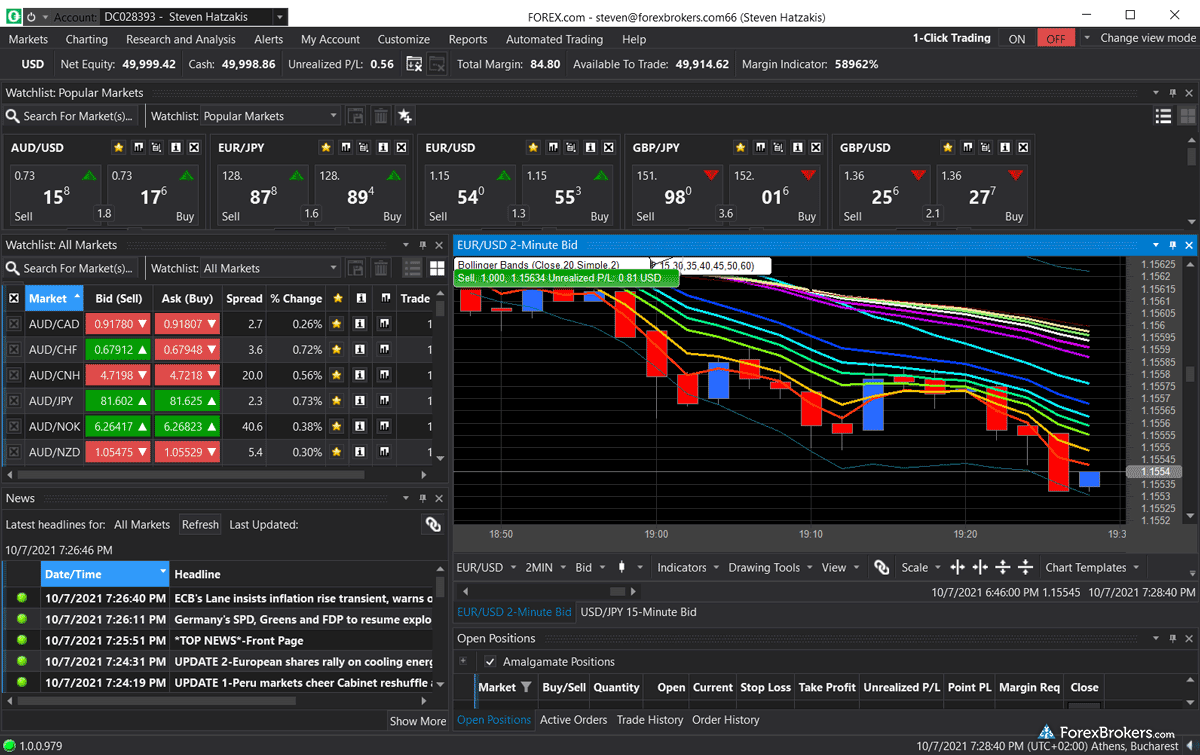

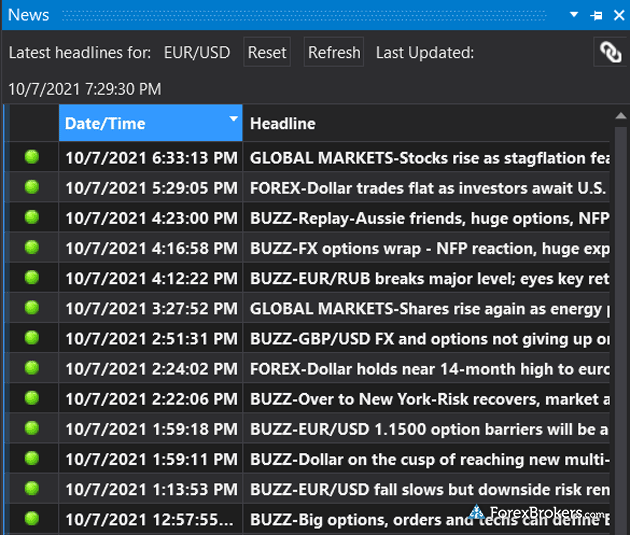

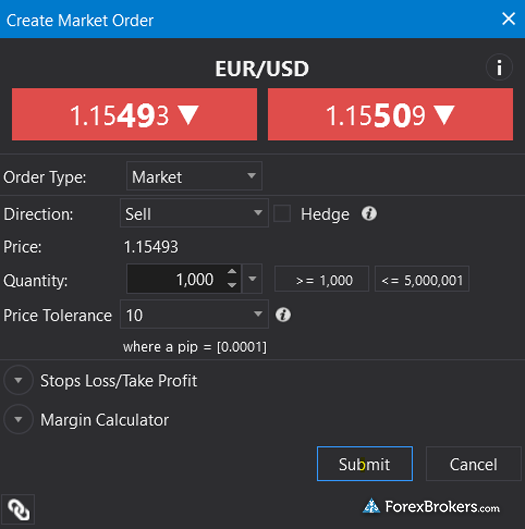

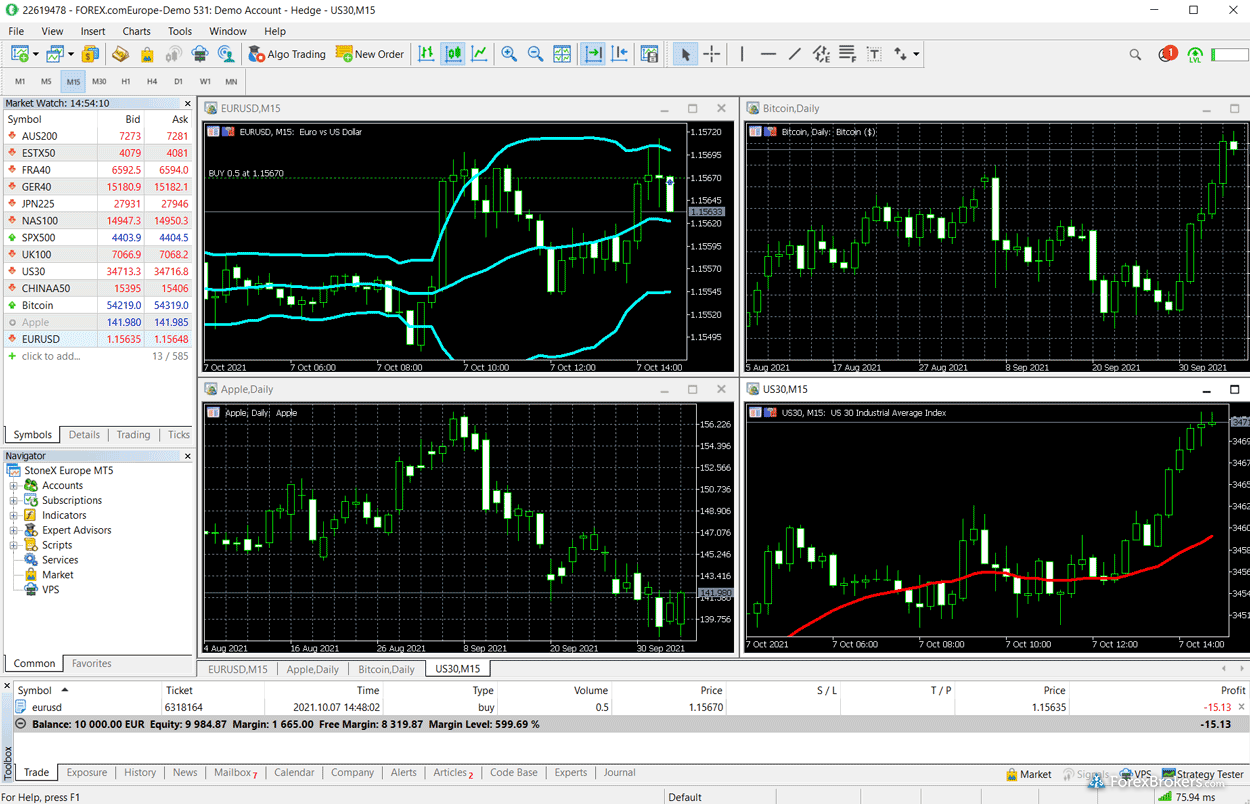

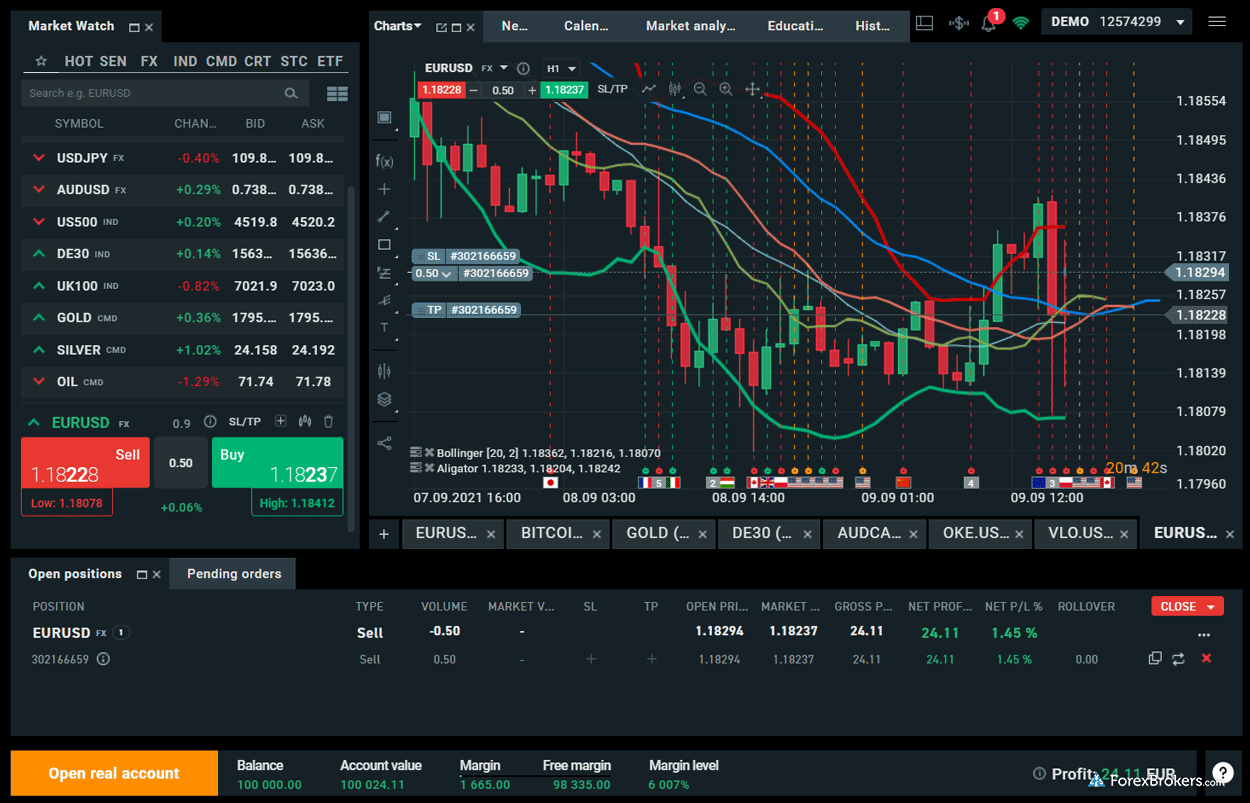

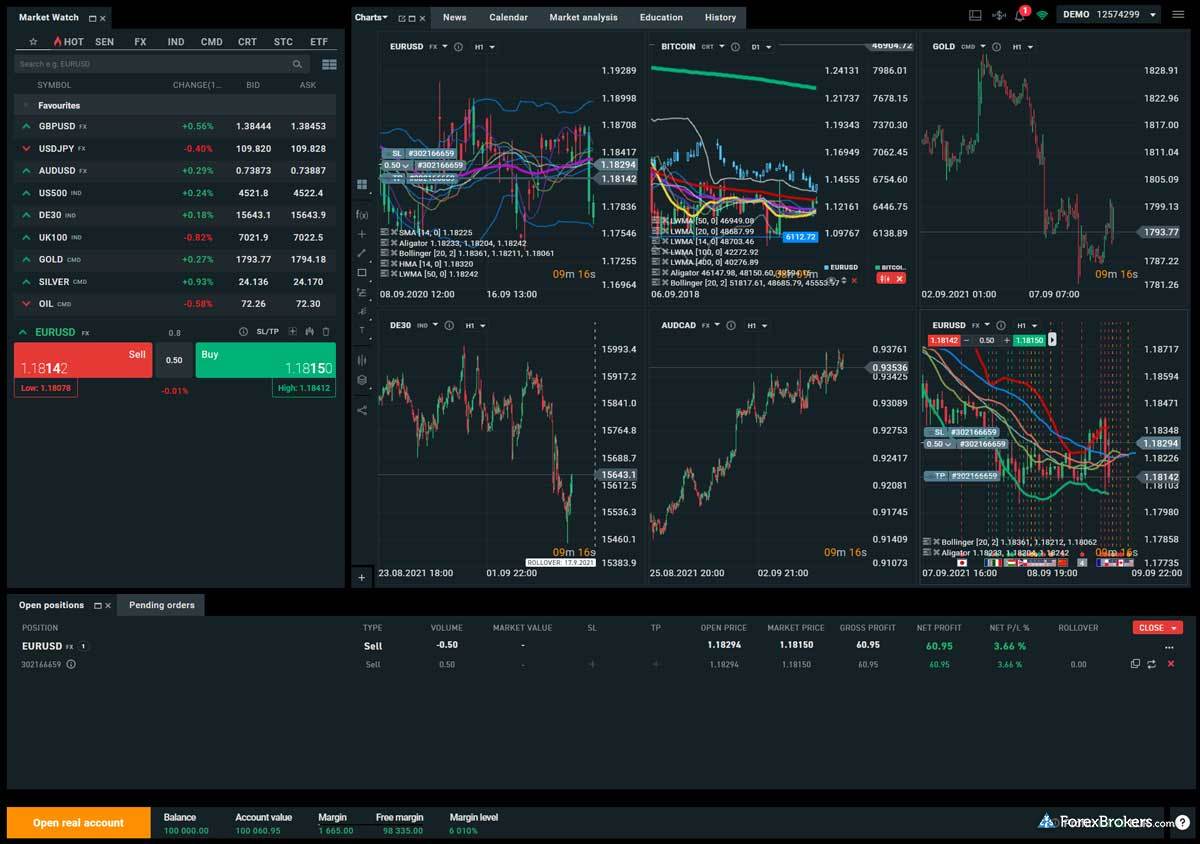

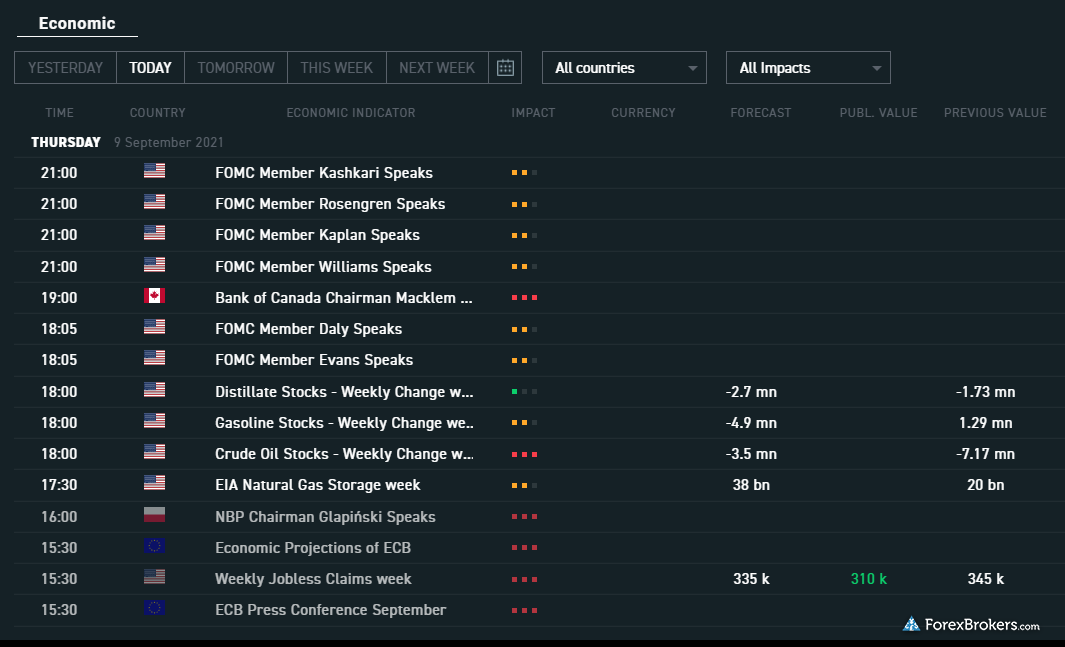

FOREX.com is another forex broker that delivers excellent trading platform options for Saudi investors in 2024. FOREX.com offers a complete suite of platforms that suit a variety of experience levels, including its flagship Advanced Trading desktop platform and Web Trading interface. Popular third-party platforms available at FOREX.com include TradingView, known for its advanced charting capabilities, the full MetaTrader suite (both MetaTrader 4 and MetaTrader 5), and NinjaTrader. Read more about what makes FOREX.com’s platforms great by reading my review of FOREX.com.

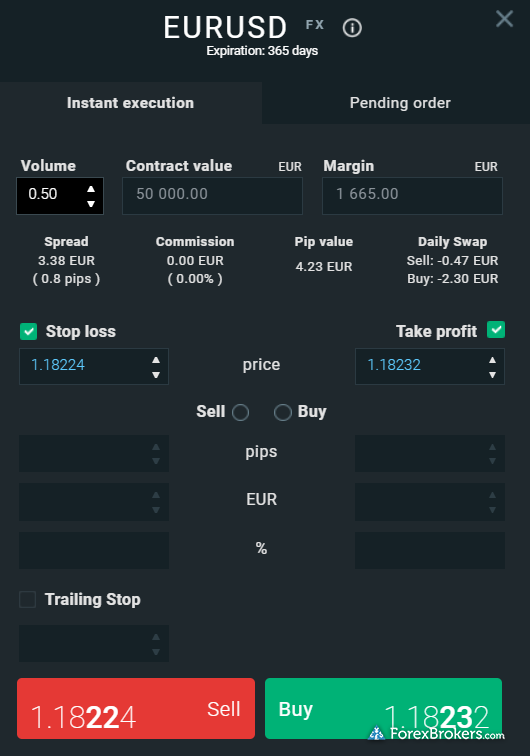

Browse a gallery of screenshots from FOREX.com’s trading platforms, taken by our research team during our product testing.

3. XTB

95 Trust Score - Publicly traded

XTB is another top trading platform provider for forex traders in Saudi Arabia in 2024. XTB’s platform suite includes the proprietary xTrade5 web platform and mobile app, each of which showcase a good balance of user-friendly layouts and advanced trading tools. XTB also offers the MetaTrader 4 (MT4) platform – though unfortunately this platform must be requested manually from select global XTB offices. Learn more by reading my XTB review.

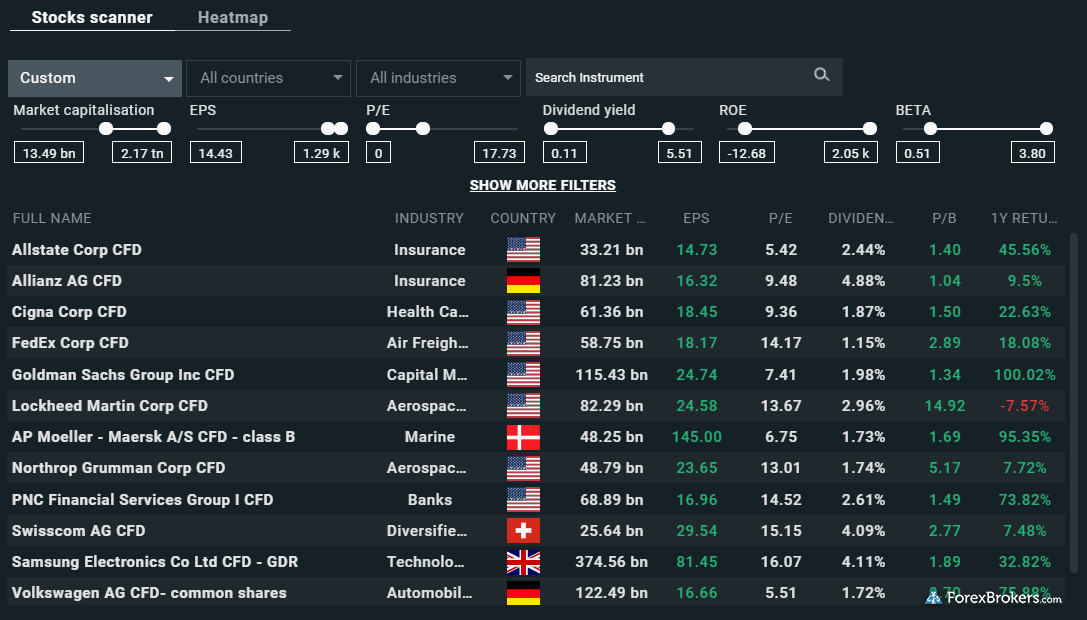

Check out some screenshots from XTB's trading platforms, taken by our research team during our product testing.

How to Verify CMA Authorisation

To identify if a forex broker is authorised by the CMA use this directory.

What protection does the CMA provide forex traders?

While the Capital Market Authority (CMA) oversees the financial markets in the Kingdom of Saudi Arabia, there are no rules that explicitly pertain to retail forex or derivatives traders. As a result, many forex brokers that accept residents of Saudi Arabia are regulated in other reputable jurisdictions – just not by the CMA.

The Capital Markets Law (pursuant to Royal Decree no. 30 from 2003, Article 32) outlines the regulation and licensing requirements for securities brokers in the Kingdom – including dealers. The CMA does offer a portal for filing complaints to Saudi and GCC citizens, but this may only cover cases where your broker is regulated by the CMA.

Why regulation is important

Choosing a forex broker that is licensed in reputable jurisdictions can help you to avoid forex scams. Check out my educational series dedicated to forex scams to learn how to identify common forex scams and to discover what to do if you've been scammed. Bitcoin traders and crypto devotees will find information about how to spot common crypto scams.

Is forex trading legal in Saudi Arabia?

Yes, forex trading in Saudi Arabia is legal – as long as you transact with brokers that are regulated in Saudi Arabia by the local authorities. If you are a Saudi national, you will usually have no restrictions on the amount of money you can deposit or withdraw, whether you are dealing with locally regulated brokers, or with foreign brokers that are regulated outside of the Kingdom.

That being said, your broker can impose its own limits, and you'll need to pass the initial Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements, which are verified during the account application process.

It's also worth noting that any person's ability (or inability) to open a brokerage account in Saudi Arabia is dependent on their status as a Politically Exposed Person (PEP). This includes government officials or members of the royal family.

Saudi Arabia's financial markets

Forex traders may recognize the riyal (SAR) as Saudi Arabia's national currency. The riyal is subdivided into 100 smaller denominations, known as halalas. Forex markets and Saudi forex brokers are affected by the monetary policy as regulated by the Saudi Arabian Monetary Authority (SAMA), which issues and manages Saudi Arabia's national currency.

The primary stock market in Saudi Arabia is the Saudi Stock Exchange – or, Tadāwul – based in Riyadh, and considered to be the largest capital market in the Middle East. The Saudi Stock Exchange provides listing services for stocks, mutual funds, real estate investment trusts (REITs), and exchange-traded funds (ETFs).

The Saudi Stock Exchange also offers trading services for Islamic products, such as sukuk (sharia-compliant, fixed-income instruments). Many of the forex brokers that accept Saudi Arabian residents as clients will offer the ability to own what's known as an Islamic account. At the most basic level, Islamic accounts are Sharia-compliant interest-free accounts that are reserved for clients who follow the Islamic faith.

Is forex trading halal in Saudi Arabia?

Many forex brokers offer islamic trading acounts which are Sharia-compliant and thus are halal (or, permissable). Trading accounts which are prohibited (or, haram) in Islamic finance are typically the ones where roll-over charges are incurred from holding positions overnight, akin to interest-bearing accounts. In an Islamic forex account these interest charges are either removed entirely or replaced with a per-trade commission – though the exact policy will vary from broker to broker.

What is the safest forex broker?

I’ve been reviewing IG for years now, and based on its numerous number regulatory licenses in reputable jurisdictions, status as a publicly traded company (LSE:IGG), and high overall Trust Score, I consider IG to be the most trusted forex broker that accepts residents of Saudi Arabia. IG has been in business for nearly 40 years and is also the only forex broker that holds licenses from both the United States and Switzerland (both of which are highly coveted and extremely difficult to acquire). Learn more by checking out my review of IG.

How do you get started trading forex in Saudi Arabia?

If you want to start trading forex in Saudi Arabia, you should begin by picking a trusted forex broker that is well-regulated and properly licensed in reputable international regulatory jurisdictions. Read on below to see my step-by-step guide to getting started as a forex trader in Saudi Arabia:

- Choose a reputable broker. The first step to getting started trading forex as a Saudi citizen or resident is to make sure you are dealing with a highly-regulated and trustworthy broker.

- Get comfortable with your broker’s trading platform. Explore everything your broker has to offer: mobile apps, web platforms, and desktop software (I always recommend starting out with your broker’s free demo account).

- Fund your account. To trade with a live account, you’ll first need to fund it with a deposit method accepted by your broker. PayPal grown in popularity as a payment method for forex trading accounts thanks to its international presence and range of supported currencies. Check out o our guide to the best PayPal forex brokers to learn more.

- Develop a trading plan. Even the best traders can lose money, but the key to long-term success lies in sticking to a trading plan that keeps your average losses low (relative to your average profits).

- Enter the forex market. Choose your desired trade size, and open a long position by clicking buy on a given currency, or open a short position by clicking sell.

Article Resources

CMA Website, CMA Wikipedia, CMA Directory

Compare Saudi Arabia Brokers

Popular Forex Guides

- Compare Forex Brokers

- Best TradingView Forex Brokers of 2024

- International Forex Brokers Search

- Best Zero Spread Forex Brokers of 2024

- Best MetaTrader 4 Brokers of 2024

- Best Forex Brokers for Beginners of 2024

- Best Copy Trading Platforms of 2024

- Best Forex Trading Apps of 2024

- Best Forex Brokers of 2024

More Forex Guides

Find the best forex brokers in the Middle East and Africa

Middle East

- Best Forex Brokers in Saudi Arabia for 2024

- Best Forex Brokers in Israel for 2024

- Best Forex Brokers in United Arab Emirates for 2024

Africa

- Best Forex Brokers in Kenya for 2024

- Best Forex Brokers in Nigeria for 2024

- Best Forex Brokers in South Africa for 2024

2024 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.