Best Switzerland Forex Brokers of 2024

ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Switzerland’s banking system and financial regulatory apparatus make for a robust trading environment for forex and CFD traders. Trading forex (currencies) in Switzerland is popular among residents. Forex brokers must become authorised by the Swiss Financial Market Supervisory Authority (FINMA) to operate in Switzerland. FINMA's website is finma.ch.

FINMA was established in 2009 from three of Switzerland's predecessor regulatory institutions including the Swiss Federal Banking Commission (SFBC), the Federal Office of Private Insurance (FOPI) and the Anti-Money Laundering Control Authority (AMLCO). For a historical breakdown, here is a link to FINMA's webpage on Wikipedia.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Best Swiss Forex Brokers

To find the best forex brokers in Switzerland, we created a list of all FINMA authorised brokers, then ranked brokers by their Overall ranking.

Here is our list of the top Swiss forex brokers:

-

IG

- Best overall broker, most trusted

-

Interactive Brokers

- Great overall, best for professionals

-

Saxo

- Best web-based trading platform

- Swissquote - Trusted broker, best banking services

- FlowBank - Large investment product offering

Swiss Forex Brokers Comparison

Compare Swiss authorised forex and CFDs brokers side by side using the forex broker comparison tool or the summary table below. This broker list is sorted by my overall rankings of the top forex brokers.

| Company | Accepts CH Residents | Regulated by FINMA | Average Spread EUR/USD - Standard | Minimum Deposit | Overall Rating | Visit Site |

IG IG

|

0.98 | £250.00 |

|

Visit Site

|

||

Interactive Brokers Interactive Brokers

|

0.63 | $0 |

|

Visit Site

|

||

Saxo Saxo

|

1.1 | $0 |

|

Visit Site

|

||

Swissquote Swissquote

|

N/A | $1000 |

|

|||

FlowBank FlowBank

|

N/A | $0 |

|

|||

FOREX.com FOREX.com

|

1.4 | $100 |

|

|||

XTB XTB

|

1.00 | $0 |

|

|||

Capital.com Capital.com

|

0.67 | $20 |

|

Visit Site

|

||

AvaTrade AvaTrade

|

0.92 | $100 |

|

Visit Site

|

||

Plus500 Plus500

|

N/A | €100 |

|

Visit Site

|

||

FXCM FXCM

|

0.74 | Starts from $50 |

|

Visit Site

|

||

Admirals Admirals

|

0.8 | $100 |

|

|||

Pepperstone Pepperstone

|

0.77 | $200 |

|

Visit Site

|

||

XM Group XM Group

|

1.6 | $5 |

|

Visit Site

|

||

FP Markets FP Markets

|

1.1 | $100 AUD |

|

Visit Site

|

||

IC Markets IC Markets

|

0.62 | $200 |

|

Visit Site

|

||

Tickmill Tickmill

|

0.51 | $100 |

|

Visit Site

|

||

BlackBull Markets BlackBull Markets

|

0.76 | $0 |

|

Visit Site

|

||

Vantage Vantage

|

1.30 | $50 |

|

|||

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

0.6 | $20 |

|

|||

HFM HFM

|

1.2 | $0 |

|

Visit Site

|

||

Trading 212 Trading 212

|

1.9 | €10 |

|

|||

Trade Nation Trade Nation

|

0.6 | $0 |

|

|||

Moneta Markets Moneta Markets

|

1.27 | $50 |

|

|||

Eightcap Eightcap

|

1.0 | $100 |

|

Visit Site

|

||

MultiBank MultiBank

|

N/A | $50 |

|

|||

ACY Securities ACY Securities

|

1.2 | $50 |

|

Visit Site

|

||

easyMarkets easyMarkets

|

0.9 | $50 |

|

|||

Spreadex Spreadex

|

0.81 | $0 |

|

Visit Site

|

||

IFC Markets IFC Markets

|

1.44 | $1 |

|

What are the most trusted forex brokers?

I’ve tested over 60 international forex brokers and researched each broker’s individual regulatory status in reputable jurisdictions across the world (learn more by checking out our Trust Score page). Of the brokers that are regulated by the Swiss Financial Market Supervisory Authority (FINMA), I’ve selected the following brokers as my top picks for the most trusted forex brokers in Switzerland in 2023:

1. IG

99 Trust Score - Most trusted broker in 2024, Best Overall Broker in 2024

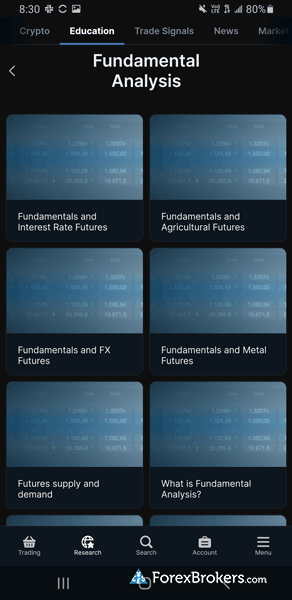

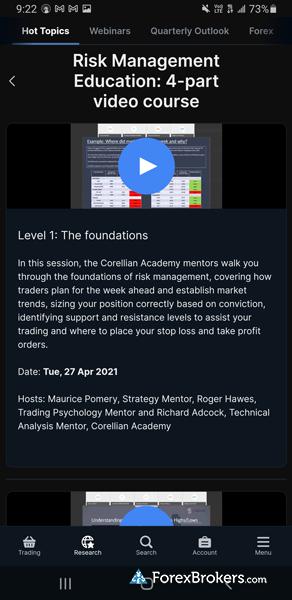

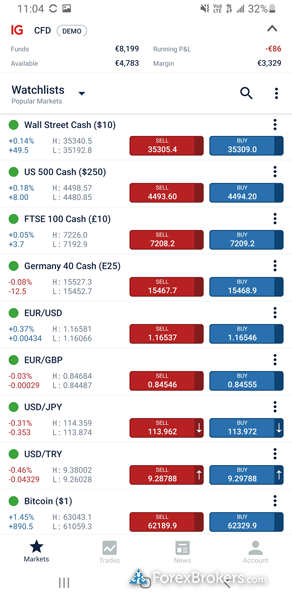

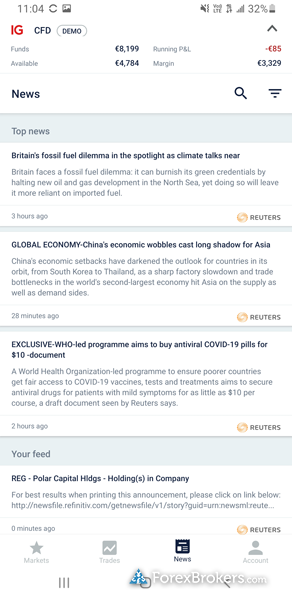

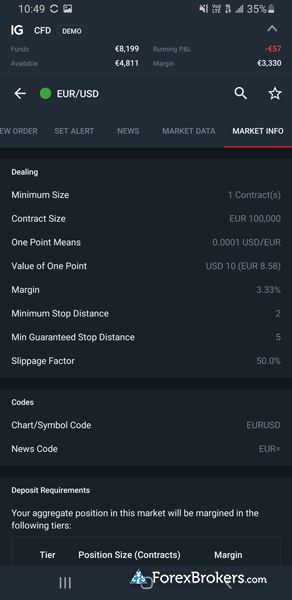

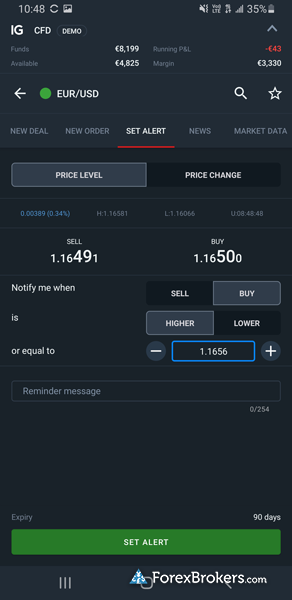

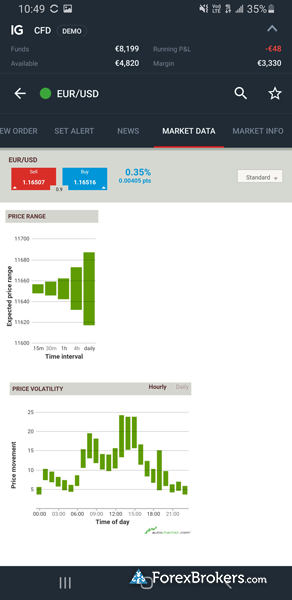

IG is my top choice for the most trusted forex broker in Switzerland in 2024. IG is well-capitalized and publicly traded, regulated by FINMA, and holds dozens of regulatory licenses in major regulatory jurisdictions around the globe. I’ve been reviewing IG for years, and I’ve ranked IG as one of the most trusted brokers in the industry year after year. IG delivers a wide range of markets, innovative trading platforms, high-quality educational content, and competitive trading costs. Learn more by reading my review of IG.

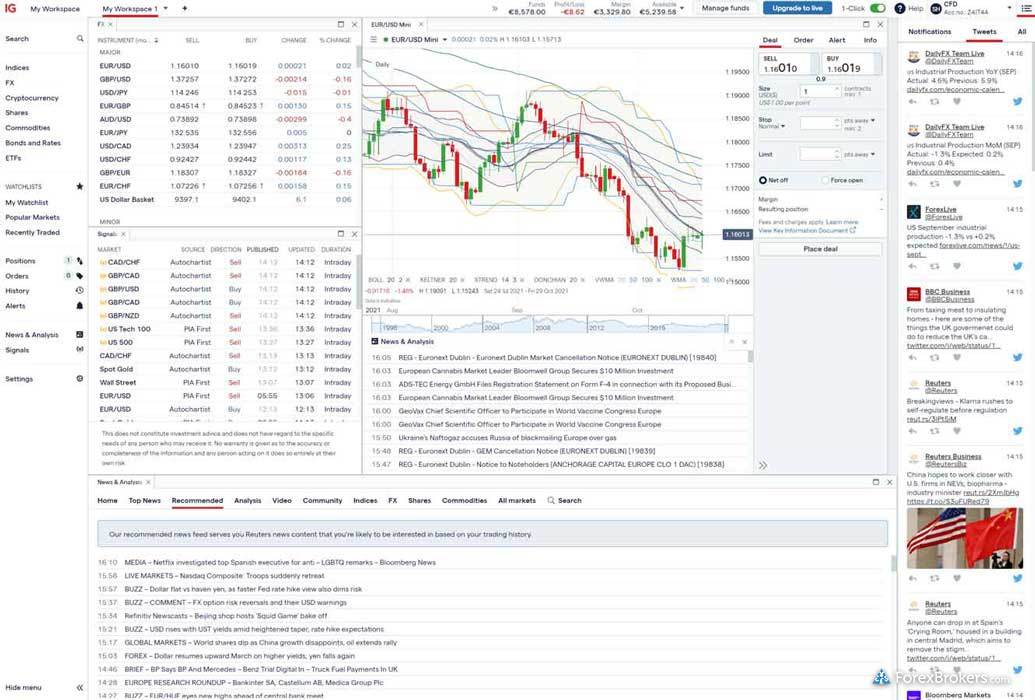

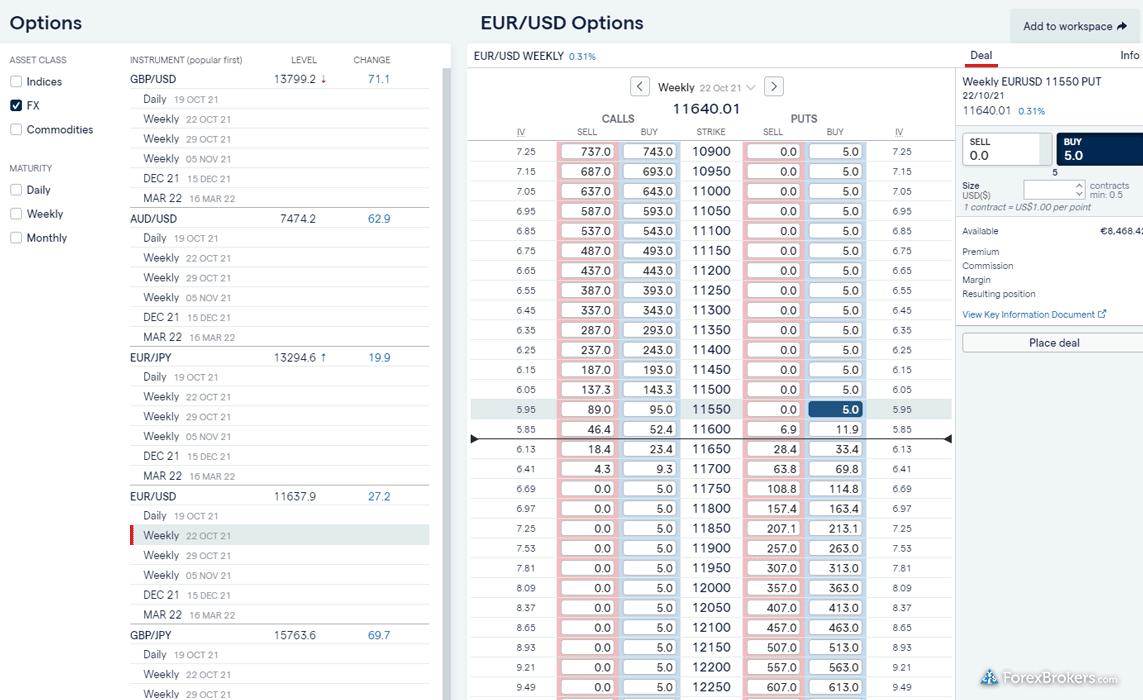

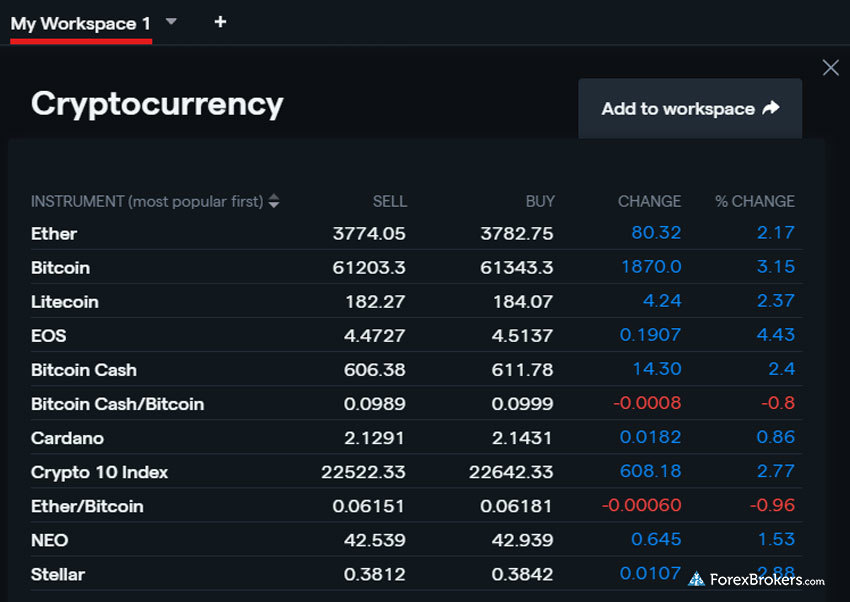

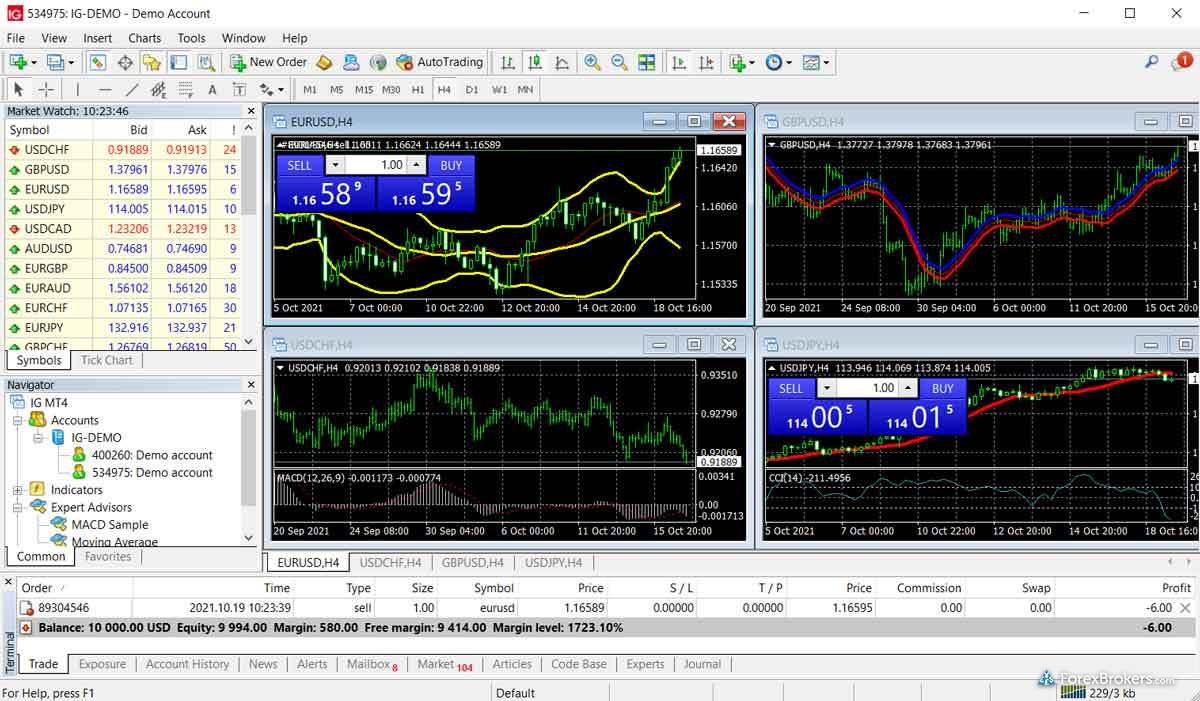

Check out a gallery of screenshots from IG's trading platforms, taken by our research team during our product testing.

2. Swissquote

99 Trust Score - Great all-around forex broker, operates a Swiss bank

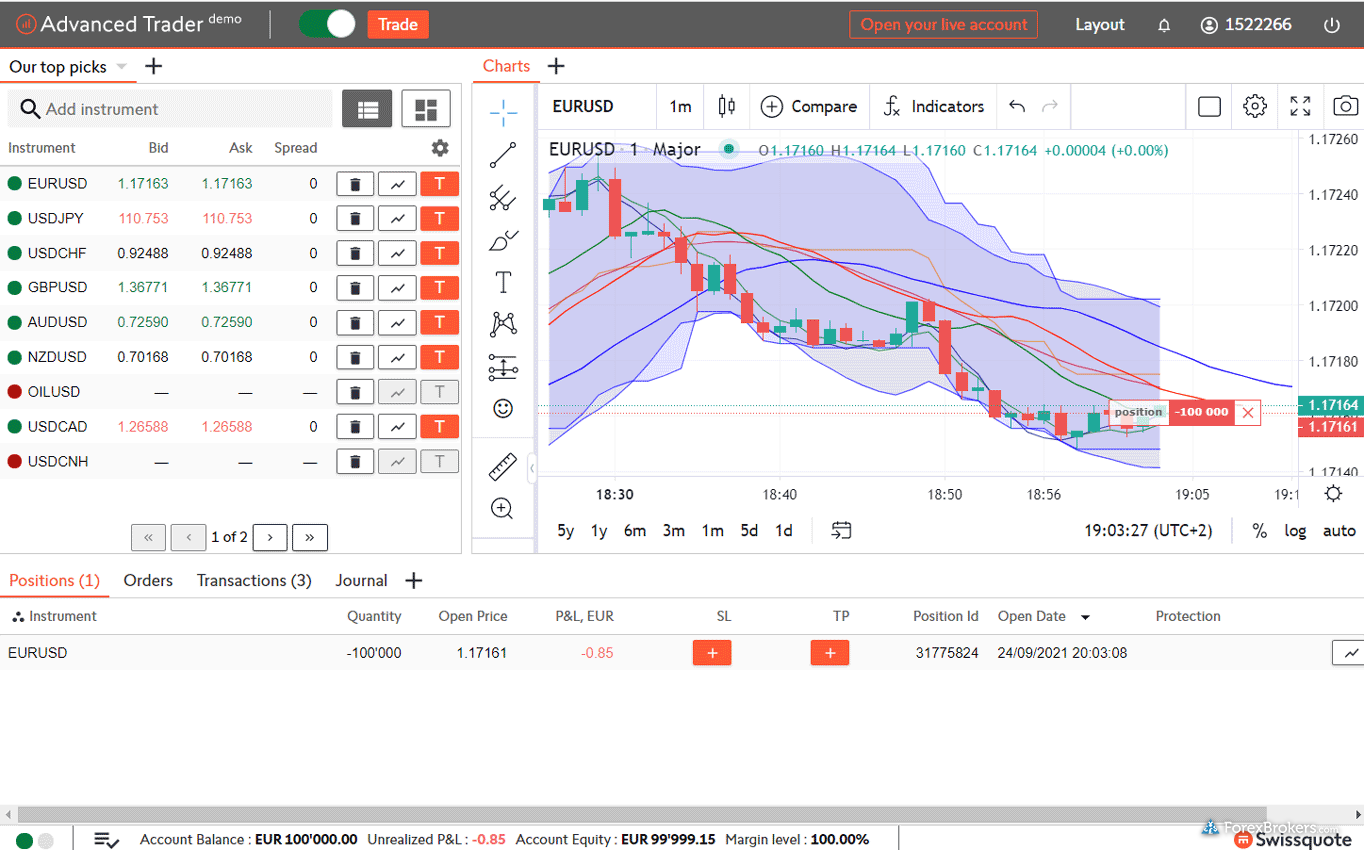

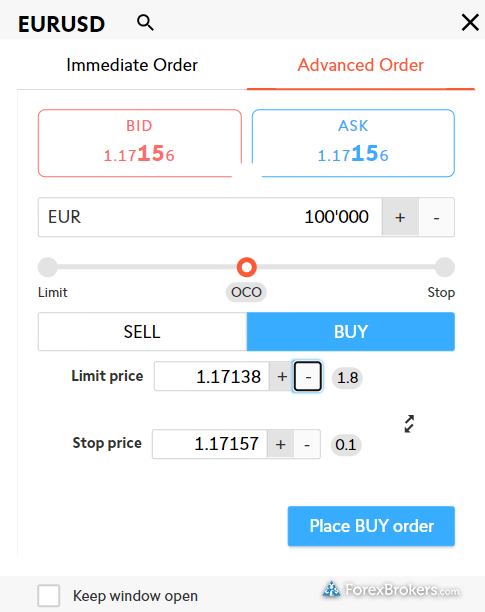

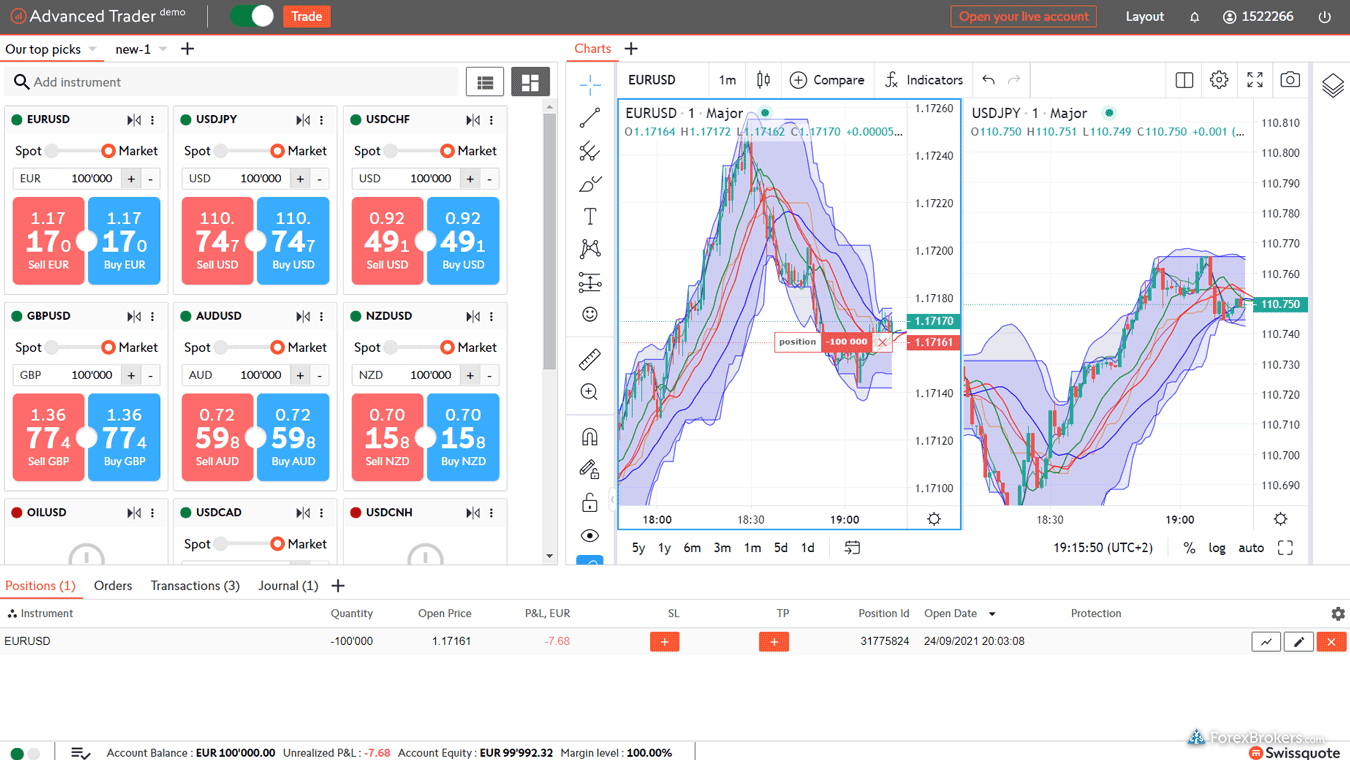

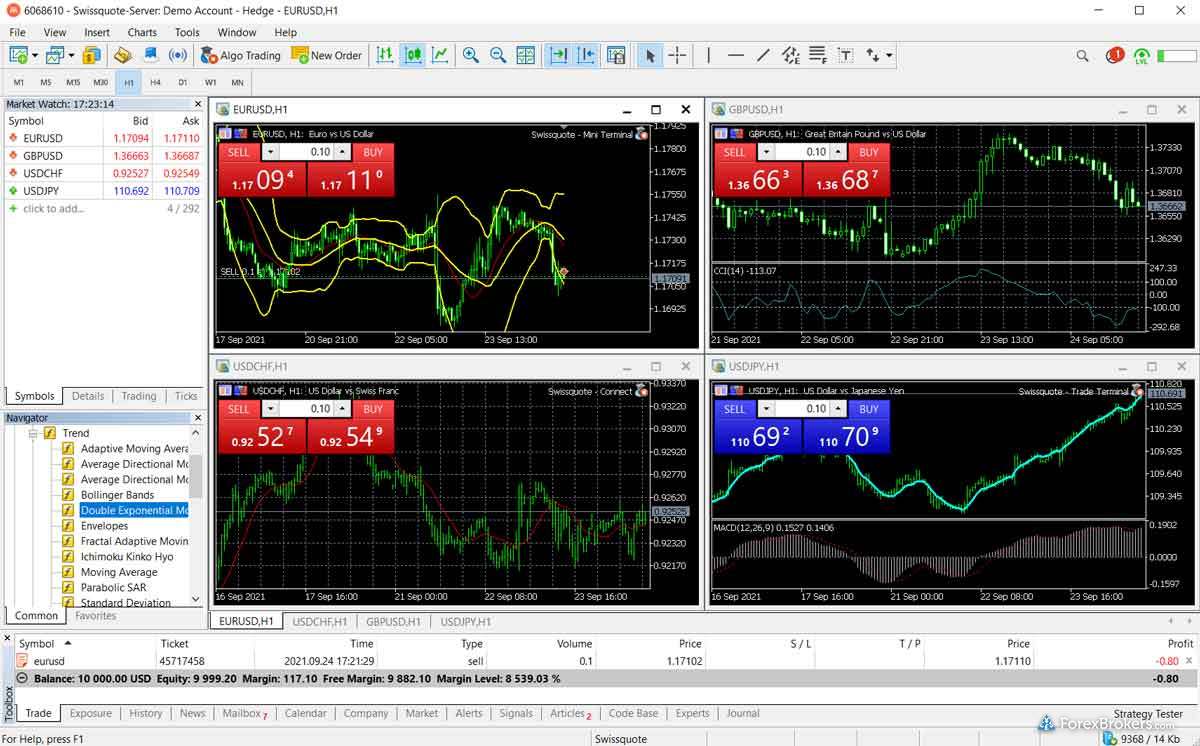

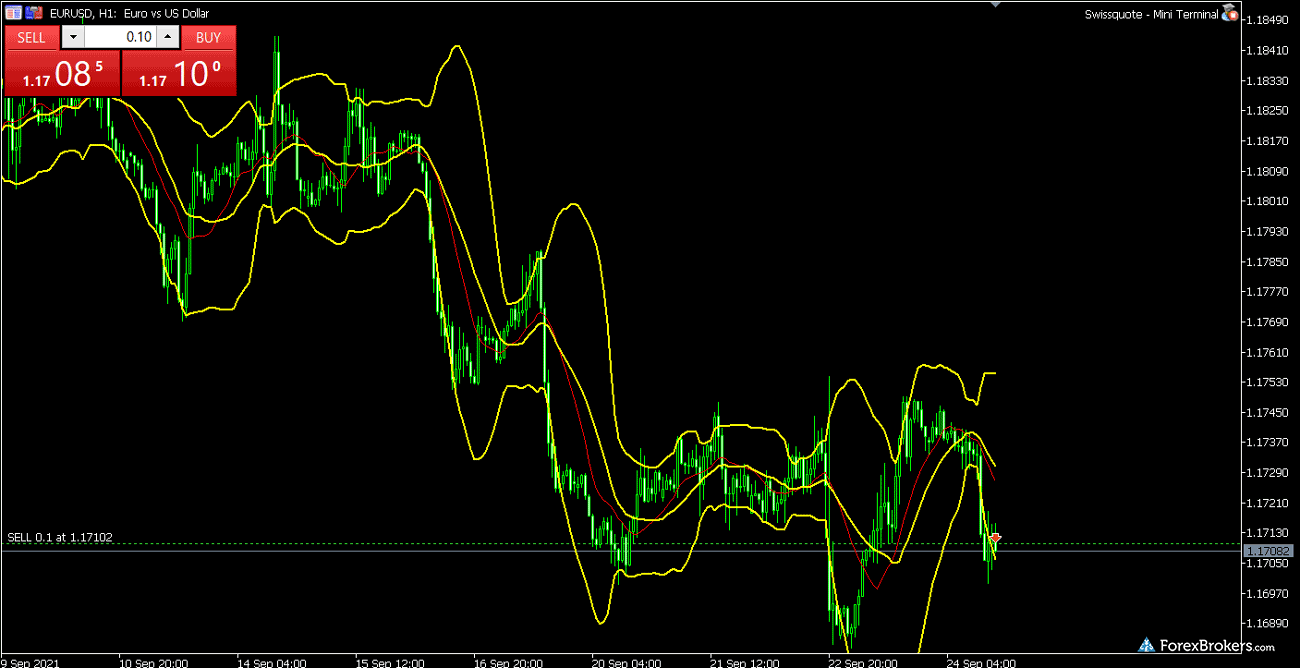

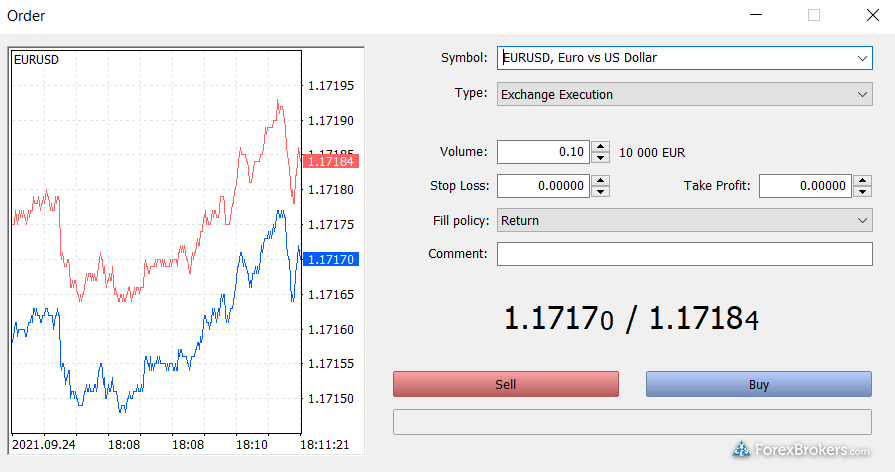

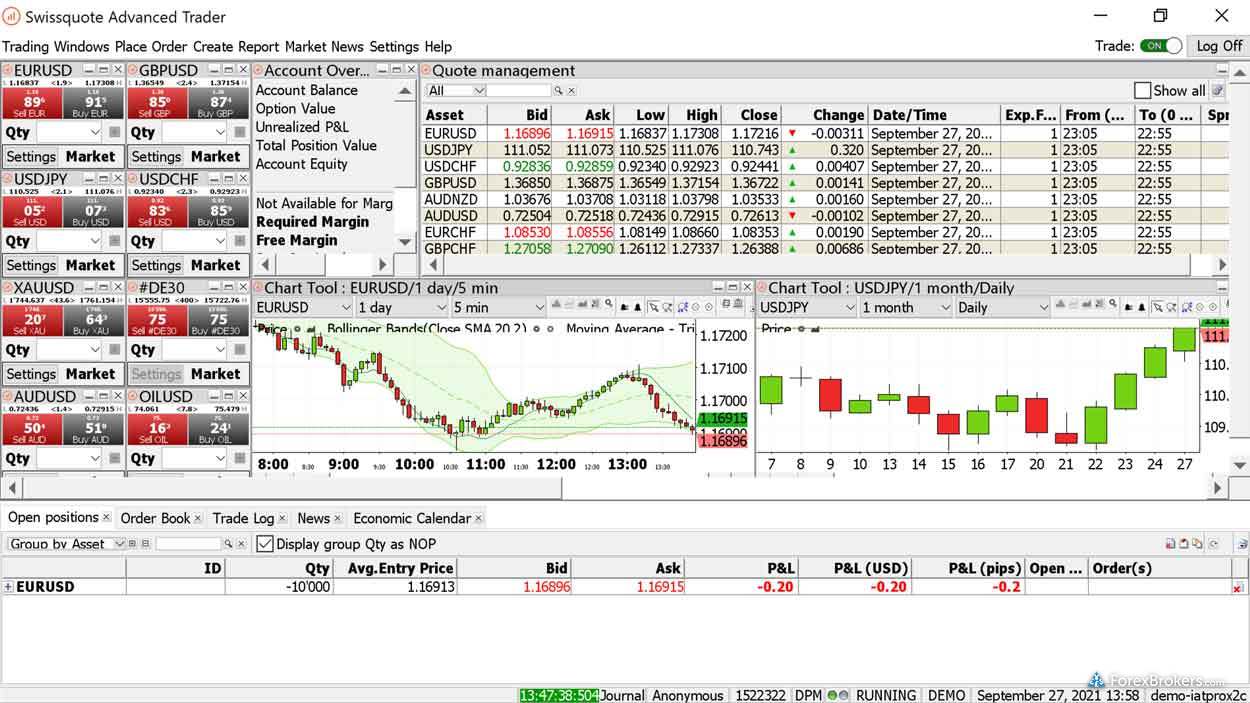

Swissquote Bank is another excellent broker that I’ve rated as being highly trusted for forex traders. Swissquote is regulated by FINMA and publicly traded on the Swiss Exchange (SWX: SQN). Headquartered in Switzerland, Swissquote offers access to over two and a half million products and operates two banks, helping the broker earn our 2024 Annual Award for #1 Banking Services. Swissquote was also among the first banks to launch crypto trading and serve as a custodian for Bitcoin investors. Learn more by reading my review of Swissquote.

Take a look at a gallery of screenshots from Swissquote's trading platforms, taken by our research team during our product testing.

3. Saxo

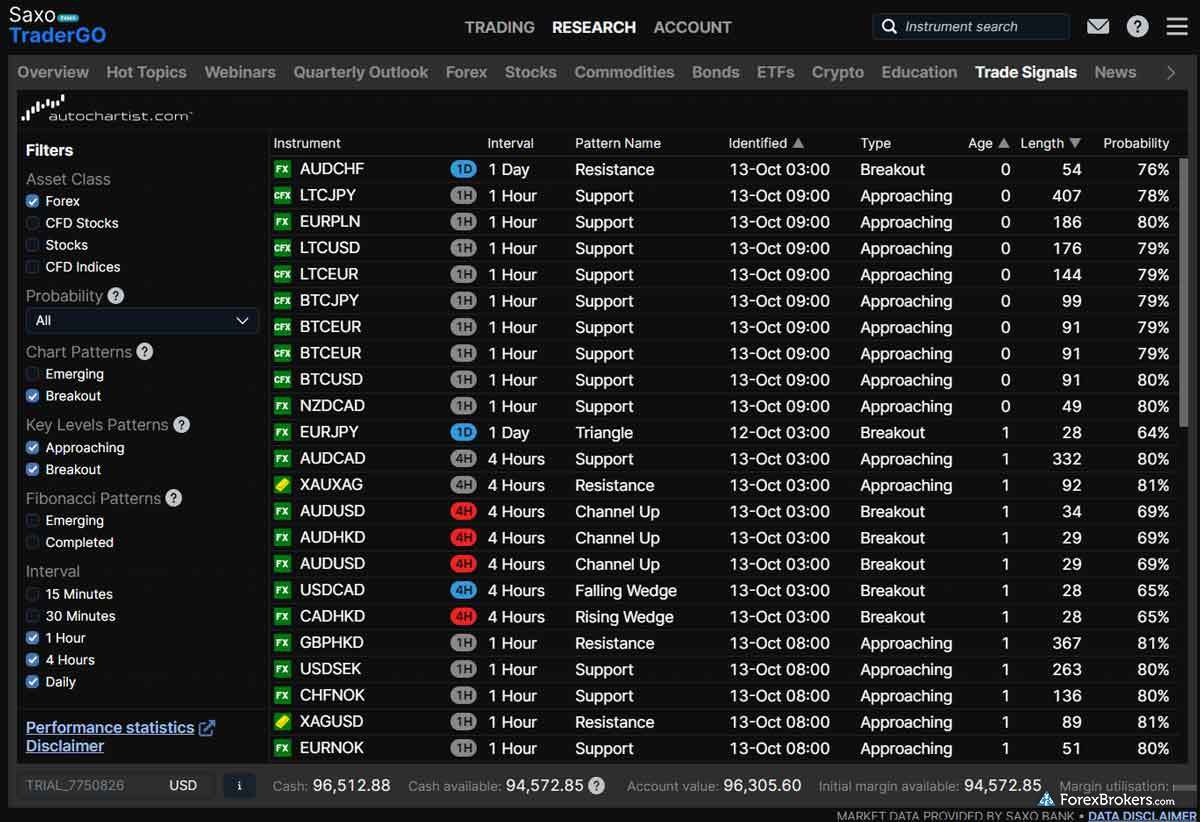

99 Trust Score - Operates three banks, earned our top 2024 Annual Award for Platforms & Tools

Saxo is another great choice from among the most trusted forex brokers in Switzerland in 2024. In addition to being regulated by FINMA, Saxo holds numerous licenses from reputable jurisdictions around the world and operates three fully regulated banks. I’ve also ranked Saxo highly for the massive range of markets that are available within its award-winning trading platform suite. Learn more about why I think Saxo is an excellent choice for forex traders by reading my Saxo review.

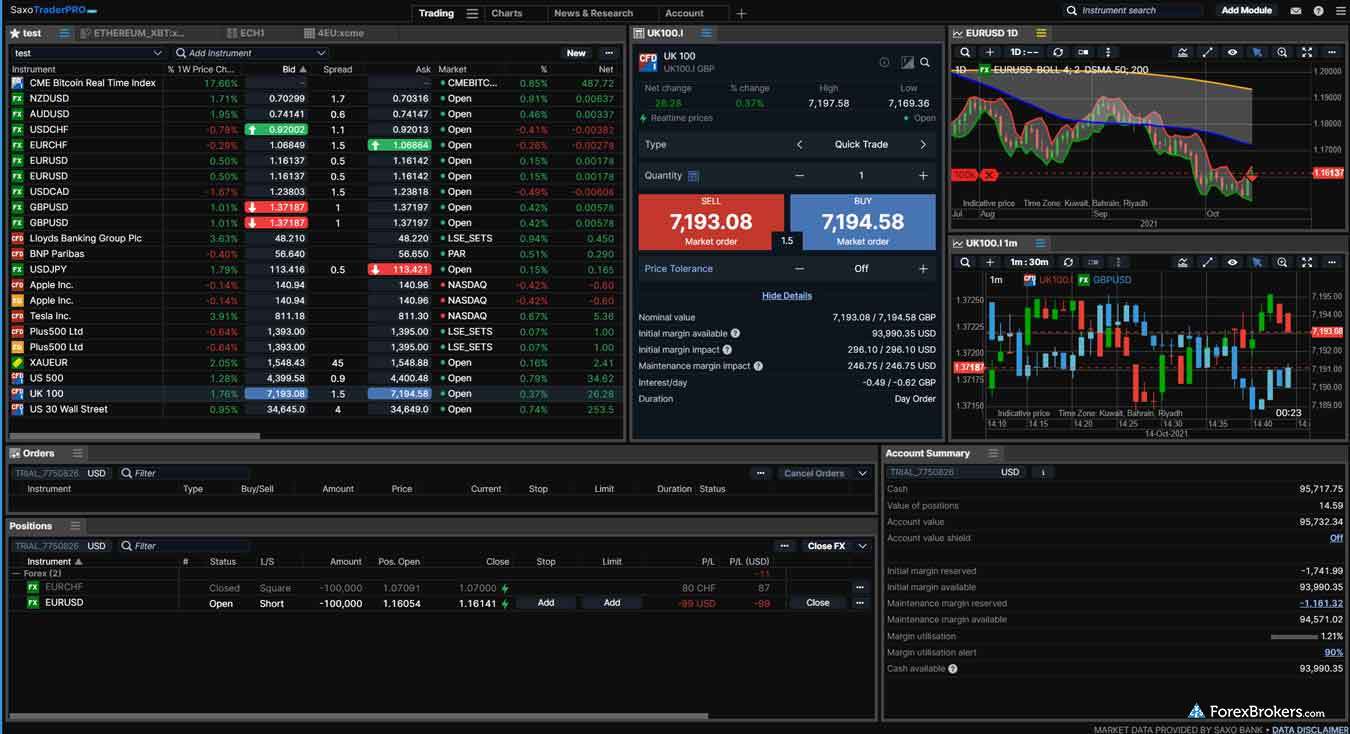

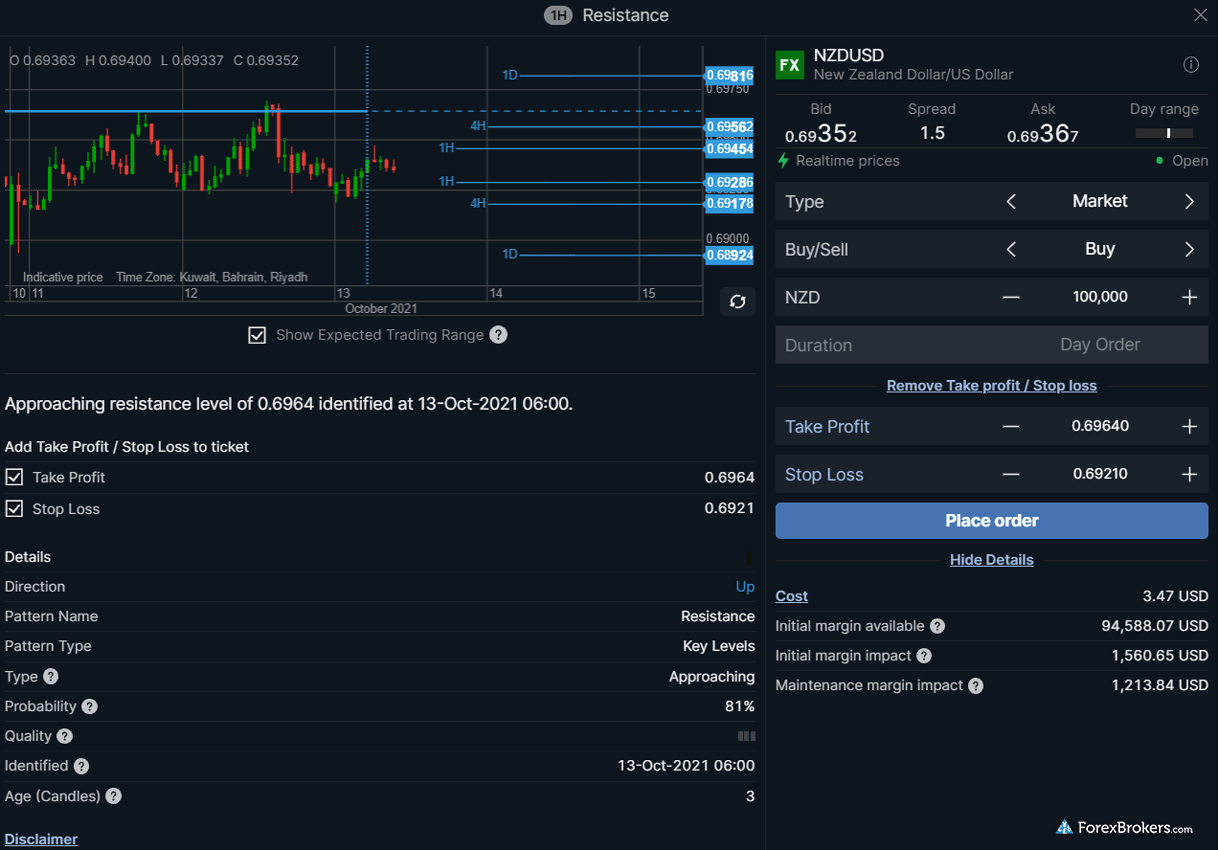

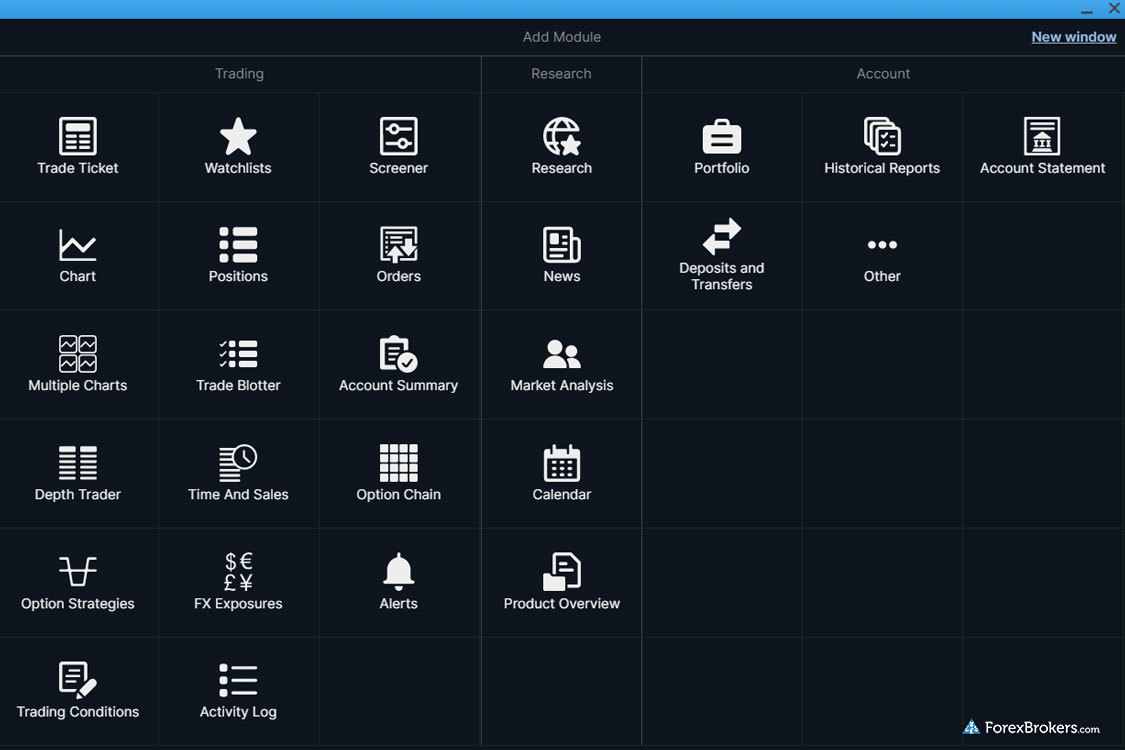

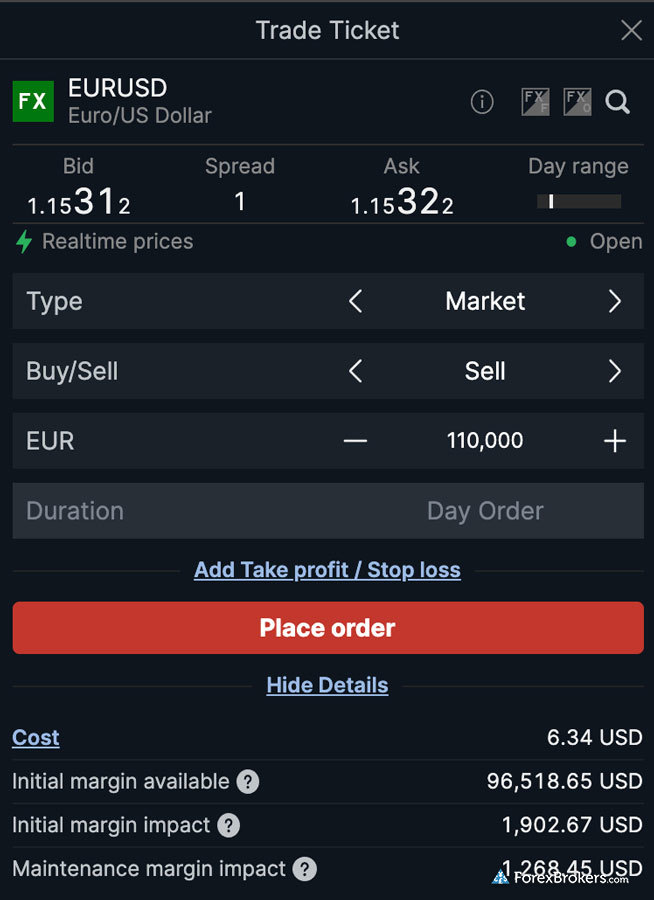

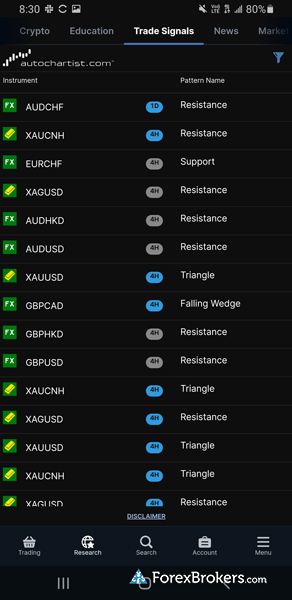

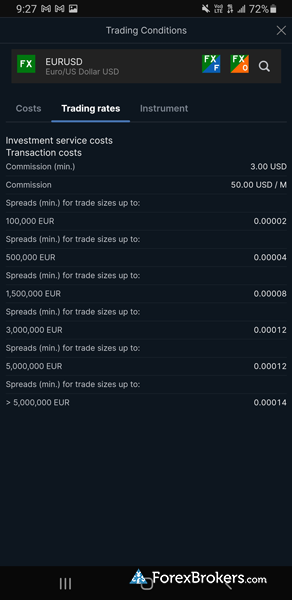

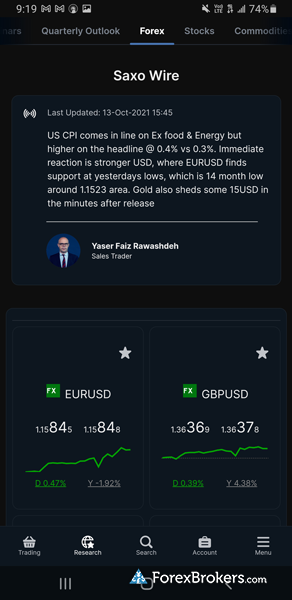

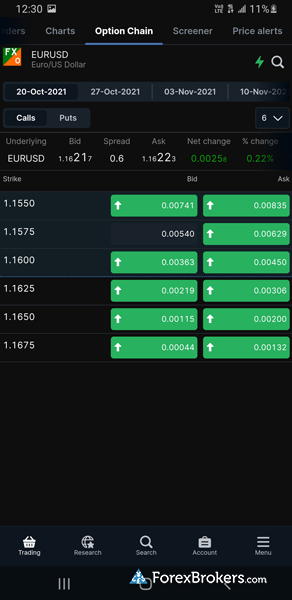

Browse a gallery of screenshots from Saxo's trading platforms, taken by our research team during our product testing.

Why regulation is important

Choosing a reputable, well-regulated forex broker is a crucial step towards avoiding forex scams. My educational series dedicated to forex scams shows you how to identify common forex scams and provides helpful information about what to do if you've been scammed. I also explain how crypto enthusiasts and bitcoin traders can spot common crypto scams.

What is the best forex broker in Switzerland?

IG is the best broker in Switzerland in 2024. With its excellent trading platforms, sleek mobile apps, comprehensive research offering, and wide range of tradeable markets, IG dominates the competition across multiple categories. IG is regulated by FINMA and operates IG Bank in Switzerland, which provides many of the perks that forex traders would expect from owning a Swiss bank account.

Which forex broker has the best mobile app?

Saxo's mobile app is the top choice for forex traders in 2024. The SaxoTraderGO web and mobile platforms provide a powerful selection of tools combined with top-notch research in a highly unified cross-platform experience. The IG Trading app is packed with sophisticated features like alerts, sentiment readings, and high-powered charting capabilities.

Neck and neck with Saxo is IG, which delivers a mobile app packed with sophisticated features like alerts, sentiment readings, and high-powered charting capabilities.

Which Swiss forex broker is best for beginners?

IG offers the best Swiss forex trading experience for beginners in 2023, due to its well-designed, easy-to-use trading platforms and its comprehensive educational courses. DailyFx – IG’s in-house content producer – creates informative articles and videos, and IG has even developed a standalone mobile app (in addition to their award-winning IG Trading app) dedicated to helping beginners learn about the financial markets.

New to forex trading?

Check out our beginner's guide to forex trading. You'll learn some of the most important forex fundamentals, and we'll show you our top picks for the best forex brokers for beginner traders.

How to Verify FINMA Authorisation

To identify if a forex broker is regulated by FINMA, the first step is to identify the name of the entity from the disclosure text on the broker's Swiss homepage. For example, here's the key disclosure text from Swissquote's website.

Swissquote Bank Ltd holds a banking license issued by its supervisory authority the Swiss Federal Financial Market Supervisory Authority (FINMA) and is a member of the Swiss Bankers Association."

Next, look up the firm on the list of supervised institutions listed on FINMA's website to validate the firm's current regulatory status. Here is the official FINMA page for Swissquote Bank Ltd.

What protection does FINMA provide forex traders?

FINMA helps protect forex traders through esisuisse, the appointed self-regulatory organization for banks and brokers in Switzerland that provides up to CHF 100,000 of depositor protection per customer in the event that a FINMA-regulated broker goes bankrupt. If your broker’s liquid assets can’t cover the CHF 100,000, esisuisse, steps in and funds the disbursement of protected deposits.

In addition to requiring that Swiss forex brokers hold a banking license in Switzerland, FINMA is an efficient regulator responding to over 6,000 inquiries in 2022 alone, while supervising more than 500 banks, including 74 securities brokers according to FINMA’s latest annual report.

Good to know:

esisuisse’s payment liability is limited to 1.6% of total deposits in Switzerland (minimum of CHF 6 billion). That amount should be sufficient to cover one broker in the event of insolvency, but might not be enough to cover a systemic event that affects multiple banks at the same time.

Is forex trading legal in Switzerland?

Yes, but only if you are trading with a broker that is licensed by FINMA and holds the required Swiss banking license. For that reason, it is crucial for Swiss residents to choose forex brokers that are regulated in Switzerland. Using a well-regulated forex broker will also reduce your chances of falling victim to a potential scam broker.

Switzerland’s financial markets

Forex traders will recognize the Swiss franc (CHF) as Switzerland’s national currency (known in the forex world as “the Swissie”). The Swiss franc – as well as Swiss markets and swiss forex brokers – are affected by monetary policy as dictated and regulated by the Swiss National Bank (SNB).

In addition to the exacting regulations built into the Swiss financial system, Switzerland is home to a robust deposit protection system. Under the Swiss Banking act, all Swiss banks and dealers of securities must have deposits protected – up to a max of 100,000 CHF – by esisuisse (originally known as the Swiss Banks’ and Securities Dealers’ Depositor Protection Association).

Switzerland’s primary stock market is the SIX Swiss Exchange, based in Zurich. The SIX Exchange is one of the largest stock exchanges in Europe and features over 46,000 tradeable securities, alongside equities, bonds, ETFs, and even crypto products.

Switzerland is also known for the staunch privacy protections in place for financial customers; though Swiss banks can be required in certain special circumstances to reveal account holder details – such as in relation to a criminal investigation – Swiss banks are required by law to protect the confidentiality of their clients.

What is a forex broker?

The forex – or, foreign exchange – market is the largest financial market in the world. A forex broker is a company that helps facilitate trades in this market. Forex brokers grant you – whether you are a retail or professional client – the ability to buy or sell currencies via an online trading platform. Forex brokers act either as an agent (sending trades to another dealer) or as a dealer (taking the other side of each trade).

Broadly speaking, forex brokers are financial institutions that accept your deposits in connection with maintaining a live trading or brokerage account, and execute your orders (instructions) to buy or sell currencies. Because brokers accept deposits, you must be sure they are properly licensed and regulated, just as you would when depositing money with an institution claiming to be a bank.

What is the minimum deposit for forex trading in Switzerland?

The minimum deposit requirements for forex trading will vary depending on your chosen forex broker. Swissquote, for example, requires a high minimum deposit of $2,000, whereas FlowBank boasts a $0 minimum deposit requirement. As for my other top picks for the best forex brokers in Switzerland, IG requires a minimum deposit of $250, and Saxo’s minimum deposit requirement is $1,000. To see minimum deposit requirements for over 60 brokers, check out our industry-leading forex broker reviews.

Is Switzerland tax-free for forex trading?

No, Switzerland is not tax-free for forex trading. However, Swiss forex brokers will not withhold any taxes from your forex trading because of other factors relevant to your tax obligations in Switzerland.

For example, unless you are a Swiss citizen or resident, neither Swiss tax law nor tax obligations in Switzerland will apply to you because your obligations will remain in your country of residence where you must report your worldwide income (including any gains or losses from forex trading) – provided you don’t live in Switzerland for more than 6 months out of the year.

Note: One exception is the stamp duty tax that investors pay when trading securities (not forex) in Switzerland. This tax is applicable even if you are not a Swiss resident. Brokers will deduct these fees when you trade on the Swiss stock market, for example, even if you are using a forex broker.

If you are a Swiss national or resident, your classification as a private investor (which provides many tax breaks, including no capital gains tax) or professional investor can impact your tax rate on investments, including capital gains on short-term and longer-term investments, such as forex.

To determine if you qualify for “private investor” status as a Swiss resident, the following five statements must all be true:

- You have held securities for at least six months before selling.

- Less than half of your net income is derived from capital gains.

- Your trading turnover volume is not more than five times the value of your portfolio on January 1st of the calendar year in question.

- You are using your own proprietary capital which is not provided by others, or via a loan.

- Except for hedging purposes, you are not trading in derivatives.

Note: Tax laws vary across the 26 cantons in Switzerland. Always be sure to contact a local tax accountant to learn how the local tax laws apply to you.

Article Resources

FINMA Website , FINMA Wikipedia FINMA Registration Example

Compare Switzerland Brokers

Popular Forex Guides

- International Forex Brokers Search

- Best Copy Trading Platforms of 2024

- Best Forex Brokers of 2024

- Best Forex Trading Apps of 2024

- Best TradingView Forex Brokers of 2024

- Compare Forex Brokers

- Best Forex Brokers for Beginners of 2024

- Best Zero Spread Forex Brokers of 2024

- Best MetaTrader 4 Brokers of 2024

More Forex Guides

Find the best forex brokers in Europe

- Best Forex Brokers in Austria for 2024

- Best Forex Brokers in Cyprus for 2024

- Best Forex Brokers in Denmark for 2024

- Best Forex Brokers in Finland for 2024

- Best Forex Brokers in France for 2024

- Best Forex Brokers in Germany for 2024

- Best Forex Brokers in Ireland for 2024

- Best Forex Brokers in Italy for 2024

- Best Netherlands Forex Brokers of 2024

- Best Forex Brokers in Norway for 2024

- Best Forex Brokers in Poland for 2024

- Best Forex Brokers in Portugal for 2024

- Best Forex Brokers in Spain for 2024

- Best Forex Brokers in Sweden for 2024

- Best Switzerland Forex Brokers of 2024

- Best Forex Brokers in Turkey for 2024

- Best Forex Brokers in Ukraine for 2024

- Best UK Forex Brokers of 2024

2024 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.