Best Forex Brokers in United Arab Emirates for 2024

ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Trading forex (currencies) in the United Arab Emirates is popular among residents. While recommended, forex brokers are not required to become authorised by the Securities and Commodities Authority (SCA) to accept residents of the United Arab Emirates as customers.

The Securities and Commodities Authority is the financial regulatory body in the United Arab Emirates. Website: https://www.sca.gov.ae. We recommend that United Arab Emirates residents also follow the SCA on Twitter: https://twitter.com/sca_uae.

The SCA was established in 2000 and is responsible for supervising and monitoring the markets in the United Arab Emirates. For a historical breakdown, here's a link to the Securities and Commodities Authority webpage on Wikipedia.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Best Forex Brokers United Arab Emirates

To find the best forex brokers in the United Arab Emirates, we created a list of all brokers that accept residents of the United Arab Emirates as new clients. We then ranked brokers by their Overall ranking.

Here is our list of the best forex brokers in the United Arab Emirates:

-

IG

- Best overall broker, most trusted

-

Saxo

- Best web-based trading platform

- FOREX.com - Excellent all-round offering

- XTB - Great research and education

- Swissquote - Trusted broker, best banking services

-

AvaTrade

- Great for beginners and copy trading

-

Plus500

- Multi-asset CFD broker, intuitive platform

United Arab Emirates Forex Brokers Comparison

Compare United Arab Emirates authorised forex and CFDs brokers side by side using the forex broker comparison tool or the summary table below. This broker list is sorted by my overall rankings of the top forex brokers.

| Company | Accepts AE Residents | Authorised or Regulated by the DFSA | Average Spread EUR/USD - Standard | Minimum Deposit | Overall Rating | Visit Site |

IG IG

|

0.98 | £250.00 |

|

Visit Site

|

||

Saxo Saxo

|

1.1 | $0 |

|

Visit Site

|

||

FOREX.com FOREX.com

|

1.4 | $100 |

|

|||

XTB XTB

|

1.00 | $0 |

|

|||

Swissquote Swissquote

|

N/A | $1000 |

|

|||

AvaTrade AvaTrade

|

0.92 | $100 |

|

Visit Site

|

||

Plus500 Plus500

|

N/A | €100 |

|

Visit Site

|

||

Pepperstone Pepperstone

|

0.77 | $200 |

|

Visit Site

|

||

XM Group XM Group

|

1.6 | $5 |

|

Visit Site

|

||

Tickmill Tickmill

|

0.51 | $100 |

|

Visit Site

|

||

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

0.6 | $20 |

|

|||

HFM HFM

|

1.2 | $0 |

|

Visit Site

|

||

MultiBank MultiBank

|

N/A | $50 |

|

|||

Interactive Brokers Interactive Brokers

|

0.63 | $0 |

|

Visit Site

|

||

eToro eToro

|

1 | $10-$10,000 |

|

|||

Capital.com Capital.com

|

0.67 | $20 |

|

Visit Site

|

||

OANDA OANDA

|

1.57 | $0 |

|

|||

FXCM FXCM

|

0.74 | Starts from $50 |

|

Visit Site

|

||

Admirals Admirals

|

0.8 | $100 |

|

|||

FP Markets FP Markets

|

1.1 | $100 AUD |

|

Visit Site

|

||

IC Markets IC Markets

|

0.62 | $200 |

|

Visit Site

|

||

BlackBull Markets BlackBull Markets

|

0.76 | $0 |

|

Visit Site

|

||

Vantage Vantage

|

1.30 | $50 |

|

|||

FlowBank FlowBank

|

N/A | $0 |

|

|||

Trade Nation Trade Nation

|

0.6 | $0 |

|

|||

Moneta Markets Moneta Markets

|

1.27 | $50 |

|

|||

Eightcap Eightcap

|

1.0 | $100 |

|

Visit Site

|

||

ACY Securities ACY Securities

|

1.2 | $50 |

|

Visit Site

|

||

easyMarkets easyMarkets

|

0.9 | $50 |

|

|||

Spreadex Spreadex

|

0.81 | $0 |

|

Visit Site

|

||

Libertex (Forex Club) Libertex (Forex Club)

|

N/A | $10 |

|

Which platform is best for forex trading in Dubai?

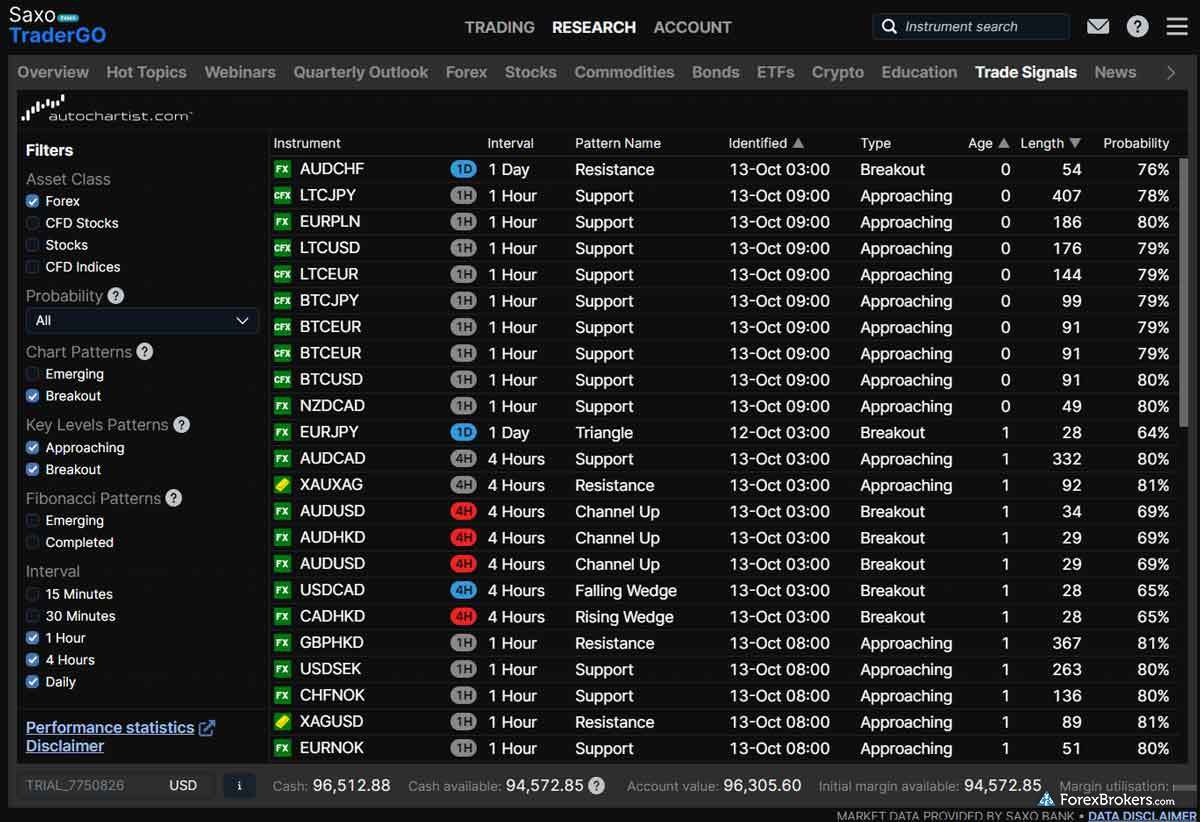

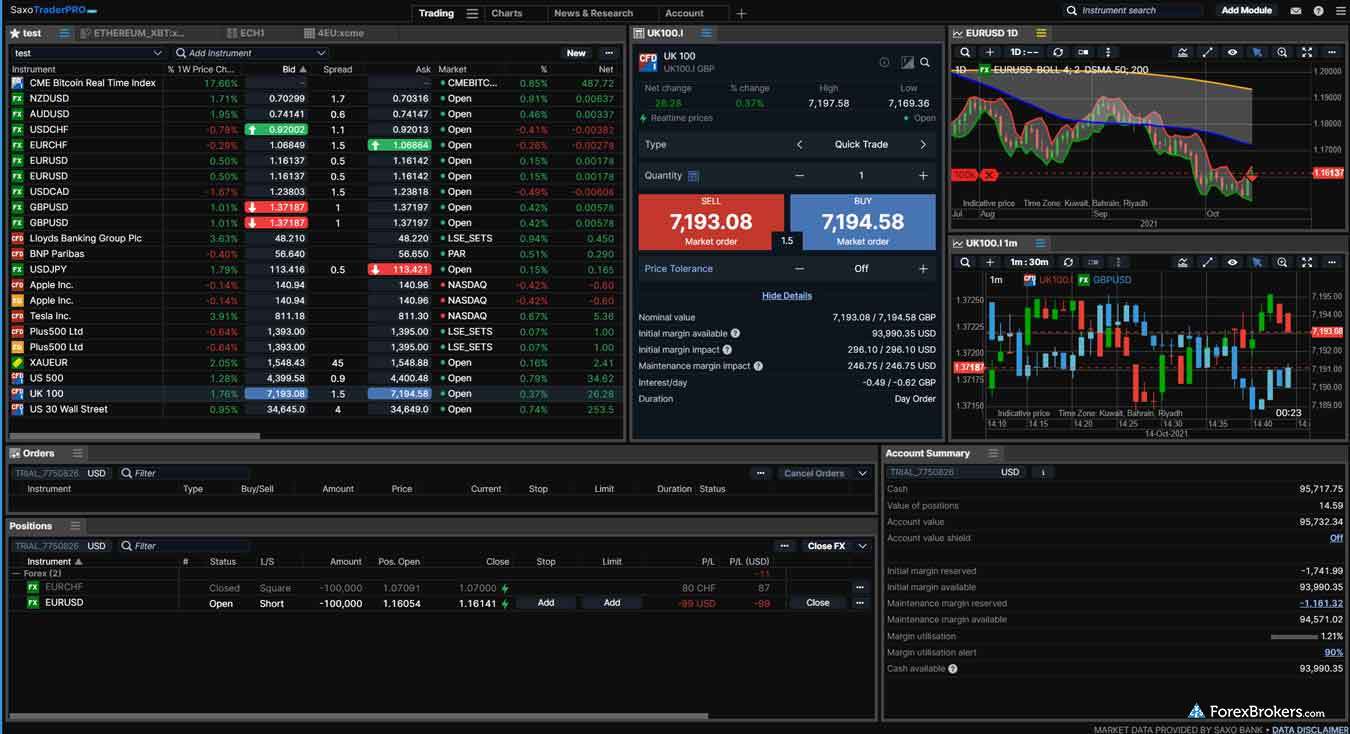

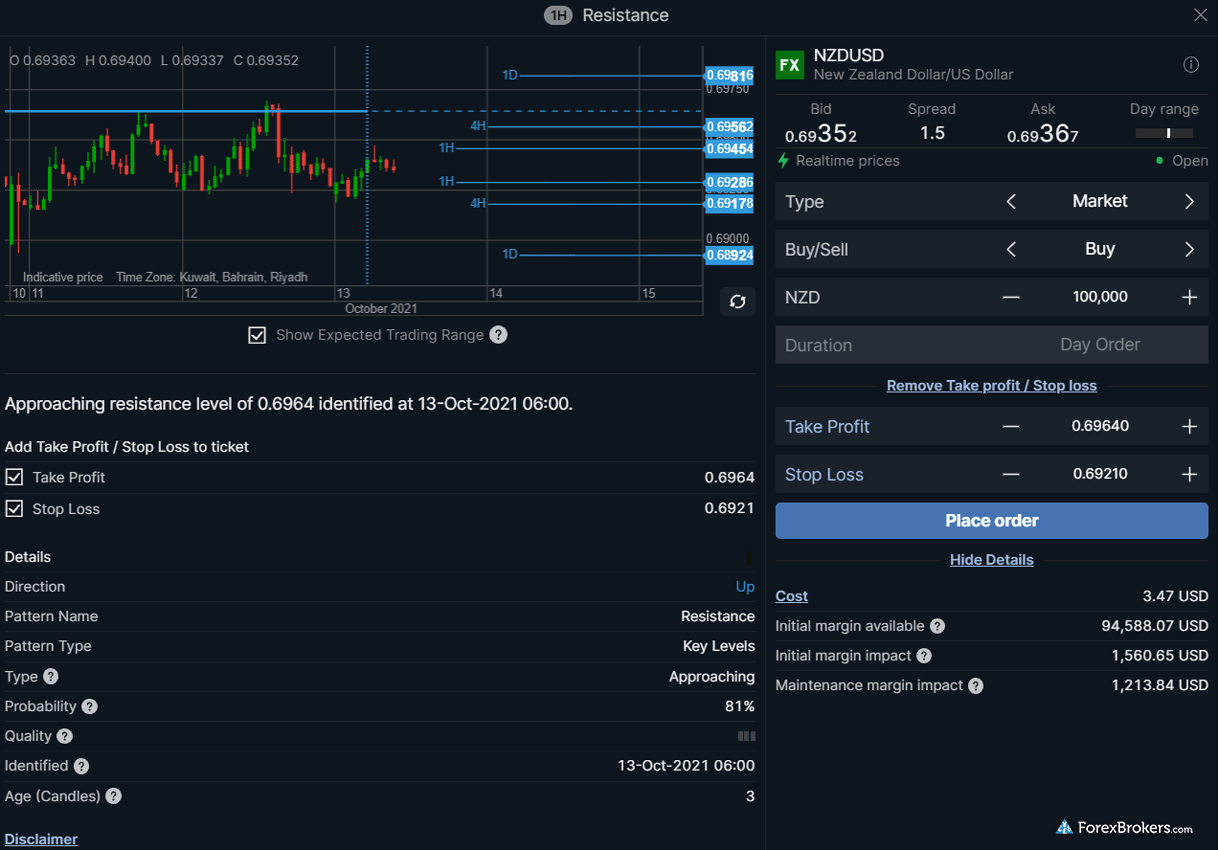

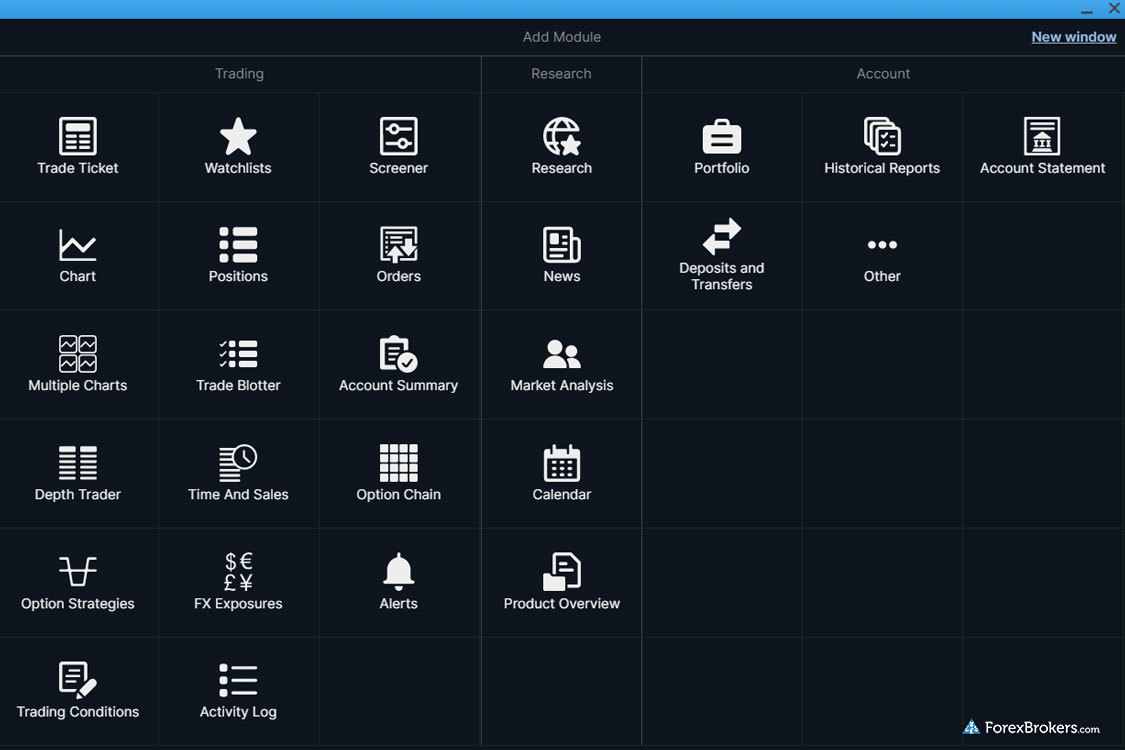

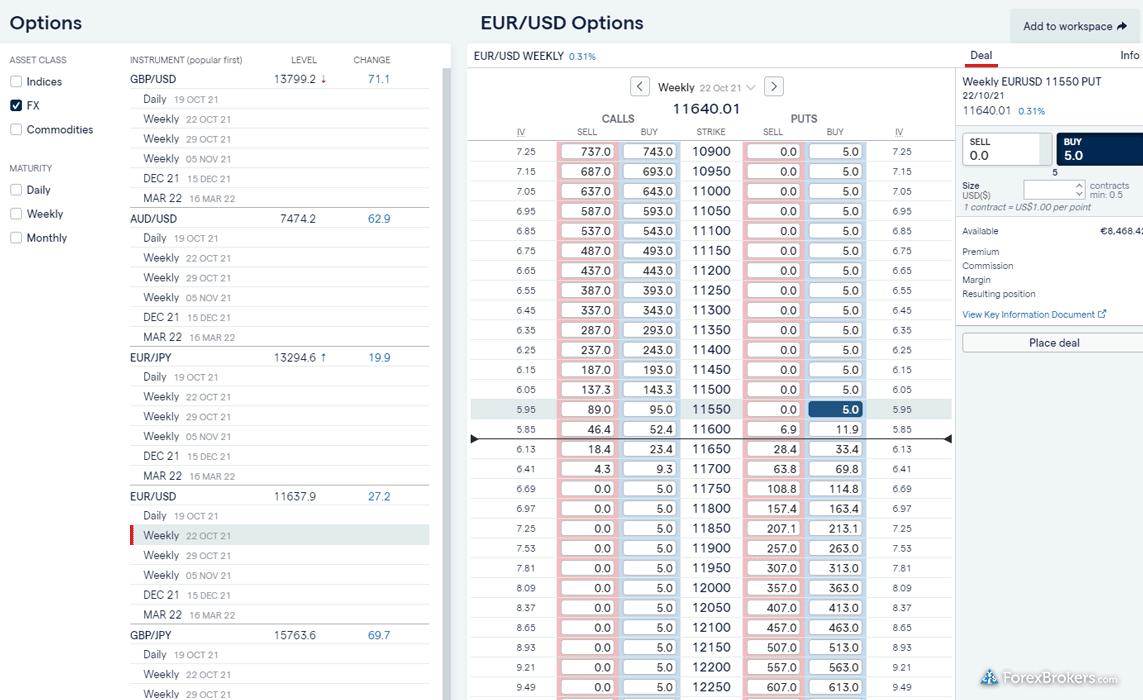

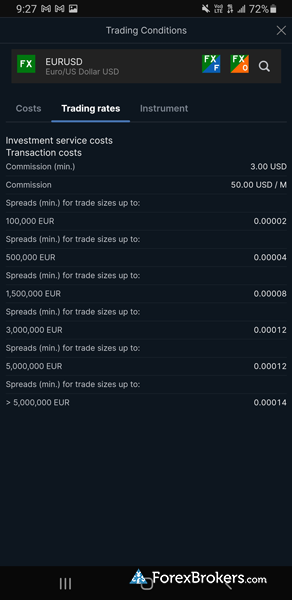

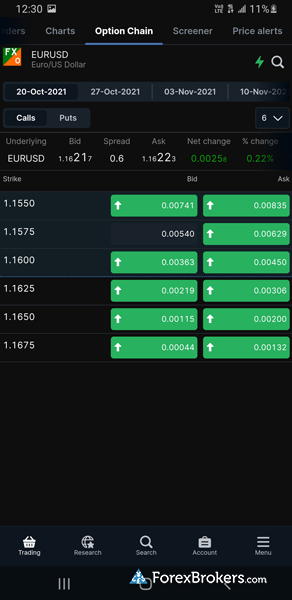

Saxo is my pick for the best forex trading platform provider in Dubai in 2024, when considering all forex brokers that are regulated by the Dubai Financial Services Authority (DFSA) and that accept residents from the UAE. Saxo’s platform suite (SaxoTraderGO for web and mobile and SaxoTraderPRO for desktop) strikes a near-perfect balance of ease-of-use and advanced features, creating a rich trading experience for traders of all experience levels. Learn more about why I rate Saxo’s trading platforms so highly by checking out my review of Saxo.

Browse a gallery of screenshots from Saxo's trading platforms, taken by our research team during our product testing.

What is the best broker in Dubai?

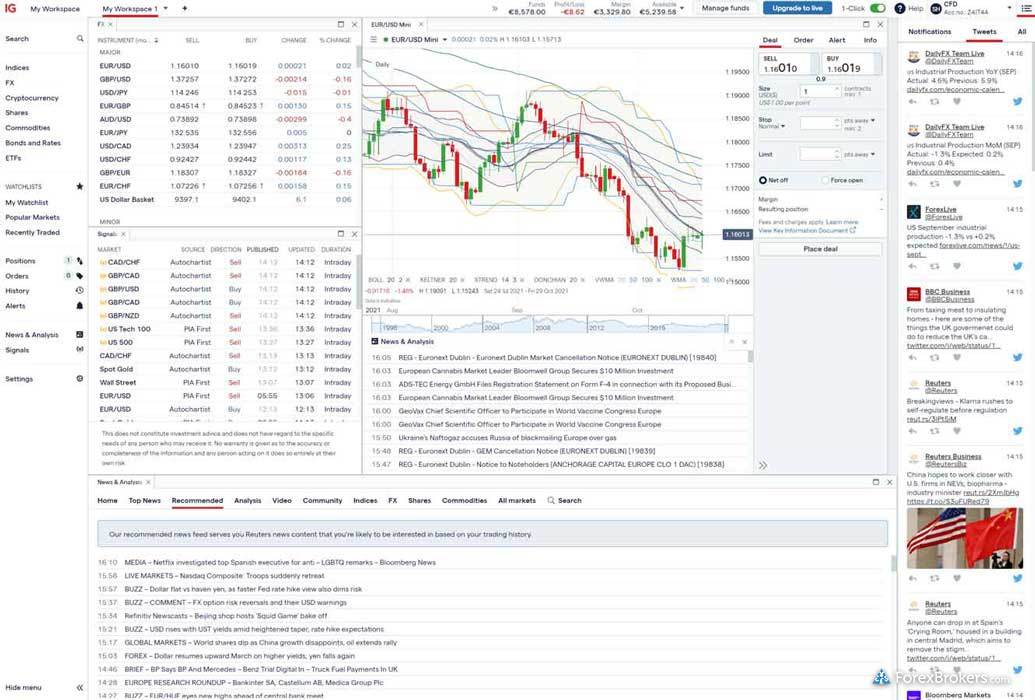

IG is the best forex broker in the UAE in 2024. When considering all forex brokers regulated by the DFSA in Dubai (and that accept residents of the UAE), IG stands out as the clear favorite. IG delivers excellent trading platforms, a suite of powerful mobile apps, top-notch research, and the highest attainable Trust Score for a forex broker. With its wide range of currency pairs and a truly vast selection of tradeable markets, IG is our top pick for investors based in the UAE and Dubai.

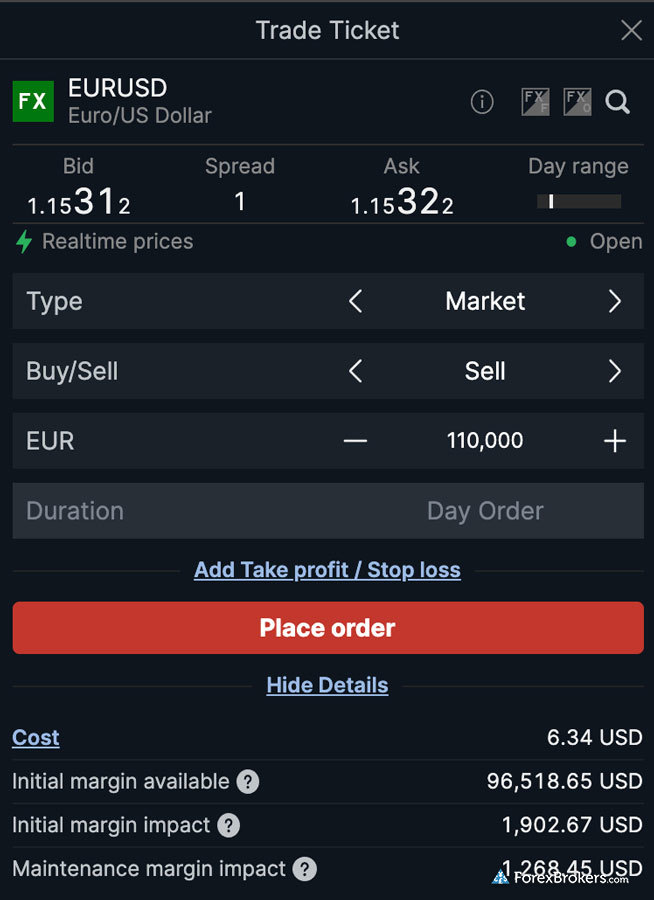

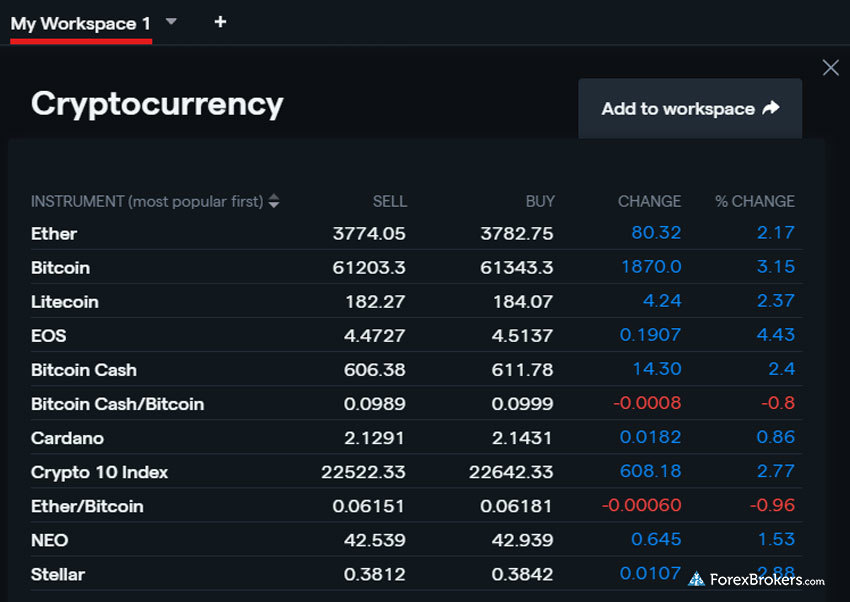

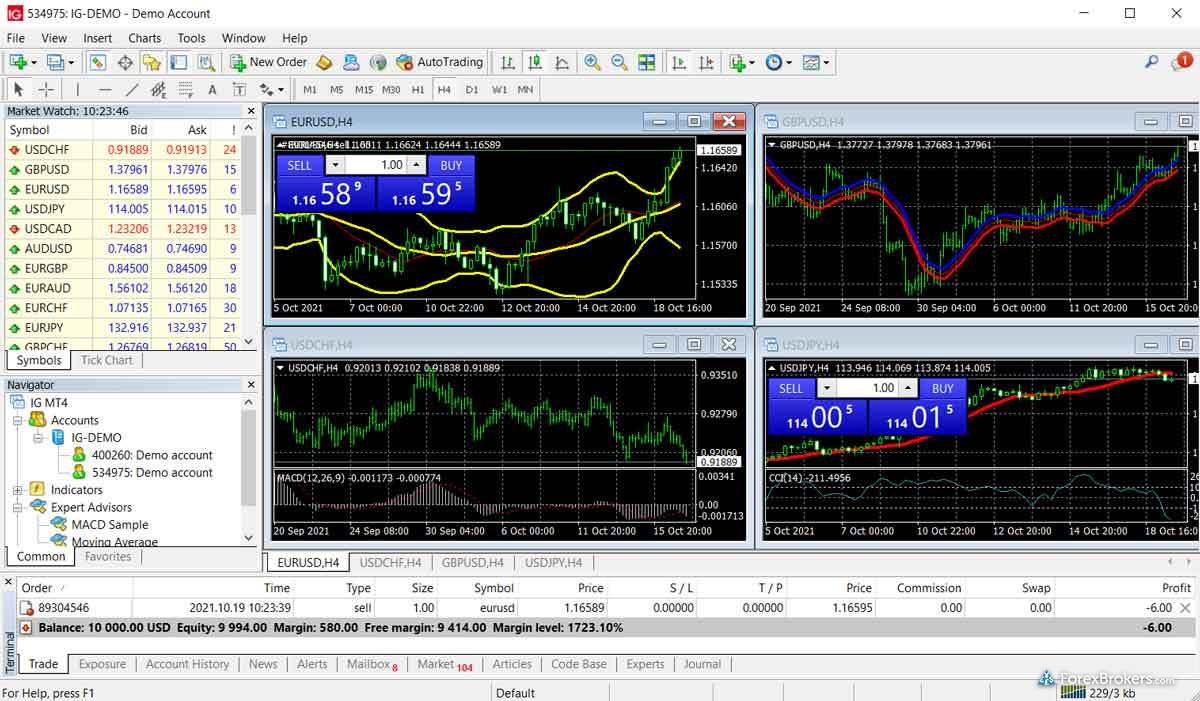

Check out a gallery of screenshots from IG's trading platforms, taken by our research team during our product testing.

Which broker has the best mobile app?

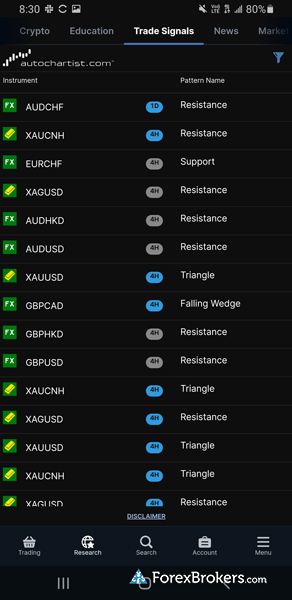

Saxo, which is DFSA-regulated in the UAE, is an excellent choice for UAE-based traders and investors who are looking for a superior mobile app. Saxo’s SaxoTraderGO innovative web and mobile trading platforms deliver a superior selection of tools and state-of-the-art research. Saxo’s SaxoTraderGO mobile app is a favorite of mine, and I appreciate how closely Saxo’s flagship mobile app offering mirrors the SaxoTraderGO web-based platform experience. SaxoTraderGO for mobile is intelligently designed, easy to use, and packed with powerful charting and excellent reading tools.

Check out a gallery of screenshots from Saxo's mobile platforms, taken by our research team during our product testing.

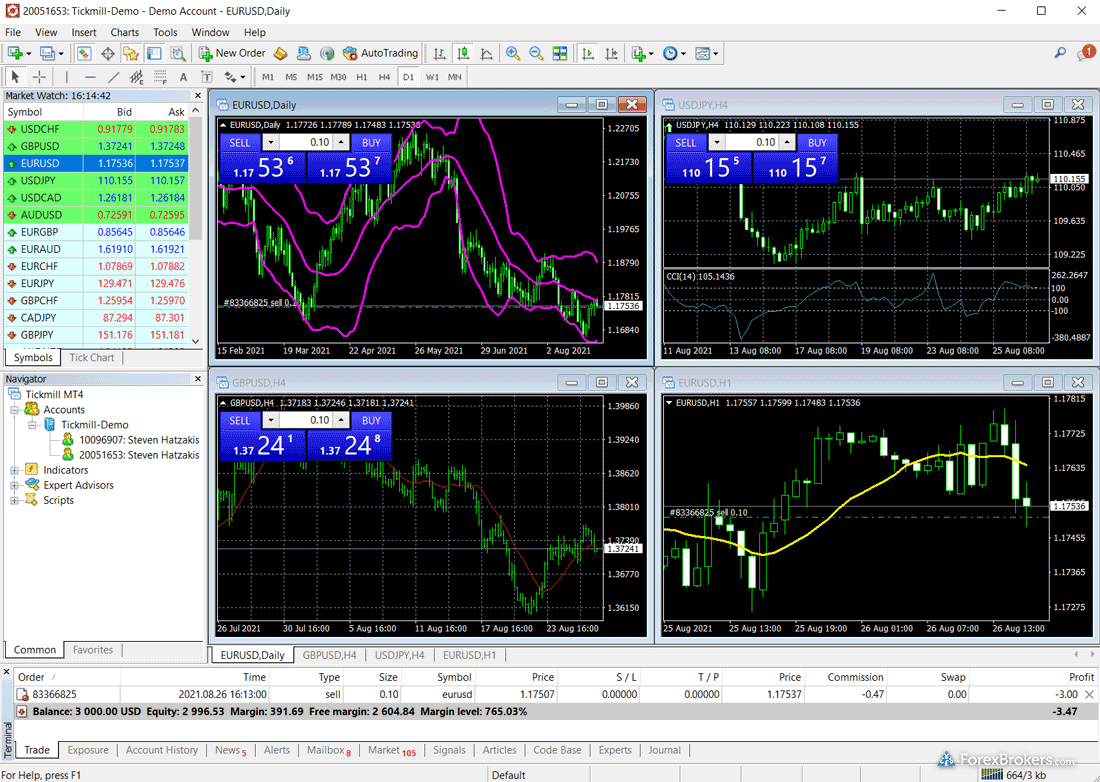

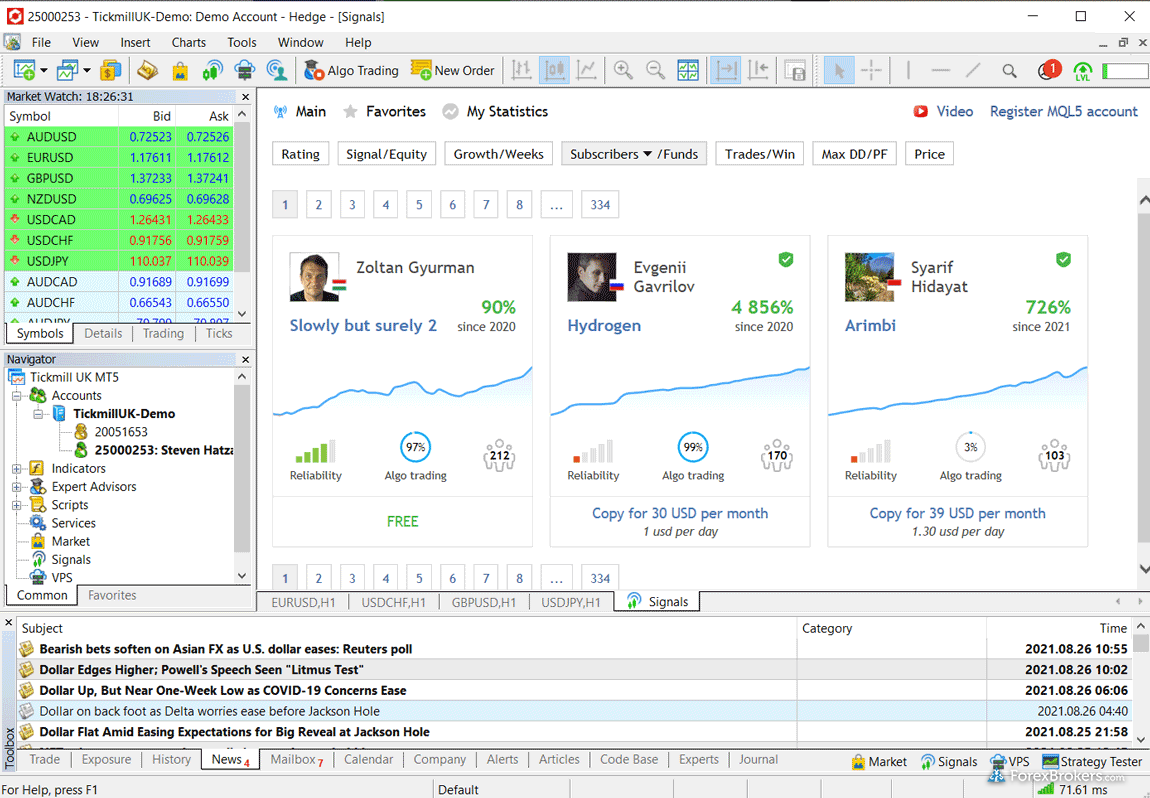

Can I use MetaTrader in the UAE?

Yes, the MetaTrader platform, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), is legal and available to residents of the UAE – provided your forex broker is regulated in Dubai by the DFSA. If you are looking for the best forex broker in Dubai for MetaTrader users, our top pick is Pepperstone.

Learn more about MetaTrader

Find out why MetaTrader is one of the most popular trading platforms in the world by checking out our guide to MetaTrader, or read our guide to MetaTrader 5.

Which broker is best for beginners?

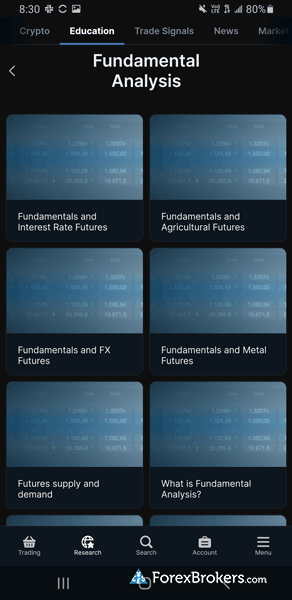

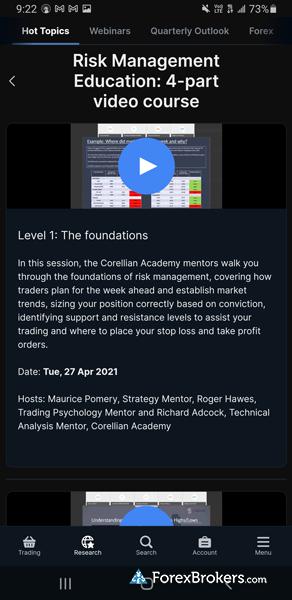

IG is the best forex broker for beginners in 2024, due to its vast selection of educational resources, which include guided courses that allow you to chart your own progress as you learn about forex and CFD trading. DailyFx – IG’s in-house content developer – produces a healthy variety of informative articles and videos, and IG has even developed its own standalone mobile app (in addition to its award-winning IG Trading app) that is exclusively dedicated to teaching beginners the ins and outs of the financial markets.

New to forex trading?

Check out our beginner's guide to forex trading. You'll learn some of the most important forex fundamentals, and we'll show you our top picks for the best forex brokers for beginner traders.

How to Verify SCA Authorisation

Unfortunately, the SCA does not provide a list of authorized forex brokers; however, residents can contact the SCA directly to verify authorisation.

What protection does the SCA provide forex traders?

Forex traders in the UAE benefit from a variety of Securities and Commodities Authority (SCA) protections. The SCA has put out numerous warnings for investors to avoid dealing with brokers that aren’t licensed in the UAE, and has taken action against regulated brokers in the case of violations. The SCA also provides a complaints submission mechanism for the public in cases where issues and/or disputes can’t be resolved directly with an SCA-regulated broker.

The UAE operates under a tri-peak regulatory structure. The SCA (the first peak) regulates the financial markets in the United Arab Emirates (UAE) that exist outside of the Dubai International Financial Centre (DIFC). The DIFC is a financial hub in Dubai that is regulated by the Dubai Financial Services Authority (DFSA) (the second peak). The third peak is the Central Bank of the UAE (CBUAE), which regulates UAE monetary policy and the banking industry.

The DFSA regulates 617 financial institutions, including forex brokers, as of June 2023. The SCA regulates 129 active financial institutions including forex brokers that are licensed in the UAE. The SCA has been active in its enforcement of compliance with periodic inspections of at least 125 financial institutions, including 14 brokers – according to its latest annual report from 2021.

Is forex trading legal in Dubai?

Yes, if you reside in Dubai, you can legally trade forex with brokers that are properly licensed and regulated by the DFSA (according to Regulatory Law 2004 as enacted by the ruler of Dubai). Forex brokers (and other financial institutions) that operate outside of the DIFC (i.e. outside of Dubai) are regulated by the Securities and Commodities Authority (SCA). It’s also worth noting that the Central Bank of the UAE regulates the foreign exchange markets and supervises banks and payment providers. Brokers authorized by the CBUAE hold a monetary intermediary license, whereas exchange-traded forex products are regulated by the Securities & Commodities Authority (SCA)

The UAE’S financial markets

Forex traders may recognize the dirham (AED) as the national currency of the United Arab Emirates. Though comprised of seven separate emirates, the main financial centers of the UAE are undisputedly Abu Dhabi and Dubai. As such, the UAE features two primary financial securities exchanges: the Abu Dhabi Securities Exchange (ADX), and the Dubai Financial Market (DFM).

The ADX, based in Abu Dhabi, was established in the year 2000 and operates as a market for trading securities while also being vested with certain supervisory powers. One of the largest markets in the Arab world, the ADX offers shares, bonds, exchange-traded funds (ETFs), and other SCA-approved financial instruments. The DFM, based in Dubai, functions as a secondary market for trading securities, bonds, mutual funds, as well as other local or foreign DFM-approved financial instruments.

Excluding the city of Dubai, the Central Bank of the UAE (CBUAE) is the primary national regulator for all financial services firms in the UAE, including banks and forex brokers. The Securities and Commodities Authority (SCA) is the governmental agency that oversees the local stock and commodity exchanges in Dubai.

Within Dubai exists a unique special economic zone known as the Dubai International Financial Center (DIFC). The primary regulator for the financial services industry within the DIFC is the Dubai Financial Services Authority (DFSA), which enforces licensing and membership compliance for forex brokers in Dubai, and regulates the trading of securities, commodities, investment funds, and derivatives.

Why regulation is important

Choosing a well-regulated forex broker is important for avoiding forex scams. Check out my popular educational series that teaches you how to identify common forex scams and provides helpful information about what to do if you've been scammed. For crypto traders, I explain how you can spot common crypto scams.

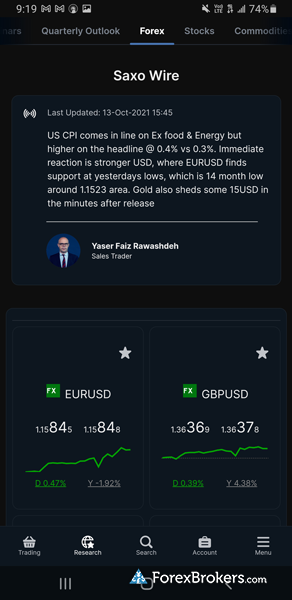

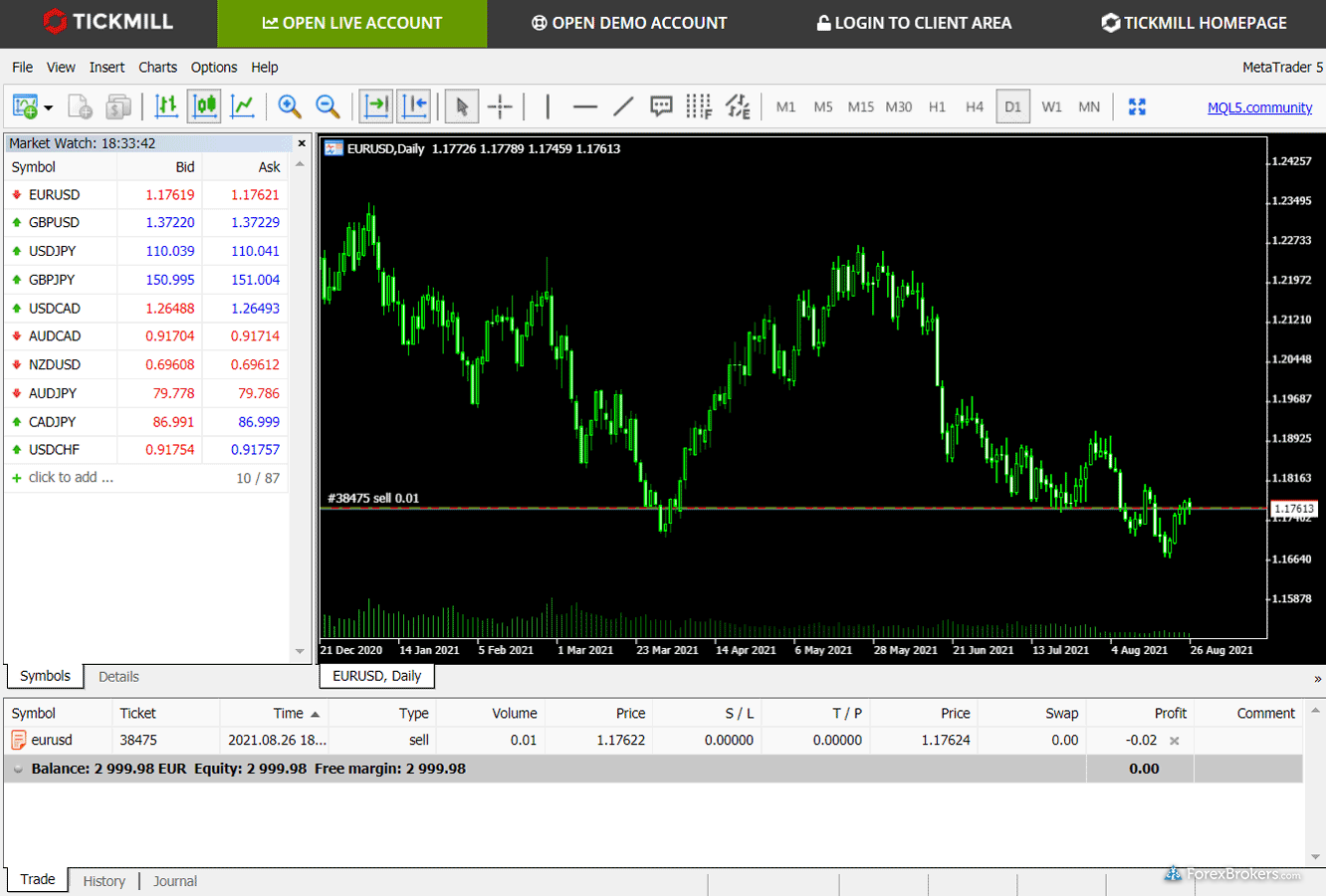

Which forex broker has the lowest spread in UAE?

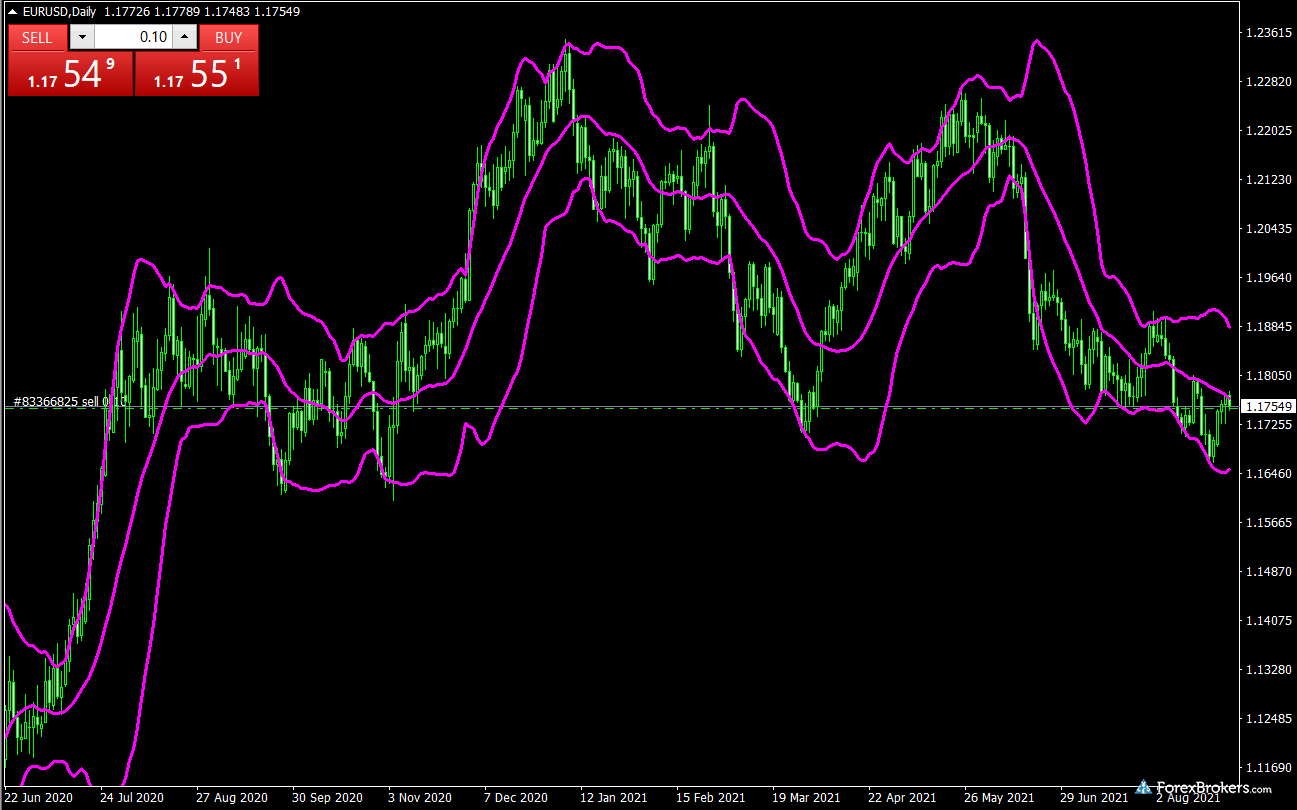

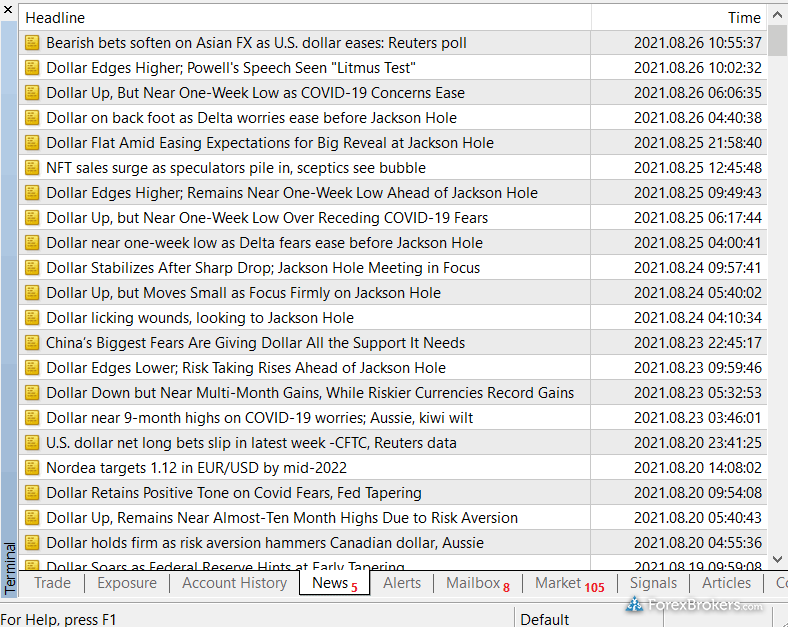

According to the data I've gathered, Tickmill is the forex broker that delivers the lowest spreads in the UAE. Tickmill accepts residents from the UAE as clients and offers average spreads that are close to half a pip. Whether you trade on Tickmill's VIP or PRO account, effective spreads are incredibly low thanks in part to low per-trade commissions and low average spreads on major currency pairs (such as the EUR/USD). Tickmill earned the number one spot for Commissions & Fees in our 2024 Annual Awards, further solidifying its position as the best forex broker for low-spread trading across the UAE. Learn more by reading my review of Tickmill.

Check out a gallery of screenshots from Tickmill's trading platforms, taken by our research team during our product testing.

Low-spread forex trading

Forex trading costs can add up; if you are looking for brokers that deliver the lowest possible spreads, check out our popular Zero Spread Forex Guide.

How do you get started trading forex in the United Arab Emirates?

If you want to start trading forex in the United Arab Emirates, it’s important to start by choosing a forex broker that is well-regulated and properly licensed in the UAE by the DFSA or SCA. While this list isn’t meant to be exhaustive (not every trader’s needs are the same), here are five general steps you can take to start on your forex trading journey as a resident of the UAE.

- Choose a regulated forex broker. Make sure that your broker is regulated with either the SCA or DFSA – depending on whether you live within the DIFC or outside of Dubai. To help reduce your risk of falling victim to a forex scam, you should always make sure your broker is well-regulated, well-capitalized, and financially secure.

- Use free demo account before trading with real money. Make sure to learn how your broker’s trading software works before placing real trades in your live account. A free demo account is a great way to experiment with managing open orders and placing trades – without risking real money.

- Develop a trading plan that aligns with your goals and lifestyle. How much do you want to make, and what amount can you risk per trade (or per day, or per week)? What is the ideal trade size and trade duration relative to your balance? These are just a few questions that traders must answer when designing their trading plans.

- Learn to identify trading opportunities. Whether you are looking at charts and conducting technical analysis, consuming market research or fundamental analysis, or using trading signals, it’s important to learn how to identify the right trading opportunities for your strategy.

- Test your strategy with real money. Start with an amount of capital that you can afford to lose and test your strategy on a small scale before scaling it to larger amounts of capital.

Article Resources

Securities and Commodities Authority, SCA Contact, SCA Wikipedia

Compare United Arab Emirates Brokers

Popular Forex Guides

- International Forex Brokers Search

- Best MetaTrader 4 Brokers of 2024

- Best Copy Trading Platforms of 2024

- Best Zero Spread Forex Brokers of 2024

- Best Forex Brokers for Beginners of 2024

- Best Forex Brokers of 2024

- Best Forex Trading Apps of 2024

- Compare Forex Brokers

- Best TradingView Forex Brokers of 2024

More Forex Guides

Find the best forex brokers in the Middle East and Africa

Middle East

- Best Forex Brokers in Saudi Arabia for 2024

- Best Forex Brokers in Israel for 2024

- Best Forex Brokers in United Arab Emirates for 2024

Africa

- Best Forex Brokers in Kenya for 2024

- Best Forex Brokers in Nigeria for 2024

- Best Forex Brokers in South Africa for 2024

2024 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.