Best overall forex broker for hedging - IG

| Company |

Overall Rating |

Average Spread EUR/USD - Standard |

Commissions & Fees |

Minimum Deposit |

Visit Site |

IG IG

|

|

0.98 info |

|

£250.00 |

Visit Site

|

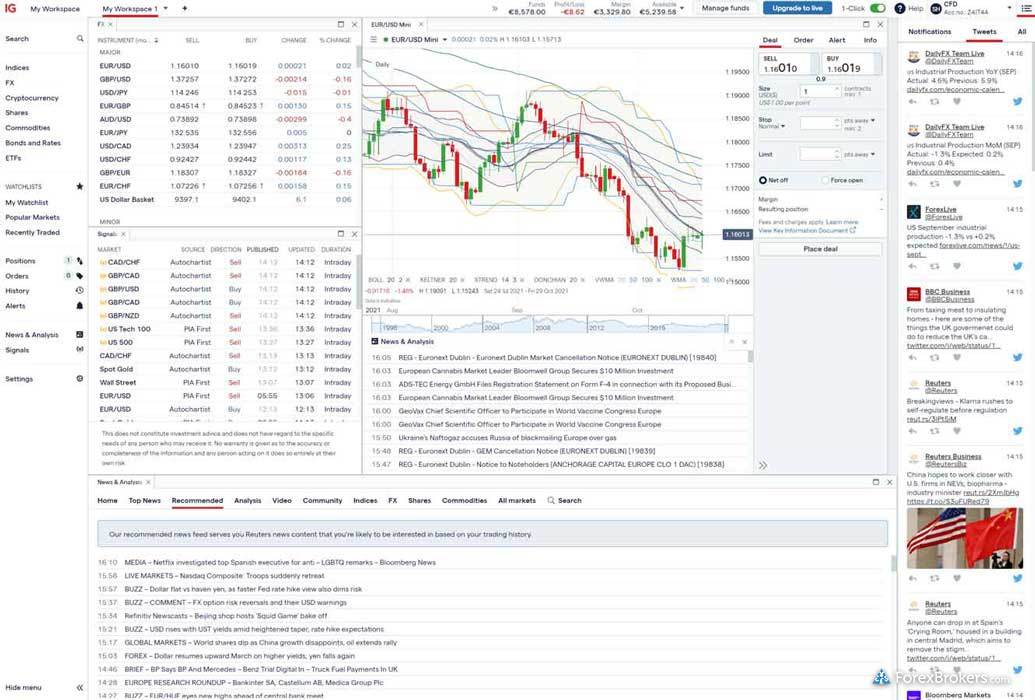

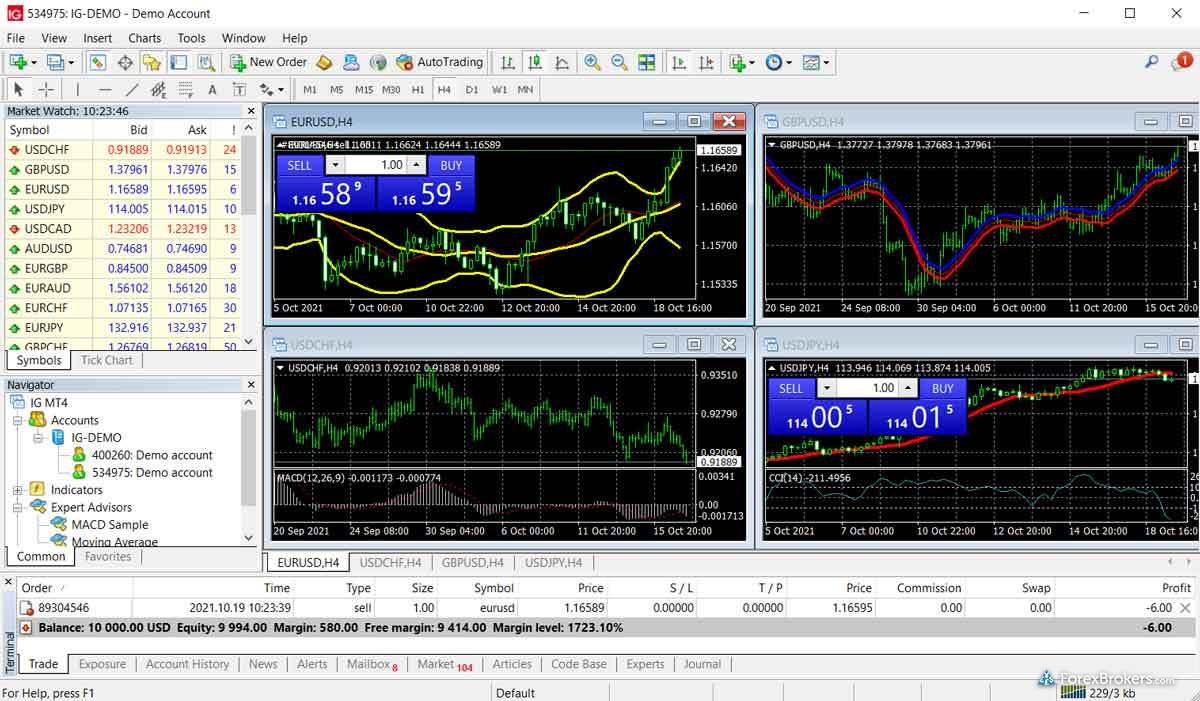

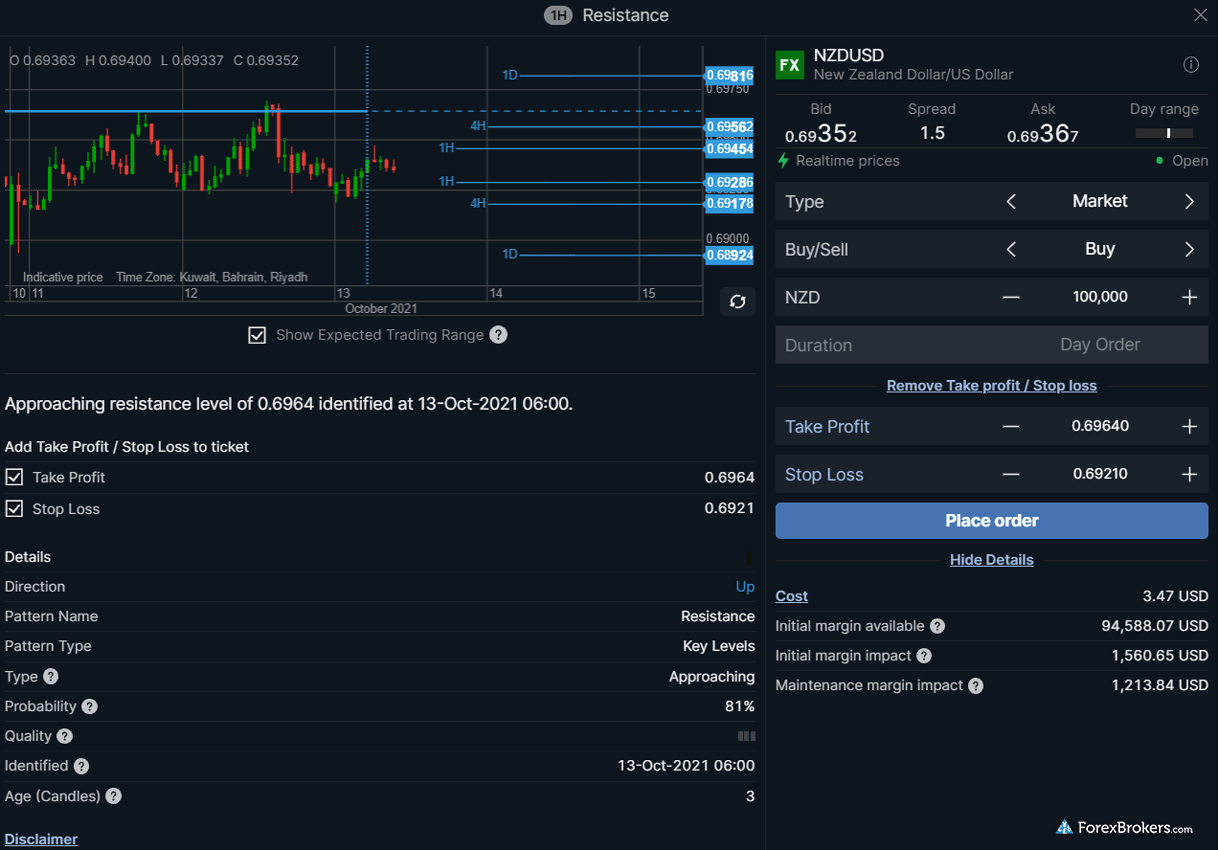

As one of the most highly trusted and regulated brokers we review, IG is my top choice for hedging forex in 2024. With IG’s award-winning web trading platform and mobile trading app, you can toggle hedging using the “force open” setting, allowing you to open trades in opposing directions on the same currency pair.

One nice feature I like about IG’s trading platform interface specifically for hedging is that when I’m placing a new order to hedge, or modifying an existing hedged trade, the platform shows a preview of the resulting positions. This preview lets me easily and quickly see how deeply hedged, and in which direction, my position will become. Read my in-depth IG review to learn more about why it's a great overall choice for a broker.

Great for both hedging and currency conversion - Interactive Brokers

| Company |

Overall Rating |

Average Spread EUR/USD - Standard |

Commissions & Fees |

Minimum Deposit |

Visit Site |

Interactive Brokers Interactive Brokers

|

|

0.63 info |

|

$0 |

Visit Site

|

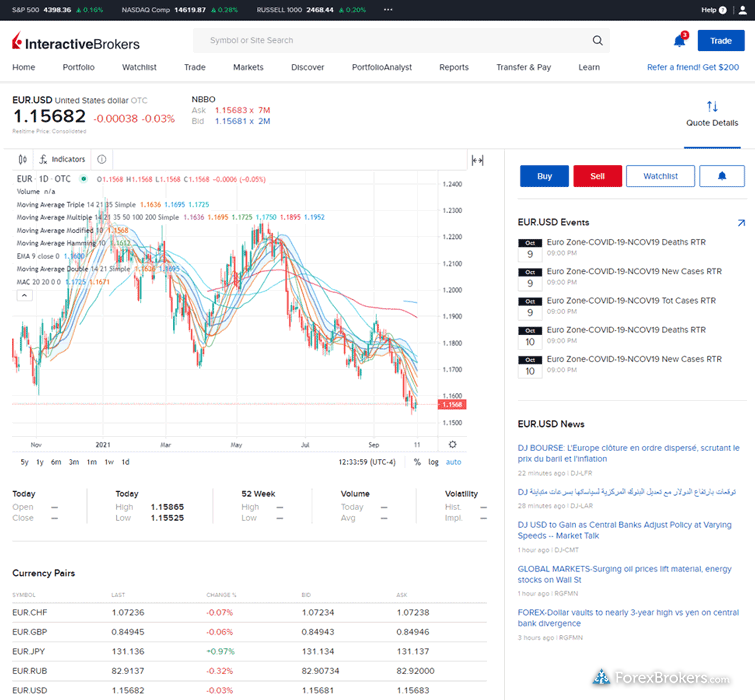

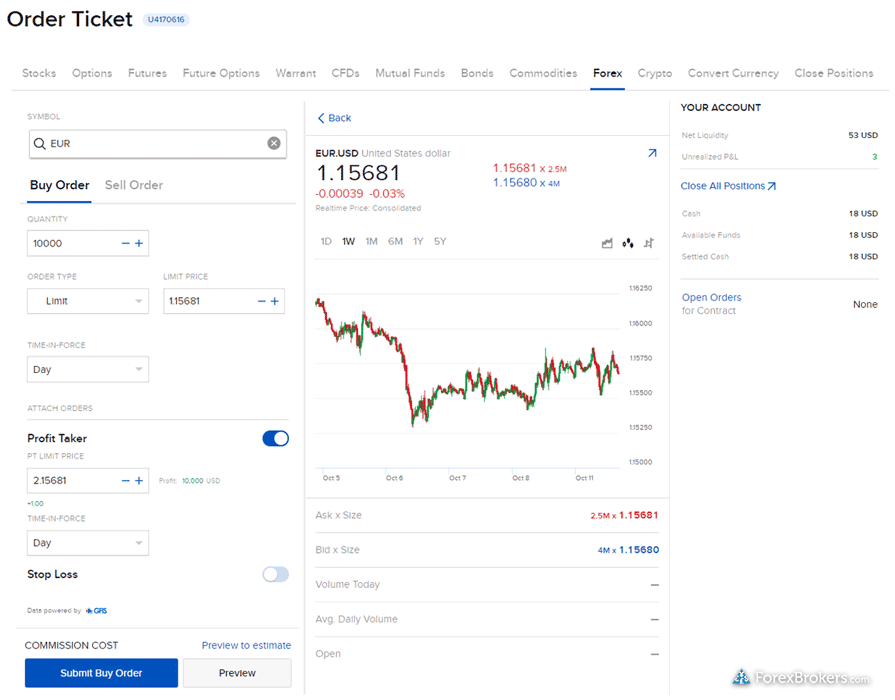

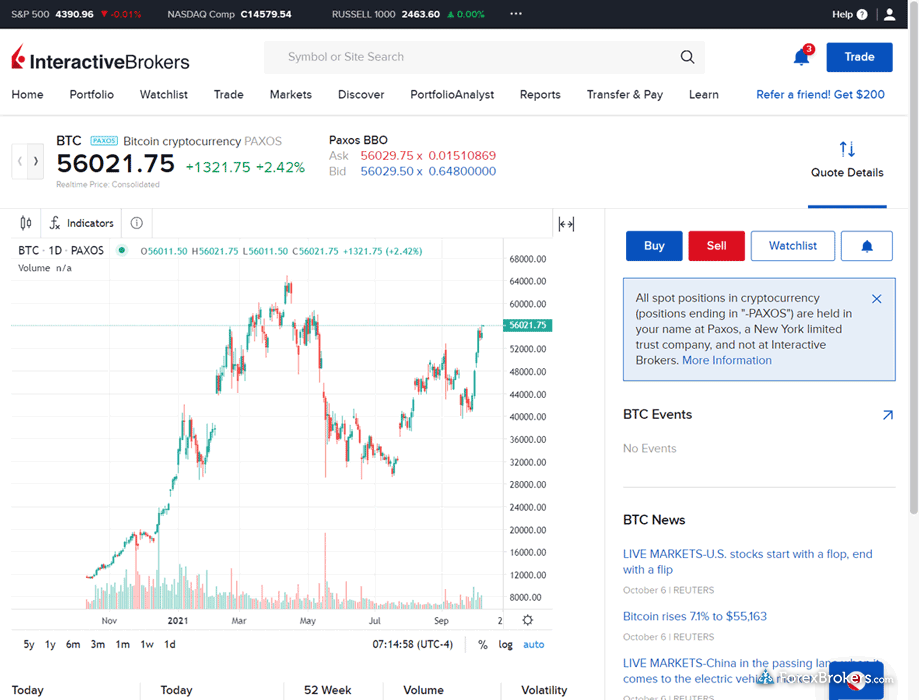

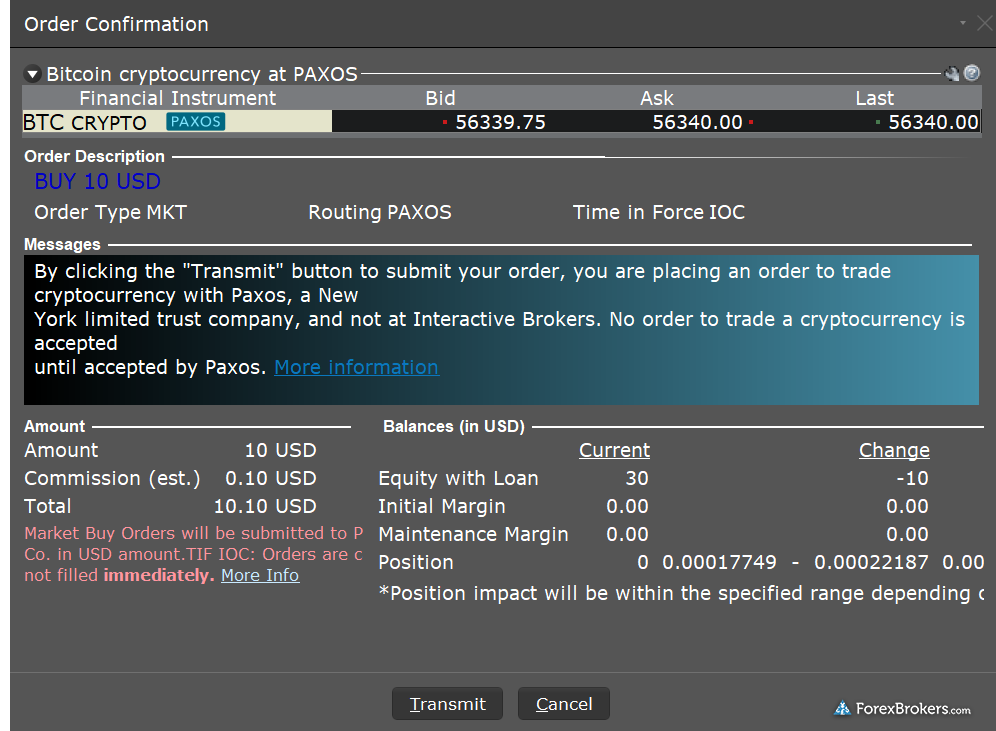

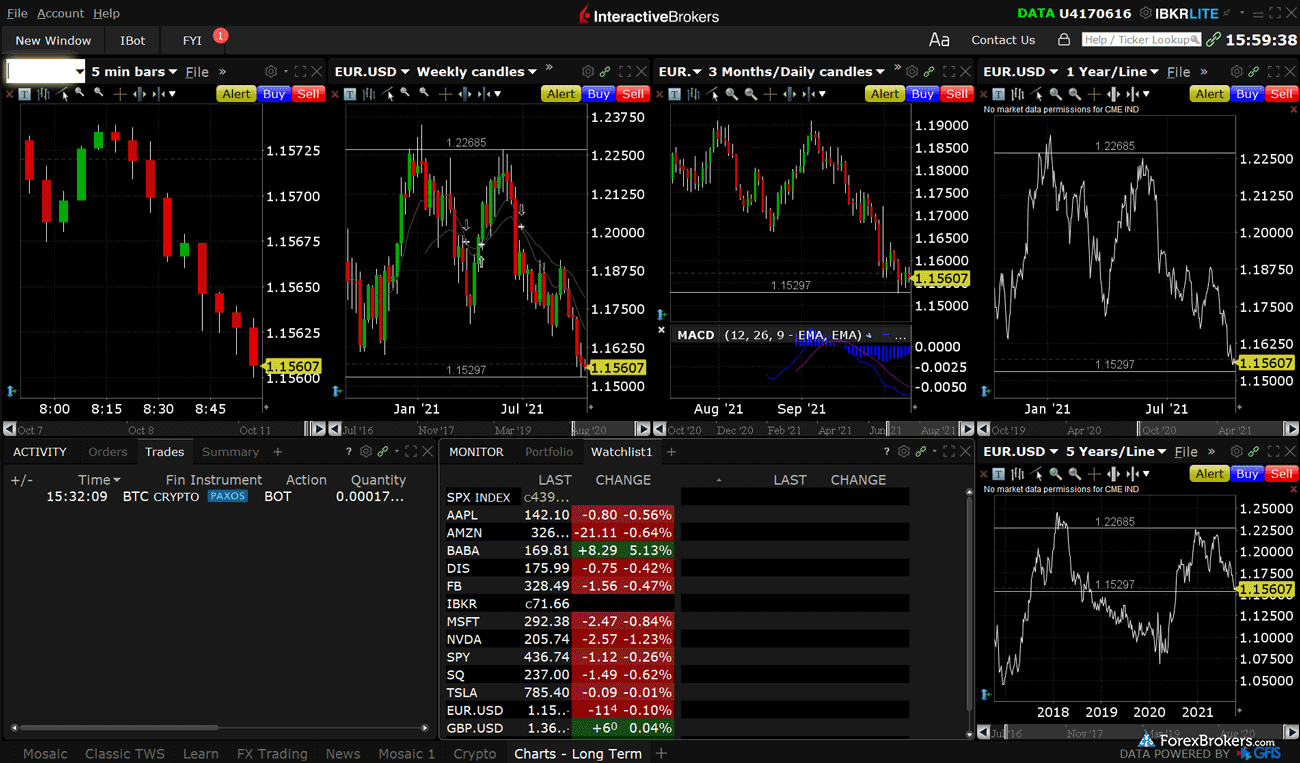

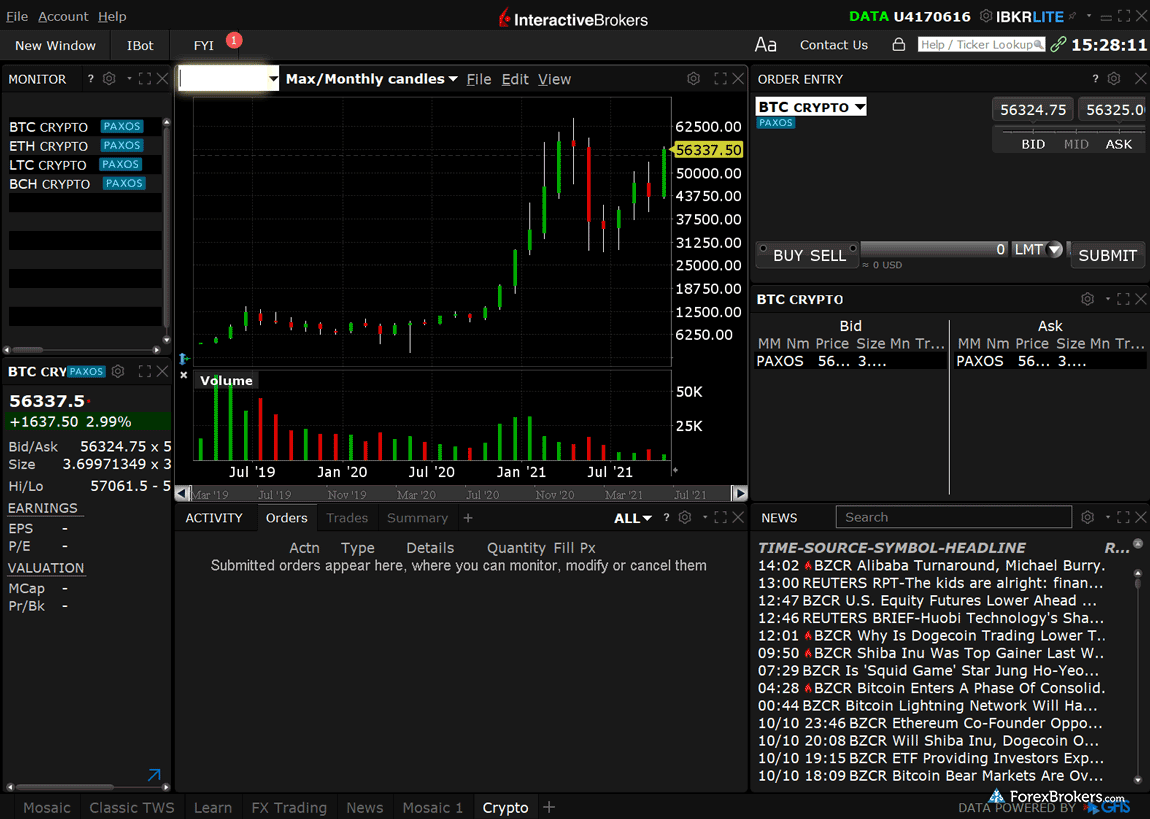

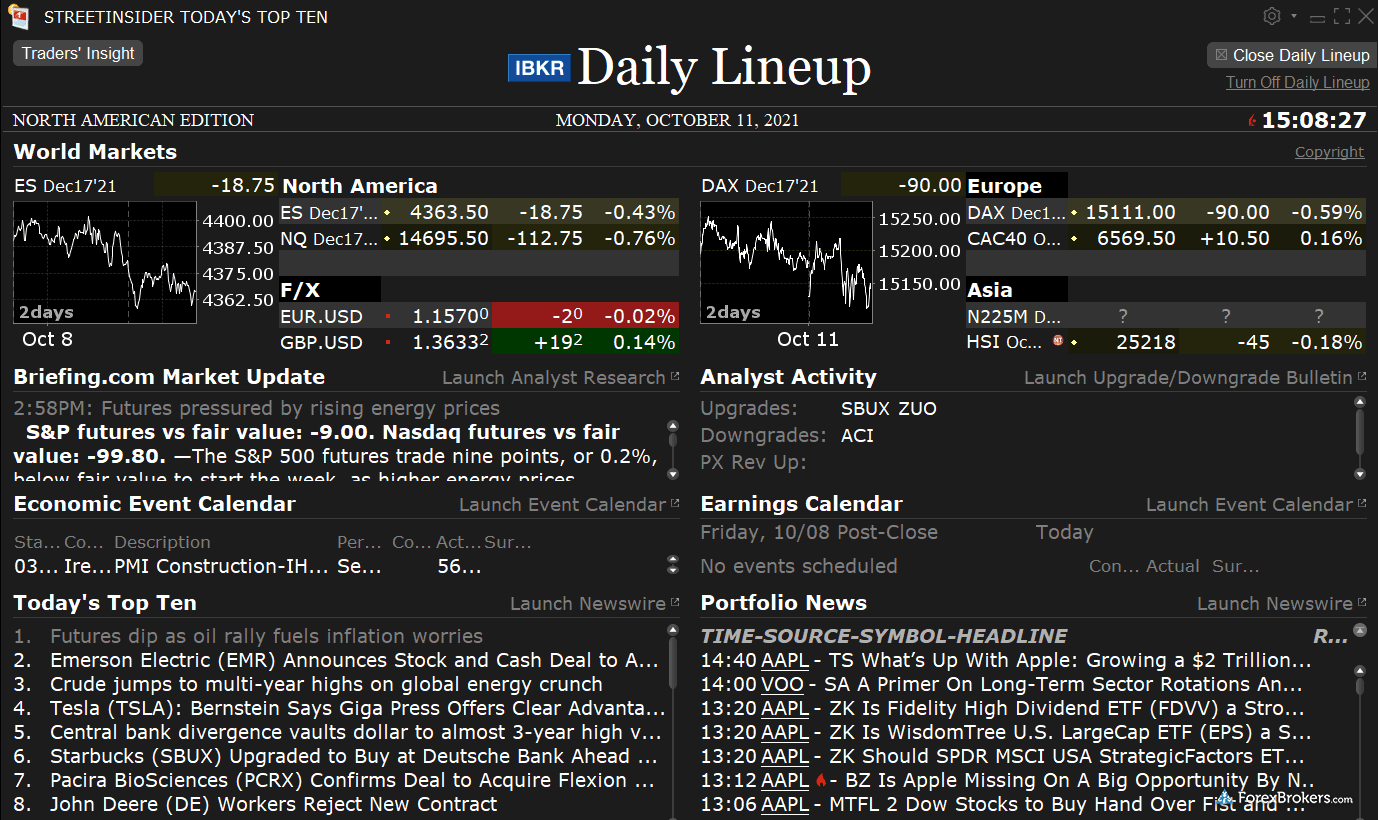

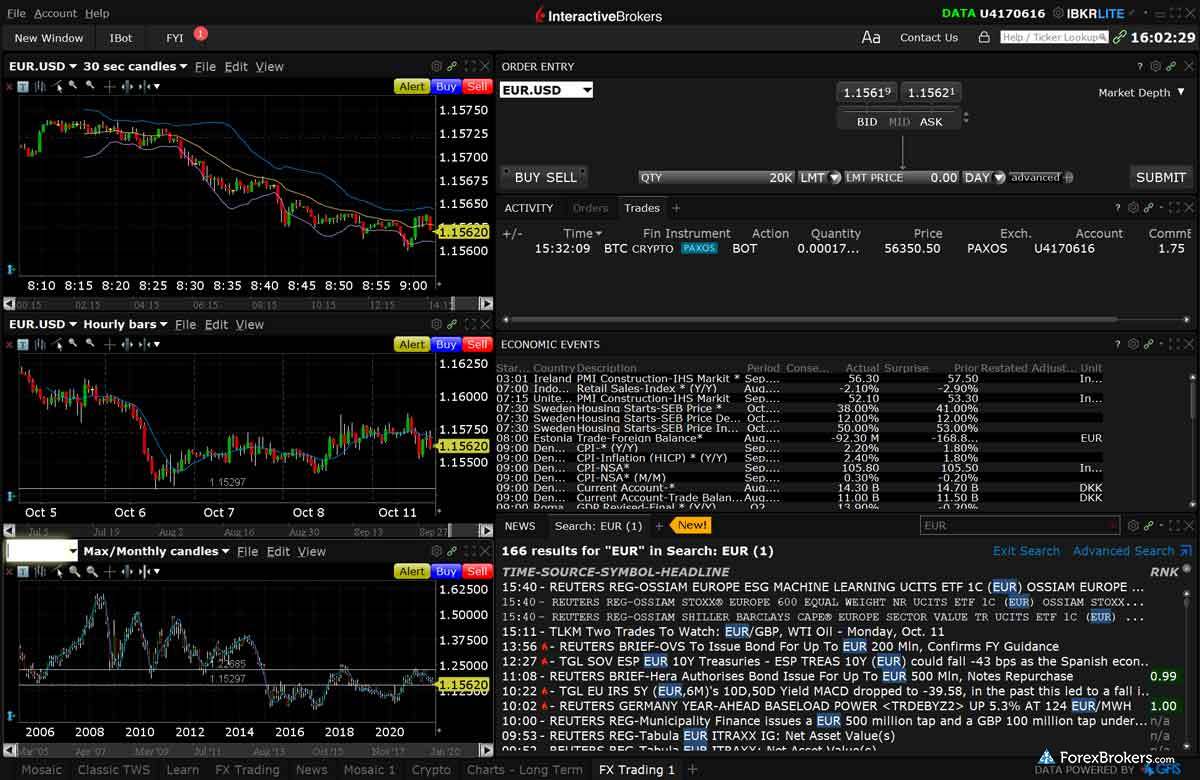

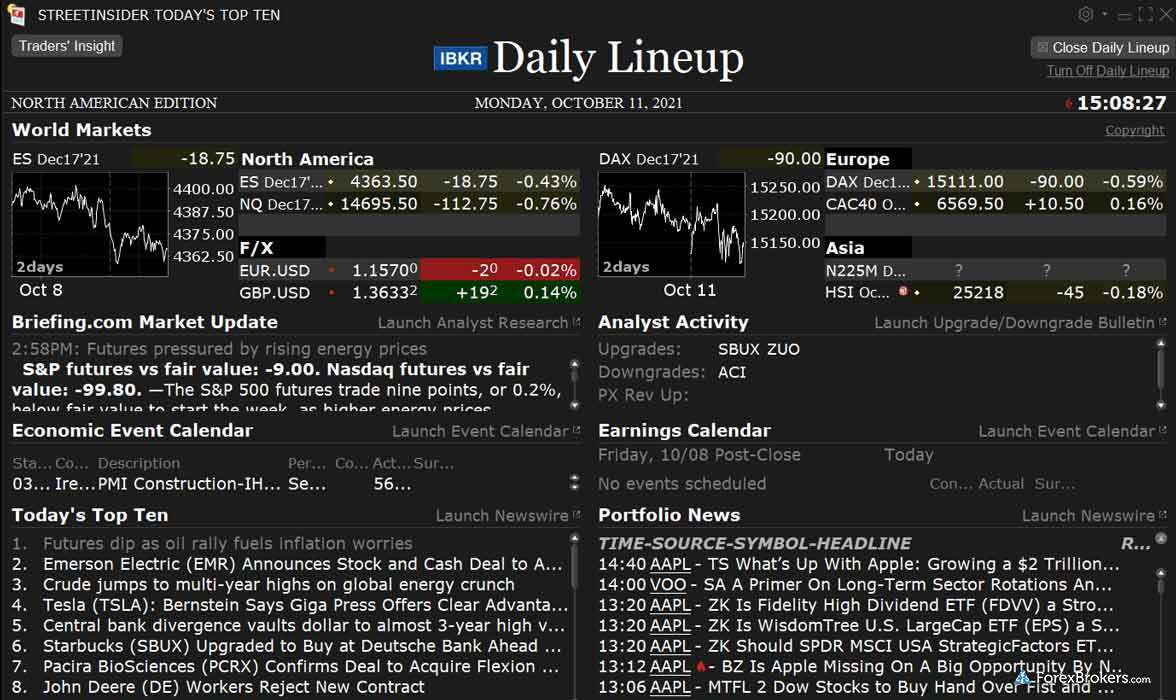

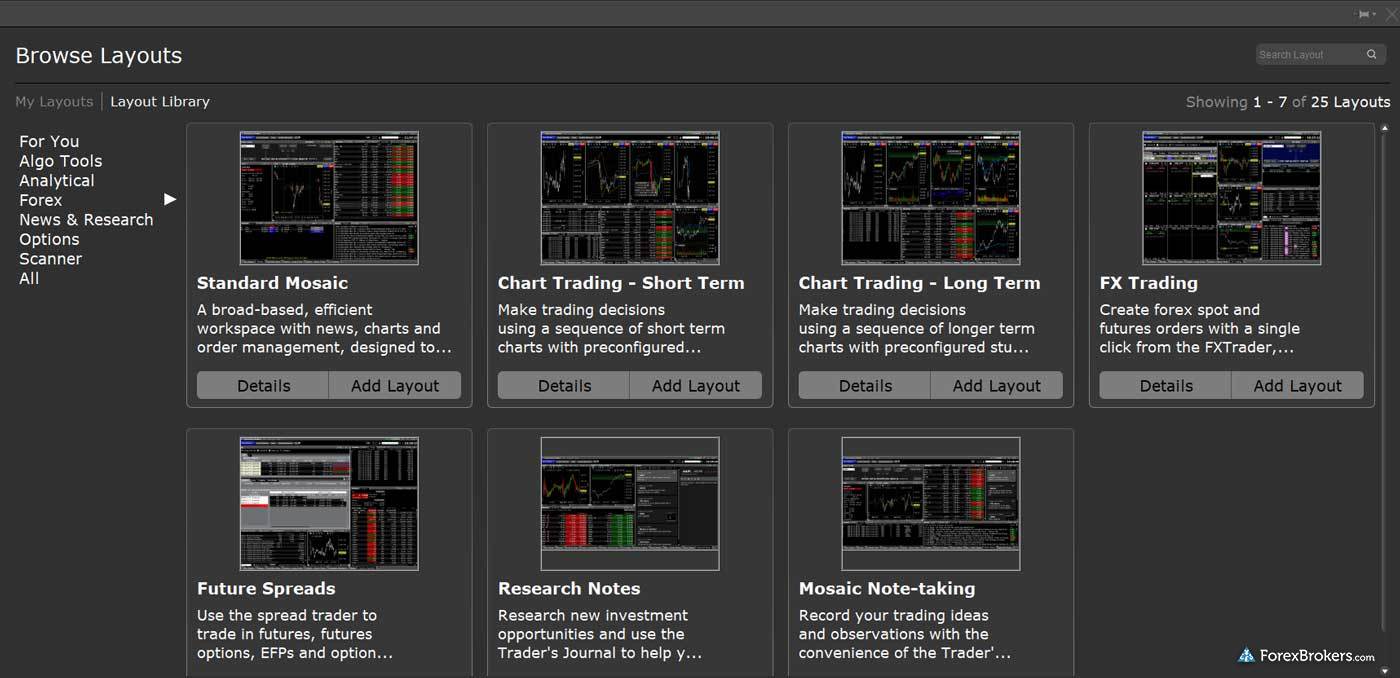

Interactive Brokers (IBKR) is another excellent choice for traders looking to hedge their forex-related orders at a highly trusted multi-asset broker. Traders on IBKR have access to a broad range of markets and instruments to either hedge directly or indirectly. This includes advanced options for how currency conversion takes place when trading on foreign exchanges, depending on your base currency.

Even if you don’t have access to forex trading directly based on your account or location, traders at IBKR can use forex futures and options to indirectly hedge their forex positions elsewhere. Learn more about the options available for forex trading by checking out my Interactive Brokers review.

Multiple choices for hedging strategies - Saxo

| Company |

Overall Rating |

Average Spread EUR/USD - Standard |

Commissions & Fees |

Minimum Deposit |

Visit Site |

Saxo Saxo

|

|

1.1 info |

|

$0 |

Visit Site

|

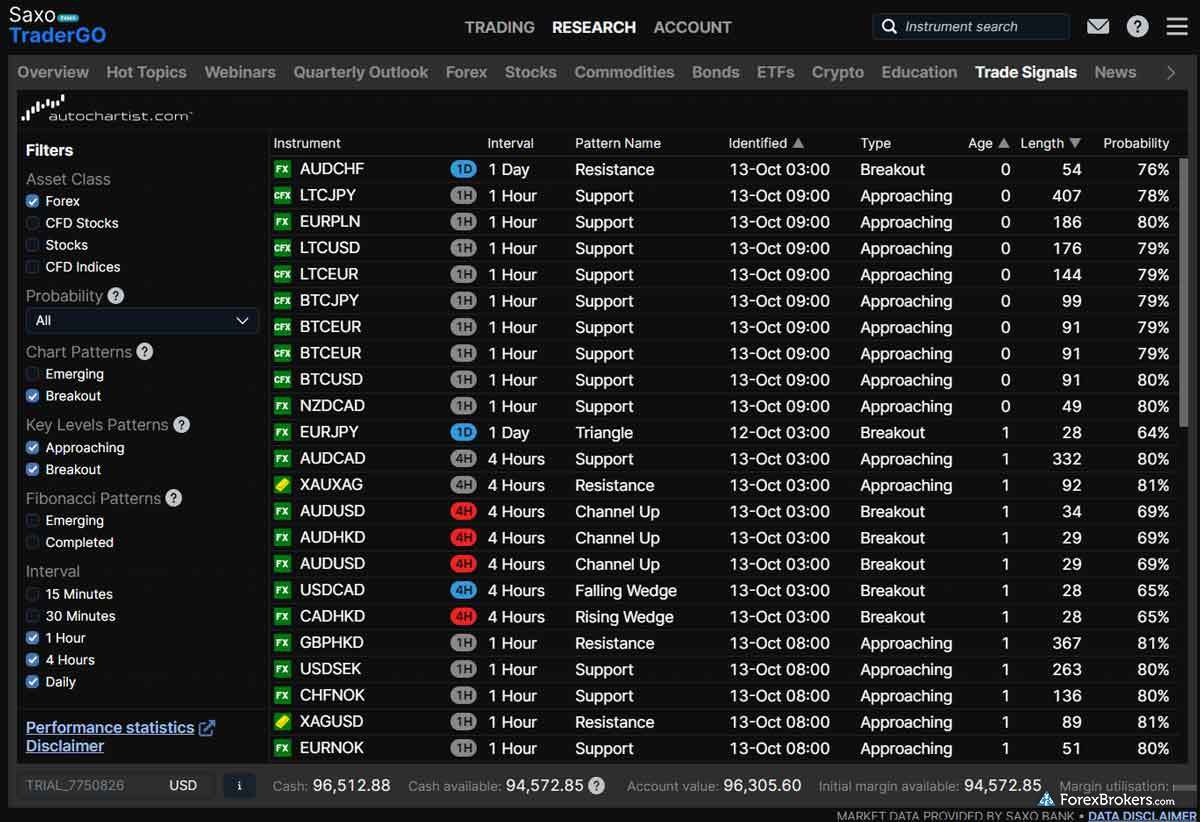

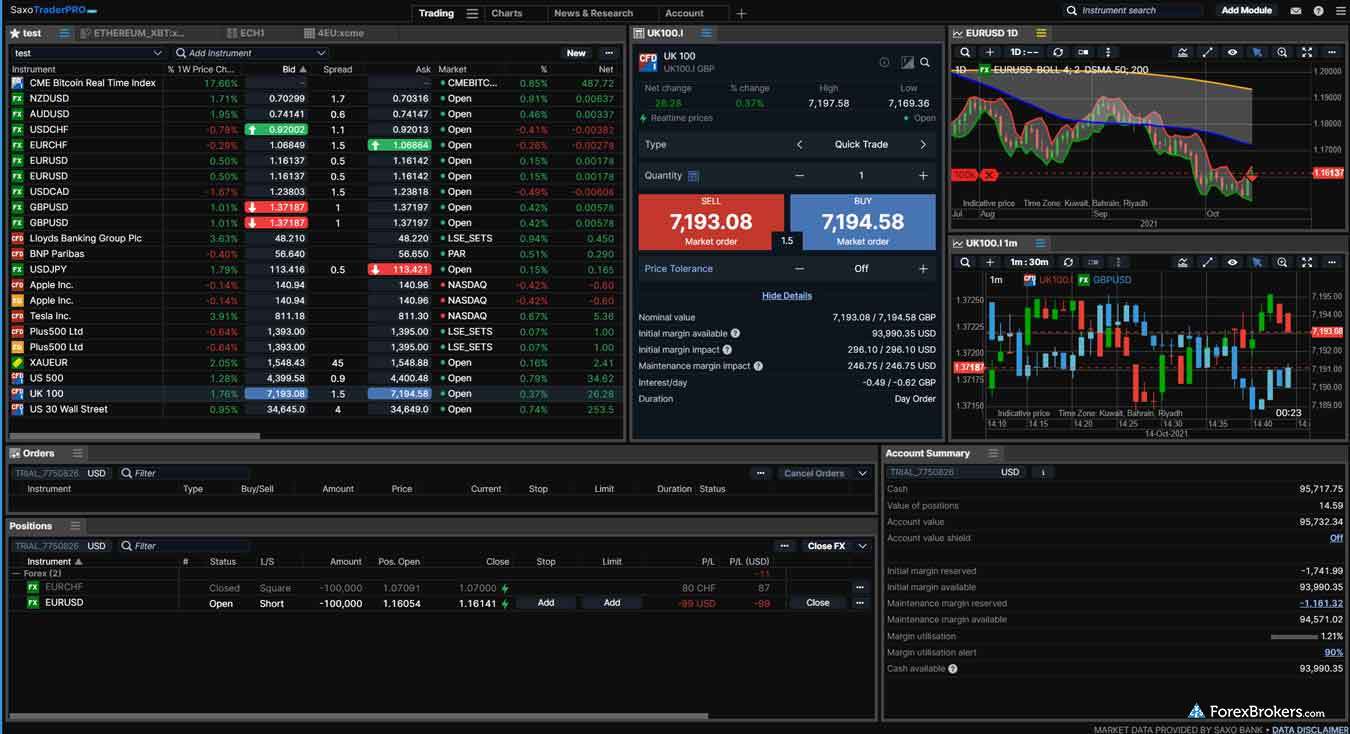

A well-regulated, highly trusted broker that ranks for many key categories, Saxo is another one of my top choices for hedging forex. Saxo offers you the ability to hedge in two ways: either by selecting “force open” after you have real-time first-in-first-out (FIFO) enabled, or enabling end-of-day FIFO as the netting method.

These settings are all configurable inside their easy-to-use SaxoTraderGO platform, making it relatively simple to switch hedging on or off with a few clicks. This seamless integration makes them stand out against the other competition in this field. Read my full Saxo review to learn more.

The importance of using regulated brokers to hedge

There are many possible reasons why an investor may want to hedge a position but, regardless of strategy, reliable execution of that hedge trade is essential. In an absolute worst-case scenario, a hedge trade fails and leaves your original position completely exposed.

It’s extremely important to use brokers that are regulated and highly trusted to reduce your risk of potential situations where a dispute can arise over your hedge trade. Each broker we review is rated using our proprietary Trust Score to allow you to judge their overall trustworthiness and reliability.

model_trainingDid you know?

Even brokers themselves may employ hedging to manage their own risk when executing client orders, such as when you’re executing a trade with a market maker broker.

FAQs

Is hedging legal in forex?

Hedging is not legal everywhere. Whether your broker offers hedging depends on your country of residence and the regulatory framework in which the broker operates. In the United States, the NFA has banned hedging for retail forex traders and requires that brokers close trades on a first-in-first-out (FIFO) basis while netting existing client account positions in their backend.

What types of investments can you hedge with a forex broker?

Hedging can be achieved in a variety of ways, both directly and indirectly. Much depends on what your hedging broker offers, the range of markets being accessed, and whether direct hedging is permitted or available for a specific security.

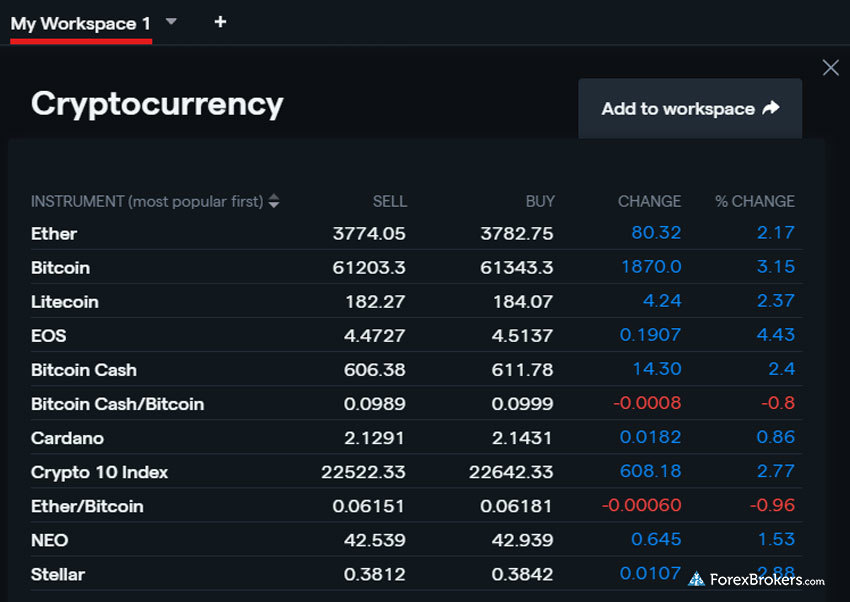

If the broker permits direct hedging, you can simply open an opposing trade to sell a forex currency pair or other security (like CFDs, futures, stocks, or crypto) for an amount based on the percentage you want to hedge.

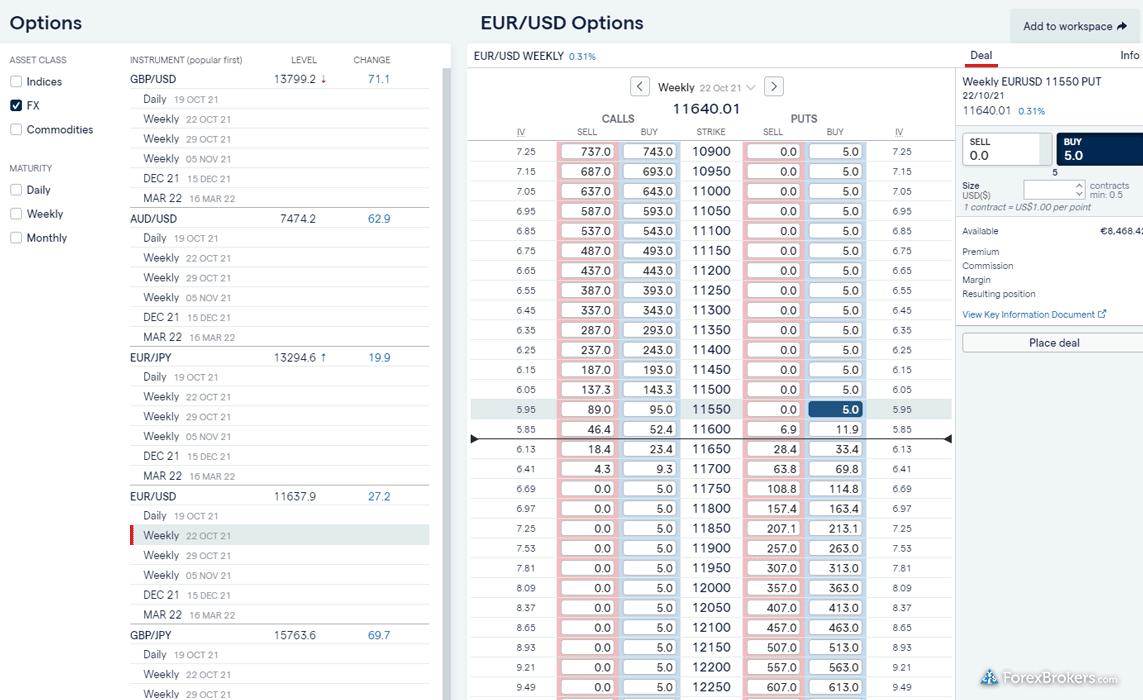

On the other hand, you can hedge indirectly by trading a different instrument for the same asset class, such as buying or selling forex options to hedge spot forex or vice versa. For example, a trader expecting a long-term appreciation in a currency pair may hedge their position against the event of a short-term pullback by purchasing a forex put option on that same pair. Should the market suddenly drop, the trader will profit from the put option and counteract the loss taken in the long-term position.

Do all brokers allow hedging?

No, not all forex brokers allow hedging. Whether hedging is available to you will depend on the individual broker and any applicable regulatory restrictions that may be in place based on your country of residence or the broker’s regulatory location.

Even hedging forex brokers may have platforms or account types that need to be adjusted to enable hedging. For example, CMC Markets allows you to enable hedging by disabling account netting from within their NextGeneration platform settings.

What is the best broker for hedging?

IG is the best broker for hedging in 2024. In addition to being our number one broker across nearly every other category, IG makes it easy to enable hedging, where permitted, from within its web platform or mobile app. When testing IG’s hedging capability, my testing found that their platform provides an option to toggle between “net off” (which means an opposing trade will close an existing one) and “force open” (which will open a new hedging position in the opposing direction without closing the initial trade). Check out my IG review to learn more about why IG stands out among the top forex brokers.

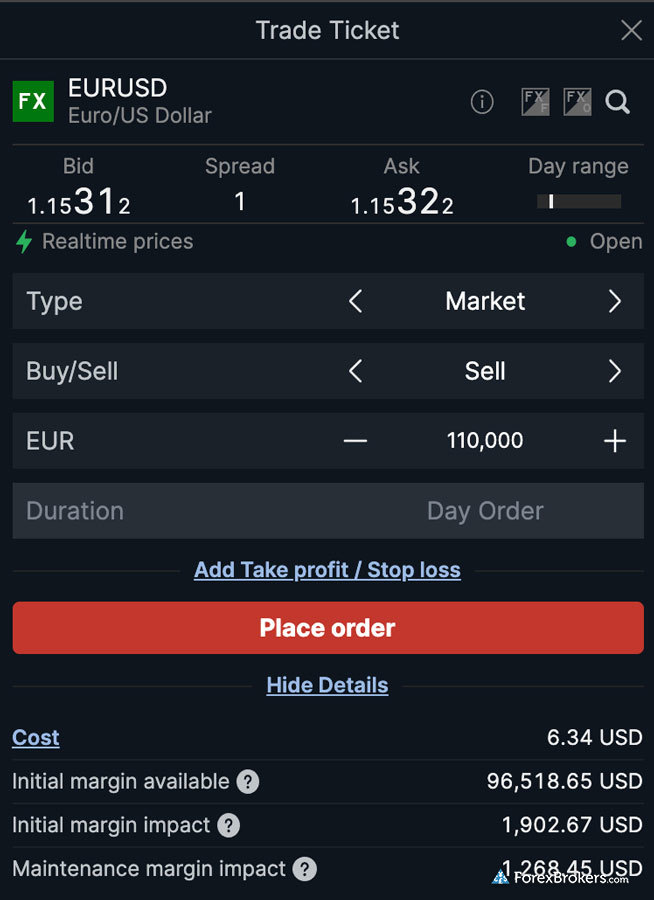

Hedging vs netting

Hedging brokers allow you to temporarily change directions while keeping both positions open. For example, let's say you opened a significant long position on the EUR/USD but now see the possibility of a downward trend that may only last a few hours. You might attempt to profit from this news by opening a new short position as a hedge against your existing long position. Both trades will be active, with their own stop or take profit limits (if enabled). Hedging can give you more control over setting stop or take profit limits on each individual trade.

Brokers that do not allow direct hedging will often offset trades using netting on a first-in-first-out (FIFO) basis. When netting is enabled you cannot hedge, and your broker simply increases or decreases your long or short position depending on what the overall net hedge would have been. This trade execution method is required by law in the U.S. for retail traders. When using FIFO, if you had multiple trades open for a given currency pair and wanted to close a portion of your overall position, the oldest trades would be the first to close.

savingsImportant:

A key point to consider with hedging is that you still incur trading costs from the multiple and distinct open positions, like spread costs or overnight fees.

Now that you've seen our picks for the best hedging forex brokers, check out the ForexBrokers.com Overall Rankings. We've evaluated over 60 forex brokers, using a testing methodology that's based on 100+ data-driven variables and thousands of data points. Check out our full-length, in-depth forex broker reviews.

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

IG

IG

Interactive Brokers

Interactive Brokers

Saxo

Saxo

CMC Markets

CMC Markets

FOREX.com

FOREX.com

TD Ameritrade

TD Ameritrade

City Index

City Index

XTB

XTB

eToro

eToro

Swissquote

Swissquote

Capital.com

Capital.com

AvaTrade

AvaTrade

Plus500

Plus500

OANDA

OANDA

FXCM

FXCM

Admirals

Admirals

Pepperstone

Pepperstone

XM Group

XM Group

FP Markets

FP Markets

FxPro

FxPro

IC Markets

IC Markets

Markets.com

Markets.com

Tickmill

Tickmill

Fineco Bank

Fineco Bank

BlackBull Markets

BlackBull Markets

Vantage

Vantage

HYCM (Henyep Capital Markets)

HYCM (Henyep Capital Markets)

HFM

HFM

ThinkMarkets

ThinkMarkets

FlowBank

FlowBank

DooPrime

DooPrime

Trading 212

Trading 212

BDSwiss

BDSwiss

Trade Nation

Trade Nation

TMGM

TMGM

Moneta Markets

Moneta Markets

Eightcap

Eightcap

MultiBank

MultiBank

ACY Securities

ACY Securities

RoboForex (RoboMarkets)

RoboForex (RoboMarkets)

VT Markets

VT Markets

easyMarkets

easyMarkets

IronFX

IronFX

Spreadex

Spreadex

IFC Markets

IFC Markets

Trade360

Trade360

Octa

Octa

Axi

Axi

TeleTrade

TeleTrade

GKFX

GKFX

Vestle

Vestle

FXOpen

FXOpen

FXPrimus

FXPrimus

Forex4you

Forex4you

GBE brokers

GBE brokers

Alpari

Alpari

TopFX

TopFX

Libertex (Forex Club)

Libertex (Forex Club)

LegacyFX

LegacyFX

FXGT.com

FXGT.com

ATFX

ATFX

Xtrade

Xtrade