Best Forex Brokers in Poland for 2024

ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

In recent years, Poland has transformed from an emerging economy into a highly developed market, joining 25 other countries (such as the U.S., U.K., and Australia) that have attained “developed market” status with the FTSE Russell.

Regulation by the Polish Financial Supervisory Authority (PFSA) and the country’s robust capital markets have created an environment conducive to trading and speculating on forex, CFDs, and a range of other asset classes.

This guide will help you find the best, most trusted forex brokers for trading forex and CFDs in Poland in 2024.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Best Forex Brokers in Poland

To help you find the best forex brokers in Poland, we’ve compiled a list of regulated brokers that currently accept residents of Poland as clients. We then ranked those brokers based on our extensive independent research (learn more about how we test brokers).

Here is our list of the top forex brokers in Poland for 2024:

-

Saxo

- Best web-based trading platform

- CMC Markets - Excellent overall, best platform technology

- FOREX.com - Excellent all-round offering

- XTB - Great research and education

-

Capital.com

- Great for beginners, easy to use

-

AvaTrade

- Great for beginners and copy trading

-

Plus500

- Multi-asset CFD broker, intuitive platform

Best Forex Brokers Poland Comparison

Compare authorised forex and CFDs brokers side by side using the forex broker comparison tool or the summary table below. This broker list is sorted by my overall rankings of the top forex brokers.

| Company | Accepts PL Residents | Average Spread EUR/USD - Standard | Minimum Deposit | Overall Rating | Visit Site |

Saxo Saxo

|

1.1 | $0 |

|

Visit Site

|

|

CMC Markets CMC Markets

|

0.61 | $0 |

|

||

FOREX.com FOREX.com

|

1.4 | $100 |

|

||

XTB XTB

|

1.00 | $0 |

|

||

Capital.com Capital.com

|

0.67 | $20 |

|

Visit Site

|

|

AvaTrade AvaTrade

|

0.92 | $100 |

|

Visit Site

|

|

Plus500 Plus500

|

N/A | €100 |

|

Visit Site

|

|

FXCM FXCM

|

0.74 | Starts from $50 |

|

Visit Site

|

|

Pepperstone Pepperstone

|

0.77 | $200 |

|

Visit Site

|

|

XM Group XM Group

|

1.6 | $5 |

|

Visit Site

|

|

FP Markets FP Markets

|

1.1 | $100 AUD |

|

Visit Site

|

|

IC Markets IC Markets

|

0.62 | $200 |

|

Visit Site

|

|

Tickmill Tickmill

|

0.51 | $100 |

|

||

BlackBull Markets BlackBull Markets

|

0.76 | $0 |

|

Visit Site

|

|

HFM HFM

|

1.2 | $0 |

|

Visit Site

|

|

FlowBank FlowBank

|

N/A | $0 |

|

||

Trading 212 Trading 212

|

1.9 | €10 |

|

||

Trade Nation Trade Nation

|

0.6 | $0 |

|

||

Moneta Markets Moneta Markets

|

1.27 | $50 |

|

||

Eightcap Eightcap

|

1.0 | $100 |

|

Visit Site

|

|

ACY Securities ACY Securities

|

1.2 | $50 |

|

Visit Site

|

|

easyMarkets easyMarkets

|

0.9 | $50 |

|

||

Spreadex Spreadex

|

0.81 | $0 |

|

Visit Site

|

Who are the most trusted forex brokers in Poland?

The following brokers accept clients locally in Poland. Based on our research into each broker’s range of regulatory licenses – we’ve created this list of the Top 5 most trusted forex brokers in Poland in 2024 (learn more by visiting our Trust Score page).

#1 - CMC Markets

99 Trust Score - Publicly traded, won our 2024 Annual Award for #1 Most Currency Pairs

CMC Markets is regulated by some of the most important global financial regulators, including five Tier-1 jurisdictions. CMC Markets is also publicly traded; to become publicly traded, brokers must make numerous public disclosures for compliance purposes. Read our full-length review of CMC Markets.

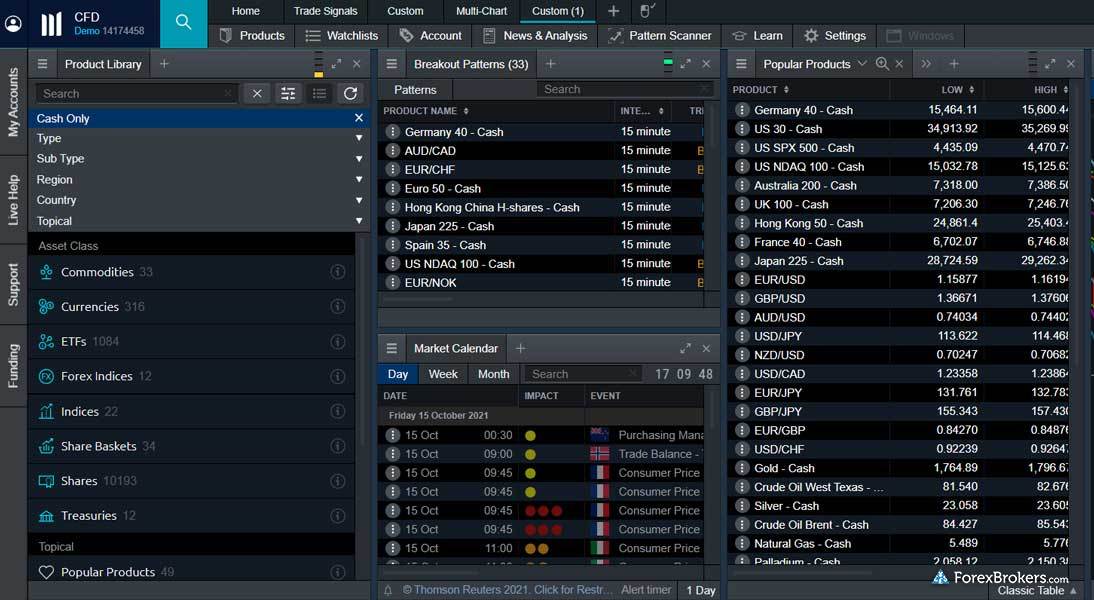

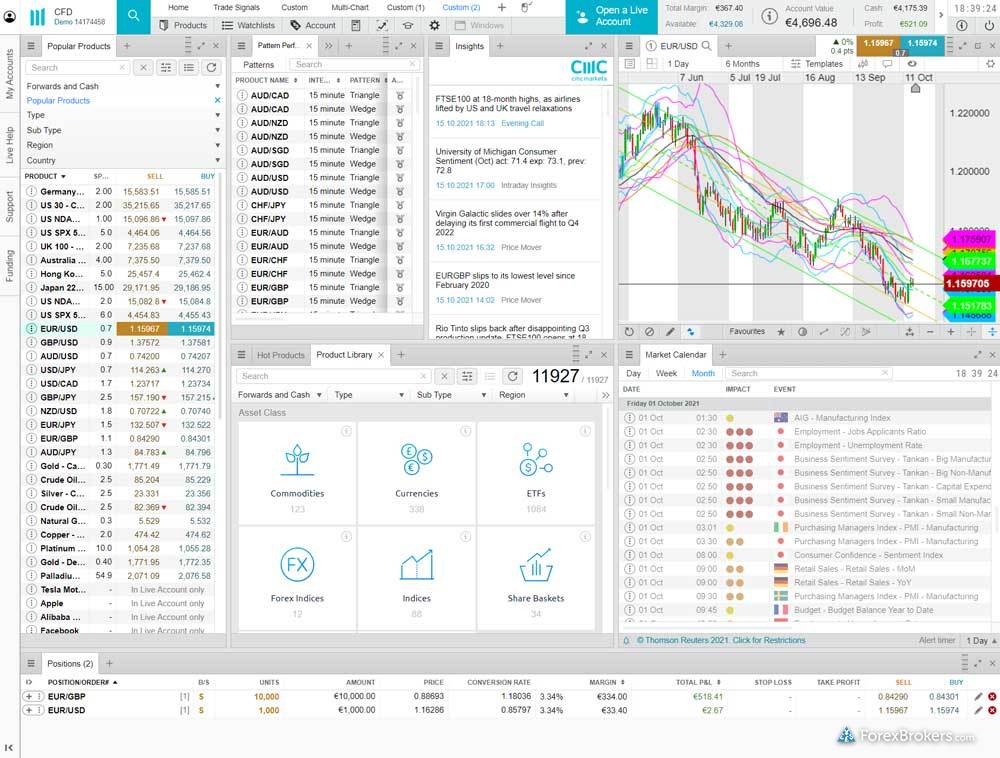

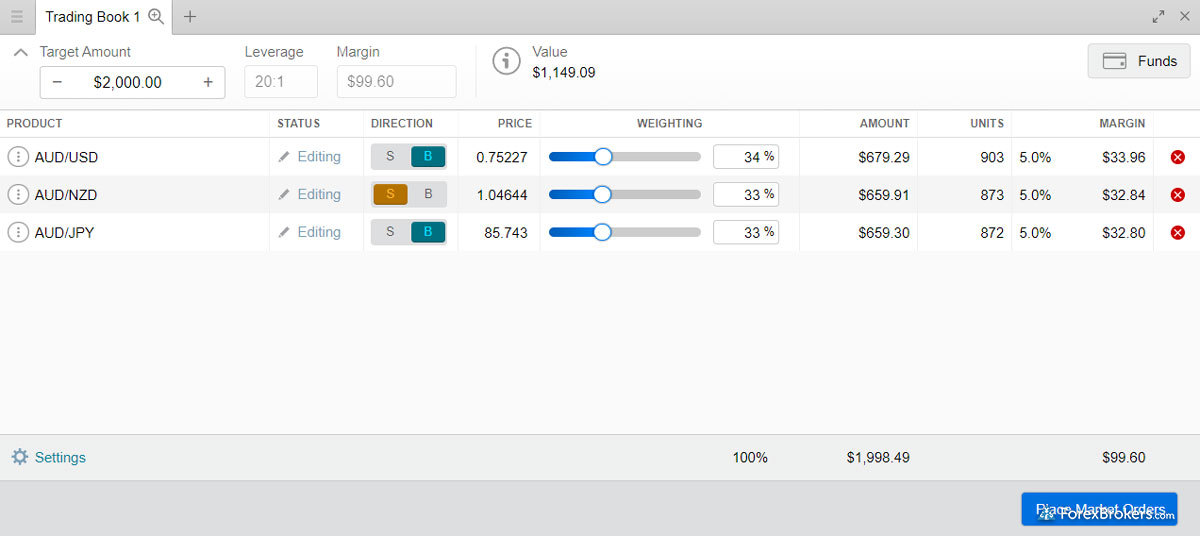

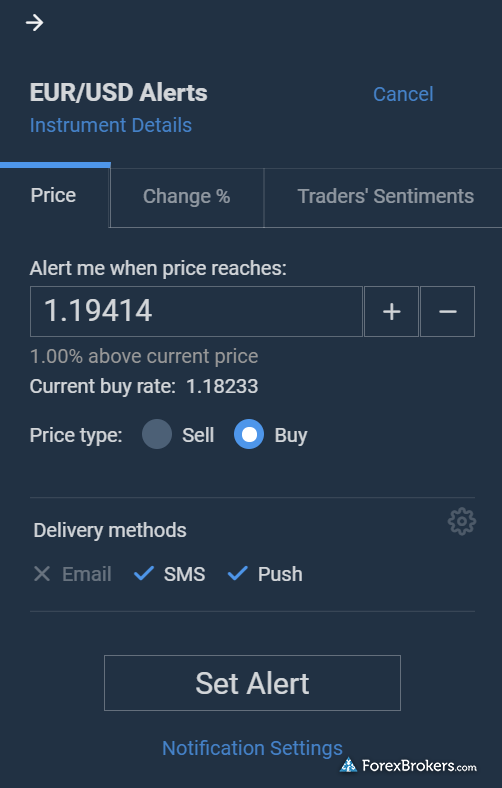

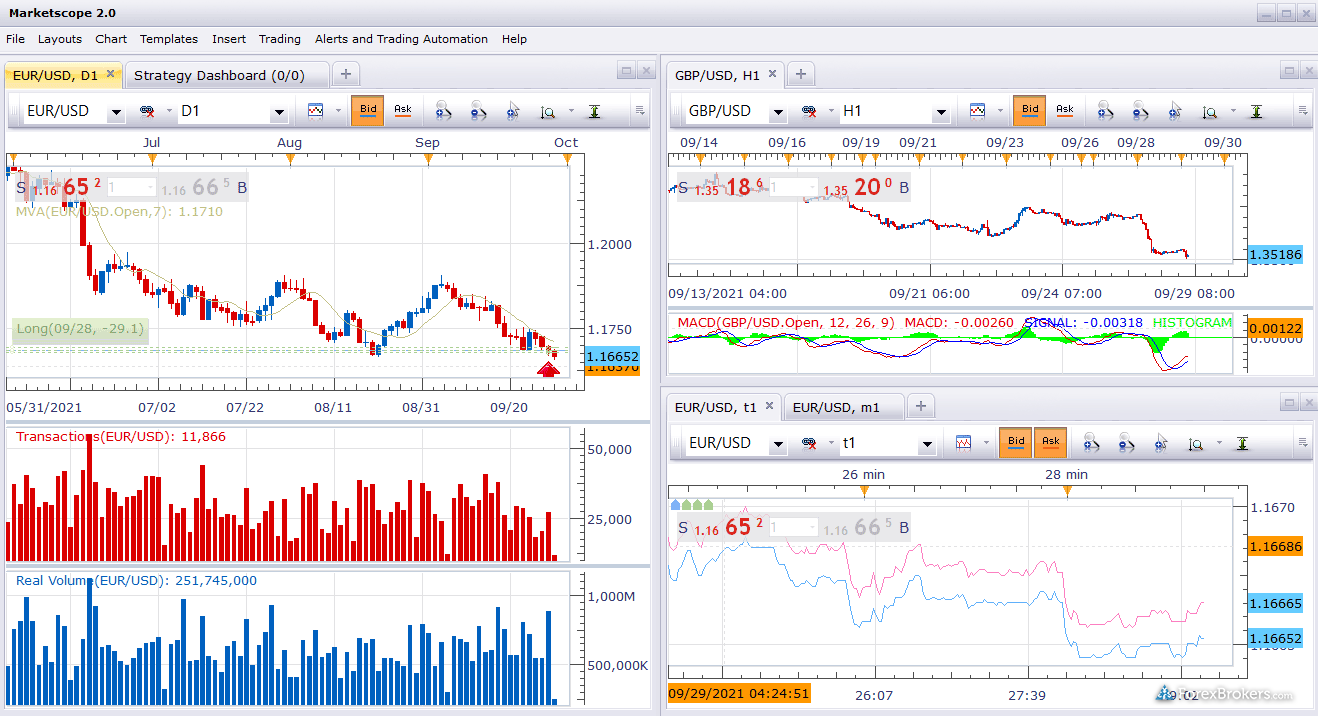

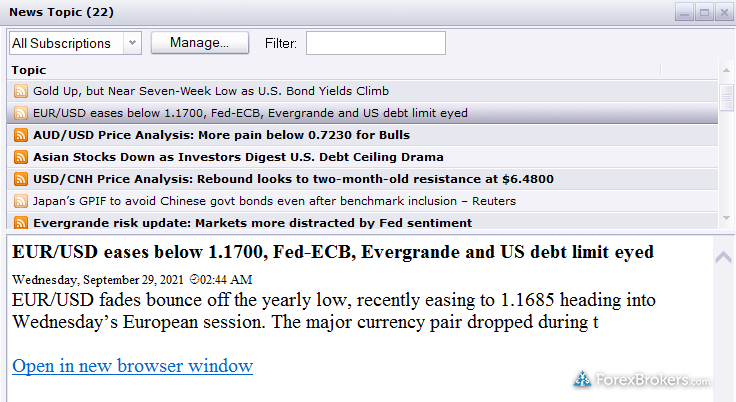

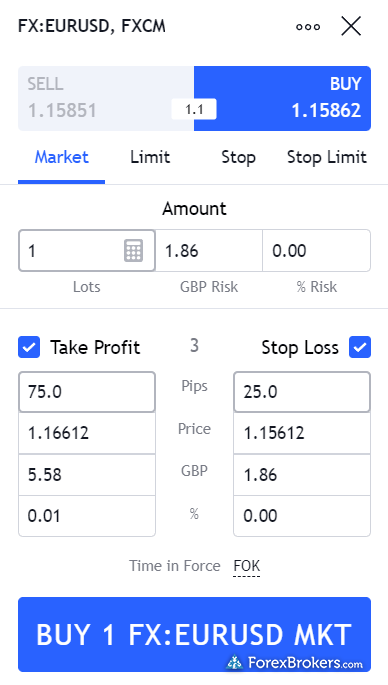

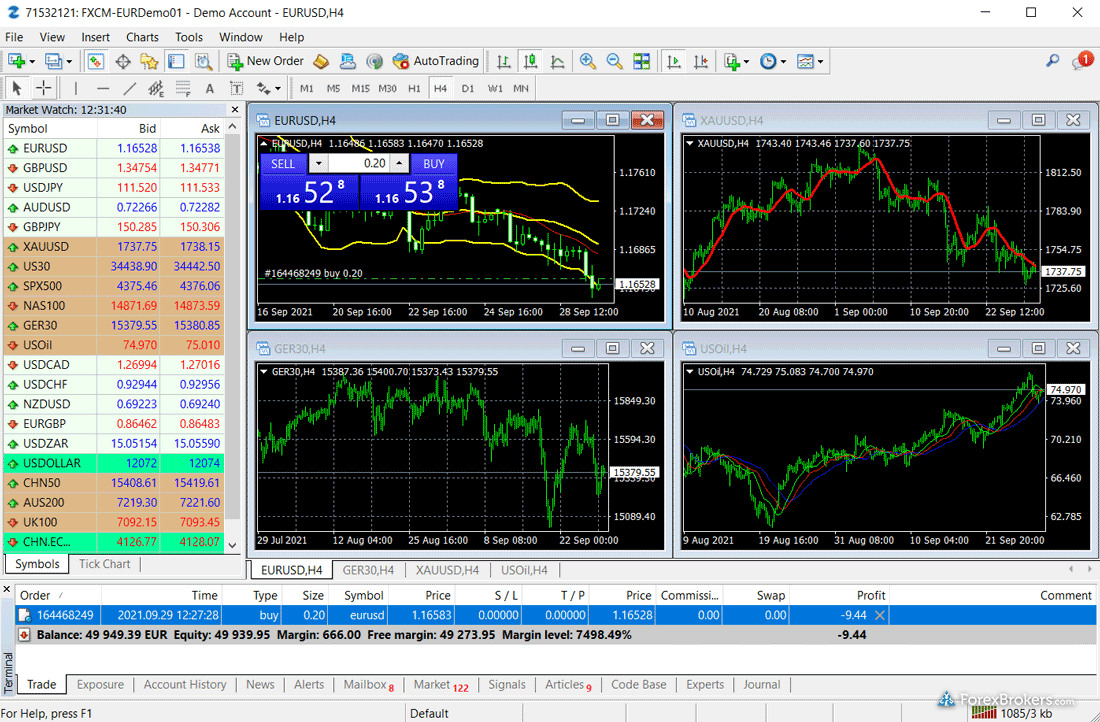

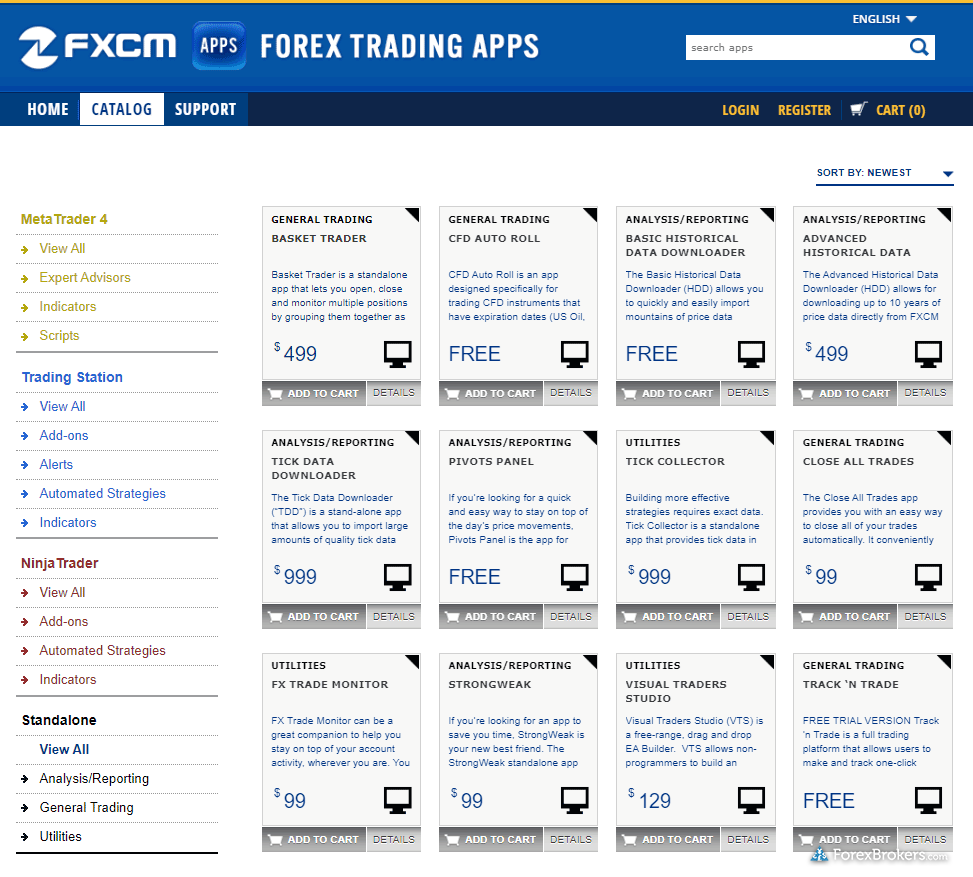

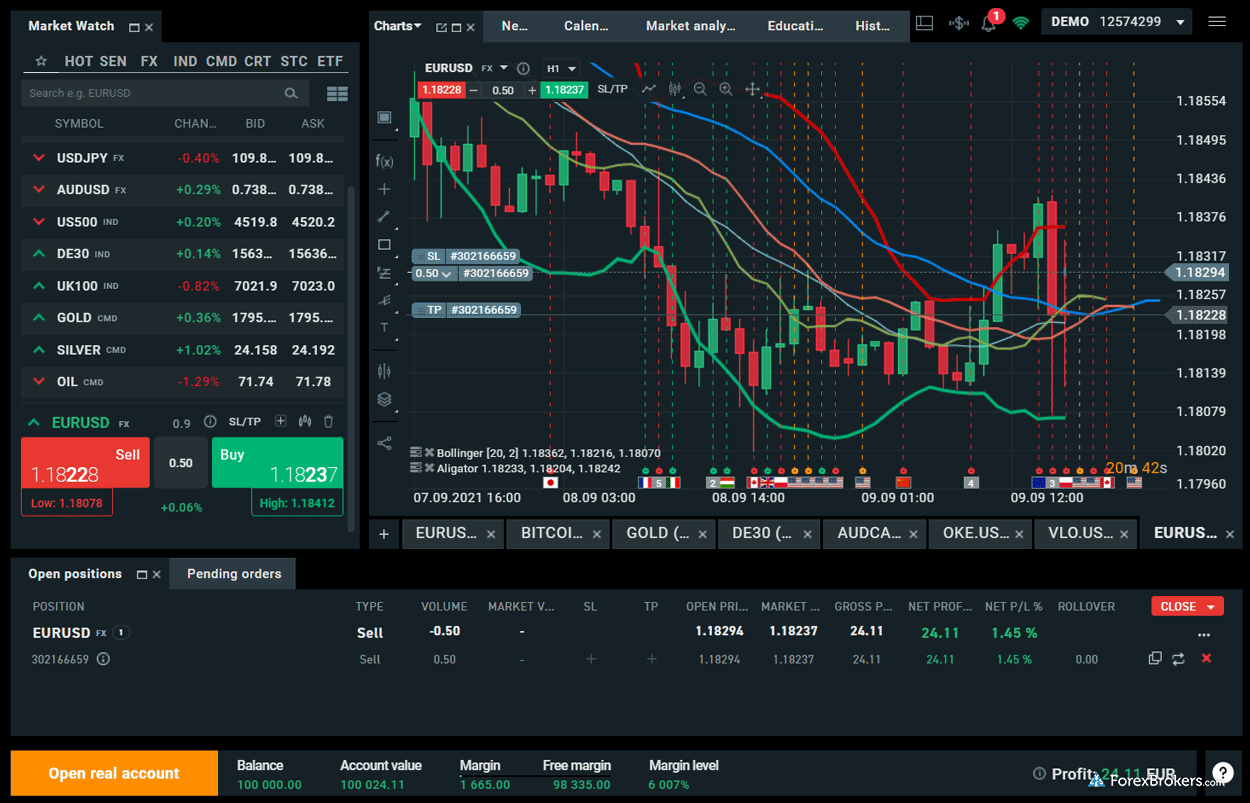

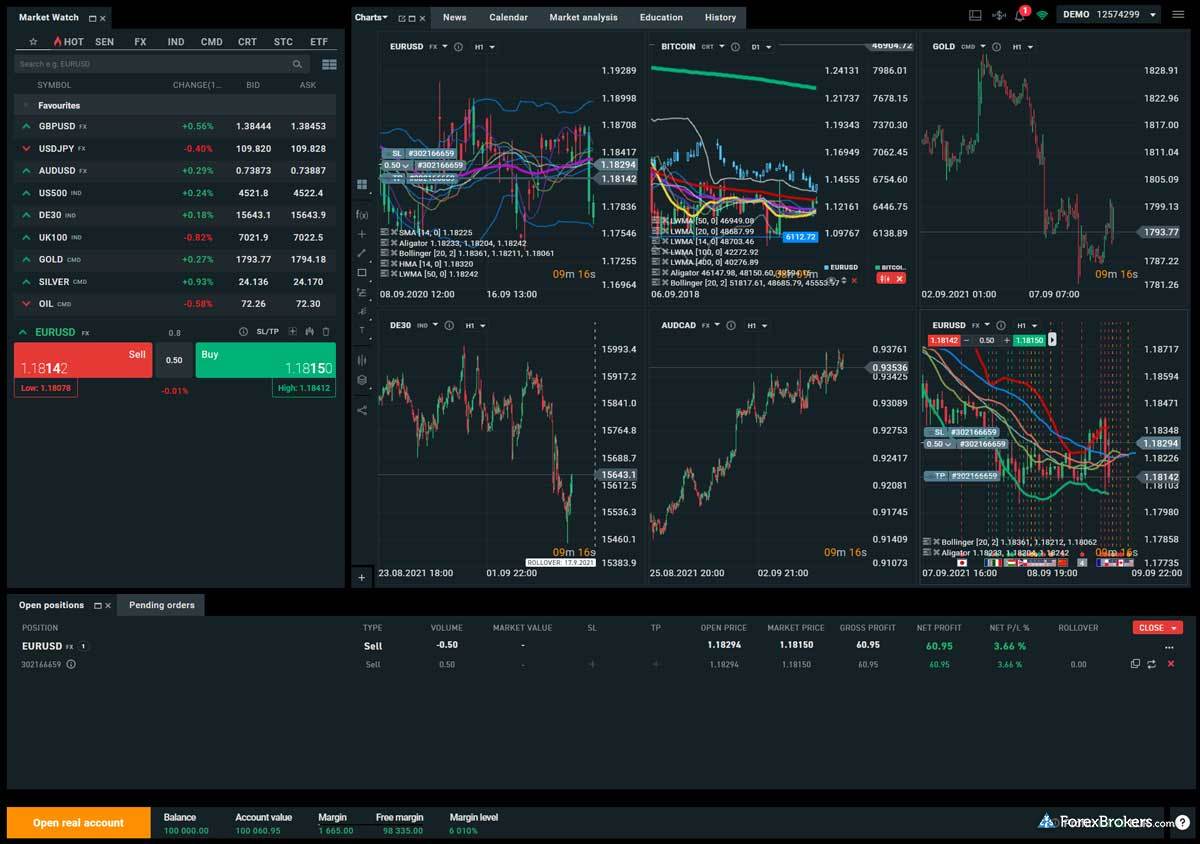

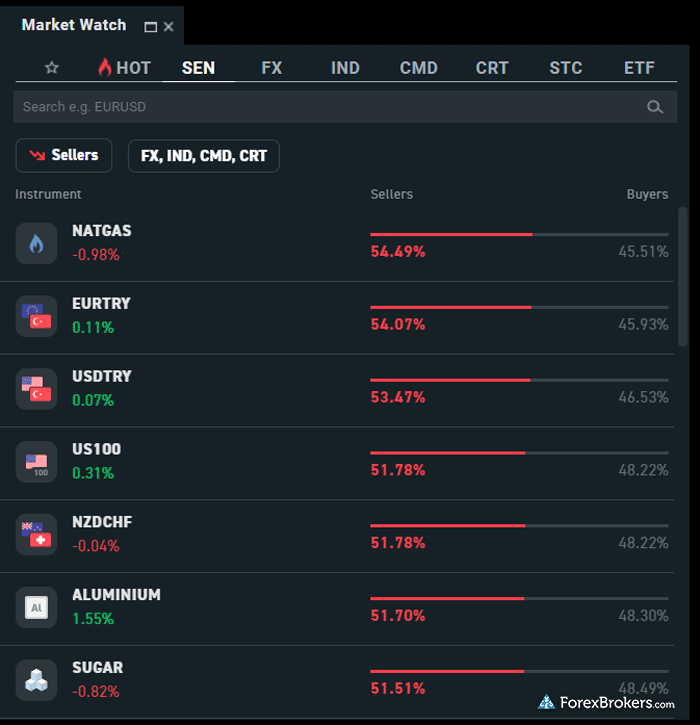

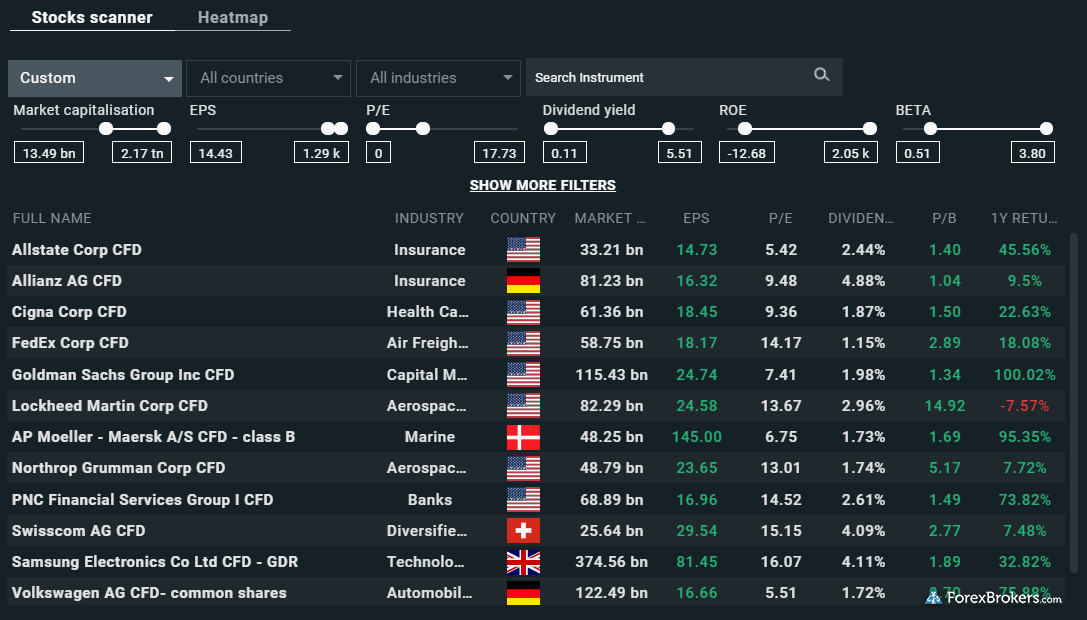

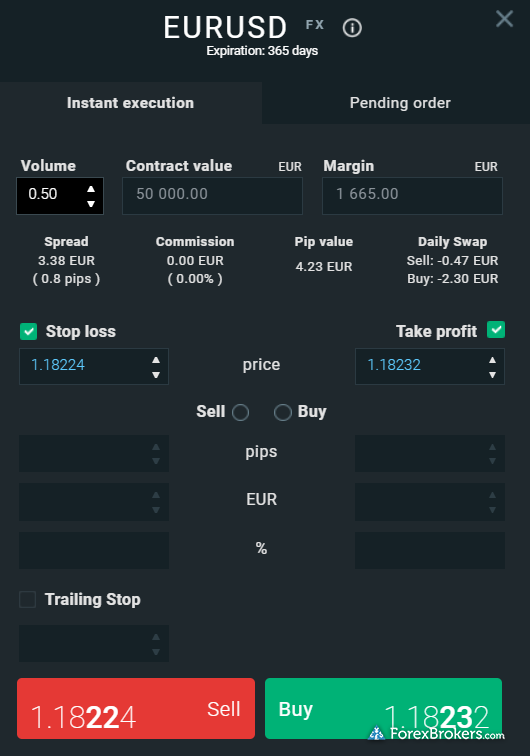

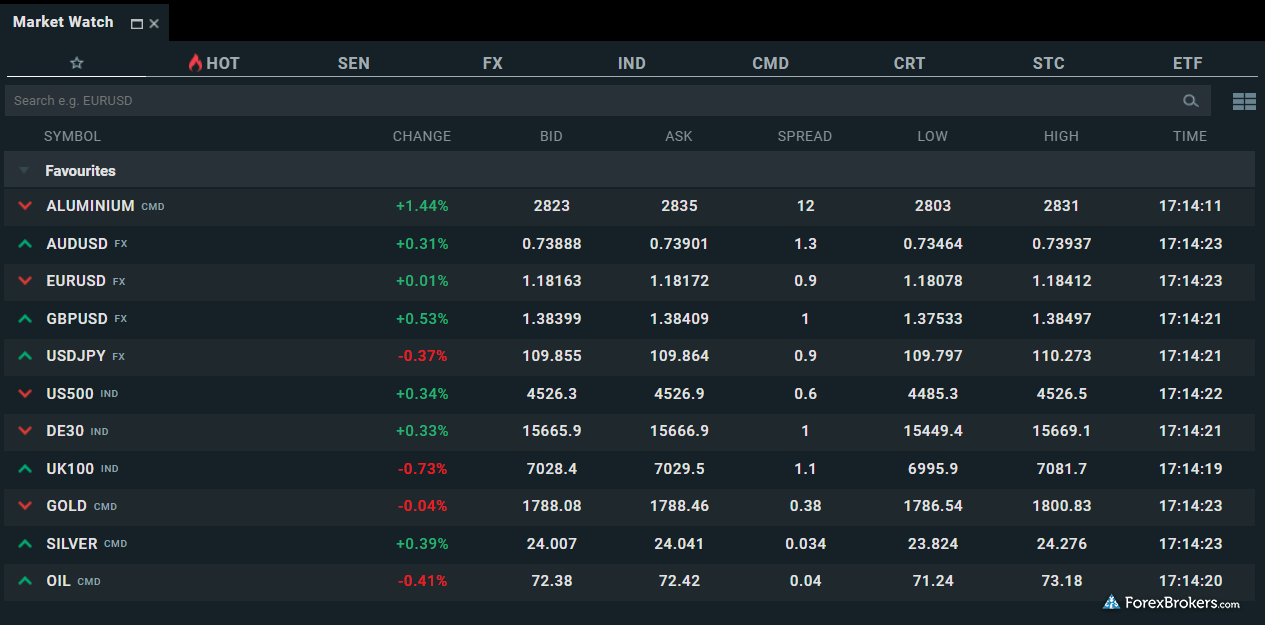

Check out some screenshots from CMC Markets' trading platforms, taken by our research team during our product testing.

#2 - Saxo Bank

99 Trust Score - Operates three banks, earned our top 2024 Annual Award for Platforms & Tools

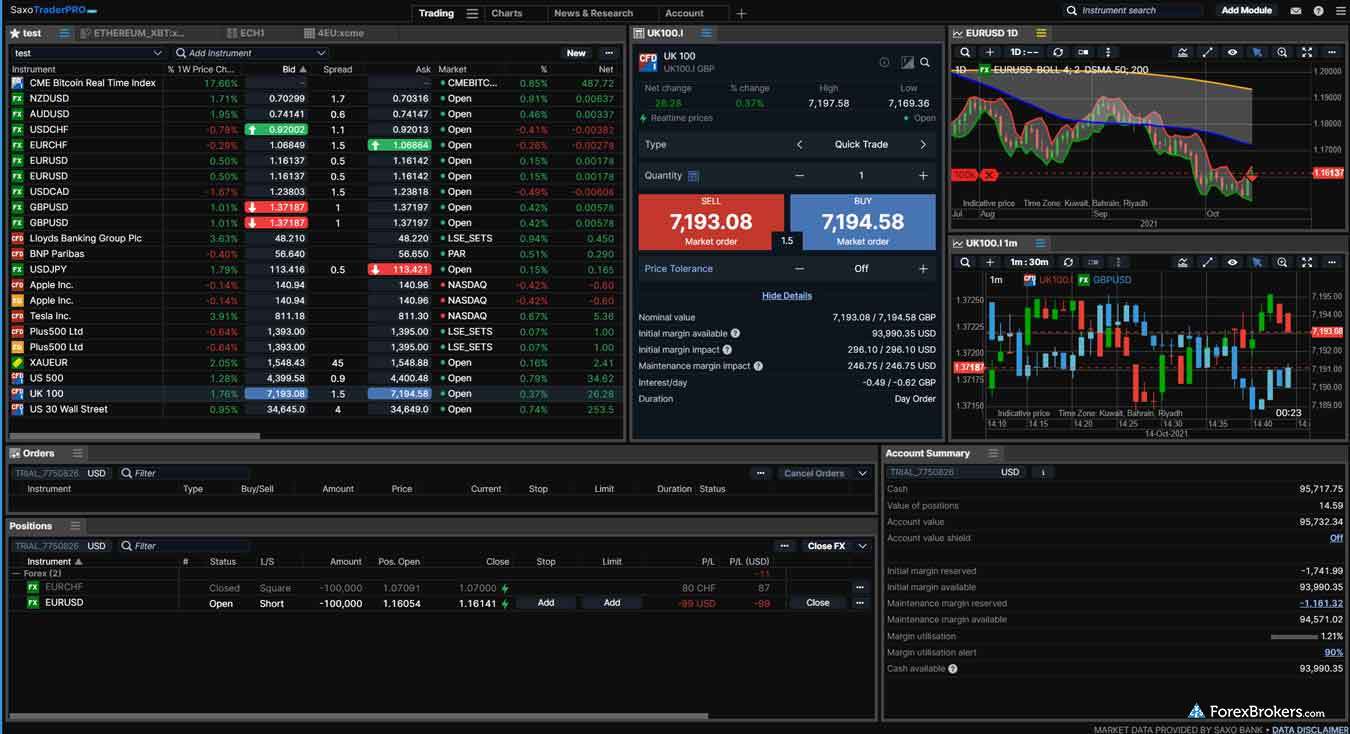

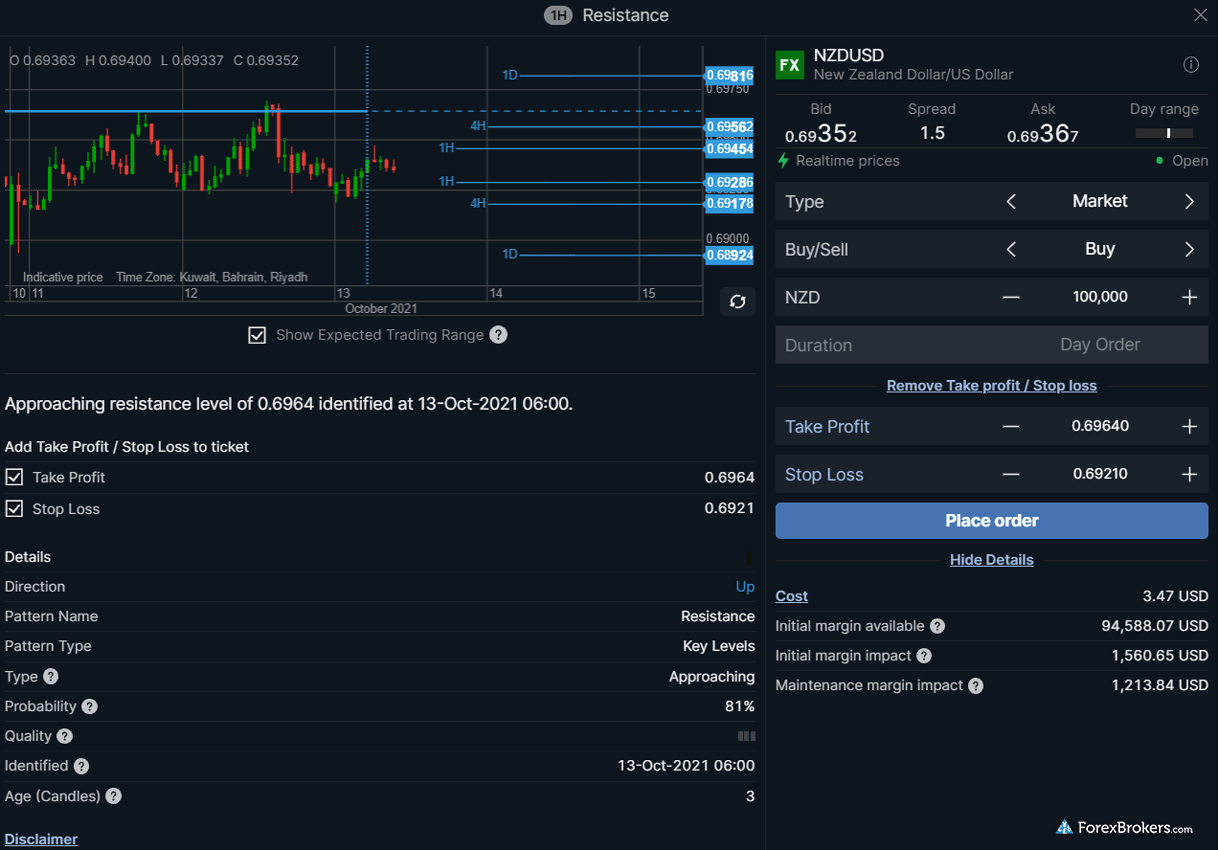

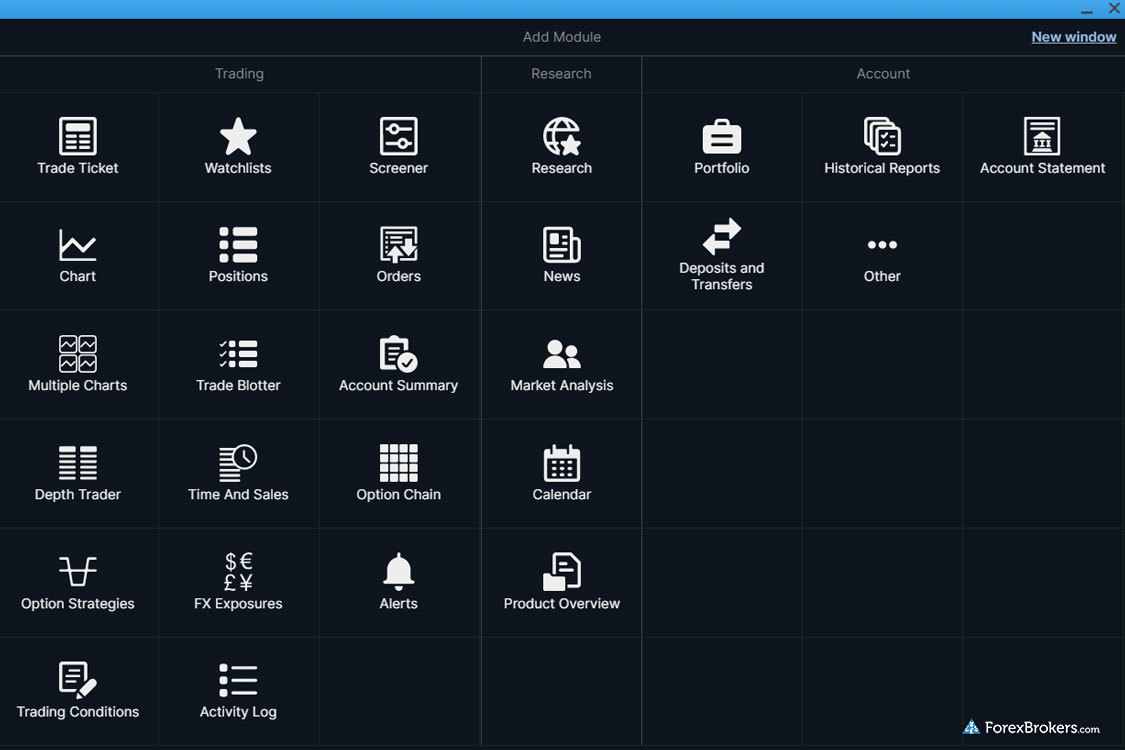

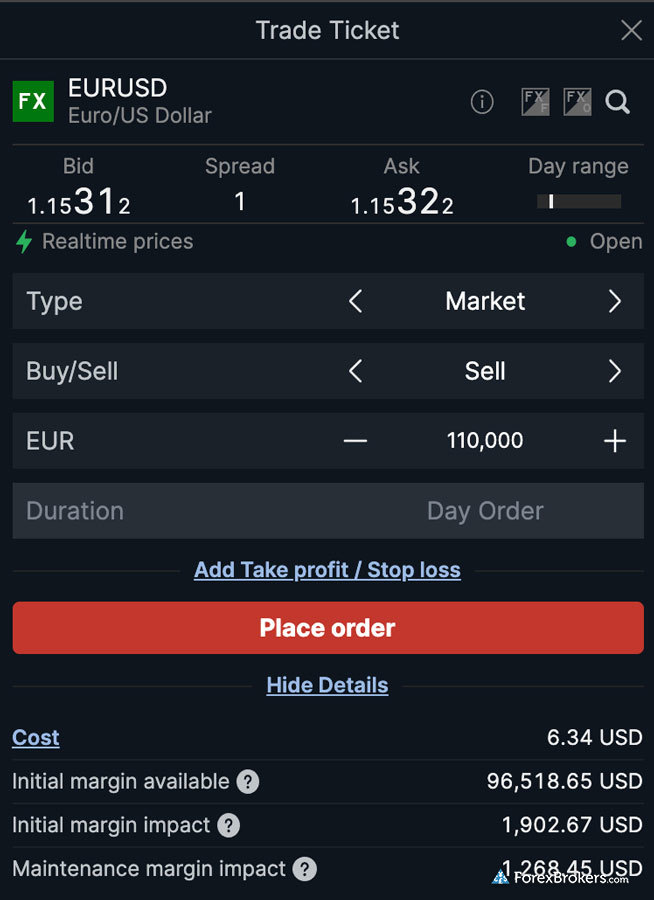

Saxo Bank operates three fully regulated banks and is licensed in seven Tier-1 jurisdictions across more than a dozen international jurisdictions. Saxo Bank holds over €85 billion in client assets and has operated for over thirty years. Check out our full-length review of Saxo Bank to learn more.

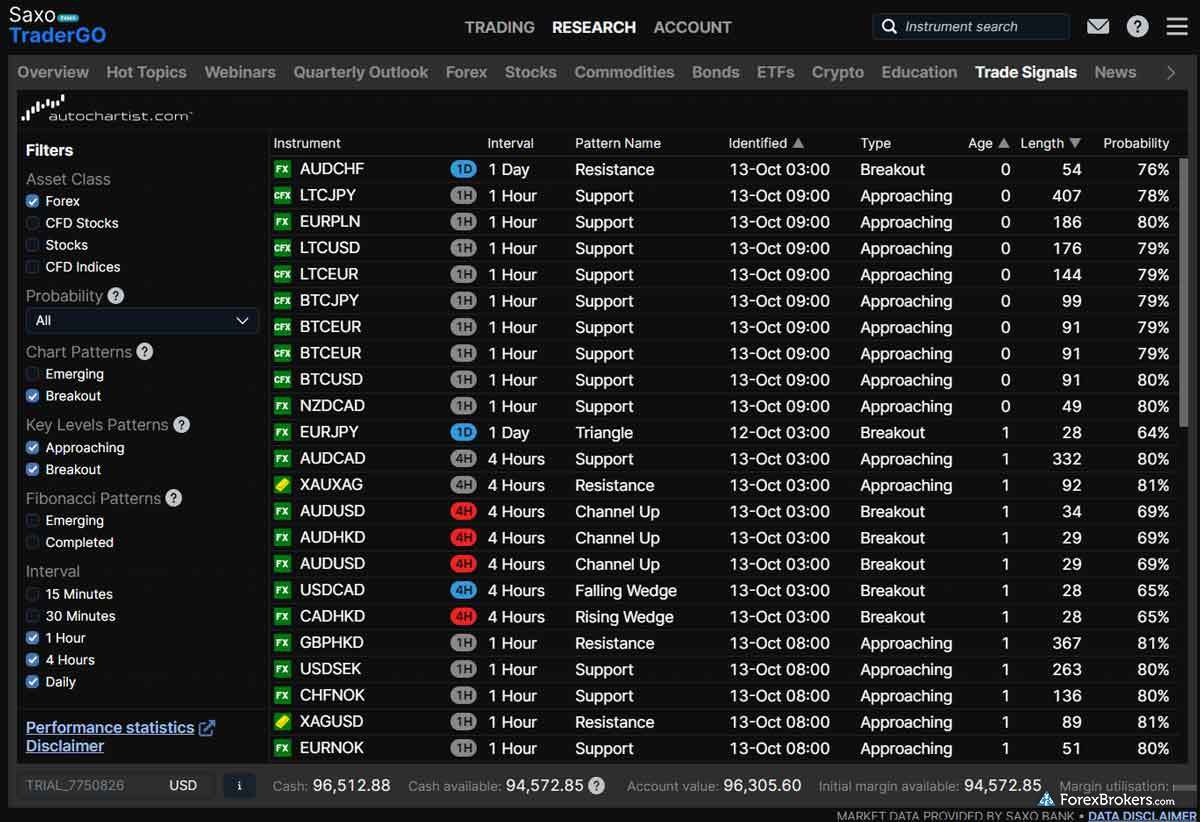

Browse a gallery of screenshots from Saxo Bank's trading platforms, taken by our research team during our product testing.

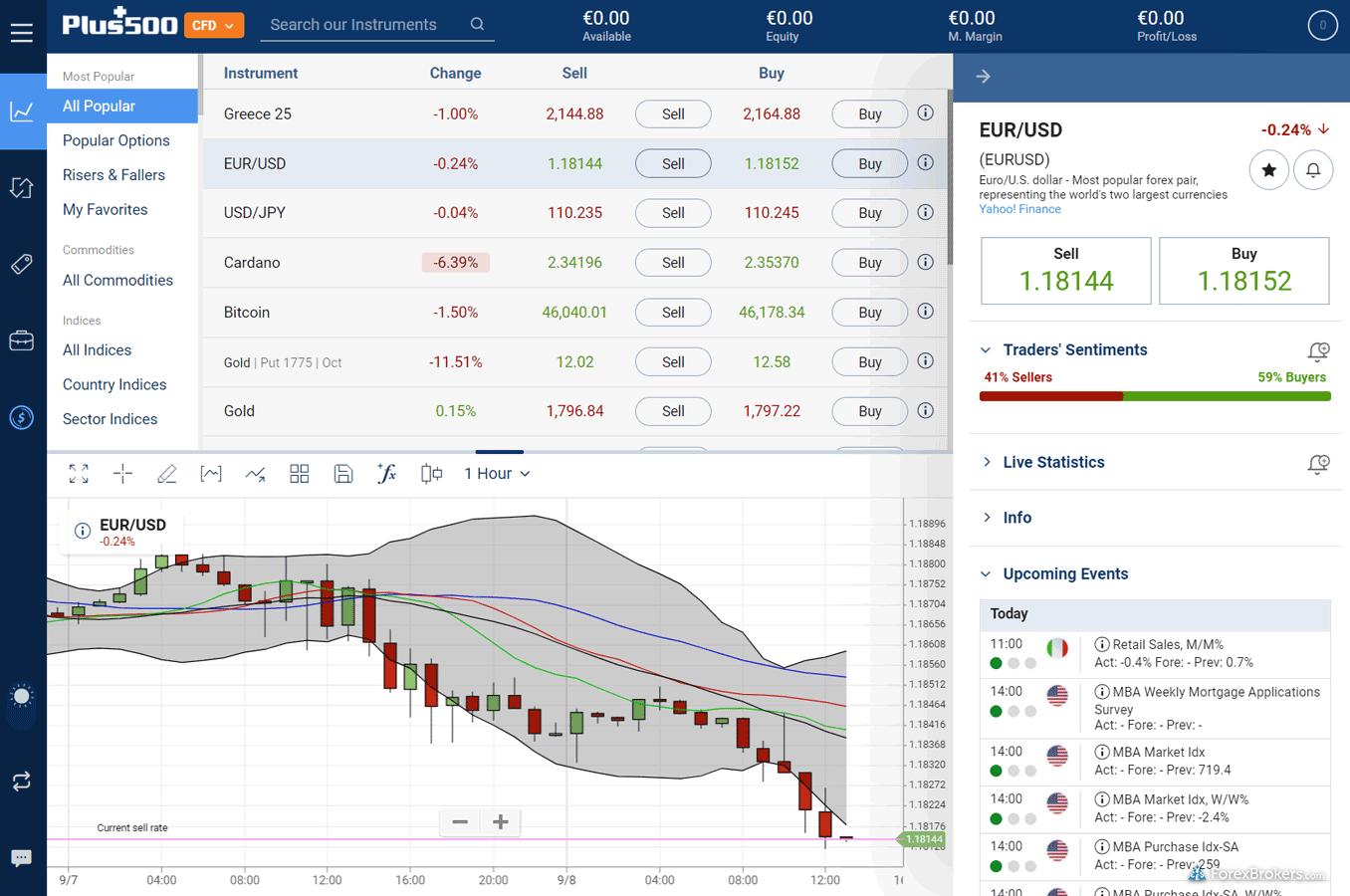

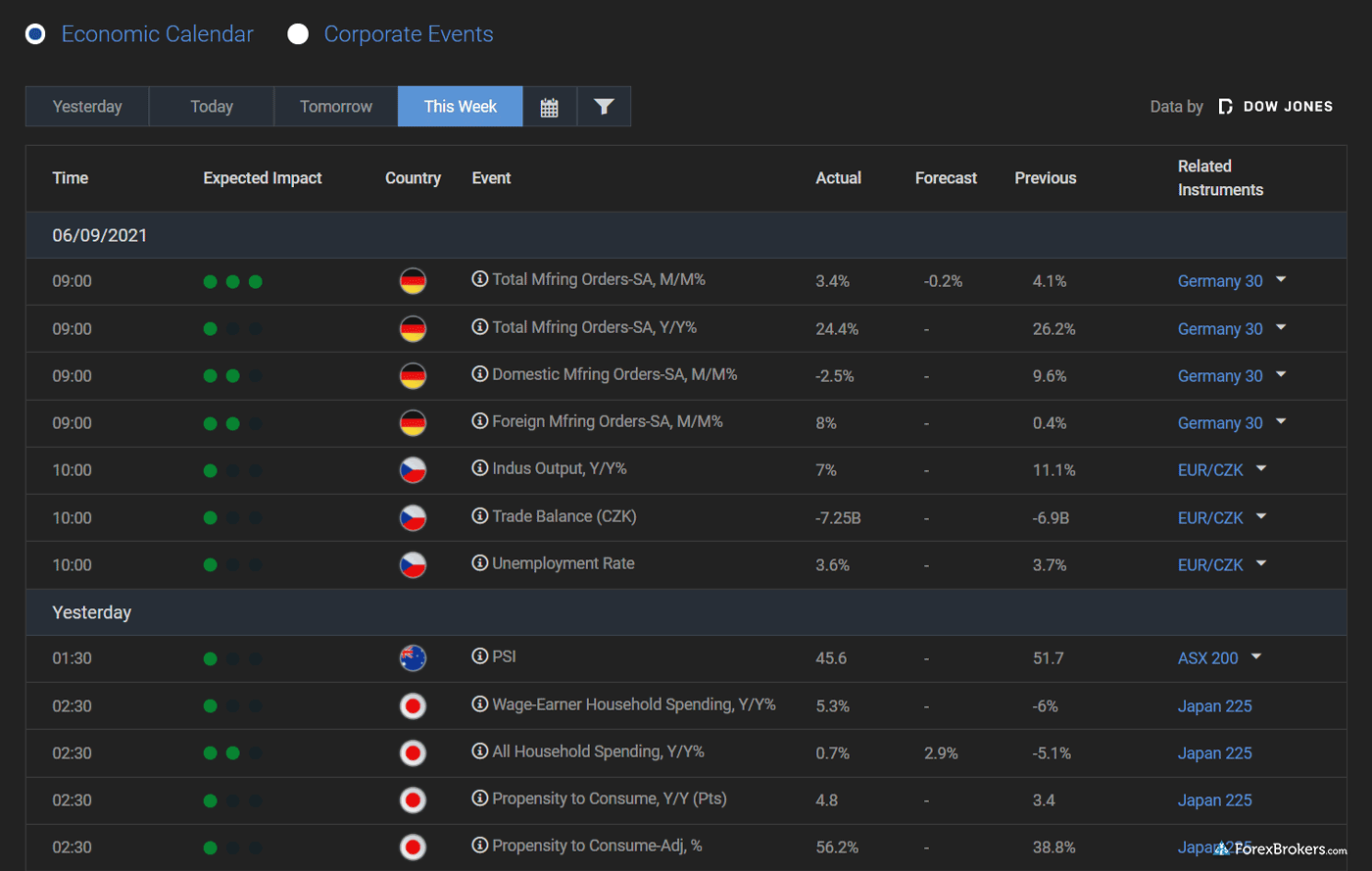

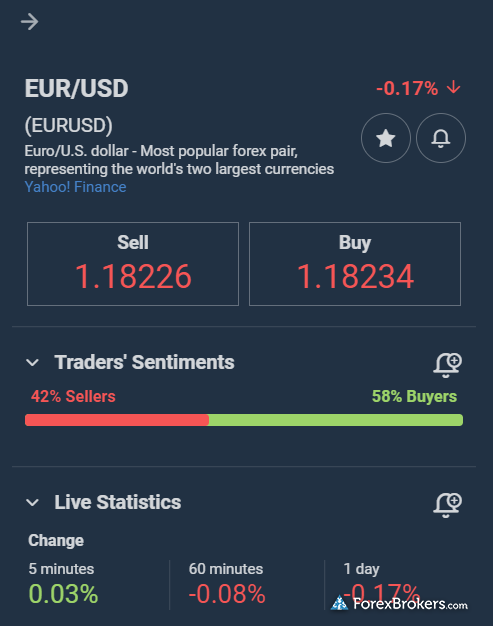

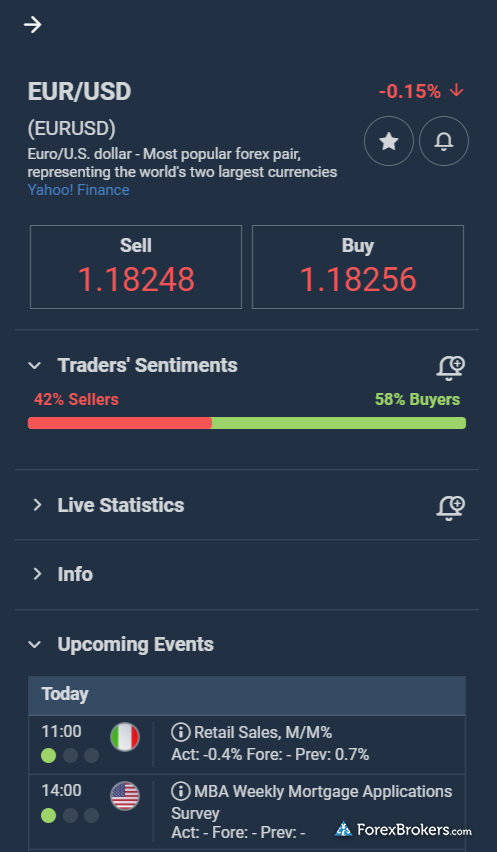

#3 - Plus500

98 Trust Score - Publicly traded

Plus500 is publicly traded on the London Stock Exchange (LSE: PLUS) and licensed by six Tier-1 regulatory jurisdictions. Plus500’s easy-to-use trading platform helped the broker earn Best in Class honors for Beginners in our 2024 Annual Awards. Check out our in-depth review of Plus500 to see why this broker attracts beginner forex traders that are looking for a user-friendly experience.

Check out a gallery of screenshots from Plus500’s trading platforms, taken by our research team during our product testing.

#4 - FXCM

96 Trust Score - Publicly traded

In operation since 1999, FXCM is publicly traded as a subsidiary of Jefferies Financial Group Inc (NYSE: JEF) and is licensed across six regulatory jurisdictions. Headquartered in London, FXCM has multiple international offices and holds licenses in several major global regulatory hubs globally. Check out our full-length review of FXCM to learn more.

Browse a gallery of screenshots from FXCM's trading platforms, taken by our research team during our product testing.

#5 - XTB

95 Trust Score - Publicly traded

Founded in Poland in 2004, XTB holds regulatory licenses in five regulatory jurisdictions, including the Financial Conduct Authority (FCA). Read our full-length review of XTB to learn more.

Check out some screenshots from XTB's trading platforms, taken by our research team during our product testing.

About the Polish Financial Supervisory Authority (Komisja Nadzoru Finansowego)

The Polish Financial Supervisory Authority (PFSA), known locally as the Komisja Nadzoru Finansowego (KNF), is the national regulator of financial markets in Poland. The PFSA oversees banks, brokers, and the broader capital markets. In addition to regulating local markets and forex brokers, the PFSA also regulates certain activities of Poland’s main exchange, the Warsaw Stock Exchange (WSE), following the provisions made to the 2005 Act on Trading in Financial Instruments.

Originally founded as the Warsaw Mercantile Exchange in 1817, the Warsaw Stock Exchange (WSE) was formed in 1991 after significant regulatory changes helped transform Poland’s financial markets, and in 2010 the company behind the exchange – Giełda Papierów Wartościowych w Warszawie (GPW) – was listed on the WSE. Today, the Warsaw Stock Exchange is self-governed with the majority of voting rights retained by the State Treasury.

How to Verify PFSA Authorisation

To verify PFSA authorisation, you can search among 4,000 brokers to discover authorised entities in Poland on the PFSA’s official site.

We’ll use XTB (check out our full review of XTB) as an example to demonstrate how it works:

- On the PFSA’s “Entities Search” page, search for the keyword “XTB”.

- Click on the official entity name for XTB Group (XTB S.A.).

- This search will return the regulatory status of the broker, including its address and history of regulatory developments. Also included is a list of activities that the firm is permitted to carry out.

- The PFSA’s official website lists XTB S.A. as being authorised and regulated by the KNF (PFSA) in Poland.

Why verifying regulation is important

Verifying that your forex broker is well-regulated in reputable jurisdictions is an important step towards avoiding forex scams. Check out my educational series about forex scams to learn how to identify common forex scams and to find out what you can do if you've been scammed. I also explain how crypto enthusiasts and bitcoin traders can spot common crypto scams.

Is forex trading legal in Poland?

Yes, forex trading in Poland is legal. That being said, it’s important to choose online forex brokers that are properly regulated to reduce your chances of falling victim to forex scams. If you are a Polish Citizen or National and want to trade forex, it is best to do so with a broker that is regulated in Poland (as outlined by the PFSA in Poland) – or at least within the EU – to receive the maximum potential regulatory protections. Learn more about forex regulation by visiting our Trust Score page.

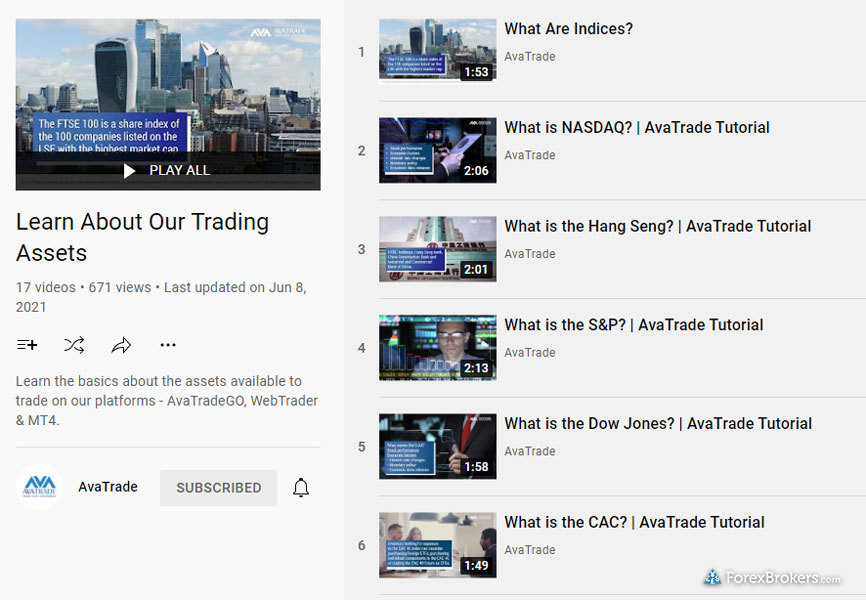

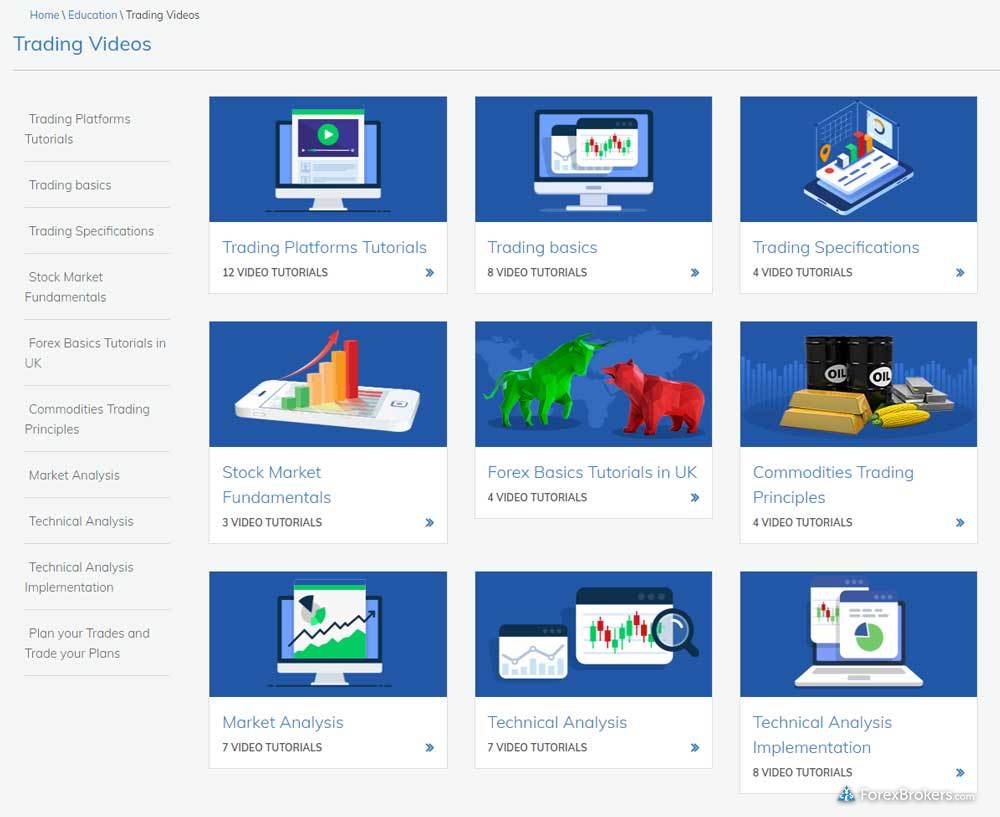

Which forex broker is best for beginners?

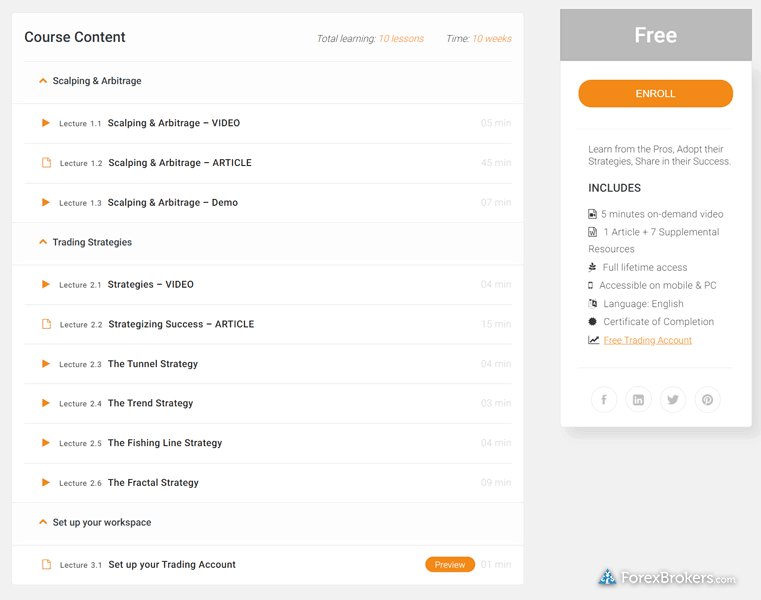

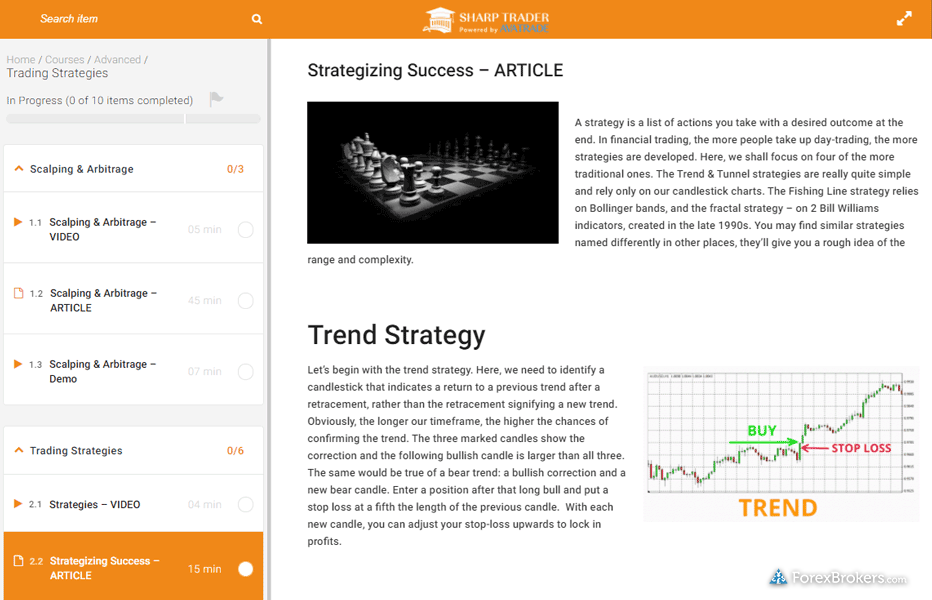

AvaTrade is the best forex broker in Poland for beginner forex traders in 2024. AvaTrade offers in-depth educational features for beginners, including over 100 articles, a rich assortment of video content, and integrated quizzes (complete with progress tracking). AvaTrade's SharpTrader educational courses are organized by experience level, and the broker's educational resources are either developed in-house or sourced from third-party providers such as Trading Central. The broker's abundance of content designed to help new forex traders helped AvaTrade earn Best in Class honors for Education in our 2024 Annual Awards. To learn more, check out our review of AvaTrade.

Check out a gallery of screenshots from AvaTrade's educational offering, taken by our research team during our product testing.

Getting started with forex trading

New to forex trading, and want to learn more about the best platforms, tools, and educational experiences for beginner forex traders? Check out our guide to forex trading for beginners.

Compare Poland Brokers

Popular Forex Guides

- Best MetaTrader 4 Brokers of 2024

- Best TradingView Forex Brokers of 2024

- Best Zero Spread Forex Brokers of 2024

- Best Forex Trading Apps of 2024

- International Forex Brokers Search

- Best Forex Brokers for Beginners of 2024

- Compare Forex Brokers

- Best Copy Trading Platforms of 2024

- Best Forex Brokers of 2024

More Forex Guides

Find the best forex brokers in Europe

- Best Forex Brokers in Austria for 2024

- Best Forex Brokers in Cyprus for 2024

- Best Forex Brokers in Denmark for 2024

- Best Forex Brokers in Finland for 2024

- Best Forex Brokers in France for 2024

- Best Forex Brokers in Germany for 2024

- Best Forex Brokers in Ireland for 2024

- Best Forex Brokers in Italy for 2024

- Best Netherlands Forex Brokers of 2024

- Best Forex Brokers in Norway for 2024

- Best Forex Brokers in Poland for 2024

- Best Forex Brokers in Portugal for 2024

- Best Forex Brokers in Spain for 2024

- Best Forex Brokers in Sweden for 2024

- Best Switzerland Forex Brokers of 2024

- Best Forex Brokers in Turkey for 2024

- Best Forex Brokers in Ukraine for 2024

- Best UK Forex Brokers of 2024

2024 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.