Best Forex Brokers in Singapore for 2024

ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Trading forex (currencies) in Singapore is popular among residents. Before any fx broker in Singapore can accept forex and CFD traders as clients, they must become authorised by the Monetary Authority of Singapore (MAS), which is the financial regulatory body in Singapore. MAS's website is mas.gov.sg. We recommend Singaporean residents to follow the MAS on twitter, @MAS_sg.

MAS is Singapore's Central Bank and financial markets regulatory body and was founded in 1971. For a historical breakdown, here's a link to the Monetary Authority of Singapore's webpage on Wikipedia.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Best Forex Brokers in Singapore

To find the best forex brokers in Singapore, we created a list of all MAS authorized brokers, then ranked brokers by both trustworthiness, as well as their Overall ranking.

Here is our list of the top forex brokers in Singapore:

-

IG

- Best overall broker, most trusted

-

Interactive Brokers

- Great overall, best for professionals

-

Saxo

- Best web-based trading platform

- CMC Markets - Excellent overall, best platform technology

- City Index - Excellent all-round offering

-

Plus500

- Multi-asset CFD broker, intuitive platform

Singapore Forex Brokers Comparison

Compare Singapore authorised forex and CFDs brokers side by side using the forex broker comparison tool or the summary table below. This broker list is sorted by my overall rankings of the top forex brokers.

| Company | Accepts SG Residents | Regulated by MAS | Average Spread EUR/USD - Standard | Minimum Deposit | Overall Rating | Visit Site |

IG IG

|

0.98 | £250.00 |

|

Visit Site

|

||

Interactive Brokers Interactive Brokers

|

0.63 | $0 |

|

Visit Site

|

||

Saxo Saxo

|

1.1 | $0 |

|

Visit Site

|

||

CMC Markets CMC Markets

|

0.61 | $0 |

|

|||

City Index City Index

|

1.4 | £100.00 |

|

|||

Plus500 Plus500

|

N/A | €100 |

|

Visit Site

|

||

Capital.com Capital.com

|

0.67 | $20 |

|

Visit Site

|

||

AvaTrade AvaTrade

|

0.92 | $100 |

|

Visit Site

|

||

FXCM FXCM

|

0.74 | Starts from $50 |

|

Visit Site

|

||

Admirals Admirals

|

0.8 | $100 |

|

|||

Pepperstone Pepperstone

|

0.77 | $200 |

|

Visit Site

|

||

XM Group XM Group

|

1.6 | $5 |

|

Visit Site

|

||

FP Markets FP Markets

|

1.1 | $100 AUD |

|

Visit Site

|

||

IC Markets IC Markets

|

0.62 | $200 |

|

Visit Site

|

||

Tickmill Tickmill

|

0.51 | $100 |

|

Visit Site

|

||

BlackBull Markets BlackBull Markets

|

0.76 | $0 |

|

Visit Site

|

||

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

0.6 | $20 |

|

|||

HFM HFM

|

1.2 | $0 |

|

Visit Site

|

||

FlowBank FlowBank

|

N/A | $0 |

|

|||

Trade Nation Trade Nation

|

0.6 | $0 |

|

|||

Moneta Markets Moneta Markets

|

1.27 | $50 |

|

|||

Eightcap Eightcap

|

1.0 | $100 |

|

Visit Site

|

||

ACY Securities ACY Securities

|

1.2 | $50 |

|

Visit Site

|

||

easyMarkets easyMarkets

|

0.9 | $50 |

|

|||

Spreadex Spreadex

|

0.81 | $0 |

|

Visit Site

|

||

Octa Octa

|

0.9 | $25 |

|

|||

Libertex (Forex Club) Libertex (Forex Club)

|

N/A | $10 |

|

How to Verify MAS Authorisation

To identify if a forex broker is regulated by MAS, the first step is to identify the register number from the disclosure text at the bottom of the broker's Singapore homepage. For example, here's the key disclosure text from CMC Markets's website:

CMC Markets Singapore Pte. Ltd. (Reg. No./UEN 200605050E) is regulated by the Monetary Authority of Singapore and holds a capital markets services licence for dealing in securities and leveraged foreign exchange, and is an exempt financial adviser.

Next, look up the firm on the MAS website to validate the register number is, in fact, legitimate. Here is the official MAS page for CMC Markets Singapore Pte. Ltd..

Why regulation is important

Choosing a reputable, well-regulated forex broker is a crucial step towards avoiding forex scams. My educational series dedicated to forex scams shows you how to identify common forex scams and provides helpful information about what to do if you've been scammed. I also explain how crypto enthusiasts and bitcoin traders can spot common crypto scams.

About the Monetary Authority of Singapore (MAS)

Established in 1971 to coordinate the country’s financial sector, the Monetary Authority of Singapore (MAS) has a dual role; it operates both as a central bank and a financial regulator. As a central bank, MAS adopts non-inflationary monetary policies while managing Singapore’s exchange rate and liquidity in the banking sector. As a financial regulator, MAS offers prudential oversight for all financial institutions in Singapore and works with the industry to promote the country as a dynamic financial hub.

Did you know?

MAS holds a staggering S$416 billion in its official foreign reserves as of March 2023.

Is trading forex legal in Singapore?

Over five million residents can freely and legally trade forex in Singapore, so long as they do so with brokers that are regulated by the Monetary Authority of Singapore. MAS has long placed an emphasis on strong Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) guidelines as they pertain to brokers in Singapore, having been a founding member of the inter-governmental organization Asia Pacific Group on Money Laundering (APML).

To identify if your preferred forex broker in Singapore is regulated by MAS, we recommend validating the broker’s registration number through the regulator’s official page. You can typically find the broker’s registration number within the disclosure text at the bottom of their homepage.

Is forex taxed in Singapore?

In a break from tradition, forex trading in Singapore is not subject to taxation unless it is your main source of income, wherein your trading would be classified as a business activity. The Inland Revenue Authority of Singapore (IRAS) categorizes profits derived from forex trading as personal investments and thus those who trade as a hobby are exempt from paying Income or Capital Gains Tax.

While residents of Singapore are responsible for reporting taxable events to the government, with professional forex traders who trade for a living potentially paying an Income Tax rate of up to 22%, we recommend consulting with your local accountant to best determine your specific tax obligations.

Which forex broker is the best in Singapore?

IG is the best forex broker in Singapore. Simply put, IG provides an exceptional overall trading experience, complete with excellent trading and research tools, industry-leading education, and nearly 20,000 CFDs in its extensive product suite. Singaporeans looking for educational resources will find both written and video content along with weekly webinars, all of which complement the comprehensive courses available within the IG Academy. IG’s modern mobile app is loaded with 30 technical indicators, 20 drawing tools, and 16 selectable time frames across five chart types.

Which forex brokers are regulated in Singapore by the MAS?

Some of the best forex brokers from around the world hold regulatory licenses with the MAS. I’ve reviewed and tested over 60 of the best international forex brokers in the industry and conducted thorough research into each broker’s range of regulatory licenses to determine their individual Trust Scores. Here are my top three picks for the best forex brokers regulated by the MAS in Singapore in 2024:

1. IG

99 Trust Score - Most trusted broker in 2024, Best Overall Broker in 2024

IG is well-capitalized, holding over $498 billion as of May 31 2023, and authorized by eight highly trusted Tier-1 regulators, including the Monetary Authority in Singapore (MAS). Because IG is regulated by MAS, the broker is subject to client money protection guidelines as prescribed under Singapore’s Securities and Futures Act of 2001. As such, IG is required to separate client money from its own resources and not use them in the course of business activities, resulting in the distribution of all money held on behalf of clients across several top-tier banks. As well as ranking as the most trusted forex broker in our 2024 Annual Awards, IG also finished best-in-class for offering of investments, commissions and fees, education, mobile trading and professional trading.

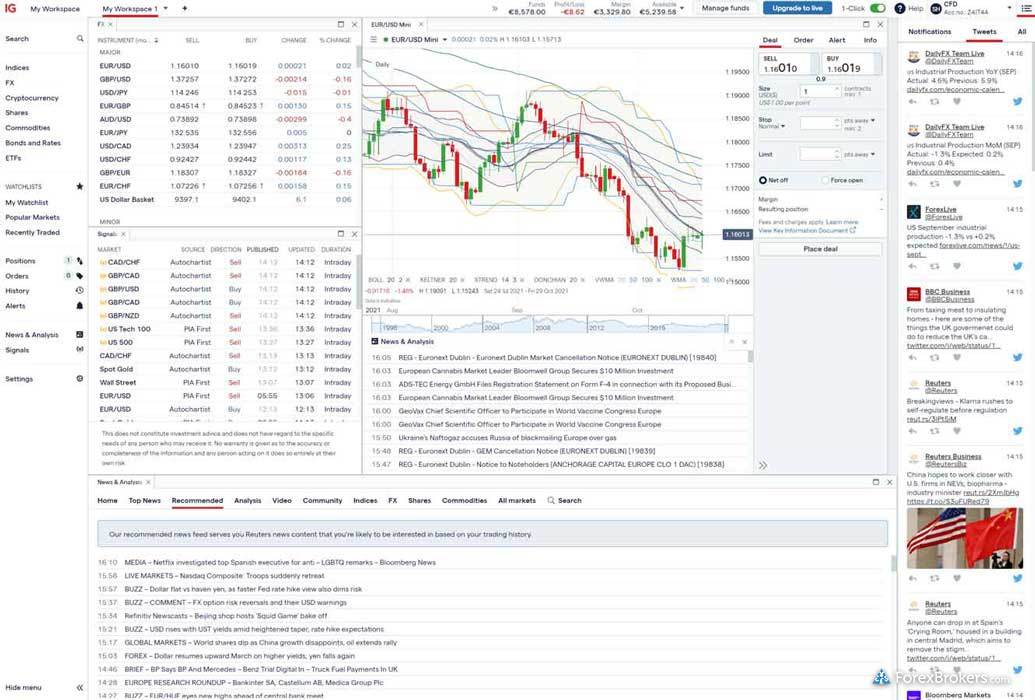

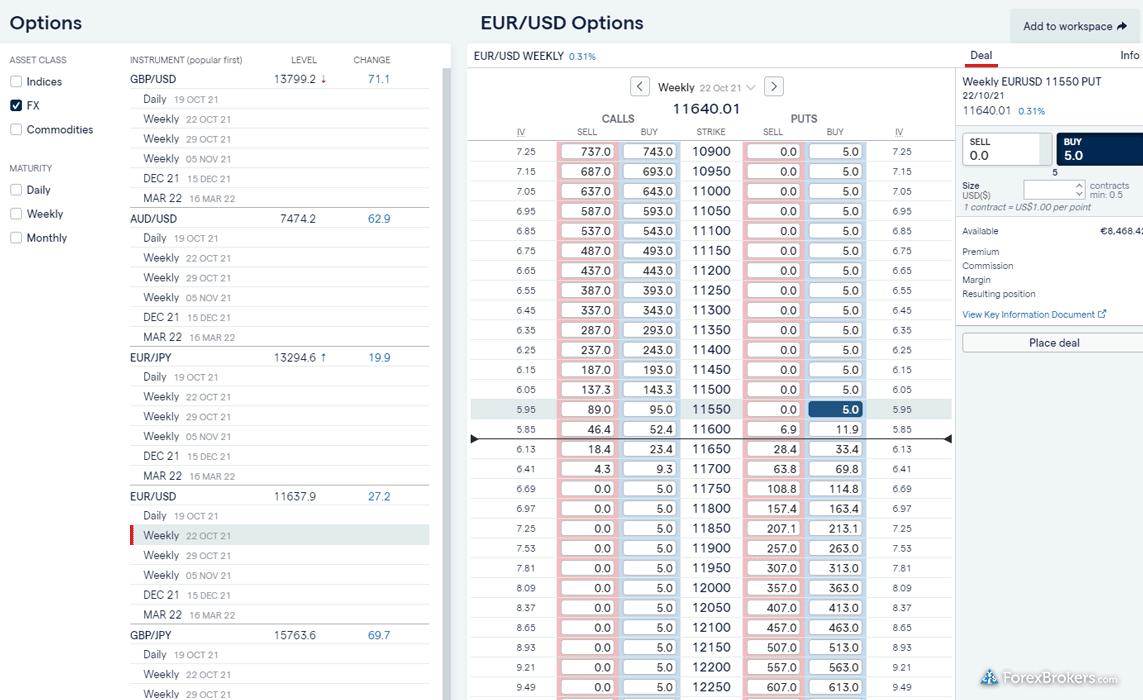

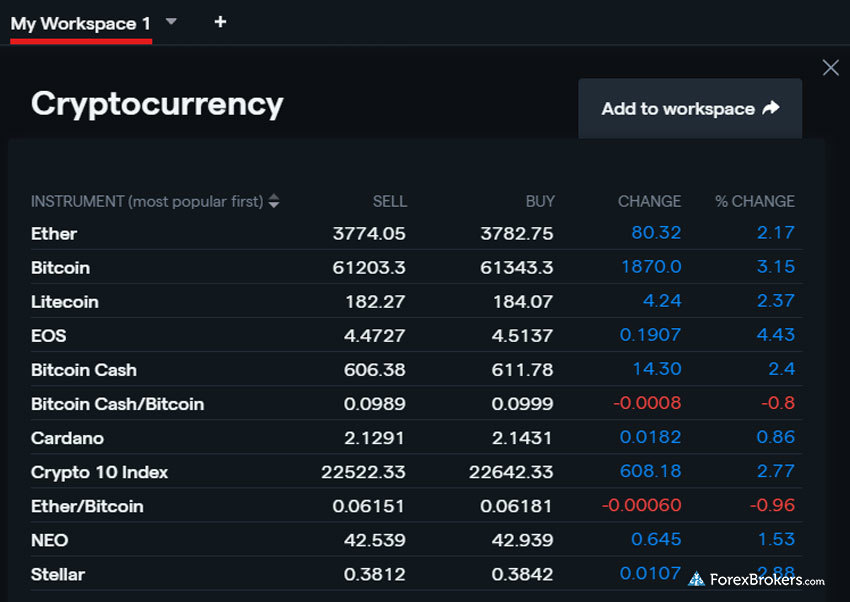

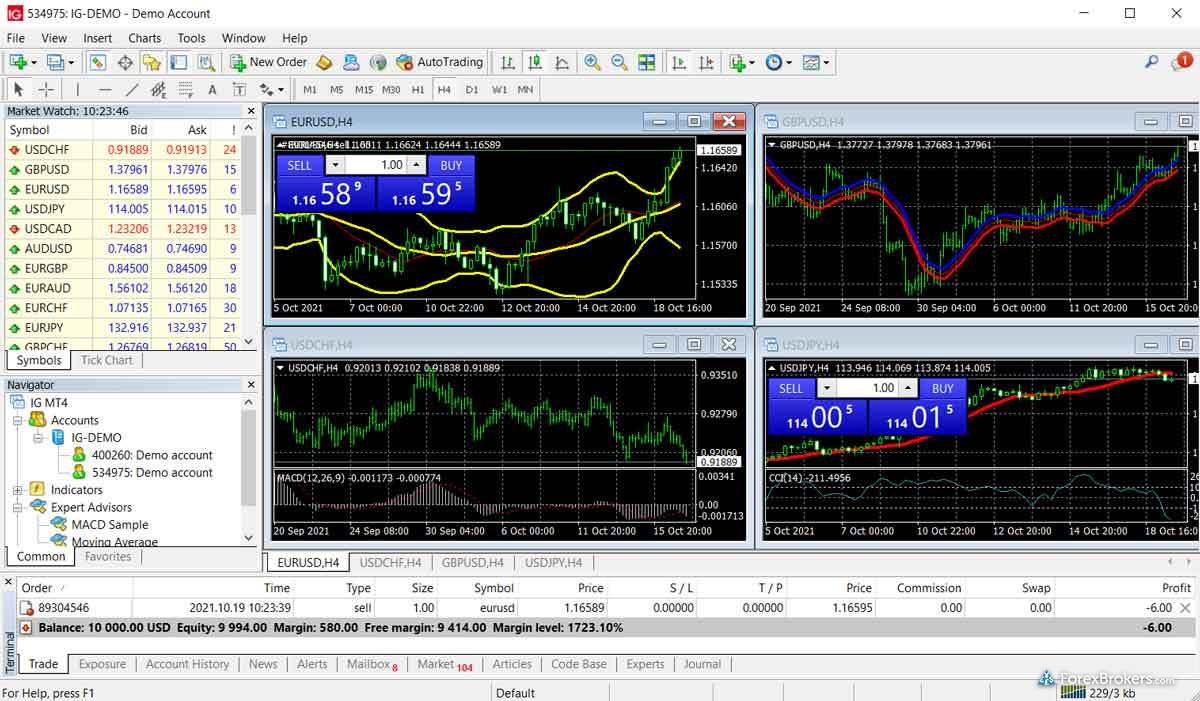

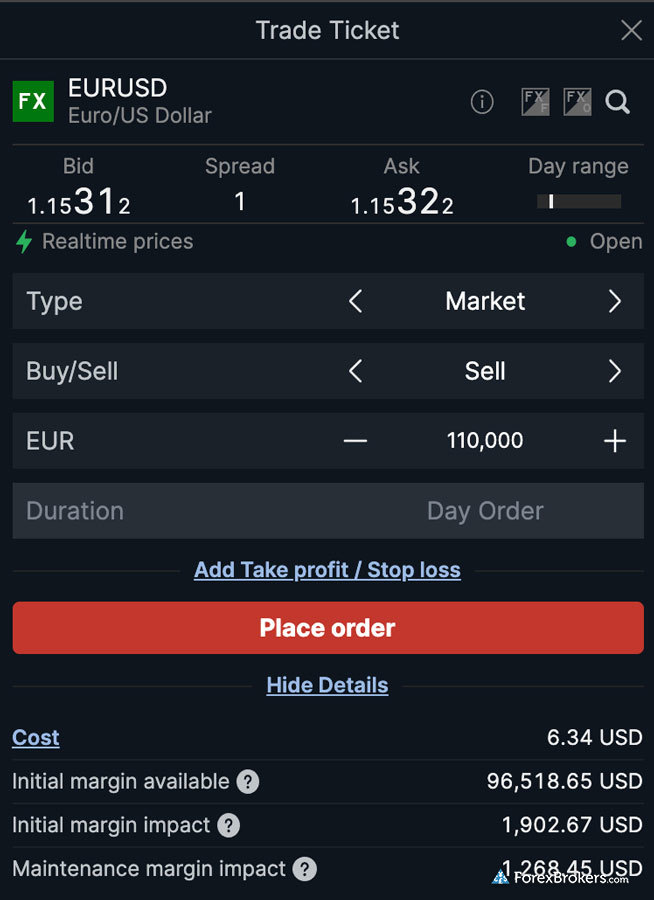

Here's a gallery of screenshots from IG's trading platforms, taken by our research team during our product testing.

2. Saxo

99 Trust Score - Operates three banks, earned our top 2024 Annual Award for Platforms & Tools

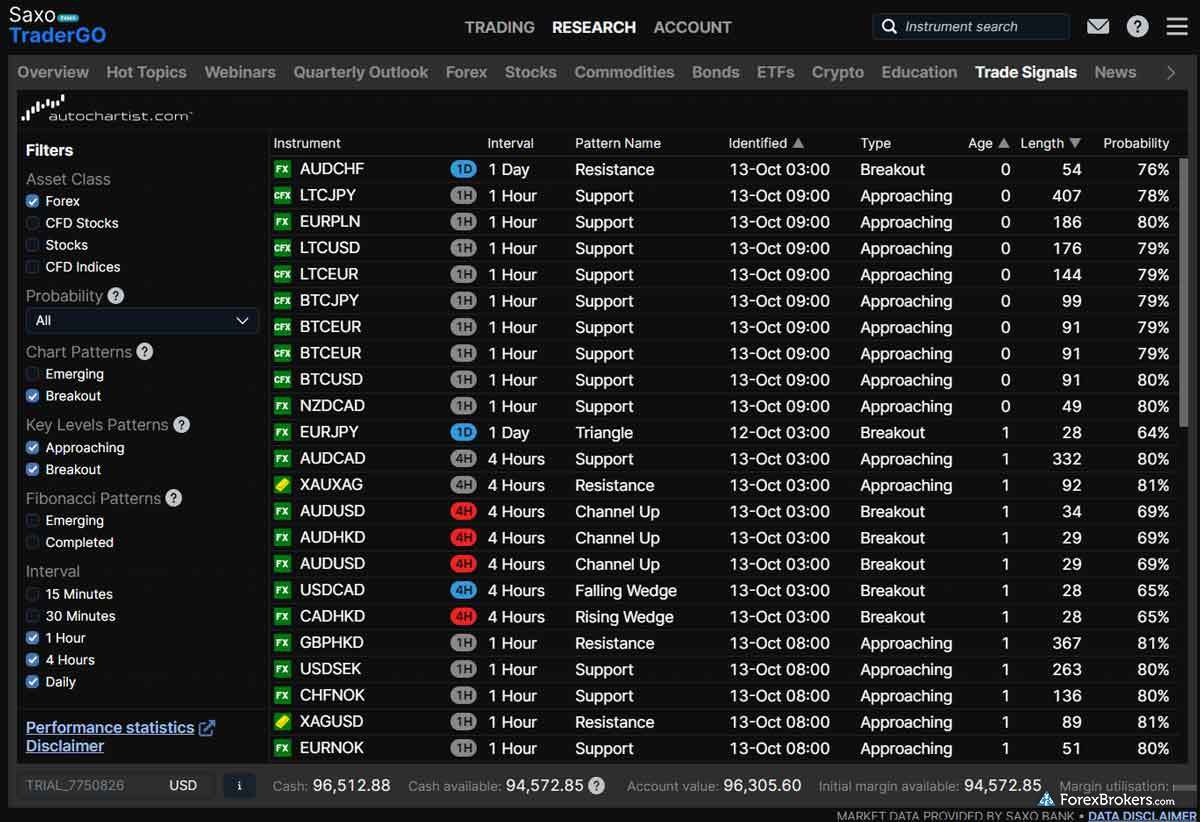

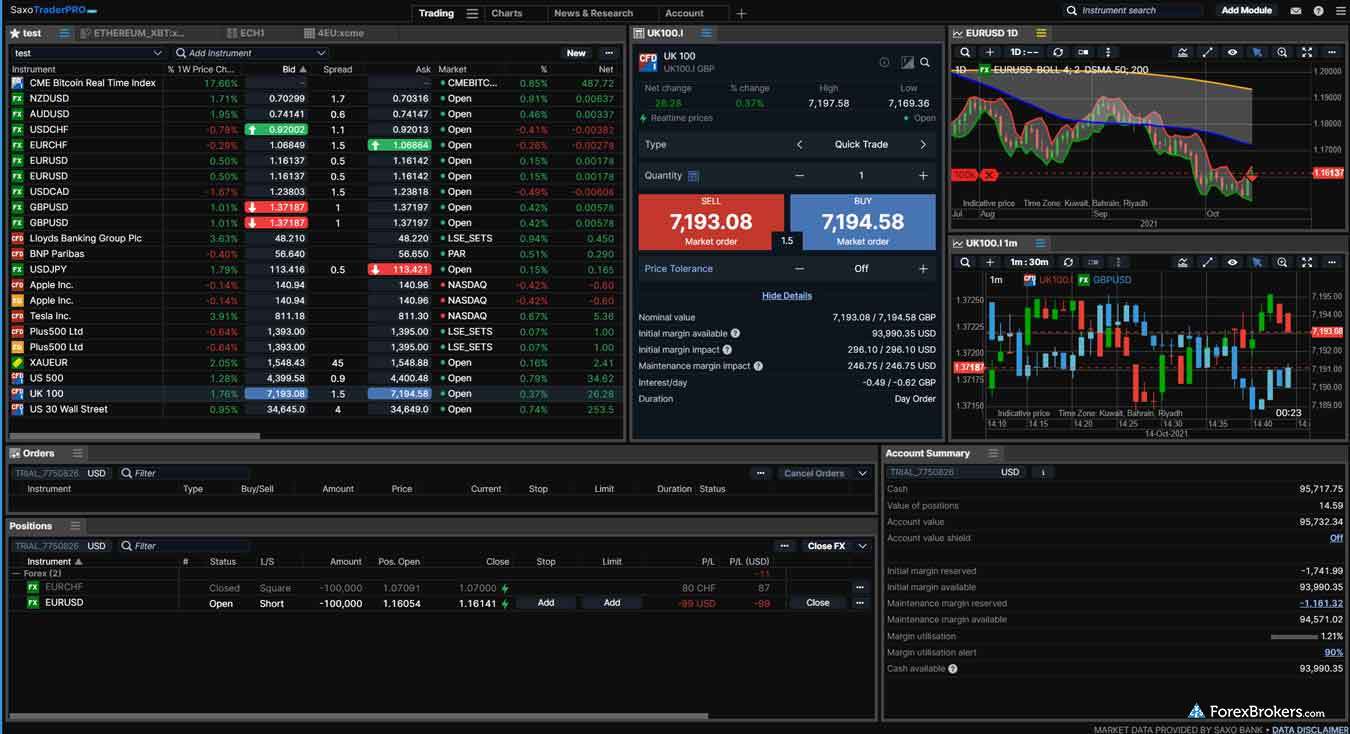

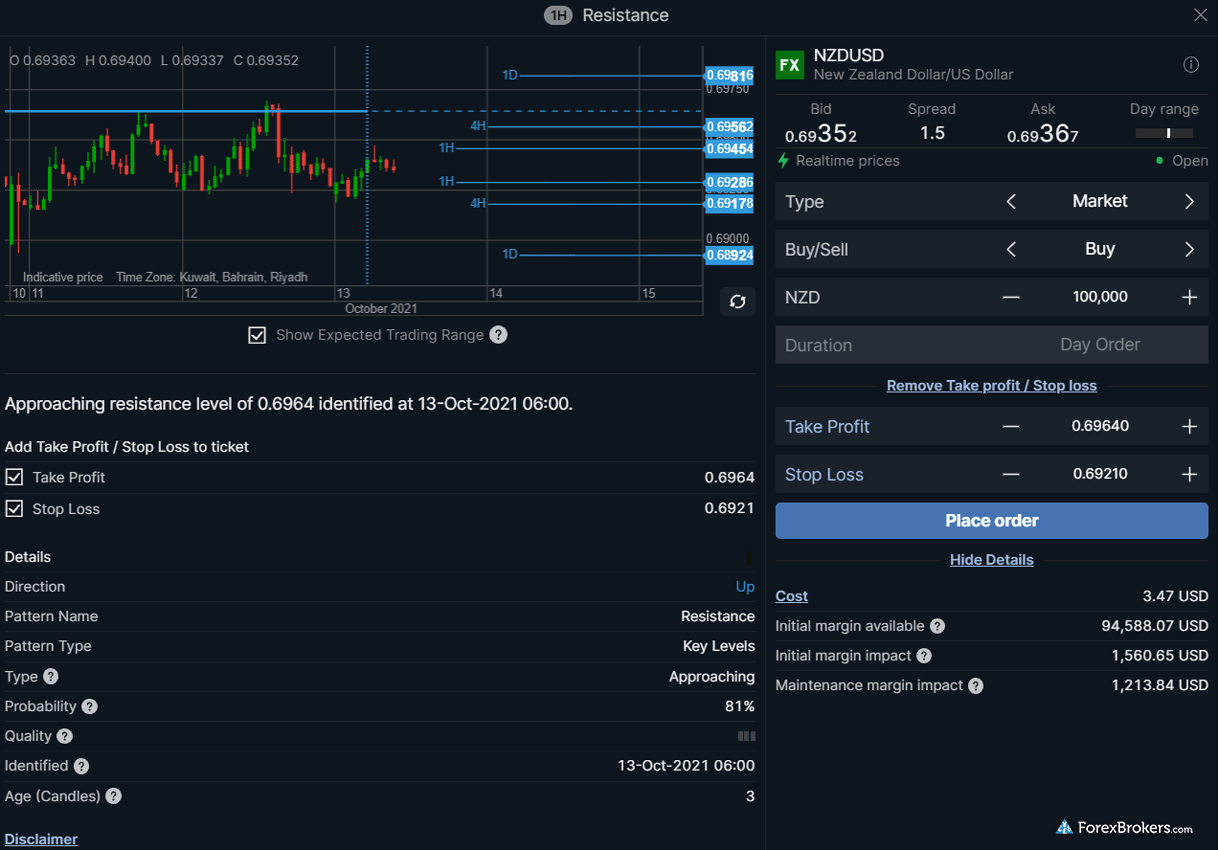

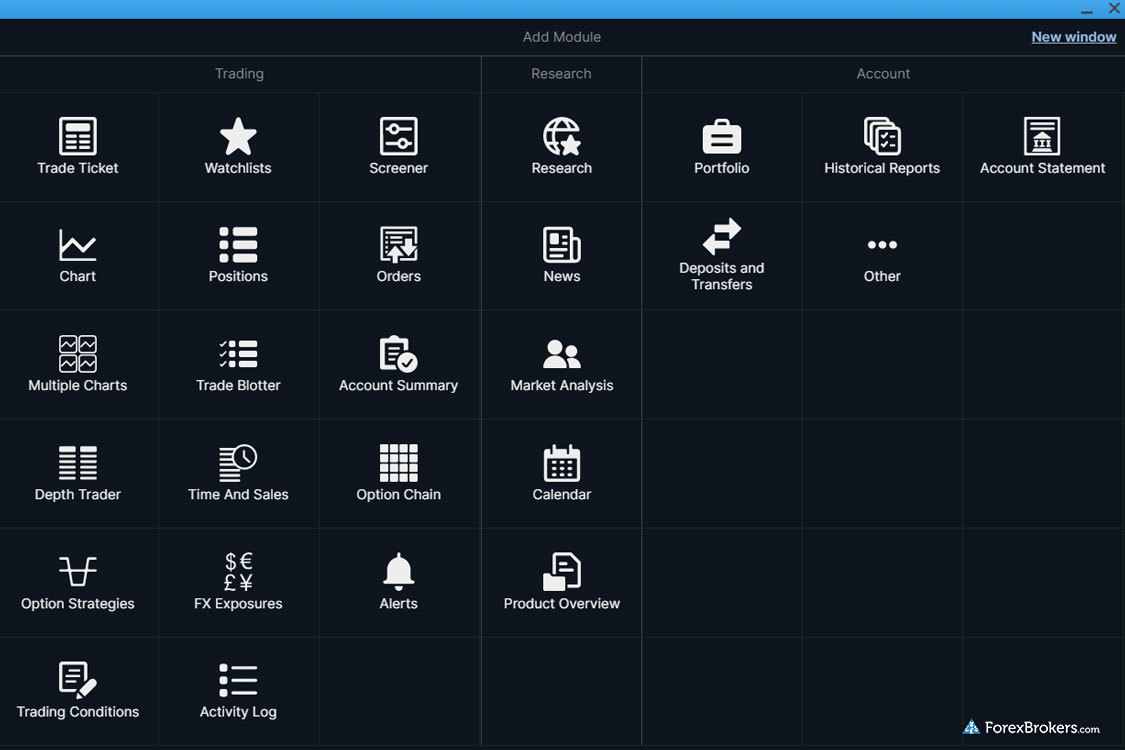

Saxo is highly trusted and authorized by seven Tier-1 regulators (this includes highly coveted licenses from the United States and UK). Notably, Saxo holds a Capital Markets Services (CMS) license with MAS, meaning it has been assessed on factors such as the ability to meet minimum financial requirements as stipulated by the Securities and Futures Act. Saxo delivers one of the best forex trading platforms in Singapore as well as access to over 70,000 financial instruments. Saxo also publishes average spread data – not only across daily trading sessions but by order size, which offers traders the opportunity for execution at scale.

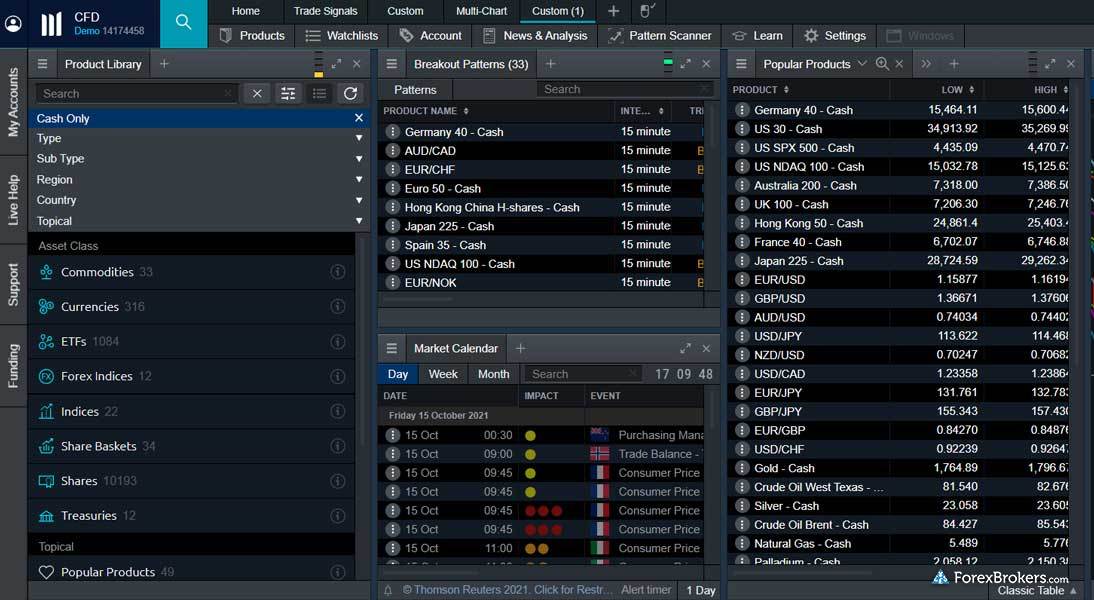

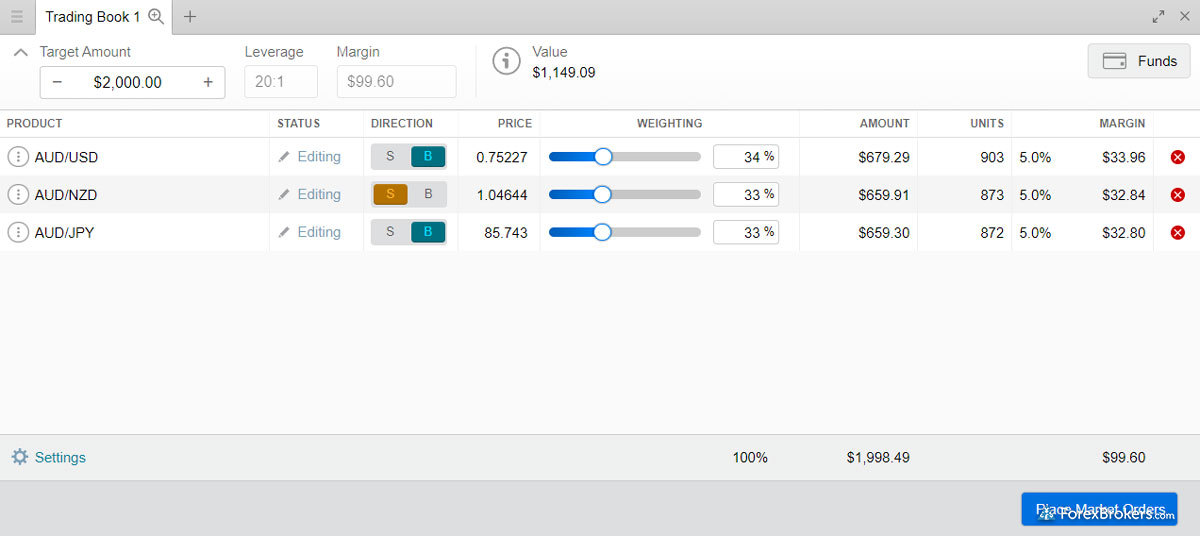

Check out this gallery of screenshots from Saxo's trading platforms, taken by our research team during our product testing.

3. CMC Markets

99 Trust Score - Publicly traded, won our 2024 Annual Award for #1 Most Currency Pairs

CMC Markets is a highly trusted forex broker in Singapore authorized by five Tier-1 jurisdictions and two Tier-2 jurisdictions, including in Canadaand the U.K. In line with MAS regulation and to protect funds in the event of insolvency, CMC Markets holds all retail client money in segregated bank accounts with banks that are licensed in the country under the Singapore Banking Act of 1970. This means that CMC Markets does not hedge their positions in order to meet trading obligations, as stipulated by the Securities and Futures Act.

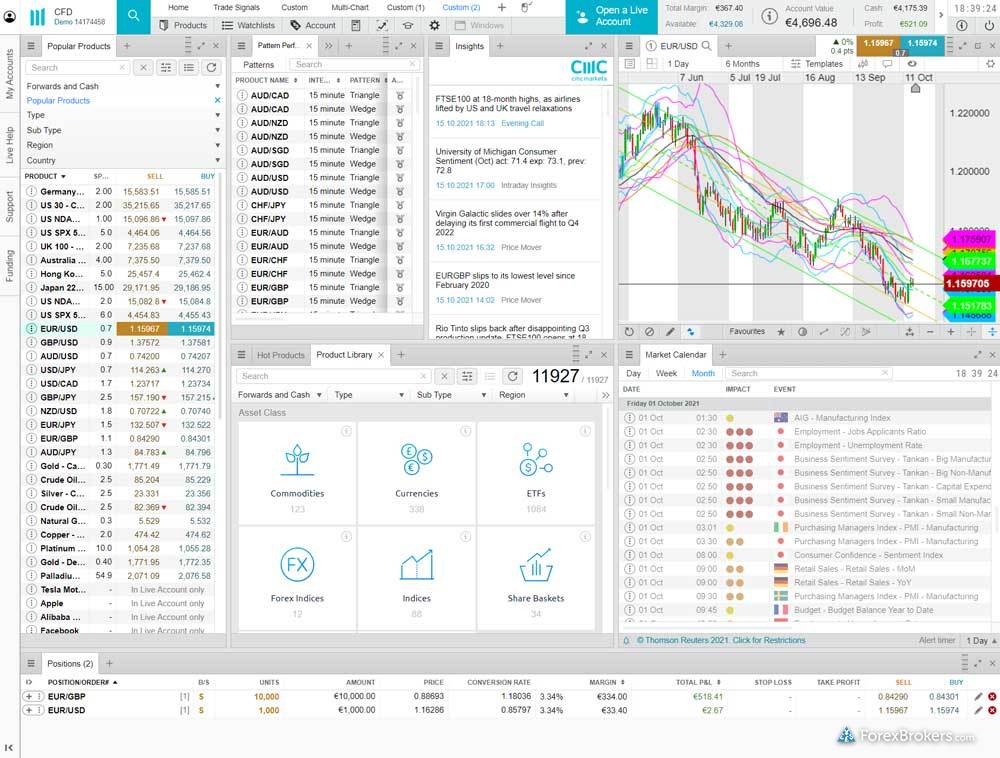

Take a look at a gallery of screenshots from CMC Markets' trading platforms, taken by our research team during our product testing.

How to get started forex trading in Singapore

When opening a forex trading account in Singapore, it’s important to make sure that you are choosing a forex broker that is regulated and licensed in Singapore by the Monetary Authority of Singapore, a Tier-1 regulatory agency. Once you've picked a forex broker that is right for your individual needs, follow these important next steps to get started as a forex trader in Singapore:

- Complete the live account application process. Make sure to read through all applicable terms and conditions.

- Fund your new brokerage account. Choose your preferred deposit method, and make sure you are starting with an amount you can afford to risk.

- Try out a demo (virtual trading) account. Familiarize yourself with the broker’s trading platform, get comfortable with the broker’s website and product offerings, and consume any available educational content.

- Put together a trading plan. Even the best traders can lose money, but the key to long-term success lies in sticking to a trading plan that keeps your average losses low (relative to your average profits). Learn more about trading plans by checking out my guide to getting started as a forex trader.

- Enter the forex market. Choose your desired trade size, and open a long position by clicking buy on a given currency, or open a short position by clicking sell.

How to start forex trading

Learn more about getting started as a forex trader by checking out my in-depth Forex 101 educational series. I go over everything you need to know to start out as a forex trader; you'll learn about forex and currency trading, leverage in the forex market, how to calculate pips, and more.

Article Resources

MAS Website, CMC Markets MAS Registration, Wikipedia

Compare Singapore Brokers

Popular Forex Guides

- Best MetaTrader 4 Brokers of 2024

- Best Zero Spread Forex Brokers of 2024

- Compare Forex Brokers

- Best Forex Brokers of 2024

- Best TradingView Forex Brokers of 2024

- International Forex Brokers Search

- Best Forex Trading Apps of 2024

- Best Copy Trading Platforms of 2024

- Best Forex Brokers for Beginners of 2024

More Forex Guides

Find the best forex brokers in the Asia-Pacific region

Asia

- Best Forex Brokers in India for 2024

- Best Forex Brokers in Indonesia for 2024

- Best Forex Brokers in Malaysia for 2024

- Best Forex Brokers in Pakistan for 2024

- Best Forex Brokers in Philippines for 2024

- Best Forex Brokers in Russia for 2024

- Best Forex Brokers in Singapore for 2024

- Best Forex Brokers in Thailand for 2024

- Best Forex Brokers in Turkey for 2024

Oceania

2024 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.