IC Markets vs Tickmill Comparison

We’ve made it easy to compare the best forex brokers, side-by-side. Our editorial team has collected thousands of data points, written hundreds of thousands of words of research, and tested over 60 brokers to help you find the best forex brokers in the industry. Our research is unbiased and independent; learn more about how we test. That same research and data powers our broker comparisons. Let's compare IC Markets vs Tickmill.

Can I trust IC Markets?

IC Markets is not publicly traded and does not operate a bank. IC Markets is authorised by two Tier-1 regulators (Highly Trusted), zero Tier-2 regulators (Trusted), zero Tier-3 regulators (Average Risk), and two Tier-4 regulators (High Risk). IC Markets is authorised by the following tier-1 regulators: Australian Securities & Investment Commission (ASIC) and regulated in the European Union via the MiFID passporting system.

Can I trust Tickmill?

Tickmill is not publicly traded and does not operate a bank. Tickmill is authorised by two Tier-1 regulators (Highly Trusted), one Tier-2 regulator (Trusted), zero Tier-3 regulators (Average Risk), and one Tier-4 regulator (High Risk). Tickmill is authorised by the following Tier-1 regulators: Financial Conduct Authority (FCA) and regulated in the European Union via the MiFID passporting system.

Is IC Markets good?

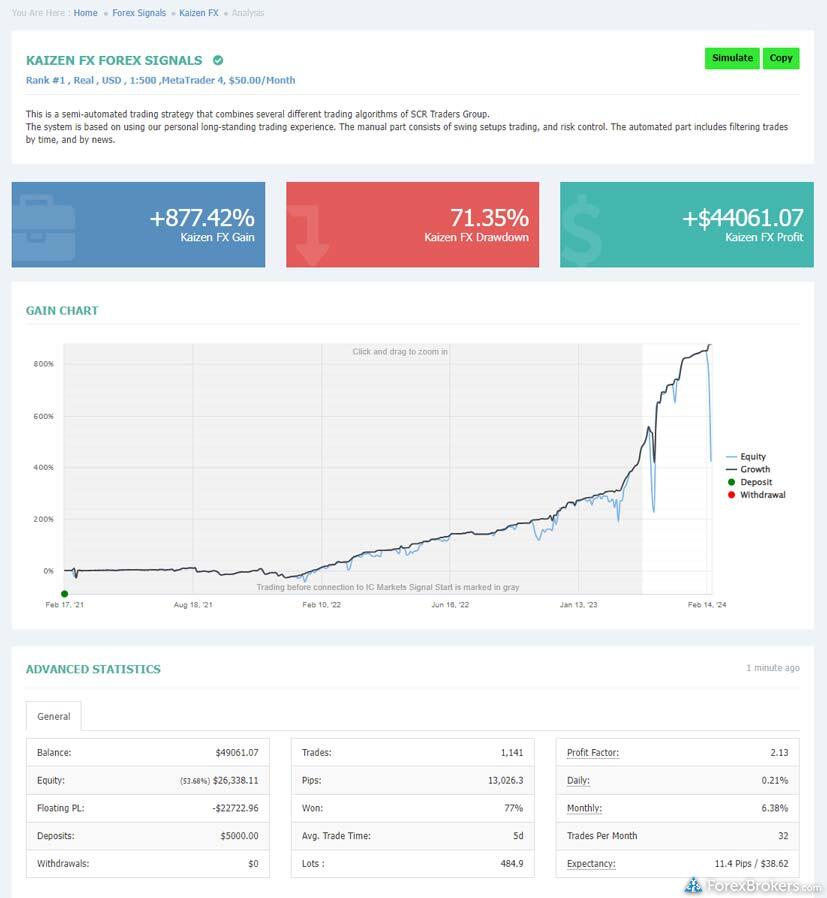

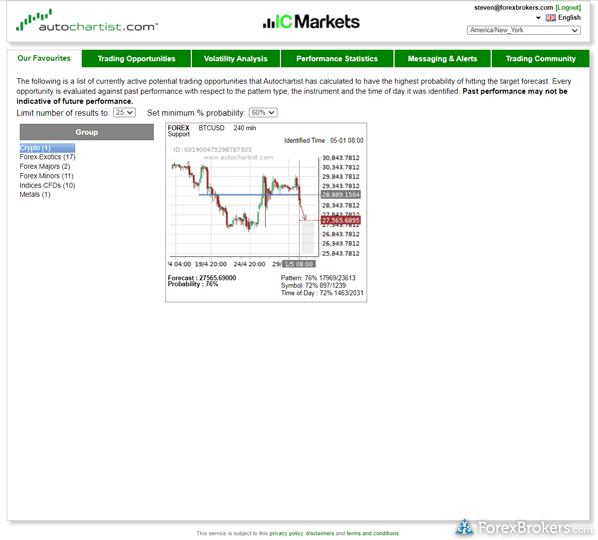

IC Markets’ competitive pricing and scalable execution make it an excellent option for algorithmic traders. Though it supports an impressive range of third-party tools and plugins, IC Markets’ research and education offerings are not as impressive as those offered by industry leaders.

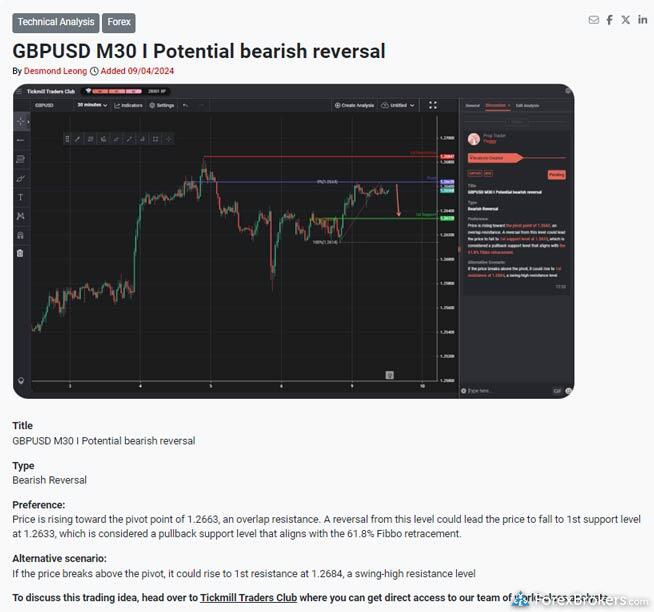

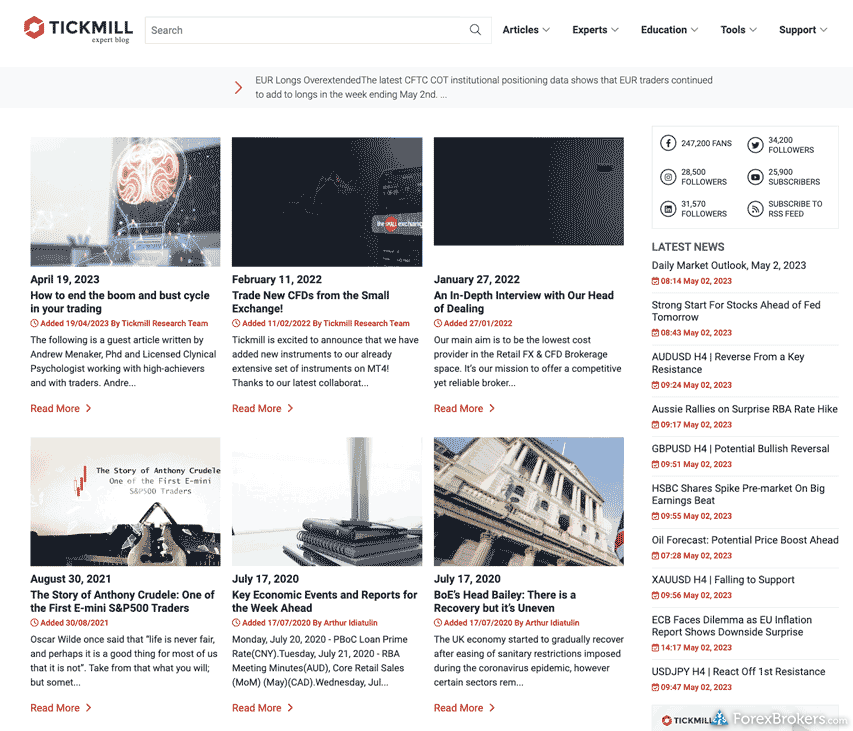

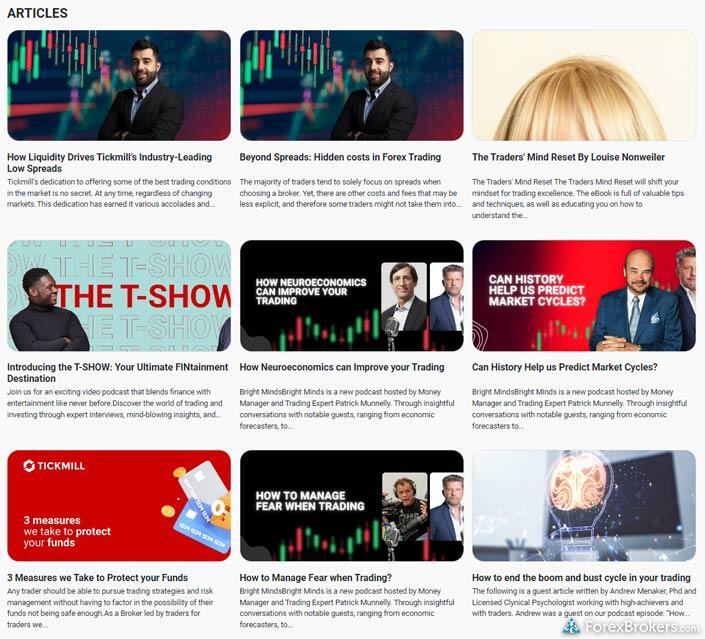

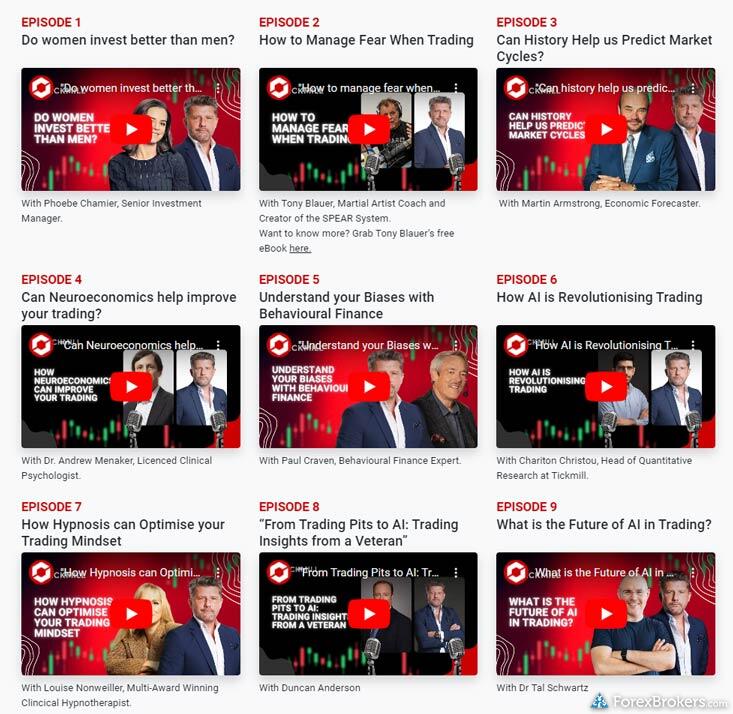

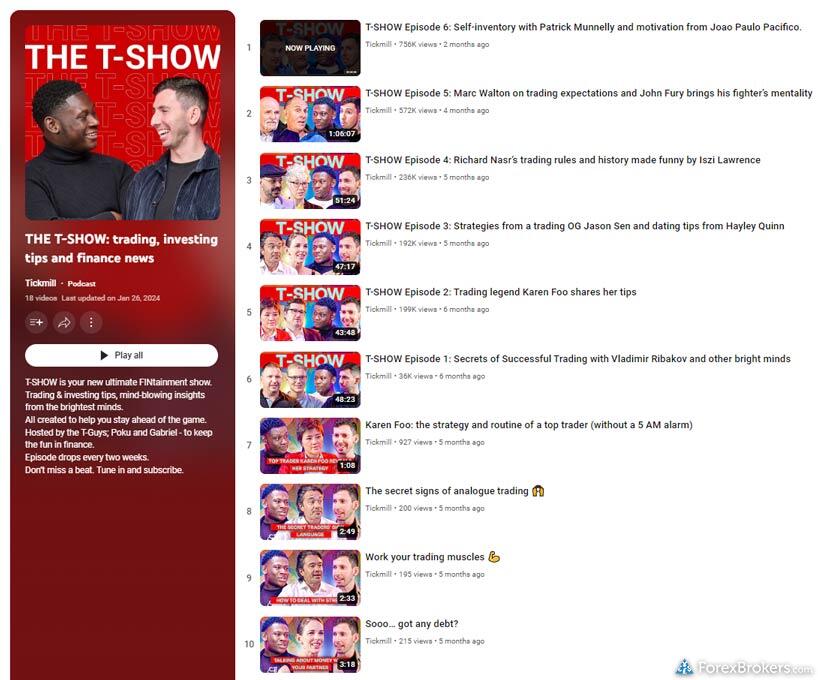

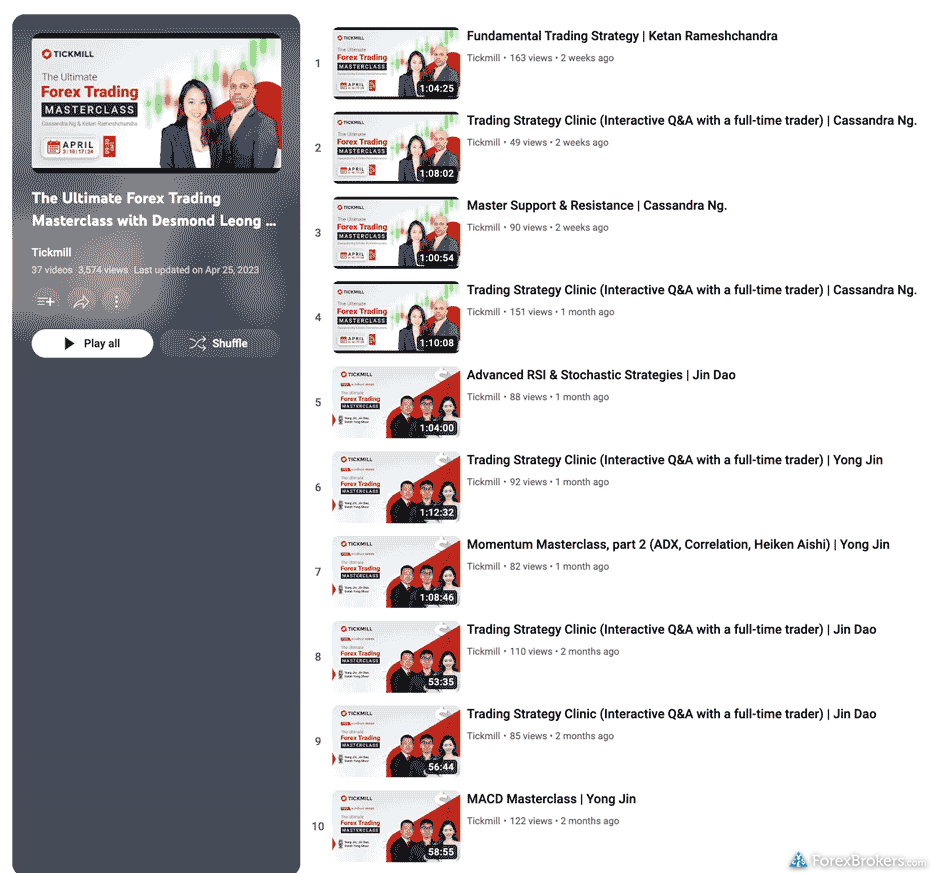

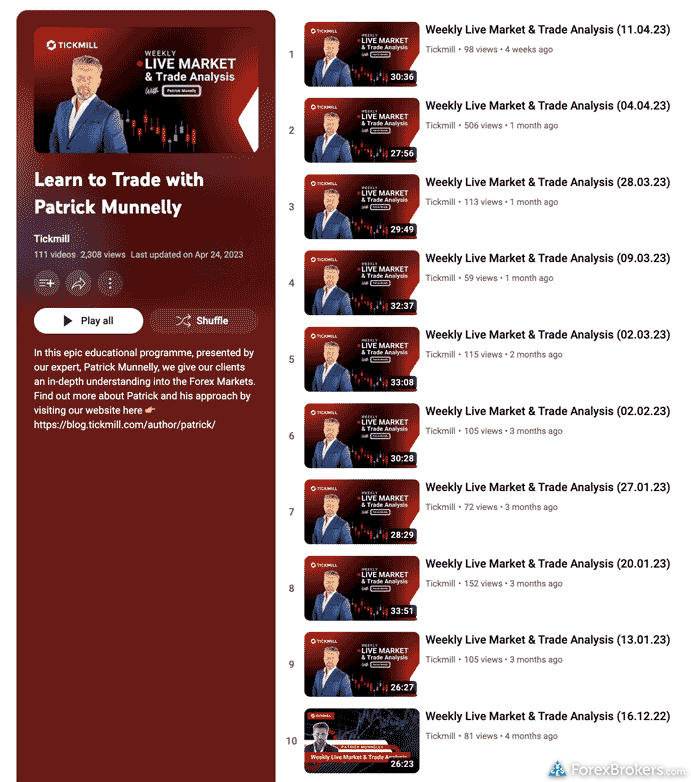

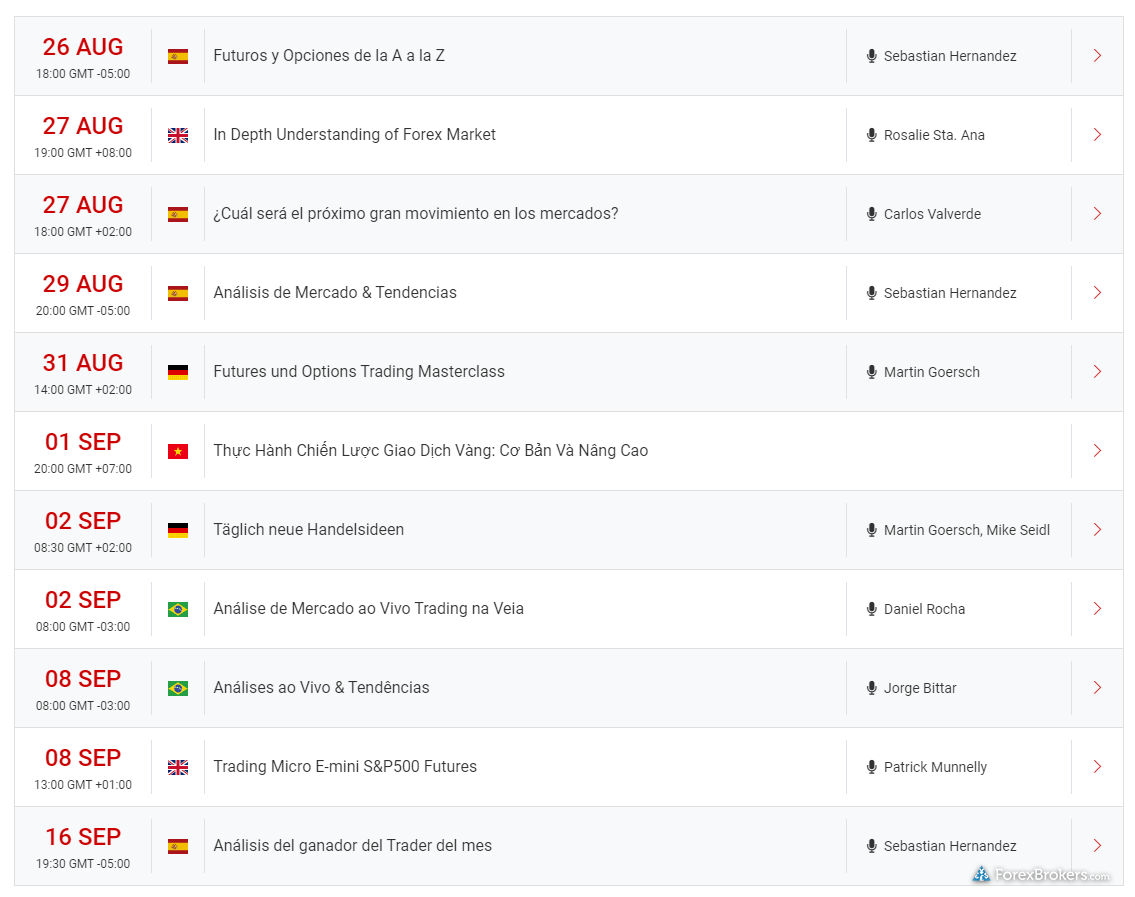

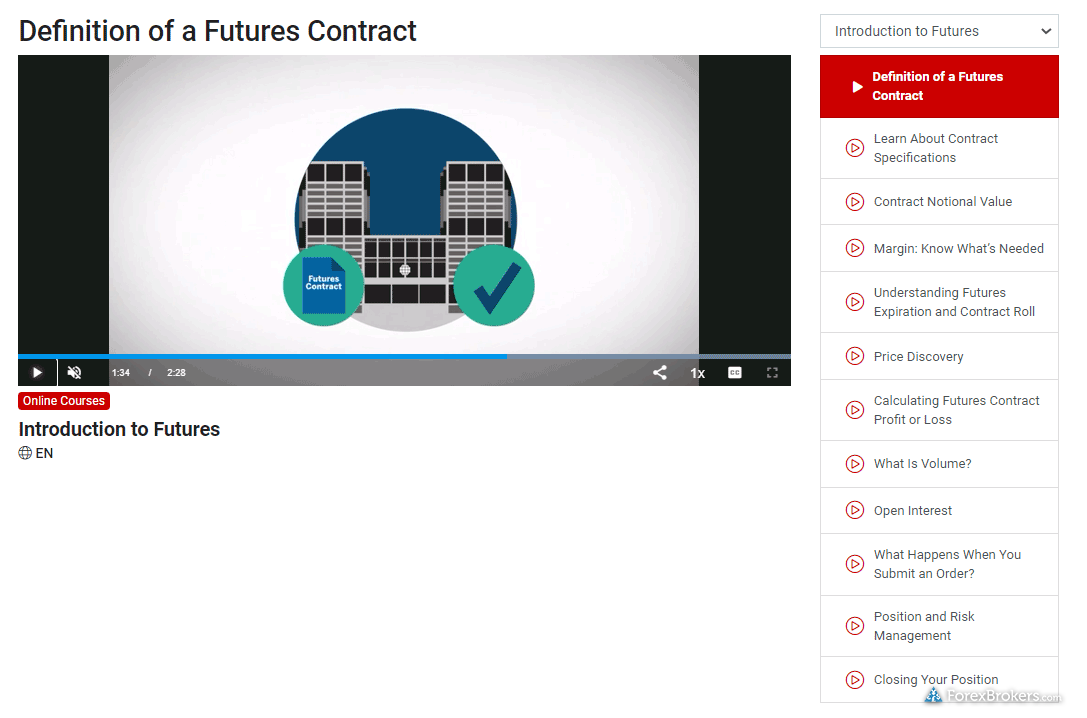

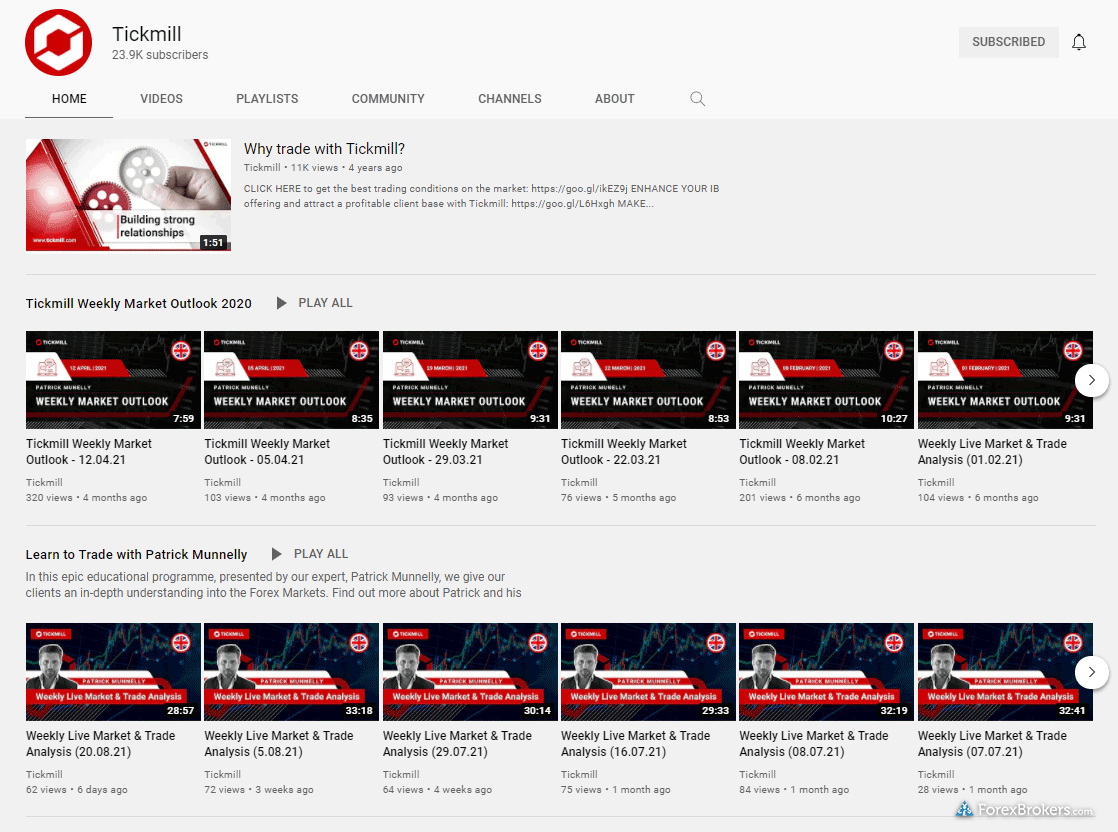

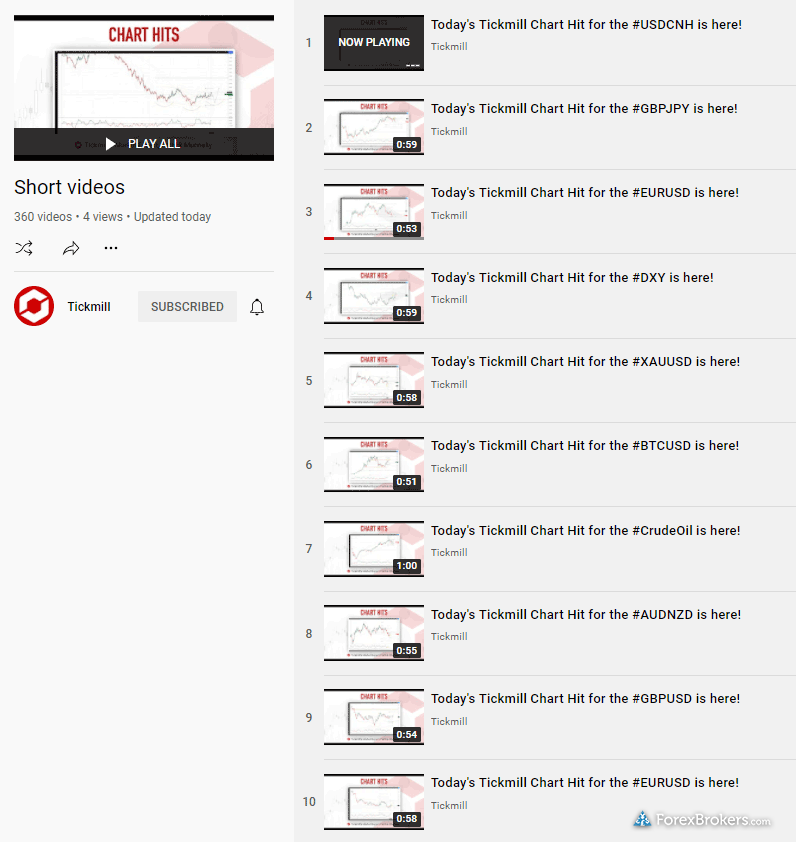

Is Tickmill good?

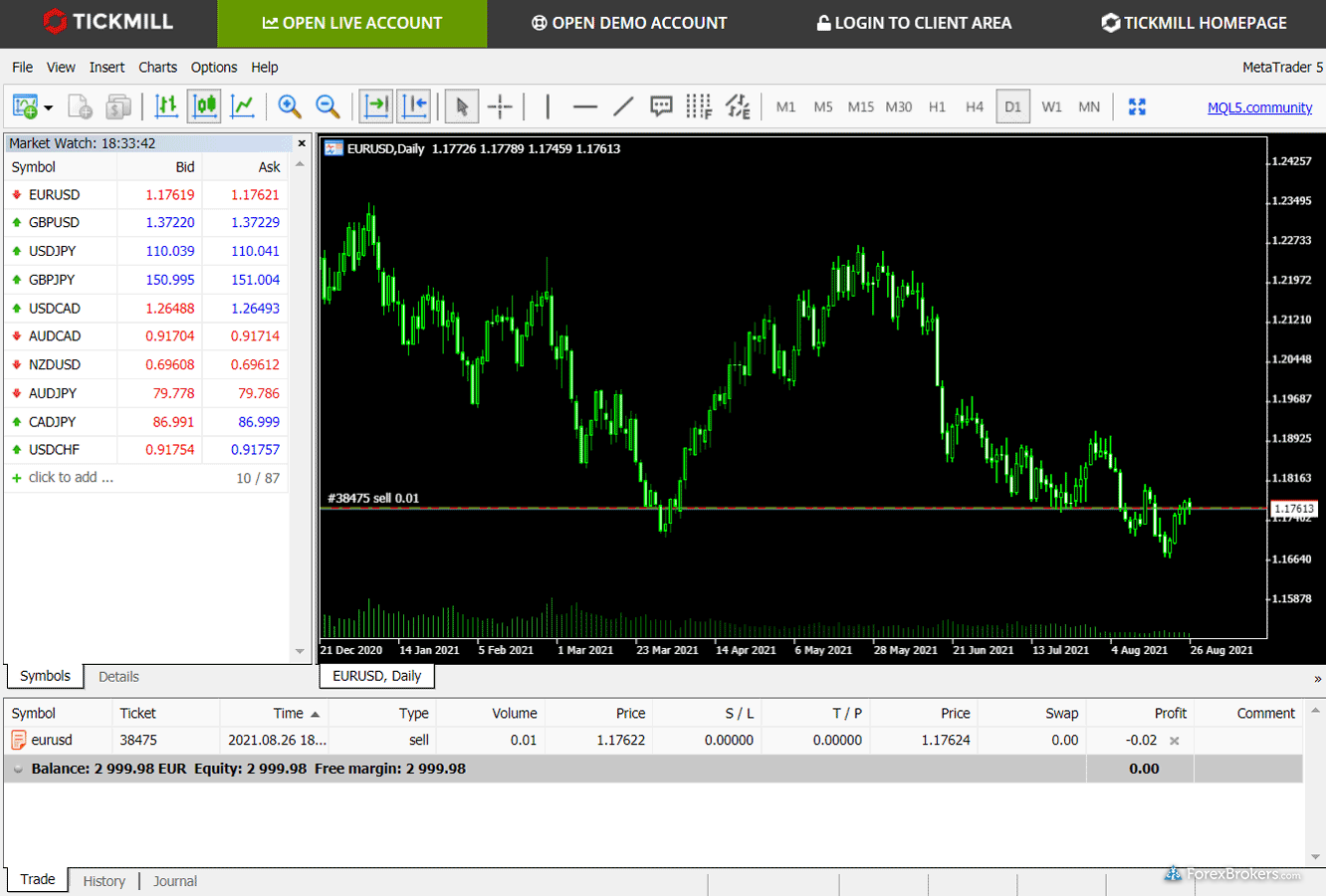

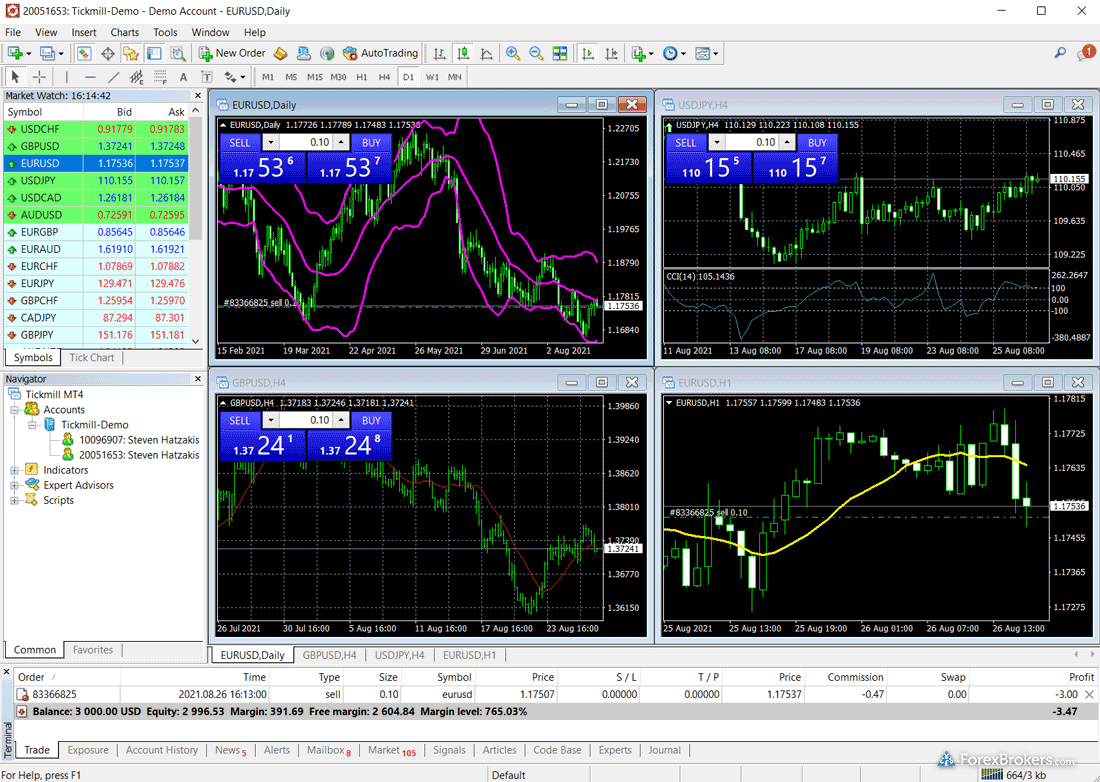

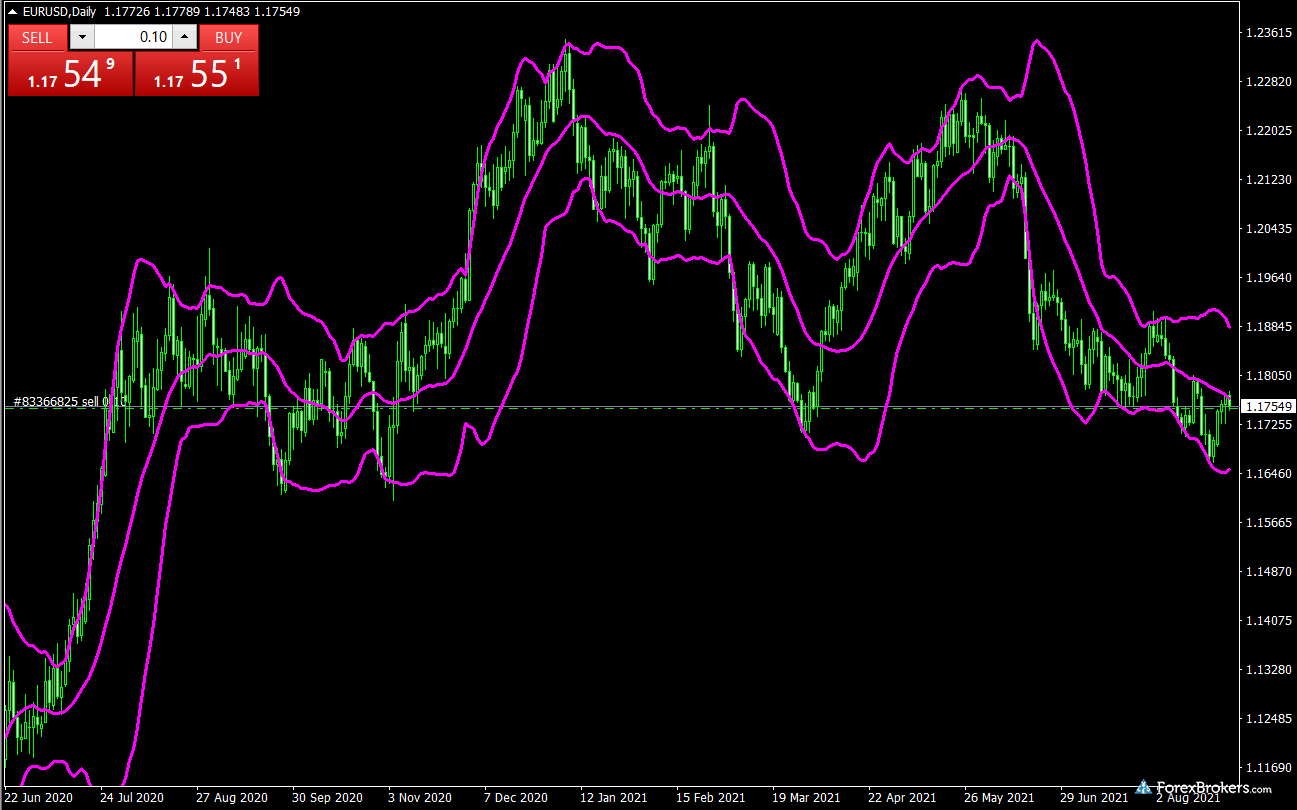

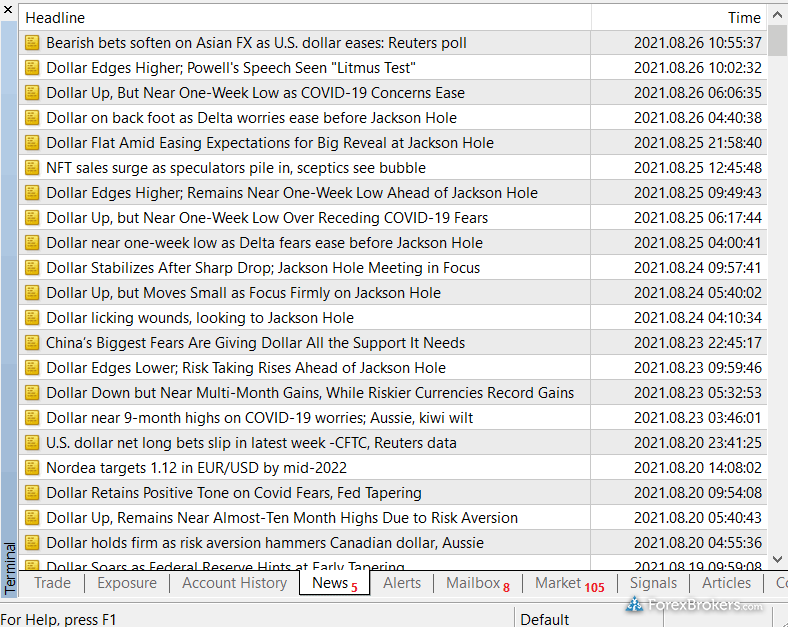

Tickmill is a run-of-the-mill MetaTrader broker that offers a limited selection of tradeable securities. The broker does offer very competitive commission-based pricing for professionals through its VIP and Pro accounts.

What is the minimum deposit requirement for opening an account with IC Markets?

To open a trading account with IC Markets, you'll need to make an initial minimum deposit of $200.

What is the minimum deposit requirement for opening an account with Tickmill?

Tickmill requires a minimum deposit of $100 before you can open an account and start trading.

What funding options does each broker offer?

It's important to make sure that your forex broker accepts the funding options and deposit methods that work best for you. Both IC Markets and Tickmill offer Visa/Mastercard (Credit/Debit), Bank Wire (Deposit/Withdraw), PayPal (Deposit/Withdraw), Skrill (Deposit/Withdraw) and Neteller (Deposit/Withdraw).

Does IC Markets or Tickmill offer lower pricing?

Comparing the trading costs of forex and CFDs is not easy. Not every broker publishes average spread data, and pricing structures vary. Based on our thorough, data-driven testing of each broker's commissions and fees, we found that Tickmill offers better pricing overall for traders.

Methodology: When testing each broker's commissions, fees, and pricing, we analyze multiple trade scenarios and award points based on the expansiveness (or inexpensiveness) of the broker's spreads. We then run multiple scenarios for different investor types, incorporating any miscellaneous fees, to determine an "all-in" cost per trade. Learn more about how we test.

Is IC Markets or Tickmill safer for forex and CFDs trading?

At ForexBrokers.com, we track over 110 international regulatory agencies and sort them by tiers (Tier-1, Tier-2, Tier-3, Tier-4, and Tier-5) to help you choose well-regulated, highly trusted forex brokers. Learn more about our proprietary Trust Score rating system. Based on our research on the regulatory status of over 60 brokers, we've found that Both IC Markets and Tickmill hold 2 global Tier-1 licenses. Tickmill holds 2 global Tier-2 licenses, while IC Markets holds 0.

After evaluating each broker based on their number of held licenses, years in business, and a range of other data-driven variables, we've determined that Tickmill (86) earned a higher Trust Score than IC Markets (84).

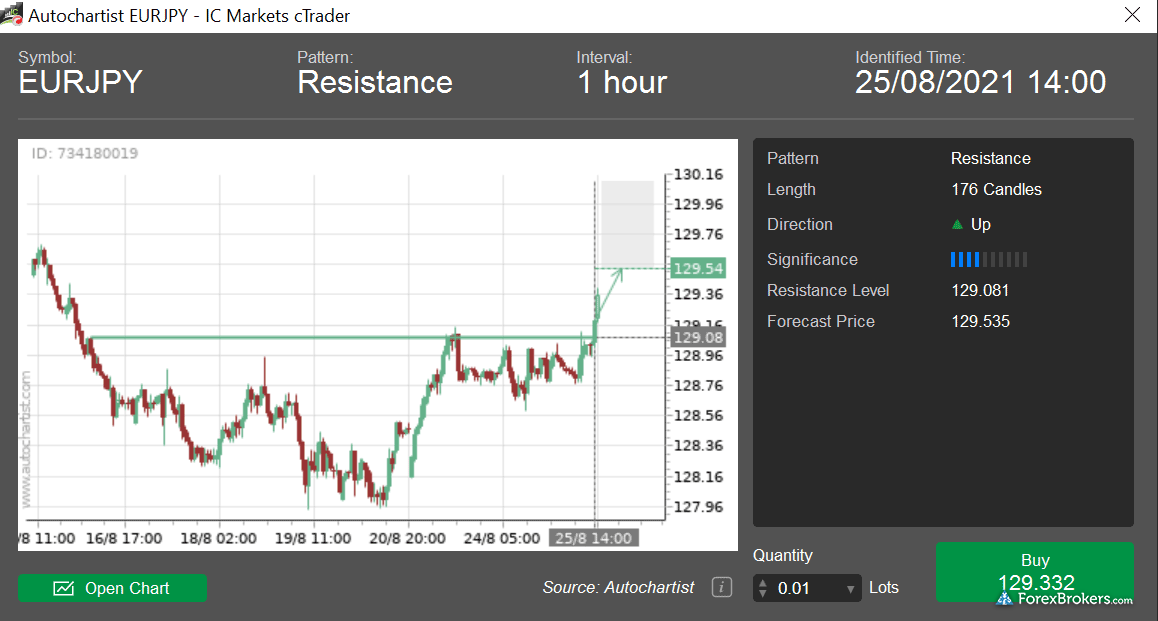

Which trading platform is better: IC Markets or Tickmill?

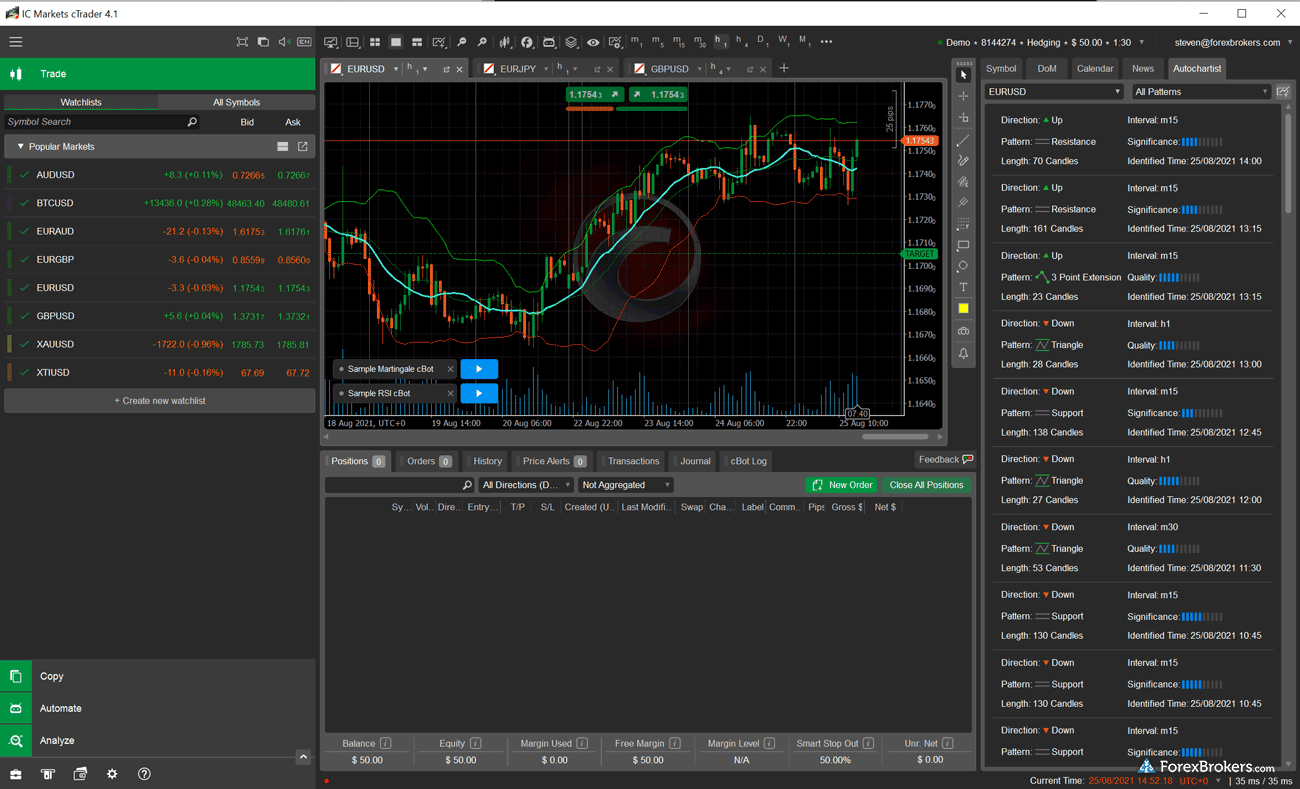

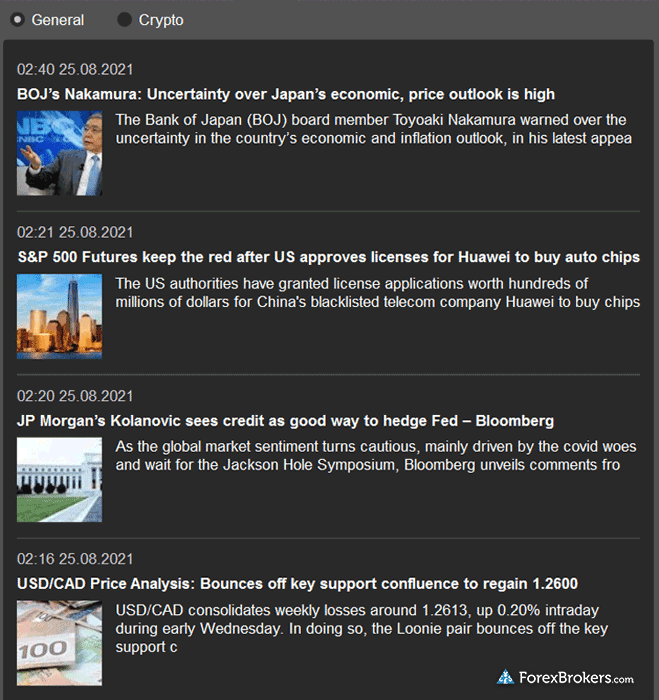

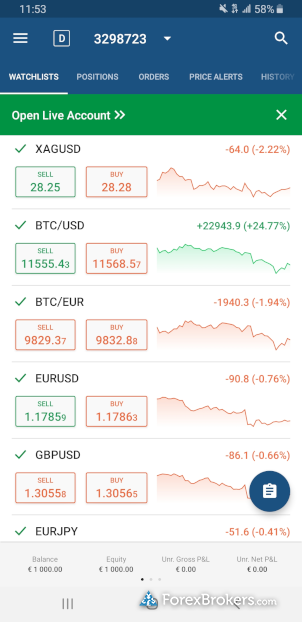

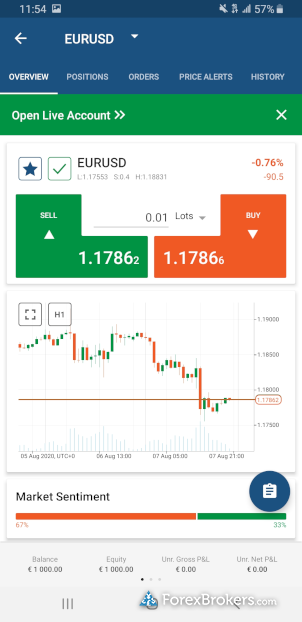

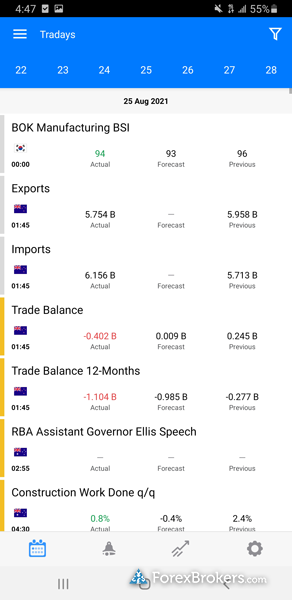

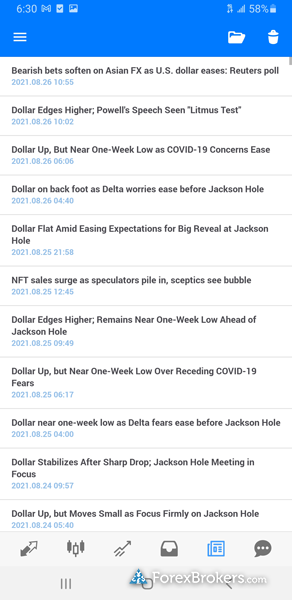

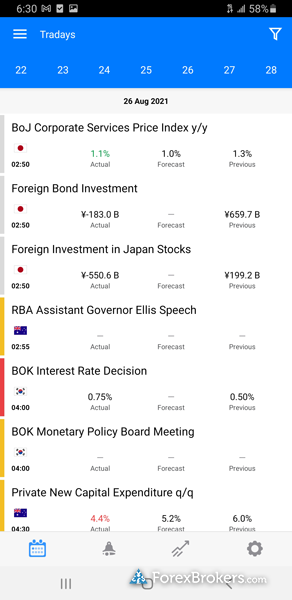

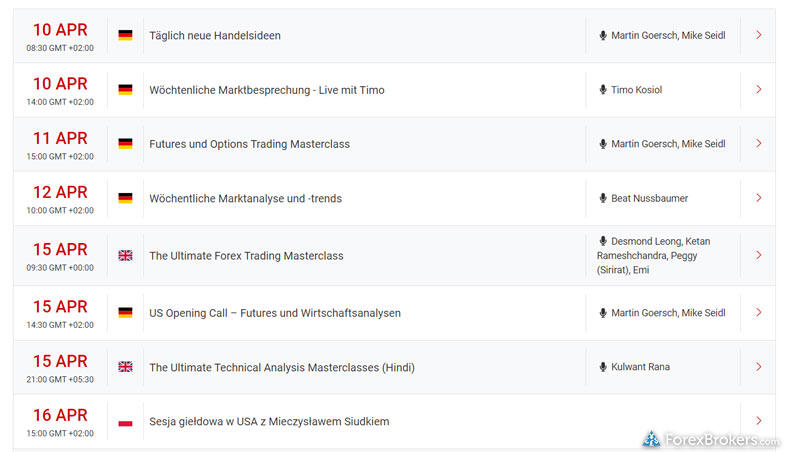

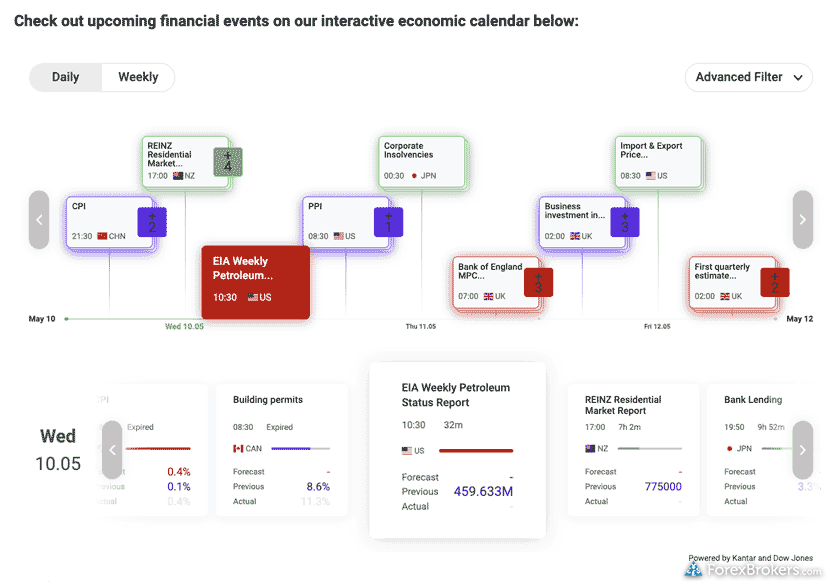

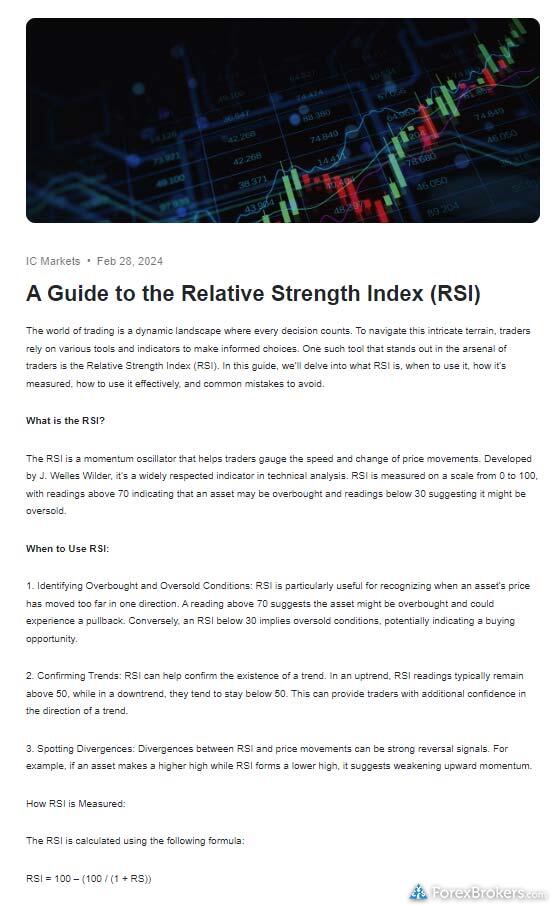

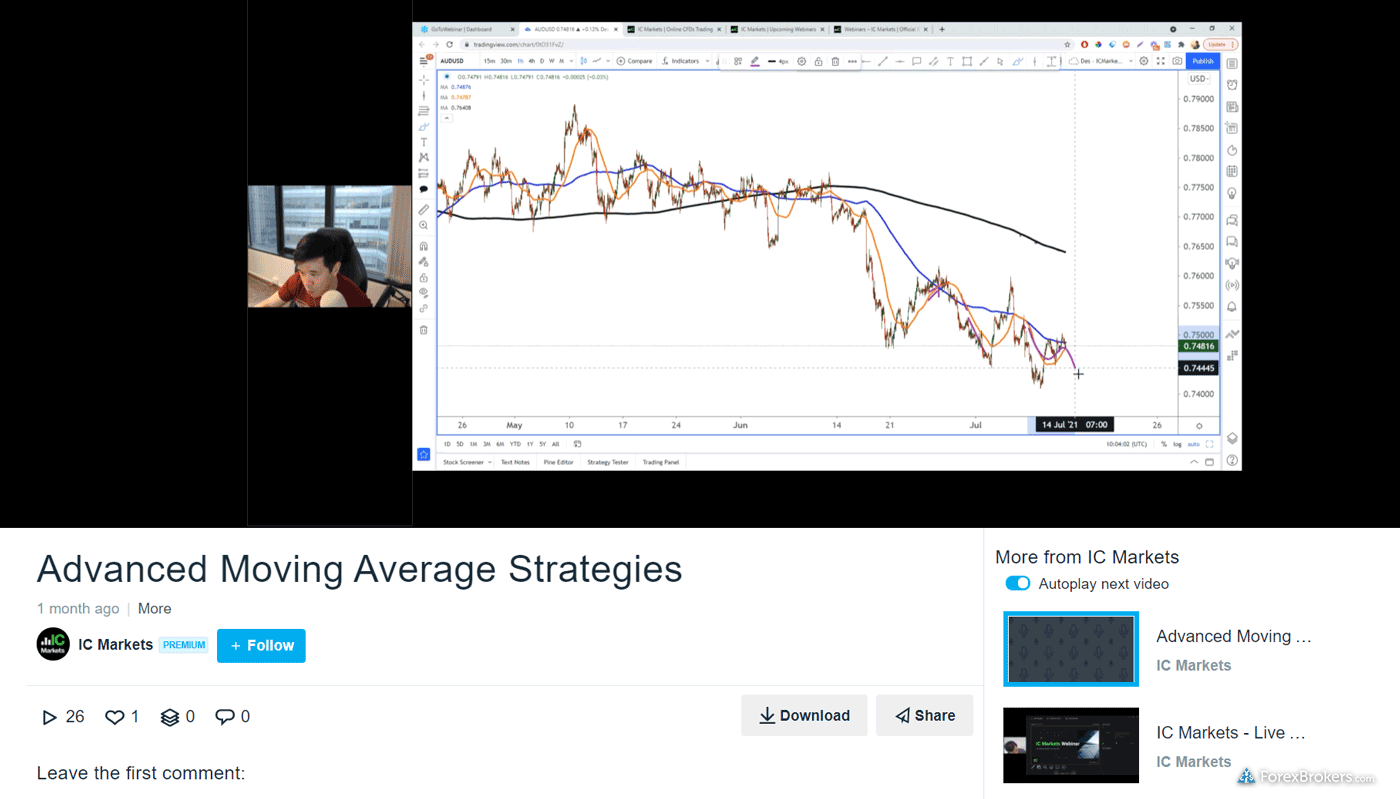

To compare the trading platforms of both IC Markets and Tickmill, we tested each broker's trading tools, research capabilities, and mobile apps. For trading tools, IC Markets offers a better experience. With research, Tickmill offers superior market research. Finally, we found IC Markets to provide better mobile trading apps.

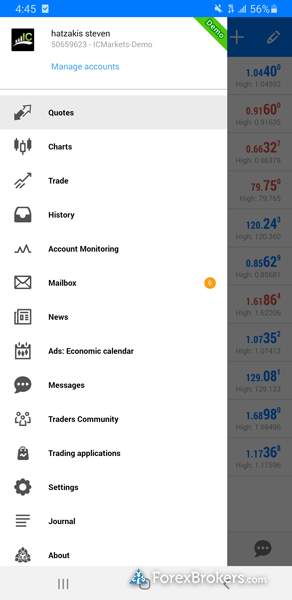

Here’s what trading platforms are available at IC Markets:

- Proprietary Platform - No

- Web Platform - Yes

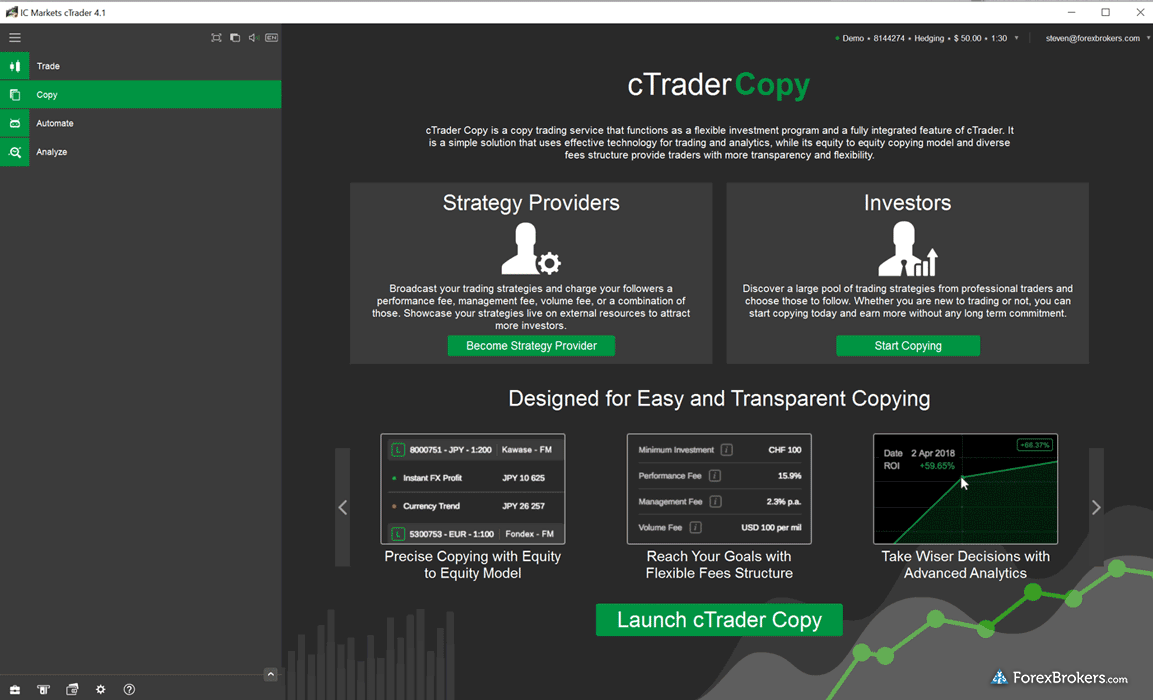

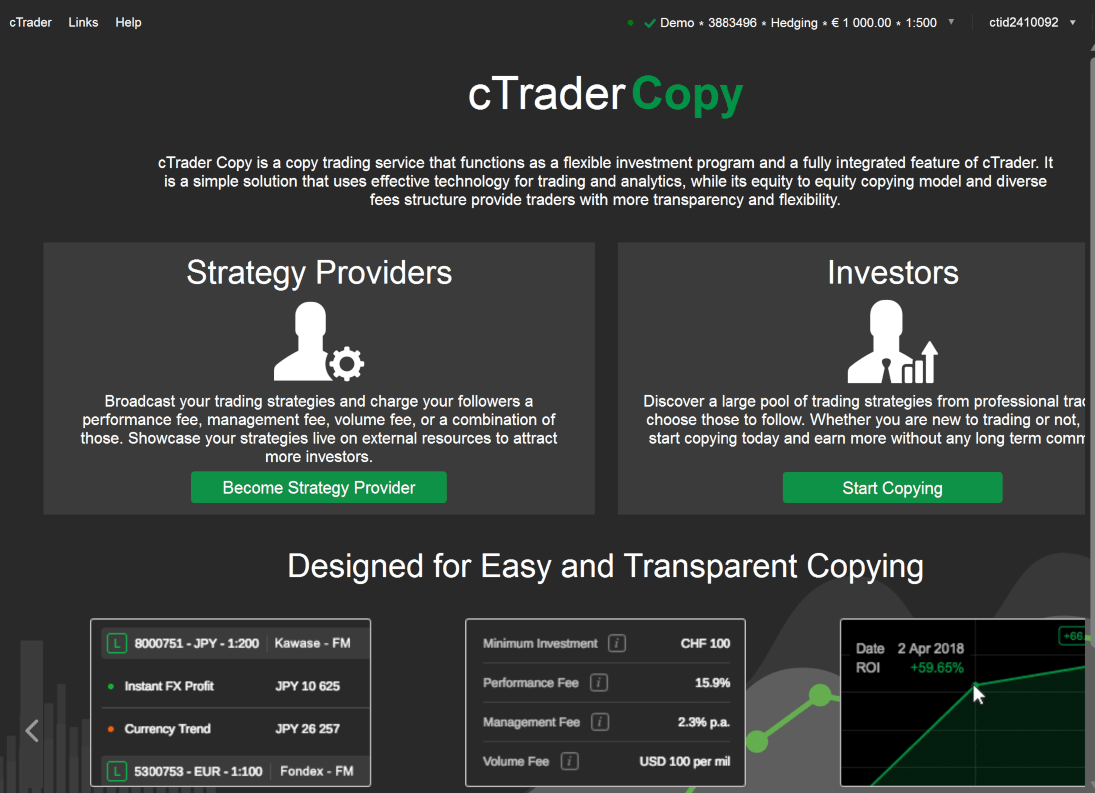

- cTrader - Yes

- DupliTrade - No

- MT4 - Yes

- MT5 - Yes

- ZuluTrade - Yes

- TradingView - Yes

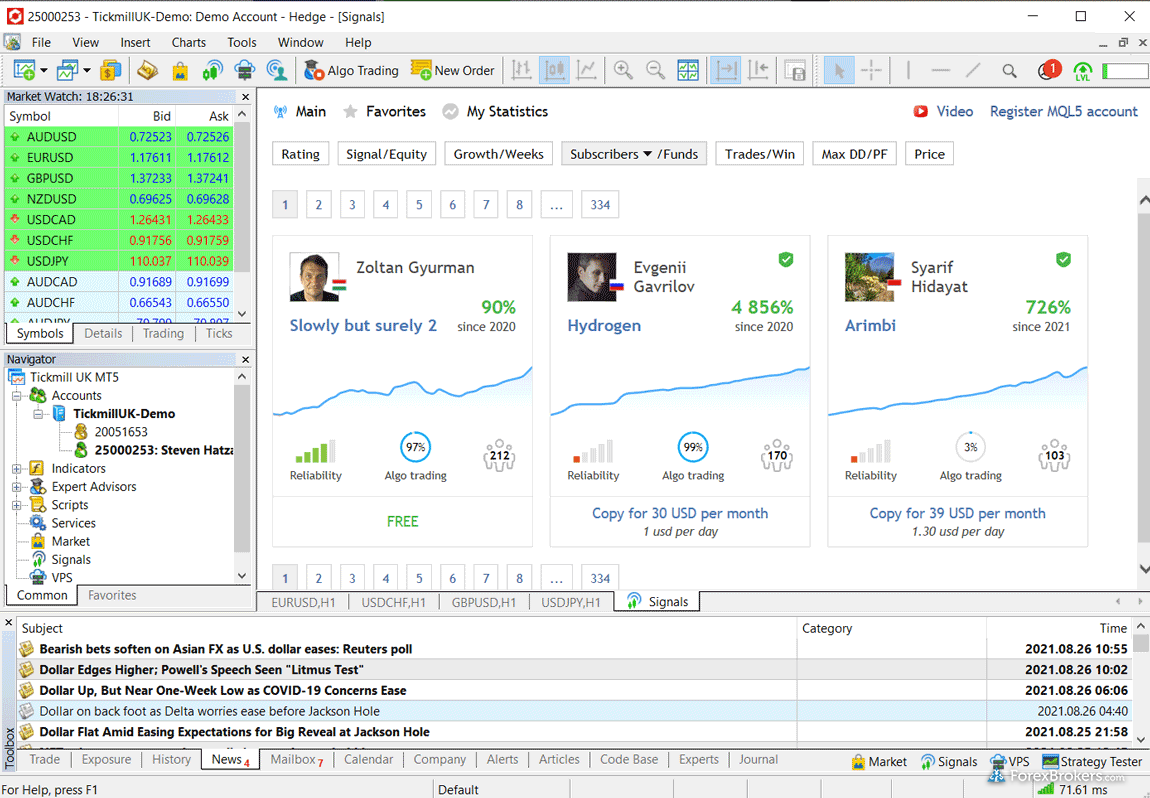

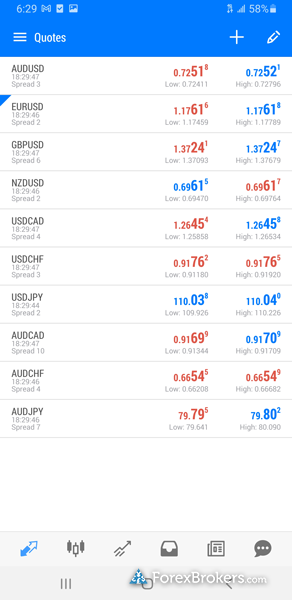

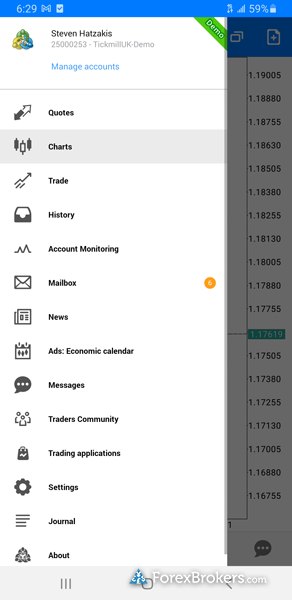

Here’s what trading platforms are available at Tickmill:

- Proprietary Platform - No

- Web Platform - Yes

- cTrader - No

- DupliTrade - No

- MT4 - Yes

- MT5 - Yes

- ZuluTrade - No

- TradingView - No

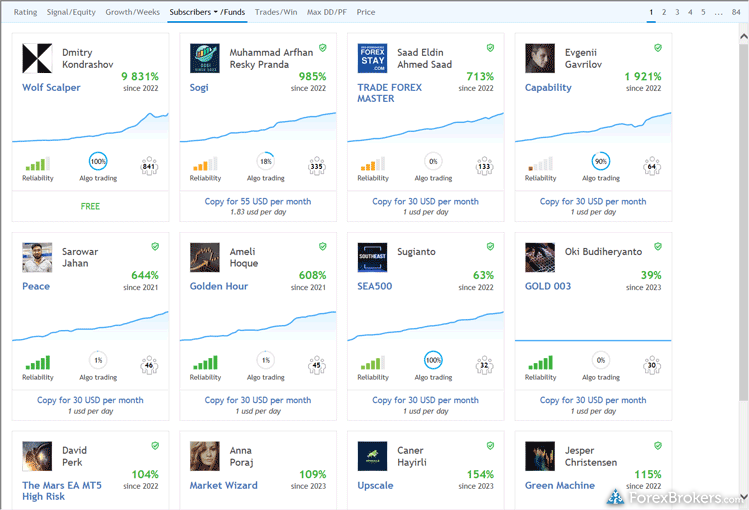

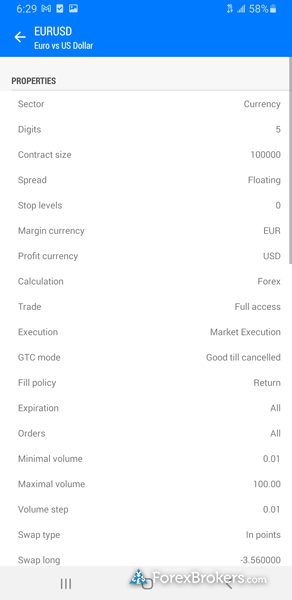

What about MetaTrader? How about copy trading?

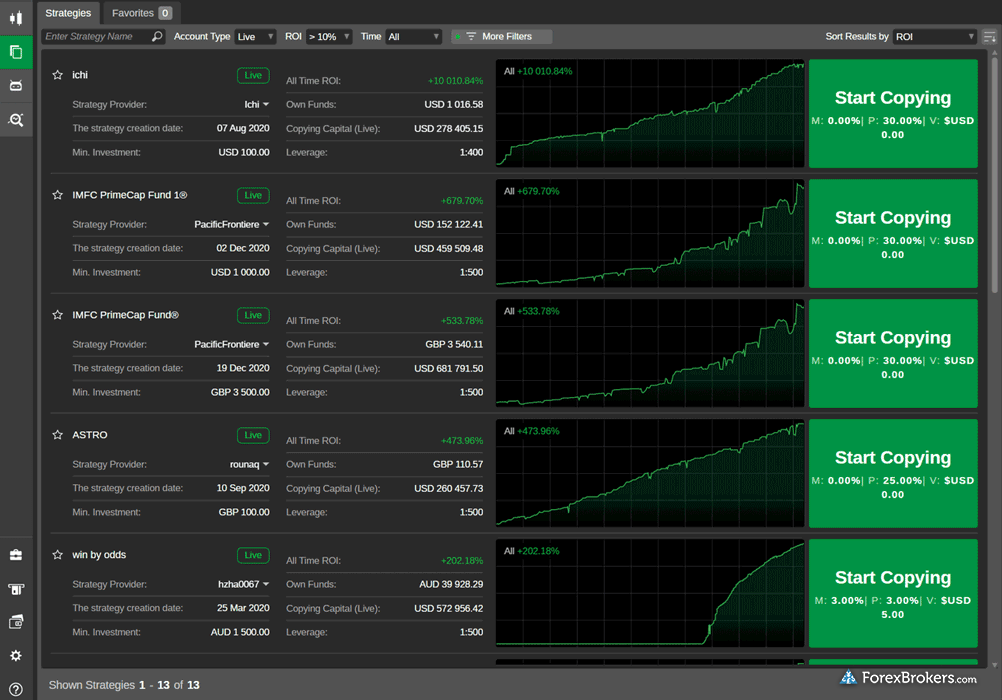

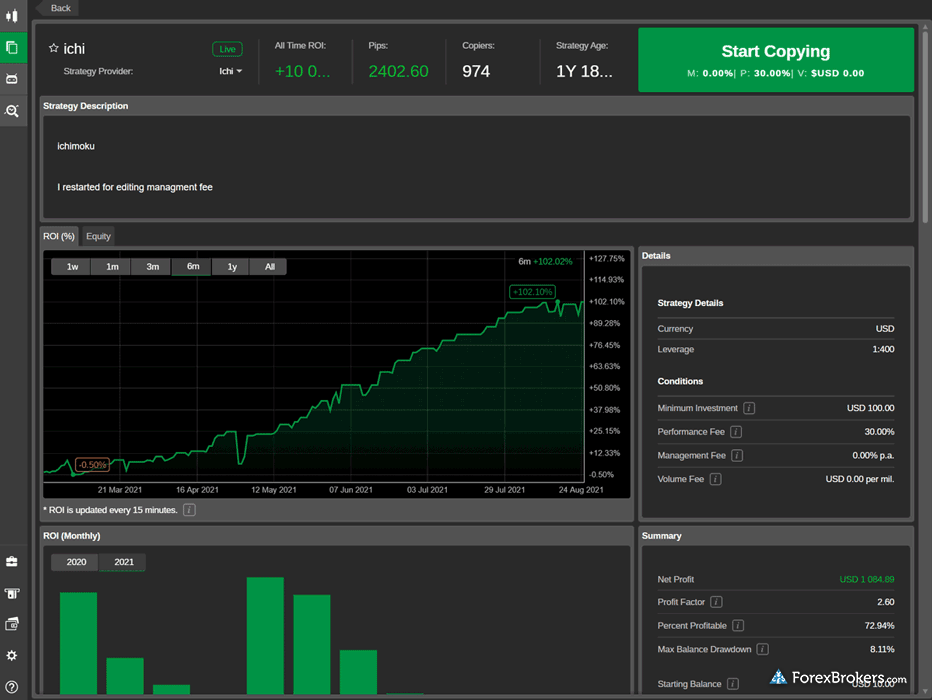

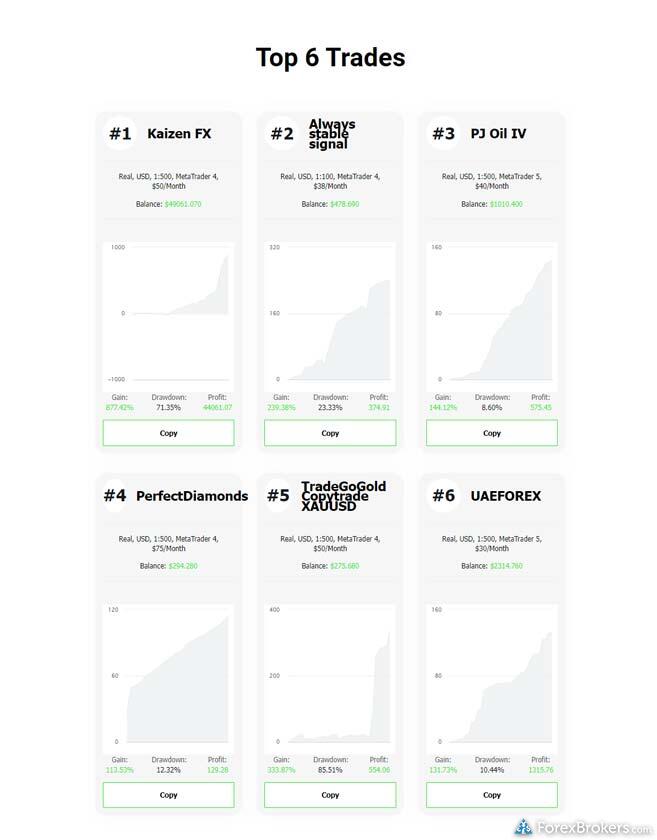

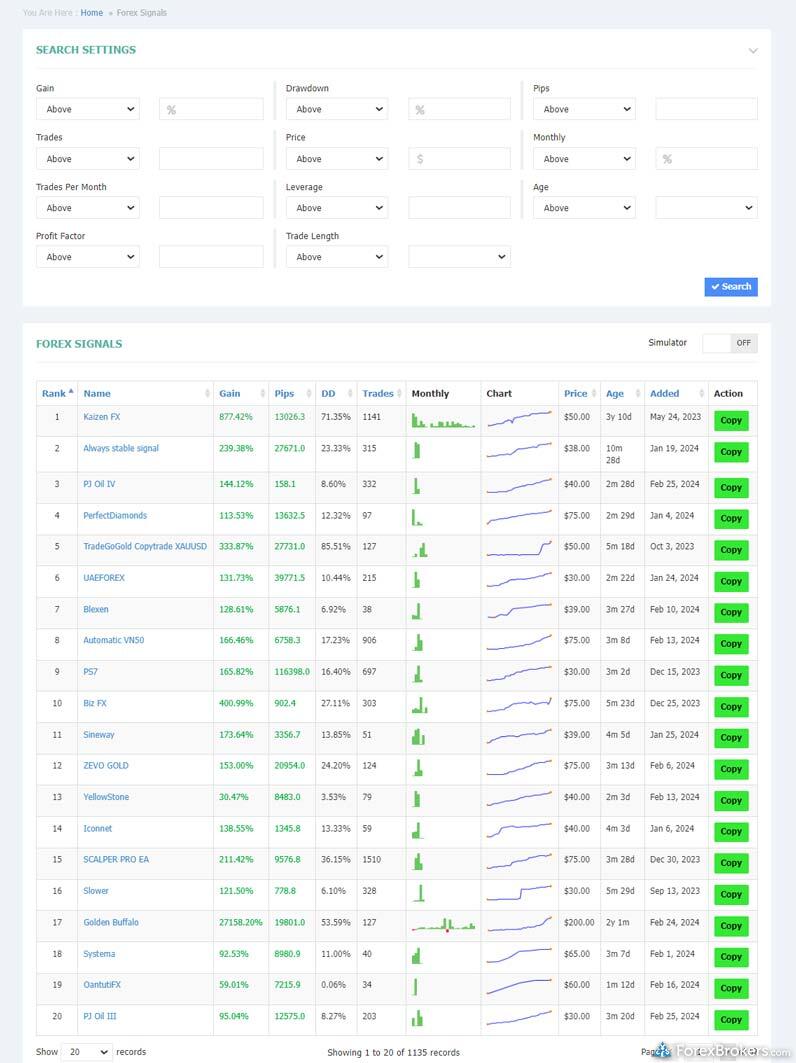

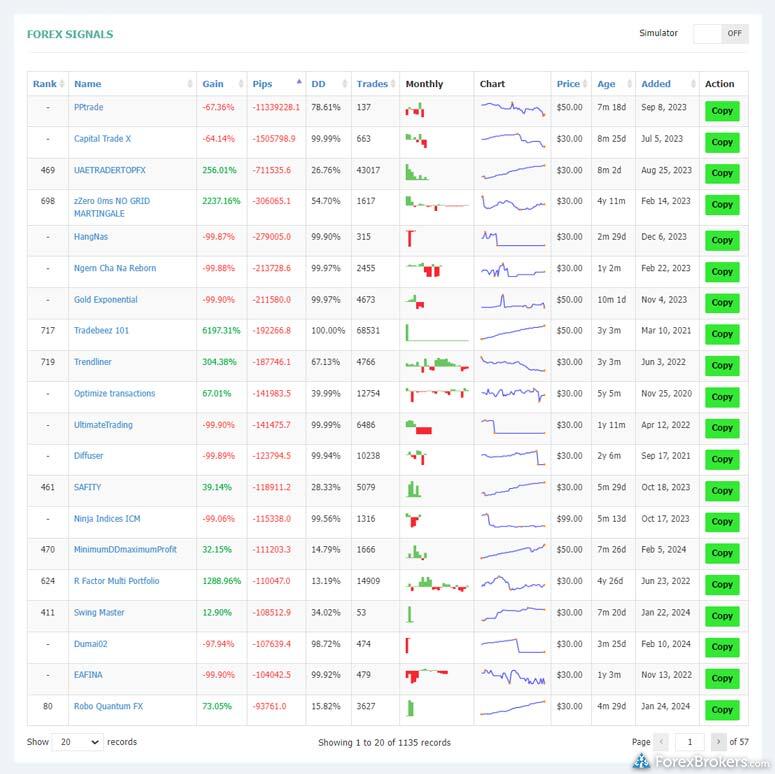

The MetaTrader trading platform suite is wildly popular among forex and CFD traders across the globe. Both IC Markets and Tickmill offer MetaTrader 4 (MT4). Forex traders also appreciate the ability to engage in social copy trading. IC Markets and Tickmill both offer copy trading.

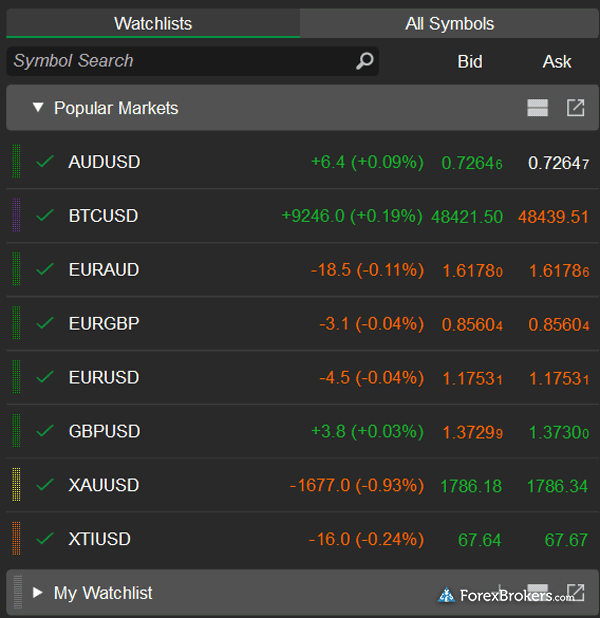

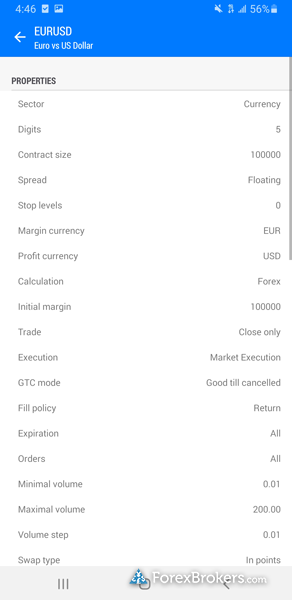

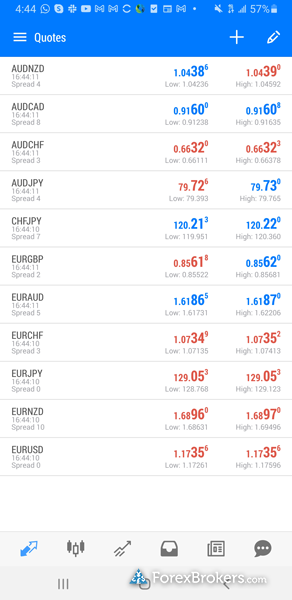

What can I trade with each broker?

Tickmill provides traders 63 currency pairs (e.g., EUR/USD) compared to IC Markets's 61 available pairs. If you are interested in trading CFDs, IC Markets offers traders access to 3583 CFDs, while Tickmill offers access to 725 CFDs; so IC Markets offers 2858 more CFDs than Tickmill.

We found in our testing that IC Markets offers a more diverse selection of investment options than Tickmill, allowing you to trade Forex Trading (Spot or CFDs), U.S. Stocks (CFD), Int'l Stock Trading (Non CFD), Cryptocurrency (Derivative) and Social Trading / Copy Trading. Neither have Cryptocurrency (Physical) and Spread Betting.

Overall winner: IC Markets

travel_explore See the best forex brokers in your country.

Use our international search tool to find a broker that accepts clients from your country.

Popular Forex Reviews

Popular Forex Guides

Popular Forex Education

More Forex Guides

Popular Forex Broker Reviews

announcementPlease note:

We review each broker’s overall global offering – a “Yes” checkmark in our Compare Tool does not guarantee the availability of any specific features in your country of residence. To verify the availability of any features within your country of residence, please contact the broker directly.

%20(2).png)

-desktop-platform-.jpg)

-desktop-platform-charts-.jpg)

-desktop-platform-watchlist-views-.jpg)