City Index vs TeleTrade Comparison

We’ve made it easy to compare the best forex brokers, side-by-side. Our editorial team has collected thousands of data points, written hundreds of thousands of words of research, and tested over 60 brokers to help you find the best forex brokers in the industry. Our research is unbiased and independent; learn more about how we test. That same research and data powers our broker comparisons. Let's compare City Index vs TeleTrade.

Can I trust City Index?

City Index is publicly traded, does not operate a bank, and is authorised by seven Tier-1 regulators (Highly Trusted), one Tier-2 regulator (Trusted), zero Rier-3 regulator (Average Risk), and one Tier-4 regulator (High Risk). City Index is authorised by the following Tier-1 regulators: Australian Securities & Investment Commission (ASIC), Monetary Authority of Singapore (MAS), Canadian Investment Regulatory Organization (CIRO), Japanese Financial Services Authority (JFSA), Commodity Futures Trading Commission (CFTC), Financial Conduct Authority (FCA), and regulated in the European Union via the MiFID passporting system.

Can I trust TeleTrade?

TeleTrade is not publicly traded and does not operate a bank. TeleTrade is authorised by one Tier-1 regulator (Highly Trusted), zero Tier-2 regulators (Trusted), zero Tier-3 regulator (Average Risk), and zero Tier-4 regulators (High Risk). TeleTrade is authorised by the following Tier-1 regulator: Regulated in the European Union via the MiFID passporting system.

Is City Index good?

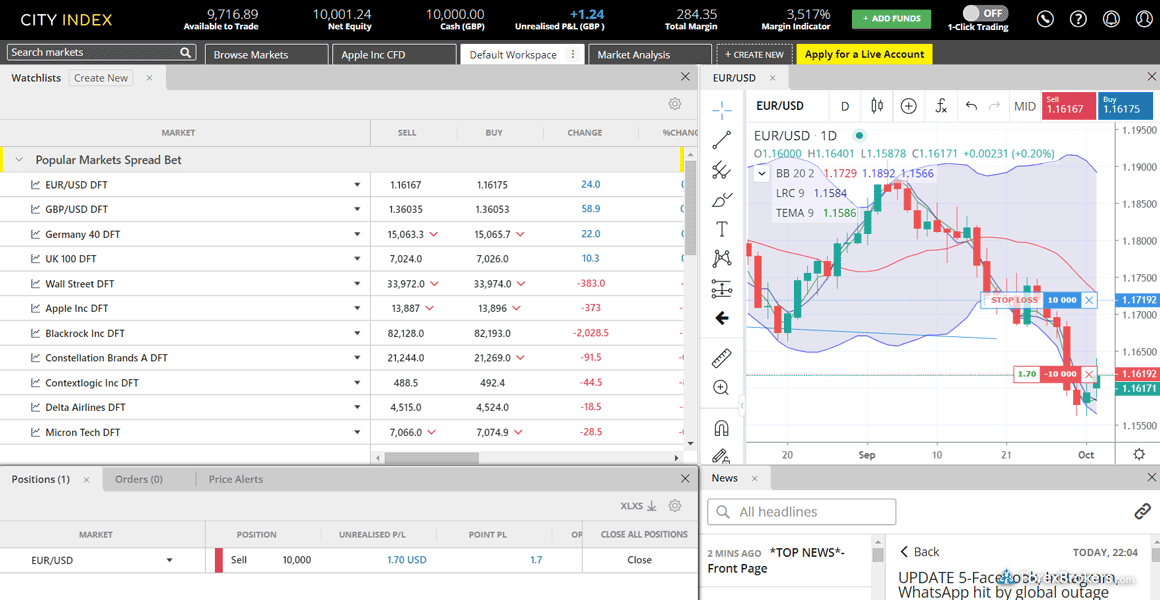

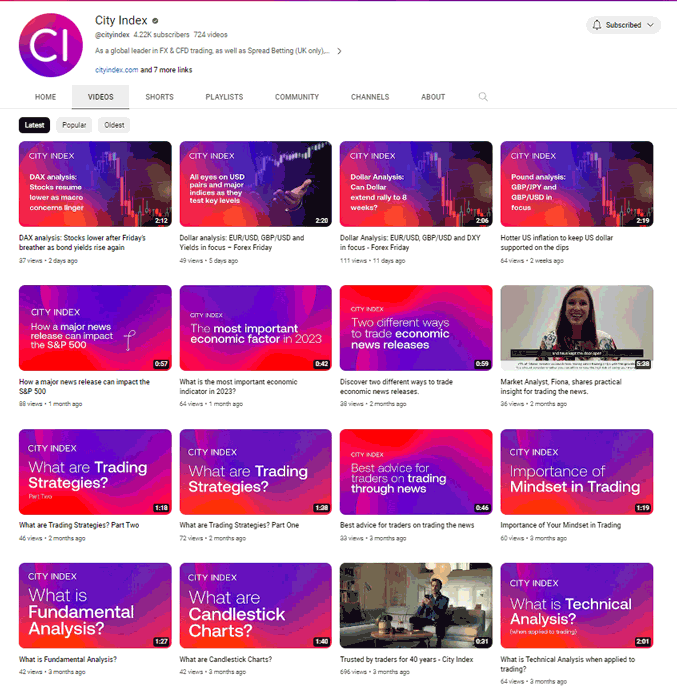

Backed by StoneX Group, City Index is a trusted brand known for its versatile trading platforms, excellent mobile app, diverse market research, and extensive range of tradeable markets.

Is TeleTrade good?

TeleTrade was an early pioneer of mobile apps for finance, then became a forex and CFD broker, now offering the MetaTrader platform. With just one regulatory license, Teletrade has a lower Trust Score than more established forex brokers.

What is the minimum deposit requirement for opening an account with City Index?

To open a trading account with City Index, you'll need to make an initial minimum deposit of £100.00.

What is the minimum deposit requirement for opening an account with TeleTrade?

TeleTrade requires a minimum deposit of $100 before you can open an account and start trading.

What funding options does each broker offer?

It's important to make sure that your forex broker accepts the funding options and deposit methods that work best for you. City Index offers Visa/Mastercard (Credit/Debit), Bank Wire (Deposit/Withdraw) and PayPal (Deposit/Withdraw) for banking, whereas TeleTrade provides Visa/Mastercard (Credit/Debit), Bank Wire (Deposit/Withdraw), Skrill (Deposit/Withdraw) and Neteller (Deposit/Withdraw).

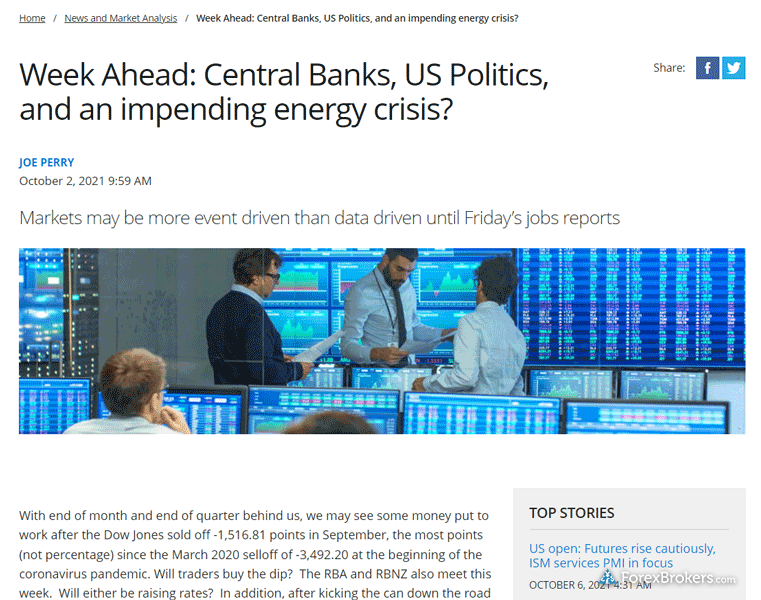

Does City Index or TeleTrade offer lower pricing?

Comparing the trading costs of forex and CFDs is not easy. Not every broker publishes average spread data, and pricing structures vary. Based on our thorough, data-driven testing of each broker's commissions and fees, we found that City Index offers better pricing overall for traders.

Methodology: When testing each broker's commissions, fees, and pricing, we analyze multiple trade scenarios and award points based on the expansiveness (or inexpensiveness) of the broker's spreads. We then run multiple scenarios for different investor types, incorporating any miscellaneous fees, to determine an "all-in" cost per trade. Learn more about how we test.

Is City Index or TeleTrade safer for forex and CFDs trading?

At ForexBrokers.com, we track over 110 international regulatory agencies and sort them by tiers (Tier-1, Tier-2, Tier-3, Tier-4, and Tier-5) to help you choose well-regulated, highly trusted forex brokers. Learn more about our proprietary Trust Score rating system. Based on our research on the regulatory status of over 60 brokers, we've found that City Index holds 7 global Tier-1 licenses, while TeleTrade holds 1. City Index holds 1 global Tier-2 licenses, while TeleTrade holds 0.

After evaluating each broker based on their number of held licenses, years in business, and a range of other data-driven variables, we've determined that City Index (99) earned a higher Trust Score than TeleTrade (71).

Which trading platform is better: City Index or TeleTrade?

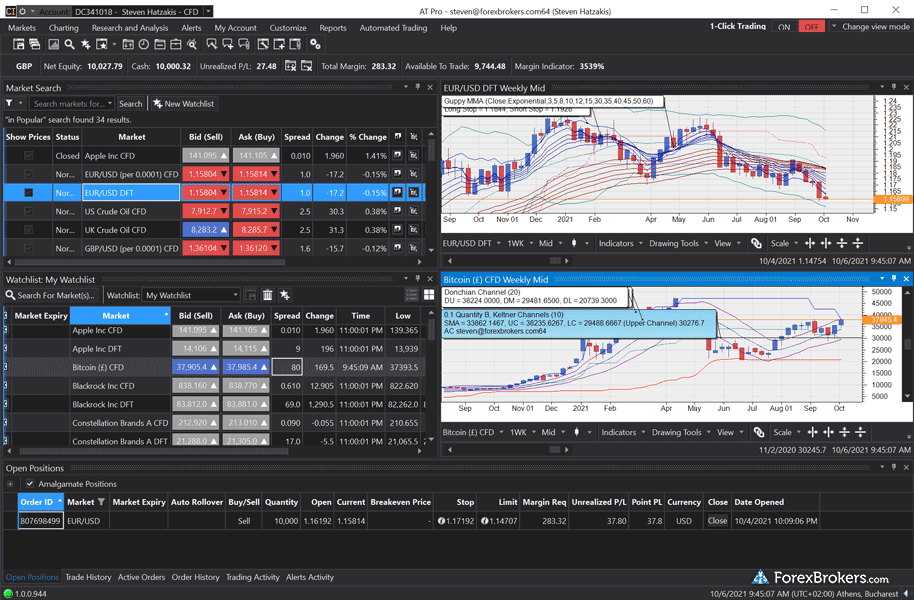

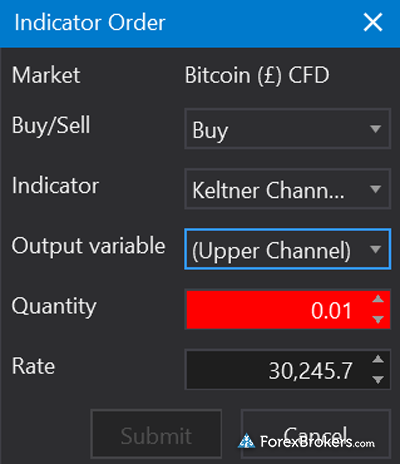

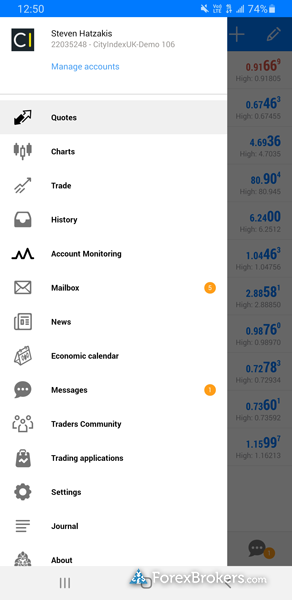

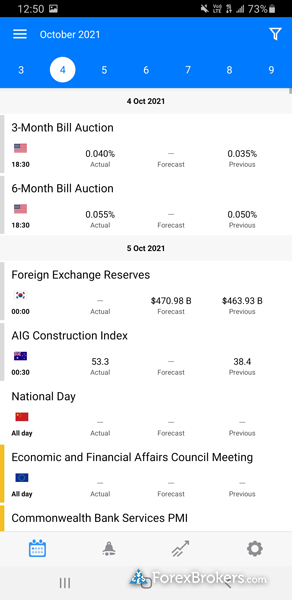

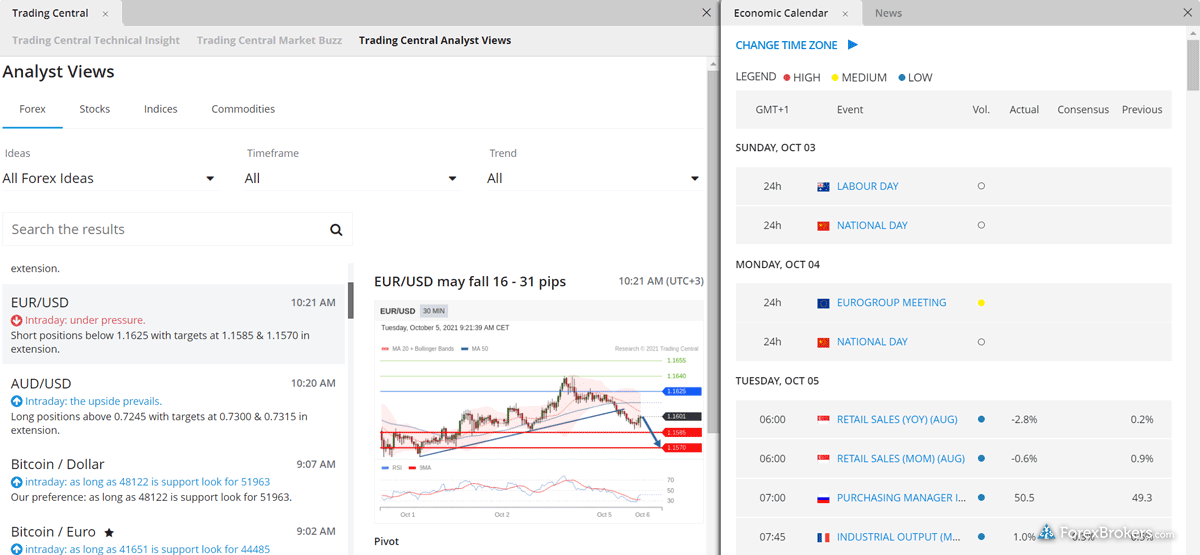

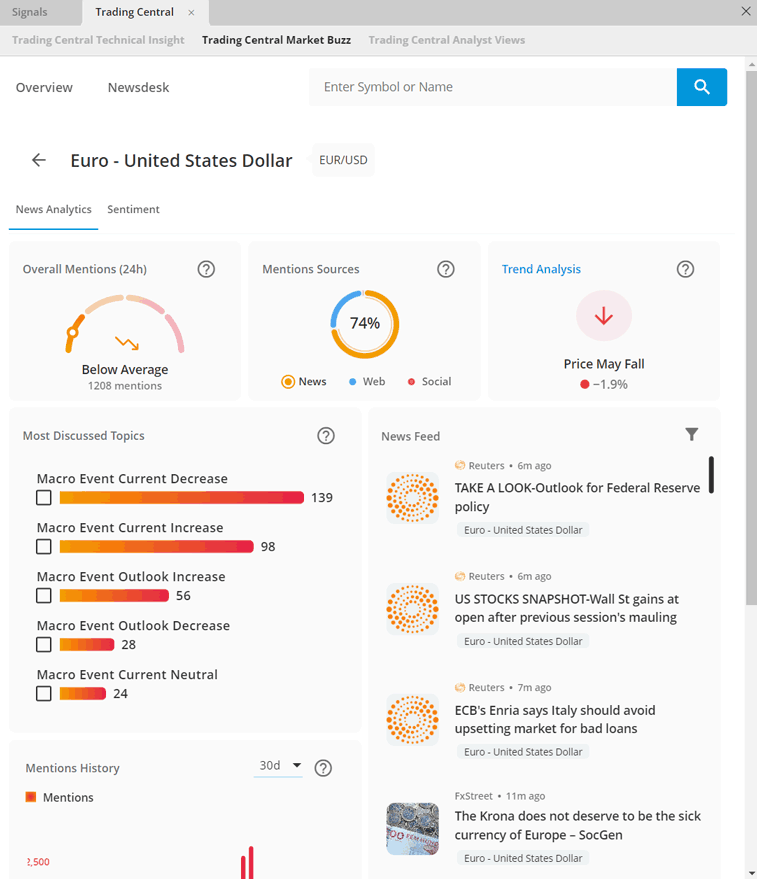

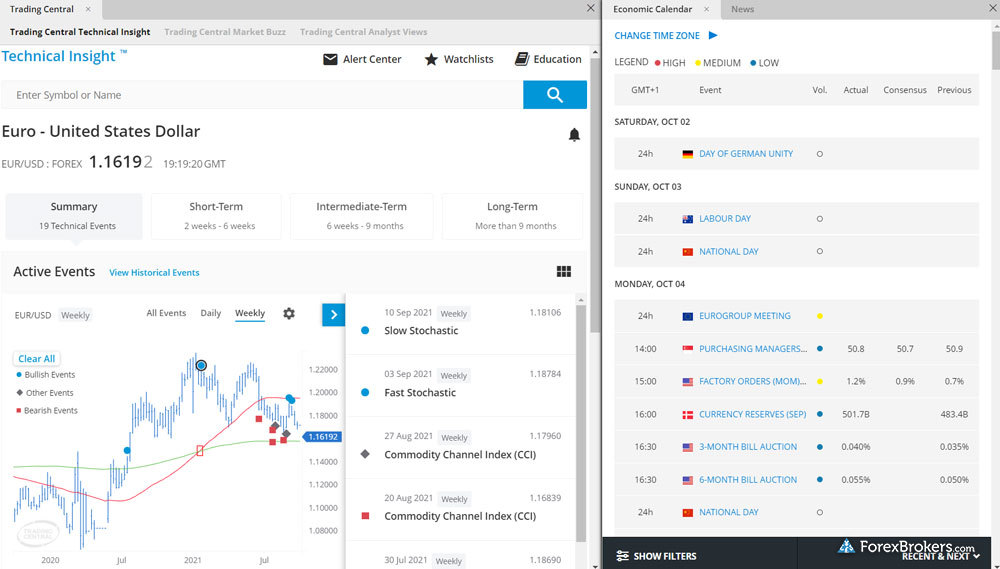

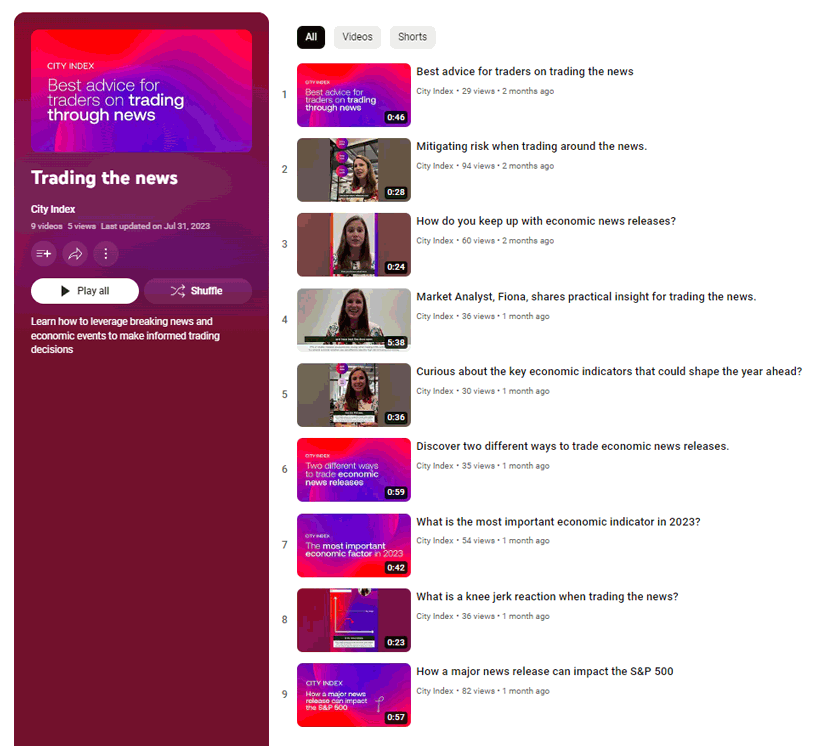

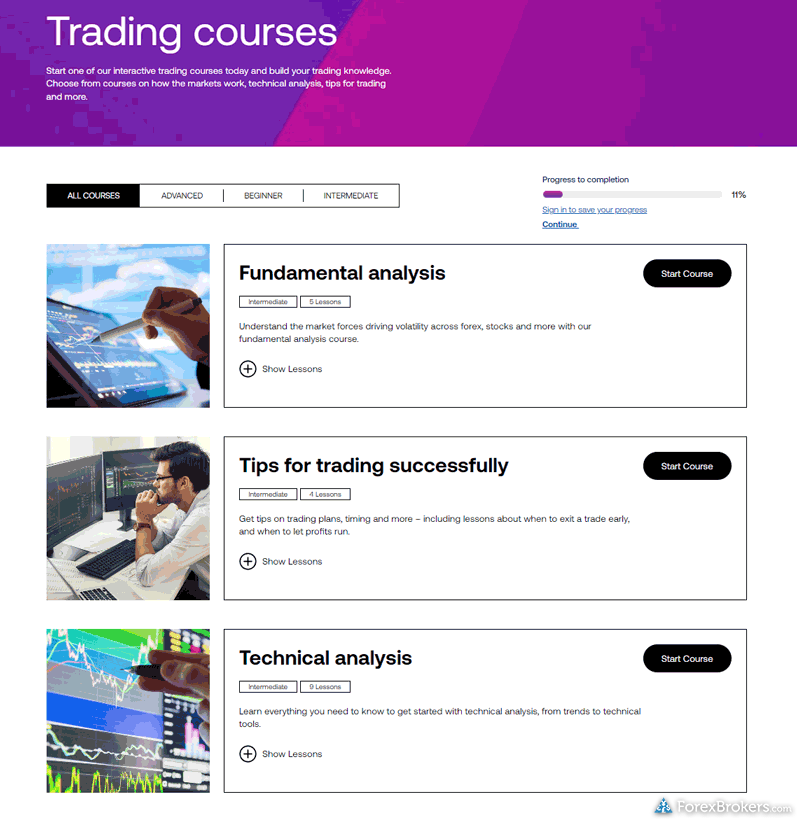

To compare the trading platforms of both City Index and TeleTrade, we tested each broker's trading tools, research capabilities, and mobile apps. For trading tools, City Index offers a better experience. With research, City Index offers superior market research. Finally, we found City Index to provide better mobile trading apps.

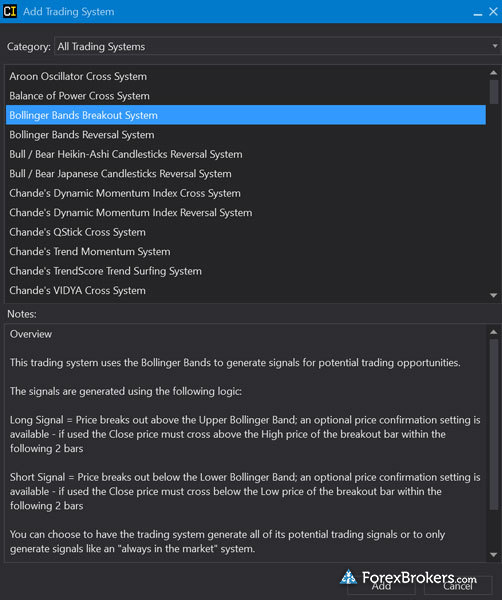

Here’s what trading platforms are available at City Index:

- Proprietary Platform - Yes

- Web Platform - Yes

- cTrader - No

- DupliTrade - No

- MT4 - Yes

- MT5 - No

- ZuluTrade - No

- TradingView - Yes

Here’s what trading platforms are available at TeleTrade:

- Proprietary Platform - No

- Web Platform - Yes

- cTrader - No

- DupliTrade - No

- MT4 - Yes

- MT5 - Yes

- ZuluTrade - Yes

- TradingView - No

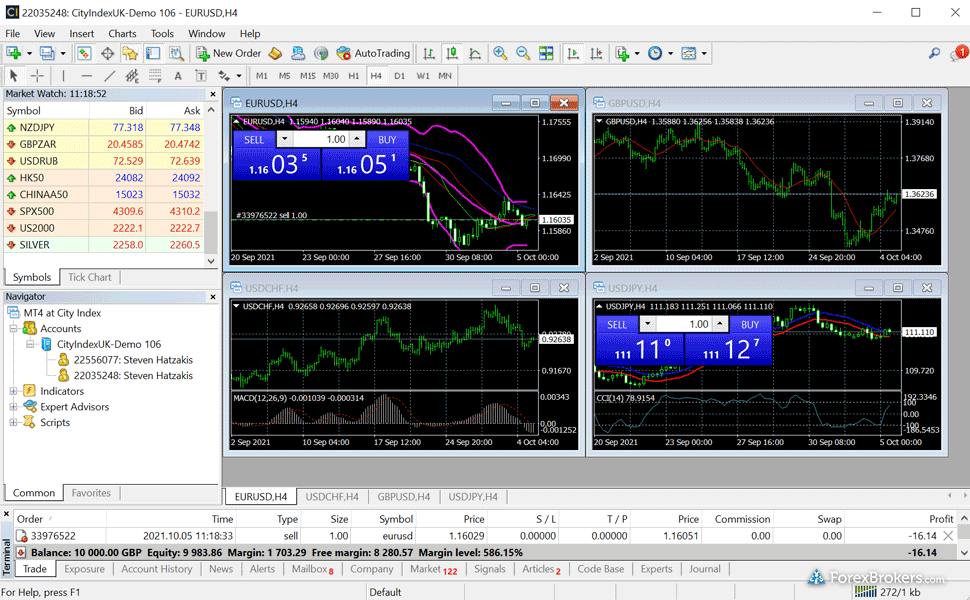

What about MetaTrader? How about copy trading?

The MetaTrader trading platform suite is wildly popular among forex and CFD traders across the globe. Both City Index and TeleTrade offer MetaTrader 4 (MT4). Forex traders also appreciate the ability to engage in social copy trading. City Index and TeleTrade both offer copy trading.

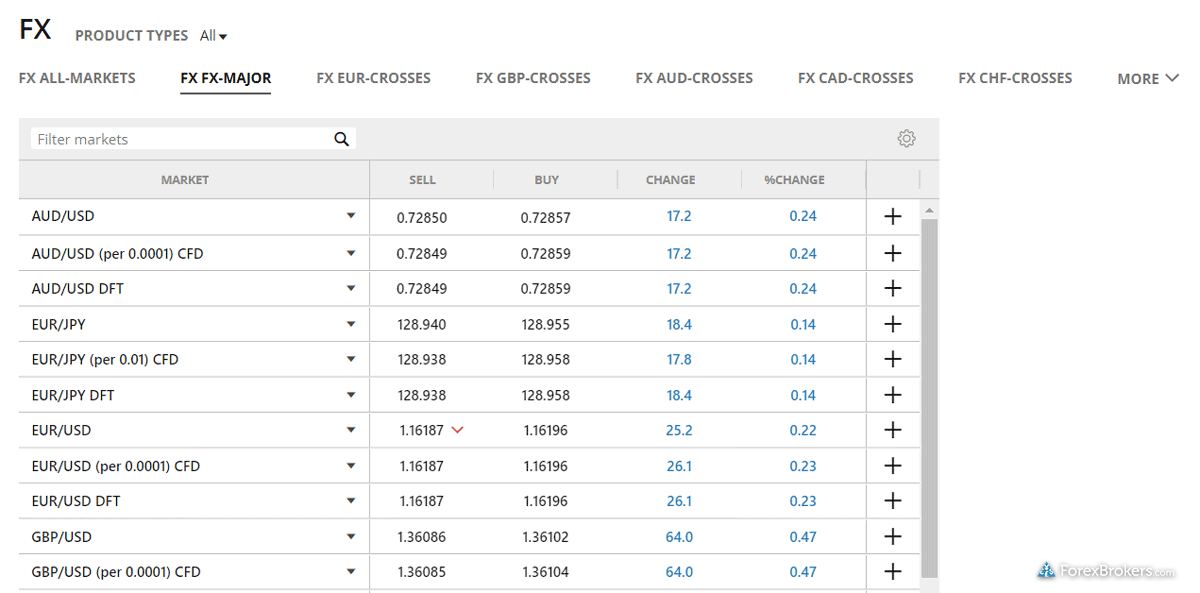

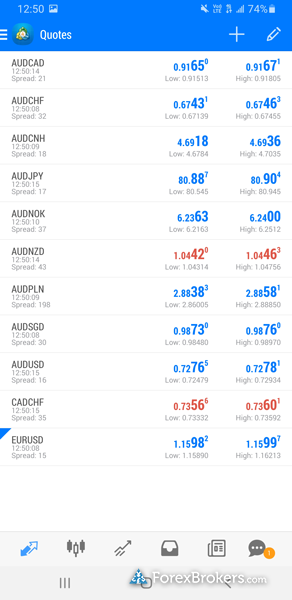

What can I trade with each broker?

City Index provides traders 84 currency pairs (e.g., EUR/USD) compared to TeleTrade's 61 available pairs. If you are interested in trading CFDs, City Index offers traders access to 13500 CFDs, while TeleTrade offers access to 500 CFDs; so City Index offers 13000 more CFDs than TeleTrade.

We found in our testing that City Index offers a more diverse selection of investment options than TeleTrade, allowing you to trade Forex Trading (Spot or CFDs), U.S. Stocks (CFD), Cryptocurrency (Derivative), Social Trading / Copy Trading and Spread Betting. Neither have Int'l Stock Trading (Non CFD) and Cryptocurrency (Physical).

Overall winner: City Index

travel_explore See the best forex brokers in your country.

Use our international search tool to find a broker that accepts clients from your country.

Popular Forex Reviews

Popular Forex Guides

Popular Forex Education

More Forex Guides

Popular Forex Broker Reviews

announcementPlease note:

We review each broker’s overall global offering – a “Yes” checkmark in our Compare Tool does not guarantee the availability of any specific features in your country of residence. To verify the availability of any features within your country of residence, please contact the broker directly.